Академический Документы

Профессиональный Документы

Культура Документы

9706 w13 QP 42

Загружено:

gkawsar22Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

9706 w13 QP 42

Загружено:

gkawsar22Авторское право:

Доступные форматы

UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS General Certificate of Education Advanced Level

ACCOUNTING Paper 4 Problem Solving (Supplementary Topics) Additional Materials: Answer Booklet/Paper

9706/42

October/November 2013 2 hours

*3184799459*

READ THESE INSTRUCTIONS FIRST If you have been given an Answer Booklet, follow the instructions on the front cover of the Booklet. Write your Centre number, candidate number and name on all the work you hand in. Write in dark blue or black pen. You may use a soft pencil for any diagrams, graphs or rough working. Do not use staples, paper clips, highlighters, glue or correction fluid. Answer all questions. All accounting statements are to be presented in good style. International accounting terms and formats should be used as appropriate. Workings should be shown. You may use a calculator. At the end of the examination, fasten all your work securely together. The number of marks is given in brackets [ ] at the end of each question or part question.

This document consists of 7 printed pages and 1 blank page.

IB13 11_9706_42/6RP UCLES 2013

[Turn over

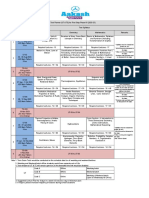

2 1 Alvin, Bertram and Chana are in partnership preparing accounts to 30 June. They share profits and losses in the ratio 4:3:1. On 30 June 2013, the partners decided to convert the business to a new limited company, Albech Ltd. Statement of Financial Position at 30 June 2013 $ Assets Non-current assets (NBV) Current assets Inventories Trade receivables Cash and cash equivalents Total assets Equity Capital account Alvin Bertram Chana Alvin Bertram Chana $ 75 000 90 000 60 000 24 840 44 950 18 555 88 345 313 345 $ $ 250 000 89 345 53 485 9 250 152 080 402 080

225 000 Current account

Total equity Liabilities Non-current liabilities Alvin 8% loan account Current liabilities Trade payables Total liabilities Total equity and liabilities

40 000 48 735 88 735 402 080

Permission to reproduce items where third-party owned material protected by copyright is included has been sought and cleared where possible. Every reasonable effort has been made by the publisher (UCLES) to trace copyright holders, but if any items requiring clearance have unwittingly been included, the publisher will be pleased to make amends at the earliest possible opportunity. University of Cambridge International Examinations is part of the Cambridge Assessment Group. Cambridge Assessment is the brand name of University of Cambridge Local Examinations Syndicate (UCLES), which is itself a department of the University of Cambridge.

UCLES 2013

9706/42/O/N/13

3 The terms of the transfer were as follows: 1 2 The agreed valuation of the business was $475 000. Consideration was to be satisfied as follows. 200 000 ordinary shares of $1 each. 200 000 8% non-redeemable preference shares of $0.50 each. Sufficient 10% long term debentures to enable Alvin to receive the same amount of annual interest he currently receives on his loan. The balance to be cash in the form of a long term bank loan. The ordinary shares and cash were allocated in the profit sharing ratio whilst the preference shares were allocated in the ratio of the capital account balances at 30 June 2013. All assets and liabilities were transferred to the new company with the exception of trade receivables, trade payables and the cash and cash equivalents. A bad debt of $720 was written off. Discounts of $3060 were agreed with the suppliers. All other assets were transferred at their book value. The loan from Alvin was repaid to him.

3 4 5 6 7 8

REQUIRED (a) Prepare the partnership realisation account. (b) Prepare the bank account. (c) Prepare the partners capital accounts to close the partnership. (d) Prepare the opening statement of financial position of Albech Ltd at 1 July 2013. [8] [8] [8] [10] [Total: 34]

UCLES 2013

9706/42/O/N/13

[Turn over

4 BLANK PAGE

UCLES 2013

9706/42/O/N/13

5 2 Swiftsure plc has provided the following financial information for the year ended 31 March 2013. Income Statement for the year ended 31 March 2013 $000 Revenue Cost of sales Gross profit Distribution costs Administrative expenses Profit/(Loss) from operations Income from investments Finance costs Profit/(Loss) before tax Tax Profit/(Loss) for the year attributable to equity holders 756 (454) 302 (126) (200) (24) 5 (12) (31) 0 (31) 2012 $000 942 (528) 414 (130) (165) 119 4 (12) 111 (25) 86

Statement of changes in equity for the year ended 31 March Retained earnings Balance at start of year Profit/(Loss) for the year Dividends paid Balance at end of year 2013 $000 110 (31) (49) 30 2012 $000 70 86 (46) 110

UCLES 2013

9706/42/O/N/13

[Turn over

6 Statements of Financial Position at 31 March 2013 $000 Assets Non-current assets Property plant and equipment Goodwill Investments Current assets Inventories Trade and other receivables Cash and cash equivalents Total assets Equity Ordinary shares Non-redeemable preference shares Share premium Retained earnings Total equity Liabilities Non-current liabilities 6% debentures Current liabilities Trade and other payables Current tax liabilities Bank overdraft Total liabilities Total equity and liabilities 274 90 75 439 74 95 169 608 180 100 30 30 340 2012 $000 217 90 75 382 54 65 76 195 577 120 80 110 310

150 57 61 118 268 608

200 42 25 67 267 577

UCLES 2013

9706/42/O/N/13

7 Note to the statement of financial position at 31 March 2013 Buildings $000 Cost Balance at 1 April 2012 Purchases Disposals Balance at 31 March 2013 Depreciation Balance at 1 April 2012 Disposals Charge for the year Balance at 31 March 2013 Net book value Balance at 31 March 2013 Balance at 31 March 2012 240 80 320 87 55 142 Plant & equipment $000 110 68 (20) 158 62 (12) 28 78 Motor vehicles $000 24 12 36 8 12 20 Total $000 374 160 (20) 514 157 (12) 95 240

178 153

80 48

16 16

274 217

During the year plant and equipment was sold for $5000. Additional information 1 2 3 4 $50 000 of the 6% debentures were redeemed at par on 31 March 2013. 20 000 additional $1 non-redeemable preference shares were issued at par on 1 October 2012. Preference dividends of $4000 were paid during the year. A rights issue of 1 new ordinary $1 share for every 2 held at a premium of $0.50 was made on 1 January 2013. No new shares had been issued in the year ended 31 March 2012. A final dividend on the ordinary shares of $0.30 per share was paid on 30 June 2012 and an interim dividend of $0.05 per share was paid on 31 March 2013.

REQUIRED (a) Prepare a statement of cash flows for the year ended 31 March 2013 in accordance with IAS 7. [28] (b) (i) Explain the difference between a cash budget and a statement of cash flows. (ii) State two purposes for which Swiftsure plc would use a statement of cash flows. (c) Explain the term impairment of non-current assets with reference to IAS 36. [4] [4] [4] [Total: 40]

UCLES 2013

9706/42/O/N/13

[Turn over

8 3 Sanghera Manufacturing plc produces office desks in two versions, standard and superior. The following information is available. Per unit Direct materials Direct labour Other variable costs Selling price Maximum demand per month Standard 5 kilos at $4.60 per kilo 3 hours at $8 an hour $10 $79 4000 units Superior 6 kilos at $6 per kilo 3 hours at $9 an hour $14 $103 3000 units

Total fixed costs for a month are $130 000. REQUIRED (a) Prepare a marginal costing statement showing the maximum monthly profit which can be achieved. [6] In recent months only 33 800 kilos of raw materials have been available for purchase. REQUIRED (b) Calculate the maximum monthly profit which can be achieved when there is a shortage of raw material. [11] The directors of Sanghera Manufacturing plc are considering investing in new machinery which would reduce wastage of raw materials. If the new machinery is purchased the usage of raw materials would be reduced by 9%. Annual depreciation on the new machinery would be $12 000 higher than that on the old machinery. The additional funds required to finance the purchase of the new machinery could be used elsewhere to bring in an income of $24 000 a year. The use of the new machinery would cause other variable costs to rise to $12 per unit for the standard model and $15.50 for the superior model. REQUIRED (c) Calculate the maximum monthly profit which could be achieved with the new machinery, assuming that the shortage of raw material continues. [13] (d) Advise the directors whether they should proceed with the purchase of the new machinery. [2] The directors of Sanghera Manufacturing plc wish to raise additional finance for investment purposes. REQUIRED (e) (i) Identify two possible sources of finance the directors could use. (ii) Explain one advantage and one disadvantage of each method you have chosen. [2] [6]

[Total: 40]

UCLES 2013

9706/42/O/N/13

Вам также может понравиться

- Qualifying Test Result (2014-15) Subject: Chemistry: Bangladesh School MuscatДокумент2 страницыQualifying Test Result (2014-15) Subject: Chemistry: Bangladesh School Muscatgkawsar22Оценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- BondingДокумент5 страницBondinggkawsar22Оценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Report of Preparatory Mockigcse SCДокумент55 страницReport of Preparatory Mockigcse SCgkawsar22Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Relative Atomic MassДокумент8 страницRelative Atomic Massgkawsar22Оценок пока нет

- Acid & BaseДокумент3 страницыAcid & Basegkawsar22Оценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Heinemann IGCSEChemistry Teachers CDSample Activity 51Документ1 страницаHeinemann IGCSEChemistry Teachers CDSample Activity 51gkawsar22Оценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Test Nichrome Wire Wire Wire ColourДокумент2 страницыTest Nichrome Wire Wire Wire Colourgkawsar22Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Guide To Practical QuestionsДокумент10 страницA Guide To Practical Questionsgkawsar22Оценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Activity 13.3: How Does Concentration Affect Reaction Rate?Документ2 страницыActivity 13.3: How Does Concentration Affect Reaction Rate?gkawsar22Оценок пока нет

- Acids QuestionsДокумент21 страницаAcids QuestionseeenusОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Guide To Practical QuestionsДокумент10 страницA Guide To Practical Questionsgkawsar22Оценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Seperatting and AnalysisДокумент3 страницыSeperatting and Analysisgkawsar22Оценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Plan For Weak StudentsДокумент1 страницаPlan For Weak Studentsgkawsar22Оценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Bangladesh School Muscat Class Notes Subjects: Social Studies Class-2 Section: A, B Chapter - 7 (Bangladesh Our Motherland)Документ5 страницBangladesh School Muscat Class Notes Subjects: Social Studies Class-2 Section: A, B Chapter - 7 (Bangladesh Our Motherland)gkawsar22Оценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Trump's Fake ElectorsДокумент10 страницTrump's Fake ElectorssiesmannОценок пока нет

- Assignment Class X Arithmetic Progression: AnswersДокумент1 страницаAssignment Class X Arithmetic Progression: AnswersCRPF SchoolОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- ACCA Advanced Corporate Reporting 2005Документ763 страницыACCA Advanced Corporate Reporting 2005Platonic100% (2)

- The Role of Mahatma Gandhi in The Freedom Movement of IndiaДокумент11 страницThe Role of Mahatma Gandhi in The Freedom Movement of IndiaSwathi Prasad100% (6)

- Unified Power Quality Conditioner (Upqc) With Pi and Hysteresis Controller For Power Quality Improvement in Distribution SystemsДокумент7 страницUnified Power Quality Conditioner (Upqc) With Pi and Hysteresis Controller For Power Quality Improvement in Distribution SystemsKANNAN MANIОценок пока нет

- NCPДокумент3 страницыNCPchesca_paunganОценок пока нет

- STAFFINGДокумент6 страницSTAFFINGSaloni AgrawalОценок пока нет

- The Changeling by Thomas MiddletonДокумент47 страницThe Changeling by Thomas MiddletonPaulinaOdeth RothОценок пока нет

- Sodium Borate: What Is Boron?Документ2 страницыSodium Borate: What Is Boron?Gary WhiteОценок пока нет

- Maths Lowersixth ExamsДокумент2 страницыMaths Lowersixth ExamsAlphonsius WongОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- UT & TE Planner - AY 2023-24 - Phase-01Документ1 страницаUT & TE Planner - AY 2023-24 - Phase-01Atharv KumarОценок пока нет

- SEx 3Документ33 страницыSEx 3Amir Madani100% (4)

- Chhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDFДокумент18 страницChhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDF余鸿潇Оценок пока нет

- (Dan Stone) The Historiography of The HolocaustДокумент586 страниц(Dan Stone) The Historiography of The HolocaustPop Catalin100% (1)

- List of Saturday Opened Branches and Sub BranchesДокумент12 страницList of Saturday Opened Branches and Sub BranchesSarmad SonyalОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Simulation of Channel Estimation and Equalization For WiMAX PHY Layer in Simulink PDFДокумент6 страницSimulation of Channel Estimation and Equalization For WiMAX PHY Layer in Simulink PDFayadmanОценок пока нет

- Best-First SearchДокумент2 страницыBest-First Searchgabby209Оценок пока нет

- In The World of Nursing Education, The Nurs FPX 4900 Assessment Stands As A PivotalДокумент3 страницыIn The World of Nursing Education, The Nurs FPX 4900 Assessment Stands As A Pivotalarthurella789Оценок пока нет

- The Training Toolbox: Forced Reps - The Real Strength SenseiДокумент7 страницThe Training Toolbox: Forced Reps - The Real Strength SenseiSean DrewОценок пока нет

- PMS Past Paper Pakistan Studies 2019Документ3 страницыPMS Past Paper Pakistan Studies 2019AsmaMaryamОценок пока нет

- Marketing Mix of Van HeusenДокумент38 страницMarketing Mix of Van HeusenShail PatelОценок пока нет

- Insung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningДокумент81 страницаInsung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningJack000123Оценок пока нет

- Advanced Technical Analysis: - Online Live Interactive SessionДокумент4 страницыAdvanced Technical Analysis: - Online Live Interactive SessionmahendarОценок пока нет

- 2018080, CRPC Research PaperДокумент23 страницы2018080, CRPC Research Paperguru charanОценок пока нет

- IBM System X UPS Guide v1.4.0Документ71 страницаIBM System X UPS Guide v1.4.0Phil JonesОценок пока нет

- ObliCon Digests PDFДокумент48 страницObliCon Digests PDFvictoria pepitoОценок пока нет

- Sample Midterm ExamДокумент6 страницSample Midterm ExamRenel AluciljaОценок пока нет

- Chapter 4 - Risk Assessment ProceduresДокумент40 страницChapter 4 - Risk Assessment ProceduresTeltel BillenaОценок пока нет

- ESU Mauritius Newsletter Dec 2014Документ8 страницESU Mauritius Newsletter Dec 2014Ashesh RamjeeawonОценок пока нет

- Mathematics: Quarter 3 - Module 6Документ15 страницMathematics: Quarter 3 - Module 6Ray Phillip G. Jorduela0% (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)