Академический Документы

Профессиональный Документы

Культура Документы

Allianz Corporate Profile Brochure

Загружено:

jimbumba0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров28 страницAllianz SE is rated by the three international leading rating agencies Standard and Poor's, Moody's and A.M. Best established by an interactive rating process.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAllianz SE is rated by the three international leading rating agencies Standard and Poor's, Moody's and A.M. Best established by an interactive rating process.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров28 страницAllianz Corporate Profile Brochure

Загружено:

jimbumbaAllianz SE is rated by the three international leading rating agencies Standard and Poor's, Moody's and A.M. Best established by an interactive rating process.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 28

CORPORATE PROFILE

Allianz Takaful -2009

Here you can nd all fundamental key indicators about the Allianz share from 2005 to 2008.

2008 2007 2006 2005

Number of shares outstanding as of December 31 453,050,000 450,150,000 432,150,000 406,040,000

Weighted number of shares outstanding 450,161,145 442,544,977 410,871,602 389,756,350

Share price as of December 31 EUR 75.00 147.95 154.76 127.94

High for the year EUR 145.92 178.64 156.75 129.70

Low for the year EUR 46.64 133.92 110.20 89.72

Share price performance in the year % - 49.3 - 4.4 21.0 31.1

Market capitalization as of December 31 EUR

bn

34.0 66.6 66.9 51.9

Average number of shares traded per day mn 5.0 4.2 3.3 3.1

Beta-Factor

1

1.3 1.2 1.2 1.3

Basic earnings per share EUR -5.43 18.00 17.09 11.24

Price-earnings ratio - 8.2 9.1 11.4

Dividend per share EUR 3.50

2

5.50 3.80 2.00

Dividend yield as of December 31 % 4.7 3.7 2.5 1.6

Payout ratio % 40

3

31 23 19

Return on equity after income tax

4

% 9.7

3

15.0

3

15.0

3

12.8

1 In comparison with Dow Jones EURO STOXX 50; source: Bloomberg

2 Dividend proposal

3 Based on net income from continuing operations.

4 Based on average shareholders equity. Average shareholders equity has been calculated based upon the average of the current

and preceding years shareholders equity

Allianz SE is rated by the three international leading rating agencies Standard & Poors, Moodys and A.M. Best

established by an interactive rating process.

Allianz obtained very favourable ratings by these three agencies. They all have reafrmed their evaluations. Please

nd the current ratings set out below.

Solicited ratings assigned to Allianz SE (as of May 2009)

Ratings

1

S&P Moodys A.M. Best

Insurer nancial strength

rating

AA / stable outlook

(afrmed 05/13/2009)

Aa3 / stable outlook

(afrmed 02/26/2009)

A+ / stable outlook

(afrmed 03/11/2009)

Counterparty credit rating AA / stable outlook

(afrmed 05/13/2009)

Not rated aa

2

/ stable outlook

(afrmed 03/11/2009)

Senior unsecured debt

rating

AA

(afrmed 05/13/2009)

Aa3 / stable outlook

(afrmed 02/26/2009)

aa / stable outlook

(afrmed 03/11/2009)

Subordinated debt rating A+/A

(afrmed

05/13/2009)

3

A2 / A3

3

/ stable outlook

(afrmed 02/26/2009)

aa-

3

/ stable outlook

(afrmed 03/11/2009)

Commercial paper

(short term) rating

A-1+

(afrmed 05/13/2009)

Prime-1 / stable outlook

(afrmed 02/26/2009)

Not rated

1 Includes Ratings for securities isued by Allianz Finance B.V., Allianz Finance II B.V. and Allianz Finance Corporation.

2 Issuer credit rating.

3 Final Ratings vary on the basis of the terms.

Board

Allianz Takaful, B.S.C (Closed)

P.O.Box 31397

Manama

Kingdom of Bahrain

Tel.: +973 17 568222

Fax: +973 17 582114

C.R. No. 66716

www.allianz.com.bh

Вам также может понравиться

- Overview of Investment Controlling Presentation IДокумент40 страницOverview of Investment Controlling Presentation Ichuff6675Оценок пока нет

- Nomura Global Quantitative Equity Conference 435935Документ48 страницNomura Global Quantitative Equity Conference 435935Mukund Singh100% (1)

- Monthly Bulletin - January 2012Документ30 страницMonthly Bulletin - January 2012bingcaingoОценок пока нет

- Financial Management Assignment: MarchДокумент8 страницFinancial Management Assignment: MarchSurya KiranОценок пока нет

- Ings BHD RR 3Q FY2012Документ6 страницIngs BHD RR 3Q FY2012Lionel TanОценок пока нет

- Wah Seong 4QFY11 20120223Документ3 страницыWah Seong 4QFY11 20120223Bimb SecОценок пока нет

- Steelpath MLP InfographicДокумент2 страницыSteelpath MLP Infographicapi-247644767Оценок пока нет

- Thomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)Документ6 страницThomson Reuters Company in Context Report: Aflac Incorporated (Afl-N)sinnlosОценок пока нет

- BIMBSec - TM 1QFY12 Results Review - 20120531Документ3 страницыBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecОценок пока нет

- Stock Evaluation PDFДокумент11 страницStock Evaluation PDFmaxmunirОценок пока нет

- American Vanguard Corporation (Security AnaylisisДокумент18 страницAmerican Vanguard Corporation (Security AnaylisisMehmet SahinОценок пока нет

- Allegiant Travel BUY: Market Edge ResearchДокумент4 страницыAllegiant Travel BUY: Market Edge Researchchdn20Оценок пока нет

- Value SpreadsheetДокумент58 страницValue SpreadsheetJitendra SutarОценок пока нет

- DuPont formula ROE analysis Oberyn Martell Inc 2009 vs 2013Документ6 страницDuPont formula ROE analysis Oberyn Martell Inc 2009 vs 2013anashj250% (2)

- Pran AmclДокумент11 страницPran AmclrobinrokonОценок пока нет

- SSRN Id3789918Документ19 страницSSRN Id3789918Gazmend MejziniОценок пока нет

- TM 4QFY11 Results 20120227Документ3 страницыTM 4QFY11 Results 20120227Bimb SecОценок пока нет

- Libyan InvestmentsДокумент20 страницLibyan InvestmentsAyam ZebossОценок пока нет

- Biocon - Ratio Calc & Analysis FULLДокумент13 страницBiocon - Ratio Calc & Analysis FULLPankaj GulatiОценок пока нет

- Analyst Rating: About Apple IncДокумент8 страницAnalyst Rating: About Apple Incqwe200Оценок пока нет

- European Autos & Parts 2009 Q4 BarclaysДокумент181 страницаEuropean Autos & Parts 2009 Q4 BarclaysAlphatrackerОценок пока нет

- Oh! My Lord, Increase Me in Knowledge: - :-Sponsored byДокумент27 страницOh! My Lord, Increase Me in Knowledge: - :-Sponsored byMohammadYounusAliОценок пока нет

- Autos - Pent-Up Demand in OctДокумент8 страницAutos - Pent-Up Demand in OctTariq HaqueОценок пока нет

- Beta SecuritiesДокумент5 страницBeta SecuritiesZSОценок пока нет

- Harley DavidsonДокумент5 страницHarley DavidsonpagalinsanОценок пока нет

- Aci Reuters BuyДокумент6 страницAci Reuters BuysinnlosОценок пока нет

- Honda Motor Company: Presented By: Zach Bodine March 9, 2006Документ25 страницHonda Motor Company: Presented By: Zach Bodine March 9, 2006Rohit KatyalОценок пока нет

- Hap Seng Plantations 4QFY11Result 20120215Документ3 страницыHap Seng Plantations 4QFY11Result 20120215Bimb SecОценок пока нет

- Nomura European Equity Strategy - August 21 2011 - Worse Than 08Документ16 страницNomura European Equity Strategy - August 21 2011 - Worse Than 08blemishesОценок пока нет

- 10 Year Financials of AAPL - Apple Inc. - GuruFocusДокумент2 страницы10 Year Financials of AAPL - Apple Inc. - GuruFocusEchuOkan1Оценок пока нет

- Tata Steel Ratio AnalysisДокумент53 страницыTata Steel Ratio AnalysisNikam PranitОценок пока нет

- Havells Initiating Coverage 27 Apr 2011Документ23 страницыHavells Initiating Coverage 27 Apr 2011ananth999Оценок пока нет

- Brown-Forman Initiating CoverageДокумент96 страницBrown-Forman Initiating CoverageRestructuring100% (1)

- AsddДокумент5 страницAsddajinkya_patil_11Оценок пока нет

- JF - India 31 01 07 PDFДокумент3 страницыJF - India 31 01 07 PDFstavros7Оценок пока нет

- 1.1 What Is Their Profit Margin? Profit MarginДокумент16 страниц1.1 What Is Their Profit Margin? Profit MarginVenay SahadeoОценок пока нет

- Tutorial 6 FAT SolutionДокумент11 страницTutorial 6 FAT SolutionAhmad FarisОценок пока нет

- Ratio Analysis: Per Share RatiosДокумент6 страницRatio Analysis: Per Share RatiosSwaraj SidhuОценок пока нет

- Esn 120301Документ63 страницыEsn 120301mvk911Оценок пока нет

- Anf VLДокумент1 страницаAnf VLJohn Aldridge ChewОценок пока нет

- BMW Financial Statement Analysis Reveals Profitability and Liquidity TrendsДокумент27 страницBMW Financial Statement Analysis Reveals Profitability and Liquidity Trendssaurabhm707Оценок пока нет

- Financial Analysis: Frame Work For Financial Analysis of Packages Ltd.Документ41 страницаFinancial Analysis: Frame Work For Financial Analysis of Packages Ltd.Ch Bilal HanjraОценок пока нет

- SSM Abn AmroДокумент12 страницSSM Abn AmroJolin MajminОценок пока нет

- Quantitative Stock ScreeningДокумент10 страницQuantitative Stock ScreeningLello PacellaОценок пока нет

- Exercise Financial Ratio Analysis 1Документ1 страницаExercise Financial Ratio Analysis 1walixz_87Оценок пока нет

- Essar SteelДокумент10 страницEssar Steelchin2dabgarОценок пока нет

- Eva TutorialДокумент15 страницEva TutorialPayal ChauhanОценок пока нет

- ValueResearchFundcard EdelweissELSS 2013may28Документ6 страницValueResearchFundcard EdelweissELSS 2013may28hemant1108aranghОценок пока нет

- Maruti SuzukiДокумент13 страницMaruti SuzukildhboyОценок пока нет

- BMW Annual Report 2013Документ208 страницBMW Annual Report 2013api-253150011Оценок пока нет

- Accounting & Financial Reporting Chapter 14Документ9 страницAccounting & Financial Reporting Chapter 14Ahmed El-HashemyОценок пока нет

- Workbook1 2Документ73 страницыWorkbook1 2Sandeep ChowdhuryОценок пока нет

- III. Estimating Growth: DCF ValuationДокумент48 страницIII. Estimating Growth: DCF Valuationiqrajawed11Оценок пока нет

- Harness Performance and AttributionsДокумент12 страницHarness Performance and AttributionsyochamОценок пока нет

- BNP Paribas Tax Advantage Plan ReviewДокумент4 страницыBNP Paribas Tax Advantage Plan ReviewYogi173Оценок пока нет

- SERIES 7 EXAM STUDY GUIDE + TEST BANKОт EverandSERIES 7 EXAM STUDY GUIDE + TEST BANKРейтинг: 2.5 из 5 звезд2.5/5 (3)

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKОт EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKОценок пока нет

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- Shock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryОт EverandShock Absorbers, Dampers, Springs & Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryОценок пока нет

- Proposed GHiE On Professional Fees February 2021Документ6 страницProposed GHiE On Professional Fees February 2021PATCADS STRUCTURAL SOLUTIONSОценок пока нет

- New Players New GameДокумент82 страницыNew Players New Gamepraetorians2009Оценок пока нет

- Dhaka Bank LTD - 2009Документ4 страницыDhaka Bank LTD - 2009Sagor SahabuddinОценок пока нет

- SMERA Rating CertificateДокумент1 страницаSMERA Rating CertificateSrinivas MaheshwariОценок пока нет

- Infrastructure and Project Finance Rating CriteriaДокумент38 страницInfrastructure and Project Finance Rating CriteriaSebastián Burgos ArévaloОценок пока нет

- Role of Creative StrategiesДокумент40 страницRole of Creative StrategiesSunil Bhamu67% (3)

- SGBAU-Bharti-2020 Teach Posts @NMK - Co .In PDFДокумент7 страницSGBAU-Bharti-2020 Teach Posts @NMK - Co .In PDFJYOTI KAPAREОценок пока нет

- Individual Performance Commitment and Review FormДокумент1 страницаIndividual Performance Commitment and Review FormKaren Feyt MallariОценок пока нет

- Unethical Leadership at EnronДокумент2 страницыUnethical Leadership at EnronDPS1911Оценок пока нет

- Performance Appraisal PPT (Autosaved)Документ46 страницPerformance Appraisal PPT (Autosaved)joydaradruОценок пока нет

- Crisil ProjectДокумент30 страницCrisil Projectharleen kaurОценок пока нет

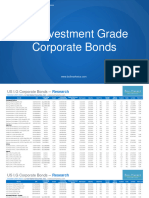

- Corporate US IGДокумент23 страницыCorporate US IGtarja19761Оценок пока нет

- Self-Assessment Guide: Food & Beverage ServiceДокумент2 страницыSelf-Assessment Guide: Food & Beverage ServiceMary Jane OcampoОценок пока нет

- ASE supplier assessment formДокумент2 страницыASE supplier assessment formEnahs RamirezОценок пока нет

- Performance Appraisal Goals ExamplesДокумент6 страницPerformance Appraisal Goals ExamplesKyle annieОценок пока нет

- Abad Et Al. (2018) - The Influence of Rating Levels and Rating Convergence On The Spillover Effects of Sovereign Credit ActionsДокумент46 страницAbad Et Al. (2018) - The Influence of Rating Levels and Rating Convergence On The Spillover Effects of Sovereign Credit Actions謝文良Оценок пока нет

- Probation Period EvaluationДокумент1 страницаProbation Period EvaluationMuhammad Zeeshan100% (2)

- MAA Textile SME Rating ReportДокумент8 страницMAA Textile SME Rating ReportMd. Nazrul Islam BhuiyanОценок пока нет

- Competitive Profile Matrix: Prepared By: Sara Jane E. MagsipocДокумент18 страницCompetitive Profile Matrix: Prepared By: Sara Jane E. MagsipoctalakayutubОценок пока нет

- Questionnaire For Consumer Preference For Bisleri 500mlДокумент3 страницыQuestionnaire For Consumer Preference For Bisleri 500mlganusabhahit775% (8)

- UBS Subordinated Bank Bonds 20100916Документ17 страницUBS Subordinated Bank Bonds 20100916dtm541Оценок пока нет

- Risk & Return NCFMДокумент41 страницаRisk & Return NCFMworld4meОценок пока нет

- Performance AppraisalДокумент54 страницыPerformance AppraisalbasheerОценок пока нет

- Unit 3 Developing Secure Info SystemДокумент4 страницыUnit 3 Developing Secure Info SystemLuvish YadavОценок пока нет

- IFE Matrix guide for evaluating internal factorsДокумент4 страницыIFE Matrix guide for evaluating internal factorsSudip DhakalОценок пока нет

- IPCRF TeacherPH - XLSX 1568123189Документ12 страницIPCRF TeacherPH - XLSX 1568123189Asiale Almocera100% (1)

- ACME2019 - ST - Johns - Concept Note ACME ProjectДокумент1 страницаACME2019 - ST - Johns - Concept Note ACME ProjectSurya RaoОценок пока нет

- Top NCD Picks for September 2013Документ1 страницаTop NCD Picks for September 2013vivekrajbhilai5850Оценок пока нет

- Credit Analysis TrainingДокумент2 страницыCredit Analysis TrainingrashbasheerОценок пока нет