Академический Документы

Профессиональный Документы

Культура Документы

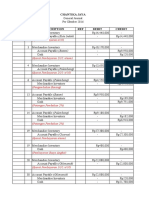

Bank Reconciliation

Загружено:

bub12345678Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bank Reconciliation

Загружено:

bub12345678Авторское право:

Доступные форматы

Ch-3 Bank Reconciliation Statement

1. A Bank Reconciliation Statement is a (a) Part of Cash Book; (c) Part of financial statements, Answer: (d) None of the above. Reason: Bank reconciliation statement is a statement which reconciles bank Balance as per Cash Book with Balance as per Pass Book (Bank statement) by showing all causes of different between the two. So, none of above applies here. 2. A Bank Reconciliation Statement is prepared with the help of: (a) Bank statement and bank column of the Cash Book. (b) Bank statement and cash column of the Cash Book (c) Bank column of the Cash Book and cash column of the Cash Book (d) None of the above. Answer: (a) Bank statement and bank column of the Cash Book. Reason: Bank reconciliation statement is a statement which reconciles bank Balance as per Cash Book with Balance as per Pass Book (Bank statement) by showing all causes of different between the two. 3. Debit balance as per Cash Book of ABC Enterprises as on 31.3.2009 is Rs. 1,500. Cheques deposited but not cleared amounts to Rs. 100 and Cheques issued but not presented of Rs. 150. The bank allowed interest amounting Rs. 50 and collected dividend Rs. 50 on behalf of ABC Enterprises. Balance as per pass book should be (a) Rs. 1,600. (b) Rs. 1,450. (c) Rs. 1,850. (d) Rs. 1,650. Answer: (d) Rs. 1,650. Reason: Bank Reconciliation Statement. Debit balance as per cash book (-) Cheque deposited but not cleared (+)Cheques issued but not presented (+)bank allowed interest (+) dividend collected on behalf of ABC Enterprises. Balance as per pass book 4. 1500 100 150 50 50 1650 (b) (d) Part of Bank Account; none of the above.

The cash book showed an overdraft of Rs. 1,500, but the pass book made up to the same date showed that cheques of Rs. 100, Rs. 50 and Rs. 125 respectively had not been presented for payments; and the cheque of Rs. 400 paid into account had not been cleared. The balance as per the pass book will be (a) Rs. 1,100. (b) Rs. 2,175. (c) Rs. 1,625. (d) Rs. 1,375.

VXplain to score more post your doubts at vxplain@gmail.com /www.vxplain.com Page 1

Answer: (c) Rs. 1,625. Reason: Bank Reconciliation Statement. Credit balance as( overdraft) per cash book (+) Cheque deposited but not cleared (-)Cheques issued but not presented for payment(100+50+125) Balance as per pass book 5. 1500 400 275 1625

When balance as per Cash Book is the starting point, uncollected cheques are: (a) Added in the bank reconciliation statement (b) Subtracted in the bank reconciliation statement (c) Not required to be adjusted in the bank reconciliation statement (d) Neither of the above. Answer: (b) Subtracted in the bank reconciliation statement Reason: Uncollected cheques means cheque deposited in bank but not cleared. Entry for Such cheque would have been made in cash book but not in pass book. So, for reconciliation such amount need to be subtracted as it would have been already added.

6.

A Bank Reconciliation Statement is prepared to know the causes for the difference between: (a) The balances as per cash column of Cash Book and the Pass Book. (b) The balance as per bank column of Cash Book and the Pass Book. (c) The balance as per bank column of Cash Book and balances as per cash column of Cash Book (d) Neither of the above. Answer: (b) the balance as per bank column of Cash Book and the Pass Book. Reason: Bank reconciliation statement is a statement which reconciles bank Balance as per Cash Book with Balance as per Pass Book (Bank statement) by showing all causes of different between the two.

7.

Which of the following is not the salient feature of bank reconciliation statement? (a) Any undue delay in the clearance of cheques will be shown up by the reconciliation (b) Reconciliation statement will help in finding the person doing any fraud (c) Reconciliation is done by the bankers (d) It helps in finding out the actual position of the bank balance. Answer: (c) Reconciliation is done by the bankers Reason: Reconciliation is done by Account holder or customer but not the bankers

VXplain to score more post your doubts at vxplain@gmail.com /www.vxplain.com Page 2

Вам также может понравиться

- 400-Article Text-951-1-10-20181225Документ17 страниц400-Article Text-951-1-10-20181225bub12345678Оценок пока нет

- Grade 4 Multiplication Table 2to10 FДокумент2 страницыGrade 4 Multiplication Table 2to10 FVihaan VibhorОценок пока нет

- Photolithography LessonsДокумент4 страницыPhotolithography LessonsDeep BhattacharjeeОценок пока нет

- Nano LectureДокумент31 страницаNano Lecturebub12345678Оценок пока нет

- Yarn StructureДокумент10 страницYarn Structurebub12345678Оценок пока нет

- 39 PDFДокумент20 страниц39 PDFskgolbanОценок пока нет

- Understanding Racemic Drugs and Their EnantiomersДокумент6 страницUnderstanding Racemic Drugs and Their Enantiomersbub12345678Оценок пока нет

- Preparing Samples For Western Blot Analysis: Protein QuantificationДокумент7 страницPreparing Samples For Western Blot Analysis: Protein QuantificationAhmed IsmailОценок пока нет

- January 2019 - December 2019Документ12 страницJanuary 2019 - December 2019AnaRajčevićОценок пока нет

- Blank Rainbow Monthly CalendarДокумент1 страницаBlank Rainbow Monthly CalendarHannahОценок пока нет

- Medicine For The MindДокумент87 страницMedicine For The Mindbub12345678Оценок пока нет

- User Education Guidelines APAДокумент15 страницUser Education Guidelines APADilhara PinnaduwageОценок пока нет

- Quarterly revenue trends 2010-2020Документ1 страницаQuarterly revenue trends 2010-2020bub12345678Оценок пока нет

- Dyeing With Vat Dyes PDFДокумент30 страницDyeing With Vat Dyes PDFAjith SatyapalaОценок пока нет

- Weekly PlannerДокумент1 страницаWeekly PlannerKhor Han YiОценок пока нет

- Instron MerlinДокумент76 страницInstron Merlinjsidev100% (4)

- Flywheel PDFДокумент25 страницFlywheel PDFbub12345678100% (7)

- Semi LogScaledДокумент1 страницаSemi LogScaledEmily WongОценок пока нет

- USTER AFIS PRO 2 The Fiber Process Control SystemДокумент24 страницыUSTER AFIS PRO 2 The Fiber Process Control Systembub1234567875% (8)

- Carding Machine - Operating PrincipleДокумент11 страницCarding Machine - Operating PrincipleNilam Sihar0% (1)

- Vectors AlgebraДокумент19 страницVectors AlgebraJose Maria Hazel TadlasОценок пока нет

- c1Документ19 страницc1jimjoneОценок пока нет

- Problem 2 Find The Sum of All The Even-Valued Terms in The Fibonacci Sequence Which Do Not Exceed Four MillionДокумент2 страницыProblem 2 Find The Sum of All The Even-Valued Terms in The Fibonacci Sequence Which Do Not Exceed Four MillionMateus PimentelОценок пока нет

- Vectors AlgebraДокумент19 страницVectors AlgebraJose Maria Hazel TadlasОценок пока нет

- Process ControlДокумент30 страницProcess ControlhaishpithadiyaОценок пока нет

- Machines and Tools For Wood Based Furniture ProductionДокумент2 страницыMachines and Tools For Wood Based Furniture Productionbub12345678Оценок пока нет

- TDA7375A: 2 X 37W Dual/Quad Power Amplifier For Car RadioДокумент14 страницTDA7375A: 2 X 37W Dual/Quad Power Amplifier For Car RadioMarcell JeldesОценок пока нет

- How Com Graph STDДокумент5 страницHow Com Graph STDEhsan Mohades Rad100% (1)

- Mass-spring systems and the relationship between frequency, mass and spring constantДокумент12 страницMass-spring systems and the relationship between frequency, mass and spring constantsanoizuОценок пока нет

- Mechanical VibrationsДокумент11 страницMechanical Vibrationsbub12345678Оценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- DO 178B DetailedДокумент25 страницDO 178B DetailedSenthil KumarОценок пока нет

- GREEN Manual - 2021Документ157 страницGREEN Manual - 2021Bon Ber Amad Orofeo100% (2)

- BH2 S4CLD2208 BPD en inДокумент18 страницBH2 S4CLD2208 BPD en inSibucharanОценок пока нет

- City Profil Addis AbabaДокумент33 страницыCity Profil Addis AbabaEyuale TОценок пока нет

- Advert-Manager-Operational Risk and ComplianceДокумент4 страницыAdvert-Manager-Operational Risk and ComplianceRashid BumarwaОценок пока нет

- Service 31200800 11-13-13 CE-AUS English PDFДокумент262 страницыService 31200800 11-13-13 CE-AUS English PDFduongpn100% (1)

- Unified HSE Passport Standard LRДокумент60 страницUnified HSE Passport Standard LRSHRISH SHUKLAОценок пока нет

- Krautkramer USN 58R: The Ultrasonic Instrument For The Workshop, Even For Automated InspectionsДокумент1 страницаKrautkramer USN 58R: The Ultrasonic Instrument For The Workshop, Even For Automated InspectionsAli MohsinОценок пока нет

- Safety Data Sheet for Anionic Polymer LiquidДокумент6 страницSafety Data Sheet for Anionic Polymer LiquidZi Wei LeongОценок пока нет

- Annexure CДокумент63 страницыAnnexure CSandeep VermaОценок пока нет

- CIA Interview GuideДокумент14 страницCIA Interview GuideCody ToebbickeОценок пока нет

- Gobenciong v CA ruling on preventive suspensionДокумент3 страницыGobenciong v CA ruling on preventive suspensionBambi GumbanОценок пока нет

- Employee Selection Psychological TestingДокумент65 страницEmployee Selection Psychological TestingPatricia Andrea UgayОценок пока нет

- 1 ComplaintДокумент6 страниц1 ComplaintIvy PazОценок пока нет

- Partnership Formation EssentialsДокумент2 страницыPartnership Formation EssentialsRodolfo ManalacОценок пока нет

- Earth / Ground Test (Version 1) : Za'immul Na'imДокумент4 страницыEarth / Ground Test (Version 1) : Za'immul Na'imMd Rodi BidinОценок пока нет

- See Repair Manual PDFДокумент1 050 страницSee Repair Manual PDFJorge MonteiroОценок пока нет

- Actividad 3-Semana2-DécimoДокумент7 страницActividad 3-Semana2-DécimoAmaury VillalbaОценок пока нет

- Clinical ChemistryДокумент23 страницыClinical ChemistryRezzy Mae Panadero OraОценок пока нет

- Itc Diversification Case SolutionДокумент40 страницItc Diversification Case SolutionDivya PujariОценок пока нет

- Playlist ArchacДокумент30 страницPlaylist ArchacMartin JánošíkОценок пока нет

- Page 34-45 BLK PicДокумент12 страницPage 34-45 BLK PicMihir MehraОценок пока нет

- The Quadrifilar Helix Antenna: Sec 22.1 IntroductionДокумент20 страницThe Quadrifilar Helix Antenna: Sec 22.1 Introductionenmanuel enmanuel silva zaldivarОценок пока нет

- LeadershipДокумент5 страницLeadershipapi-3850643Оценок пока нет

- Political Science Class 12TH Project Work 2022-23Документ2 страницыPolitical Science Class 12TH Project Work 2022-23Hariom Yadav100% (1)

- PT Amar Sejahtera General LedgerДокумент6 страницPT Amar Sejahtera General LedgerRiska GintingОценок пока нет

- Nice - Folder - Bar - System - en Mbar HighlightedДокумент16 страницNice - Folder - Bar - System - en Mbar HighlightedSamastha Nair SamajamОценок пока нет

- Contrafund 31-07-2020Документ12 страницContrafund 31-07-2020b1OSphereОценок пока нет

- Segment Reporting NotesДокумент2 страницыSegment Reporting NotesAshis Kumar MuduliОценок пока нет

- Toshiba Satellite l645Документ2 страницыToshiba Satellite l645pintarbacaОценок пока нет