Академический Документы

Профессиональный Документы

Культура Документы

Tutorial Questions Weesadk 5. - Risk Uncertain

Загружено:

Minh VănОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tutorial Questions Weesadk 5. - Risk Uncertain

Загружено:

Minh VănАвторское право:

Доступные форматы

AFF9260 Australian capital markets WEEK 5 Tutorial Questions: Risk and Uncertainty

1. The table below shows the probability distribution of shares prices for Company . !a" Calculate the e#pected $alue of this share price !b" Assume that Company shares ha$e a lon%&term standard de$iation of returns of 0.'(. )f the shares of Company * ha$e an e#pected return of 9.1(+ and a standard de$iation of 0.'2, which company-s shares would be selected by a risk a$erse in$estor and why. Share return (%) Pro a ility

7.95 7.49 8.12 8.42 8.96 9.12 9.25 9.36 9.75 8.75 7.85

2.

0.08 0.06 0.04 0.07 0.08 0.18 0.16 0.12 0.07 0.09 0.05

A risk neutral in$estor is plannin% to in$est his money for one year. )f there is /ero inflation he would be willin% to in$est at 10+ per annum. )n fact he e#pects that the inflation rate o$er the comin% year will be '+ per annum & what is the minimum interest rate he would accept in this case. 0ohn approaches a bank for a loan for one year. The risk a$erse bank has assessed the credit risk of 0ohn, and has decided that 0ohn is a risky borrower with an e#pected default rate of 0.01+. The bank is willin% to lend to 0ohn, pro$ided he pays an interest rate which yields the bank an e#pected return of 11+ per annum. 2hat interest rate would they char%e. !Assume /ero inflation"

(.

'.

*riefly e#plain !1&2 sentences" what is $olatility, e#cess return, and hed%in%.

3olatiliy 4 refers to the amount of uncertainty or risk about the si/e of chan%es in a security5s $alue. 6#cess return 4 )n$estment returns from a security or portfolio that e#ceed a benchmark or inde# with a similar le$el of risk.! total return of an asset or security portfolio less the risk&free return" 7ed%in% 4 8the practice of mana%in% risk e#posure, usually by takin% contracts !such as deri$ati$es" that ha$e an offsettin% e#posure- and 8a process of establishin% a second position to counterbalance an e#posed e#istin% position-.

1.

6#plain the concept of a risk&return trade&off.

The risk9return tradeoff is the balance between the desire for the lowest possible risk and the hi%hest possible return. 6. :isk mana%ement is important to the lon%&term sur$i$al of a corporation !a" ;efine and e#plain the nature of risk. &:isk is the possibility or probability that somethin% may occur that is une#pected, not anticipated. &:isk adds uncertainty to the business mana%ement and forecastin% processes. &A business is e#posed to both operational risks and financial risks.

AFF9260 Australian capital markets

&<perational risks impact upon the normal day&to&day functions of a business. &Financial risks affect business cash flows and the $alue of balance sheet assets and liabilities. !b" 2hat is the purpose of risk mana%ement. &To ensure an or%anisation is aware of the risks associated with all aspects of its business operations. &To ensure personnel consider the risk outcomes that deri$e from their business decisions. &To establish robust risk mana%ement ob=ecti$es, policies, procedures and strate%ies that result in all risk e#posures bein% identified, measured and mana%ed. &To miti%ate potential ne%ati$e operational and financial impacts of risk. &To protect personnel. !c" ;iscuss who is responsible for the establishment of risk mana%ement ob=ecti$es, policies, procedures and strate%ies in a corporation. 3iney > ?hillips 1@ A 1, p. 609. The board of directors of an or%anisation is responsible for the determination and documentation of all risk mana%ement ob=ecti$es. <nce the board has determined the ob=ecti$es !which risks must be mana%ed", it will determine related risk mana%ement policiesB that is, how the risk mana%ement ob=ecti$es will be implemented. The chief e#ecuti$e officer and e#ecuti$e mana%ement will establish risk mana%ement procedures,strate%ies and reportin% structures. The procedures and strate%ies are de$eloped within the constraints of the risk mana%ement ob=ecti$es and policies set by the board. C. )t is often ar%ued in the risk mana%ement literature that risk must be identified, measured, and mana%ed. ;iscuss the lo%ic and reasons behind the contention that risk must be identified, measured and mana%ed. 3iney > ?hillips 1@ A ', p. 609.

*efore an or%anisation can be%in to mana%e risk e#posures it needs to know what those e#posures areB therefore it is necessary to identify all potential risk e#posures relatin% to all financial and operational components of a business. The number, e#tent and scope of risk e#posures will $ary dependin% on the business operationB for e#ample, a minin% company will be e#posed to a different ran%e of risks than would a financial institution or a hotel chain. <nce a risk e#posure is identified it is necessary to measure the potential operational and financial impacts of the e#posure, %i$en a ran%e of scenarios. *ased on this Duantitati$e analysis, an or%anisation will decide how, or if, the risk is to be mana%ed. Ei$en a decision to mana%e a risk, the or%anisation will determine alternati$e strate%ies that may be appropriate to mana%e the risk determine the most suitable strate%y and put procedures in place to implement the strate%y. @. <F :esources Gimited has recently issued H10 million in floatin% rate notes in order to fund the ne#t sta%e of an e#ploration pro=ect. The notes pay an annual coupon of **I2 plus 210 basis points. The company approaches Je%a *ank Gimited to establish an intermediated $anilla swap. The swap contrast sets a fi#ed rate of 6.10 per cent per annum and a reference rate of the 12 month **I2.

!a" 2hat is an intermediated $anilla swap. !b" At the first interest payment date, the **I2 is 6.C1 per cent per annum. ;raw and fully label a dia%ram showin% all the applicable interest rates at that date. !c" 2hich party to the swap contract is reDuired to make the first payment. 7ow much is the payment. 2hy don-t both parties need to make a payment. 3iney > ?hillips 1@ A 1', p. 610. 9. Kse the followin% returns, calculate the a$era%e returns and the standard de$iations for shares X and Y.

AFF9260 Australian capital markets

Returns

1 2 3 4 5 6 7 8

year 0.18 0.12 0.14 0.17 0.21 0.08 0.08 0.24

X 0.11 0.19 0.06 0.08 0.06 0.21 0.27 0.06

Вам также может понравиться

- CFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyОт EverandCFA 2012: Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyРейтинг: 3 из 5 звезд3/5 (2)

- Chapter 20 Interest Rate Risk: 1. ObjectivesДокумент14 страницChapter 20 Interest Rate Risk: 1. Objectivessamuel_dwumfourОценок пока нет

- Financial Management - MasenoДокумент42 страницыFinancial Management - MasenoPerbz JayОценок пока нет

- THE CAPITAL ASET PRICING McODELДокумент5 страницTHE CAPITAL ASET PRICING McODELperumal7Оценок пока нет

- BEC 0809 AICPA Newly Released QuestionsДокумент22 страницыBEC 0809 AICPA Newly Released Questionsrajkrishna03Оценок пока нет

- Seminar 5 Mini CaseДокумент5 страницSeminar 5 Mini Casebbaker2014100% (1)

- Weighted Average Cost of CapitalДокумент13 страницWeighted Average Cost of CapitalAkhil RupaniОценок пока нет

- Weighted Average Cost of CapitalДокумент12 страницWeighted Average Cost of CapitalAkhil RupaniОценок пока нет

- Capital BudgetingДокумент34 страницыCapital BudgetingHija S YangeОценок пока нет

- Advanced MGT Accounting Paper 3.2Документ242 страницыAdvanced MGT Accounting Paper 3.2Noah Mzyece DhlaminiОценок пока нет

- Topic 7. Cash Flows From Investment Activity ProcessДокумент8 страницTopic 7. Cash Flows From Investment Activity ProcessCristina LupascuОценок пока нет

- Introduction To Value-at-Risk PDFДокумент10 страницIntroduction To Value-at-Risk PDFHasan SadozyeОценок пока нет

- Risk Management in Banking Sector Project Report Mba FinanceДокумент70 страницRisk Management in Banking Sector Project Report Mba Financebalki12360% (5)

- Capital Asset Pricing Model ("CAPM")Документ3 страницыCapital Asset Pricing Model ("CAPM")Akhil RupaniОценок пока нет

- Blackbook Project On Research On Credit Risk ManagementДокумент97 страницBlackbook Project On Research On Credit Risk Management998730372657% (7)

- Sample of Risk Management Policy - An OutlineДокумент5 страницSample of Risk Management Policy - An OutlineRizaldi DjamilОценок пока нет

- CHAPTER 5 - Portfolio TheoryДокумент58 страницCHAPTER 5 - Portfolio TheoryKabutu ChuungaОценок пока нет

- Sharpe RatioДокумент5 страницSharpe RatioAlicia WhiteОценок пока нет

- How Efficient Is Your FrontierДокумент16 страницHow Efficient Is Your FrontierDANОценок пока нет

- Financial Risk and Financial Performance of Commercial Banks in Rwanda A Case of Equity Bank RwandaДокумент8 страницFinancial Risk and Financial Performance of Commercial Banks in Rwanda A Case of Equity Bank RwandaSolomon MainaОценок пока нет

- Testbank - Chapter 15Документ4 страницыTestbank - Chapter 15naztig_0170% (1)

- CF - Cost of CapitalДокумент74 страницыCF - Cost of CapitalShafiqОценок пока нет

- Portfolio Long Ans QuestionДокумент5 страницPortfolio Long Ans QuestionAurora AcharyaОценок пока нет

- Project Report MbaДокумент70 страницProject Report MbaLic Ludhiana100% (1)

- Estimating The Cost of Risky Debt by Ian CooperДокумент8 страницEstimating The Cost of Risky Debt by Ian CooperAntonio EmmeОценок пока нет

- Ch18 FinancialRisksДокумент37 страницCh18 FinancialRiskssamuel_dwumfourОценок пока нет

- Hurdle Rates Iii: Estimating Equity Risk Premiums Part IДокумент12 страницHurdle Rates Iii: Estimating Equity Risk Premiums Part IAnshik BansalОценок пока нет

- Cap Market MIDTERM REVIEWERДокумент13 страницCap Market MIDTERM REVIEWERMargaux Julienne CastilloОценок пока нет

- Topic 7. Cash Flows From Investment Activity ProcessДокумент8 страницTopic 7. Cash Flows From Investment Activity ProcessDaniela CaraОценок пока нет

- Risk Adjusted Discount RateДокумент3 страницыRisk Adjusted Discount RateHoney KullarОценок пока нет

- Expected Shortfall - An Alternative Risk Measure To Value-At-RiskДокумент14 страницExpected Shortfall - An Alternative Risk Measure To Value-At-Risksirj0_hnОценок пока нет

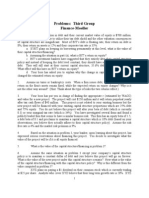

- Problems: Third Group Finance-MoellerДокумент4 страницыProblems: Third Group Finance-MoellerEvan BenedictОценок пока нет

- CS 564AR Lecture 11 Fall 05Документ50 страницCS 564AR Lecture 11 Fall 05John ArthurОценок пока нет

- Paper 1akkxbДокумент3 страницыPaper 1akkxbhinagarg373Оценок пока нет

- Chap 016Документ77 страницChap 016limed1100% (1)

- Exam FRM 2023Документ6 страницExam FRM 2023Slava HAОценок пока нет

- Dokumen - Tips - MCQ Working Capital Management Cpar 1 84Документ18 страницDokumen - Tips - MCQ Working Capital Management Cpar 1 84Sabahat JavedОценок пока нет

- Chap 013Документ102 страницыChap 013limed1Оценок пока нет

- Group - 1 (Kiran Mazumdar Shaw)Документ8 страницGroup - 1 (Kiran Mazumdar Shaw)Ashish GoyalОценок пока нет

- Liquidity Risk Management (Liquidity)Документ16 страницLiquidity Risk Management (Liquidity)Pallavi Ranjan100% (1)

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesДокумент17 страницChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourОценок пока нет

- Risk and Rates of ReturnДокумент22 страницыRisk and Rates of ReturnJollybelleann MarcosОценок пока нет

- 06 Cost of CapitalДокумент13 страниц06 Cost of Capitallawrence.dururuОценок пока нет

- 2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesДокумент5 страниц2 Liquid Ratio or Acid Test Ratio Liquid Assets Liquid LiabilitiesowaishazaraОценок пока нет

- Credit Analysis and FormulaeДокумент6 страницCredit Analysis and FormulaeNitin SharmaОценок пока нет

- Assembling A Client Portfolio - A Simplified Theoretical PerspectiveДокумент8 страницAssembling A Client Portfolio - A Simplified Theoretical PerspectivePatrick Kiragu Mwangi BA, BSc., MA, ACSIОценок пока нет

- Fin315 - Business Finance Chapter 10 and 11 NAME (PLEASE PRINT)Документ8 страницFin315 - Business Finance Chapter 10 and 11 NAME (PLEASE PRINT)Ryan Xuan0% (1)

- Shapiro CHAPTER 5 SolutionsДокумент11 страницShapiro CHAPTER 5 Solutionsjimmy_chou13140% (1)

- Suppose A Stock Had An Initial Price of 83 Per ShareДокумент8 страницSuppose A Stock Had An Initial Price of 83 Per ShareDoreenОценок пока нет

- Types and Costs of Financial Capital: True-False QuestionsДокумент8 страницTypes and Costs of Financial Capital: True-False Questionsbia070386Оценок пока нет

- CH 06Документ21 страницаCH 06Junaid JamshaidОценок пока нет

- Capital Structure and Dividend PolicyДокумент13 страницCapital Structure and Dividend PolicySiddharth VermaОценок пока нет

- Chapter 14 Capital Structure and Financial Ratios: Answer 1Документ12 страницChapter 14 Capital Structure and Financial Ratios: Answer 1samuel_dwumfourОценок пока нет

- Cash Flow InvestmentsДокумент17 страницCash Flow Investmentskuky6549369Оценок пока нет

- MAS - Cost of Capital 11pagesДокумент11 страницMAS - Cost of Capital 11pageskevinlim186100% (1)

- Chapter Twenty-One Managing Liquidity Risk On The Balance SheetДокумент15 страницChapter Twenty-One Managing Liquidity Risk On The Balance SheetBiloni KadakiaОценок пока нет

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Cost Guide May5-2010aszzzaДокумент43 страницыCost Guide May5-2010aszzzaMinh VănОценок пока нет

- Sec One 950123 05 2539Документ161 страницаSec One 950123 05 2539Minh VănОценок пока нет

- Perkem2010 1 22Документ11 страницPerkem2010 1 22Minh VănОценок пока нет

- The Effect of Foreign Bank Entry and Ownership Structure On The Philippine Domestic Banking Market - JasBF 2003Документ23 страницыThe Effect of Foreign Bank Entry and Ownership Structure On The Philippine Domestic Banking Market - JasBF 2003Minh VănОценок пока нет

- Nepal 8Документ44 страницыNepal 8mehulraoОценок пока нет

- CMI Sofassstware Tool Manual20140909Документ43 страницыCMI Sofassstware Tool Manual20140909Minh VănОценок пока нет

- Role of Foraaaaaeign Banks in Emerging Markets BodyДокумент40 страницRole of Foraaaaaeign Banks in Emerging Markets BodyMinh VănОценок пока нет

- NipaaaaaДокумент18 страницNipaaaaaMinh VănОценок пока нет

- Ismail Abd RahmanaaaaaДокумент19 страницIsmail Abd RahmanaaaaaMinh VănОценок пока нет

- FSMP en Ch03aaaaaДокумент29 страницFSMP en Ch03aaaaaMinh VănОценок пока нет

- Li 5 AДокумент24 страницыLi 5 AMinh VănОценок пока нет

- GuisseaaaaaДокумент63 страницыGuisseaaaaaMinh VănОценок пока нет

- Kyeong Et AlaДокумент7 страницKyeong Et AlaMinh VănОценок пока нет

- Classens, K. and Van Horen, N. (2012) Foreign Banks: Trends, Impact and Financial Stability', IMF Working Paper, International Monetary FundДокумент4 страницыClassens, K. and Van Horen, N. (2012) Foreign Banks: Trends, Impact and Financial Stability', IMF Working Paper, International Monetary FundMinh VănОценок пока нет

- 1392 2758 2010 21 5 464aaaaaДокумент11 страниц1392 2758 2010 21 5 464aaaaaMinh VănОценок пока нет

- Foreign Banks PaperaaaaaДокумент51 страницаForeign Banks PaperaaaaaMinh VănОценок пока нет

- Bispap 23 QaaaaaДокумент7 страницBispap 23 QaaaaaMinh VănОценок пока нет

- Nepal 8Документ44 страницыNepal 8mehulraoОценок пока нет

- File LoadaДокумент1 страницаFile LoadaMinh VănОценок пока нет

- bmd110155 33 49aaaaaДокумент17 страницbmd110155 33 49aaaaaMinh VănОценок пока нет

- BR0 Sec M20 Official 0 Use 0 Only 090Документ25 страницBR0 Sec M20 Official 0 Use 0 Only 090Minh VănОценок пока нет

- Bank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeДокумент15 страницBank Efficiency and Non-Performing Loans: Evidence From Malaysia and SingaporeMinh VănОценок пока нет

- Foreign Portfolio Investment and Economic Growth in MalaysiaДокумент15 страницForeign Portfolio Investment and Economic Growth in MalaysiaMinh VănОценок пока нет

- AaaaaДокумент85 страницAaaaaMinh VănОценок пока нет

- Current Account BalanceДокумент4 страницыCurrent Account BalanceMinh VănОценок пока нет

- Peak-Load Pricing: Charging More When Its Costs More To ProduceДокумент7 страницPeak-Load Pricing: Charging More When Its Costs More To ProduceMinh Văn100% (1)

- Government DebtaДокумент3 страницыGovernment DebtaMinh VănОценок пока нет

- Graph GDP Worlda Bank 4Документ7 страницGraph GDP Worlda Bank 4Minh VănОценок пока нет

- University of Ballarat: BUMKT6942 International BusinessДокумент14 страницUniversity of Ballarat: BUMKT6942 International BusinessKevin ShahОценок пока нет

- Glossary Entrepreneurship Development: V+TeamДокумент8 страницGlossary Entrepreneurship Development: V+TeamCorey PageОценок пока нет

- Finance Module 8 Capital Budgeting - InvestmentДокумент8 страницFinance Module 8 Capital Budgeting - InvestmentKJ Jones100% (1)

- BS50619006056314 PDFДокумент3 страницыBS50619006056314 PDFAldrin Frank ValdezОценок пока нет

- The Pricing of Crude Oil: Stephanie Dunn and James HollowayДокумент10 страницThe Pricing of Crude Oil: Stephanie Dunn and James HollowayAnand aashishОценок пока нет

- Women and Banks Are Female Customers Facing Discrimination?Документ29 страницWomen and Banks Are Female Customers Facing Discrimination?Joaquín Vicente Ramos RodríguezОценок пока нет

- Degree of Financial Leverage Formula Excel TemplateДокумент4 страницыDegree of Financial Leverage Formula Excel TemplateSyed Mursaleen ShahОценок пока нет

- Bank Written 90 Math BankДокумент29 страницBank Written 90 Math BankWakil0% (1)

- IAS 1 Presentation of Financial StatementsДокумент12 страницIAS 1 Presentation of Financial StatementsIFRS is easyОценок пока нет

- Ceres Gardening Company Graded QuestionsДокумент4 страницыCeres Gardening Company Graded QuestionsSai KumarОценок пока нет

- A Global Market Rotation Strategy With An Annual Performance of 41.4 PercentДокумент6 страницA Global Market Rotation Strategy With An Annual Performance of 41.4 PercentLogical Invest100% (1)

- Lesson 5 (Semis)Документ10 страницLesson 5 (Semis)Joesil Dianne SempronОценок пока нет

- Introduction To Agricultural AccountingДокумент54 страницыIntroduction To Agricultural AccountingManal ElkhoshkhanyОценок пока нет

- Partnership Dissolution From Prof. Cecilia MercadoДокумент7 страницPartnership Dissolution From Prof. Cecilia MercadoChitz Pobar0% (1)

- Portfolio ManagementДокумент45 страницPortfolio ManagementSukesh Nair100% (1)

- Introduction To Investment BankingДокумент45 страницIntroduction To Investment BankingHuế ThùyОценок пока нет

- Villena v. Batangas (Retirement Pay)Документ9 страницVillena v. Batangas (Retirement Pay)Ching ApostolОценок пока нет

- WP10 2013 Distribution Income and Fiscal Incidence 18062013Документ49 страницWP10 2013 Distribution Income and Fiscal Incidence 18062013akinky3sumОценок пока нет

- Cost Estimation: (CHAPTER-3)Документ43 страницыCost Estimation: (CHAPTER-3)fentaw melkieОценок пока нет

- Gibson10e ch02Документ23 страницыGibson10e ch02SHAMRAIZKHANОценок пока нет

- A History of NHS PrivatisationДокумент16 страницA History of NHS PrivatisationProtect our NHSОценок пока нет

- Sap Fico NotesДокумент42 страницыSap Fico NotesRama KrishnaОценок пока нет

- Project Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oДокумент79 страницProject Report of Accounting in Banks and Balance Sheet 1. INTRODUCTION A Banking Company Means and Includes Any Company Which Carries On Business oanreshaОценок пока нет

- SINAG Business PlanДокумент23 страницыSINAG Business PlanErika FloresОценок пока нет

- What Is CARPДокумент33 страницыWhat Is CARPWorstWitch TalaОценок пока нет

- Capital Budgeting Techniques IRRДокумент12 страницCapital Budgeting Techniques IRRraza572hammadОценок пока нет

- Inventory Management Mahindra TractorsДокумент25 страницInventory Management Mahindra TractorsShanmuka Sreenivas0% (1)

- Estimating and Costing MaterialДокумент42 страницыEstimating and Costing MaterialQuestion paperОценок пока нет

- Corporate Finance and Investment AnalysisДокумент80 страницCorporate Finance and Investment AnalysisCristina PopОценок пока нет

- 01 Seatwork VAT Subject TransactionДокумент2 страницы01 Seatwork VAT Subject TransactionJaneLayugCabacunganОценок пока нет

- SDA Accounting Manual - Jan 2011Документ616 страницSDA Accounting Manual - Jan 2011haroldpsb100% (2)