Академический Документы

Профессиональный Документы

Культура Документы

7110 w11 Ms 21

Загружено:

mstudy1234560 оценок0% нашли этот документ полезным (0 голосов)

26 просмотров10 страницMark scheme is published as an aid to teachers and candidates, to indicate the requirements of the examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the details of the discussions that took place at an Examiners' meeting before marking began.

Исходное описание:

Оригинальное название

7110_w11_ms_21

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документMark scheme is published as an aid to teachers and candidates, to indicate the requirements of the examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the details of the discussions that took place at an Examiners' meeting before marking began.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

26 просмотров10 страниц7110 w11 Ms 21

Загружено:

mstudy123456Mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the details of the discussions that took place at an Examiners' meeting before marking began.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 10

UNIVERSITY OF CAMBRIDGE INTERNATIONAL EXAMINATIONS

GCE Ordinary Level

MARK SCHEME for the October/November 2011 question paper

for the guidance of teachers

7110 PRINCIPLES OF ACCOUNTS

7110/21 Paper 2 (Structured), maximum raw mark 120

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of

the examination. It shows the basis on which Examiners were instructed to award marks. It does not

indicate the details of the discussions that took place at an Examiners meeting before marking began,

which would have considered the acceptability of alternative answers.

Mark schemes must be read in conjunction with the question papers and the report on the

examination.

Cambridge will not enter into discussions or correspondence in connection with these mark schemes.

Cambridge is publishing the mark schemes for the October/November 2011 question papers for most

IGCSE, GCE Advanced Level and Advanced Subsidiary Level syllabuses and some Ordinary Level

syllabuses.

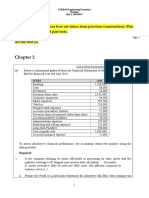

Page 2 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

1 Books of Christos

Michelle Account

July 1 Balance b/d 200 (1) July 16 Sales returns 8 (1)

July 7 Sales 150 (1) July 31 Bank 195 (1)

July 31 Discount 5 (1)

Allowed

July 31 Balance c/d 142

350 350

1 Aug Balance b/d 142 (1)

[6]

(b) Sales returns journal (1) [1]

(c) Christos Trial Balance at 31 July 2011

$ $

Capital 5 900(2of)

Drawings 8 000

Office furniture 5 000

Provision for depreciation on office furniture 3 200

Inventory 4 150

Bank overdraft 250

Trade payables 2 950

Sundry expenses 10 600

Purchases 32 400

Provision for doubtful debts 350

Revenue (sales) 53 750

Trade receivables 6 250 _____

66 400 (2) 66 400 (2)

[6]

(d) Trade receivables (1) [1]

Page 3 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

(e) Trial balance Balance sheet

Proves arithmetic accuracy of double entry Proves agreement of the balance sheet

equation

Includes all account balances Includes only assets and liabilities

Recorded as debit and credit balances Recorded as assets and liabilities after

and includes revenue items revenue accounts prepared

Recorded in any order Recorded in defined categories e.g. fixed

assets

Contains only exact balances Contains net figures e.g. book value of fixed

assets of debtors after provisions

(2) marks x 2 differences [4]

[Total: 18]

Page 4 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

2 (a) Credit note (1) [1]

(b) Error of commission (1) [1]

(c) Dr Cr

$ $

(i) 10 April M.H Supplies Ltd 180 (1)

Suspense 180 (1)

(ii) 20 April M.H Supplies 1200 (1)

M.Hardware Ltd. 1200 (1)

(iii) 23 April Suspense 66 (1)

M.H Supplies Ltd 66 (1)

[6]

(d) Suspense account

$ $

Balance/difference 114 (2) M.H Supplies Ltd 180 (1)

M.H Supplies 66 (1) ___

180 180

[4]

(e) M.H Supplies Ltd adjusted balance at 31 August 2011

$

Original balance at 30 April 466 Dr

Plus Trade discount error 180 (1of)

Transaction posted to M.Hardware Ltd 1200 (1)

1380

1846

Less Error in cash discount posting 66 (1of)

Corrected balance 1780 (1of)

[4]

(f) Quick processing.

Accurate.

Automatic updating of balances.

Large volume of data can be processed.

Electronic storage uses less space.

Security of data may be easier.

(2) x 2 points [4]

[Total: 20]

Page 5 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

3 (a) Accumulated fund:

Assets

$

Subscriptions in arrears 270 (1)

Inventory of refreshments 2200

Prepaid operating expenses 100

Equipment 3200

Bank 105 (1)

5875 (1)

Liabilities

Subscriptions in advance 175 (1)

Accumulated fund 5700 (2) or (1)OF

[6]

(b) Sandbury Sports Club

Refreshment Trading Account for the year ended 31 October 2011

$ $

Sales of refreshments 25 000 (1)

Opening inventory 2 200

Purchases 19 000

21 200

Closing inventory 700 (1)

Cost of sales 20 500 (1)

Gross profit 4 500 (1)

[4]

Page 6 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

(c) Sandbury Sports Club

Income and Expenditure Account for the year ended 31 October 2011

$ $

Income

Subscriptions (3200 + 175 + 90) 3465 (2)

Profit on refreshments 4500 (1of)

7965

Less

Expenditure

Bad debts 120 (2)

Rent and rates 1200 (1)

Operating expenses 4100

(3750 + 100 (1) 250 (1))

Depreciation on equipment 1400 (1)

6820

Surplus 1145 (1)

[10]

(d) (i) Current liabilities (1)

They are creditors of the club for services to be provided in the future (1)

(ii) Non-current assets (1)

It is capital expenditure (1)

Used for more than one accounting period

[4]

[Total: 24]

Page 7 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

4 (a) (i) $

Opening inventory 18 000

Purchases 178 000 (1 of)

196 000

Closing inventory 36 000

Cost of sales 160 000 (2)

[3]

(ii) Gross profit $160 000 x 25% = 40 000 (1)

Net profit $200 000 x 6% = 12 000 (1)

Expenses 28 000 (1)

[3]

(b) (i) Current assets = 60 000 (1) = 1.2:1 (1)

Liabilities due in less than one year

50 000 (1)

[3]

(ii) Current assets - Inventory 24 000 (1) = 0.5:1 (1)

Liabilities due in less than one year 50 000 (1)

[3]

(c) The quick ratio (acid test) excludes inventory (1)

The inventory may be difficult or take a long time to sell.

Inventory may deteriorate or become obsolete.

Inventory is two stages away from cash.

Debtors is one stage away from cash.

Only liquid assets are included.

(2) x 1 point

[3]

(d) Invest more capital.

Reduce drawings.

Reduce costs/expenses.

Sell surplus non-current assets.

Raise a loan.

Offer cash discount to trade receivables to speed up receipts.

Sell for cash.

(1) x 3 points

[3]

[Total: 18]

Page 8 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

5 Donney and Raj

Income Statement for the year ended 30 September 2011

$ $

Revenue (sales) 365 000

Less Returns 9 200

355 800(1)

Inventory at 1 October 2009 53 500

Purchases 173 000 (1)

Plus Carriage inwards 4 950 (1)

231 450

Less Returns 5 500 (1)

225 950

Less Inventory at 30 September 2010 61 450 (1)

Cost of sales 164 500

Gross profit 191 300(1)

Less

Carriage outwards 11 550 (1)

Administration expenses (25 750 630) 25 120 (2)

Wages and salaries (66 700 + 2 700) 69 400 (2)

Provisions for depreciation-

Motor vehicles 10 000 (1)

Fixtures and fittings 7 500 (1)

Sundry expenses 10 250 (1)

Advertising 23 480 (1)

Finance costs (loan interest)(2 000 + 2 000) 4 000 (2)

Bad debt 2 500 (1)

Increase in provision for doubtful debts 400 (1)

164 200

Profit for the year 27 100

Less Appropriations:

Interest on capital:

Donney 6 000

Raj 4 000

10 000 (1)

17 100

Salary Raj 12 000 (1)

5 100

Share of profit:

Donney 3 400

Raj 1 700

5 100(2of)

[23]

Page 9 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

Balance Sheet at 30 September 2011

$ $ $

Cost Accumulated

Depreciation NBV

Non-current assets

Property 170 000 170 000

Motor vehicles 75 000 35 000 40 000 (1)OF

Fixtures and fittings 50 000 31 500 18 500 (1)OF

295 000 66 500 228 500

Current assets

Inventory 61 450 (1)

Trade receivables 60 000

Less: provision for

doubtful debts (2 400)

57 600 (2)

Other receivables (Prepaid admin expenses) 630 (1)

119 680

Less:

Current liabilities

Trade payables (30 500) (1)

Other payables: (accrued Wages and salaries)

(2 700) (1)

(loan interest) (2 000) (1)

Bank overdraft (4 380) (1)

(39 580)

Net current assets 80 100(1)

308 600

Less

Non-current liabilities

8% loan repayable 31 December 2025 (50 000)(1)

258 600

Financed by:

Capital accounts:

Donney 150 000

Raj 100 000

250 000 (1)

Current accounts:

Donney 9 400Cr

Raj 800Dr

8 600 (4)

258 600

[17]

Suitable alternative layouts accepted

Page 10 Mark Scheme: Teachers version Syllabus Paper

GCE O LEVEL October/November 2011 7110 21

University of Cambridge International Examinations 2011

Current accounts

Donney Raj Donney Raj

$ $ $ $

Balance b/d 3 500 Balance b/d 15 000

Drawings 15 000 15 000(1) Interest on capital 6 000 4 000 (1of)

Salary 12 000 (1)

Share of profit 3 400 1 700 (1of)

Balance c/d 9 400 Balance c/d 800

24 400 18 500 24 400 18 500

[Total: 40 marks]

Вам также может понравиться

- 7110 s12 Ms 21Документ7 страниц7110 s12 Ms 21mstudy123456Оценок пока нет

- 7110 w12 Ms 22Документ7 страниц7110 w12 Ms 22mstudy123456Оценок пока нет

- MARK SCHEME For The November 2004 Question PaperДокумент8 страницMARK SCHEME For The November 2004 Question Papermstudy123456Оценок пока нет

- 7110 w12 Ms 21Документ6 страниц7110 w12 Ms 21mstudy123456Оценок пока нет

- 7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question PaperДокумент6 страниц7110 Principles of Acounts: MARK SCHEME For The October/November 2006 Question Papermstudy123456Оценок пока нет

- 9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersДокумент5 страниц9706 Accounting: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersSaad MansoorОценок пока нет

- 0452 w11 Ms 13Документ7 страниц0452 w11 Ms 13Faisal RaoОценок пока нет

- 0452 w11 Ms 12Документ8 страниц0452 w11 Ms 12Faisal RaoОценок пока нет

- 9 BBДокумент5 страниц9 BBIlesh DinyaОценок пока нет

- 0452 m15 Ms 12Документ9 страниц0452 m15 Ms 12IslamAltawanayОценок пока нет

- 0452 s11 Ms 13Документ8 страниц0452 s11 Ms 13Athul TomyОценок пока нет

- 9706 w10 Ms 41Документ5 страниц9706 w10 Ms 41kanz_h118Оценок пока нет

- 9706 Accounting: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersДокумент6 страниц9706 Accounting: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersJhagantini PalaniveluОценок пока нет

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesДокумент7 страниц9706 Accounting: MARK SCHEME For The October/November 2013 SeriesCambridge Mathematics by Bisharat AliОценок пока нет

- 0452 s11 Ms 22Документ9 страниц0452 s11 Ms 22Athul TomyОценок пока нет

- Business Book o LevelДокумент7 страницBusiness Book o LevelaviiishiiОценок пока нет

- ASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307Документ8 страницASE 3902 - IAS - Revised Syllabus - Answers To Specimen Paper 2008 16307WinnieOngОценок пока нет

- 0452 Accounting: MARK SCHEME For The October/November 2012 SeriesДокумент10 страниц0452 Accounting: MARK SCHEME For The October/November 2012 SeriesJoel GwenereОценок пока нет

- 9706 Accounting: MARK SCHEME For The March 2016 SeriesДокумент8 страниц9706 Accounting: MARK SCHEME For The March 2016 SeriesEn DimunОценок пока нет

- 9706 w11 Ms 41 PDFДокумент5 страниц9706 w11 Ms 41 PDFVaanya PoyrooОценок пока нет

- LCCI ACCOUNTING TITLEДокумент9 страницLCCI ACCOUNTING TITLEmappymappymappyОценок пока нет

- WAC11 01 MSC 20210517Документ24 страницыWAC11 01 MSC 20210517Mashhood Babar ButtОценок пока нет

- 0452 s10 Ms 21Документ8 страниц0452 s10 Ms 21cleverheart123Оценок пока нет

- Mark Scheme (Provisional)Документ24 страницыMark Scheme (Provisional)new yearОценок пока нет

- 0452 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersДокумент17 страниц0452 Accounting: MARK SCHEME For The October/November 2011 Question Paper For The Guidance of TeachersannabellОценок пока нет

- 9706 Accounting: MARK SCHEME For The October/November 2013 SeriesДокумент5 страниц9706 Accounting: MARK SCHEME For The October/November 2013 SeriestarunyadavfutureОценок пока нет

- 0452 Accounting: MARK SCHEME For The May/June 2015 SeriesДокумент9 страниц0452 Accounting: MARK SCHEME For The May/June 2015 SeriesEn DimunОценок пока нет

- 0452 Accounting: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersДокумент18 страниц0452 Accounting: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersannabellОценок пока нет

- 0452 Accounting: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersДокумент7 страниц0452 Accounting: MARK SCHEME For The May/June 2010 Question Paper For The Guidance of TeachersShady Onsi AnisОценок пока нет

- Solution Past Paper Higher-Series4-08hkДокумент16 страницSolution Past Paper Higher-Series4-08hkJoyce LimОценок пока нет

- 0452 Accounting: MARK SCHEME For The May/June 2015 SeriesДокумент9 страниц0452 Accounting: MARK SCHEME For The May/June 2015 SeriesIron OneОценок пока нет

- Ratios Q1 AnsДокумент2 страницыRatios Q1 AnsSAADОценок пока нет

- MARK SCHEME For The June 2004 Question PapersДокумент9 страницMARK SCHEME For The June 2004 Question PapersRobert EdwardsОценок пока нет

- 0452 s12 Ms 22Документ9 страниц0452 s12 Ms 22Faisal RaoОценок пока нет

- 9706 Accounting: MARK SCHEME For The October/November 2015 SeriesДокумент8 страниц9706 Accounting: MARK SCHEME For The October/November 2015 Seriestecho2345Оценок пока нет

- Financial Performance Evaluation of Smithson PlcДокумент5 страницFinancial Performance Evaluation of Smithson PlcAyesha SheheryarОценок пока нет

- 2014 Accounting Specimen Paper 1 Mark Scheme PDFДокумент8 страниц2014 Accounting Specimen Paper 1 Mark Scheme PDFSpike RockОценок пока нет

- National University of Science and TechnologyДокумент5 страницNational University of Science and TechnologyPATIENCE MUSHONGAОценок пока нет

- 9706 Accounting: MARK SCHEME For The May/June 2007 Question PaperДокумент7 страниц9706 Accounting: MARK SCHEME For The May/June 2007 Question Paperroukaiya_peerkhanОценок пока нет

- 7110 w15 Ms 21 PDFДокумент11 страниц7110 w15 Ms 21 PDFRachel RAMSAMYОценок пока нет

- 0452 w15 Ms 22 PDFДокумент10 страниц0452 w15 Ms 22 PDFAnonymous ustYBQOaEB100% (2)

- National University of Science and TechnologyДокумент8 страницNational University of Science and TechnologyPATIENCE MUSHONGAОценок пока нет

- 7110 s08 Ms 2Документ8 страниц7110 s08 Ms 2meelas123Оценок пока нет

- 9706 Accounting: MARK SCHEME For The October/November 2008 Question PaperДокумент5 страниц9706 Accounting: MARK SCHEME For The October/November 2008 Question PapercheekybuoiОценок пока нет

- ACC1006 EOY Essay DrillДокумент13 страницACC1006 EOY Essay DrillTiffany Tan Suet YiОценок пока нет

- AFE 5008 Model Answers for Final ExamsДокумент10 страницAFE 5008 Model Answers for Final ExamsDiana TuckerОценок пока нет

- University of Zimbabwe: Professional and Industrial StudiesДокумент7 страницUniversity of Zimbabwe: Professional and Industrial StudiesBrightwell InvestmentsОценок пока нет

- 4ac1 02 Rms 20240125Документ9 страниц4ac1 02 Rms 20240125Nang Phyu Sin Yadanar KyawОценок пока нет

- CH 3.1 Tabular Analysis - SДокумент14 страницCH 3.1 Tabular Analysis - Sসাঈদ আহমদ100% (2)

- 0452 w07 Ms 3 PDFДокумент9 страниц0452 w07 Ms 3 PDFHassan PansariОценок пока нет

- Chapter 4-Profitability Analysis: Multiple ChoiceДокумент30 страницChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderОценок пока нет

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОт EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosОценок пока нет

- Equity Valuation: Models from Leading Investment BanksОт EverandEquity Valuation: Models from Leading Investment BanksJan ViebigОценок пока нет

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersОт EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersОценок пока нет

- Information Technology Outsourcing Transactions: Process, Strategies, and ContractsОт EverandInformation Technology Outsourcing Transactions: Process, Strategies, and ContractsОценок пока нет

- 0486 w09 QP 4Документ36 страниц0486 w09 QP 4mstudy123456Оценок пока нет

- 0547 s06 TN 3Документ20 страниц0547 s06 TN 3mstudy123456Оценок пока нет

- 0654 w04 Ms 6Документ6 страниц0654 w04 Ms 6mstudy123456Оценок пока нет

- 9697 w11 QP 41Документ2 страницы9697 w11 QP 41mstudy123456Оценок пока нет

- 0420-Nos As 1Документ24 страницы0420-Nos As 1Ali HassamОценок пока нет

- 0445 s13 ErДокумент37 страниц0445 s13 Ermstudy123456Оценок пока нет

- Literature (English) : International General Certificate of Secondary EducationДокумент1 страницаLiterature (English) : International General Certificate of Secondary Educationmstudy123456Оценок пока нет

- 9701 s06 Ms 4Документ5 страниц9701 s06 Ms 4Kenzy99Оценок пока нет

- 9694 s11 QP 21Документ8 страниц9694 s11 QP 21mstudy123456Оценок пока нет

- 9695 s05 QP 4Документ12 страниц9695 s05 QP 4mstudy123456Оценок пока нет

- 9697 s12 QP 53Документ4 страницы9697 s12 QP 53mstudy123456Оценок пока нет

- 9694 w10 QP 23Документ8 страниц9694 w10 QP 23mstudy123456Оценок пока нет

- 9697 s12 QP 33Документ4 страницы9697 s12 QP 33mstudy123456Оценок пока нет

- Frequently Asked Questions: A/AS Level Sociology (9699)Документ1 страницаFrequently Asked Questions: A/AS Level Sociology (9699)mstudy123456Оценок пока нет

- 9693 s12 QP 2Документ12 страниц9693 s12 QP 2mstudy123456Оценок пока нет

- 9689 w05 ErДокумент4 страницы9689 w05 Ermstudy123456Оценок пока нет

- 9719 SPANISH 8685 Spanish Language: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersДокумент3 страницы9719 SPANISH 8685 Spanish Language: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of Teachersmstudy123456Оценок пока нет

- 8004 General Paper: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersДокумент12 страниц8004 General Paper: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of Teachersmrustudy12345678Оценок пока нет

- 9274 w12 ErДокумент21 страница9274 w12 Ermstudy123456Оценок пока нет

- 9706 s11 Ms 41Документ5 страниц9706 s11 Ms 41HAHA_123Оценок пока нет

- First Language Spanish: Paper 8665/22 Reading and WritingДокумент6 страницFirst Language Spanish: Paper 8665/22 Reading and Writingmstudy123456Оценок пока нет

- 8780 w12 QP 1Документ16 страниц8780 w12 QP 1mstudy123456Оценок пока нет

- 8695 s13 Ms 21Документ6 страниц8695 s13 Ms 21mstudy123456Оценок пока нет

- University of Cambridge International Examinations General Certificate of Education Advanced LevelДокумент2 страницыUniversity of Cambridge International Examinations General Certificate of Education Advanced Levelmstudy123456Оценок пока нет

- 9084 s10 Ms 31Документ7 страниц9084 s10 Ms 31olamideОценок пока нет

- English Language: PAPER 1 Passages For CommentДокумент8 страницEnglish Language: PAPER 1 Passages For Commentmstudy123456Оценок пока нет

- 8679 w04 ErДокумент4 страницы8679 w04 Ermstudy123456Оценок пока нет

- SpanishДокумент2 страницыSpanishmstudy123456Оценок пока нет

- 8693 English Language: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersДокумент4 страницы8693 English Language: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersmstudy123456Оценок пока нет

- 8683 w12 Ms 1Документ4 страницы8683 w12 Ms 1mstudy123456Оценок пока нет

- Performance Comparison: EBL vs UCBLLong termAAAAStableApril 9 2012Short termST-2ST-2Документ31 страницаPerformance Comparison: EBL vs UCBLLong termAAAAStableApril 9 2012Short termST-2ST-2Aniruddha RantuОценок пока нет

- Draft Contract For Sale and Purchase of BrentmoorДокумент12 страницDraft Contract For Sale and Purchase of BrentmoorFauquier NowОценок пока нет

- Practicalweek48 0809answersДокумент8 страницPracticalweek48 0809answersLaura BasalicОценок пока нет

- Website - Project TopicsДокумент5 страницWebsite - Project TopicsAvnish AnandОценок пока нет

- Advanced Financial Management by ICPAP PDFДокумент265 страницAdvanced Financial Management by ICPAP PDFjj0% (1)

- Dfi 211 Lecturer I-3Документ40 страницDfi 211 Lecturer I-3CatherineОценок пока нет

- Management Accounting and Analysis: Name: Rana Vivek SinghДокумент8 страницManagement Accounting and Analysis: Name: Rana Vivek SinghRana Vivek SinghОценок пока нет

- Thermalnet Methodology Guideline On Techno Economic AssessmentДокумент25 страницThermalnet Methodology Guideline On Techno Economic Assessmentskywalk189Оценок пока нет

- Parrino 2e PowerPoint Review Ch01Документ50 страницParrino 2e PowerPoint Review Ch01Khadija AlkebsiОценок пока нет

- The World Bank For Official Use Only: Report NoДокумент84 страницыThe World Bank For Official Use Only: Report Noamirali_bhimaniОценок пока нет

- Documents On Multi Level Marketing - Direct Selling FraudДокумент61 страницаDocuments On Multi Level Marketing - Direct Selling FraudJayanath JayanthanОценок пока нет

- Sample of Memorandum of AgreementДокумент2 страницыSample of Memorandum of AgreementJuris PoetОценок пока нет

- Coop Primer On Setting UpДокумент11 страницCoop Primer On Setting UpErwin Nunez100% (1)

- Pre Sanction AppraisalДокумент8 страницPre Sanction Appraisalpiyush kumar nandaОценок пока нет

- Application Form For Vehicle Car LoanДокумент9 страницApplication Form For Vehicle Car LoanAbhishekGautamОценок пока нет

- Role of Financial Intermediaries in Poverty ReductionДокумент6 страницRole of Financial Intermediaries in Poverty ReductionShreyas DicholkarОценок пока нет

- 5 Housing LoansДокумент11 страниц5 Housing LoansJerzy ZuñigaОценок пока нет

- Gol ExamE-DДокумент7 страницGol ExamE-Dpeemosh6535Оценок пока нет

- Jonsay vs. Solidbank Corporation Now MetropolitanBank and Trust CompanyДокумент43 страницыJonsay vs. Solidbank Corporation Now MetropolitanBank and Trust CompanyAnnaОценок пока нет

- Engineering Economics RevisionДокумент43 страницыEngineering Economics RevisionDanial IzzatОценок пока нет

- Internship Report on Sustainable Financial Inclusion and Poverty Alleviation through Smart Banking at Bank AsiaДокумент70 страницInternship Report on Sustainable Financial Inclusion and Poverty Alleviation through Smart Banking at Bank AsiashopnoОценок пока нет

- Guingona V City FiscalДокумент1 страницаGuingona V City FiscalFaye Jennifer Pascua PerezОценок пока нет

- Streetwise Seller FinancingДокумент97 страницStreetwise Seller FinancingihutagalungОценок пока нет

- ACC 102 Chapter 14 Review QuestionsДокумент2 страницыACC 102 Chapter 14 Review QuestionsKaitlyn MakiОценок пока нет

- Assignment-1 Collapsed Bank Lehman BrothersДокумент3 страницыAssignment-1 Collapsed Bank Lehman BrothersAditya SawantОценок пока нет

- Declaration of Facts and Commercial BillДокумент7 страницDeclaration of Facts and Commercial BillSue Rhoades100% (4)

- Chapter 8 VДокумент28 страницChapter 8 VAdd AllОценок пока нет

- Modified Multiple ChoiceДокумент3 страницыModified Multiple ChoiceJun RectoОценок пока нет

- CH 07Документ8 страницCH 07Saleh RaoufОценок пока нет

- Banking Awareness Questions With AnswersДокумент3 страницыBanking Awareness Questions With AnswersarunkumarraviОценок пока нет