Академический Документы

Профессиональный Документы

Культура Документы

Balancing The Public and The Private Interest - A Dilemma of Accounting Profession

Загружено:

Sasha KhalishahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balancing The Public and The Private Interest - A Dilemma of Accounting Profession

Загружено:

Sasha KhalishahАвторское право:

Доступные форматы

Available online at www.sciencedirect.

com

ScienceDirect

Procedia - Social and Behavioral Sciences 92 (2013) 930 935

Lumen International Conference Logos Universality Mentality Education Novelty (LUMEN 2013)

Balancing the Public and the Private Interest A Dilemma of Accounting Profession

Adriana Tiron Tudor

a

a*

Babes-Bolyai University, Faculty of Economics and Business Administration, Teodor Mihali 58-60, Cluj-Napoca, 400591, Romania

Abstract Public interest is highly important to the accounting profession because, according to the professions code of ethics, a label of the accountancy profession is its acceptance of the responsibility to act in the public interest"(IFAC, 2011), but there is not a common consensus on what exactly is in the public interest. In the same time, the accountancy profession includes individuals and private companies profit oriented. In this circumstance, the objective of the paper is to explain the concept of public interest from both sides: the accounting profession, and expectations of the interested parties. For this, a literature review analyzes the main studies in accounting research literature that analyze public interest from a theoretical approach. This study provides an accounting conceptual framework for public interest, based on the definitions of 'public interest,' and the dilemma between public and private interest. Also, proposes an evaluation tool of the degree to which any policy, action, process, or condition are in the public interest. The framework and the assessment tool are "designed to provide policymakers, regulators, and business leaders with the means to more consistently assess many of the issues which are currently in debates at the national and international levels."(IFAC, 2011) 2013 The Authors. Published by Elsevier Ltd. 2013 Theand/or Authors. Published byunder Elsevier Ltd. Selection peer-review responsibility of Lumen Research Center in Social and Humanistic Sciences, Asociatia Selection and/or peer-review under responsibility of Lumen Research Center in Social and Humanistic Sciences, Asociatia Lumen. Lumen.

Keywords: public interest, accounting profession, dilemmas

1. Introduction In recent decades, especially in the early 1980s, there was a dramatic expansion in the financial market concerning the companys financial mechanisms and a series of sophisticated financial instruments appeared. At the same time, this complexity created opacity, mostly because of the lack of transparency, but also the

Corresponding author. Tel.: +40-0726-779-474. E-mail address: adriana.tiron@econ.ubbcluj.ro

1877-0428 2013 The Authors. Published by Elsevier Ltd. Selection and/or peer-review under responsibility of Lumen Research Center in Social and Humanistic Sciences, Asociatia Lumen. doi:10.1016/j.sbspro.2013.08.779

Adriana Tiron Tudor / Procedia - Social and Behavioral Sciences 92 (2013) 930 935

931

difficulties in the understanding of investors, producers of financial information or auditors. All these elements lead to the diminishing opportunities for comparison; verification and certification of financial information considers Mr. Stavros B. Thomadakis, the Chairman of the Public Interest Oversight Board in his speech about "The accounting profession and the turning point of the crisis (Tomadakis, 2009) Financial failures of companies that seemed particularly solid, bankruptcies of some major companies, in some cases triggered by the fraudulent or make-up sets of financial statements, eroded public confidence in accounting and implicitly in financial auditing and finally in the whole accounting profession. One of the criticisms addressed directly to the accounting profession is the fact that the accounting and audit standards are essentially subjective and therefore, do not represent the interests and values of society (Zaid, 1997). Some researchers (Mattli & Buthe, 2005) have begun to ask questions about the ability of accountants to comply with their duties in connection with the public interest, and the social role of accounting, which has led to increasing concern about the future of the accounting profession. Sikka et. al. (1989) studied the perception of UK professional bodies of how their actions serve the public interest. They believe that the accounting profession plays a pivotal and influential role in the auditing and regulation of economic and social affairs. The professional bodies analyzed exposed deep interest in the role of accounting and auditing in society, compared with the low attention given to professional obligations to act as an advocate (guardian) of the public interest. Thus, there is no correlation between reported obligations and their implementation in practice. It is imperative for the community of accountants to restore public confidence vis--vis their profession. In this respect, Rezaee (2004) thinks that public trust in the auditors professional judgment and reputation plays a crucial role in strengthening the audit function that adds value through services that increase the credibility of published financial statements. Besides professional bodies, governments, regulators, supervisory bodies, and the business community as a whole are interested in this approach. In this condition, the purpose of the research is to clarify the concept of public interest into the context of accounting profession interaction with the interested parties. For this reason was used a theoretical approach based on a literature review analyze of the main studies in accounting research literature about public interest. The results of this research are to provide an accounting conceptual framework for public interest, based on the definitions of 'public interest,' and the dilemma between public and private interest and to propose an evaluation tool of the degree to which any policy, action, process, or condition are in the public interest. The paper's structure consists of six sections. The first section includes a synthetic overview of the importance of public interest for the accounting profession. Thereafter, we present the papers research methodology, followed by a discussion of the findings about the main pillars of the conceptual framework of public interest and a possible assessment tool of accounting actions in the public interest. We close in the last section with some conclusions. 2. Methodology Research This study is a review, based on the content analysis of significant articles from the literature and speeches of famous international personalities on recapturing public trust by the accounting profession. The paper develops the meaning and implications of the public interest concept, based on a survey of the scientific studies published in relevant books and journals, and studies of international professional organizations in this area of interest. 3. Public interest concept

According to the legitimacy theory, society and their members gives legitimacy to an organization, a profession only when the entitys value system is similar to that of the society in which it operates. Between them, there is a social contract, an agreement (Deegan, 2002).

932

Adriana Tiron Tudor / Procedia - Social and Behavioral Sciences 92 (2013) 930 935

A profession can be defined by the following elements: a doctrine, an authority, an internal system of discipline, a code of ethics and culture. Applying this definition to the accounting profession, one must add a new characteristic: members of this profession provide services not in their own interest but for the public good, to meet the needs of the public interest. In the accounting profession case, it has assumed responsibility to serve the public interest, and professional authority of accountants justification is underline when said accounting information serves its purpose. Therefore, professional accountants recognize their responsibility to act in the public interest as part of a social contract. Moreover, the society is confident that members of the accounting profession are working in the public interest, respecting the "fundamental principles of professional conduct, such as expertise, knowledge, competence and integrity". (Jackling B, Watty K, 2008) In accordance with the legitimacy theory, an organizations survival is threatened if the community finds that the organization has violated the social contract. It is crucial to remember that it is the societys perception of the organizations behaviour, which is more valuable than it is the actual conduct. Community expectations can change over time, and standards that are legitimate at some point of time can be considered illegitimate at a later date (Deegan, 2002). The slow shift of the focus of auditing and accounting firms onto reaping bigger and quicker profit, the increased risk of a conflict within the social contract between the entity and society, an antagonism between the public interest, and financial self-interest of the accountant. Another theory that emphasizes the social role of the audit belongs to Professor Theodore Limperg at the University of Amsterdam in 1930. This Theory of Inspired Confidence connects the companies needs of reliable financial information with the ability of auditors to meet these requirements. Also, explain how the changes in the needs of society and the evolution of auditing methods and techniques interact, and change the role of the audit function. The audit is discussed in this theory from an economic perspective (Carmichael, 2009). Considering financial audit, it has no purpose or value if we do not consider its practical utility; to provide audit services traditionally demanded by the society. Initially, the audit function was to meet a need of individuals or groups within the society, for information or assurance regarding the activities and performance of others in that they have a legitimate interest (Flint, 1988). Services offered by the accounting profession are public goods because they are indispensable for the society as a whole. In the absence of regulations, service providers would not provide correctly these public goods. The clients of the accounting profession are the customers, creditors, governments, employers, employees, investors, business communities, donors, and others who rely on the objectivity and integrity of professional accountants to maintain the proper functioning of the economy. Professional accountants deal with a narrow range of activities, namely the preparation and delivery of accounting, compilation of financial statements, than their analysis and audit. They serve the interests of their clients; they have a service contract with them, a commercial contract with all its well-known components (contracting parties, object, deadline, value, and responsibilities of the parties). Thus, one can say that professional accountants serve private interests (those of the customers). Moreover, at the macroeconomic level, taking into consideration all the financial statements of all economic actors that can be analyzed with a common standard, it is already a matter of public interest. 4. Conflict between public interest and private interest

The notion of public interest is abstract; it refers to the society as a whole, seeing all its members together and not each of them individually. Public interest is defined in various ways, in the international literature. Baker (2005) devotes a study to defining the public interest mission concept based on an analysis of prominent bodies of the American accounting profession that declare they act for the public interest. In his study, Baker notes the existence of an ambiguity about how the accounting profession serves the public interest (given its own business interests). Baker defines public interest as the collective welfare of the people and institutions, and the

Adriana Tiron Tudor / Procedia - Social and Behavioral Sciences 92 (2013) 930 935

933

profession has to protect the economic interests of third parties by providing relevant and reliable economic data in terms of facilitating decision-making and effective economic action. Hanlon (1994) suggested that pursuing self-interest has led to a crisis in the accounting profession. Accountants put too strong an emphasis on the commercial side of their services; they prefer indicators related to turnover, revenue, and profit at the expense of other indicators that would reflect the public interest. The demise of Arthur Andersen is the result of their failure to meet societys expectations. This failure resulted in the termination of the social contract between society and this auditing company. This event has had wider consequences: the failure of some significant member players can be considered the beginning of an identity crisis of the whole accounting profession, which may affect the survival of other large, medium-sized, or small accounting firms and bodies of the accounting profession in general. Lee (1995) analyzed the accounting profession in the United Kingdom and USA to ascertain the phenomenon of conflict between personal and public interests. He showed how the British and American accounting profession has, due to a heated public debate on this issue, elaborated a professional outsourcing defence mission. The author concludes that the economic self-interest of accounting professionals is compatible with the accounting professions desire to promote the public interest. ORegan (2007) studied the accounting and auditing profession in Ireland and how they serve the public interest. This reflects a general confidence in the operation of the market, with regulation being considered necessary only to address shortcomings of the market. In the last period, a combination of factors, ranging from corporate collapses in which the sovereignty of the auditing profession were questioned, to a variety of political pressures arising from globalization and the exigencies of international financial markets, created an environment in which increased state action has been seen as critical to securing the public interest. In Ireland, these international developments conjoined with political and media disquiet at revelations regarding the conduct of leading accountants and auditing firms to create a situation in which modifications to this regime could be considered. The result was a state initiative to introduce an independent body, the Irish Auditing and Accounting Supervisory Authority, to regulate the profession. This study used public interest theories as the dominant paradigm to investigate this development. 5. An assessment tool of public interest oriented accounting profession actions

In 2003, IFAC reconsidered its regulatory responsibilities to determine how they can increase their position in ensuring that professional accountants worldwide serve the public interest in their activities. As part of this process, IFAC launched a series of consultations with global regulatory agencies, regional and international organizations, its member organizations, and the accounting profession. In November 2010, IFAC, with the intention of clarifying the concept of public interest, launched a public debate by issuing a position paper entitled A Public Interest Framework for the Accountancy Profession, intended to serve IFAC member organizations and others to determine better if they serve to the public interest through their actions and institutions. IFAC believes that all professional organizations should take public interest into account when discussing whose interests the profession serves. IFAC believes that the public interest can be defined as the net benefits derived for, and procedural rigor employed on behalf of, all society in relation to any action, decision, or policy. (IFAC, 2012) In order to define the public good, IFAC set up a conceptual framework based on three criteria: consideration of costs and benefits for the society as a whole, adherence to democratic principles and processes, and respect for cultural and ethical diversity. The conceptual framework provides criteria which help to formulate policy positions of the profession, as well as a well-defined benchmark for new regulations for the development of professional standards and assessment of the public interest. This document was truly well received by the international community of accounting professionals, regarding the comments received from professional organizations.

934

Adriana Tiron Tudor / Procedia - Social and Behavioral Sciences 92 (2013) 930 935

To determine if an action, decision, or policy undertaken are in the public interest, an assessment can be made against the public interest criteria, conscious of the dimensions of the assessment outcome (net benefits) and process. This involves two dimensions to be assessed: -Assessment of costs/benefit, the extent to which, for society as a whole, the benefits of the action, decision, or policy outweigh the costs; and -Assessment of the process, the extent to which the manner for considering the action, decision, or policy was conducted with the qualities of transparency, public accountability, independence, competence, adherence to due process, and participation. IFAC considers the degree to which each assessment is applied should correspond to the size, scope, and potential repercussions of the subject under evaluation (IFAC, 2012). Also, cultural differences and ethical systems should be considered in assessing whether or not the public interest is being served, especially where institutions are operating internationally. As a consequence of this, it started a process of changing some parts of the accounting profession code of ethics, and addressing conflicts of interest. 6. Conclusions

In the present context, we can say that the last financial crisis, which started in 2007, is a massive failure of the struggle between private and public interests at the expense of the latter. In pursuit of quick profits, speculative actions occur in all areas of activity. In recent years, various professional bodies, and especially the IFAC, have done great efforts to restore confidence in the accounting profession, and to strengthen its accountability to the public interest. Auditing standards were revised to increase objectivity and clarity; the Code of Ethics was also reviewed, especially with regard to the independence of professional accountants and conflict of interest. We are strongly convinced that societys trust in the accounting profession can only be strengthened if the accounting profession itself steps up its efforts to achieve these objectives. All these efforts of professional bodies are also made for the benefit of their members, in defence of confidence in the profession. Thus, the social contract between the accounting profession and the society, the community can be upheld, and the latter should not be forced to terminate this contract and seek other solutions. References

Baker, R.C. (2005), What is the meaning of the public interest?: Examining the ideology of the American public accounting profession, Accounting, Auditing & Accountability Journal, Vol. 18, Iss. 5, pp. 690703. Carmichael, D.R. (2009), The PCAOB and the Social Responsibility of the Independent Auditor, Valencia Conference on the value of audit. Deegan, C. (2002), Introduction: The legitimizing effect of social and environmental disclosures a theoretical foundation, Accounting, Auditing & Accountability Journal, Vol. 15, Iss. 3, pp. 282311. Flint, D. (1988), Philosophy and Principles of Auditing: An Introduction, London, McMillan. IFAC (2012), Public Interest Framework for the Accountancy Profession, Policy position no. 5, http://www.ifac.org/sites/default/files/publications/exposure-drafts/ED-Reg-PublIc-Policy_IFAC-Definitional-Framework-of-the-Public-Interest.pdf IFAC (2011) Handbook of the Code of Ethics for Professional Accountants Jackling B, Watty K (2008) The Accounting Professional of the Future: Never Mind the Quality Check the Look! http://www.afaanz.org/openconf/2008/modules/request.php?module=oc_proceedings&ac tion=view.php&a=Accept+as+Forum&id=420>. Lee, T. (1995), The professionalization of accountancy: a history of protecting the public interest in a self-interested way, Accounting, Auditing & Accountability Journal, Vol. 8, Iss. 4, pp. 4869. Hanlon, G. (1994), The Commercialisation of Accountancy: Flexible Accumulation and the Transformation of the Service Class. London, Macmillan. Mattli, W.,Buthe, T. (2005), Accountability in Accounting? The Politics of Private Rule-Making in the Public Interest, Governance: An International Journal of Policy, Administration, and Institutions, Vol. 18, No. 3, pp. 399429. ORegan P. (2007), Regulation, the public interest and the establishment of an accounting supervisory body, Journal of Management and Governance, Vol. 14, No. 4, pp. 297312.

Adriana Tiron Tudor / Procedia - Social and Behavioral Sciences 92 (2013) 930 935

935

Rezaee, Z. (2004),Restoring public trust in the accounting profession by developing anti-fraud education, programs, and auditing, Managerial Auditing Journal, Vol. 19, No. 1, pp. 134148. Sikka, P., Willmott, H., Lowe, T. (1989), Guardians of Knowledge and Public Interest: Evidence and Issues of Accountability in the UK Accountancy Profession, Accounting, Auditing & Accountability Journal, Vol. 2, Iss. 2. Thomadakis B.S. (2009) The accounting profession and the turning point of the crisis, Speech at a joint Estonian Auditing Board and IFAC Conference,http://users.cc.uoa.gr/thomadakis/index.php?lang=en&mode=pdf&file=2009-09-09-SpeechZaid, O.A. (1997), Could Auditing Standards Be Based on Societys Values? Journal of Business Ethics, Vol. 16, No. 11, pp. 11851200.

Вам также может понравиться

- 349-Article Text-636-1-10-20150722 PDFДокумент50 страниц349-Article Text-636-1-10-20150722 PDFSasha KhalishahОценок пока нет

- Correlations: Strong Positive Positive Relationships: Strongest 10 Strong 7Документ1 страницаCorrelations: Strong Positive Positive Relationships: Strongest 10 Strong 7Sasha KhalishahОценок пока нет

- Performance ManagementДокумент45 страницPerformance ManagementSasha KhalishahОценок пока нет

- 2009-03-15 225020 The Arnold Palmer HospitalДокумент4 страницы2009-03-15 225020 The Arnold Palmer Hospitaltrashmain25Оценок пока нет

- Aggregate Plan - Syndicate 5Документ3 страницыAggregate Plan - Syndicate 5Sasha KhalishahОценок пока нет

- Syndicate 7 - Microsoft Competing On Talent (A)Документ8 страницSyndicate 7 - Microsoft Competing On Talent (A)Sasha Khalishah100% (1)

- Case Primus Automation Division 2002Документ16 страницCase Primus Automation Division 2002Sasha Khalishah50% (2)

- Mattel Recalls 2007: Communication Implications For Quality Control, Outsourcing, and Consumer RelationsДокумент28 страницMattel Recalls 2007: Communication Implications For Quality Control, Outsourcing, and Consumer RelationsSasha KhalishahОценок пока нет

- Rethinking Foundation of EthicsДокумент15 страницRethinking Foundation of EthicsSasha KhalishahОценок пока нет

- Sustainability Report PT Holcim PDFДокумент96 страницSustainability Report PT Holcim PDFSasha KhalishahОценок пока нет

- Internal Audit and Management EntityДокумент5 страницInternal Audit and Management EntitySasha KhalishahОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Role of Judicial Accounting and Its Impact in Reducing The Phenomenon of Money LaunderingДокумент14 страницThe Role of Judicial Accounting and Its Impact in Reducing The Phenomenon of Money LaunderingIJAR JOURNALОценок пока нет

- AFC Club Licensing Regulations 2021Документ64 страницыAFC Club Licensing Regulations 2021MilkyОценок пока нет

- Punguza Mizigo Amendment Bill 2019 AДокумент17 страницPunguza Mizigo Amendment Bill 2019 AtnkОценок пока нет

- 5 MBA Freshers Resume Samples, Examples - Download Now! PDFДокумент7 страниц5 MBA Freshers Resume Samples, Examples - Download Now! PDFPiyushKumarОценок пока нет

- Sample Review ReportДокумент2 страницыSample Review ReportMae AstovezaОценок пока нет

- BA 5019 SHRM Question BankДокумент9 страницBA 5019 SHRM Question BankDEAN RESEARCH AND DEVELOPMENTОценок пока нет

- HB 265-2005 Meta Management A Stakeholder Quality Management Approach To Whole-Of-Enterprise ManagementДокумент25 страницHB 265-2005 Meta Management A Stakeholder Quality Management Approach To Whole-Of-Enterprise ManagementSAI Global - APACОценок пока нет

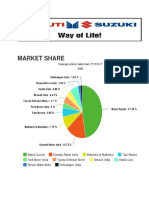

- Maruti Suzuki India LimitedДокумент17 страницMaruti Suzuki India LimitedDinesh KumarОценок пока нет

- Condominium Common SenseДокумент139 страницCondominium Common Senseseph8765Оценок пока нет

- Brantford 2011 Financial ReportsДокумент168 страницBrantford 2011 Financial ReportsHugo RodriguesОценок пока нет

- IFMIS - The Indian ExperienceДокумент44 страницыIFMIS - The Indian ExperiencesukeshsanghiОценок пока нет

- AuditingДокумент85 страницAuditingAiyub Uddin100% (1)

- Logging and Auditing Aid in Early WarningДокумент13 страницLogging and Auditing Aid in Early WarningrajinishОценок пока нет

- SBD Works (ICB) - November-FinalДокумент154 страницыSBD Works (ICB) - November-FinalHabtamu Desalegn75% (4)

- Ground Handling Certification Manual: Civil Aviation Authority of Sri LankaДокумент63 страницыGround Handling Certification Manual: Civil Aviation Authority of Sri LankaaminadabОценок пока нет

- Project Plan For Implementation of The Information Security Management SystemДокумент7 страницProject Plan For Implementation of The Information Security Management SystemSeb Wala0% (1)

- SODPOC North Vista Hospital DocumentsДокумент7 страницSODPOC North Vista Hospital DocumentsLas Vegas Review-JournalОценок пока нет

- Asq Certifications: Raising Your Marketability, Value, & KnowledgeДокумент25 страницAsq Certifications: Raising Your Marketability, Value, & KnowledgeAnjali NagarОценок пока нет

- AudTheo Compilation Chap9 14Документ130 страницAudTheo Compilation Chap9 14Chris tine Mae MendozaОценок пока нет

- Management Review Agenda TS 16949Документ2 страницыManagement Review Agenda TS 16949ArunОценок пока нет

- Bsci Auditing Cycle PDFДокумент7 страницBsci Auditing Cycle PDFShiv Raj Mathur100% (1)

- Verified Carbon StandardДокумент34 страницыVerified Carbon Standardkamlesh pardeshiОценок пока нет

- Chapter 05 Organizational Ethics and The Law: Answer KeyДокумент6 страницChapter 05 Organizational Ethics and The Law: Answer KeyMaryam Al-Samhan100% (1)

- National Food Co. (AMERICANA) Environmental Operating ProceduresДокумент3 страницыNational Food Co. (AMERICANA) Environmental Operating ProceduresAhmed TharwatОценок пока нет

- Risks Due To Convergence of Physical Security SystemsДокумент5 страницRisks Due To Convergence of Physical Security SystemsMuhammad Dawood Abu AnasОценок пока нет

- Environmental Aspects and ImpactДокумент69 страницEnvironmental Aspects and ImpactnormalОценок пока нет

- Intosai-P: Principles of Transparency and AccountabilityДокумент11 страницIntosai-P: Principles of Transparency and AccountabilityishtiaqОценок пока нет

- Su 1: Foundations of Internal AuditingДокумент1 страницаSu 1: Foundations of Internal Auditingʚïɞ Fi Fi ʚïɞОценок пока нет

- Personnel and Training SlidesДокумент36 страницPersonnel and Training SlidesKusum Shrestha100% (2)

- PQPДокумент16 страницPQPMuhammad ShazwanuddinОценок пока нет