Академический Документы

Профессиональный Документы

Культура Документы

Tax Cheat Sheet - Exam 1

Загружено:

tyg1992Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Cheat Sheet - Exam 1

Загружено:

tyg1992Авторское право:

Доступные форматы

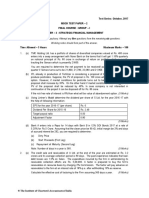

Chapter 1 Qualifying Child: child, stepchild, adopted, sibling, half/step-sibling, descendant, foster child, must be younger or permanently disabled

Domicile Test: lived with taxpayer for more than the year Age Test: under 19, full-time student under 24 (enrolled at least 5 months) Joint Return Test: child doesnt file joint return with spouse, unless its to claim refund Citizenship Test: US citizen, resident of US, Mexico, or Canada, alien child adopted/living with US citizen Self-Support Test- child cannot provide more than of their own support Qualifying Relatives: relative to taxpayer or member of household Gross Income Test: Gross income not greater than $3900 Support Test: support must come from taxpayer Joint Return Test: doesnt file joint return with spouse, unless its to claim refund Citizenship Test: US citizen, resident of US, Mexico, or Canada, alien child adopted/living with US citizen Basic Gain & Loss: Amount Realized (Sales PriceSales Expense)- Adjusted Basis (Cost-Acc. Depreciation)= Realized Gain/Loss Capital Gains/Losses: Short term- held for <12 months- tax ordinary Long Term- held for > 12 month. If the Tax bracket: (10% &15% is 0%) (25% & 35% is 15%) (39.6% is 20%) Long Term Capital Loss- Only $3000 per year; carryforward the unused balance Chapter 2 Excluded From Gross Income: accident, casualty, health and life insurance proceeds, bequests, child support, damages for physical personal injury/sickness, disability benefits, gifts, inheritances, meals and lodging, military allowances, ministers dwelling rental allowance, municipal bond interest, relocation payments, tuition/book scholarships, social security & veterans benefits, welfare payments, workers compensation Alimony: deductible-payer; taxable-payee

Prizes & Awards: Winning from: tv, radio, door prizes, lotteries are income (Line 21) Exception: Employee awards of tangible personal property (up to $400) received for recognition of length of service or safety achievement. Up to $1,600 under qualified plan award Life Insurance: Interest is taxable Unemployment Comp: Line 19 Chapter 3 Net Operating Losses: from business and casualty items only, carry back two years then forward twenty, must elect this in year of a loss Hobby Losses: activities not engaged in for profit motive, only deduct expenses up to amount of hobby income, hobby income must always be included Chapter 4 Active Income: wages, salaries, self-employed Portfolio Income: dividends and interest Passive Income: rental real estate Moving Expenses: $0.24 per mile, must change job sites, at least 50 miles away, must work 39 weeks out of the year after move. Form 3903 Traditional IRA: deduction for AGI, distributions in retirement are taxable (line 32) MAX: $5,500 Roth IRA: no deduction for AGI, distribution in retirement is not taxable MAX: $5,500 **** if 50 and older $1,000 more can be added ** phase out: (high of range-AGI)/ (high of range-low of range) x (5500 or 6500) Chapter 5 Schedule A: Medical Expenses: prescription drugs/medicines, fees for doctors/dentist/nurse/hospital, hearing aids/ eyeglasses/dentures/contact lenses, medical transportation/lodging/crutches/wheelchairs, birth control prescription, acupuncture, psychiatric care, insurance/medicare premiums, nursing home care for chronically ill ($0.24 per mile, $50 per night/person overnight; no meal) Interest: deductible- mortgage, mortgage penalties, investment (only deduct up to income, rest carriedforward). Education: $2,500 per year, deduction for AGI. Contributions: Up to 50% of AGI Casualty & Theft Losses: deductible in year of loss. Unless President declares disaster area losses, rule A- decrease of fair market value, not exceed adjusted

basis of property (partial/complete destruction of personal, business, investment), (Gross loss- $100= Net Loss- 10% of AGI= casualty loss deduction) rule B- deduction for adjusted basis (complete destruction of business/ investment property) Schedule B: Interest- Everything Dividends- Tax bracket: (10% &15% is 0%) (25% & 35% is 15%) (39.6% is 20%) IF DIVIDENDS ARE IN 10% OR MORE, SUBTRACT FROM INCOME BEFORE CALCULTING TAX!!!!! Schedule C: Gambling Winning: only if professional; losses on Schedule A under miscellaneous Transportation: $0.565 per mile (Line 9) Standard mileage method: Business miles x .565 Actual cost method: Actual costs x percentage Travel Expenses: airfare, lodging, taxis, laundry, tips, meals Primarily Business in US: all travel deductible, business and personal expenses split in Primarily Business outside US: travel cost split between business and personal based on days Primarily Pleasure: travel non-deductible, meals, lodging, transportation split between personal and business Entertainment: 50% deduction directly related to business Educational: cost of course, lodging, 50% of meals/entertainment (if primarily to obtain qualifying education), Paid to meet requirements of employer, law, regulation or maintain/improve existing skills. Educators can deduct $250 (have to work at least 900 hours) Dues & Subscriptions: must be related to profession Special Clothing & Uniforms: required & cannot be worn outside Business Gifts: deduct $25 per done per year, plus the cost of wrapping & shipping. Husband & wife are considered one done, unless both are clients. No limitation on small business gifts up to $4 each, if company name is on them. Gifts to supervisor/boss non-deductible Bad Debts: business bad debts are ordinary deductions- deductible, no limit, arise from trade/business. Non-business are short-term capital losses, when individual is not in the business of loaning money Office-in-Home: home must be used regularly and exclusively as place of business, regular place to

meet clients/patients, office is separate, dwelling unit is used for inventory storage. Income Limitation: cannot create a net loss for the business. Allocation: % of sq feet rent, home insurance, repairs, cleaning, gardening, homeowners dues, and depreciation, excess carried-forward Form 8829: self-employed. Allowable deducts schedule c, if taken as an employee business expense schedule a, but must be for employers convenience & no regular office provided Schedule D: non-business bad debts under shortterm, limit $3,000, remaining balance can be carriedforward. Bankrupt! Form 8582: Passive loss rule: may not deduct in excess of gains, losses can carry-forward, deduct when investment is sold, cannot offset active/ portfolio income Rental property is passive, even if actively managed unless heavily involved (more than 50% personal service or more than 750 hours), individual taxpayers can take up to $25,000 of rental loss against ordinary income, $25,000 is reduced $0.50 per $1 over AGI $100,000 Schedule E: Primarily personal use- rented less than 15 days; rental income not taxable, mortgage interest & real estate taxes schedule a, other expenses are non-deductible Primarily rental use- rented more than 15 days and personal use isnt more than 14 days or 10% of rented days; allocation- rental days / total days used= rental%, Expenses x rental%= rental deductions, personal days/total days= personal%, personal% of mortgage& real estate on schedule A If rental deductions exceed rental income, deduct against other income, passive loss Dual use- rented more than 15 days and personal days more than 14 days or 10% of rental days, allocation: same as primarily rental Formula: Gross rental income-interest & taxes=balance- utilities & maintenance=balance depreciation (limit to the amount left) = Net Income Schedule SE:

Вам также может понравиться

- 2013 REG Last Minute Study Notes (Bonus)Документ47 страниц2013 REG Last Minute Study Notes (Bonus)olegscherbina100% (3)

- CPA Exam Regulation - Entity Comparison ChartДокумент5 страницCPA Exam Regulation - Entity Comparison ChartMelissa Abel100% (1)

- Comprehensive Problem Accounting 101Документ2 страницыComprehensive Problem Accounting 101Heidi Norris Dawson25% (4)

- Tax Cheat SheetДокумент2 страницыTax Cheat SheetJean Pingfang Koh100% (3)

- Tax Cheat Sheet Exam 2-bДокумент5 страницTax Cheat Sheet Exam 2-btyg1992Оценок пока нет

- REG NotesДокумент41 страницаREG NotesNick Huynh75% (4)

- Agency: REG - Notes Chapter 7Документ9 страницAgency: REG - Notes Chapter 7mohit2ucОценок пока нет

- IT NINJA-CPA-Review-BEC-Notes ITДокумент24 страницыIT NINJA-CPA-Review-BEC-Notes ITSāikrushna KāvūriОценок пока нет

- Tax FormulasДокумент13 страницTax FormulasCrnc NavidadОценок пока нет

- Financial Statement AssignmentДокумент16 страницFinancial Statement Assignmentapi-275910271Оценок пока нет

- Tax Cheat Sheet Exam 2 - CH 7,8,10,11Документ2 страницыTax Cheat Sheet Exam 2 - CH 7,8,10,11tyg1992Оценок пока нет

- Oracle Apps Financial Interview Questions Answers GuideДокумент7 страницOracle Apps Financial Interview Questions Answers GuideJohn StephensОценок пока нет

- 26 - LCCI L2 BKA - ASE 20093 - MS - Sep 2019 PDFДокумент16 страниц26 - LCCI L2 BKA - ASE 20093 - MS - Sep 2019 PDFKhin Zaw Htwe100% (3)

- Chapter Two Relevant Information and Decision Making: 5.1 The Role of Accounting in Special DecisionsДокумент11 страницChapter Two Relevant Information and Decision Making: 5.1 The Role of Accounting in Special DecisionsshimelisОценок пока нет

- Tax Notes Ch. 1-6Документ3 страницыTax Notes Ch. 1-6tyg1992Оценок пока нет

- USD Tax Clinics: Dan Kimmons Reference Librarian USD Legal Research Center 619.260.6846 Dkimmons@sandiego - EduДокумент36 страницUSD Tax Clinics: Dan Kimmons Reference Librarian USD Legal Research Center 619.260.6846 Dkimmons@sandiego - EducglaskoОценок пока нет

- A Accrual Accounting MethodДокумент19 страницA Accrual Accounting MethodVivian Montenegro GarciaОценок пока нет

- 9 Expenses & Other IncomesДокумент22 страницы9 Expenses & Other IncomesZindgiKiKhatirОценок пока нет

- Financial Accounting and AnalysisДокумент8 страницFinancial Accounting and AnalysisRia LapizОценок пока нет

- An Overview of Itemized DeductionsДокумент19 страницAn Overview of Itemized DeductionsRock Rose100% (1)

- CpaДокумент17 страницCpaKeti AnevskiОценок пока нет

- Account ClassificationДокумент3 страницыAccount ClassificationUsama MukhtarОценок пока нет

- Rules of Debits and CreditsДокумент6 страницRules of Debits and CreditsJubelle Tacusalme Punzalan100% (1)

- Taxation CheatsheetДокумент2 страницыTaxation CheatsheetKem Hạt DẻОценок пока нет

- Tax Prep ChecklistДокумент3 страницыTax Prep ChecklistNabeel SamadОценок пока нет

- Accounting TerminologyДокумент71 страницаAccounting TerminologyBiplob K. SannyasiОценок пока нет

- Bookkeeping PDFДокумент4 страницыBookkeeping PDFYo Yo0% (1)

- BVA CheatsheetДокумент3 страницыBVA CheatsheetMina ChangОценок пока нет

- Basic Tax OutlineДокумент29 страницBasic Tax OutlinestaceyОценок пока нет

- Regulation MyNotesДокумент50 страницRegulation MyNotesaudalogy100% (1)

- (ToA) Cash & Cash EquivalentsДокумент1 страница(ToA) Cash & Cash Equivalentslooter198Оценок пока нет

- Federal Income Tax Final Outline - 2011 HeenДокумент62 страницыFederal Income Tax Final Outline - 2011 HeenMandy RovelliОценок пока нет

- Module 2 Introducting Financial Statements - 6th EditionДокумент7 страницModule 2 Introducting Financial Statements - 6th EditionjoshОценок пока нет

- Terminology Balance SheetДокумент3 страницыTerminology Balance SheetMarcel Díaz AdriàОценок пока нет

- Personal Financial Statement 2637980Документ3 страницыPersonal Financial Statement 2637980Alexander Weir-WitmerОценок пока нет

- Tax Cheat Sheet AY1415 Semester 2 V2Документ3 страницыTax Cheat Sheet AY1415 Semester 2 V2Krithika NaiduОценок пока нет

- Tax Formula and Tax Determination An Overview of Property TransactionsДокумент23 страницыTax Formula and Tax Determination An Overview of Property TransactionsJames Riley Case100% (1)

- Accounting Basics 1Документ75 страницAccounting Basics 1allangreslyОценок пока нет

- Sole Proprietorship Vs Partnership Vs Limited Liability Company (LLC) Vs Corporation Vs S CorporationДокумент8 страницSole Proprietorship Vs Partnership Vs Limited Liability Company (LLC) Vs Corporation Vs S CorporationAlex TranОценок пока нет

- CPA Reg Practice Individual TaxationДокумент2 страницыCPA Reg Practice Individual TaxationMatthew AminiОценок пока нет

- PFSAДокумент84 страницыPFSAAkinlabi HendricksОценок пока нет

- Federal Taxation I - W AnswersДокумент8 страницFederal Taxation I - W AnswersGracie Ortuoste0% (1)

- TOP 250+ IFRS Interview Questions and Answers 28 PDFДокумент1 страницаTOP 250+ IFRS Interview Questions and Answers 28 PDFHafisMohammedSahib100% (1)

- Personal Financial StatementДокумент3 страницыPersonal Financial StatementIra Hilado BelicenaОценок пока нет

- Self-Employed PersonДокумент3 страницыSelf-Employed PersonqwertyОценок пока нет

- Taxation of Partnerships PowerpointДокумент7 страницTaxation of Partnerships PowerpointALAJID, KIM EMMANUELОценок пока нет

- Business Enterprise OutlineДокумент48 страницBusiness Enterprise OutlineRyan TengowskiОценок пока нет

- KAHS Registration Doc. 2018Документ2 страницыKAHS Registration Doc. 2018Kimberley Alpine Hockey SchoolОценок пока нет

- Accounting Crash CourseДокумент7 страницAccounting Crash CourseschmooflaОценок пока нет

- Prepare and Match ReciptsДокумент15 страницPrepare and Match Reciptstafese kuracheОценок пока нет

- SSA AcronymsДокумент14 страницSSA AcronymsAtul SharmaОценок пока нет

- Exam 2 Income Tax Study Guide (The Better Version)Документ48 страницExam 2 Income Tax Study Guide (The Better Version)Mary Tol100% (1)

- Accounting As An Information SystemДокумент14 страницAccounting As An Information SystemAimee SagastumeОценок пока нет

- Individual Tax Return Problem 2 Form 1040 Schedule AДокумент1 страницаIndividual Tax Return Problem 2 Form 1040 Schedule AHenry PhamОценок пока нет

- CPA Regulation (Reg) Notes 2013Документ7 страницCPA Regulation (Reg) Notes 2013amichalek0820100% (3)

- 078 Federal Income TaxДокумент67 страниц078 Federal Income Taxcitygirl518Оценок пока нет

- Projected Balance SheetДокумент1 страницаProjected Balance Sheetr.jeyashankar9550100% (1)

- Taxation IIДокумент467 страницTaxation IItoufiqОценок пока нет

- Tax Book 2016-17 - Version 1.0a USB PDFДокумент372 страницыTax Book 2016-17 - Version 1.0a USB PDFemc2_mcv100% (1)

- Chapter 2 - Corporate Formations and Capital StructureДокумент17 страницChapter 2 - Corporate Formations and Capital StructuresegajayОценок пока нет

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityОт EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityОценок пока нет

- SOC - Chapter 1-4 NotesДокумент4 страницыSOC - Chapter 1-4 Notestyg1992Оценок пока нет

- Rory Irizarri: Next-Gen Online NetworkingДокумент1 страницаRory Irizarri: Next-Gen Online Networkingtyg1992Оценок пока нет

- Evaluating A Company's Resources, Capabilities, and CompetitivenessДокумент44 страницыEvaluating A Company's Resources, Capabilities, and Competitivenesstyg1992100% (1)

- Chap 015Документ75 страницChap 015tyg1992100% (1)

- Itemized Deductions & Other Incentives: Income Tax Fundamentals 2014Документ44 страницыItemized Deductions & Other Incentives: Income Tax Fundamentals 2014tyg1992Оценок пока нет

- Chapter One: Mcgraw-Hill/IrwinДокумент17 страницChapter One: Mcgraw-Hill/Irwintyg1992Оценок пока нет

- Derivative Review - Fall 2014Документ9 страницDerivative Review - Fall 2014tyg1992Оценок пока нет

- Competitive Advantage (CA) Means PeopleДокумент3 страницыCompetitive Advantage (CA) Means Peopletyg1992Оценок пока нет

- Johnson & JohnsonДокумент130 страницJohnson & Johnsontyg1992Оценок пока нет

- CPA Journal - The External Confirmation ProcessДокумент4 страницыCPA Journal - The External Confirmation Processtyg1992Оценок пока нет

- Robert Frost QuoteДокумент1 страницаRobert Frost Quotetyg1992Оценок пока нет

- Unit 1 (Autosaved)Документ23 страницыUnit 1 (Autosaved)Yuvnesh KumarОценок пока нет

- FM Cia 1.2Документ7 страницFM Cia 1.2Rohit GoyalОценок пока нет

- Business Plan Guide Only Complete SampleДокумент42 страницыBusiness Plan Guide Only Complete SampleJitter GromiaОценок пока нет

- REYES, RespondentsДокумент6 страницREYES, RespondentsPat EspinozaОценок пока нет

- Price WarsДокумент29 страницPrice WarsDave GremmelsОценок пока нет

- Seligram Case QuestionsДокумент2 страницыSeligram Case QuestionsZain Bharwani100% (1)

- AFM Sample Model - 2 (Horizontal)Документ18 страницAFM Sample Model - 2 (Horizontal)munaftОценок пока нет

- MBA 503 Milestone 2 - LawiДокумент8 страницMBA 503 Milestone 2 - LawiJeremy LawiОценок пока нет

- ESDC Employment ContractДокумент3 страницыESDC Employment ContractMang JoseОценок пока нет

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerДокумент16 страницQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerJINENDRA JAINОценок пока нет

- Reddit - FAR NotesДокумент232 страницыReddit - FAR Notesneha jainОценок пока нет

- Tax Notification Account Billing Information Tab PDFДокумент2 страницыTax Notification Account Billing Information Tab PDFIbrahiem MohammadОценок пока нет

- Sample 1 JVAДокумент4 страницыSample 1 JVALourdes Mae Acosta JangОценок пока нет

- APRIL Sal Slip PDFДокумент1 страницаAPRIL Sal Slip PDFGaurav KapahiОценок пока нет

- Nec 7 InsuranceДокумент44 страницыNec 7 Insurancenishant khadkaОценок пока нет

- NCC Bank ReportДокумент65 страницNCC Bank Reportইফতি ইসলামОценок пока нет

- Inverse Floater Valuation ParametersДокумент20 страницInverse Floater Valuation ParametersNishant KumarОценок пока нет

- The Payment of Bonus Act, 1965Документ15 страницThe Payment of Bonus Act, 1965Raman GhaiОценок пока нет

- XII Test (Death, Ret - Diss)Документ4 страницыXII Test (Death, Ret - Diss)MLastTryОценок пока нет

- 2012 Annual Report AcerinoxДокумент142 страницы2012 Annual Report Acerinoxaniket_ghoseОценок пока нет

- Assignment On Decision Making ProcessДокумент23 страницыAssignment On Decision Making ProcessMuhammad SaeedОценок пока нет

- BS - May 1Документ14 страницBS - May 1Lingesh SivaОценок пока нет

- Reviewer in Intermediate Accounting (Midterm)Документ9 страницReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoОценок пока нет

- Cash Budgeting Notes and QuestionsДокумент39 страницCash Budgeting Notes and Questions邹尧Оценок пока нет

- International Financial Institutions and Human Rights - Implications For Public Health PDFДокумент17 страницInternational Financial Institutions and Human Rights - Implications For Public Health PDFFERNANDA LAGE ALVES DANTASОценок пока нет

- Service Marketing Case 8Документ12 страницService Marketing Case 8Herry Windawaty100% (7)

- I. Adjustments Ii. WorksheetДокумент11 страницI. Adjustments Ii. WorksheetDarwyn MendozaОценок пока нет