Академический Документы

Профессиональный Документы

Культура Документы

Depreciation Schedule: Income Statement 95

Загружено:

zahid_mahmood3811Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Depreciation Schedule: Income Statement 95

Загружено:

zahid_mahmood3811Авторское право:

Доступные форматы

Jun 2007 paper 1 1 2 3 B A C Capital expenditure is all expenditure involved in purchasing and making ready a new fixed asset

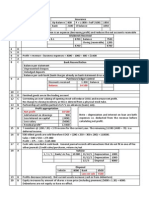

as well as improvements to an existing fixed asset (A, C and D are capital expenditure) The deposit is prepaid income and cannot be recorded as sales until the goods have been supplied. Depreciation schedule Year to Book value (start) Depreciation for year Book value (end) Sept 2005 $26 000 26 x .2 = $5 200 26 5.2 = $20 800 Sept 2006 $20 800 20.8 x .2 = $4 160 20.8 4.16 = $16 640 If sold for $12000 there is a loss of (12000 16640) = $4640 Write off the bad debt first 28000 2100 = $25 900. Allowance for doubtful debts Balance end (25900 x .05) 1 295 Balance (start) 1 200 Income statement 95 1 295 1 295 It is prudent to show inventory at the lower of cost and net realisable value to avoid overstating the asset. Consistency means that statements are prepared using the same policies and principles each year. Error of principle the new machine is an asset but has been debited to an expense account Trade receivables (debtors) Balance (start) 280 Bank (cash rec) 520 Sales 550 Discount All 30 Bad debts 15 Balance end 265 830 830 The balance would need to be credited twice- once to reverse the error, once to enter correctly. Purchases ledger has a credit balance so a credit will increase it. A error of original entry no effect on trial balance B both accounts have been debited creating a trial balance imbalance. C error of omission no effect on trial balance D error of principle no effect on trial balance Trade payables (creditors) Bank (payments to suppliers) 212 760 Balance (start) 51 660 Discount received 1 000 Purchases 218 440 Balance (end) 56 340 270 100 270 100 IAS 2 inventory is reported at cost or net realisable value whichever is lower Net realisable value = selling price any costs to sell Cost Net realisable value Inventory = 2160 + 2740 = $4900 Item 1 2 160 (2450 190) 2 260 cost < realisable value Item 2 3 190 (3 060 320) 2 740 cost > realisable value Balance sheet (Owners equity section) Capital (start) 52 add capital introduced 25 net profit (loss) (9) less drawings (13) Capital (end) 55

5 6 7 8

C A C C

9 10

D B

11

12

13

14

15

16 17 18 19 20

C D C A B

21 22 23 24 25 26 27 28

C C A D A C

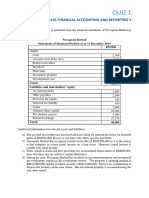

Profit appropriation Net profit 60 000 Salary A (9 000) Interest on Capital A (400) Interest on capital M (500) Residual profit 50 100 Profit share A 33 400 Profit share B 16 700 Ms share of profit = 16700 + 900 =$ 17 200 If mark-up = 50%, gross profit % = 33.33%. Therefore if 21000 (sales) $7000 (Gross profit) = $14000 (COGS) Closing stock = 15000 (op stock) + 18000 (purchases) - 14 000 (COGS) = $19 000 Closing stock (trading statement) = 20% x 93 500 = $18 700 Closing stock (balance sheet) = 18700 unrealised profit (18700 / 1.1) = $17 000 April receipts = (.2 x 220) + (.5 x 270) + (.3 x 240) = 44 + 135 + 72 = $251 000 Net assets do not change (no cash/assets received) Reserves are reduced to fund the bonus issue Pay interest first. Interest = 160 x 8% = $12 800. Remaining profit for dividends = 105 12.8 = $92 200. Maximum dividend 92.2/700 = 0.1317 A return on total assets C net/gross profit percentage D ROCE Inventory turnover = COGS / Ave stock. COGS = 5 (inv t/over) x $54 (ave stock) = $270 Sales = 270 x 1.3333 = $360 000 Liquidity ratio = (CA stock) : CL = 150 : (40 + 90 + 80) = 0.71 : 1 No correct answer because proposed dividend is not considered a liability any longer. Trade receivables turnover = debtors / credit sales x 360 debtors = (40 / 360) x 1406070 = 156 230 GP increase so selling price/mark-up has increased. NP fallen so a non-COGS expense has increased. Actual is below budget so absorption is less than budgeted for. Variable costs are materials and labour ($40 000). Variable cost per unit = $40 / 2 = $20 X makes a contribution of $6 per unit x 4000 units = $24 000. This leaves (48 24) = $24000 fixed costs for Y to cover. BEP = fixed costs / contribution = $24 / (12 8) = 6000 units Absorption rate = budgeted costs / budgeted patient days = $11 500 / (25 x 10) = $46 per patient day Contribution = selling price variable costs = 10 (1.2 + 0.8 + 1) = $7

29 30

A C

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- 2008 June Paper 1Документ2 страницы2008 June Paper 1zahid_mahmood3811Оценок пока нет

- Insurance: Balance 14 100Документ2 страницыInsurance: Balance 14 100zahid_mahmood3811Оценок пока нет

- Income Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent ReceivedДокумент2 страницыIncome Summary 3500 Balance (Prepayment) 1000: November 2009 Paper 11 Rent Receivedzahid_mahmood3811Оценок пока нет

- Capital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation AccountДокумент2 страницыCapital X (Share of Gain) 10 Capital Y (Share of Gain) 5: Revaluation Accountzahid_mahmood3811Оценок пока нет

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)От EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Рейтинг: 3.5 из 5 звезд3.5/5 (17)

- Revise Mid TermДокумент43 страницыRevise Mid TermThe FacesОценок пока нет

- Accounting and Finance Formulas: A Simple IntroductionОт EverandAccounting and Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)

- 2012 Nov Paper 32Документ2 страницы2012 Nov Paper 32zahid_mahmood3811Оценок пока нет

- MANACC - NotesW - Answers - BEP - The Master BudgetДокумент6 страницMANACC - NotesW - Answers - BEP - The Master Budgetldeguzman210000000953Оценок пока нет

- General Journal: Goodwill 70Документ2 страницыGeneral Journal: Goodwill 70zahid_mahmood3811Оценок пока нет

- 2013 June Paper 11Документ2 страницы2013 June Paper 11zahid_mahmood3811Оценок пока нет

- A) 1-Adjustment 1: Closing InventoryДокумент12 страницA) 1-Adjustment 1: Closing InventoryTuba AkbarОценок пока нет

- F7 SolutionsДокумент15 страницF7 Solutionsnoor ul anumОценок пока нет

- Additional Practice Exam Solution Updated Nov 19Документ7 страницAdditional Practice Exam Solution Updated Nov 19Shaunny BravoОценок пока нет

- Ch8 LongДокумент14 страницCh8 LongratikdayalОценок пока нет

- (Done) Activity-Chapter 2Документ8 страниц(Done) Activity-Chapter 2bbrightvc 一ไบร์ทОценок пока нет

- Lecture Notes Topic 4 Part 2Документ34 страницыLecture Notes Topic 4 Part 2sir bookkeeperОценок пока нет

- Soha Balance SheeДокумент7 страницSoha Balance SheeMohamed ZaitoonОценок пока нет

- Answers To Week 1 HomeworkДокумент6 страницAnswers To Week 1 Homeworkmzvette234Оценок пока нет

- Unit7 D (A2)Документ10 страницUnit7 D (A2)punte77Оценок пока нет

- Chapter 12 SolutionsДокумент10 страницChapter 12 Solutionshassan.murad100% (2)

- Acc Tut 12 Final JTДокумент21 страницаAcc Tut 12 Final JTxhayyyzОценок пока нет

- Seminar in Management AccountingДокумент6 страницSeminar in Management AccountinglolaОценок пока нет

- Year Revenue Cogs Depreciation S&A Taxable Income After-Tax Operating IncomeДокумент6 страницYear Revenue Cogs Depreciation S&A Taxable Income After-Tax Operating IncomeSpandana AchantaОценок пока нет

- EXERCISE 12-2 (15 Minutes)Документ9 страницEXERCISE 12-2 (15 Minutes)Mari Louis Noriell MejiaОценок пока нет

- Sol ch13Документ6 страницSol ch13Kailash KumarОценок пока нет

- 2022 All Solved Past PapersДокумент209 страниц2022 All Solved Past PapersareehaanaaveedОценок пока нет

- Chapter 9Документ22 страницыChapter 9Glynes NaboaОценок пока нет

- F9 - IPRO - Mock 1 - AnswersДокумент12 страницF9 - IPRO - Mock 1 - AnswersOlivier MОценок пока нет

- AC517Документ11 страницAC517Inaia ScottОценок пока нет

- Chapter 9Документ18 страницChapter 9Kate RamirezОценок пока нет

- Answer 11Документ10 страницAnswer 11kamallОценок пока нет

- Managerial Accounting - WS4 Connect Homework GradedДокумент9 страницManagerial Accounting - WS4 Connect Homework GradedJason HamiltonОценок пока нет

- Solutions To Chapter 10 Project Analysis: Est Time: 01-05Документ17 страницSolutions To Chapter 10 Project Analysis: Est Time: 01-05pinkwine2001Оценок пока нет

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIДокумент6 страницIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezОценок пока нет

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsДокумент12 страницSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranОценок пока нет

- Chapter 13 SolutionsДокумент5 страницChapter 13 SolutionsStephen Ayala100% (1)

- Chapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsДокумент9 страницChapter No. 2 Financial Statements, Taxes and Cash Flow Solutions To Questions and ProblemsNuman Rox0% (1)

- LeverageДокумент22 страницыLeverageAmelia PutriОценок пока нет

- Mfin202 Ch3 SolutionsДокумент14 страницMfin202 Ch3 SolutionsNayyar Abbas0% (1)

- Advanced Accounting Chapter 9Документ22 страницыAdvanced Accounting Chapter 9Ya LunОценок пока нет

- Week 5 NoteДокумент3 страницыWeek 5 Notenguyenlethuylinh0905Оценок пока нет

- Quiz 2 Solutions...Документ34 страницыQuiz 2 Solutions...Esmer AliyevaОценок пока нет

- SOLUTIONS - Practice Final ExamДокумент12 страницSOLUTIONS - Practice Final ExamsebmccabeeОценок пока нет

- Fundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFДокумент38 страницFundamentals of Corporate Finance 7Th Edition Brealey Solutions Manual Full Chapter PDFcolonizeverseaat100% (10)

- ACCA F2 AC N MCДокумент10 страницACCA F2 AC N MCSamuel DwumfourОценок пока нет

- AC550 Week Four AssigmentДокумент8 страницAC550 Week Four Assigmentsweetpr22Оценок пока нет

- Financial Accounting - Tugas 5 - 30 Oktober 2019Документ3 страницыFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanОценок пока нет

- Mock Test SolutionsДокумент11 страницMock Test SolutionsMyraОценок пока нет

- Concepts Review and Critical Thinking Questions 4Документ6 страницConcepts Review and Critical Thinking Questions 4fnrbhcОценок пока нет

- Dewa Satria Rachman Lubis - 11 - 4-17Документ15 страницDewa Satria Rachman Lubis - 11 - 4-17DewaSatriaОценок пока нет

- Chapter+2 3Документ14 страницChapter+2 3kanasanОценок пока нет

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayДокумент22 страницыAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedОценок пока нет

- Managerial Accounting Chapter 6 Homework: 4 Out of 4 PointsДокумент10 страницManagerial Accounting Chapter 6 Homework: 4 Out of 4 PointsReal Estate Golden TownОценок пока нет

- Corporate FinanceДокумент11 страницCorporate FinanceShamsul HaqimОценок пока нет

- Solutions To End-Of-Chapter ProblemsДокумент22 страницыSolutions To End-Of-Chapter ProblemsKalyani GogoiОценок пока нет

- 7110 s03 QP 1Документ12 страниц7110 s03 QP 1zahid_mahmood3811Оценок пока нет

- 7110 s03 Ms 1Документ1 страница7110 s03 Ms 1zahid_mahmood3811Оценок пока нет

- 7110 s04 Ms 1Документ1 страница7110 s04 Ms 1zahid_mahmood3811Оценок пока нет

- Aqa Accn4 W Ms Jun13Документ12 страницAqa Accn4 W Ms Jun13zahid_mahmood3811Оценок пока нет

- Question Paper Unit f012 01 Accounting ApplicationsДокумент28 страницQuestion Paper Unit f012 01 Accounting Applicationszahid_mahmood3811Оценок пока нет

- Aqa Accn1 QP Jun13 2Документ20 страницAqa Accn1 QP Jun13 2zahid_mahmood3811Оценок пока нет

- Aqa Accn4 W Ms Jun12Документ15 страницAqa Accn4 W Ms Jun12zahid_mahmood3811Оценок пока нет

- Lasania Real TasteДокумент6 страницLasania Real Tastezahid_mahmood3811Оценок пока нет

- Aqa 2121 Accn3 W MS Jan 12Документ14 страницAqa 2121 Accn3 W MS Jan 12zahid_mahmood3811Оценок пока нет

- Aqa Accn1 QP Jun12Документ16 страницAqa Accn1 QP Jun12zahid_mahmood3811Оценок пока нет

- Aqa Accn1 W Ms Jan13Документ10 страницAqa Accn1 W Ms Jan13zahid_mahmood3811Оценок пока нет

- GoodmorningДокумент17 страницGoodmorningzahid_mahmood3811Оценок пока нет

- 2012 Nov Paper 32Документ2 страницы2012 Nov Paper 32zahid_mahmood3811Оценок пока нет

- 2013 June Paper 11Документ2 страницы2013 June Paper 11zahid_mahmood3811Оценок пока нет

- Profit (50:50 Split) 16: RealisationДокумент3 страницыProfit (50:50 Split) 16: Realisationzahid_mahmood3811Оценок пока нет

- General Journal: Goodwill 70Документ2 страницыGeneral Journal: Goodwill 70zahid_mahmood3811Оценок пока нет

- Diet PlanДокумент1 страницаDiet Planzahid_mahmood3811Оценок пока нет

- (Normal Probability) (Discrete Probability) : Xy Xy X yДокумент1 страница(Normal Probability) (Discrete Probability) : Xy Xy X yzahid_mahmood3811Оценок пока нет

- Ratio Analysis of IJMДокумент26 страницRatio Analysis of IJMawaismaqbool83% (6)

- 2022-07-16 IFR AsiaДокумент42 страницы2022-07-16 IFR AsialeenaОценок пока нет

- Accounting/Actg Misc Valix Chapter 1-Chapter 6-Joy: Click Here For AnswersДокумент22 страницыAccounting/Actg Misc Valix Chapter 1-Chapter 6-Joy: Click Here For AnswersMarjorie PalmaОценок пока нет

- Annual Report 2018 2019Документ272 страницыAnnual Report 2018 2019Nishita AkterОценок пока нет

- Updated ABAT SEC 10-K Distributor Report - Final DraftДокумент32 страницыUpdated ABAT SEC 10-K Distributor Report - Final DraftabateventsОценок пока нет

- Strategic Management of Coca ColaДокумент84 страницыStrategic Management of Coca ColaAnjum hayatОценок пока нет

- Investments Time and Capital MarketsДокумент41 страницаInvestments Time and Capital MarketsAgam Moga AnandaОценок пока нет

- 1.omc JR - Assistance PDFДокумент384 страницы1.omc JR - Assistance PDFNaresh Kumar BeheraОценок пока нет

- Green FundingДокумент21 страницаGreen Fundingamreensiddiqui1501Оценок пока нет

- Initial Public Offering (Ipo)Документ59 страницInitial Public Offering (Ipo)Arun Guleria85% (40)

- Details of Jivan Arogya PlanДокумент4 страницыDetails of Jivan Arogya PlanbhaveshbhoiОценок пока нет

- Nature of Financial ManagementДокумент12 страницNature of Financial ManagementShashankОценок пока нет

- KPIT Technologies Fundamental AnalysisДокумент15 страницKPIT Technologies Fundamental AnalysisvvpvarunОценок пока нет

- Measures To Improve Life Insurance ProfitabilityДокумент9 страницMeasures To Improve Life Insurance ProfitabilityTirth ShahОценок пока нет

- Market Outlook: Dealer's DiaryДокумент16 страницMarket Outlook: Dealer's DiaryAngel BrokingОценок пока нет

- QUIZ 1 Deferred Taxes SolutionДокумент3 страницыQUIZ 1 Deferred Taxes SolutionMohd NuuranОценок пока нет

- Partnership FormationДокумент5 страницPartnership FormationAra AlcantaraОценок пока нет

- Final Exam - Part IДокумент2 страницыFinal Exam - Part IPriyanka PatelОценок пока нет

- Seminarski Rad 2014-15 FPSP ModelДокумент7 страницSeminarski Rad 2014-15 FPSP ModelAleksandar TomićОценок пока нет

- Case Study Hertz CorporationДокумент27 страницCase Study Hertz CorporationEliasVoelker60% (5)

- What Is Return On Equity - ROE?Документ12 страницWhat Is Return On Equity - ROE?Christine DavidОценок пока нет

- Tybcom - A - Group No. - 5Документ10 страницTybcom - A - Group No. - 5Mnimi SalesОценок пока нет

- Harvard Business Review - What Is Strategy - Michael Porter PDFДокумент21 страницаHarvard Business Review - What Is Strategy - Michael Porter PDFPrem ChopraОценок пока нет

- Chapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksДокумент25 страницChapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksAli EmadОценок пока нет

- Banking and InsuranceДокумент13 страницBanking and InsuranceKiran Kumar50% (2)

- Running Head: A Financial Forecast For New World Chemicals IncДокумент9 страницRunning Head: A Financial Forecast For New World Chemicals IncTimОценок пока нет

- All Book Answers 1Документ50 страницAll Book Answers 1Josh Gabriel BorrasОценок пока нет

- Business Cycles in Romania PAperДокумент10 страницBusiness Cycles in Romania PAperElena PotoroacăОценок пока нет

- Sources of FundsДокумент22 страницыSources of FundsImtiaz RashidОценок пока нет

- Sustainable Banking With The PoorДокумент8 страницSustainable Banking With The PoorramiraliОценок пока нет