Академический Документы

Профессиональный Документы

Культура Документы

GC and T - Done

Загружено:

Hashir KhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GC and T - Done

Загружено:

Hashir KhanАвторское право:

Доступные форматы

Berglof and Pajste (2005) has examined What do Firms Disclose and Why?

Enforcing Corporate Governance and Transparency in Central and Eastern Europe. Specific corporate-governance rules are often controversial, most observers agree on the need to disclose who owns and controls a firm and what governance arrangements are in place. This paper examines such disclosure in a sample of 370 companies listed on stock exchanges in Central and Eastern Europe. The data show widespread non-disclosure of even the most basic elements of corporate-governance arrangements, despite existing regulation. The level of disclosure varies substantially across firms, and there is a strong country effect in what companies disclose. Overall, what is disclosed depends on the legal framework and practice in a given country, but it does not correlate with firms' financial performance. On the other hand, financial performance is strongly related with how easily available the information is to the public. In particular, information is more available in larger firms, firms with lower leverage, higher market-to-book ratios, and more concentrated ownership. Berglf, E., & Pajuste, A. (2005). What do firms disclose and why? Enforcing corporate governance and transparency in Central and Eastern Europe. Oxford Review of Economic Policy, 21(2), 178-197.

Millar , Eldomiaty and Choi (2005) has studied Corporate governance and institutional transparency in emerging markets .This paper posits that differences in corporate governance structure partly result from differences in institutional arrangements linked to business systems. We developed a new international triad of business systems: the Anglo-American, the Communitarian and the Emerging system, building on the frameworks of Choi etal. (British Academy of Management (Kynoch Birmingham) 1996, Management International Review 39, 257279, 1999). A common factor determining the success of a corporate governance structure is the extent to which it is transparent to market forces. Such transparency is more than pure financial transparency; as it can also be based on factors such as governmental, banking and other types of institutional transparency mechanism. There may also be a choice for firms to adopt voluntary corporate disclosure in situations where mandatory disclosure is not established. The Asian financial crisis of 19971999 and the more recent corporate governance scandals such as Enron, Andersen and Worldcom in the United States and Ahold and Parmalat in Europe show that corporate governance and business ethics issues exist throughout the world. As an illustration we focus on Asias emerging1 markets, as, both in view of the pressure of globalization and taking into account the institutional arrangements peculiar to the emerging business system, these issues are important there. Particularly for those who have to find an accommodation between the corporate governance structures and disclosure standards of the Emerging system and those of the AngloAmerican and Communitarian systems.

Millar, C. C., Eldomiaty, T. I., Choi, C. J., & Hilton, B. (2005). Corporate governance and institutional transparency in emerging markets. Journal of Business Ethics, 59(1-2), 163-174.

Bhat, G., Hope, O. K., & Kang, T. (2006). Does corporate governance transparency affect the accuracy of analyst forecasts?. Accounting & Finance,46(5), 715-732.

Bhat , Hope and Kang (2006) has examined Does corporate governancetransparencyaffect

the accuracy of analyst forecasts?. Using country-level proxies for corporategovernance transparency, this paper investigates how differences in transparency across 21 countries affect the average forecast accuracy of analysts for the country's firms. They have used these variable in their stuy Corporate transparency,Corporate governance ,Disclosures and Analyst forecasts.The association between financial transparency and analyst forecast accuracy has been well documented in previous published literature; however, the association between governance transparency and analyst forecast accuracy remains unexplored. Using the two distinct country-level factors isolated by Bushman et al.(2004), governance transparency and financial transparency, we investigate whether corporate governance information impacts on the accuracy of earnings forecasts over and above financial information. We document that governance transparency is positively associated with analyst forecast accuracy after controlling for financial transparency and other variables. Furthermore, our results suggest that governance-related disclosure plays a bigger role in improving the information environment when financial disclosures are less transparent. Our empirical evidence also suggests that the significance of governance transparency on analyst forecast accuracy is higher when legal enforcement is weak.

Hassan . M , Haat . C, Rashidah and R, Sakthi (2008) "Corporate governance, transparency and performance of Malaysian companies", Managerial Auditing Journal, Vol. 23 Iss: 8, pp.744 - 778 Keywords:

Hassan . M , Haat . C, Rashidah and R, Sakthi (2008) has analysed Corporate governance, transparency and performance of Malaysian companies.The paper aims to examine the effect of good corporate governance practices on corporate transparency and performance of Malaysian listed companies. The variable used in study were Business performance, Corporate

governance, Malaysia, Shareholder value analysis. Samples were selected using matched-sampling method and hierarchical regression was employed to test the relationship between among corporate governance mechanism, transparency and performance.Corporate governance factors have a strong predicting power on company performance, mainly due to debt monitoring and foreign ownership. However, there is a significant negative relation between audit quality and performance. The results find that performance is not associated with the level of disclosure and timely reporting. The results indicate that disclosure and timeliness are not significant contributing factors in the relationship between corporate governance and market performance..The data covers a one-year period of 2002 only. This paper deals only with one -way causality running from corporate governance mechanisms to performance, even though, there is evidence of reverse-way and two-way causality in governance literature.This paper indicates that internal governance mechanisms are not important determinants to corporate performance. However, governance in forms of debt monitoring and foreign ownership have significant influence on corporate performance. Transparency (i.e. disclosure and timeliness of reporting) is not a significant mediating variable between corporate governance and performance.Distinct from previous empirical research as the

disclosure level is measured using self-designed corporate governance index. Apart from a study conducted in an Asian setting of Malaysia, the study also tests transparency as a mediating variable between corporate governance and performance

Chen , Chung and Liao (2007) have examined Corporate Governance and Equity Liquidity:

analysis of S&P transparency and disclosure rankings . This paper sets out to investigate the effects of disclosure, and other corporate governance mechanisms, on equity liquidity, arguing that those companies adopting poor information transparency and disclosure practices will experience serious information asymmetry. They have 6 variables which are Corporate governance ,transparency and disclosure , asymmetric information costs and liquidity. Since poor corporate governance leads to greater information asymmetry, liquidity providers will incur relatively higher adverse information risks and will therefore offer higher information asymmetry components in their effective bid-ask spreads. The Transparency and Disclosure (T&D) rankings of the individual stocks on the S&P 500 index are employed to examine whether firms with greater T&D rankings have lower information asymmetry components and lower stock spreads. Their results reveal that the economic costs of equity liquidity, i.e. the effective spread and the quoted half-spread, are greater for those companies with poor information transparency and disclosure practices.

Chen, W. P., Chung, H., Lee, C., & Liao, W. L. (2007). Corporate Governance and Equity Liquidity: analysis of S&P transparency and disclosure rankings. Corporate Governance: An International Review, 15(4), 644-660.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Develop Country Is That Which Has The Best Standard of Living and Where People Have Generally High Level of Incom1Документ5 страницA Develop Country Is That Which Has The Best Standard of Living and Where People Have Generally High Level of Incom1Hashir KhanОценок пока нет

- Cap Assignment 1septДокумент4 страницыCap Assignment 1septHashir KhanОценок пока нет

- Finance for Non-Finance ManagersДокумент4 страницыFinance for Non-Finance ManagersHashir KhanОценок пока нет

- Tax System in Pakistan.Документ20 страницTax System in Pakistan.Hashir KhanОценок пока нет

- Corporate FinanceДокумент14 страницCorporate FinanceHashir KhanОценок пока нет

- Rayyan DataДокумент16 страницRayyan DataHashir KhanОценок пока нет

- How To Start A New BusinesssДокумент15 страницHow To Start A New BusinesssHashir KhanОценок пока нет

- Presentation 1Документ12 страницPresentation 1Hashir KhanОценок пока нет

- How To Start A New BusinesssДокумент15 страницHow To Start A New BusinesssHashir KhanОценок пока нет

- Training Calendar 2014Документ12 страницTraining Calendar 2014Hashir KhanОценок пока нет

- CG and R and A-DoneДокумент5 страницCG and R and A-DoneHashir KhanОценок пока нет

- GC and BOD DoneДокумент6 страницGC and BOD DoneHashir KhanОценок пока нет

- Non Current Assets 2011Документ2 страницыNon Current Assets 2011Hashir KhanОценок пока нет

- Ratio Analysis ofДокумент10 страницRatio Analysis ofHashir KhanОценок пока нет

- International Stander On AuditingДокумент2 страницыInternational Stander On AuditingHashir KhanОценок пока нет

- Advances & Investments Ratios of Top Pakistani BanksДокумент7 страницAdvances & Investments Ratios of Top Pakistani BanksHashir KhanОценок пока нет

- Horizontal AnalysisДокумент2 страницыHorizontal AnalysisHashir KhanОценок пока нет

- Non Current Assets 2011Документ20 страницNon Current Assets 2011Hashir KhanОценок пока нет

- Tax System in PakistanДокумент53 страницыTax System in PakistanHashir Khan100% (1)

- Buraj BankДокумент13 страницBuraj BankHashir KhanОценок пока нет

- Final ChangeДокумент29 страницFinal ChangeHashir KhanОценок пока нет

- Auditing AssignmentДокумент11 страницAuditing AssignmentHashir KhanОценок пока нет

- Mid Term Law AssignmentДокумент14 страницMid Term Law AssignmentHashir KhanОценок пока нет

- ISA 260 Communication with Those Charged with GovernanceДокумент6 страницISA 260 Communication with Those Charged with GovernanceHashir KhanОценок пока нет

- Post Incorporation DocumentsДокумент9 страницPost Incorporation DocumentsHashir KhanОценок пока нет

- FORM21Документ1 страницаFORM21Hashir KhanОценок пока нет

- Name and Roll Number Umer Asif BBA11521 Sarfraz Khan BBA11575 Khadija Iqbal BBA11577 Saher Aslam BBA11581 Hashir Khan BBA11589Документ13 страницName and Roll Number Umer Asif BBA11521 Sarfraz Khan BBA11575 Khadija Iqbal BBA11577 Saher Aslam BBA11581 Hashir Khan BBA11589Hashir KhanОценок пока нет

- FORM29Документ2 страницыFORM29Muhammad SalmanОценок пока нет

- FORM28Документ2 страницыFORM28Hashir KhanОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Picpa WMMC Cup 2019 General Contest Rules and MechanicsДокумент2 страницыPicpa WMMC Cup 2019 General Contest Rules and MechanicsCarlo ValdezОценок пока нет

- NBFC Regulations OverviewДокумент60 страницNBFC Regulations OverviewVikas AroraОценок пока нет

- (Template) FABM 1 Activity 1.3 &1.4Документ3 страницы(Template) FABM 1 Activity 1.3 &1.4Christine Yarso TabloОценок пока нет

- Audit Quality in AustraliaДокумент71 страницаAudit Quality in AustraliaShuyan LiОценок пока нет

- Theory Base of AccountingДокумент11 страницTheory Base of AccountingEshuОценок пока нет

- NINJA Book Reg 1 EthicsДокумент38 страницNINJA Book Reg 1 EthicsJaffery143Оценок пока нет

- PT&T Retrenchment ValidДокумент4 страницыPT&T Retrenchment ValidAerwin AbesamisОценок пока нет

- Turning Risk Into ResultsДокумент14 страницTurning Risk Into Resultsririschristin_171952Оценок пока нет

- AUDITING THEORY MCQs ON ANALYTICAL PROCEDURES AND TESTS OF DETAILSДокумент21 страницаAUDITING THEORY MCQs ON ANALYTICAL PROCEDURES AND TESTS OF DETAILSYeovil Pansacala67% (3)

- Strategy Analysis & ChoiceДокумент49 страницStrategy Analysis & ChoiceA'del JummaОценок пока нет

- Chapter 3Документ10 страницChapter 3AbhiОценок пока нет

- Mas Practice Standards and Ethical ConsiderationsACДокумент3 страницыMas Practice Standards and Ethical ConsiderationsACLorenz BaguioОценок пока нет

- Proton Analysis inДокумент46 страницProton Analysis inRedhanuha Abdullah100% (4)

- NAP Form No. 3 Request For Authority To Dispose RecordsДокумент3 страницыNAP Form No. 3 Request For Authority To Dispose RecordsCHERRY100% (1)

- Lucky 2007 - 06 - 30Документ65 страницLucky 2007 - 06 - 30Muzammil ShahidОценок пока нет

- Jose Maria College Student Practicum JournalДокумент39 страницJose Maria College Student Practicum JournalPorferia PugosaОценок пока нет

- AnswersДокумент15 страницAnswersHarmeet KaurОценок пока нет

- Fraud Chapter 1Документ3 страницыFraud Chapter 1Jeffrey O'LearyОценок пока нет

- Exam Notification DEC 14Документ1 страницаExam Notification DEC 1409itm6832mbaОценок пока нет

- Agency Theory, Costs, and Director DutiesДокумент49 страницAgency Theory, Costs, and Director DutiesMohsin ZafarОценок пока нет

- EFfCI guidelines for remote audits of cosmetic ingredient suppliers during COVID-19Документ8 страницEFfCI guidelines for remote audits of cosmetic ingredient suppliers during COVID-19Aladdin MobarakОценок пока нет

- Guidelines on Tertiary Education Subsidy DisbursementsДокумент26 страницGuidelines on Tertiary Education Subsidy Disbursementsnanie1986100% (2)

- Enron Scandal - Wikipedia PDFДокумент31 страницаEnron Scandal - Wikipedia PDFJohn Philip De GuzmanОценок пока нет

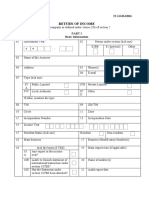

- Return of Income: Basic InformationДокумент8 страницReturn of Income: Basic InformationSudmanОценок пока нет

- Cost accounting concepts explainedДокумент37 страницCost accounting concepts explainedEhsan Umer Farooqi100% (1)

- Pt. Angkasa: NO. Account December 31, 2010 Debit CreditДокумент10 страницPt. Angkasa: NO. Account December 31, 2010 Debit CreditSamsul ArifinОценок пока нет

- AT - (14) Internal ControlДокумент16 страницAT - (14) Internal ControlCarla TañecaОценок пока нет

- Gori Maliha 7a wp7 - Accounting Report AssignmentДокумент6 страницGori Maliha 7a wp7 - Accounting Report Assignmentapi-321168520Оценок пока нет

- SATU Annual Report 2018Документ187 страницSATU Annual Report 2018sinta nuriaОценок пока нет