Академический Документы

Профессиональный Документы

Культура Документы

April 2014, Global Manufacturing Activity Indicator (PMI)

Загружено:

Eduardo PetazzeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

April 2014, Global Manufacturing Activity Indicator (PMI)

Загружено:

Eduardo PetazzeАвторское право:

Доступные форматы

April 2014, Global Manufacturing Activity Indicator (PMI)

by Eduardo Petazze

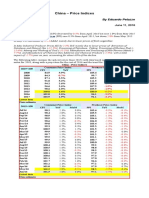

The global manufacturing sector continued to expand at a slower pace than the previous month.

An unexpected fall in PMI survey in Japan, contrary to the trend in the manufacturing industry until March 2014 reduced by 0.3 points on

global PMI.

Summary

Mfg. Apr. 2014 Summary

Rate of change

Number of countries

negative unchange positive total

Expanding (PMI>50.09)

13

1

16

30

Stable (PMI~50.0)

0

0

0

0

Contracting (PMI<49.91)

6

0

3

9

Total

19

1

19

39

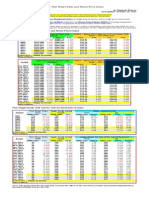

Breakdown by countries and links

Worldwide Manufacturing PMI (SA)

2013

2014

Apr14 vs. Mar14

weight

Reference links

Country

Jan Feb Mar Apr Jan Feb Mar Apr Chg. Direction

Rate of Chg

1.35% Australian Industry Group Australia

40.2 45.6 44.4 36.7 46.7 48.6 47.9 44.8 -3.1 Contracting Faster

0.48%

Bank Austria

Austria

48.6 48.3 48.1 47.8 54.0 53.0 51.0 51.4 0.4 Expanding Faster

3.24%

HSBC - Apr14 report

Brazil

53.2 52.5 51.8 50.8 50.8 50.4 50.6 49.3 -1.3 Contracting from expanding

2.05%

See detail below

Canada

54.7 54.1 55.5 51.2 54.3 55.1 54.3 53.5 -0.8 Expanding Slower

18.94%

See detail below

China

51.4 50.3 51.3 50.5 50.0 49.4 49.2 49.3 0.1 Contracting Unchange

0.38%

HSBC - Apr14 Report

Czech Rep. 48.3 49.9 49.1 49.5 55.9 56.5 55.5 56.5 1.0 Expanding Faster

0.28%

DILF

Denmark

55.7 61.7 51.5 49.3 57.1 57.2 62.5 60.4 -2.1 Expanding Slower

0.74%

HSBC - Apr14 Report

Egipt

45.0 46.0 44.8 44.2 48.7 50.0 49.8 49.5 -0.3 Contracting Faster

3.03%

MARKIT

France

42.9 43.9 44.0 44.4 49.3 49.7 52.1 51.2 -0.9 Expanding Slower

4.32%

MARKIT / BME

Germany

49.8 50.3 49.0 48.1 56.5 54.8 53.7 54.1 0.4 Expanding Faster

0.35%

MARKIT

Greece

41.7 43.0 42.1 45.0 51.2 51.3 49.7 51.1 1.4 Expanding from contracting

0.52%

HSBC composite

Hong Kong 52.5 51.2 50.5 49.9 52.7 53.3 49.9 49.7 -0.2 Contracting Faster

0.27%

MLBKT

Hungary

55.9 54.1 55.5 51.5 57.9 54.3 53.7 54.6 0.9 Expanding Faster

7.03%

HSBC - Apr14 Report

India

53.2 54.2 52.0 51.0 51.4 52.5 51.3 51.3 0.0 Expanding Unchange

1.79%

HSBC - Apr14 report

Indonesia

49.7 50.5 51.3 51.7 51.0 50.5 50.1 51.1 1.0 Expanding Faster

0.25%

Investec

Ireland

50.3 51.5 48.6 48.0 52.8 52.9 55.5 56.1 0.6 Expanding Faster

0.37%

IPLMA - Bank Hapoalim

Israel

49.3 53.6 51.8 50.8 49.5 50.0 48.9 51.4 2.5 Expanding from contracting

2.39%

MARKIT / ADACI

Italy

47.8 45.8 44.5 45.5 53.1 52.3 52.4 54.0 1.6 Expanding Faster

6.26%

MARKIT / JMMA

Japan

47.7 48.5 50.4 51.1 56.6 55.5 53.9 49.4 -4.5 Contracting from expanding

2.27%

HSBC - Apr14 report

Korea

49.9 50.9 52.0 52.6 50.9 49.8 50.4 50.2 -0.2 Expanding Slower

0.09% BLOMINVEST Bank - Report Lebanon

44.5 45.5 46.2 48.5 2.3 Contracting Slower

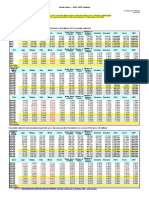

2.49%

See detail below

Mexico

53.0 52.6 52.3 51.3 52.3 51.6 52.2 51.9 -0.3 Expanding Slower

0.93%

NEVI

Netherlands 50.2 49.0 48.0 48.2 54.8 55.2 53.7 53.4 -0.3 Expanding Slower

0.19% Business NZ - Apr14 Report N. Zealand 55.0 55.4 52.7 55.9 56.2 56.3 58.0 55.2 -2.8 Expanding Slower

0.37%

NIMA - Apr14 Report

Norway

49.9 48.5 49.7 49.2 52.9 51.5 52.4 51.2 -1.2 Expanding Slower

1.11%

HSBC - Apr14 report

Poland

48.6 48.9 48.2 46.9 55.4 55.9 54.0 52.0 -2.0 Expanding Slower

3.41%

HSBC - Apr14 Report

Russia

52.0 52.0 50.8 50.6 48.0 48.5 48.3 48.5 0.2 Contracting Slower

1.28% SABB HSBC - Apr14 Report S. Arabia

58.1 58.5 58.9 58.0 59.7 58.6 57.0 58.5 1.5 Expanding Faster

0.48%

SIPMM

Singapore

50.2 49.4 50.6 50.3 50.5 50.9 50.8 51.1 0.3 Expanding Faster

0.80%

See detail below

S. Africa

49.6 51.9 49.4 50.4 50.1 51.6 50.3 48.4 -1.9 Contracting from expanding

1.85%

MARKIT

Spain

46.1 46.8 44.2 44.7 52.2 52.5 52.8 52.7 -0.1 Expanding Unchange

0.54%

SILF

Sweden

49.2 50.9 52.1 49.6 56.4 54.6 56.5 55.5 -1.0 Expanding Slower

0.50% SVME / CREDIT SUISSE Swiss

52.4 50.3 49.2 49.9 56.1 57.6 54.4 55.8 1.4 Expanding Faster

1.26%

HSBC - Apr14 Report

Taiwan

51.5 50.2 51.2 50.7 55.5 54.7 52.7 52.3 -0.4 Expanding Slower

1.58%

HSBC - Apr14 Report

Turkey

54.0 53.5 52.3 51.3 52.7 53.4 51.7 51.1 -0.6 Expanding Slower

0.37%

HSBC - Apr14 Report

UAE

55.0 55.4 54.3 54.0 57.1 57.3 57.7 58.3 0.6 Expanding Faster

3.23%

MARKIT / CIPS

UK

50.5 47.9 48.6 50.2 56.6 56.2 55.8 57.3 1.5 Expanding Faster

22.70%

See detail below

USA

52.8 53.1 52.4 50.8 53.7 54.1 54.3 54.9 0.6 Expanding Faster

0.50%

HSBC - Apr14 Report

Vietnam

50.1 48.3 50.8 51.0 52.1 51.0 51.3 53.1 1.8 Expanding Faster

100.0%

Worldwide Mfg PMI

see Note

51.0 51.0 50.8 50.0 52.6 52.5 52.2 52.0 -0.2 Expanding Slower

MARKIT

Euro area

47.9 47.9 46.8 46.7 54.0 53.2 53.0 53.4 0.4 Expanding Faster

HSBC EMI (Composite)

Emerging

54.1 52.6 52.8 51.5 51.4 51.1 50.3 50.4 0.1 Expanding Unchange

JP Morgan

Global

51.4 50.9 51.1 50.4 53.0 53.2 52.4 51.9 -0.5 Expanding Slower

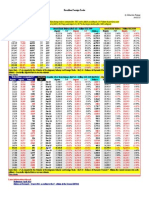

More than one PMI survey

Country Jan Feb Mar Apr Jan Feb Mar Apr Chg. Direction

Rate of Chg

Markit - RBC

50.5 57.1 49.3 50.1 51.7 52.9 53.3 52.9 -0.4 Expanding Slower

IVEY

Canada

58.9 51.1 61.6 52.2 56.8 57.2 55.2 54.1 -1.1 Expanding Slower

Canada average

54.7 54.1 55.5 51.2 54.3 55.1 54.3 53.5 -0.8 Expanding Slower

CFLP - Stats (Chinese)

50.4 50.1 50.9 50.6 50.5 50.2 50.3 50.4 0.1 Expanding Unchange

HSBC - Apr14 report

China

52.3 50.4 51.6 50.4 49.5 48.5 48.0 48.1 0.1 Contracting Unchange

China average

51.4 50.3 51.3 50.5 50.0 49.4 49.2 49.3 0.1 Contracting Unchange

INEGI - SA data:

51.5 53.1 53.9 52.2 52.5 52.3 52.4 52.8 0.3 Expanding Faster

IIEEM report - SA data:

52.5 51.5 50.8 49.9 50.4 50.4 52.4 51.1 -1.4 Expanding Slower

Mexico

HSBC- Apr14 Report

55.0 53.4 52.2 51.7 54.0 52.0 51.7 51.8 0.1 Expanding Unchange

Mexico average

53.0 52.6 52.3 51.3 52.3 51.6 52.2 51.9 -0.3 Expanding Slower

BER-KAGISO -Apr14 -xls

48.9 52.3 48.8 49.6 49.9 51.7 50.3 47.4 -2.9 Contracting from expanding

HSBC - Apr14 Report

S. Africa

50.3 51.5 50.0 51.3 50.3 51.5 50.2 49.4 -0.8 Contracting from expanding

S. Africa Average

49.6 51.9 49.4 50.4 50.1 51.6 50.3 48.4 -1.9 Contracting from expanding

US Regional PMI (see below)

50.3 51.9 51.0 50.4 56.1 52.1 53.6 54.3 0.7 Expanding Faster

ISM Report On Business

52.3 53.1 51.5 50.0 51.3 53.2 53.7 54.9 1.2 Expanding Faster

USA

MARKIT

55.8 54.3 54.6 52.1 53.7 57.1 55.5 55.4 -0.1 Expanding Unchange

US average

52.8 53.1 52.4 50.8 53.7 54.1 54.3 54.9 0.6 Expanding Faster

US Regional Average Manufacturing PMI

50.3 51.9 51.0 50.4 56.1 52.1 53.6 54.3 0.7 Expanding Faster

CHICAGO B. BAROMETER

53.9 55.0 52.2 49.3 59.6 59.8 55.9 63.0 7.1 Expanding Faster

Dallas Manufacturing as if it were PMI

53.1 51.5 53.3 49.6 53.0 53.4 55.8 57.5 1.7 Expanding Faster

Kansas City Fed Mfg. (SA) as if were PMI 49.5 46.0 48.0 48.5 52.5 52.0 55.0 53.5 -1.5 Expanding Slower

Richmond Mfg. Activity as if it were PMI 45.0 49.7 49.8 47.3 55.9 47.2 46.7 53.5 6.8 Expanding from contracting

Philadelphia - Business Outlook Survey

47.2 44.1 49.3 50.5 54.7 46.9 54.5 58.3 3.8 Expanding Faster

ISM - Milwaukee - (Bloomberg chart)

51.3 56.5 51.0 48.4 52.8 48.6 56.0 47.3 -8.8 Contracting from expanding

ISM-NY - Apr14 Report

56.7 58.8 51.2 58.3 64.4 57.0 52.0 50.6 -1.4 Expanding Slower

Empire State Mfg - Current conditions

46.0 53.6 53.2 51.2 56.3 52.2 52.8 50.6 -2.2 Expanding Slower

Last data published in bold

Revised data in italics

Note: Worldwide Manufacturing PMI was weighted by GDP-PPP estimate by the IMF for 2014 (April 2014 estimate)

Additional Links

Week Ahead Economic Overview [19-23 May]: Flash PMI data for the US, China and the Eurozone

China's economy in worst growth patch since early-2009

Global healthcare services activity rises sharply in April

JPMorgan Global Composite PMI

JPMorgan Global Services PMI

HSBC China Services PMI

Markit Eurozone Composite PMI

UK PMI surveys signal faster economic growth and record job creation at start of second quarter

Inflationary pressures ease in Fragile 5 emerging economies

UK PMI surveys signal faster economic growth and record job creation at start of second quarter

Signs of life in Spanish economy after strong start to second quarter

Markit US Services PMI

Week Ahead 5-9 May]: Manufacturing and services PMI releases to add insights into global economic trends

China CFLP non-manufacturing PMI at 54.8, from 54.5 in Mar14 (Chinese)

China - CFLP Manufacturing PMI

US economy stagnates in first quarter

Japan Manufacturing Production Index and PMI

Japan Manufacturing PMI slides into contraction, but some signs point to short-lived impact from sales tax rise

Вам также может понравиться

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaДокумент1 страницаChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeОценок пока нет

- Turkey - Gross Domestic Product, Outlook 2016-2017Документ1 страницаTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- China - Price IndicesДокумент1 страницаChina - Price IndicesEduardo PetazzeОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- India - Index of Industrial ProductionДокумент1 страницаIndia - Index of Industrial ProductionEduardo PetazzeОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Germany - Renewable Energies ActДокумент1 страницаGermany - Renewable Energies ActEduardo PetazzeОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Reflections On The Greek Crisis and The Level of EmploymentДокумент1 страницаReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeОценок пока нет

- WTI Spot PriceДокумент4 страницыWTI Spot PriceEduardo Petazze100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Highlights, Wednesday June 8, 2016Документ1 страницаHighlights, Wednesday June 8, 2016Eduardo PetazzeОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Analysis and Estimation of The US Oil ProductionДокумент1 страницаAnalysis and Estimation of The US Oil ProductionEduardo PetazzeОценок пока нет

- México, PBI 2015Документ1 страницаMéxico, PBI 2015Eduardo PetazzeОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Документ1 страницаCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeОценок пока нет

- U.S. Employment Situation - 2015 / 2017 OutlookДокумент1 страницаU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeОценок пока нет

- India 2015 GDPДокумент1 страницаIndia 2015 GDPEduardo PetazzeОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- U.S. New Home Sales and House Price IndexДокумент1 страницаU.S. New Home Sales and House Price IndexEduardo PetazzeОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Singapore - 2015 GDP OutlookДокумент1 страницаSingapore - 2015 GDP OutlookEduardo PetazzeОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- South Africa - 2015 GDP OutlookДокумент1 страницаSouth Africa - 2015 GDP OutlookEduardo PetazzeОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- U.S. Federal Open Market Committee: Federal Funds RateДокумент1 страницаU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Japan, Population and Labour Force - 2015-2017 OutlookДокумент1 страницаJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeОценок пока нет

- US Mining Production IndexДокумент1 страницаUS Mining Production IndexEduardo PetazzeОценок пока нет

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesДокумент1 страницаUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeОценок пока нет

- Mainland China - Interest Rates and InflationДокумент1 страницаMainland China - Interest Rates and InflationEduardo PetazzeОценок пока нет

- China - Power GenerationДокумент1 страницаChina - Power GenerationEduardo PetazzeОценок пока нет

- Highlights in Scribd, Updated in April 2015Документ1 страницаHighlights in Scribd, Updated in April 2015Eduardo PetazzeОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- European Commission, Spring 2015 Economic Forecast, Employment SituationДокумент1 страницаEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeОценок пока нет

- Brazilian Foreign TradeДокумент1 страницаBrazilian Foreign TradeEduardo PetazzeОценок пока нет

- US - Personal Income and Outlays - 2015-2016 OutlookДокумент1 страницаUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeОценок пока нет

- Chile, Monthly Index of Economic Activity, IMACECДокумент2 страницыChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeОценок пока нет

- South Korea, Monthly Industrial StatisticsДокумент1 страницаSouth Korea, Monthly Industrial StatisticsEduardo PetazzeОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- United States - Gross Domestic Product by IndustryДокумент1 страницаUnited States - Gross Domestic Product by IndustryEduardo PetazzeОценок пока нет

- Japan, Indices of Industrial ProductionДокумент1 страницаJapan, Indices of Industrial ProductionEduardo PetazzeОценок пока нет

- Business Plan Report of Nari SringarДокумент31 страницаBusiness Plan Report of Nari SringarAakriti SapkotaОценок пока нет

- Blades Expands Internationally with Thai SubsidiaryДокумент4 страницыBlades Expands Internationally with Thai SubsidiaryFaizan ChОценок пока нет

- UET Fee Challan TitleДокумент1 страницаUET Fee Challan Titlemubarakuet225Оценок пока нет

- Shared and Composed by Aniqa Malik EcomomicsДокумент87 страницShared and Composed by Aniqa Malik EcomomicssdsdawoodОценок пока нет

- Chapter 1 - Introduction To Strategic ManagementДокумент39 страницChapter 1 - Introduction To Strategic ManagementMuthukumar Veerappan100% (1)

- HET New+Classical+and+New+KeynesianДокумент55 страницHET New+Classical+and+New+Keynesiansyedur92Оценок пока нет

- Economics For Today 5th Edition Layton Solutions ManualДокумент10 страницEconomics For Today 5th Edition Layton Solutions Manualcassandracruzpkteqnymcf100% (31)

- SBI Plans 'By-Invitation-Only' Branches in 20 CitiesДокумент1 страницаSBI Plans 'By-Invitation-Only' Branches in 20 CitiesSanjay Sinha0% (1)

- Time Series Analysis ForecastingДокумент18 страницTime Series Analysis ForecastingUttam BiswasОценок пока нет

- David Kreps-Gramsci and Foucault - A Reassessment-Ashgate (2015)Документ210 страницDavid Kreps-Gramsci and Foucault - A Reassessment-Ashgate (2015)Roc SolàОценок пока нет

- Folk Exam Janitorial Costs Shipping ExpensesДокумент3 страницыFolk Exam Janitorial Costs Shipping ExpensesabeeralkhawaldehОценок пока нет

- Case Study On ITC E-ChoupalДокумент3 страницыCase Study On ITC E-ChoupalRaafia RizwanОценок пока нет

- Ali Kadri - Imperialism With Reference To SyriaДокумент137 страницAli Kadri - Imperialism With Reference To SyriaRastyAhmadОценок пока нет

- Chapter 1 Microeconomics FTUДокумент17 страницChapter 1 Microeconomics FTUVăn PhạmОценок пока нет

- Semi Detailed Lesson Plan in Applied Economics Date:, 2016 Track: Academic Time: 2:20 - 3:20 P.M. Grade 11 Strand: ABM Code: ABM - AE12-Ia-d-1Документ2 страницыSemi Detailed Lesson Plan in Applied Economics Date:, 2016 Track: Academic Time: 2:20 - 3:20 P.M. Grade 11 Strand: ABM Code: ABM - AE12-Ia-d-1Myla Ebillo67% (3)

- Class Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25Документ2 страницыClass Test-I Intermediate Microeconomics-II Time: 1 Hour Maximum Marks: 25amrat meenaОценок пока нет

- Profitability AnalysisДокумент43 страницыProfitability AnalysisAvinash Iyer100% (1)

- Case 4 - Curled MetalДокумент4 страницыCase 4 - Curled MetalSravya DoppaniОценок пока нет

- The Shock DoctrineДокумент1 страницаThe Shock DoctrineEaswer SanОценок пока нет

- Pump-Dump Manipulation AnalysiДокумент15 страницPump-Dump Manipulation Analysihedrywan8Оценок пока нет

- Economics WordsearchДокумент1 страницаEconomics WordsearchSandy SaddlerОценок пока нет

- Public Finance Chapter 4Документ36 страницPublic Finance Chapter 4LEWOYE BANTIEОценок пока нет

- Profit and Loss, by Ludwig Von MisesДокумент59 страницProfit and Loss, by Ludwig Von MisesLudwig von Mises Institute100% (20)

- Currency War - Reasons and RepercussionsДокумент15 страницCurrency War - Reasons and RepercussionsRaja Raja91% (11)

- Man Eco 3Документ3 страницыMan Eco 3James Angelo AragoОценок пока нет

- Demand AnalysisДокумент42 страницыDemand AnalysisTejas PatilОценок пока нет

- Chapter 01Документ15 страницChapter 01Saad AnisОценок пока нет

- Eco AssignmentДокумент6 страницEco AssignmentYukta PatilОценок пока нет

- IIT Madras MBA Programme Curriculum (July 2018Документ93 страницыIIT Madras MBA Programme Curriculum (July 2018karanОценок пока нет

- MMPC 014Документ6 страницMMPC 014Pawan ShokeenОценок пока нет