Академический Документы

Профессиональный Документы

Культура Документы

Assignment On Jamuna Bank

Загружено:

SkyDriver100%(1)100% нашли этот документ полезным (1 голос)

355 просмотров24 страницыAn assignment about Jamuna Bank in Bangladesh

Оригинальное название

Assignment on Jamuna Bank

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAn assignment about Jamuna Bank in Bangladesh

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

355 просмотров24 страницыAssignment On Jamuna Bank

Загружено:

SkyDriverAn assignment about Jamuna Bank in Bangladesh

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 24

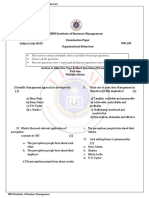

ASSIGNMENT ON

Organizational Behavior Practices of Jamuna Bank

2

East West University

Submitted To

Sharmin Akther

Lecturer, Department of Business Administration

East West University

Submitted By

Group-Innovative Thinkers

Course: MGT251 (Organizational Behavior)

Section: 04

Contribution of Members

25% 25% 25% 25% 25%

100% 100% 100% 100% 100%

0%

50%

100%

Mohammad

Jahurul Islam

Nouman

Hossain

Sohanur

Rahman

Adnan Islam Yesmin Akter

Contribution Out of 100

Sl no:

Name of the students

ID No.

1 Mohammad Jahurul Islam 2012-3-10-083

2 Nouman Hossain 2012-3-10-098

3 Sohanur Rahman 2012-3-10-160

4 Adnan Islam 2012-3-10-090

5

3

Letter of Transmittal

Date: 13

rd

March, 2014

Sharmin Akther

Lecturer

Department of Business Administration

East West University

Subject: Submission of assignment on Organizational Behavior Practices of Jamuna Bank .

Dear Madam,

This is to inform you that we are submitting the assignment on Organizational Behavior

Practices of Jamuna Bank upon completion of our formal assignment attachment with

Jamuna Bank Limited. We have tried to discuss all the relevant points of a feasibility

study while keeping consistency with Jamuna Bank Limited.

We would be glad to clarify any discrepancy that may arise or any clarification that you

may require

Thanking you in anticipation,

Group Name: - Innovative Thinkers

Sincerely yours

Sl no:

Name of the students

ID No.

1 Mohammad Jahurul Islam 2012-3-10-083

2 Nouman Hossain 2012-3-10-098

3 Sohanur Rahman 2012-3-10-160

4 Adnan Islam 2012-3-10-090

4

ACKNOWLEDGEMENT

First and fore mostly we would like to thank the Almighty Allah who blessed us with knowledge,

understanding and ability to do this Assignment.

We are indebted to many people for providing us encouragement and support during our learning and

working while making this Assignment and we want to show our gratefulness to these people. We are

very much grateful to Ms. Sharmin Akther, our respected course instructor of MGT251

(Organizational Behavior), who assigned us this challenging work. She always guided us to take and

overcome this challenge successfully. Without her help in every step it was quite impossible for us to

finish this report properly in time.

We are also grateful to Abu-Taher, Branch Manager, Jamuna Bank Ltd. We also thank Quamrul

Hassan Faisal, First Executive Officer, Jamuna Bank Ltd Select for giving us valuable information.

5

Table of Content

Topic Pages

Chapter # I: Introduction 06

Brief History of Jamuna Bank Ltd 06

Chapter # II: Main Body 07-18

Employee motivational tools used by Jamuna Bank(JBL)

Application of OB by JBL

Employee Involvement program byJBL

Variable pay programs

Conflict & Negotiations of Jamuna Bank(JBL)

Conflict in JBL

Negotiations

Organizational Culture

Recommendation

09

10

11

13

15

16

18

20

Chapter # III: Conclusion 21

Definitions of Terms

Appendix

Bibliography

22

23

24

6

Introduction

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 with

its head office at Printers Building (2

nd

floor and 8

th

floor), 5, Rajuk Avenue, Dhaka-1000. The Bank

started its operation from 3rd June 2001.

Jamuna Bank Limited is a highly capitalized new generation Bank started its operation with an

authorized capital of Tk.1600.00 million and paid up capital of Tk.390.00 million, as of December

2006 Paid up capital of the Bank raised to Tk.1072.5 million and number of branches raised to 29

(Twenty nine).

JBL undertakes all type of banking transactions to support the development of trade and commerce in

the country. JBLs services are also available for the entrepreneurs to set up new ventures and BMRE

for industrial units. The Bank gives special emphasis on Export, Import, Trade Finance, SME

Finance, Retail Credit and Finance to Women Entrepreneurs.

To provide clientele services in respect of International Trade it has established wide correspondent

banking relationship with local and foreign banks covering major trade and financial centers at home

and abroad.

Vision statement of the bank

To be in the forefront of national development by providing all the customers inspirational strength,

dependable support and the most comprehensive range of business solutions, through our team of

professionals who work passionately to be outstanding in everything we do.

Mision statement of the bank

Jamuna Bank Ltd will become most caring, focused for equitable growth based on diversified

deployment of resources, and nevertheless would remain healthy and gainfully profitable Bank.

Will become most caring, focused for equitable growth based on diversified deployment resources,

and nevertheless would remain healthy and gainfully profitable Bank. Jamuna Bank Limited aims to

become one of the leading banks in Bangladesh by prudence, flair and quality of operations in their

banking sector. The bank has some mission to achieve the organizational goals. Some of them are as

follows as:

7

Jamuna Bank Limited provides high quality financial services to strengthen the well being and success

of individual, industries and business communities.

Its aim to ensure their competitive advantages by upgrading banking technology and information

system.

JBL intends to play more important role in economic development of Bangladesh and its financial

relations with the rest of the world by interlining both modernistic and international operations.

JBL encourages investors to boost up share market.

The bank creates wealth for the shareholders.

The bank believes in strong capitalization.

It maintains high standard of corporate and business ethics.

Jamuna Bank Limited extends highest quality of services, which attracts the customers to choose them

first.

The bank creates wealth for the shareholders.

The bank maintains congenial atmosphere for which people are proud and eager to word with Jamuna

Bank Limited.

Jamuna Bank Limited intends to provide better benefits to their customers and good returns to their

shareholders.

The bank intends to meet the needs of their clients and enhance their profitability by creating corporate

culture.

Jamuna Bank Ltd will become most caring, focused for equitable growth based on diversified

deployment of resources, and nevertheless would remain healthy and gainfully profitable Bank.

Product Scheme

The products and services can be classifying in two ways & those are.

The deposit products & services

The lending products & services

Deposits products & services Lending/Investment products & services

Corporate Bankin

g

Hi-her Purchase

Personal Banking Lease Finance

Online Banking Personal loan for woman

Monthly Savings Scheme Project Finance

i Monthly Benefit Scheme

ii Loan Syndication

8

Double/Triple Benefit Scheme Consumer Credit

Marriage Scheme Import and Export. Handling Financing

Education Scheme

Lakhpati Deposit Scheme

Q-Cash ATM

Principal activities of Jamuna bank Ltd.

The principal activities of the bank are to provide all kind of commercial bank activities encompass a

wide range of services including excepting deposits, making loans, discounting bills, conducting

money transfer and foreign exchange transactions and performing other related services such as safe

keeping, collections, issuing guarantees, acceptances and letters of credit to its customers through its

branches in Bangladesh.

THE BANKER CUSTOMER RELATIONSHIP

The Banker Customer relationship is essentially a debtor-creditor contractual relationship. This

relationship may be divided into two categories,

1. Legal relationship

2. Behavioral relationship

After the contractual relationship is established between the banker and customer, they have to avoid

by some implied conditions of the contract as well as practices of the bank.

Some of the conditions and practices are as follows:

1. Customer is to use cheque books while demanding payment from his account.

2. Customer should keep cheque books in his safe custody.

3. Customer must inform the bank on time for any loss of cheque leaf or cheque books.

4. Customer while depositing money or presenting cheque, they must do that during business hour of the

bank.

5. Banker also should give necessary banking advice and help the customer in various banking activities.

Rights of a customer

Duties & obligations of a banker

Right to deposit money in his A/C on time. Must credit the deposited the amount to the

customers A/C.

9

Right to demand repayment by issuing cheque or

written order properly in proper time and place.

Must honor cheque if otherwise in order.

Right to get pass book/statement of A/C. Must supply pass boo/statement of A/C as

demanded.

Right to stop payment on his cheque. Must abide by the stop payment order.

Right to give standing instructions. Must abide by the instructions.

Right to claim interest of his deposit balance in the

interest bearing account.

Must pay/credit interest as per rule.

Right to have secrecy of his account. Must maintain secrecy of customers A/C if the

bankers not bound to disclose it under certain

conditions.

Right to claim damages of any loss and for

defamation due to wrongful/willful dishonor of

cheque by bank.

Must compensate the loss.

Right to demand the proceeds of the instrument

deposited for collection and collected accordingly.

Must collect the proceeds of the instrument in

customers A/C and honor the cheque drown

against the amount.

Right to claim money paid by bank from his A/C

wrongly or payment is not made in due courses.

Payment should be made in due courses in good

faith and without negligence.

Right to return deposit if not in proper manner and

time.

Must deposit the amount properly and in time.

Right to return the cheque if not drown properly or

in time or for some other reason.

Must demand payment by issuing cheque or

written order properly.

Right to debit customers A/C for any charges,

interest and commission if recoverable.

Must pay the bank charges, interest and

commission if payable.

Right to lien, right of set off etc. Must abide by the law.

Employee motivational tools used within the Jamuna Bank:

Concept of Management by objectives (MBO)

10

Management by objectives (MBO), also known as management by results (MBR), is a process of

defining objectives within an organization so that management and employees agree to the objectives

and understand what they need to do in the organization in order to achieve them. The term

"management by objectives" was first popularized by Peter Drucker in his 1954 book The Practice of

Management.

The essence of MBO is participative goal setting, choosing course of actions and decision making.

An important part of the MBO is the measurement and the comparison of the employees actual

performance with the standards set. Ideally, when employees themselves have been involved with the

goal setting and choosing the course of action to be followed by them, they are more likely to fulfill

their responsibilities.

According to George S. Odiorne, the system of management by objectives can be described as a

process whereby the superior and subordinate jointly identify its common goals, define each

individual's major areas of responsibility in terms of the results expected of him, and use these

measures as guides for operating the unit and assessing the contribution of each of its members.

Applications of OB by Jamuna Bank:

Jamuna Bank has been set the principle of Management by Objectives (MBO) is for employees to

have a clear understanding of the roles and responsibilities expected of them. Then they can

understand how their activities relate to the achievement of the organization's goal. Also places

importance on fulfilling the personal goals of each employee.

Employee of Jamuna Bank get some of the important features and advantages of MBO are:

1. Motivation Involving employees in the whole process of goal setting and increasing

employee empowerment. This increases employee job satisfaction and commitment.

2. Better communication and coordination Frequent reviews and interactions between

superiors and subordinates help to maintain harmonious relationships within the organization

and also to solve many problems.

3. Clarity of goals

4. Subordinates tend to have a higher commitment to objectives they set for themselves than

those imposed on them by another person.

5. Managers can ensure that objectives of the subordinates are linked to the organization's

objectives.

6. Common goal for whole organization means it is a directive principle of management.

Linking MBO and Goal-Seeing Theory:

Since it was first researched five decades ago, goal-setting theory has been the most researched, utilized, and

established theory of work motivation in the field of industrial and organizational psychology (PSU, 2012).

The theory began with the early work on levels of aspiration developed by Kurt Lewin and has since been

primarily developed by Dr. Edwin Locke, who began goal setting research in the 1960s. The research revealed

11

an inductive relationship between goal setting and improved production performance. A goal is the aim of an

action or task that a person consciously desires to achieve or obtain (Locke & Latham, 2002; Locke & Latham,

2006). Goal setting involves the conscious process of establishing levels of performance in order to obtain

desirable outcomes. If individuals or teams find that their current performance is not achieving desired goals,

they typically become motivated to increase effort or change their strategy (Locke & Latham, 2006).

After implementing that Goal-setting theory, Jamuna Bank finds that:

1. Goal-setting theory demonstrates that:

a. Hard goals result in a higher level of individual performance than do easy goals.

b. Specific hard goals result in higher levels of performance than no goals at all or generalized

goals.

c. Feedback on ones performance leads to higher performance.

d. Implies that goals must be perceived as feasible

e. Is most effective when the goals are difficult enough to require stretching

2. MBO directly advocates specific goals and feedback.

3. The only area of possible disagreement with goal setting theory is participation.

MBO strongly advocates it.

Goal-setting theoryassigning goals to subordinatesfrequently works just as well participation.

Jamuna Bank arranges employee Recognition Programs:

A. What Are Employee Recognition Programs?

Employee recognition programs consist of personal attention, expressing interest, approval, and

appreciation for a job well done. They can take numerous forms. The best ones use multiple sources

and recognize both individual and group accomplishments.

B. Linking Recognition Programs and Reinforcement Theory

About Fifteen-hundred employees were surveyed in a variety of work settings about what they

considered to be the most powerful workplace motivator. Their response was recognition!

12

Consistent with reinforcement theory, rewarding a behavior with recognition immediately following

that behavior is likely to encourage its repetition.

Employee Involvement programs by Jamuna Bank:

A. What Is Employee Involvement?

Employee involvement has become a catchall term to cover a variety of techniques. It encompasses

employee participation or participative management, workplace democracy, empowerment, and

employee ownership. Employee involvement is a participative process that uses the entire capacity of

employees and is designed to encourage increased commitment to the organizations success. The

underlying logic is that by involving workers in those decisions that affect them and by increasing

their autonomy and control over their work lives, employees will become more motivated, more

committed to the organization, more productive, and more satisfied with their jobs.

B. Examples of Employee Involvement Programs

Four forms of employee involvement are participative management, representative participation,

quality circles, and employee stock ownership plans. Participative management- The distinct

characteristic common to all participative management programs is that subordinates actually share a

significant immediate degree of decision-making power with their superiors. It has been promoted as

a panacea for poor morale and low productivity. However, it is not appropriate for every organization.

For it to work, there must be adequate time to participate, the issues in which employees get involved

must be relevant to their interests, employees must have the ability (intelligence, technical

knowledge, communication skills) to participate, and the organizations culture must support

employee involvement. Managers often do not know everything their employees do. Better decisions,

Increased commitment to decisions, Intrinsically rewarding employees makes their jobs more

interesting and meaningful.

Dozens of studies have been conducted but the findings are mixed. It appears that participation

typically has only a modest influence on productivity, motivation, and job satisfaction.

Job Redesign and Scheduling Programs by Jamuna Bank:

13

. Ways to reshape jobs so that they are more challenging, stimulating, and motivating.

Three Job redesign optionsjob rotation, job enlargement, and job enrichment

Job rotation (sometimes referred to as cross-training). The practice of periodic shifting of

an employee from one task to another.

o Reduces boredom and increases motivation

o Training costs are increased, productivity is reduced

Job enlargement Expanding jobs horizontally.

o Efforts have met with less than enthusiastic results

o Some successful applications.

Job enrichment refers to the vertical expansion of jobs. Increases the degree to which worker

controls planning, execution, and evaluation of their work.

How does management enrich an employees job?

Combining tasks

Forming natural work units

Establishing client relationships

Expanding jobs vertically

Opening feedback channels

Overall evidence indicates that job enrichment reduces absenteeism and turnover costs and increases

satisfaction. Evidence is inconclusive on the issue of productivity.

Flextime (flexible work hours). Allows employees some discretion over when they arrive at and

leave work.

Benefits include reduced absenteeism, increased productivity, reduced overtime expense, and

reduced hostility toward management, and increased autonomy and responsibility for

employees.

Major drawback is that its not applicable to all jobs.

14

Job sharing allows two or more individuals to split a traditional 40-hour a week job. Telecommuting,

employees who do their work at home at least two days a week on a computer that is linked to their

office.

Variable Pay Programs by Jamuna Bank:

Variable Pay Programs can take the form of piece-rate wages, bonuses, profit sharing and gain

sharing. A portion of an employees pay is based on some individual and/or organizational measure

of performance. Unlike more traditional base-pay programs, variable pay is not an annuitythere is

no guarantee. The fluctuation in variable pay programs makes them attractive to management. The

organizations fixed labor costs turn into a variable cost reducing expenses when performance

declines. Also, tying pay to performance recognizes contribution rather than being a form of

entitlement. Four widely used programs are piece-rate wages, bonuses, profit sharing, and gain

sharing:

Piece-rate wages

a. Around for nearly a century

b. Popular as a means for compensating production workers

c. Workers are paid a fixed sum for each unit of production completed.

d. A pure piece-rate planthe employee gets no base salary and is paid only for production.

For example: Selling peanuts in ballparks works this way.

e. Modified piece-rate planemployees earn a base hourly wage plus a piece-rate

differential.

Bonuses

These can be paid exclusively to executives or to all employees. Increasingly, bonus plans are

taking on a larger net within organizations to include lower-ranking employees to reward production

and increased profits.

15

Skill-Based Pay Plans by Jamuna Bank :

Skill-based pay is an alternative to job-based pay. It is sometimes called competency-based pay or

knowledge-based pay. Competency-based pay sets pay levels on the basis of how many skills

employees have or how many jobs they can. The appeal, from managements perspective is

flexibility:

Filling staffing needs is easier when employee skills are interchangeable.

Organizations today require more generalists and fewer specialists.

It facilitates communication across the organization because people gain a better

understanding of others jobs.

It lessens dysfunctional protection of territory behavior.

Additionally, it helps meet the needs of ambitious employees who confront minimal

advancement opportunities.

It appears to lead to performance improvements.

Downside of skill-based pay:

People can top out, learning all the skills the program calls for them to learn.

Skills can become obsolete. Organizations paying for skills they no longer need.

Skill-based plans do not address level of performance.

Conflict in Jamuna Bank

A process that begins when one party perceives that another party has negatively affected, or is about

to negatively affects something that the first party cares about. It is that point in an ongoing activity

when an interaction crosses over to become an interparty conflict.

Defining Conflict

Conflicts a process in which people disagree over significant issues, thereby creating friction. For

conflict to exist, several factors must be present:

People must have opposing interests, thoughts, perceptions, and feelings

16

Those involved must recognize the existence of different points of view

The disagreement must be ongoing rather than a singular occurrence

Conflict can be a destructive force. However, it can also be beneficial when used as a Source of

renewal and creativity. Before we look at views, sources, consequences, and ways to manage conflict,

note that we often use the terms conflict and competition interchangeably, although the two differ.

Competitions the rivalry between individuals or groups over an outcome and always has a winner and

a loser. While competition can be one of the sources of conflict, conflict does not necessarily involve

winners and loser; we can have conflict over issues, but cooperate so that no one loses or wins

Source of conflicts in Jamuna Bank

17

How can conflict be managed in Bank successfully?

Indirect conflict management approaches

Reduced interdependence, Adjusting the level of interdependency among units or individuals when

workflow conflicts exist Options:-Decoupling, buffering, and linking pin roles. Lose-lose conflict:

nobody gets what he or she wants. AvoidanceEveryone simply pretends that the conflict does not

really exist and hopes that it will go away. Accommodation or smoothingInvolves playing down

differences among the conflicting parties and highlighting similarities and areas of agreement

CompromiseEach party gives up something of value, but neither partys desires are fully satisfied.

Win-Lose conflict one party achieves its desires at the expense and to the exclusion of the other

partys desires. CompetitionOne party achieves a victory through the use of force, superior skills, or

domination. Authoritative commandUse of formal authority to dictate a solution and specify who

gains what and who loses what.

Win-win solutions should:Achieve each others goals; Be acceptable to both parties; Establish a

process whereby both parties see a responsibility to be open and honest about facts and feelings.

Negotiation on Jamuna Bank

Negotiation is a process whereby two or more parties reach a mutually agreeable arrangement. It is

one of the most commonly used and beneficial skills managers can develop. The global business

environment, the diverse workforce, rapid pace of change, and shift toward teams and empowerment

all require managers to hone their negotiation skills.

The Negotiation Process

All negotiations share four common elements:32

Members involved are in some way interdependent

Members are in conflict over goals and processes

Members involved are motivated and capable of influencing one another

18

Members believe they can reach an agreement

Phases of Negotiation

Selective disclosure: Negotiators highlight positive information and downplay or fail to mention

negative information

Misrepresentation: Negotiators misstate facts or their position; for example, they misrepresent the

lowest price they are willing to accept

Deception and lying: Negotiators give the other party factually incorrect information or

information that leads to incorrect assumptions or conclusions

False threat and false promises: Negotiators provide misinformation about actions that they may

take and concessions they may be willing to make

Inflict direct or indirect harm: Negotiators intentionally sabotage the other partys chance of

success any of these violations is likely to occur in negotiations. The last two, giving false

information inflicting harms, are the most severe violations, although how a negotiator ranks the

others depends on his values and morals, and in some cases, his culture. Table 11.6 provides some

guidelines for monitoring your own ethical behavior.

Organizational Behavior

Organizational culture (strong culture, weak culture, general organizational culture;

how employees learn culture within the organization):

Small idea about their culture:

19

As preparing the term paper on organizational behavior we selected Jamuna Bank. And we conduct

a field survey in the bank with some questioner and direct communication. Now as describing their

organizational culture their answer was very mixed and tricky. Not negative and not in positive side.

But the organizational culture is sometimes very strong in the customer service sector, daily routine

work, and seriousness in the work. Also in some sector as they have mentioned that there org culture

is comparatively weak is the objection to use innovation at their work. They have to be observed.

They have a boundary and they cannot do anything beyond their boundary line. There is no scope to

make the work in own style. For this reason it can be considered as a weak part of the organizational

culture.

When surveying we noted some of their values and culture. They have some important values that

they think it is important part of their culture. These are

i. Customer focus

ii. Integrity

iii. Quality

iv. Team work

v. Harmony

vi. Fairness

vii. Courtesy

viii. Commitment

ix. Respect for the individuals

x. And most important Business ethics.

These are some values that they agree that it is part of their culture. They are strictly follower of these

values. So we discussed a brief detail of Jamuna Bank. Now we are going to describe about how

employees learn culture within the organization. Besides, the bank has innovated different services

like online banking, i banking, credit transfer etc for the welfare of the customers which can be also

said to be a part of the organizations culture.

How employees learn culture within the organization?

The employees of the Jamuna Bank learn culture through the corporate environment. Sometimes they

provide training to the employees to act and work like their own culture. For some extent the learning

of culture varies from person to person. The employee who is very eager to work they learn culture

comparatively fast than the others. in contraction one employee said that the learning of culture is

very much influenced b y the upper level managers. If the upper level managers are friendly to the

employees than it is certain that the employees will learn culture and work through culture. And if the

first line managers or officers are not so communicative or very tough in nature, it is hard to learn

culture but not impossible. Besides, the organization is very structured in corporate line. Moreover, in

20

certain situation like turnover or absenteeism the Organizations culture is to follow some certain

rules and back to back solution. And also the org conduct a performing appraisal, evaluation

semiannually or annually to monitor the performance of the individuals employees. Besides, they

perform different types of CSR activity like scholarship program for the poor students, providing help

to the natural calamity affected people which are their part of the culture and employees learn it.

Mainly the individuals take chance and cope with the environment to learn organizational culture at

their own accord or at stack. There are some activities (short points) which help them to learn

organization culture properly. They are:

To manage and operate the bank in the most efficient manner to enhance financial

performance and to control cost of fund.

To strive for customer satisfaction through quality control and delivery of timely services

To identify customers credit and other banking needs and monitor their perception through

their performance.

Reviewing the update policies procedures and practices to broad the ability to extent better

service to the customers.

To diversify portfolio both in the retail and wholesale market

Increasing direct contact with customers in order to cultivate a closer relationship between the

bank and its customers.

Now those are the culture learning activities which help the employees learning culture.

Recommendation

The following factors are recommended to this report to improve customers perception about the

advertisement of Jamuna Bank Limited. Though JBL is more popular to the customers for their better

services but they have to expand it. It is therefore imperative to get to the customers to know their

impression on the services of this important communication medium. Such as:

The Bank can get huge more popularity to the people by using different advertisement tool to

its customer.

The Bank should give more emphasize on their marketing efforts and try to increase their

sales force.

21

Conclusion

It is a great pleasure for us to have practical exposure to Jamuna Bank Limited, Dakshinkhan Branch.

At present Jamuna Bank Limited is one of the developing banks in Bangladesh. Because of its

services the bank has already achieved immense popularity top let people know about the company,

every company uses different types of promotional tools. Though personal selling is used in a wide

range but besides this JBL must have to use other tools to advertise their banks products and

services. Such Billboard is one of the most popular using promotional tools to the company. As it is

cheap and mostly seen in an open place, most of the company likes to use this tool because of its wide

repeated exposure.

END

22

Definition of terms

ADB- Asian Development Bank

DPC- Asian Disaster Preparedness Centre

ADRC -Asian Disaster Reduction Centre

AFD- Armed Forces Division

APD- Academy for Planning and Development

ASEAN - Association of South East Asian Nations

BARD- Bangladesh Academy for Rural Development

BBS -Bangladesh Bureau of Statistics

BCAS- Bangladesh Centre for Advanced Studies

BCS - Bangladesh Civil Service

BDRCS- Bangladesh Red Crescent Society

BFS&CD- Bangladesh Fire Service and Civil Defense

BGD -Bangladesh

BGS- British Geological Survey

BMD- Bangladesh Meteorological Department

BNBC- Bangladesh National Building Code

BNDV -Bangladesh National Disaster Volunteers

BPATC- Bangladesh Public Administration Training Centre

BS -Bangladesh Scouts

BUET- Bangladesh University of Engineering and Technology

BWDB- Bangladesh Water Development Board

CBO- Community Based Organization

CCC - Climate Change Cell

CCDMC- City Corporation Disaster Management Committee

23

Appendix

24

Bibliography

1.Annual Report of Jamuna Bank Limited, 2005, 2006,2007

2. Chowdhury, L.R; A Textbook on Foreign Exchange, Fair Corporation,139, Azimpur, Dhaka, 1205

3. Foreign Exchange Manual, Jamuna Bank Limited., 1

st

November,2009

4. Collyer Gary, ICC Uniform Customs And Practice For Documentary Credits ,3rdEdition,

International Chamber Of Commerce, ICC Publication No.600

5. Bangladesh Bank Foreign Exchange Guidelines, Volume-1

6. www.jamunabankbd.com

7. http://en.wikipedia.org/wiki/Management_by_objectives

8. https://www.google.com.bd/search?q=google&ie=utf-8&oe=utf-8&rls=org.mozilla:en-

US:official&client=firefox-a&channel=fflb&gws_rd=cr&ei

9. http://home.ubalt.edu/ntsbmilb/ob/ob6/sld006.htm

.X..

Вам также может понравиться

- DragonDreaming International Ebook v02.03-2Документ28 страницDragonDreaming International Ebook v02.03-2Tim LueschenОценок пока нет

- English (Step Ahead)Документ33 страницыEnglish (Step Ahead)ry4nek4100% (1)

- TOPIC 1 - Public Speaking SkillsДокумент72 страницыTOPIC 1 - Public Speaking SkillsAyan AkupОценок пока нет

- Case Study Ratio AnalysisДокумент6 страницCase Study Ratio Analysisash867240% (1)

- Garrett-Satan and The Powers (Apocalyptic Vision, Christian Reflection, Baylor University, 2010)Документ8 страницGarrett-Satan and The Powers (Apocalyptic Vision, Christian Reflection, Baylor University, 2010)Luis EchegollenОценок пока нет

- Risk Criteria - When Is Low Enough Good Enough - SaudiДокумент8 страницRisk Criteria - When Is Low Enough Good Enough - Saudiuserscribd2011Оценок пока нет

- STD-Insurance Commission TRAD REVIEWER Rev1 PDFДокумент24 страницыSTD-Insurance Commission TRAD REVIEWER Rev1 PDFJomar Carabot100% (1)

- Eyob Finance ManualДокумент46 страницEyob Finance ManualMiki DeregeОценок пока нет

- Physics Project On Circular MotionДокумент22 страницыPhysics Project On Circular Motionishan67% (3)

- TASK SHEET - Preliminary Pages of CBLMДокумент2 страницыTASK SHEET - Preliminary Pages of CBLMEdleo Maghopoy80% (5)

- How To Love The LORD With All Your Heart, Soul, and StrengthДокумент5 страницHow To Love The LORD With All Your Heart, Soul, and StrengthGodmadeMusic100% (1)

- Training Needs AssessmentДокумент4 страницыTraining Needs AssessmentbalwinderОценок пока нет

- Change Management - The Systems and Tools For Managing ChangeДокумент7 страницChange Management - The Systems and Tools For Managing ChangeMilin ShahОценок пока нет

- Contemporary Issues and Challenges in Management Practice and Theory-LibreДокумент18 страницContemporary Issues and Challenges in Management Practice and Theory-LibreSumera BokhariОценок пока нет

- An Assignment On Banking System in Bangladesh: Course Name: Money and Banking Course Code: AFC 121 Semester: 2ndДокумент12 страницAn Assignment On Banking System in Bangladesh: Course Name: Money and Banking Course Code: AFC 121 Semester: 2ndMD. IBRAHIM KHOLILULLAH50% (2)

- 1.guess Questions - Theory - Questions and AnswersДокумент44 страницы1.guess Questions - Theory - Questions and AnswersKrishnaKorada100% (14)

- Training Needs AssessmentДокумент3 страницыTraining Needs AssessmentSusanna SamuelОценок пока нет

- Strategic Management of Comet TransportДокумент25 страницStrategic Management of Comet TransportDanudear DanielОценок пока нет

- Delegation & DecentralisationДокумент4 страницыDelegation & DecentralisationKunal Maste50% (2)

- The Bukowitz and Williams KM CycleДокумент6 страницThe Bukowitz and Williams KM CycleRisqi EkoОценок пока нет

- Term Paper On Issues Related To HRMДокумент11 страницTerm Paper On Issues Related To HRMJahid HasanОценок пока нет

- Executive Summary of PTCLДокумент1 страницаExecutive Summary of PTCLAli AbbasОценок пока нет

- Human Resource Management in Bangladesh - Exim BankДокумент57 страницHuman Resource Management in Bangladesh - Exim BankShohidullah Kaiser100% (2)

- Unit 4Документ13 страницUnit 4Elaiya BharathiОценок пока нет

- Case Study No. 1 Gardeners+Документ2 страницыCase Study No. 1 Gardeners+Angelee GarciaОценок пока нет

- Human Resource Planning OutlineДокумент4 страницыHuman Resource Planning OutlineWaqas SheikhОценок пока нет

- MB0052 - Strategic Management and Business Policy - Set 2Документ10 страницMB0052 - Strategic Management and Business Policy - Set 2Abhishek JainОценок пока нет

- Accounting Information System Individual AssignmentДокумент3 страницыAccounting Information System Individual Assignmentmarlon_akay100% (1)

- Feasibility StudyДокумент17 страницFeasibility StudyKen ReyesОценок пока нет

- Principles for Designing Integrated HRD SystemsДокумент4 страницыPrinciples for Designing Integrated HRD SystemsMani KandanОценок пока нет

- The Role of Planning and Forecasting in Business OrganizationДокумент44 страницыThe Role of Planning and Forecasting in Business OrganizationAyalsew MekonnenОценок пока нет

- Paper 1 Managing ChangeДокумент7 страницPaper 1 Managing ChangeManerly Flodeilla SalvatoreОценок пока нет

- MBE Unit IДокумент36 страницMBE Unit Istandalonemba50% (2)

- Limitations of Human Resource PlanningДокумент6 страницLimitations of Human Resource PlanningSanju SharmaОценок пока нет

- Fishbone AnalysisДокумент1 страницаFishbone AnalysisnoorafifahabubakarОценок пока нет

- Lorie Savage Capital JB 1949Документ11 страницLorie Savage Capital JB 1949akumar_45291100% (1)

- Program Development: Zuhaira U. EbrahimДокумент23 страницыProgram Development: Zuhaira U. Ebrahimlang0510Оценок пока нет

- 1-1 The Importance of Business ManagementДокумент30 страниц1-1 The Importance of Business ManagementPreetaman Singh100% (1)

- Presentation On NEFT SystemДокумент9 страницPresentation On NEFT Systemswapnil chapa100% (1)

- SWOT Analysis of MIS GraduatesДокумент1 страницаSWOT Analysis of MIS GraduatesMdSumonMia100% (1)

- Chapter 1Документ26 страницChapter 1Baby KhorОценок пока нет

- Questions Related To Planning (Chapter 4)Документ14 страницQuestions Related To Planning (Chapter 4)Wilson AdrikoОценок пока нет

- What Problems Are Demographic Shifts and Layoff Practices Causing For Succession PlanningДокумент3 страницыWhat Problems Are Demographic Shifts and Layoff Practices Causing For Succession PlanningNurImam100% (2)

- Power and Politics A Revealing Case StudyДокумент9 страницPower and Politics A Revealing Case Studysrpr180% (5)

- Standard Chartered Bank ShortcutДокумент20 страницStandard Chartered Bank ShortcutRoyОценок пока нет

- The Implication of MIS in A Banking SystemДокумент9 страницThe Implication of MIS in A Banking SystemSAMUEL KIMANIОценок пока нет

- The Basic Characteristics of an Effective MISДокумент6 страницThe Basic Characteristics of an Effective MISnblroshanОценок пока нет

- 2 Change ManagementДокумент14 страниц2 Change ManagementRaymond Krishnil KumarОценок пока нет

- PPM Unit 3 Notes on Staffing, Directing, MotivationДокумент61 страницаPPM Unit 3 Notes on Staffing, Directing, MotivationDrRam Singh KambojОценок пока нет

- Colleg Factors On Assessment of Non PerfoДокумент67 страницColleg Factors On Assessment of Non Perfodaniel nugusieОценок пока нет

- Who Determines Demand Levels and CompositionДокумент2 страницыWho Determines Demand Levels and CompositionSean Chris Conson0% (1)

- St. Mary'S University School of Graduate StudiesДокумент50 страницSt. Mary'S University School of Graduate StudiesFiro FiroОценок пока нет

- BA7401 International Business ManagementДокумент166 страницBA7401 International Business ManagementSathish Kumar100% (1)

- Budgetary Control System and Inventory Management - Research Study - 150075041Документ3 страницыBudgetary Control System and Inventory Management - Research Study - 150075041aarohi bhattОценок пока нет

- Management Theory Chapter 5 & 6Документ41 страницаManagement Theory Chapter 5 & 6AddiОценок пока нет

- MBA Curriculum at Metropolitan University, SylhetДокумент176 страницMBA Curriculum at Metropolitan University, SylhetMahbub HussainОценок пока нет

- Case Study Publication Full PDFДокумент146 страницCase Study Publication Full PDFClaudio MiksicОценок пока нет

- Human Resource Management AnswersДокумент6 страницHuman Resource Management AnswerseirulzОценок пока нет

- Employee Motivation - Case Study 1Документ5 страницEmployee Motivation - Case Study 1rohitkirar100% (1)

- Orange The Juicy Hrms Part 1Документ1 страницаOrange The Juicy Hrms Part 1ayi imaduddinОценок пока нет

- Role Negotiation Yields Cooperation at Bokaro Steel PlantДокумент22 страницыRole Negotiation Yields Cooperation at Bokaro Steel PlantRaunak Kaushik0% (2)

- Final of HRMДокумент12 страницFinal of HRMMiltonmisduОценок пока нет

- Strategic Plans of Microfinance FirmДокумент23 страницыStrategic Plans of Microfinance FirmAnatol PaladeОценок пока нет

- On Job Training in Branch Banking OperationДокумент7 страницOn Job Training in Branch Banking OperationAshebirОценок пока нет

- Ch01 RETAIL MARKETING EnvironmentДокумент10 страницCh01 RETAIL MARKETING Environmenttb7976skОценок пока нет

- Authority MBAДокумент26 страницAuthority MBADhruba Jyoti GogoiОценок пока нет

- Is Fiscal Policy the Answer?: A Developing Country PerspectiveОт EverandIs Fiscal Policy the Answer?: A Developing Country PerspectiveОценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Overweight and Obesity in AmericaДокумент10 страницOverweight and Obesity in Americamzvette234Оценок пока нет

- Sap Interface PDFДокумент1 страницаSap Interface PDFAwais SafdarОценок пока нет

- Ra 6770Документ8 страницRa 6770Jamiah Obillo HulipasОценок пока нет

- TEACHING AS A NOBLE PROFESSIONДокумент6 страницTEACHING AS A NOBLE PROFESSIONShaiОценок пока нет

- MKTG10001Документ38 страницMKTG10001Jessica KokОценок пока нет

- Competitor Analysis - Taxi Service in IndiaДокумент7 страницCompetitor Analysis - Taxi Service in IndiaSachin s.p50% (2)

- SAP FICO Asset Accounting 1Документ3 страницыSAP FICO Asset Accounting 1Ananthakumar AОценок пока нет

- Swadhin Bangla Betar KendraДокумент21 страницаSwadhin Bangla Betar KendraMusfiqur Rahman ApuОценок пока нет

- Karakteristik Morfologik Kambing Spesifik Lokal Di Kabupaten Samosir Sumatera UtaraДокумент6 страницKarakteristik Morfologik Kambing Spesifik Lokal Di Kabupaten Samosir Sumatera UtaraOlivia SimanungkalitОценок пока нет

- Mathematical Language and Symbols ExplainedДокумент5 страницMathematical Language and Symbols Explainedcyra6flores6verderaОценок пока нет

- Paper 3 Vol XXXX No. 2 Dec 2010Документ11 страницPaper 3 Vol XXXX No. 2 Dec 2010Mubi BaloliyaОценок пока нет

- Organizational Behaviour PDFДокумент4 страницыOrganizational Behaviour PDFmaria0% (1)

- Understanding Culture, Society, and Politics - IntroductionДокумент55 страницUnderstanding Culture, Society, and Politics - IntroductionTeacher DennisОценок пока нет

- Edith Bonomi CV SummaryДокумент1 страницаEdith Bonomi CV SummaryEdithОценок пока нет

- Equivalent Representations, Useful Forms, Functions of Square MatricesДокумент57 страницEquivalent Representations, Useful Forms, Functions of Square MatricesWiccy IhenaОценок пока нет

- 22-Submission File-35-1-10-20190811Документ3 страницы22-Submission File-35-1-10-20190811DhevОценок пока нет

- FN MKGGMS: Experiment 2.acceleration of GravityДокумент8 страницFN MKGGMS: Experiment 2.acceleration of GravityJessica RossОценок пока нет

- AbstractДокумент23 страницыAbstractaashish21081986Оценок пока нет

- Advantage and Disadvantage Bode PlotДокумент2 страницыAdvantage and Disadvantage Bode PlotJohan Sulaiman33% (3)

- Comparison of Treadmill Based and Track Based Rockport 1 Mile Walk Test For Estimating Aerobic Capacity in Healthy Adults Ages 30-50 YearsДокумент4 страницыComparison of Treadmill Based and Track Based Rockport 1 Mile Walk Test For Estimating Aerobic Capacity in Healthy Adults Ages 30-50 Yearsmanjula dangeОценок пока нет

- Balay Dako Menu DigitalДокумент27 страницBalay Dako Menu DigitalCarlo -Оценок пока нет