Академический Документы

Профессиональный Документы

Культура Документы

HTTP

Загружено:

nidhipatellОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

HTTP

Загружено:

nidhipatellАвторское право:

Доступные форматы

http://www.ibef.org/industry/bankingindia.

aspx Banking Sector in India

Last Updated: October 2013 Indian Banking Sector: Brief Introduction Indias Rs 77 trillion (US$ 1.25 trillion)-banking industry is the backbone to the economy. The sector emerged strong from global financial turmoil and proved its mettle when the developed economies were shaking. Indias banking sector is on a high-growth trajectory with around 3.5 ATMs and less than seven bank branches per 100,000 people, according to a World Bank report. The statistics are going to improve in near future as the Government aims to have maximum financial inclusion in the country. Policymakers are making all the efforts to provide a facilitating policy framework and infrastructure support to ensure meaningful financial inclusion. Apart from that, financial institutions are collaborating with other service providers (in the fields of telecom, technology and consumer product providers) to create an enabling environment. Online Banking Do-it-yourself is the new banking norm. Just an access to high-speed internet and user-friendly smart-phone applications have made people shift to alternative channels of banking. Many banks have adopted new-age internet tools to reach out to their clients to facilitate easy and comfortable banking. For instance, in ING Vysya Bank, 80 per cent of demand draft volumes generate through real time gross settlement (RTGS) and national electronics funds transfer (NEFT) while for HDFC Bank, 82 per cent of all transactions come from non-bank channels, with net banking and mobile banking accounting for 44 per cent of all transactions. "Most online transactions are real-time and do not involve paper-based transactions, thus saving customer time. We are witnessing rapid customer adoption for net banking over and above their normal account related transactions. They are now viewing net banking as a single stop for all their banking requirements," said Tejas Maniar, Head, net banking, HDFC Bank, said. Some banks like ICICI Bank have endeavoured to take a step further and introduce social mediabased banking apps. Pockets by ICICI allows its customers to have the convenience of banking while they are on Facebook. Similarly, Kotak Mahindra Bank is working on online personal finance management tools, shopping cart and an e-relationship manager.

Bankers reveal that customers use their net-banking facility for non-account related matters like bills payment, viewing credit card statements, ticket booking etc. For banks, online banking helps save costs too. The cost of doing a transaction at a teller counter ranges from Rs 40 to Rs 50 (US$ 0.65- 0.81) per transaction while in the case of net banking this lowers significantly to Rs 2 to Rs 3 (US$ 0.032-0.048) per transaction. Key Statistics

According to the Reserve Bank of India (RBI)s Quarterly Statistics on Deposits and Credit of Scheduled Commercial Banks, March 2013, Nationalised Banks accounted for 52.4 per cent of the aggregate deposits, while the State Bank of India (SBI) and its Associates accounted for 22 per cent. The share of New Private Sector Banks, Old Private Sector Banks, Foreign Banks, and Regional Rural Banks in aggregate deposits was 13.6 per cent, 5.1 per cent, 4 per cent and 2.9 per cent, respectively. Nationalised Banks accounted for the highest share of 51 per cent in gross bank credit followed by State Bank of India and its Associates (22.7 per cent) and New Private Sector Banks (14 per cent). Foreign Banks, Old Private Sector Banks and Regional Rural Banks had shares of around 4.9 per cent, 5 per cent and 2.5 per cent, respectively. Banks credit (loan) growth increased to 18 per cent for the fortnight ended September 6, 2013, while deposits grew by 13.37 per cent showed the data by RBI. India's foreign exchange reserves increased to US$ 277.73 billion as of October 4, 2013.

Recent Developments

Private lender HDFC Bank is planning to launch 500 mini branches, to be handled by one to three people, across India by the end of FY14. The bank has added about 219 mini branches pan-India since 2012. The basic motive behind such a initiative by the bank is to take the formal banking experience to people in unbanked and under-banked areas. A mini branch, manned by one, two or three persons, offers the entire range of products and services including savings and current accounts, fixed deposits, recurring deposits, credit card, instant debit card and also ATM facility. Products such as two wheeler loan, tractor loan, commercial vehicle loan, agricultural and commodities loan among others are also offered. Saudi Arabias National Commercial Bank is said to have signed Tata Consultancy Services (TCS) to make Indias largest software exporter implement its core banking platform for the former. TCS offers a plethora of retail banking solutions under BaNCS, a brand of core banking suite. National Commercial Bank intends to develop electronic services and provide technology-based banking solutions to its clients through this initiative. On the similar lines, ING Vysya Bank Ltd has appointed IBM and its MobileFirst banking solution for the development of its ING Vysya Mobile - a cost effective, secure and scalable mobile banking application. The new application will help the bank

maximise its reach to untapped markets. Moreover, the advanced features will enhance banks involvement with its clients, facilitating higher availability and convenience. Government Initiatives

In order to enhance financial inclusion in India, the RBI has taken an important step that has given banks conditional freedom to open branches in tier-I cities without seeking the central banks approval in each case. Also, the RBI has relaxed the norms for banks borrowing through foreign currency. For bank borrowings exceeding half the unimpaired tier-I capital made on or before November 30, 2013, for availing of RBIs swap facility, the central bank lowered the maturity requirement from three years to a year. The initiative aims to attract foreign inflows, as it is easier to get loans for one year, rather than three years. However, borrowings taken after November 30, would have to have maturity period of three years.

Road Ahead Banking industry is evolving to be more competitive and pro-active. Banks have started adopting new techniques like mobile and internet to provide their services. Projections have stated that the Indian banking and securities companies will spend about Rs 41,700 crore (US$ 6.78 billion) on IT products and services in 2013, 13 per cent more than what they spent in 2012. This includes spending on internal IT services (including personnel), software, data centre technologies, devices and telecom services, according to a study by research and analyst firm Gartner. Another report prepared by KPMG prepared in association with the Confederation of Indian Industry (CII) states that the Indian banking sector is expected to become fifth largest in the world by 2020. The report highlights that India is one of the top 10 economies of the world and with relatively lower domestic credit to gross domestic product (GDP) percentage, their lies a huge scope of growth for the banking sector. Bank credit is expected to grow at a compounded annual growth rate (CAGR) of 17 per cent in the medium term, eventually leading to higher credit penetration in the economy. Exchange Rate Used: INR 1 = US$ 0.01625 as on October 18, 2013 References: Media Reports, Press releases, RBI Documents.

Вам также может понравиться

- The Reward System: Asst. Prof. Anvi D. Kakkad, NLSIMCS 1Документ22 страницыThe Reward System: Asst. Prof. Anvi D. Kakkad, NLSIMCS 1nidhipatellОценок пока нет

- Read MeДокумент1 страницаRead MenidhipatellОценок пока нет

- HelloДокумент1 страницаHellonidhipatellОценок пока нет

- Time Effect That We Can See in The WorldДокумент1 страницаTime Effect That We Can See in The WorldnidhipatellОценок пока нет

- Enterprise Resource Planning (ERP) SystemsДокумент14 страницEnterprise Resource Planning (ERP) SystemsnidhipatellОценок пока нет

- GCR Group-3Документ49 страницGCR Group-3nidhipatellОценок пока нет

- Ha ThodiДокумент1 страницаHa ThodinidhipatellОценок пока нет

- Examining The Relationship of Work-Life Conflict and Employee Performance (A Case From NADRA Pakistan)Документ8 страницExamining The Relationship of Work-Life Conflict and Employee Performance (A Case From NADRA Pakistan)nidhipatellОценок пока нет

- Coaching and MentoringДокумент19 страницCoaching and MentoringnidhipatellОценок пока нет

- Gujarat Technological University AhmedabadДокумент2 страницыGujarat Technological University AhmedabadnidhipatellОценок пока нет

- VirtualDJ 5 - User GuideДокумент60 страницVirtualDJ 5 - User GuideJrex2224Оценок пока нет

- On Glass CeilingДокумент20 страницOn Glass Ceilingnidhipatell0% (1)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- SkillsetbehavioursetДокумент1 страницаSkillsetbehavioursetapi-3754364Оценок пока нет

- 4604 18765 1 PB PDFДокумент5 страниц4604 18765 1 PB PDFAqeelaBabarОценок пока нет

- 52 WK 52 WK Market Cap High Low Company Name Last Price % CHGДокумент3 страницы52 WK 52 WK Market Cap High Low Company Name Last Price % CHGnidhipatellОценок пока нет

- Eij Mrs 2041Документ10 страницEij Mrs 2041nidhipatellОценок пока нет

- Worck Life ConflictДокумент2 страницыWorck Life ConflictnidhipatellОценок пока нет

- KC1602Документ3 страницыKC1602nidhipatellОценок пока нет

- Link 3Документ1 страницаLink 3nidhipatellОценок пока нет

- Book 2Документ1 страницаBook 2nidhipatellОценок пока нет

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Bill Gates: Richest Man AliveДокумент13 страницBill Gates: Richest Man AlivenidhipatellОценок пока нет

- MarketingДокумент10 страницMarketingnidhipatellОценок пока нет

- MarketingДокумент10 страницMarketingnidhipatellОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Warren Buffet Powerpoint Presentation PDF FreeДокумент7 страницWarren Buffet Powerpoint Presentation PDF FreeHeeba jeeОценок пока нет

- Answer Key - Importing and ExportingДокумент4 страницыAnswer Key - Importing and Exportingmaria ronoraОценок пока нет

- NSSCO Economics SyllabusДокумент28 страницNSSCO Economics SyllabusKatjiuapengaОценок пока нет

- Winnipeg Transit - Route 11 To Kildonan Via DowntownДокумент5 страницWinnipeg Transit - Route 11 To Kildonan Via Downtownrcoffey_3Оценок пока нет

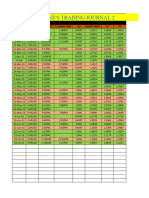

- Edrine Trading Journal 2Документ449 страницEdrine Trading Journal 2Edrinanimous AnandezОценок пока нет

- Budget Law SonДокумент16 страницBudget Law SonObrabotka FotografiyОценок пока нет

- Cash Basis Accounting Vs Accrual SystemДокумент3 страницыCash Basis Accounting Vs Accrual SystemAllen Jade PateñaОценок пока нет

- Project Work Report On Liquidity Management of Global IME Bank Ltd.Документ41 страницаProject Work Report On Liquidity Management of Global IME Bank Ltd.Shreesha Bhatta100% (4)

- Labor and UnemploymentДокумент3 страницыLabor and UnemploymentRIZZA MAE OLANOОценок пока нет

- Group-5 Chor BazaarДокумент8 страницGroup-5 Chor Bazaarsipun acharyaОценок пока нет

- International Trade 3Rd Edition by Robert C Feenstra Full Chapter PDFДокумент27 страницInternational Trade 3Rd Edition by Robert C Feenstra Full Chapter PDFsandra.watkins960100% (65)

- Bishop Centers For Care NOTICE - FINALДокумент2 страницыBishop Centers For Care NOTICE - FINALJames Mulder0% (1)

- Persuasive Essay - Project 4Документ6 страницPersuasive Essay - Project 4api-302893696Оценок пока нет

- Finshots Calculator For Tax RegimeДокумент6 страницFinshots Calculator For Tax RegimeSantosh mudaliarОценок пока нет

- Habitat International: Nesru H. Koroso, Monica Lengoiboni, Jaap A. ZevenbergenДокумент15 страницHabitat International: Nesru H. Koroso, Monica Lengoiboni, Jaap A. ZevenbergenSG GhoshОценок пока нет

- Economic Applications 225 SP 20Документ7 страницEconomic Applications 225 SP 20Muhammad UmarОценок пока нет

- CH 5 Elasticity and Its ApplicationДокумент17 страницCH 5 Elasticity and Its ApplicationAlfian NugrahaОценок пока нет

- RJ Analyze A Salary-Based Budget 1 Steven NДокумент3 страницыRJ Analyze A Salary-Based Budget 1 Steven Napi-541902866100% (1)

- 2023 11 11 16 29 12 Statement - 1699680552067Документ7 страниц2023 11 11 16 29 12 Statement - 1699680552067roshansm1978Оценок пока нет

- BBS 1st Year Business Economics 0009Документ6 страницBBS 1st Year Business Economics 0009Suzain Nath90% (10)

- LEC (2) International AccountingДокумент9 страницLEC (2) International AccountingMariam AbdelalimОценок пока нет

- Delcam - PowerINSPECT 2017 WhatsNew CNC RU - 2016Документ40 страницDelcam - PowerINSPECT 2017 WhatsNew CNC RU - 2016phạm minh hùngОценок пока нет

- Pa2 Class 10 SSTДокумент5 страницPa2 Class 10 SSTRavi DeshwalОценок пока нет

- REPORT P3 - JAVIER, DANICA T. (The Evolution of Philippine Housing Policy and Institution)Документ4 страницыREPORT P3 - JAVIER, DANICA T. (The Evolution of Philippine Housing Policy and Institution)DaNica Tomboc JavierОценок пока нет

- Leather Industry 1Документ12 страницLeather Industry 1Abhinanda GhoshОценок пока нет

- PP White FTC Lite RP307 HD LiteДокумент2 страницыPP White FTC Lite RP307 HD LiteCris AlexandrescuОценок пока нет

- Sesina Petros - Application Assignment On Use of Government PoliciesДокумент1 страницаSesina Petros - Application Assignment On Use of Government PoliciesSesinaОценок пока нет

- Esspresso Case WriteupДокумент3 страницыEsspresso Case WriteupGautamОценок пока нет

- ABM-APPLIED-ECONOMICS-12 Q1 W4 Mod4Документ25 страницABM-APPLIED-ECONOMICS-12 Q1 W4 Mod4Yannah LongalongОценок пока нет

- Vishwas's ProjectДокумент71 страницаVishwas's ProjectRAMJI VISHWAKARMAОценок пока нет