Академический Документы

Профессиональный Документы

Культура Документы

Bill Spetrino - The World's Greatest Dividend Stock

Загружено:

Juan Marcos Tripolone AguirreИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bill Spetrino - The World's Greatest Dividend Stock

Загружено:

Juan Marcos Tripolone AguirreАвторское право:

Доступные форматы

!

"# %&'()*+

,'#-.#+. /010)#2)

3.&45

A Moneynews.com Special Report

by Bill Spetrino

2 The WorId's Greatest Dividend Stock SpeciaI Report

My name is Bill Spetrino, and Im here to tell you

that you can fnd incredible investing success with high-

dividend-yield stocks. How do I know? Because Ive

done it myself.

But before I get to the stock that started it all for

me the one thats still an incredible wealth-building

machine today it may help to know a little more

about me.

First, its worth noting that I didnt come into the

world with a head start in the riches department. I

was born to a family of ordinary means in the suburbs

of Cleveland, Ohio. My dad was not a congressman

like Warren Buffetts dad was, nor was he a banker,

industrialist, or global businessman. Truly, no one in

my family possessed any unique fnancial planning

ability other than hard work and thrift.

Admittedly, I personally never enjoyed manual labor

or, frankly, working for others. I always wanted to do

my own thing.

I graduated from John Carroll University in

University Heights, Ohio, with a degree in accounting.

But a brief stint at Citigroup taught me one valuable

lesson: I did not want to be part of corporate America.

So instead I bowed out and became a part-time

instructor at a community college, where I worked for

a decade while I started my own small business, buying

and selling an eclectic mix of sports memorabilia, life

insurance, vitamins, and golf balls.

The frst six years forging my own way without a

steady full-time paycheck were really hard, because

all the money my wife and I made went toward making

extra payments on our condo and covering our living

expenses. Many friends and family members ridiculed

our thrifty lifestyle, but pushing ahead undeterred, we

were mortgage free within eight years.

Then, in 1990, my focus switched from sports

memorabilia to providing corporate entertainment

services, and my wife and I were able to start saving

money to build our fnancial future, starting with just

$9,000 of capital we had at the time. And, importantly,

I discovered Wall Street, or more specifcally, the

incredible power of dividend-paying stocks.

Today, we have more than $1 million in the bank.

And, quite literally, the money I earn from my regular

dividend payments alone easily covers all of my

familys living expenses.

In The Dividend Machine newsletter, which

was launched in 2009 when I was discovered

by Christopher Ruddy and Newsmax, I have

recommended a number of great dividend stocks, all of

which Ive bought myself as part of my overall nest egg.

But today, in this Special Report, I want to introduce

you to the belle of the ball, so to speak. What Im

talking about is owning the best company in America

tobacco giant Altria (NYSE symbol: MO).

Many otherwise thoughtful, intelligent people have

railed against me on this stock. They have told me

Altria is involved in a no-growth, declining-volume

industry, with ever-dimmer future prospects.

Yet to accept that knee-jerk reaction is to ignore this

companys massive free cash fow, its high return on

equity, and its ability to generate profts in good and

bad economic times alike.

Lets look at reality: It costs about 2 cents to make a

pack of cigarettes, which is sold for anywhere between

$5 and $12, depending on the state. In addition, state

and federal governments raise large sums of money by

taxing this product, meaning they have a vested interest

in making sure manufacturers dont go out of business

anytime soon.

Apple is a great, proftable company, but even they

would kill for Altria-like proft margins on any of their

products. Altria is one of the only companies in the

world that is able to enjoy this degree of proftability.

Another factor may sound like a liability, but is

actually a beneft: the ban on cigarette advertising.

Thats because Altria owners of the leading

Marlboro brand, among others already has vast

brand recognition and is the established juggernaut.

So without advertising, upstarts and competitors have

a much tougher time making any inroads into its

dominant market share.

Wouldnt you like to own a company with an

affordable product, high margins, and 50 percent

market share in an industry where competitors have

almost zero chance of muscling in on your business,

due to severely limited marketing options?

This Secret Makes AItria the Most

ProtabIe Stock You Can Own

Wharton professor Jeremy Siegel reports that 97

percent of the gain of the Dow Jones Industrial Average

since 1900 came from reinvested dividends. This means

SpeciaI Report The WorId's Greatest Dividend Stock 3

that just 3 percent of the return came from capital

appreciation!

So why is it that so many stock-market gamblers

keep chasing after capital gains? Because thats whats

considered sexy.

Unfortunately, oftentimes, whats considered

sexy isnt what is actually smart. Whats smart is to

go where the real returns are. And the real returns

overwhelmingly come from reinvested dividends.

In building your own Dividend Machine, I want you

to combine two mighty forces compound interest

and the power of reinvested dividends for a total

return that blows index funds right out of the water.

My own experience is telling. In 1994, I rolled over

an individual retirement account into Altria and have

since reinvested the dividends. Flash forward to 2011:

My Altria holdings pay me more than 78 percent of the

initial investment from 1994. My portfolio has grown

by more than 1,329 percent in that time span, greater

than 15 percent compounded annually.

On one stock: Altria.

A fuke? Lets introduce some more facts for you to

digest. In 2007, Siegel revealed that Federal Reserve

Chairman Ben Bernanke had his entire portfolio in one

single stock: Altria.

Now Bernanke, who also is a respected economist,

has not amassed the investment record of Warren

Buffett, but lets examine some facts that Bernanke

must have considered.

From 1925 to 2007, Altrias average annual returns

(when considering reinvested dividends) exceeded

17 percent a year, versus 10 percent for the market,

surpassing all other stocks, according to Siegels study.

Since 1957, when Siegels study of the S&P 500s

highest-yielding stocks began, considering reinvested

dividends, one stock has reigned supreme: Altria.

Lets get some perspective on that. In 1957, $10,000

invested in the S&P 500 composite, with dividends

reinvested, would have returned $1.4 million, about

10.9 percent compounded annually.

The same $10,000 invested in Altria, with dividends

reinvested, returned more than $46.2 million! Is this a

signifcant difference to you? It is to me.

I personally started buying Altria in 2000 at $24

per share, and the stock promptly dropped almost 25

percent in less than two months.

Thankfully, rather than acting like a normal stock

investor and bailing out, I had the sense (and the

fortitude) to continue to accumulate more shares at

prices as low as $18.75 per share.

The stock was over $38 per share eight months later.

AItria: High Risk, or High Reward?

So, why do critics continually claim that Altria is not

a good stock to own?

The frst reasonable question they ask is: What

happens if smoking is made illegal?

Here are the facts: The United States is over $16

trillion in debt and appears ready to run trillion-

dollar defcits for the next decade. Almost every state

government is broke, despite the billions of dollars

raised in state tobacco taxes.

It is estimated that the personal income tax would

have to be almost doubled to make up the shortfall

in taxes generated by tobacco federal excise taxes,

payroll taxes, and federal income taxes. Politicians in

Washington would not be re-elected if that happened.

Consider what Napoleon said in the 1800s, This

vice brings in one hundred million francs in taxes every

year. I will certainly forbid it at once, as soon as you

can name a virtue that brings in as much revenue.

Another worry is that increased state and federal

excise taxes will hurt demand. That hasnt proven true

Bill Spetrino !" $ %&'()""!'*$+ !*,)"-'&

./' /$" )$&*)0 1!++!'*" ('& /!1")+( $*0 /!"

lnvesLors solely Lhrough sLraLeglc lnvesung.

2 -&$!*)0 $33'4*-$*-5 /) 6&$04$-)0 (&'1

7'/* 8$&&'++ 9*!,)&"!-: !* ;/!' $*0 "%)*- $

decade Leachlng. A llfelong enLrepreneur

$" .)++5 <%)-&!*' ")- '4- -' 4*0)&"-$*0 $*0

codlfy a slmple dlvldend lnvesung sLraLegy

('& +!()5 $* !0)$ -/$- ),)*-4$++: +)0 -' -/)

creauon of 1he ulvldend Machlne. Pe wroLe abouL lL ln hls book,

!"#$%&'( !"#$%&'( *#+ !"#$%&' ,"-', coverlng how Lo plck

Lhe klnds of dlvldend sLocks Warren 8ueu or Lhe laLe Slr !ohn

1empleLon would recommend, long-Lerm cash generaLors wlLh

handsome appreclauon as well. Pls dlvldend plcks now gener-

aLe all of hls famlly's llvlng expenses and more, and Lhey keep on

growlng. Pe consulLs wlLh a worldwlde base of cllenLs on lnvesL-

lng and Lax plannlng from hls home ln Chlo.

in reality.

Canadian smokers pay more than $12 a pack for Marlboros that

cost $5 here. That tells me theres a lot of latent pricing power in the

U.S. market that Altria has at its disposal.

A third argument against Altria is the shrinking percentage of the

U.S. population that smokes. Thats true. But the tobacco market

remains enormous, with $721 billion in sales annually. And even

though the market is not experiencing double-digit growth, it is still

growing at a rate of about 4.5 percent per year.

Whats more, Altria has diversifed into the premium wine and

beer businesses as well and continues to grow its smokeless cigarette

business.

Another reason critics dont like Altria is the notion that lawsuits

will bankrupt the industry. Yet consider this fact: Any tobacco

judgments that are won in a state are deducted from the amount each

state gets from the national settlement, which is separate from the

states own tax.

For example, if Illinois gets $7 million in 2013, but a smoker wins a

$5 million lawsuit, then Illinois will not get the $7 million it expects in

2013. The state will get only $2 million, per the settlement. Will a state

appellate judge rule for a smoker who wins a large judgment when

he knows the money is squeezed from a fnancially struggling state? I

personally dont think so.

The last reason is that the dividend is somehow not safe because

the payout ratio is 92 percent, which is quite high. On the surface,

that sounds legitimate. However, Altria has more than a 50 percent

market share and is growing its market share annually. The product,

unlike most, is not capital intensive and costs just pennies to produce.

Advertising is illegal, so a competitor trying to gain market share does

not have many options.

In short, Altria is a recession-proof business and sells an easily

affordable product with predictable income. By acquiring shares today

you can feel comfortable knowing that your dividends are being paid

by one of the worlds most proftable companies.

This company is so stable that it makes IBM look risky. As an

investor, you really cant ask for much more than what Altria can give

you a 17 percent average return.

Sincerely,

Bill Spetrino

4 The WorId's Greatest Dividend Stock SpeciaI Report

2011 The Dividend Machine. All Rights

Reserved. The Dividend Machine is a

publication of Newsmax Media, Inc., and

Newsmax.com. It is published monthly for

$99 per year and is offered electronically

through Newsmax.com and Moneynews.com.

For rights and permissions, contact the

publisher at P.O. Box 20989, West Palm Beach,

Florida 33416. To contact The Dividend

Machine, send e-mail to: dividendmachine@

newsmax.com Subscription/Customer Service

contact (888) 766-7542 or dividendmachine@

nevsmax.com Senu e-mail auuiess clanges

to dividendmachine@newsmax.com.

Chief Executive Offcer

CHRISTOPHER RUDDY

Financial Publisher

AARON DeHOOG

Senior Financial Editor

BILL SPETRINO

Editor

MICHAEL BERG

Art/Production Director

ELIZABETH DOLE

The Dividend Machine

DISCLAIMER: The owner, publisher, and

editor are not responsible for errors and

omissions. This publication is intended

solely for information purposes and is not

to be construed, under any circumstances,

by implication or otherwise, as an offer to

sell or a solicitation to buy or sell or trade

in any commodities or securities herein

named. Information is obtained from

sources believed to be reliable, but is in no

way guaranteed. No guarantee of any kind

is implied or possible where projections

of future conditions are attempted. In no

event should the content of this market

letter be construed as an express or implied

promise, guarantee, or implication by or

from The Dividend Machine, or any of

its offcers, directors, employees, affliates,

or other agents that you will proft or

that losses can or will be limited in any

manner whatsoever. Some recommended

trades may involve securities held by

our offcers, affliates, editors, writers, or

employees, and investment decisions may

be inconsistent with or even contradictory

to the discussion or recommendation in

The Dividend Machine. Past results are

no indication of future performance. All

investments are subject to risk, which

should be considered before making

any investment decisions. Consult your

personal investment advisers before

making an investment decision. Please

view our Terms of Use for full disclosure

at www.newsmax.com/terms.html.

Copyright 2011 The Dividend Machine.

Вам также может понравиться

- Make Your Family Rich: Why to Replace Retirement Planning with Succession PlanningОт EverandMake Your Family Rich: Why to Replace Retirement Planning with Succession PlanningОценок пока нет

- Bruce G. McCarthy The PipelineДокумент27 страницBruce G. McCarthy The Pipelinethetruththewholetruthandnothingbutthetruth100% (2)

- A Guide To Investing in Closed-End Funds: Key PointsДокумент4 страницыA Guide To Investing in Closed-End Funds: Key Pointsemirav2Оценок пока нет

- Investing for Beginners: The Ultimate Stock Market Guide to Teach You How to Make Money (Achieve Financial Freedom by Investing Like the Best in the World)От EverandInvesting for Beginners: The Ultimate Stock Market Guide to Teach You How to Make Money (Achieve Financial Freedom by Investing Like the Best in the World)Оценок пока нет

- TurtleДокумент12 страницTurtleanon-373190Оценок пока нет

- What are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceОт EverandWhat are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceОценок пока нет

- Lou Simpson GEICO LettersДокумент24 страницыLou Simpson GEICO LettersDaniel TanОценок пока нет

- How to Make a Million Dollars an Hour: Why Hedge Funds Get Away with Siphoning Off America's WealthОт EverandHow to Make a Million Dollars an Hour: Why Hedge Funds Get Away with Siphoning Off America's WealthРейтинг: 3.5 из 5 звезд3.5/5 (5)

- Casino in New YorkДокумент91 страницаCasino in New YorkZijian Zhuang50% (2)

- Stop Acting Rich: ...And Start Living Like A Real MillionaireОт EverandStop Acting Rich: ...And Start Living Like A Real MillionaireРейтинг: 4 из 5 звезд4/5 (51)

- Index Investing & Financial Independence For Expats: Getting Started GuideДокумент54 страницыIndex Investing & Financial Independence For Expats: Getting Started GuideAmr Mustafa ToradОценок пока нет

- Five Techniques To Improve Your Luck - Farnam StreetДокумент8 страницFive Techniques To Improve Your Luck - Farnam StreetBernardo FusatoОценок пока нет

- Common Sense Investing by John BogleДокумент2 страницыCommon Sense Investing by John BogleGlenn JareckiОценок пока нет

- InvestopediaДокумент7 страницInvestopediaakhaveОценок пока нет

- The Bond King: How One Man Made a Market, Built an Empire, and Lost It AllОт EverandThe Bond King: How One Man Made a Market, Built an Empire, and Lost It AllРейтинг: 3.5 из 5 звезд3.5/5 (10)

- MaddenДокумент28 страницMaddenRobert RoderickОценок пока нет

- Economics in 1 LessonДокумент24 страницыEconomics in 1 LessonfaridОценок пока нет

- Financial Freedom Blueprint: 7 Steps to Accelerate Your Path to ProsperityОт EverandFinancial Freedom Blueprint: 7 Steps to Accelerate Your Path to ProsperityОценок пока нет

- How To Invest $50,000 - Louis Navellier's Emerging GrowthДокумент2 страницыHow To Invest $50,000 - Louis Navellier's Emerging Growthsan MunОценок пока нет

- Locavesting: The Revolution in Local Investing and How to Profit From ItОт EverandLocavesting: The Revolution in Local Investing and How to Profit From ItРейтинг: 4 из 5 звезд4/5 (3)

- The New Rules of Money: 10RDG0012 v1 5-10Документ5 страницThe New Rules of Money: 10RDG0012 v1 5-10sheikjimmyОценок пока нет

- Survival Investing: How to Prosper Amid Thieving Banks and Corrupt GovernmentsОт EverandSurvival Investing: How to Prosper Amid Thieving Banks and Corrupt GovernmentsРейтинг: 3.5 из 5 звезд3.5/5 (3)

- Mauldin September 24Документ12 страницMauldin September 24richardck61Оценок пока нет

- FinancialSuccessStrategies BrianTracyДокумент10 страницFinancialSuccessStrategies BrianTracyzapacitaf100% (3)

- Stock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashОт EverandStock Market Investing for Beginners: The Keys to Protecting Your Wealth and Making Big Profits In a Market CrashОценок пока нет

- Step 1: Change Your Life With One CalculationДокумент28 страницStep 1: Change Your Life With One CalculationTumwine Kahweza Prosper100% (2)

- The Death of Capital Gains Investing: And What to Replace It WithОт EverandThe Death of Capital Gains Investing: And What to Replace It WithОценок пока нет

- 13 Steps To Investing FoolishlyДокумент33 страницы13 Steps To Investing FoolishlyadikesaОценок пока нет

- Disband the Corrupt Federal Reserve System and the Irs Now!От EverandDisband the Corrupt Federal Reserve System and the Irs Now!Рейтинг: 5 из 5 звезд5/5 (1)

- Kiyosaki New Rules of MoneyДокумент5 страницKiyosaki New Rules of MoneyJunkEmailtroll100% (5)

- How To Live RichДокумент10 страницHow To Live RichIbukunОценок пока нет

- Bank On Yourself Special ReportДокумент26 страницBank On Yourself Special ReportMike HОценок пока нет

- Chapter 22 Taxation and Governmet InterventionДокумент11 страницChapter 22 Taxation and Governmet Interventionsekeresova.nikolaОценок пока нет

- Income Inequality and Basic IncomeДокумент18 страницIncome Inequality and Basic IncomeRyanОценок пока нет

- Retirees Face A Bleak FutureДокумент3 страницыRetirees Face A Bleak FutureKevin SearlsОценок пока нет

- Economics 101: Without The Bull It by Mike MitroskyДокумент11 страницEconomics 101: Without The Bull It by Mike MitroskyEl Scampio100% (1)

- Becoming MillionaireДокумент6 страницBecoming MillionaireBeata PieńkowskaОценок пока нет

- How To Invest $100 (Test)Документ1 страницаHow To Invest $100 (Test)Lucky LyonОценок пока нет

- Buffet Editorial 7-14-11Документ1 страницаBuffet Editorial 7-14-11ben3172Оценок пока нет

- 19.02.23 A Living WageДокумент3 страницы19.02.23 A Living WageWilliam R. HortonОценок пока нет

- 22 Wealth MultipliersДокумент19 страниц22 Wealth MultipliersShantrece MarshallОценок пока нет

- The Story of BrokeДокумент8 страницThe Story of BrokeJagadees SPОценок пока нет

- Government Austerity Measures Next StepДокумент10 страницGovernment Austerity Measures Next StepkakeroteОценок пока нет

- Social Investment Forum: The Future For InvestorsДокумент9 страницSocial Investment Forum: The Future For InvestorsMarcia LauraОценок пока нет

- Sumit Swipe File The Biblical Money Code PDFДокумент41 страницаSumit Swipe File The Biblical Money Code PDFJohnny CageОценок пока нет

- Stop Coddling The Super-Rich BuffetДокумент3 страницыStop Coddling The Super-Rich BuffetSanyu LakhaniОценок пока нет

- Insiders Power December 2014Документ17 страницInsiders Power December 2014InterAnalyst, LLCОценок пока нет

- Economy Report: January 2014Документ11 страницEconomy Report: January 2014api-244097691Оценок пока нет

- Bank On Yourself Special ReportДокумент25 страницBank On Yourself Special Reportblcksource100% (1)

- Wealth Inequality Is SoaringДокумент3 страницыWealth Inequality Is SoaringshinibeniОценок пока нет

- IceCap February 2011 Global Market OutlookДокумент8 страницIceCap February 2011 Global Market OutlookIceCap Asset ManagementОценок пока нет

- Capitalism in AmericaДокумент6 страницCapitalism in AmericaK.D.McCoyОценок пока нет

- 4-14 Saving Perspectives For MillenialsДокумент29 страниц4-14 Saving Perspectives For MillenialsTimothy RamseyОценок пока нет

- Consumer SpendingДокумент2 страницыConsumer SpendingSteveHanОценок пока нет

- How To Build A Career in TechДокумент105 страницHow To Build A Career in TechgeoffpercyОценок пока нет

- How To Build A Career in TechДокумент105 страницHow To Build A Career in TechgeoffpercyОценок пока нет

- A LATTICE-THEORETICAL FIXPOINT THEOREM - Tarski PDFДокумент26 страницA LATTICE-THEORETICAL FIXPOINT THEOREM - Tarski PDFJuan Marcos Tripolone AguirreОценок пока нет

- Chain Stability in Trading Networks John William Hatfield Scott Duke Kominers Alexandru Nichifor Michael Ostrovsky Alexander WestkampДокумент20 страницChain Stability in Trading Networks John William Hatfield Scott Duke Kominers Alexandru Nichifor Michael Ostrovsky Alexander WestkampJuan Marcos Tripolone AguirreОценок пока нет

- Ascending Prices and Package Bidding A Theoretical and Experimental Analysis John H. KagelДокумент37 страницAscending Prices and Package Bidding A Theoretical and Experimental Analysis John H. KagelJuan Marcos Tripolone AguirreОценок пока нет

- Ascending Auctions With Package Bidding Lawrence M. AusubelДокумент43 страницыAscending Auctions With Package Bidding Lawrence M. AusubelJuan Marcos Tripolone AguirreОценок пока нет

- Ascending Proxy Auctions Lawrence M. AusubelДокумент33 страницыAscending Proxy Auctions Lawrence M. AusubelJuan Marcos Tripolone AguirreОценок пока нет

- 3 Little-Known Income Strategies To Triple Your ReturnДокумент9 страниц3 Little-Known Income Strategies To Triple Your ReturnJuan Marcos Tripolone AguirreОценок пока нет

- 3 Uncommon Income Plays For The Renegade InvestorДокумент8 страниц3 Uncommon Income Plays For The Renegade InvestorJuan Marcos Tripolone AguirreОценок пока нет

- Mary Kay Cosmetics Inc. - Corporate Planning in An Era of UncertaintyДокумент27 страницMary Kay Cosmetics Inc. - Corporate Planning in An Era of UncertaintyJuan Marcos Tripolone AguirreОценок пока нет

- Mary Kay Ash - Perfil y BiografíaДокумент12 страницMary Kay Ash - Perfil y BiografíaJuan Marcos Tripolone AguirreОценок пока нет

- Gh. Ionescu - Adina Negrusa - Mary Kay Ash, The Greatest Female Entrepreneur in American HistoryДокумент14 страницGh. Ionescu - Adina Negrusa - Mary Kay Ash, The Greatest Female Entrepreneur in American HistoryJuan Marcos Tripolone AguirreОценок пока нет

- Sir Templeton's 16 Rules For Investment SuccessДокумент20 страницSir Templeton's 16 Rules For Investment Successmstybluemoon100% (1)

- Wills PPT For MBA Class Demo Strati OnДокумент26 страницWills PPT For MBA Class Demo Strati Onknowsaurav1947Оценок пока нет

- CAPGEMINI Aptitude Test PapersДокумент10 страницCAPGEMINI Aptitude Test PapersTejaRam AugusthyaОценок пока нет

- Itc-Impact of Itc On FMCG SectorДокумент145 страницItc-Impact of Itc On FMCG SectorPradeep RajputОценок пока нет

- NRI InvestmentДокумент9 страницNRI Investmentapi-3822396100% (2)

- AgarbattiДокумент42 страницыAgarbattiDhwani Thakkar50% (2)

- ITC Corporate PresentationДокумент59 страницITC Corporate Presentationpankaj kumar singhОценок пока нет

- RA 6956 - Modifying Excise Tax On Wines, Liquor, EtcДокумент3 страницыRA 6956 - Modifying Excise Tax On Wines, Liquor, EtcCrislene CruzОценок пока нет

- HMSP - Annual Report - 2018Документ293 страницыHMSP - Annual Report - 2018Andini TahunОценок пока нет

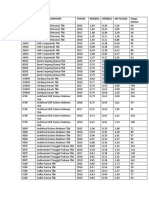

- Kode Nama Perusahaan Tahun ROE (X1) DER (X2) WCTO (X3) Harga SahamДокумент2 страницыKode Nama Perusahaan Tahun ROE (X1) DER (X2) WCTO (X3) Harga SahamSaniaОценок пока нет

- Imperial Tobacco Co. of India Ltd. Vs Registrar of Trade Marks and Anr. On 28 May, 1968Документ19 страницImperial Tobacco Co. of India Ltd. Vs Registrar of Trade Marks and Anr. On 28 May, 1968AvYlashKumbharОценок пока нет

- Argumentative EssaysДокумент7 страницArgumentative EssaysSarah Tasnia100% (1)

- H. B. FULLER, INC. ''Public-Enemy Number - . - ?'' Could H.B. Fuller Adhesives, Killing Tens of Thousands of Latin Street Children, Also Be Responsible For Gluing Smokers' Lungs Closed ?Документ41 страницаH. B. FULLER, INC. ''Public-Enemy Number - . - ?'' Could H.B. Fuller Adhesives, Killing Tens of Thousands of Latin Street Children, Also Be Responsible For Gluing Smokers' Lungs Closed ?extemporaneousОценок пока нет

- The External AssesmentДокумент5 страницThe External Assesmentmanu21y2kОценок пока нет

- 1309267060binder2Документ38 страниц1309267060binder2CoolerAdsОценок пока нет

- The Salvia Divinorum Research and Information CenterДокумент622 страницыThe Salvia Divinorum Research and Information CenterScuturici Ioan Daniel100% (1)

- Nicotex ICanYouCanДокумент4 страницыNicotex ICanYouCanĐức Đào TrungОценок пока нет

- The Creative Concept and Its Role in Advertising Design: DR - Amira KadryДокумент7 страницThe Creative Concept and Its Role in Advertising Design: DR - Amira KadrySocialMedia MYОценок пока нет

- Uas Bahasa Inggris SMK Kelas XiДокумент9 страницUas Bahasa Inggris SMK Kelas Xiregina lampita sihombingОценок пока нет

- Study On Effectiveness of Training and Development ProgramДокумент55 страницStudy On Effectiveness of Training and Development ProgramVanditha B 19183Оценок пока нет

- Amrita ProjectДокумент136 страницAmrita ProjectShweta SinghОценок пока нет

- Smoke-Free Workplace Policy & ProgramДокумент2 страницыSmoke-Free Workplace Policy & ProgramArra StypayhorliksonОценок пока нет

- ITC Industry AnalysisДокумент5 страницITC Industry AnalysisChida_m33% (3)

- 420code DigitalДокумент57 страниц420code DigitalE AОценок пока нет

- Philip Morris v. CA (G.R. No. 91332)Документ2 страницыPhilip Morris v. CA (G.R. No. 91332)James AndrinОценок пока нет

- Project On ITC FoodsДокумент29 страницProject On ITC FoodsNirmal83% (6)

- Training and Development at Bvirla HR ProjectsДокумент65 страницTraining and Development at Bvirla HR Projectsvipul tandonОценок пока нет

- Law and Tax 1Документ4 страницыLaw and Tax 1Gwendolyn PansoyОценок пока нет

- PD Enec 308 - May 2012Документ2 страницыPD Enec 308 - May 2012Abraham Seco ArmestoОценок пока нет

- (-) Maurice Forget - Quick Smart English C1 Advanced-Brookemead English Language Trainning PDFДокумент132 страницы(-) Maurice Forget - Quick Smart English C1 Advanced-Brookemead English Language Trainning PDFLuis Heredia Vasquez0% (1)

- Baggage Rules at A Glance - CBECДокумент16 страницBaggage Rules at A Glance - CBECshish0iitrОценок пока нет

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetОт EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetРейтинг: 5 из 5 звезд5/5 (2)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsОт EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsРейтинг: 5 из 5 звезд5/5 (1)

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)От EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityОт EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityРейтинг: 4.5 из 5 звезд4.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (34)

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Corporate Finance Formulas: A Simple IntroductionОт EverandCorporate Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)