Академический Документы

Профессиональный Документы

Культура Документы

Faq On Neft Revised

Загружено:

pawanrokz12340 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров5 страницfaqs

Оригинальное название

Faq on Neft Revised

Авторское право

© © All Rights Reserved

Доступные форматы

DOC, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документfaqs

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров5 страницFaq On Neft Revised

Загружено:

pawanrokz1234faqs

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOC, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

Frequently Asked Questions - NEFT

Q.1. What is NEFT?

Ans: National Electronic Funds Transfer (NEFT) is a nation-wide payment system facilitating one-to-one

funds transfer. Under this cheme! indi"iduals! firms and corporates can electronically transfer funds from

any #an$ #ranch to any indi"idual! firm or corporate ha"ing an account with any other #an$ #ranch in the

country participating in the cheme.

Q.2. Are all bank branches in the country part o the NEFT unds transer net!ork?

Ans: For #eing part of the NEFT funds transfer networ$! a #an$ #ranch has to #e NEFT- ena#led. The list

of #an$-wise #ranches which are participating in NEFT(%ncluding U&' (an$) is pro"ided in the we#site of

)eser"e (an$ of %ndia at http:**www.r#i.org.in*scripts*neft.asp+

Q.". Who can transer unds usin# NEFT?

Ans: %ndi"iduals! firms or corporates maintaining accounts with a #an$ #ranch can transfer funds using

NEFT. E"en such indi"iduals who do not ha"e a #an$ account (wal$-in customers) can also deposit cash

at the NEFT-ena#led #ranches with instructions to transfer funds using NEFT. ,owe"er! such cash

remittances will #e restricted to a ma+imum of )s.-.!...*- per transaction. uch customers ha"e to

furnish full details including complete address! telephone num#er! etc.NEFT! thus! facilitates originators or

remitters to initiate funds transfer transactions e"en without ha"ing a #an$ account.

Q.$. Who can recei%e unds throu#h the NEFT syste&?

Ans: %ndi"iduals! firms or corporates maintaining accounts with a #an$ #ranch can recei"e funds through

the NEFT system. %t is! therefore! necessary for the #eneficiary to ha"e an account with the NEFT

ena#led destination #an$ #ranch in the country.

The NEFT system also facilitates one-waycross-#order transfer of funds from %ndia to Nepal. This is

$nown as the %ndo-Nepal )emittance Facility cheme. A remitter can transfer funds from any of the

NEFT-ena#led #ranches in to Nepal! irrespecti"e of whether the #eneficiary in Nepal maintains an

account with a #an$ #ranch in Nepal or not. The #eneficiary would recei"e funds in Nepalese )upees.

Further details on the %ndo-Nepal )emittance Facility cheme are a"aila#le on the we#site of )eser"e

(an$ of %ndia at http:**r#idocs.r#i.org.in*rdocs*content*pdfs*/00/1.pdf.

Q.'. (s there any li&it on the a&ount that could be transerred usin# NEFT?

Ans: No. There is no limit 2 either minimum or ma+imum 2 on the amount of funds that could #e

transferred using NEFT. ,owe"er! ma+imum amount per transaction is limited to )s.-.!...*- for cash-

#ased remittances and remittances to Nepal.

Q.). Whether the syste& is centre speciic or has any #eo#raphical restriction?

Ans: No. There is no restriction of centres or of any geographical area within the country. The NEFT

system ta$es ad"antage of the core #an$ing system in #an$s. Accordingly! the settlement of funds

#etween originating and recei"ing #an$s ta$es places centrally at 3um#ai! whereas the #ranches

participating in NEFT can #e located anywhere across the length and #readth of the country.

Q.*. What are the operatin# hours o NEFT?

Ans : 4resently! NEFT operates in hourly #atches - there are twel"e settlements from / am to 5 pm on

wee$ days (3onday through Friday) and si+ settlements from / am to 6 pm on aturdays.

Q.+. ,o! does the NEFT syste& operate?

tep-6 : An indi"idual * firm * corporate intending to originate transfer of funds through NEFT has to fill an

application form pro"iding details of the #eneficiary (li$e name of the #eneficiary! name of the #an$

#ranch where the #eneficiary has an account! %F& of the #eneficiary #an$ #ranch! account type and

account num#er) and the amount to #e remitted. The application form will #e a"aila#le at the originating

#an$ #ranch. The remitter authori7es his*her #an$ #ranch to de#it his account and remit the specified

amount to the #eneficiary. &ustomers en8oying net #an$ing facility offered #y their #an$ers can also

initiate the funds transfer re9uest online. ome #an$s offer the NEFT facility e"en through the AT3s.

:al$-in customers will! howe"er! ha"e to gi"e their contact details (complete address and telephone

num#er! etc.) to the #ranch. This will help the #ranch to refund the money to the customer in case credit

could not #e afforded to the #eneficiary;s #an$ account or the transaction is re8ected * returned for any

reason.

tep-< : The originating #an$ #ranch prepares a message and sends the message to its pooling centre

(also called the NEFT er"ice &entre).

tep-= : The pooling centre forwards the message to the NEFT &learing &entre (operated #y National

&learing &ell! )eser"e (an$ of %ndia! 3um#ai) to #e included for the ne+t a"aila#le #atch.

tep-0 : The &learing &entre sorts the funds transfer transactions destination #an$-wise and prepares

accounting entries to recei"e funds from the originating #an$s (de#it) and gi"e the funds to the destination

#an$s(credit). Thereafter! #an$-wise remittance messages are forwarded to the destination #an$s through

their pooling centre (NEFT er"ice &entre).

tep-- : The destination #an$s recei"e the inward remittance messages from the &learing &entre and

pass on the credit to the #eneficiary customers; accounts.

Q.-. What is (F./?

Ans : %F& or %ndian Financial ystem &ode is an alpha-numeric code that uni9uely identifies a #an$-

#ranch participating in the NEFT system. This is an 66 digit code with the first 0 alpha characters

representing the #an$! and the last > characters representing the #ranch. The -th character is . (7ero).

%F& is used #y the NEFT system to identify the originating * destination #an$s * #ranches and also to

route the messages appropriately to the concerned #an$s * #ranches.

Q.10. ,o! can the (F./ o a bank-branch be ound?

Ans: (an$-wise list of %F&s is a"aila#le with all the #an$-#ranches participating in NEFT.?ist of #an$-

wise #ranches participating in NEFT and their %F&s is a"aila#le on the we#site of )eser"e (an$ of %ndia

athttp:**www.r#i.org.in*cripts*#s@"iewcontent.asp+A%dB<..1 . All the #an$s ha"e also #een ad"ised to

print the %F& of the #ranch on che9ues issued to their customers. For net #an$ing customers many

#an$s ha"e ena#led online search * pop-up of the %F& of the destination #an$ #ranch.

Further! #an$s ha"e also #een ad"ised to ensure that their #ranch staff pro"ide necessary assistance to

customers in filling out the re9uired details! including %F& details! in the NEFT application form! and also

help in ensuring that there is no mismatch #etween the %F& code and #ranch details of #eneficiary

#ranch as pro"ided #y the customer.

Q.11. What are the processin# or ser%ice char#es or NEFT transactions?

Ans: The structure of charges that can #e le"ied on the customer for NEFT is gi"en #elow:

a) %nward transactions at destination #an$ #ranches (for credit to #eneficiary accounts)

1 Free! no charges to #e le"ied from #eneficiaries.

#) 'utward transactions at originating #an$ #ranches 2 (4lease refer to er"ice &harges lin$).

c) &harges applica#le for transferring funds from %ndia to Nepal using the NEFT system (under the %ndo-

Nepal )emittance Facility cheme) is a"aila#le on the we#site of )(%

at http:**r#i.org.in*scripts*FACDiew.asp+A%dB>5

:ith effect from 6st Euly <.66! originating #an$s are re9uired to pay a nominal charge of <- paise each

per transaction to the clearing house as well as destination #an$ as ser"ice charge. ,owe"er! these

charges cannot #e passed on to the customers #y the #an$s.

Q.12. When can the beneiciary e2pect to #et the credit to his bank account?

Ans: The #eneficiary can e+pect to get credit for the first ten #atches on wee$ days (i.e.! transactions from

/ am to - pm) and the first fi"e #atches on aturdays (i.e.! transactions from / am to 6< noon) on the

same day. For transactions settled in the last two #atches on wee$ days (i.e.! transactions settled in the >

and 5 pm #atches) and the last #atch on aturdays (i.e.! transactions handled in the 6 pm #atch)

#eneficiaries can e+pect to get credit either on the same day or on the ne+t wor$ing day morning

(depending on the type of facility en8oyed #y the #eneficiary with his #an$).

Q.1". Who should be contacted in case o non-credit or delay in credit to the beneiciary account?

Ans: %n case of non-credit or delay in credit to the #eneficiary account! the NEFT &ustomer Facilitation

&entre (&F&) of the respecti"e #an$ can #e contacted (the remitter can contact his #an$;s &F&F the

#eneficiary may contact the &F& of his #an$). Getails of NEFT &ustomer Facilitation &entres of #an$s are

a"aila#le on the we#sites of the respecti"e #an$s. The details(including the details of U&' (an$) are also

a"aila#le on the we#site of )eser"e (an$ of %ndia at http:**www.r#i.org.in*cripts*#s@"iewcontent.asp+A

%dB<.5 . .

%f the issue is not resol"ed satisfactorily! the NEFT ,elp Ges$ (or &ustomer Facilitation &entre of )eser"e

(an$ of %ndia) at National &learing &ell! )eser"e (an$ of %ndia! 3um#ai may #e contacted through e-

mail or #y addressing correspondence to the Heneral 3anager! )eser"e (an$ of %ndia! National &learing

&entre! First Floor! Free 4ress ,ouse! Nariman 4oint! 3um#ai 2 0.. .<6.

Q.1$. What !ill happen i credit is not aorded to the account o the beneiciary?

Ans: %f it is not possi#le to afford credit to the account of the #eneficiary for whate"er reason! destination

#an$s are re9uired to return the transaction (to the originating #ranch) within two hours of completion of

the #atch in which the transaction was processed.

For e+ample! if a customer su#mits a fund transfer re9uest at 6<..- p.m. to a NEFT-ena#led #ranch! the

#ranch in turn forwards the message through its pooling centre to the NEFT &learing &entre for

processing in the immediately a"aila#le #atch which (say) is the 6... pm #atch. %f the destination #an$ is

una#le to afford the credit to the #eneficiary for any reason! it has to return the transaction to the

originating #an$! not later than in the =... pm #atch. 'n recei"ing such a returned transaction! the

originating #an$ has to credit the amount #ac$ to account of the originating customer. To conclude! for all

uncredited transactions! customers can reasona#ly e+pect the funds to #e recei"ed #ac$ #y them in

around = to 0 hours time.

Q.1'. /an NEFT be used to transer unds ro& 3 to N4E and N45 accounts?

Ans: Ies. NEFT can #e used to transfer funds from or to N)E and N)' accounts in the country. This!

howe"er! is su#8ect to the adherence of the pro"isions of the Foreign E+change 3anagement Act! <...

(FE3A) and :ire Transfer Huidelines.

Q.1). /an re&ittances be sent abroad usin# NEFT?

Ans: No. ,owe"er! a facility is a"aila#le to send outward remittances to Nepal under the %ndo-Nepal

)emittance Facility cheme.

Q.1*. What are the other transactions that could be initiated usin# NEFT?

Ans: (esides personal funds transfer! the NEFT system can also #e used for a "ariety of transaction

including payment of credit card dues to the card issuing #an$s. %t is necessary to 9uote the %F& of the

#eneficiary card issuing #an$ to initiate the #ill payment transactions using NEFT.

Q.1+. /an a transaction be ori#inated to dra! 6recei%e7 unds ro& another account?

Ans : No. NEFT is a credit-push system i.e.! transactions can #e originated only to transfer * remit funds to

a #eneficiary.

Q.1-. Would the re&itter recei%e an ackno!led#e&ent once the unds are transerred to the

account o the beneiciary?

Ans: Ies. %n case of successful credit to the #eneficiaryJs account! the #an$ which had originated the

transaction is e+pected to send a confirmation to the originating customer (through 3 or e-mail)

ad"ising of the credit as also mentioning the date and time of credit. For the purpose! remitters need to

pro"ide their mo#ile num#er * e-mail-id to the #ranch.

Q.20. (s there a !ay or the re&itter to track a transaction in NEFT?

Ans: Ies! the remitter can trac$ the NEFT transaction through the originating #an$ #ranch or its &F&

using the uni9ue transaction reference num#er pro"ided at the time of initiating the funds transfer. %t is

possi#le for the originating #an$ #ranch to $eep trac$ and #e aware of the status of the NEFT transaction

at all times.

Q.21. What are the pre-requisites or ori#inatin# a NEFT transaction?

Ans : Following are the pre-re9uisites for putting through a funds transfer transaction using NEFT 2

'riginating and destination #an$ #ranches should #e part of the NEFT networ$

(eneficiary details such as #eneficiary name! account num#er and account type! name and %F&

of the #eneficiary #an$ #ranch should #e a"aila#le with the remitter

For net #an$ing customers! some #an$s pro"ide the facility to automatically pop-up the %F&

once name of the destination #an$ and #ranch is highlighted * chosen * indicated * $eyed in.

Q.22. What are the beneits o usin# NEFT?

Ans: NEFT offers many advantages over the other modes of funds transfer:

The remitter need not send the physical che9ue or Gemand Graft to the #eneficiary.

The #eneficiary need not "isit his * her #an$ for depositing the paper instruments.

The #eneficiary need not #e apprehensi"e of loss * theft of physical instruments or the li$elihood

of fraudulent encashment thereof.

&ost effecti"e.

&redit confirmation of the remittances sent #y 3 or email.

)emitter can initiate the remittances from his home * place of wor$ using the internet #an$ing

also.

Near real time transfer of the funds to the #eneficiary account in a secure manner.

Вам также может понравиться

- Ad..review ReportДокумент35 страницAd..review ReportRaja Adnan RiazОценок пока нет

- 1.1 Introduction of E-BankingДокумент33 страницы1.1 Introduction of E-BankingahmedtaniОценок пока нет

- 1.1 Introduction of E-BankingДокумент33 страницы1.1 Introduction of E-BankingahmedtaniОценок пока нет

- RtgsДокумент2 страницыRtgsRavi AgarwalОценок пока нет

- APPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesДокумент4 страницыAPPLICATION FORM For Internet (Retail) / Mobile / Tele Banking FacilitiesKevin JacobОценок пока нет

- Public Service Commission, Uttar PradeshДокумент5 страницPublic Service Commission, Uttar PradeshDrPankaj YaduvanshiОценок пока нет

- Phone call server IVR systems provides servicesДокумент3 страницыPhone call server IVR systems provides servicesManoj Kumar MohanОценок пока нет

- You're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowДокумент6 страницYou're Nearly There! To Ensure That Your Payment Is Received by Your Institution Without Any Delays, Please Follow The Instructions BelowJosin JoseОценок пока нет

- Project Report of Digital MarketingДокумент20 страницProject Report of Digital MarketingNitya Gupta100% (1)

- State Bank of Travancore: "Sbtonline"Документ3 страницыState Bank of Travancore: "Sbtonline"mamshadmmОценок пока нет

- Starting A Business - Marikina CityДокумент16 страницStarting A Business - Marikina Cityraighnejames19Оценок пока нет

- Contract: InformationДокумент9 страницContract: InformationAmber YounasОценок пока нет

- Project of E-Banking Definition of E-BankingДокумент28 страницProject of E-Banking Definition of E-Bankingniraliparekh27Оценок пока нет

- Xaviers Institute of Business Management StudiesДокумент8 страницXaviers Institute of Business Management StudiesremoroОценок пока нет

- Harsh (Naaptol)Документ12 страницHarsh (Naaptol)Abhishek DubeyОценок пока нет

- Instructions For Form 1420 (Contractor Employee Biographical Data Sheet)Документ2 страницыInstructions For Form 1420 (Contractor Employee Biographical Data Sheet)tanu_farzanaОценок пока нет

- GK Capsule For Ibps ClerkДокумент16 страницGK Capsule For Ibps ClerkHitesh MendirattaОценок пока нет

- Smith E-Commerce Consulting M S: Ample Usiness LANДокумент16 страницSmith E-Commerce Consulting M S: Ample Usiness LANHariharan VigneshОценок пока нет

- PROJ 410 Week 5 Case Study 2 Do It Yourself OutsourcingДокумент9 страницPROJ 410 Week 5 Case Study 2 Do It Yourself OutsourcingMicahBittner100% (1)

- Open Warka Bank IraqДокумент11 страницOpen Warka Bank IraqaiesecОценок пока нет

- ExrevДокумент26 страницExrevapi-234680678100% (2)

- Useful Money Vocabulary and Terms ExplainedДокумент8 страницUseful Money Vocabulary and Terms ExplainedCVDSCRIBОценок пока нет

- PROJ 410 Week 7 Case Study 3 A+ AnswerДокумент9 страницPROJ 410 Week 7 Case Study 3 A+ AnswerMicahBittner0% (1)

- NMDFC Recruitment for various postsДокумент9 страницNMDFC Recruitment for various postsMunish KharbОценок пока нет

- Project of E-Banking Definition of E-BankingДокумент28 страницProject of E-Banking Definition of E-Bankingsangeetar28129Оценок пока нет

- IT541 - Do Nhu Tai - Project 1.4Документ4 страницыIT541 - Do Nhu Tai - Project 1.4Tran Nguyen Quynh TramОценок пока нет

- E-Term Deposite SBI FAQДокумент5 страницE-Term Deposite SBI FAQkabuldasОценок пока нет

- Voip Numbering Issues: Prepared By: Bellsouth Qwest VerizonДокумент9 страницVoip Numbering Issues: Prepared By: Bellsouth Qwest VerizonGuru BalaguruОценок пока нет

- Indian Institute of Information Technology, Allahabad: (Deemed University)Документ3 страницыIndian Institute of Information Technology, Allahabad: (Deemed University)paradoxОценок пока нет

- My Encounters With Madoff's Scheme and Other SwindlesДокумент13 страницMy Encounters With Madoff's Scheme and Other SwindlesAyush AggarwalОценок пока нет

- Chapter 2: Tax Practice EnvironmentДокумент16 страницChapter 2: Tax Practice EnvironmentYomna AttiaОценок пока нет

- Sample Relocation PlanДокумент9 страницSample Relocation PlanRitoban MukhopadhyayОценок пока нет

- Small Project Application FormДокумент7 страницSmall Project Application Formfarman masih100% (1)

- Public Service Commission, Uttar Pradesh: State Planning Institute, U.P. (Naveen Prabhag)Документ6 страницPublic Service Commission, Uttar Pradesh: State Planning Institute, U.P. (Naveen Prabhag)Ravi ChawlaОценок пока нет

- Not 0032014 1172014Документ3 страницыNot 0032014 1172014Basil Baby-PisharathuОценок пока нет

- E Banking SynopsisДокумент17 страницE Banking SynopsisharviduttaОценок пока нет

- Judicial Affidavit Rule: Object 1Документ4 страницыJudicial Affidavit Rule: Object 1bbysheОценок пока нет

- Appealing RPT AssessmentДокумент4 страницыAppealing RPT Assessmentjoannelegaspi100% (1)

- Writing Improvement ExercisesДокумент6 страницWriting Improvement ExercisesRanaAbdulAzizОценок пока нет

- ForexДокумент62 страницыForexVamshiKrishnaОценок пока нет

- Starting A Business - Davao CityДокумент15 страницStarting A Business - Davao CityKimberly BlackОценок пока нет

- Question What Could Be The Probable Reason For Not Showing The Taxes in Project Draft Invoices?Документ16 страницQuestion What Could Be The Probable Reason For Not Showing The Taxes in Project Draft Invoices?rasemahe4Оценок пока нет

- CA Firm Exam QuestionДокумент13 страницCA Firm Exam QuestionTanbir Ahsan RubelОценок пока нет

- VAT Update on Circular 06/2012Документ6 страницVAT Update on Circular 06/2012DzungОценок пока нет

- Local Offline Fast Cash MethodsДокумент12 страницLocal Offline Fast Cash MethodsunxnownlogicОценок пока нет

- Internship Sindh BankДокумент34 страницыInternship Sindh BankKR Burki100% (1)

- AFV Patrick MethodДокумент1 страницаAFV Patrick MethodAkil BeyОценок пока нет

- Reading Organizer Answer Key: Name - DateДокумент8 страницReading Organizer Answer Key: Name - DateSosukeAizenОценок пока нет

- Database Management Systems QM332 Entity-Relationship Cases: Kuwait University Dept. of QM & ISДокумент1 страницаDatabase Management Systems QM332 Entity-Relationship Cases: Kuwait University Dept. of QM & ISSubhash SagarОценок пока нет

- Success Community Keynote: Get Your #SuccessOnДокумент28 страницSuccess Community Keynote: Get Your #SuccessOnKat TranОценок пока нет

- What is a business reportДокумент7 страницWhat is a business reportPushpa BaruaОценок пока нет

- District 4 Production Warehouse - ProjectДокумент9 страницDistrict 4 Production Warehouse - ProjectKatrine ClaudiaОценок пока нет

- MOST IMPORTANT TERMS AND CONDITIONSДокумент8 страницMOST IMPORTANT TERMS AND CONDITIONSbashasaruОценок пока нет

- E-Commerce Guide on Electronic Commerce and E-AuctionsДокумент68 страницE-Commerce Guide on Electronic Commerce and E-AuctionsVishal RohithОценок пока нет

- Apply for your SBT ATM cum debit card onlineДокумент2 страницыApply for your SBT ATM cum debit card onlineviveknair9950% (2)

- Review of Some Online Banks and Visa/Master Cards IssuersОт EverandReview of Some Online Banks and Visa/Master Cards IssuersОценок пока нет

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeОт EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeОценок пока нет

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОт EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaОценок пока нет

- The Bootstrapper's Guide to the Mobile Web: Practical Plans to Get Your Business Mobile in Just a Few Days for Just a Few BucksОт EverandThe Bootstrapper's Guide to the Mobile Web: Practical Plans to Get Your Business Mobile in Just a Few Days for Just a Few BucksОценок пока нет

- 1Документ1 страница1pawanrokz1234Оценок пока нет

- Agricultural University, Jorhat. RecruitmentДокумент17 страницAgricultural University, Jorhat. RecruitmentAshis karmakarОценок пока нет

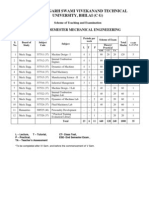

- M.tech (CAD-CAM) The Course Structure For Under Autonomy ... (20ebooks - Com)Документ22 страницыM.tech (CAD-CAM) The Course Structure For Under Autonomy ... (20ebooks - Com)pawanrokz1234Оценок пока нет

- National Institute of Technology Raipur: ADMIT CARD (SEMESTER - VII) (2013-2014 I)Документ1 страницаNational Institute of Technology Raipur: ADMIT CARD (SEMESTER - VII) (2013-2014 I)pawanrokz1234Оценок пока нет

- Document Opener Serv LetДокумент1 страницаDocument Opener Serv LetAbinesh KumarОценок пока нет

- B. Tech (NIT) Exam Time TableДокумент7 страницB. Tech (NIT) Exam Time Tablepawanrokz1234Оценок пока нет

- Recruitment Updation+of+Website HRM 1f192a215dДокумент1 страницаRecruitment Updation+of+Website HRM 1f192a215dMohit AroraОценок пока нет

- Document Opener Serv LetДокумент1 страницаDocument Opener Serv LetAbinesh KumarОценок пока нет

- Mech All PDFДокумент46 страницMech All PDFtoshugoОценок пока нет

- B.E & B.Tech. Syllabs For Mechanical Engineering 7 SemesterДокумент16 страницB.E & B.Tech. Syllabs For Mechanical Engineering 7 SemesterShashi Shekhar SharmaОценок пока нет

- Chhattisgarh Technical University B.E. Mechanical 5th Sem Subject SchemeДокумент14 страницChhattisgarh Technical University B.E. Mechanical 5th Sem Subject Schemeveer_sОценок пока нет

- Csvtu 8th Sem Syllabus For Mechanical EngineeringДокумент34 страницыCsvtu 8th Sem Syllabus For Mechanical Engineeringveer_s0% (1)

- RAVI36Документ13 страницRAVI36pawanrokz1234Оценок пока нет

- 1Документ1 страница1pawanrokz1234Оценок пока нет

- Comparing Geoid HeightДокумент4 страницыComparing Geoid Heightpawanrokz1234Оценок пока нет

- Mindlin Plate TheoryДокумент10 страницMindlin Plate TheoryKunal RanjaneОценок пока нет

- Tentative Dates of Autumn 2013 Examination (Revised)Документ1 страницаTentative Dates of Autumn 2013 Examination (Revised)pawanrokz1234Оценок пока нет

- Islam and Buddhism: Harun YahyaДокумент53 страницыIslam and Buddhism: Harun YahyaAhmed TabakovicОценок пока нет

- 100 Fortnite Tournament RegistrationДокумент1 страница100 Fortnite Tournament RegistrationEnableMrManОценок пока нет

- RUT950 Manual v1 06Документ94 страницыRUT950 Manual v1 06toumassis_pОценок пока нет

- Ebay (A) : The Customer MarketplaceДокумент2 страницыEbay (A) : The Customer MarketplaceNikith NatarajОценок пока нет

- Navotas DecДокумент23 страницыNavotas DecAngelika CalingasanОценок пока нет

- Cisco Start Catalog 1612AP LDSL 1211Документ12 страницCisco Start Catalog 1612AP LDSL 1211Ngoc The NguyenОценок пока нет

- Narrowband Iot Based Support Functions in Smart CitiesДокумент6 страницNarrowband Iot Based Support Functions in Smart CitiesAjith KumarОценок пока нет

- Wireless Network Design Mistakes to AvoidДокумент4 страницыWireless Network Design Mistakes to AvoidNayla GreigeОценок пока нет

- TEKnowlogy Solutions Basic LUM InstallationДокумент3 страницыTEKnowlogy Solutions Basic LUM InstallationTEKnowlogySolutionsОценок пока нет

- AWS Course Content - MindMajixДокумент11 страницAWS Course Content - MindMajixBabita SoroutОценок пока нет

- Smart Jewelry: Helping Your Jewelry BusinessДокумент6 страницSmart Jewelry: Helping Your Jewelry BusinessbijayanОценок пока нет

- Kerberos and NTLM AuthenticationДокумент4 страницыKerberos and NTLM AuthenticationAbhijeet KumarОценок пока нет

- Camara 3000 Sony ManualДокумент579 страницCamara 3000 Sony Manualjuan amayaОценок пока нет

- Candlestick Chart PatternsДокумент124 страницыCandlestick Chart Patternsayu abdullahОценок пока нет

- Social Media The Importance of Social MediaДокумент11 страницSocial Media The Importance of Social MediaLê Văn SơnОценок пока нет

- Hybrid Framework Elements And LayersДокумент2 страницыHybrid Framework Elements And LayersVikash SharmaОценок пока нет

- 雜項Документ3 страницы雜項阮苑庭Оценок пока нет

- Uolo Base Guidelines v.5 and v.6 Basic Labelling (Updated 8.4.2023)Документ40 страницUolo Base Guidelines v.5 and v.6 Basic Labelling (Updated 8.4.2023)Peter ParkerОценок пока нет

- A10 Thunder Series and AX Series: System Configuration and Administration GuideДокумент178 страницA10 Thunder Series and AX Series: System Configuration and Administration GuideAbrar Fazal RazzaqОценок пока нет

- CMMS ManWinWin 6 - Brochure ENДокумент5 страницCMMS ManWinWin 6 - Brochure ENyassinebouazziОценок пока нет

- Ansys Hfss Antenna l01 0 Ansys IntroДокумент6 страницAnsys Hfss Antenna l01 0 Ansys IntroKaveh KeshtkaranОценок пока нет

- PHP Login System With Admin Features - EvoltДокумент40 страницPHP Login System With Admin Features - EvoltOj Morris0% (1)

- 2015 - s2 - Compsci2 - Week 2 - Business Letter Day 6 Business EmailsДокумент35 страниц2015 - s2 - Compsci2 - Week 2 - Business Letter Day 6 Business Emailsapi-263127781Оценок пока нет

- 1cambridge English Prepare 3 WorkbookДокумент90 страниц1cambridge English Prepare 3 WorkbookMariana Villalón100% (1)

- Porter WrightДокумент4 страницыPorter Wrightadam_3000Оценок пока нет

- Ch06 MAC Layer StandardsДокумент59 страницCh06 MAC Layer StandardsvasanthmeОценок пока нет

- Samsung SM-A107M Log AnalyzerДокумент4 страницыSamsung SM-A107M Log AnalyzerAdahilton VerdugoОценок пока нет

- Lesson 1 Making Sense in A Paragraph - 053027Документ31 страницаLesson 1 Making Sense in A Paragraph - 053027Bing KadulОценок пока нет

- Computer AwarenessДокумент64 страницыComputer Awarenessgauravgupta_pusa365Оценок пока нет

- Mailman Zimbra IntegrationДокумент4 страницыMailman Zimbra Integrationtonhoang0% (1)