Академический Документы

Профессиональный Документы

Культура Документы

Feasibility Report

Загружено:

tdusantИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Feasibility Report

Загружено:

tdusantАвторское право:

Доступные форматы

Feasibility Report

<Project Name>

<Location (if applicable)>

<Client>

National Project Management System

Feasibility Phase

Prepared by:

Date:

File name / EDRM# : 226533435.doc

Last revised: December 4! 2""

Table of Contents

1.0 Executive Summary...........................................................................................3

2.0 Problem/Opportunity Definition........................................................................3

3.0 Project Scope....................................................................................................4

4.0 !entification an! "naly#i# of Option#...............................................................$

4.1Options Considered......................................................................................5

4.2Analysis of Non-Financial Factors...................................................................7

Ea!ple of E"al#ation $atri for %#alitati"e Analysis........................&

4.'Ris( Assess!ent of Options...........................................................................)

Ea!ple of E"al#ation $atri for Ris( Assess!ent..........................1*

$.0 %ecommen!e! Option# for &urt'er "naly#i#....................................................11

(.0"pproval#/Si)nature#......................................................................................11

+#blic ,or(s and -o"ern!ent .er"ices

2

Last revised: December 4! 2""

Feasibility Reports -#idelines

The Feasibility Report (FR) presents the project parameters and defines the potential

solutions to the defined problem, need or opportunity. It expands on each of these

potential solutions, providing sufficient detail and nonfinancial evaluations to permit

the project leader to recommend to the approving authority all viable potential solutions

that should be further analy!ed in the next phase (Investment "nalysis Report #I"R$).

Further, for those options %hich are considered feasible, (based upon the nonfinancial

evaluations), indicative (&lass ') cost estimates should be prepared and their estimated

duration should be determined as input to the financial analysis of options to be carried

out in the "nalysis phase. The FR should also justify %hy any potential solutions %ere

considered to be nonviable or considered to be noncompliant %ith government policy

and(or project objectives and therefore not considered further.

)hen technical studies (Investigation and Report) have been conducted, they should be

used as input to the preparation of the FR.

As defined in the *+,- 'irective for Real +roperty +rojects, in some cases, a separate

FR is not re.uired as the I"R contains a sufficient feasibility assessment.

1.0 Executive Summary

Purpose:

The purpose of the Executive Summary is to provide a very brief overview of the most essential

and decision-relevant information concerning the project.

Suggested Content:

1. Clearly state the problemopportunity being assessed.

2. !dentify any special issues that may need to be brought to the attention of "eal #roperty

!nvestment $oard %or respective "egional !nvestment $oards&. 'ention should be made of

any implications on the client%s& or other sta(eholders.

3. )ist recommended options for analysis.

2.0 Problem/Opportunity Definition

Purpose:

The purpose of this section is to describe the problem or opportunity being addressed as defined

in the project*s Statement of "e+uirement. $riefly identify the main problem or (ey issue that the

proposed project is see(ing to address. This could be asset related or space related.

+#blic ,or(s and -o"ern!ent .er"ices

'

Last revised: December 4! 2""

3.0 Project Scope

Purpose:

The purpose of this section is to fully describe the (ey re+uirements of the project. !t should

provide pertinent details regarding the context for underta(ing the proposed project. !f

information re+uired to prepare this section of the ," come from the Statement of "e+uirements

%So"& or #reliminary #roject #lan %###&- it should be referred to- and the (ey content

summari.ed. Supporting details that are found in the So" or ### do not need to be replicated in

the ,".

Suggested Content:

"SSE* +"SED P%O,E-*S

This section will describe the major asset re+uirements of the proposed project.

1. #rovide a description of the asset. !t is generally appropriate to provide the details of the asset

description in an appendix- with only a general overview and the most significant points

included in the text of the ,". Elements of the asset description may include/

the age- area and other main characteristics of the asset0

the number of occupants affected by the problem0

the nature of any recent renovations that have been underta(en %may be presented

in an appendix&0

detailed information regarding the features of the asset relevant to the project

being proposed0

whether the property has a heritage designation or whether it is subject to other

conservation initiatives. A designation by the ,1$"2 is the most pertinent designation

for #34SC assets0

who the asset is being managed by if this has any implications for the project.

2. !nclude a statement as to the overall condition of the asset and its main systems- including

any limitations it may have. !dentify upcoming project re+uirements for the asset- other than

those associated with the current project.

This information shall be summari.ed from the Asset 'anagement #lan %A'#&- the $uilding

'anagement #lan %$'#&- the $uilding Condition "eport %$C"&- and other relevant

documents. 'ost of the information in this section may be presented in an appendix- with the

main points referred to in the text of the ,".

3. $riefly discuss the operational- financial- and functional performance of the asset- and

whether performance targets for the asset are being met. !dentify any operational- financial or

functional performance issues which may be relevant to the project. This information can be

summari.ed from the A'#.

4. !dentify any future plans pertaining to the use of the asset. This may include information on

the remaining useful life of the asset- or how long #34SC may be planning to (eep the asset

%refer to A'#&.

5. !dentify any strategic considerations of relevance to this project. $riefly discuss how the

continued utili.ation of the subject property conforms to regional or local accommodation

strategies. These strategies may be identified in a Community-$ased !nvestment Strategy

%C$!S&- or they may be referred to in the A'#.

6. "eference any related documents that report the problem- need or opportunity.

7. 5escribe health and safety issues and any potential impacts on clients or tenants

+#blic ,or(s and -o"ern!ent .er"ices

4

Last revised: December 4! 2""

SP"-E +"SED P%O,E-*S

This section will describe the major clients re+uirements of the proposed project.

6ote/ !f it is a portfolio ac+uisition- then the potential client department and re+uirements should

be identified.

1. #resent the client*s re+uirements in terms of/

the existing amount of space occupied %where relevant&0 and

number of employees andor full-time e+uivalent %,TEs& as validated by the

client.

2. !dentify the type of space re+uired0 the date by which the space is re+uired0 and for how long

the space is re+uired- and if (nown- within the context of the all relevant client demand. for

this location. !dentify any special considerations that relate to either the client*s re+uirements

or the nature of the assets. Examples of this may include a client*s re+uirements for a specific

location or type of location- the enhanced security re+uirements of a highly sensitive

department- or the special re+uirements posed by a heritage building. Summary information

should be provided as to why these special re+uirements exist.

3. Consistency with Accommodation #lan.

4. 5escribe any occupancy commitments that may have been made by the client. The analyst

should identify the term of this commitment and discuss what is li(ely to happen after the

commitment expires.

5. #otential for non-compliance with space fit-up standards.

6. #roject drivers i.e.-

6ew client program0

Client space modifications %expansion- reduction- changed use of space-

consolidation&0

Timing 7 duration of occupancy.

7. !f applicable- identify potential future demand from other federal government departments

that is relevant to this project.

Tips on writing this section:

There will li(ely be much detailed information associated with this section of the ,". The project

team should present numeric information in the form of tables andor appendices- as much as

possible.

References:

"eal #roperty !nvestment 4uide- Section 8.9- 5efine Client 6eeds.

Client 5epartment Sustainable 5evelopment Strategy %current&.

4.0 !entification an! "naly#i# of Option#

Purpose:

The purpose of this section is to list and analy.e all available options for meeting the identified

project re+uirements- and to document the results of the feasibility assessment of each of the

options. 5ocumentation will include the rationale to support viable options %to be analy.ed in the

next phase- within the !A"& and the justification to screen-out non-viable options.

4.1 Options Considered

+#blic ,or(s and -o"ern!ent .er"ices

5

Last revised: December 4! 2""

Suggested Content:

1. !dentify and describe all reasonable options for satisfying the project re+uirements. At this

stage- it is preferable to identify a greater number of options and then rule them out- rather

than focusing too early on only a very limited number of options.

Asset based projects options could be/

"epairs- retrofit- renovation- conservation

5emolish and rebuild

5ispose and demolish- buy and adapt

Sell

Space based projects options could be/

:acant crown inventory

)ease tender call for existing space

"enewal in-situ

$uild-to-lease

)ease-purchase

Crown-construction

Ac+uisition of an existing building

#ublic-#rivate-#artnership %a #; screening tool is being developed for larger

project&

Space optimi.ation of existing space

2. !dentify those options which are to be carried forward for in-depth analysis- and those options

which are clearly not practical and which will be eliminated from further consideration.

$riefly state why the eliminated options are not being considered for further analysis.

3. The ," should include a $ase Case %status +uo& scenario. The $ase Case should form part of

the in-depth analysis as it is usually the fallbac( position if the recommended project is not

approved.

4. !n preparing this section- ensure that all reasonable options for providing accommodation

have been explored.

5. The feasible options that will be analy.ed need to be developed and their estimated duration

must be determined. The feasible options must also include indicative %Class 5& cost

estimates for construction- leasing- and fit up. This will help establishing life-cycle costs in

the next phase %within the !A"&. The project duration could include the following 6#'S and

project milestones/

So" approval date

### approval date

," approval date

#reliminary #roject Approval %##A& or )ease #roject Approval %)#A& date

"e+uest for !nformation date

"e+uest for <ualification date

"e+uest for #roposal date

Effective #roject Approval %E#A& date

6egotiations commencement date

)ease Contract Authority %)ease Contract Award date&

$ase $uilding construction start date

+#blic ,or(s and -o"ern!ent .er"ices

/

Last revised: December 4! 2""

,it-up design commencement date

,it-up construction commencement date

#roduct Turn-over date

'oving commencement date

!ndicative estimates could be provided for/

,it-up cost

$ase building construction cost

6et rental rates

2perating = 'aintenance cost

Taxes

)and cost

The main features of each option should be summari.ed in text or tabular form with

supporting details in an appendix %e.g. Cost "eport Template&. !t is important to identify the

(ey assumptions made and the level of ris( associated with the estimates provided. 2f note-

the indicative cost estimates should only be provided for the feasible options. 1owever- the

milestone list is re+uired for all the options assessed in the ,easibility "eport as it will be

used to determine if each option is responsive to identified timing re+uirement %please see

section 8.>&.

6. Ensure that the options reflect the re+uirements of #34SC*s Sustainable 5evelopment

Strategy.

4.2 Analysis of Non-Financial Factors

The analysis of non-financial factors is intended to ensure that all +ualitative factors that

contribute to providing value to the federal government are ta(en into account in the investment

analysis.

Suggested Content:

Provide the following information for each of the possible options:

1. !dentify all non-financial factors which may have a bearing on the selection of the preferred

options and focus on decisions that are implicit- leading up to the ##A)#A. Some of the

factors which may be considered include/

1ow well each option satisfies the identified client re+uirements. !f there are any

locational or utili.ation advantages for the client associated with certain options.

The extent to which each option is responsive to identified timing re+uirements.

5ifferences between the options with respect to various policy and regulatory

re+uirements such as for health- safety- sustainability- accessibility- contribution to the

community- and federal presence.

The degree to which the option supports heritage conservation- Treasury /oard0s

1eritage /uildings +olicy and the 4ood 6eighbour #olicy.

A +ualitative analysis of positive or negative impact of environmental factors for each

option.

The extent to which each option supports the goals and objectives of the #34SC

Sustainable 5evelopment Strategy %S5S&. !dentify any major differences between the

options in terms of their ability to meet S5S objectives.

+#blic ,or(s and -o"ern!ent .er"ices

7

Last revised: December 4! 2""

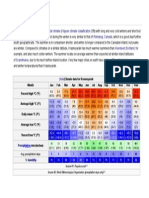

2. The use of an evaluation matrix can help to ensure that all feasible options are considered in

an organi.ed- consistent and methodical manner- and are evaluated against all relevant non-

financial factors. This will help in formulating a justifiable recommendation that reflects all

important criteria.

The evaluation matrix consists of a list of relevant factors- along with weightings that reflect

their relative significance. ,or each factor- a rating is applied that indicates the li(ely

performance of an individual option with respect to that one factor. 'ultiplying the

established weight times the score for each factor gives a weighted score. The sum of these

weighted scores gives a non-financial evaluation score for an individual option. The scores of

the various options can then be compared with the preferred option %with respect to

+ualitative factors& being the option with the highest score.

Criterion Weights: The criterion weight is a number that reflects the relative

importance of a particular criterion. Each criterion is assigned a percentage weight- so

that the weights add up to 9??@ for the full set of criteria. !n assigning criterion weights-

the analyst considers the identified criteria and determines which are primary criteria for

the particular investment situation- and which are secondary criteria. The difference in the

weights for the criteria should not be so large as to negate the importance of all but the

top weighted criterion.

Factor Rating Scales: !n order to compare the options- a rating scale is used to

transform +ualitative observations into a numerical value. !n this approach- each criterion

has a scale of ? %lowest& to A %highest&. A rating of A would indicate that the option is

highly responsive with respect to the factor- and the option enables objectives associated

with the factor to be met. A rating of ? would indicate that the option does not provide

any material benefit with respect to the factor. The analyst uses the highest applicable

rating- based on a combination of analysis and professional judgement. "atings are often

substantiated by a statement of supporting evidence.

The evaluation framewor( can assist the analyst in ma(ing appropriate trade-offs between the

benefits provided by different options- and arriving at a recommended approach which

provides the greatest overall utility. The following example illustrates the layout of an

evaluation matrix.

Example of Evaluation Matrix for Qualitative Analysis

Non-Financial

Factor

Weight

Option 1 Option 2 Option 3

Rating Score Rating Score Rating Score

Factor 1 30 4 120 3 90 4 120

Factor 2 25 2 50 5 125 4 100

Factor 3 20 4 80 2 40 3 60

Factor 4 15 5 75 1 15 4 60

Factor 5 10 2 20 3 30 3 30

otal Score 100 345 300 370

3. 5escribe the results of the analysis- including the rationale behind the ratings and weighting

factors that were applied- and the conclusions that were reached. 5etails of the analysis may

be included as an appendix.

+#blic ,or(s and -o"ern!ent .er"ices

&

Last revised: December 4! 2""

4.' Ris( Assess!ent of Options

The purpose of this section is to identify the (ey ris( factors associated with each of the options

being considered in this ,easibility "eport.

*2T34 " more substantive ris5 assessment %ill be conducted for the I"R. For

the Feasibility Report, identify the results of the preliminary ris5 assessment of

each option in terms of scope, time, cost or other considerations surrounding the

problem(opportunity such as environment, infrastructure, technical, political,

legal, organi!ational and ( or social factors. The latter considerations may be

derived from assumptions and constraints discussed in the +reliminary +roject

+lan, and %ill pertain to the project being able to attain the project objectives

9. The first step is to identify the ris( factors that could be relevant for each of the options being

analysed.

>. 3hile the relevant ris( factors will be different for each investment situation- some ris(

factors that may be considered include/

"is( that the project may not fully rectify an identified problem

"is( of user needs not being met

"is( of changing re+uirements

"is( that forecast demand fails to develop

"is( of not meeting timing re+uirements

"is( of cost overruns

"is( of future performance being impaired

"is( of environmental degradation

;. 2nce the ris( factors have been identified- it is necessary to evaluate the relative level of ris(

associated with each of the options. A suggested approach for underta(ing this assessment is

provided below. 1owever- other methodologies may be employed.

!t may be usefull to ta(e the following actions during this step/

!dentify all sources of ris( associated with each option under consideration.

Bnderta(e a ris( assessment for each element of ris( for each option. The ris( assessment

is a product of the li(elihood times the severity of the impact- as indicated below.

:ery 1igh "is( %9?& 1igh impact and high li(elihood

1igh "is( %A& 1igh impact and medium li(elihood- or

'edium impact and high li(elihood

'edium-1igh "is( %;& 'edium impact and medium li(elihood

'edium "is( %>& )ow impact and high li(elihood- or

1igh impact and low li(elihood

)ow "is( %9& )ow impact and medium li(elihood- or

'edium impact and low li(elihood

:ery )ow "is( %?& )ow impact and low li(elihood

Evaluate the overall level of ris( associated with each option. This can be done using an

evaluation matrix. The matrix identifies each ris( element as a row in the matrix- and

+#blic ,or(s and -o"ern!ent .er"ices

)

Last revised: December 4! 2""

each option as a column. Each cell in the matrix can then be used to identify the

li(elihood and impact of the individual ris( element impacting a particular option- and

assigning a score to this ris(. The intent is to determine the relative levels of ris( among

the options being evaluated.

Example of Evaluation Matrix for Risk Assessment

"is(

,actor

2ption 9 2ption > 2ption ;

"is( Score "is( Score "is( Score

,actor 9 1igh A 'edium > 'edium >

,actor > 'edium > )ow 9 'edium >

,actor ; )ow 9 :ery )ow ? )ow 9

,actor 8 :ery )ow ? 1igh A )ow 9

,actor A 'edium > 1igh A )ow 9

Total Score 9? 9; C

8. 5escribe the results of the ris( assessment and the conclusions that were reached. 3hich

option carries the lowest level of ris(D 5o any of the options carry an unacceptably high level

of ris(D The ris( assessment will be used to develop a "is( 'anagement #lan in the !A" for

the recommended options.

Tips on writing this section:

The results of the feasibility assessment should be presented in tables %rather than in text&- with

observations and conclusions discussed in the text- where possible. !t is recommended to obtain

guidance on this section from the respective Centers of Expertise. !t is important to identify the

(ey assumptions made.

+#blic ,or(s and -o"ern!ent .er"ices

1*

Last revised: December 4! 2""

References: The following is not an exhaustive list as there are numerous policies- procedures

etc.- that can be referenced and all play a part in determining appropriate options to be considered

in the !A".

!nvestment Analysis #olicy

#34SC Sustainable 5evelopment Strategy

"eal #roperty $ranch "is( 'anagement 'anual

!ntegrated "is( 'anagement #olicy. 6ovember >?9?

#34SC 6ational #roject 'anagement System Enowledge Area"is(

$.0 %ecommen!e! Option# for &urt'er "naly#i#

The intent of this section is to combine the results of all of the analyses that were underta(en.

Consider the results of the assessment of non-financial factors and ris( assessment together.

Summari.e the (ey findings of the 2ption "an(ing. !dentify which options are recommended for

further analysis %including financial analysis& during the Analysis phase in preparation of the

!A".

(.0 "pproval#/Si)nature#

+repared by0

.i1nat#re

+lease print0

Na!e +osition 2ate

Appro"ed by0

.i1nat#re

+lease print0

Na!e +osition 2ate

+#blic ,or(s and -o"ern!ent .er"ices

11

Вам также может понравиться

- Feasibility Report Preparation GuideДокумент13 страницFeasibility Report Preparation GuideAkshayKadbeОценок пока нет

- Project Proposal TemplateДокумент4 страницыProject Proposal TemplateSharlene RobertsОценок пока нет

- Scope Management PlanДокумент10 страницScope Management PlanKatherine Kelly Sedano RuttiОценок пока нет

- Budget Plan Customer Name: Directions For Using TemplateДокумент10 страницBudget Plan Customer Name: Directions For Using TemplatesemiariОценок пока нет

- Project Plan TemplateДокумент24 страницыProject Plan TemplateRajesh Prabtani100% (2)

- 4 Use Cases - ExplanationДокумент19 страниц4 Use Cases - ExplanationSomu DasОценок пока нет

- ProblemstatementworksheetДокумент4 страницыProblemstatementworksheetkeishaangeles26Оценок пока нет

- CSRA Sample RiskReportДокумент15 страницCSRA Sample RiskReportArturo RodriguezОценок пока нет

- Project Scope Statement: Is Implicitly Excluded From The ProjectДокумент6 страницProject Scope Statement: Is Implicitly Excluded From The Projectmefarooq3651Оценок пока нет

- Project Scope - TemplateДокумент2 страницыProject Scope - Templatemayur_lanjewarОценок пока нет

- AgilePM Template - Terms of Reference (ToR)Документ5 страницAgilePM Template - Terms of Reference (ToR)Abdul KhaliqОценок пока нет

- TOGAF 9 Template - Architecture DefinitionДокумент70 страницTOGAF 9 Template - Architecture DefinitionzzoraineОценок пока нет

- Master Project Plan 0.2Документ9 страницMaster Project Plan 0.2semiariОценок пока нет

- Project Scope Statement TemplateДокумент11 страницProject Scope Statement TemplateBernard OuattaraОценок пока нет

- Prescribed FormatДокумент10 страницPrescribed FormatArunachalam NarayananОценок пока нет

- Monitoring Plan Customer Name: Directions For Using TemplateДокумент10 страницMonitoring Plan Customer Name: Directions For Using TemplatesemiariОценок пока нет

- Project Scope Statement TemplateДокумент2 страницыProject Scope Statement TemplateHanseasОценок пока нет

- Comsats Institute of Information Technology LahoreДокумент5 страницComsats Institute of Information Technology Lahoremalik2k3Оценок пока нет

- Communications Plan Customer Name: Directions For Using TemplateДокумент7 страницCommunications Plan Customer Name: Directions For Using TemplatesemiariОценок пока нет

- User RequirementsДокумент8 страницUser RequirementssemiariОценок пока нет

- Unvf Application Form InstructionsДокумент4 страницыUnvf Application Form InstructionsfieqaОценок пока нет

- Final Publishable JRP ReportДокумент6 страницFinal Publishable JRP ReportLonaBrochenОценок пока нет

- 1.1. Software Development Plan - SP Ramos - OswaldoДокумент10 страниц1.1. Software Development Plan - SP Ramos - OswaldoJonnel Vasquez SilvaОценок пока нет

- Project Report of DISA 2.0 CourseДокумент21 страницаProject Report of DISA 2.0 CourseDIAMOND RULESОценок пока нет

- AEP0012Документ47 страницAEP0012AyyappanSubramanianОценок пока нет

- Project Management Plan TemplateДокумент27 страницProject Management Plan Templateinasap100% (1)

- Project Initiation Document TemplateДокумент9 страницProject Initiation Document TemplateSajalBanerjeeОценок пока нет

- Risk Assessment QuestionnaireДокумент15 страницRisk Assessment QuestionnaireFetuga Adeyinka100% (1)

- Requirements For Written Reports Introduction To Reports in ProjectДокумент12 страницRequirements For Written Reports Introduction To Reports in ProjectTodani LuvhengoОценок пока нет

- Project CharterДокумент7 страницProject CharterkrismmmmОценок пока нет

- Husky Scope Solution 2 CH 05Документ9 страницHusky Scope Solution 2 CH 05Farah ArindaОценок пока нет

- Preparing Terms of ReferenceДокумент9 страницPreparing Terms of ReferenceRana Ahmad AamirОценок пока нет

- Project Training Management Planv1.0Документ18 страницProject Training Management Planv1.0Akhil AnanthakrishnanОценок пока нет

- Graduation Project FormatДокумент27 страницGraduation Project FormatAhmed Awais100% (1)

- Business Vision Khoi TaДокумент8 страницBusiness Vision Khoi TaLePhongОценок пока нет

- Milestone Review Report Customer Name: Directions For Using TemplateДокумент8 страницMilestone Review Report Customer Name: Directions For Using TemplatesemiariОценок пока нет

- BRD Customer Client Sign Off Mahadev AnДокумент7 страницBRD Customer Client Sign Off Mahadev AnbtbowmanОценок пока нет

- Project Proposal FormatДокумент15 страницProject Proposal Formatsadish ghimireОценок пока нет

- Primavera - Questions - Key & ExplanationДокумент42 страницыPrimavera - Questions - Key & ExplanationSoham Banerjee100% (1)

- Agile SOW TemplateДокумент10 страницAgile SOW Templateblogs414Оценок пока нет

- Project Charter LongДокумент8 страницProject Charter LongSone AleksОценок пока нет

- Rice MillДокумент26 страницRice MillChristian CleofasОценок пока нет

- TEMPLATE Report Design SpecificationДокумент8 страницTEMPLATE Report Design SpecificationManuel DayОценок пока нет

- Sample Project CharterДокумент3 страницыSample Project CharterOsiris FriendОценок пока нет

- Operations Plan Customer Name: Directions For Using TemplateДокумент12 страницOperations Plan Customer Name: Directions For Using TemplatesemiariОценок пока нет

- Draft Project CharterДокумент6 страницDraft Project ChartertimdouganОценок пока нет

- Work PackageДокумент9 страницWork PackageBrittany CantrellОценок пока нет

- Oe Project Status Instructions: General InformationДокумент3 страницыOe Project Status Instructions: General Informationsayafrands6252Оценок пока нет

- Development Project Plan: WhatДокумент9 страницDevelopment Project Plan: WhatReselyn PalabinoОценок пока нет

- Review and Test PlanДокумент15 страницReview and Test PlanchidseymattОценок пока нет

- Procurement Plan: ExampleДокумент8 страницProcurement Plan: ExampleShowki WaniОценок пока нет

- Full Investment Analysis Report: (For Asset Projects at Project Approval and Initial Expenditure Authority)Документ15 страницFull Investment Analysis Report: (For Asset Projects at Project Approval and Initial Expenditure Authority)xu zhenchuanОценок пока нет

- IT Capstone Proposal TemplateДокумент12 страницIT Capstone Proposal TemplateT.c. Flatt100% (1)

- WGU From Proposal To CapstoneДокумент4 страницыWGU From Proposal To CapstoneDentMan06Оценок пока нет

- Q & As for the PMBOK® Guide Sixth EditionОт EverandQ & As for the PMBOK® Guide Sixth EditionРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Project Estimating and Cost ManagementОт EverandProject Estimating and Cost ManagementРейтинг: 4.5 из 5 звезд4.5/5 (12)

- Decimal System for Classifying Data Pertaining to the Petroleum IndustryОт EverandDecimal System for Classifying Data Pertaining to the Petroleum IndustryОценок пока нет

- BS en 1538 2000Документ54 страницыBS en 1538 2000MariusHazaparuОценок пока нет

- Climate: Subarctic Climate Köppen Climate Classification Humid Continental ClimateДокумент1 страницаClimate: Subarctic Climate Köppen Climate Classification Humid Continental ClimatetdusantОценок пока нет

- Sample CV 5Документ1 страницаSample CV 5SynchronizeОценок пока нет

- Climate: Continental Climate Köppen Climate Classification Winnipeg Canada Aberdeen Scotland ScandinaviaДокумент1 страницаClimate: Continental Climate Köppen Climate Classification Winnipeg Canada Aberdeen Scotland ScandinaviatdusantОценок пока нет

- Cheese Cake Maline Bela CokoladaДокумент2 страницыCheese Cake Maline Bela CokoladatdusantОценок пока нет

- CV Template 6Документ2 страницыCV Template 6Philippe CoutinhoОценок пока нет

- Sample CV 5Документ1 страницаSample CV 5SynchronizeОценок пока нет

- TiramisuДокумент1 страницаTiramisutdusantОценок пока нет

- Loan Amortization 18 (1) .07Документ2 страницыLoan Amortization 18 (1) .07tdusantОценок пока нет

- Standard CostingДокумент73 страницыStandard CostingpadmlataОценок пока нет

- SAP Audit of Fixed AssetsДокумент2 страницыSAP Audit of Fixed AssetsKevinОценок пока нет

- Rights and Remedies of Government - Outline.Документ7 страницRights and Remedies of Government - Outline.Char HernandezОценок пока нет

- Junior Philippine Institute of Accountants: Constitution & By-LawsДокумент24 страницыJunior Philippine Institute of Accountants: Constitution & By-LawsMikky TakahashiОценок пока нет

- FAR139 FAR 139 Cash and Accrual BasisДокумент4 страницыFAR139 FAR 139 Cash and Accrual BasisJuniah MyreОценок пока нет

- ICPA Audit Planning HandoutДокумент4 страницыICPA Audit Planning Handoutmichelle angela maramagОценок пока нет

- Behre Dolbear Feasibility Studies SOQДокумент14 страницBehre Dolbear Feasibility Studies SOQKhishigbayar PurevdavgaОценок пока нет

- Functions of AdministrationДокумент29 страницFunctions of AdministrationDishu100% (2)

- Into To World of CPAsДокумент22 страницыInto To World of CPAsKristine WaliОценок пока нет

- BSP Circular 1108Документ9 страницBSP Circular 1108Maya Julieta Catacutan-EstabilloОценок пока нет

- UBML3033 Corporate Governance Group Assignment - FBF T7 Lim Zhe Ying Top Glove Corporation BerhadДокумент19 страницUBML3033 Corporate Governance Group Assignment - FBF T7 Lim Zhe Ying Top Glove Corporation BerhadLiew Sally100% (1)

- Assignment 2Документ8 страницAssignment 2Anonymous qbVaMYIIZ100% (4)

- Audit Through CBSДокумент159 страницAudit Through CBSInfotomathiОценок пока нет

- DTI, SEC, BSP and BOI RequirementsДокумент22 страницыDTI, SEC, BSP and BOI Requirementsni_kai2001Оценок пока нет

- Running Head: Project ManagementДокумент23 страницыRunning Head: Project ManagementHassan SiddiquiОценок пока нет

- Auditing and Assurance Services 7th Edition Louwers Solutions ManualДокумент36 страницAuditing and Assurance Services 7th Edition Louwers Solutions Manualeleidinsunniah0gie8100% (39)

- Revenue Cycle in Accounting Information SystemДокумент12 страницRevenue Cycle in Accounting Information SystemkaniaОценок пока нет

- Internship Report On LESCOДокумент53 страницыInternship Report On LESCOMuhammad Abuzar100% (7)

- Corporate Governance and Firm Risk - Final Thesis (Abdullah) PDFДокумент60 страницCorporate Governance and Firm Risk - Final Thesis (Abdullah) PDFMuhammad Sualeh Khattak100% (4)

- Job OrderДокумент53 страницыJob OrderAdilla DillaОценок пока нет

- Adverse OpinionДокумент3 страницыAdverse OpinionDedy KokbusetОценок пока нет

- Naqdown Final QuestionsДокумент43 страницыNaqdown Final Questionssarahbee0% (1)

- DISA 3.0 Mod1 Day 1 Quiz 1Документ3 страницыDISA 3.0 Mod1 Day 1 Quiz 1Jackson Abraham ThekkekaraОценок пока нет

- Irfan Malik 01Документ2 страницыIrfan Malik 01Irfan AliОценок пока нет

- Rules On Bursa Malaysia Securities BerhadДокумент193 страницыRules On Bursa Malaysia Securities BerhadSeo Soon YiОценок пока нет

- Asset ImpairmentДокумент12 страницAsset Impairmentkumar.rmsОценок пока нет

- DTMFIs Minimum Licensing Requirements 2020 FinalДокумент21 страницаDTMFIs Minimum Licensing Requirements 2020 FinalLesley munikwaОценок пока нет

- FABM-1 - Module 1 - Intro To AccountingДокумент13 страницFABM-1 - Module 1 - Intro To AccountingKJ Jones100% (26)

- Resume Miraj DahalДокумент3 страницыResume Miraj DahalMirage DahalОценок пока нет

- HM Sampoerna Annual Report 2012 Laporan Tahunan HMSP Company Profile Indonesia Investments PDFДокумент101 страницаHM Sampoerna Annual Report 2012 Laporan Tahunan HMSP Company Profile Indonesia Investments PDFDewi SinulinggaОценок пока нет