Академический Документы

Профессиональный Документы

Культура Документы

Office of The City Assessor

Загружено:

chibilex0 оценок0% нашли этот документ полезным (0 голосов)

827 просмотров5 страницhi

Оригинальное название

Office of the City Assessor

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документhi

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

827 просмотров5 страницOffice of The City Assessor

Загружено:

chibilexhi

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Office of the City Assessor

Engr. FERNANDO M. FANDIO

City Assessor

Rm. 111 Pasay City Hall Bldg.

F.B. Harrison St., Pasay City, Philippines

Tel. Nos. (632) 831-6218 / 831-9446

FUNCTION:

A. Major Functions

Establish a systematic method of assessment in the manner prescribed and in accordance with the

rules and regulations issued by the Secretary of Finance;

Install and maintain real property identification and accounting system conforming to the standards

prescribed by the Secretary of Finance;

Prepare, install and maintain a system of tax mapping showing graphically all property subject to

assessment in the province, city, or municipality within Metro Manila and gather all necessary data

concerning the same;

Undertake a general revision of real property assessments within two (2) years after the effectivity of

the Local Government Code and every three (3) years thereafter;

Make frequent physical surveys to check and determine whether all real property within the locality

are properly listed in the assessment rolls;

Appraise all items of real property at current market value in accordance with R. A. 7160 and

conduct ocular inspections to determine if all properties are assessed properly;

Issue Tax Declaration/s covering newly discovered properties and transactions involving transfer of

ownership, subdivision/segregation of land into two or more parcels, and/or consolidation of two or

more parcels into a single ownership as well as other transactions involving assessment of real

property;

Enforce uniformly the exemption from real property tax prescribed under Chapter II Section 11

hereof;

Apply the appropriate assessment levels prescribed by the Sanggunian concerned;

Keep a record of all transfers, leases and mortgages of real property, rentals, insurance and cost of

construction of buildings and other improvements on land, and land income for assessment

purposes;

In case of duplication of assessment on one property, appropriate cancellation shall be made.

However, if any assessee or his representative shall object to the cancellation of the assessment

made in his name, such assessment shall not be cancelled but the fact shall be noted on the tax

declaration and assessment rolls and other property books of records. Preference, however, shall

be given to the assessment of the person who has the best title to the property or, in default thereof,

of the person who is in actual possession of the property;

Eliminate from the assessment roll of taxable property such properties which have been destroyed

or have suffered a permanent loss of value by reason of storm, flood, fire or other calamity; or being

exempt have been improperly included in the same;

Decrease the assessment where property previously assessed has suffered a substantial loss of

value by reason of physical and economic obsolescence; and

Increase the assessment where improvements and repairs have been made upon the property

subsequent to the last assessment.

B. Other Functions

Declare the property in the name of the defaulting owner, if known, or against an unknown owner,

as the case may be, and shall assess the property for taxation in accordance with the provisions of

Title II, Book II of the Local Government Code, when any person, natural or juridical, by whom real

property is required to be declared, refuses or fails for any reason to make such declaration within

the time prescribed;

Prepare and maintain an assessment roll wherein shall be listed all real property, whether taxable or

exempt, located within the territorial jurisdiction of the local government unit concerned, except in

cases where the assessors records are computerized and the same are directly and operationally

connected to the Provincial or City or Municipal Treasurer in the form of LAN or local area

networking;

Submit to the treasurer of the local government unit, on or before the thirty-first (31st) of December

each year the assessment roll containing a list of all persons whose real properties have been newly

assessed or reassessed and the value of such properties, except in cases where the assessors

records are computerized and the same are directly and operationally connected to the Provincial or

City or Municipal Treasurer in the form of LAN or local area networking;

For the purpose of obtaining information on which to base the market value of any real property, the

assessor of the province, city or municipality or his deputy may summon the owners of the

properties affected or persons having legal interest therein and their witnesses; administer oaths,

and take deposition concerning the property, its ownership, amount, nature, and value;

Recommend to the Sanggunian concerned amendments to correct errors and inequalities of

valuation in the Schedule of Fair Market Values;

The provincial, city, or municipal assessor shall within thirty (30) days give written notice of such

new or revised assessment to the person in whose name the property is declared, when real

property is assessed for the first time or when an existing assessment is increased or decreased;

In case the provincial, city, or municipal assessor within Metropolitan Manila Area concurs in the

decision of the Local Board of Assessment Appeals, it shall be his duty to notify the owner of the

property or the person having legal interest therein of such fact using the form prescribed for the

purpose. The owner of the property or the person having legal interest therein or the assessor who

is not satisfied with the decision of the Board, may, within thirty (30) days after receipt of the

decision of said Board, appeal to the Central Board of Assessment Appeals;

The provincial, city or municipal assessor shall make and keep an updated record of all idle lands

located within his jurisdiction. For purposes of collection, the provincial, city and municipal assessor

shall furnish a copy thereof to the provincial, or city treasurer who shall notify, on the basis of such

record, the owner of the property or person having legal interest therein of the imposition of the

additional tax;

The assessor concerned, upon the effectivity of the ordinance imposing special levy pursuant to

Section 241 of R. A. 7160, shall forthwith proceed to determine the annual amount of special levy

assessed against each parcel of land comprised within the area especially benefited by the public

works or improvements to be undertaken and shall send to each landowner a written notice thereof

by mail, personal service or publication in appropriate cases;

The Provincial/City Assessor sits as Chairman of the Appraisal Committee except in Cities and

Municipalities within Metropolitan Manila Area where the Assessor sits as member pursuant to E.O.

329 as amended;

Whenever appointed by the Court, the Local Assessor shall act as Commissioner;

Annotate in the tax declaration any encumbrance or adverse claims over the subject property;

Attend personally or thru his duly authorized representative all sessions of the Local and Central

Board of Assessment Appeals and present any information or record in his possession as may be

required by the Board in determining the correct assessment of the real property under appeal;

Issue upon request of owner or his authorized representative certificates pertaining to, or certified

copies of, the assessment records of real property and all other records relative to its assessment,

upon the presentation of the official receipt of payment of realty tax till the current year and upon

payment of a service charge or fee fixed therefore by the Local Sanggunian concerned; and

Exercise such other powers and perform such duties and functions as may be prescribed by law

and ordinance

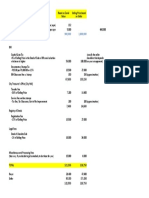

Below is a detailed summary of the steps, time and cost involved in registering property. It assumes a

standardized case of an entrepreneur who wants to purchase land and a building that is already

registered and free of title dispute.

The information appearing on this page was collected as part of the Doing Business subnational project in

Philippines. Download this Doing Business report or explore other cities and topics.

No. Procedure

Time to

Complete Associated Costs

1

Prepare the notarized deed of sale and related documents

While the deed of sale can be prepared by anyone, it must be executed

before and notarized by a notary public. In many instances, the notary

public drafts the deed of sale and conducts the whole process on behalf of

the parties.

In addition to the deed of sale, the Register of Deeds also requires both the

buyer and the seller to submit notarized secretary's certificates containing

the resolution of their board of directors approving the sale. The buyer must

also produce a certificate from the Securities and Exchange Commission

(SEC) stating that its articles of incorporation have been registered with the

SEC.

1 day PHP 83,399 (1-3% of the property value)

* 2

Obtain certified true copy of latest tax declaration and certificate of

with improvement from the City Assessors Office (CAO)

The seller must obtain a certified true copy of the latest tax declaration for

the land and the building as well as a certificate of with improvement

from the CAO as these documents are required by the BIR. Loose

documentary stamps must be affixed to these documents as proof of

payment of the documentary stamp tax (DST) on certificates. Loose

documentary stamps sold at the BIR Office cost PHP 15. However these

can be more readily purchased at city government offices at a cost ranging

from PHP 18-25 per stamp. 1 day

PHP 165 {PHP 40 per real property unit (RPU) [(Land (1RPU), Building

(1RPU)] + PHP 40 for certificate of no improvement + PHP 45 (PHP 15

documentary stamp tax per RPU/document)}

3

Obtain Certificate Authorizing Registration (CAR) from the Bureau of

Internal Revenue (BIR)

The Certificate Authorizing Registration (CAR) is a certification issued by

the BIR that the transfer and conveyance of the property was reported and

the taxes due have been fully paid.

The taxpayer/applicant must submit the following documents to the BIR:

a. Tax identification number (TIN) of seller and buyer;

b. Notarized deed of absolute sale/document of transfer, but only 14 days PHP 115 (PHP 100 certification fee + PHP 15 documentary stamp tax)

No. Procedure

Time to

Complete Associated Costs

photocopied document shall be retained by the BIR;

c. Certified true copy of the latest tax declaration issued by the City

Assessors Office for the land and improvement applicable to the taxable

transaction;

d. Owners copy (for presentation purposes only) and photocopy (for

authentication) of the Original Certificate of Title (OCT), or the certified

true copy of the Transfer Certificate of Title (TCT); and

e. Sworn declaration of with improvement by at least one (1) of the

transferees, or certificate of with improvement issued by the Assessors

Office.

4

Pay documentary stamp tax and creditable withholding tax (CWT) at

an authorized agent bank (AAB)

Prior to payment, applicant accomplishes BIR forms 2000-OT and 1606 for

DST and CWT respectively, based on the ONETT computation sheets

prepared by the BIR ONETT team. The applicant files the DST return and

CWT return and pays the taxes at the AAB of the Revenue District Office.

Payment must be made through either a managers check or cashiers check

within 5 days after the close of the month when the taxable document was

signed or within 30 days from the sale, whichever is earlier.

Upon receipt of proof of tax payment from the taxpayer/applicant, the BIR

immediately issues a claim slip.

1 day

PHP 62,550 [documentary stamp tax (PHP 15 for every PHP 1,000 or a

fraction thereof of the property value) + creditable withholding tax of 6%

of the selling price, fair market value, or zonal value, whichever is

highest.]

Note: Computation for CWT is not included in the cost reflected.

5

Pay transfer tax and obtain tax clearance certificate of real property

taxes City Treasurers Office (CTO)

The documentation shall include:

a. Deed of absolute sale (obtained in procedure 1);

b. Certificate Authorizing Registration from the BIR (obtained in Procedure

4);

c. Real property tax receipts from 2005 to 2009;

d. Payment receipts of the transfer tax, tax clearance certificate of real

property tax, application fee;

e. Authorization letter if the one processing is a representative; and

f. Community tax certificate of the corporation or the authorized

representative.

Assessment for the transfer fee, transfer tax, verification fee, application

fee, and tax clearance certificate of real property taxes is done under this

procedure. Applicant pays at the CTO cashier and receives an official

receipt. The official receipt is required for the release of the tax clearance

certificate of real property taxes.

1 day

PHP 32,450 {[PHP 34,243 (0.75% of property price + PHP 1,000 transfer

fee [PHP 500 per RPU (Land (1RPU), Building (1RPU)] + PHP 120 for

tax clearance certificate + PHP 40 application fee + PHP 15 documentary

stamp tax)}

6

Secure registration with the Register of Deeds (RD)

The buyer applies for registration with the Register of Deeds. The

documentation shall include:

a. Copy of deed of absolute sale;

b. Official receipt evidencing payment of transfer tax;

c. Certificate Authorizing Registration from the BIR (CAR) including

official receipts for payment of DST and CWT;

d. Real property tax clearance from the City Treasurers Office;

e. Original copy of owner's duplicate of TCT (in the name of the seller);

f. Original or certified true copy of the latest tax declaration;

g. Notarized secretary's certificate containing resolution of the board of

directors of the seller approving the sale;

h. Notarized secretary's certificate containing resolution of the board of

directors of the buyer approving the sale;

i. Articles of incorporation of the buyer and by-laws; and 10 days

PHP 23,863 {registration fee consisting of PHP 8,796 for first PHP

1,700,000 + PHP 90 for every PHP 20,000 or fraction thereof in excess of

PHP 1,700,000 + PHP 199.56 legal research fee (1% of the registration

fee) + PHP 30 judicial form fee + PHP 2,419.2 IT fee (PHP 268.8 per

document) + PHP 300 primary entry fee (PHP 30 per document) + PHP

480 registration fee for specific documents (PHP 120 per document) +

PHP 120 fixed entry fee for specific documents (PHP 30 per document) +

PHP 40 legal research fee for specific documents (PHP 10 per document)

+ PHP 60 annotation fee (PHP 30 per document) + PHP 258 fee for

issuance of new transfer certificate of title}

No. Procedure

Time to

Complete Associated Costs

j. Certificate from the SEC that the articles of incorporation of the buyer

have been registered.

The Register of Deeds has been fully computerized since January , 2010 as

a result of the Land Registration Authority's land titling computerization

project.

7

Obtain new tax declaration over the building and the land in the name

of buyer from CAO

The buyer applies with the CAO for the issuance of a new tax declaration

over the building in his name.

The documentation shall include:

a. Photocopy of notarized deed of sale (obtained in Procedure 1);

b. Copy of latest tax declaration (in the name of seller) (obtained in

Procedure 2);

c. Certificate authorizing registration from the BIR (obtained in Procedure

3);

d. Photocopy of official receipt of transfer tax payment (original copy to be

presented) (obtained in Procedure 5);

e. Tax clearance certificate of real property taxes from the CTO (obtained in

Procedure 5); and

f. The transfer certificate of title (TCT) issued by the RD (in the name of

the buyer) (obtained in Procedure 6).

3 days No cost (fees included in procedure 5)

* 8

Receive inspection from CAO

1 day No cost

* Takes place simultaneously with another procedure.

Вам также может понравиться

- Asset and Liability ManagementДокумент57 страницAsset and Liability ManagementMayur Federer Kunder100% (2)

- DEED OF CONDITIONAL SALe RUBEN BERANДокумент2 страницыDEED OF CONDITIONAL SALe RUBEN BERANHannahQuilang0% (1)

- Spa Form (I)Документ1 страницаSpa Form (I)cdoproperty keeshiaechem0% (1)

- Lessor Sublease Consent FormДокумент2 страницыLessor Sublease Consent FormRochelle Montesor de GuzmanОценок пока нет

- Enron Company ScandalДокумент16 страницEnron Company ScandalAbaynesh ShiferawОценок пока нет

- Nirc PDFДокумент160 страницNirc PDFCharlie Magne G. Santiaguel100% (3)

- Report of Cash Examination: Commission On AuditДокумент8 страницReport of Cash Examination: Commission On AuditRyan CanaОценок пока нет

- Study On Green Supply Chain ManagementДокумент36 страницStudy On Green Supply Chain ManagementDeep Choudhary0% (1)

- MGH GroupДокумент2 страницыMGH GroupEzaz Leo67% (3)

- Subdivision Developer Guide-DHSUD-2021Документ2 страницыSubdivision Developer Guide-DHSUD-2021ma9o0100% (1)

- Exclusive Authority To SellДокумент1 страницаExclusive Authority To SellTIN GOMEZОценок пока нет

- Letter of Intent For PrincipalДокумент3 страницыLetter of Intent For PrincipalRaysunArellanoОценок пока нет

- SPA GRACE Emma2Документ10 страницSPA GRACE Emma2Sonny Manalili CorpuzОценок пока нет

- HLURB Form No 1120Документ1 страницаHLURB Form No 1120Cherry DuldulaoОценок пока нет

- I Sag Permit ApplicationДокумент1 страницаI Sag Permit ApplicationMots OrejolaОценок пока нет

- Waiver and Relinquishment of Rights: AffiantДокумент2 страницыWaiver and Relinquishment of Rights: AffiantBayani Kamporedondo50% (2)

- Aff Transferro-Ree-1Документ2 страницыAff Transferro-Ree-1Anonymous kJPBOi0HОценок пока нет

- Quiz Chương Btap - HTRДокумент7 страницQuiz Chương Btap - HTRDOAN NGUYEN TRAN THUCОценок пока нет

- Cancellation of Encumbrance Sec 7 Ra 26 - Google SearchДокумент2 страницыCancellation of Encumbrance Sec 7 Ra 26 - Google Searchbatusay575Оценок пока нет

- Memorandum of Agreement: WitnessethДокумент2 страницыMemorandum of Agreement: WitnessethOmnibus MuscОценок пока нет

- Sample Transfer of Title ComputationДокумент1 страницаSample Transfer of Title ComputationForiel FrancoОценок пока нет

- Deed of Assignment and Transfer of RightsДокумент2 страницыDeed of Assignment and Transfer of RightsEmilio Soriano100% (1)

- Affidavit of Undertaking To Submit Transfer Certificate of Title (TCT) (For Subdivision Projects)Документ1 страницаAffidavit of Undertaking To Submit Transfer Certificate of Title (TCT) (For Subdivision Projects)yonni143Оценок пока нет

- Annex A Locational ClearanceДокумент1 страницаAnnex A Locational Clearancemary ann carreon100% (1)

- ECC Online Application Procedures (Category B-IEEC)Документ1 страницаECC Online Application Procedures (Category B-IEEC)Joseph CajoteОценок пока нет

- R-890 S. 2012Документ8 страницR-890 S. 2012mabzicleОценок пока нет

- Real Property TaxДокумент5 страницReal Property TaxRacinef Tee100% (2)

- RA 7160 Situs of The Tax - IRRДокумент71 страницаRA 7160 Situs of The Tax - IRRErnie F. CanjaОценок пока нет

- Republic Act No 7279 (Lina Law)Документ22 страницыRepublic Act No 7279 (Lina Law)Jeanne AshleyОценок пока нет

- Checklist of Requirements Application For Renewal of Mineral Production Sharing AgreementДокумент2 страницыChecklist of Requirements Application For Renewal of Mineral Production Sharing AgreementChristian Magbag100% (1)

- The Planning of Residential Developments The Planning of Residential DevelopmentsДокумент30 страницThe Planning of Residential Developments The Planning of Residential DevelopmentsFrances MarasiganОценок пока нет

- Deed of Absolute SaleДокумент3 страницыDeed of Absolute Saledrpjgmrmc bacОценок пока нет

- Project On RecruitmentДокумент90 страницProject On RecruitmentOmsi LathaОценок пока нет

- DENR River Restoration Thru Dredging ActivitiesДокумент48 страницDENR River Restoration Thru Dredging Activitiesmaricor100% (1)

- CNC IssuanceДокумент5 страницCNC IssuanceJoey S HerederoОценок пока нет

- Checklist For CRLS Subdivision...Документ14 страницChecklist For CRLS Subdivision...Jhan Melch100% (1)

- Application For Memorial Park (Final)Документ1 страницаApplication For Memorial Park (Final)Wilfredo Gabata SinoyОценок пока нет

- Authorization Letter: Assessor's Office of Cainta, RizalДокумент1 страницаAuthorization Letter: Assessor's Office of Cainta, RizalJason YangaОценок пока нет

- City of Baguio Barangay of DontoganДокумент9 страницCity of Baguio Barangay of Dontoganluningning0007Оценок пока нет

- PRLD - SRS.002-B.00 - Sworn Registration Statement (Single)Документ2 страницыPRLD - SRS.002-B.00 - Sworn Registration Statement (Single)KLASANTOS100% (1)

- Municipality of Santa Barbara's: Risk ProfileДокумент17 страницMunicipality of Santa Barbara's: Risk ProfileYANYANОценок пока нет

- DEED OF ABSOLUTE SALE AdayaДокумент5 страницDEED OF ABSOLUTE SALE AdayaMonette EspeletaОценок пока нет

- QC Amended Zoning Ordinance 2000Документ55 страницQC Amended Zoning Ordinance 2000queenietanОценок пока нет

- Extrajudicial Settlement of Estate With Waiver of RightsДокумент3 страницыExtrajudicial Settlement of Estate With Waiver of RightsmutedchildОценок пока нет

- Office of The Zoning AdministratorДокумент5 страницOffice of The Zoning AdministratorDondon Gutierrez ValdezОценок пока нет

- HLURB PoultryДокумент1 страницаHLURB PoultryKonsehal Bennet PongosОценок пока нет

- Deed of Absolute SaleДокумент2 страницыDeed of Absolute SaleAna CalustaniaОценок пока нет

- Special Power of Attorney: (Signature Over Printed Name) (Signature Over Printed Name)Документ2 страницыSpecial Power of Attorney: (Signature Over Printed Name) (Signature Over Printed Name)Robee Camille Desabelle-SumatraОценок пока нет

- RDO No. 112 Tagum City Davao Del NorteДокумент1 278 страницRDO No. 112 Tagum City Davao Del NorteArvin Antonio OrtizОценок пока нет

- Relocation Survey DefinitionДокумент2 страницыRelocation Survey DefinitionrubydelacruzОценок пока нет

- Proscenium Sample Computation - TPR - 3 BR - 57C - 268sqm - PENTHOUSE PDFДокумент1 страницаProscenium Sample Computation - TPR - 3 BR - 57C - 268sqm - PENTHOUSE PDFValerie Santiago Gayoba100% (1)

- Geodetic Engineer's Report On Relocation SurveyДокумент5 страницGeodetic Engineer's Report On Relocation SurveyMalson GutierrezОценок пока нет

- SPA JOY BERRENGUER J. BAYACA Married To ROWEL F. BAYACAДокумент3 страницыSPA JOY BERRENGUER J. BAYACA Married To ROWEL F. BAYACAAnjo AlbaОценок пока нет

- Naga Development PermitДокумент8 страницNaga Development PermitAB AgostoОценок пока нет

- 2022 Obc GuidelinesДокумент3 страницы2022 Obc GuidelinesDOLE Region 6100% (1)

- Application Alteration Condominium PlanДокумент1 страницаApplication Alteration Condominium PlanRanie DelaventeОценок пока нет

- Contract To Sell - ELENO G. SANCHEZДокумент2 страницыContract To Sell - ELENO G. SANCHEZBarn CabsОценок пока нет

- Downloadable Forms - Reqs of Substitution - Waiver of RightsДокумент1 страницаDownloadable Forms - Reqs of Substitution - Waiver of Rightsembies100% (1)

- Deed of Donation 2222Документ1 страницаDeed of Donation 2222Manny SandichoОценок пока нет

- Citizen'S Charter: City Assessor'S OfficeДокумент12 страницCitizen'S Charter: City Assessor'S OfficeMark Jeson Lianza PuraОценок пока нет

- Form Gis Sec of EccДокумент16 страницForm Gis Sec of EccELIZABETH CAI100% (1)

- Province of Bulacan - Municipality of Marilao: Municipal Planning and Development OfficeДокумент1 страницаProvince of Bulacan - Municipality of Marilao: Municipal Planning and Development OfficeBIANCA FIONA ESPESOОценок пока нет

- Authority of Signing OfficialДокумент1 страницаAuthority of Signing OfficialRichard MendezОценок пока нет

- Revised MOA Paul Andrew Pilapil Lot 1181-BДокумент3 страницыRevised MOA Paul Andrew Pilapil Lot 1181-BttunacaoОценок пока нет

- Baguio CityДокумент2 страницыBaguio CityKweeng Tayrus FaelnarОценок пока нет

- Petition - Lost Title - RichelleДокумент4 страницыPetition - Lost Title - Richelleroxsanne capati100% (1)

- RDO No. 3 - San Fernando City, La UnionДокумент1 698 страницRDO No. 3 - San Fernando City, La UnionNash A. Dugasan100% (1)

- Manual On Real Prtoperty AppraisalДокумент32 страницыManual On Real Prtoperty AppraisalSharon GonzalesОценок пока нет

- Real Property Taxation: Title IiДокумент64 страницыReal Property Taxation: Title IiAngelica Macabangun FagelaОценок пока нет

- ASFGSGДокумент58 страницASFGSGchibilexОценок пока нет

- Basic LaborДокумент4 страницыBasic LaborchibilexОценок пока нет

- Supreme CourtДокумент14 страницSupreme CourtchibilexОценок пока нет

- Slide 3. G. 1Документ13 страницSlide 3. G. 1chibilexОценок пока нет

- TrsjrykДокумент58 страницTrsjrykchibilexОценок пока нет

- Earjjjjrsjshfdhaghhhhhhhhhhhweh Di Nga! Bleh! Haha, Lolahaha. Whahaha HGKKKKKKKKKKKKKKK DreysrjktyoyuДокумент1 страницаEarjjjjrsjshfdhaghhhhhhhhhhhweh Di Nga! Bleh! Haha, Lolahaha. Whahaha HGKKKKKKKKKKKKKKK DreysrjktyoyuchibilexОценок пока нет

- DSGDДокумент58 страницDSGDchibilexОценок пока нет

- The Basic Policy of The Labor CodeДокумент3 страницыThe Basic Policy of The Labor CodechibilexОценок пока нет

- FuhДокумент58 страницFuhchibilexОценок пока нет

- SDHFHTJ 66 KДокумент58 страницSDHFHTJ 66 KchibilexОценок пока нет

- DSGSGДокумент58 страницDSGSGchibilexОценок пока нет

- An Unprobated Will Does Not Pass Any RightДокумент1 страницаAn Unprobated Will Does Not Pass Any RightchibilexОценок пока нет

- AgshhjДокумент58 страницAgshhjchibilexОценок пока нет

- SFHJHKJHKДокумент58 страницSFHJHKJHKchibilexОценок пока нет

- Epublic of The PhilippinesДокумент4 страницыEpublic of The PhilippineschibilexОценок пока нет

- Table of ContentsДокумент13 страницTable of ContentschibilexОценок пока нет

- AaaДокумент58 страницAaachibilexОценок пока нет

- SuccessДокумент31 страницаSuccesschibilexОценок пока нет

- Reflection Essay ExamplesДокумент3 страницыReflection Essay ExampleschibilexОценок пока нет

- Leading Up To World War IIДокумент7 страницLeading Up To World War IIKelly LuluОценок пока нет

- DGDHHДокумент58 страницDGDHHchibilexОценок пока нет

- The Basic Policy of The Labor CodeДокумент3 страницыThe Basic Policy of The Labor CodechibilexОценок пока нет

- 2014 Civ1 List of Cases 7-10-14Документ7 страниц2014 Civ1 List of Cases 7-10-14chibilexОценок пока нет

- KingdomNomics Quick Start 140108Документ49 страницKingdomNomics Quick Start 140108Andore BcОценок пока нет

- G.R. No. L-14074, in Re Will of RiosaДокумент5 страницG.R. No. L-14074, in Re Will of RiosachibilexОценок пока нет

- SДокумент3 страницыSchibilexОценок пока нет

- TC CreДокумент195 страницTC CrechibilexОценок пока нет

- LF2Документ8 страницLF2chibilexОценок пока нет

- Empirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Документ4 страницыEmpirical Methods: Uva - Instructions-Take-Home-Assignment-2018-2019Jason SpanoОценок пока нет

- Your Vi Bill: M/s. Sakshi DevelopersДокумент11 страницYour Vi Bill: M/s. Sakshi DevelopersAbhay SharmaОценок пока нет

- BCM 2104 - Intermediate Accounting I - October 2013Документ12 страницBCM 2104 - Intermediate Accounting I - October 2013Behind SeriesОценок пока нет

- Debentures 2024 SPCCДокумент53 страницыDebentures 2024 SPCCdollpees01Оценок пока нет

- DCC 135Документ193 страницыDCC 135Shariful IslamОценок пока нет

- Opportunity IdentificationДокумент19 страницOpportunity IdentificationAraОценок пока нет

- Weekly Learning Activity Sheet Solomon P. Lozada National High SchoolДокумент15 страницWeekly Learning Activity Sheet Solomon P. Lozada National High SchoolRutchelОценок пока нет

- HfyfuДокумент13 страницHfyfuHazelClaveОценок пока нет

- Presented By, Nikhil Varghese LEAD College of Management, PalakkadДокумент17 страницPresented By, Nikhil Varghese LEAD College of Management, PalakkadShivam SethiОценок пока нет

- Accounting of Clubs & SocietiesДокумент13 страницAccounting of Clubs & SocietiesImran MulaniОценок пока нет

- Plans and Policies 2080 81englishДокумент52 страницыPlans and Policies 2080 81englishYagya Raj BaduОценок пока нет

- Competitive Advantage of The PhilippinesДокумент20 страницCompetitive Advantage of The PhilippinesMilesОценок пока нет

- Partner Marketing Playbook: Work. Intuitive. EmearДокумент19 страницPartner Marketing Playbook: Work. Intuitive. EmearKelly YengОценок пока нет

- Dealing With Competition: Competitive ForcesДокумент9 страницDealing With Competition: Competitive Forcesasif tajОценок пока нет

- Working Paper No 14 2017 Zegarra and PecheДокумент27 страницWorking Paper No 14 2017 Zegarra and Pechejose zegarra pintoОценок пока нет

- SCB Credit Card Application FormДокумент11 страницSCB Credit Card Application FormJames TanОценок пока нет

- Shweta Final RCCДокумент65 страницShweta Final RCCidealОценок пока нет

- Business English Stock MarketДокумент2 страницыBusiness English Stock MarketMara CaiboОценок пока нет

- Form PDF 927448140281220Документ7 страницForm PDF 927448140281220Arvind KumarОценок пока нет

- Brunei Country ReportДокумент41 страницаBrunei Country ReportIndra MuraliОценок пока нет

- Principles of Acc. II Lecture NoteДокумент54 страницыPrinciples of Acc. II Lecture NoteJemal Musa83% (6)

- Chapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsДокумент3 страницыChapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsFerb CruzadaОценок пока нет

- BBM 215 - Financial Management IДокумент97 страницBBM 215 - Financial Management Iheseltine tutu100% (1)