Академический Документы

Профессиональный Документы

Культура Документы

Rethinking Consumer Product Distribution in Developing Countries

Загружено:

Dhruv MishraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Rethinking Consumer Product Distribution in Developing Countries

Загружено:

Dhruv MishraАвторское право:

Доступные форматы

1 Template: Paper Title Here

Rethinking Consumer

Product Distribution in

Developing Countries

The methods of getting products to market in India

and other developing countries are neither the best

nor most lucrative ways to deliver the goods. These

days, direct coverage is better than indirect.

2 Rethinking Consumer Product Distribution in Developing Countries

For consumer products companies in India, getting products to retail locations faster and more

cost efectively than competitors is key to top-line growth and competitive advantage. Yet India,

like many other developing countries, has yet to update its distribution models to keep up with

todays competitive, connected markets. The cost of distribution can run as high as 18 to 25

percent of sales (for example, on channel margins and trade management), making it the second-

largest line item after raw materials. Around the world, as soaring costs put pressure on margins,

and channel partners want better returns and faster growth, rethinking distribution could well

be the ticket to improved sales and top-line growth.

Win-Win-Win Distribution

Every partner in the retail distribution channelfrom manufacturer to distributor to retailer

has expectations about returns on investment. And while many players may hesitate to make

a change from a legacy distribution model for fear of compromising the needs of other stake-

holders, it is time to put those worries aside and develop a win-win-win distribution model.

The right model will not only work for India markets but also for other developing countries

with unorganized retail penetration.

When success depends on making

products more attractive and visible than

the competition, it's time to consider

direct retail coverage as a way to

improve top-line growth.

Developing a new retail distribution model requires taking a closer look at three dimensions:

coverage of retail outlets by channel partners (direct versus indirect), channel productivity

(more sales, lower costs), and the payout (total retail expenditures). In this paper, we focus on

the first dimension: direct versus indirect coverage.

Why Increase Direct Coverage

Distribution models have been evolving over the past several years. The last wave of change

involved consolidating with fewer, bigger, and better channel partners while simultaneously

rationalizing, using channel partners to get rid of slow-moving items. This led to less direct

coverage. As a result, today there is legitimate skepticism in the sales and distribution fraternity

about increasing direct coverage. Indian organizations are behind in terms of direct coverage

when compared to retailers around the world (see figure 1 on page 3).

Yet, today, when success depends largely on making products more visible than the compe-

tition, and using visual merchandising and point-of-sale strategies to communicate a products

value, we believe now is an opportune time to take another look at direct retail coverage as a

means to improve top-line growth. There are five reasons why:

3 Rethinking Consumer Product Distribution in Developing Countries

Urbanization. Swelling urbanization and population density in India means previously marginal

retailers are now more significant in billing size.

Emerging channels. The convergence of retail channelsdrugstores selling personal care

products and grocers selling healthcare productscreates opportunities to add meaningful

new retailers to distribution routes.

Ambitious distributors. Distributors today aspire to make at least INR 1 to 1.2 million per year

(US$16,000 to $19,000), which requires sales of INR 4 to 5 crores (US$656,000 to $820,000).

Covering more outlets makes these targets easier to achieve.

Improved range. Unlike indirect distribution where the wholesalers focus is largely on fast-

moving, high-volume lines, direct coverage of retail outlets allows for preferred, more efective

placement of new products and variants, which can be key to sales performance.

Visual merchandising. Stif competition requires bringing products to life at retail outlets and

making an emotional connection with consumers. Direct reach provides an opportunity to use

visual merchandising techniques to make these moment of truth connections and win the sale.

When to Expand Direct Coverage

One fear when expanding to direct coverage is higher service costs for distributors, but we

consistently see a substantial number of new retailers with a bill size that more than pays for

the added costs. Another common fear is the potential cannibalization of wholesaler sales,

but the improved range for selling can more than compensate for any potential dips in whole-

saler billing.

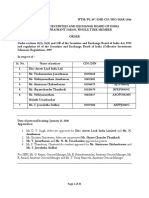

Dealers per 1oo,ooo people

Urban and rural Urban Metro Rural

Source: A.T. Kearhey ahalysis

Figure 1

Compared to best-in-olass, many food oompanies in lndia lag in terms of direot ooverage

Retail uhiverse

Best-ih-class

Average fast-novihg cohsuner goods

Laggihg fast-novihg cohsuner goods

C-

6C

C-

6C

C-

6CC

6CC-

7CC

ACC-

AC ACC-

AC

2CC-

2C

2C-

CC

6CC-

7CC

AC-

C

AC-

CC

C-

ACC

7CC-

7C

7CC-

7C

CC-

C

CC-

C

1oo% 1oo% 1oo% 1oo% 1oo% 1oo% 1oo% 1oo%

/%

So% So%

/o% /o%

o%

So%

o%

4 Rethinking Consumer Product Distribution in Developing Countries

If any of the following criteria apply to your situation, direct coverage could be a viable strategy:

Product portfolio that spans multiple categories

More than 20 percent of sales from new products

Last distribution overhaul was more than two years ago

A distribution model with a large number of small distributors

Several large shops in a beat are missed

An important diference in the emerging distribution model compared to the ones familiar

to Indian organizations is more direct coverage served by fewer and bigger distributors (see

figure 2). Keeping control of the number of distributors ensures that manufacturers distribution

costs do not increase (because of higher transportation costs) while simultaneously improving

distributors top lines to better absorb fixed costs.

Six Ways to Cover More Outlets

Expanding outlet coverage by channel partner is not a simple activity. It requires balancing the

trade-ofs between higher distribution costs and the additional gains from increased sales, and

ensuring that the new outlets are able to carry a wider range of products to compensate for

potential cannibalization of wholesaler sales. Also, during the expansion process, the sales force

and distributors must maintain business as usual even while there is a tendency to resist change.

For those who get it right, the payof can be substantial. With a comprehensive process that

generates value for all stakeholders, it is possible to increase sales anywhere from 3 to 5 percent.

We recommend a six-pronged process, what we call the 6Ps, shown in figure 3 on page 5:

Number

of channel

partners

Level of direct retail coverage

by channel partner: distributor

Figure

The new retail distribution model uses more direct coverage and fewer distributors

High

Low

High Low

Source: A.T. Kearney analysis

Past

Today

Emerging

5 Rethinking Consumer Product Distribution in Developing Countries

Build credibility with a pilot program.

Because every organization is unique,

expanding direct coverage requires

a tailored approach. Refining the new

model in two to three cities before a

wider rollout establishes proof of con-

cept and addresses unique pain points

in the early stages. A successful pilot

can convince the sales force about the

projects feasibility.

Use third-party prospectors to find new

outlets. For a typical distributor covering

a radius of 5 to 10 kilometers in urban

areas, identifying uncovered outlets is

a three- to four-week exercise. Although

this can be performed by the distributors

sales force, using third-party support for

outlet prospecting prevents disruptions

to sales schedules and gives focused,

unbiased attention to the task. Third-party

prospecting activities are best guided

by the company sales oficers who need

to ensure that the new outlets are opera-

tional (by the first bill generation) before

the sales force takes over.

Create a profile with a rule of thumb for identifying new outlets. Outlets to be added to direct

coverage should be able to order above a certain threshold (to be estimated as total category

stocked times company market share in the region). This threshold varies by industry, but we have

seen that any outlet with the potential to purchase more than INR 1500 per month and within five kilo-

meters of the distribution point can be profitably served. Outlets below this threshold are typically

unprofitable and are better served through the wholesale channel or through ready stock delivery

in kiosks, especially if there is a high density of low turnover outlets in the distributors trading area.

A focused expansion drive can help identify as much as 70 to 80 percent more retail outlets.

Partner with a distributor to serve new outlets. Identifying new outlets is only half the battle.

Getting the distributor to serve the new outlets is the other half. Regularly communicating the

benefits in terms of the impact on business turnover, profits, and return on investment is

essential to winning them over. Orchestrating several activities with the distributor will help

ensure that new outlets are added successfully. And remapping the sales and delivery beats is

essential. Remapping, ideally done jointly by the area sales manager and each distributor,

should guarantee that newly carved-out beats are economically viable. In addition to new beat

schedules, communications training for the sales force should focus on the value proposition

for new retailers. Mobilizing the distributor to scale up resources in terms of both sales force

and infrastructure (vehicles and selling resources such as handhelds) is also important. The

ideal sales and delivery beat plan minimizes the need for additional distributor investments.

Monitor performance to sustain growth. A company typically does a good job ensuring the first

bill cut at new outlets, but over time, inconsistent service levels and irregular sales visits lead to

Figure

The six Ps help companies expand

direct coverage

Source: A.T. Kearney analysis

Build

credibility

with a pilot

program

Six

strategies

for expanding

direct

coverage

Partner with

a distributor

to serve new

outlets

Use

third-party

prospectors

to ind new

outlets

Plan

centrally,

execute

locally

Create

a proile with

a rule of thumb

for developing

new outlets

Monitor

performance

to sustain

growth

6 Rethinking Consumer Product Distribution in Developing Countries

declining performance in these outlets. Regular monitoring of outlets during the gestation phase

coupled with providing retailer incentives (where applicable) can sustain new retailers in the long

run. Although the first bill gets cut within the first month of operation, reaching a steady state can

take another three to four months. During the stabilization phase, it is important to track progress

with key outlet performance metrics and to quickly address any issues.

Plan centrally, execute locally. Designing the blueprint for expanding coverage is best done

centrally. This way, a think tank can assess the market potential in each business region and

craft a suitable coverage expansion approach, implementation road map, and key metrics for

scale-up. However, on-the-ground executionincluding outlet identification and operational-

ization activitiesis best run locally under the supervision of area sales managers and company

sales oficers. A full-scale implementation across a country like India can take nine months to a

year, depending on the resources deployed. To expedite the process for quicker returns, it is

wise to deploy a full-time team.

The Ticket to Growth

In India and in other developing markets with unorganized retail markets, expanding direct

coverage can be the ticket to significant top-line growth. And it can help channel partners realize

that it is possible to improve on growth by means other than raising margins. Forward-thinking

companies that use direct coverage to keep their products visible in todays highly competitive

market will rapidly see improved sales and a solid foundation for long-term growth.

Authors

Debashish Mukherjee, partner,

New Delhi

debashish.mukherjee@atkearney.com

Subhendu Roy, principal, New Delhi

subhendu.roy@atkearney.com

Ajay Gupta, principal, Mumbai

ajay.gupta@atkearney.com

Kaushika Madhavan, partner, Mumbai

kaushik.madhavan@atkearney.com

Amit Saharia, principal, New Delhi

amit.saharia@atkearney.com

A.T. Kearney is a global team of forward-thinking partners that delivers immediate

impact and growing advantage for its clients. We are passionate problem solvers

who excel in collaborating across borders to co-create and realize elegantly simple,

practical, and sustainable results. Since 1926, we have been trusted advisors on the

most mission-critical issues to the worlds leading organizations across all major

industries and service sectors. A.T. Kearney has 57 ofices located in major business

centers across 39 countries.

Americas

Asia Pacific

Europe

Middle East

and Africa

Atlanta

Calgary

Chicago

Dallas

Detroit

Houston

Mexico City

New York

San Francisco

So Paulo

Toronto

Washington, D.C.

Bangkok

Beijing

Hong Kong

Jakarta

Kuala Lumpur

Melbourne

Mumbai

New Delhi

Seoul

Shanghai

Singapore

Sydney

Tokyo

Abu Dhabi

Dubai

Johannesburg

Manama

Riyadh

A.T. Kearney Korea LLC is a separate and

independent legal entity operating under

the A.T. Kearney name in Korea.

2013, A.T. Kearney, Inc. All rights reserved.

The signature of our namesake and founder, Andrew Thomas Kearney, on the cover of this

document represents our pledge to live the values he instilled in our firm and uphold his

commitment to ensuring essential rightness in all that we do.

For more information, permission to reprint or translate this work, and all other correspondence,

please email: insight@atkearney.com.

Amsterdam

Berlin

Brussels

Bucharest

Budapest

Copenhagen

Dsseldorf

Frankfurt

Helsinki

Istanbul

Kiev

Lisbon

Ljubljana

London

Madrid

Milan

Moscow

Munich

Oslo

Paris

Prague

Rome

Stockholm

Stuttgart

Vienna

Warsaw

Zurich

Вам также может понравиться

- Cine MexДокумент6 страницCine MexDhruv MishraОценок пока нет

- Apple SCM Group 7Документ28 страницApple SCM Group 7Dhruv MishraОценок пока нет

- KOK Lawn TennisДокумент3 страницыKOK Lawn TennisDhruv MishraОценок пока нет

- FedEx Integration of Technology SCM LatestДокумент19 страницFedEx Integration of Technology SCM LatestDhruv MishraОценок пока нет

- Kindly Find Below Our Quote For Sale of EURO/GBP Currency/Travelers Cheque/Travel CardДокумент6 страницKindly Find Below Our Quote For Sale of EURO/GBP Currency/Travelers Cheque/Travel CardDhruv MishraОценок пока нет

- Starbucks: Delivering Customer Service: Group 1 Section AДокумент11 страницStarbucks: Delivering Customer Service: Group 1 Section ADhruv MishraОценок пока нет

- Akshayam: Akshayam: The Annual Sports and Cultural Extravaganza of MDI GurgaonДокумент1 страницаAkshayam: Akshayam: The Annual Sports and Cultural Extravaganza of MDI GurgaonDhruv MishraОценок пока нет

- Case Analysis Fevikwik and The Gurgaon Market: 1 - PidiliteДокумент5 страницCase Analysis Fevikwik and The Gurgaon Market: 1 - PidiliteDhruv MishraОценок пока нет

- Sales, Marketing & Loyalty Program For Wholesalers/DistributorsДокумент2 страницыSales, Marketing & Loyalty Program For Wholesalers/DistributorsDhruv MishraОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- TCS Placement Paper On 12th Feb 2010Документ13 страницTCS Placement Paper On 12th Feb 2010Jannathul Firdous MohamedОценок пока нет

- ICE # 4 - WebДокумент12 страницICE # 4 - WebLauren KlaassenОценок пока нет

- Final Test HP0 PDFДокумент22 страницыFinal Test HP0 PDFMỹ DuyênОценок пока нет

- Mercury Athletic (Student Templates) FinalДокумент6 страницMercury Athletic (Student Templates) FinalGarland GayОценок пока нет

- Holthausen&WattsДокумент73 страницыHolthausen&WattsMariska PramitasariОценок пока нет

- Order in The Matter of Disc Assets Lead India LTDДокумент25 страницOrder in The Matter of Disc Assets Lead India LTDShyam SunderОценок пока нет

- Phoenix Light SF Limited Vs Morgan StanleyДокумент311 страницPhoenix Light SF Limited Vs Morgan StanleyRazmik BoghossianОценок пока нет

- Swap PDF!!!!!Документ24 страницыSwap PDF!!!!!Dylan LeeОценок пока нет

- Econ CH 14Документ12 страницEcon CH 14BradОценок пока нет

- Chuong 2 Forward and Futures 2013 SДокумент120 страницChuong 2 Forward and Futures 2013 Samericus_smile7474100% (1)

- English 4 IT. Praktyczny Kurs Języka Angielskiego Dla Specjalistów IT I Nie Tylko PDFДокумент283 страницыEnglish 4 IT. Praktyczny Kurs Języka Angielskiego Dla Specjalistów IT I Nie Tylko PDFFranciszek Franko100% (4)

- Pagalguy ValuationДокумент17 страницPagalguy ValuationAnkit NataniОценок пока нет

- KPMG Disruptive Tech 2017 Part1 2Документ40 страницKPMG Disruptive Tech 2017 Part1 2CrowdfundInsider100% (7)

- Pidilite IndustriesДокумент7 страницPidilite IndustriesmuralyyОценок пока нет

- (Marat Terterov) Ukraine Since The Orange RevolutiДокумент55 страниц(Marat Terterov) Ukraine Since The Orange Revoluti13SNicholasОценок пока нет

- Form of Convertible Securities Purchase AgreementДокумент10 страницForm of Convertible Securities Purchase AgreementYoichiro Taku100% (3)

- The Drivers of Corporate Water Disclosure in Enhancing Information TransparencyДокумент14 страницThe Drivers of Corporate Water Disclosure in Enhancing Information TransparencyDesa PonggokОценок пока нет

- Market X Ls FunctionsДокумент73 страницыMarket X Ls FunctionsNaresh KumarОценок пока нет

- Maskeliya Plantations PLC and Kahawatta Plantations PLC (1199)Документ22 страницыMaskeliya Plantations PLC and Kahawatta Plantations PLC (1199)Bajalock VirusОценок пока нет

- Course Outline: Prepared By: MD. EDRICH MOLLA JEWELДокумент2 страницыCourse Outline: Prepared By: MD. EDRICH MOLLA JEWELAlaminTanverОценок пока нет

- Curret Ratio Acid Test RatioДокумент7 страницCurret Ratio Acid Test RatioNIKHIL MATHEWОценок пока нет

- Budgetary Planning and ControlДокумент67 страницBudgetary Planning and ControlJade Ballado-TanОценок пока нет

- Financial Publication MarchДокумент2 страницыFinancial Publication MarchFuaad DodooОценок пока нет

- Financially Yours: Session-IIДокумент36 страницFinancially Yours: Session-IIRaviSinghОценок пока нет

- A Short Lesson On R and R-MultipleДокумент13 страницA Short Lesson On R and R-MultipleAbhiroopGupta100% (2)

- Journal of Corporate Finance: Naoya Mori, Naoshi IkedaДокумент10 страницJournal of Corporate Finance: Naoya Mori, Naoshi IkedaZahra BatoolОценок пока нет

- Yankee Candle Brand AuditДокумент7 страницYankee Candle Brand AuditLaurenHouseОценок пока нет

- Introduction of The in Duplum Rule in KenyaДокумент15 страницIntroduction of The in Duplum Rule in KenyaMacduff RonnieОценок пока нет

- Business LawДокумент23 страницыBusiness LawSimran SinhaОценок пока нет

- Ci - Cni/ Nci-Cni Cni/Group NiДокумент2 страницыCi - Cni/ Nci-Cni Cni/Group NiMark CalapatanОценок пока нет