Академический Документы

Профессиональный Документы

Культура Документы

Statutory Liquidity Ratio (SLR)

Загружено:

RajaDurai RamakrishnanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Statutory Liquidity Ratio (SLR)

Загружено:

RajaDurai RamakrishnanАвторское право:

Доступные форматы

Statutory Liquidity Ratio (SLR) 1. 2. 3. 4. 5. 6. 7.

What is SLR? What happens if SLR is decreased? But why would SBI sell G-sec? SBI takes initiative Why is it called "Statutory" Liquidity Ratio? How does SLR reduction impact Bond Yield? SLR decrease unusual To put this without getting "technically correct" What the hell is SLR?

Page | 1

SLR Means Self Loading Rifle. The INSAS Rifle used by our Jawans, is one example of SLR. But for our purpose, SLR means

Statutory Liquidity Ratio. It is a tool used by RBI to control inflation and to boost growth. Anyways since last one year, RBI's primary aim is to control inflation. If RBI sets SLR to 25%, that a Bank must keep 25% of its Total deposits, into non-cash forms prescribed by RBI: that is.

1. In Gold 2. In Corporate Bonds / Shares approved by RBI 3. G-Sec (Government Securities/ Treasury Bonds)

But most bank prefer to put all the money in Government securities (G-Sec), because they're more safe and convinient than the other two. What happens if SLR is decreased?

Earlier SLR was 24%, but on last day of July, RBI changed it to 23%. That means, if earlier SBI had total Rs.100 Deposited in all its 11,000+ branches, then SBI would have to park Rs.24 in G-sec but with new RBI rule, SBI will have to park only Rs.23. Meaning SBI can take away Rs.1 from its G-sec investment and use it for giving as loan to regular customers. So, SBI will sell G-sec worth Rs.1 from its suitcase and use that 1 Rupee for lending as House, Car, Business loans to the customers. SBI has one more rupee to lend to the customers, it'll reduce the interest rate (to seduce more customers). Thus Interest Rates go down when SLR is decreased. In real life, 1% decrease in SLR, means SBI alone will have additional Rs.10,000 crores for lending And all the banks (SBI, ICICI, Bank of Baroda etc combined), will have more than 68,000 crores for lending. Now the reverse: If SLR is increased, then banks have less money to lend = they'll charge more interest rates on loans to keep the profit margin same. But why would SBI sell G-sec?

Earlier I said, Banks prefer to park the SLR money into G-Sec, because it is safe and convenient. But when something is safe the rate of return (profit) is not high. In case of G-sec, the rate of return on G-sec is 7.5%, while if SBI lends the same money to customers- it can earn more than 10% (because car and home loans have more than 10% interest rate, usually.)

SBI takes initiative

Page | 2

Just because RBI decreased SLR, doesn't mean all banks will immediately reduce the loan interest rates (Thank god they don't behave like Oil Companies- who have formed up sort of cartel, and then rarely reduce oil prices even if crude oil price decreases in global market.) Anyways, whenever RBI decreases rates, usually SBI takes the initiative and decreases interest rates to attract new customers. [Because SBI is a big player with deep pockets, it can suffer temporary losses to get new customers- just like Wallmart etc. do by offering huge discounts]. Other banks such as ICICI, will then have to reluctantly follow the suit, to keep up with the competition of SBI. For example, on 1st august 2012, SBI reduced its Car loan interest rate from 11.25 to 10.75% and Home loan interest rate from 10.50% to 10.25%. So now if ICICI wants to keep in business, it'll have to reduce its rates. [can't just rely on Bacchan's advertisement power.] Why is it called "Statutory" Liquidity Ratio?

It is called Statutory because it is provided by the Law/Statute(The Reserve Bank of India Act). This Act says SLR cannot be more than 40% and less than 25%. [hahaha, if SLR was 40% then who would open a bank in the first place?!] But in 2007, Government amended the act and removed the lower limit of 25%, so thus RBI went to 24 and 23% SLR. How does SLR reduction impact Bond Yield?

You already know what is Bond yield. If not, then go through the Eurozone Article. (Click Me) The Newpapers are reporting that Bond Yields increased after RBI cut down the SLR. So why or how did that happen? Think about it! SLR decrease unusual

Usually, RBI would try to manipulate the money supply in the market (and thus control inflation) by changing the repo rate, and SLR is kept unchanged, but this time, RBI kept the Repo rate unchanged and instead decreased SLR, why? Again, Think about it.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Mpanzi Sacco Strategic PlanДокумент39 страницMpanzi Sacco Strategic Planna100% (2)

- Statement DownloadДокумент4 страницыStatement Downloaddennisg945133% (3)

- Principles of TakafulДокумент3 страницыPrinciples of TakafulMuhamad NazriОценок пока нет

- May 2013Документ2 страницыMay 2013Mytreyi AtluriОценок пока нет

- BB Bill Template - ScribdДокумент3 страницыBB Bill Template - ScribdSomansh Kumar100% (1)

- History and Evolution of BanksДокумент10 страницHistory and Evolution of BanksDr-Shefali GargОценок пока нет

- Cost Analysis1 SДокумент8 страницCost Analysis1 SRajaDurai RamakrishnanОценок пока нет

- Steps To Implement To BloggerДокумент1 страницаSteps To Implement To BloggerRajaDurai RamakrishnanОценок пока нет

- Name of Work:: "8443-Civil Deposit"Документ1 страницаName of Work:: "8443-Civil Deposit"RajaDurai RamakrishnanОценок пока нет

- Imports of Herb in USA Manufacturers of Herb Buyers of Herb in USAДокумент7 страницImports of Herb in USA Manufacturers of Herb Buyers of Herb in USARajaDurai RamakrishnanОценок пока нет

- The Art and Science of Asking Questions Is The Source of All Knowledge." Thomas BergerДокумент12 страницThe Art and Science of Asking Questions Is The Source of All Knowledge." Thomas BergerRajaDurai Ramakrishnan100% (1)

- Sor 2013-2014Документ90 страницSor 2013-2014RajaDurai Ramakrishnan100% (1)

- Lecture - 18 Evaluation, Feedback and Rewards (Contd.)Документ8 страницLecture - 18 Evaluation, Feedback and Rewards (Contd.)RajaDurai RamakrishnanОценок пока нет

- 04profit and LossДокумент23 страницы04profit and LossRajaDurai RamakrishnanОценок пока нет

- Lec38 JHJДокумент30 страницLec38 JHJRajaDurai RamakrishnanОценок пока нет

- Copper Measurement: Copper Size Purpose 2" X 1/ 4" 1" X 1/ 4" Main Bus 3Ph Main Nu and Sub Bus PH &N I/ C 400A I/C 200AДокумент3 страницыCopper Measurement: Copper Size Purpose 2" X 1/ 4" 1" X 1/ 4" Main Bus 3Ph Main Nu and Sub Bus PH &N I/ C 400A I/C 200ARajaDurai RamakrishnanОценок пока нет

- Data H 200A Panel Size 5' X 6' X 1 ' 16SWG Ms SheetДокумент3 страницыData H 200A Panel Size 5' X 6' X 1 ' 16SWG Ms SheetRajaDurai RamakrishnanОценок пока нет

- Data Sheet TRДокумент5 страницData Sheet TRRajaDurai RamakrishnanОценок пока нет

- SL - No Location Area of Room (In M) No. of Fans Eligible No. of Fans Proposed 48" 56" 48" 56" Principal Room 3.9X6.0 23.4 2 2Документ1 страницаSL - No Location Area of Room (In M) No. of Fans Eligible No. of Fans Proposed 48" 56" 48" 56" Principal Room 3.9X6.0 23.4 2 2RajaDurai RamakrishnanОценок пока нет

- Tally MiniДокумент2 страницыTally MiniRajaDurai RamakrishnanОценок пока нет

- Tuty Court Genset ESTIMATES NewДокумент42 страницыTuty Court Genset ESTIMATES NewRajaDurai RamakrishnanОценок пока нет

- Vepppalodai Power VerДокумент27 страницVepppalodai Power VerRajaDurai RamakrishnanОценок пока нет

- ITI APK Hostel 3lakhsДокумент10 страницITI APK Hostel 3lakhsRajaDurai RamakrishnanОценок пока нет

- UBS Wealth Insights 2013 E2B Booklet FinalДокумент21 страницаUBS Wealth Insights 2013 E2B Booklet FinalGuozheng ChinОценок пока нет

- 2.why Do Financial Institutions ExistДокумент33 страницы2.why Do Financial Institutions ExistАндријана Б. ДаневскаОценок пока нет

- Ats Final 394-8Документ5 страницAts Final 394-8Girish SharmaОценок пока нет

- Literature Review of Technology Adoption ModelsДокумент18 страницLiterature Review of Technology Adoption ModelsKhordieОценок пока нет

- Resume of Himanshu785Документ4 страницыResume of Himanshu785api-27566758Оценок пока нет

- Bank - WikipediaДокумент38 страницBank - WikipediaShruthi AmmuОценок пока нет

- Accounts Ques BankДокумент24 страницыAccounts Ques BankShubhangi GuptaОценок пока нет

- Bank StatementДокумент30 страницBank StatementFerhan IskandarОценок пока нет

- Deed of PartnershipДокумент8 страницDeed of PartnershipysnetservicesОценок пока нет

- Classification of Accounts and Accounting ProcessДокумент5 страницClassification of Accounts and Accounting ProcessBoobalan RОценок пока нет

- Meghrajsinh M Chudasama CVДокумент4 страницыMeghrajsinh M Chudasama CVVijayAhirОценок пока нет

- AML CTF Training Addis & SamriДокумент39 страницAML CTF Training Addis & SamriSISAY TSEGAYEОценок пока нет

- Elements of Finance 2Документ14 страницElements of Finance 2asticksОценок пока нет

- Proforma I2 Cns CNR 25521526Документ5 страницProforma I2 Cns CNR 25521526piyushkatariya8Оценок пока нет

- Nomura European Equity Strategy - August 21 2011 - Worse Than 08Документ16 страницNomura European Equity Strategy - August 21 2011 - Worse Than 08blemishesОценок пока нет

- SAP-FI/CO - 14 Cont : ReportsДокумент25 страницSAP-FI/CO - 14 Cont : Reportskrishna_1238Оценок пока нет

- LenderДокумент6 страницLenderANSARI MOHD MOKARRAM ZAINUL ABD-CSE SORTОценок пока нет

- Nism 6Документ30 страницNism 6Hema lathaОценок пока нет

- Bank Coursework Barclay Case StudyДокумент4 страницыBank Coursework Barclay Case Studypriyanka sharmaОценок пока нет

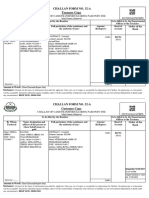

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheДокумент1 страницаChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into Theآرنولڈ دا فینОценок пока нет

- Negotiable Instruments Case ListДокумент3 страницыNegotiable Instruments Case ListShariqah Hanimai Indol Macumbal-YusophОценок пока нет

- CURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Документ7 страницCURT-ALLEN: of The Family Byron V LOVICK, Et Al. - 1 - Complaint - Gov - Uscourts.wawd.166908.1.0Jack RyanОценок пока нет

- History of Banking - National BankДокумент3 страницыHistory of Banking - National BankDerib Asmamaw50% (2)