Академический Документы

Профессиональный Документы

Культура Документы

Petronas Group Results FY2009-New

Загружено:

goldenscreen0 оценок0% нашли этот документ полезным (0 голосов)

363 просмотров14 страницPetronas Group Results For The Financial Year Ended 31 March 2009 showing Petronas financial statements and liabilities. Includes wording that clearly indicates that oil royalty was paid to Terengganu, contrary to what Prime Minister Najib Tun Razak said in Parliament when denying Kelantan oil royalty rights but instead classified as "wang ehsan".

Авторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документPetronas Group Results For The Financial Year Ended 31 March 2009 showing Petronas financial statements and liabilities. Includes wording that clearly indicates that oil royalty was paid to Terengganu, contrary to what Prime Minister Najib Tun Razak said in Parliament when denying Kelantan oil royalty rights but instead classified as "wang ehsan".

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

363 просмотров14 страницPetronas Group Results FY2009-New

Загружено:

goldenscreenPetronas Group Results For The Financial Year Ended 31 March 2009 showing Petronas financial statements and liabilities. Includes wording that clearly indicates that oil royalty was paid to Terengganu, contrary to what Prime Minister Najib Tun Razak said in Parliament when denying Kelantan oil royalty rights but instead classified as "wang ehsan".

Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 14

PETRONAS GROUP RESULTS FOR THE

FINANCIAL YEAR ENDED 31 MARCH 2009

FINANCIAL YEAR ENDED 31 MARCH

2009 +/- 2008 2007

(Restated) (Restated)

(in RM billion)

Revenue 264.2 18.4% 223.1 184.1

Profit Before Taxation 89.1 (6.7%) 95.5 76.3

EBITDA 105.5 (4.0%) 109.9 88.7

Net Profit 52.5 (13.9%) 61.0 46.4

Total Assets 388.1 14.4% 339.3 294.6

Shareholder's Funds 232.1 15.1% 201.7 171.7

(in USD billion)

Revenue 77.0 16.3% 66.2 51.0

Profit Before Taxation 26.0 (8.5%) 28.4 21.1

EBITDA 30.8 (5.5%) 32.6 24.5

Net Profit 15.3 (15.5%) 18.1 12.9

Total Assets 106.1 0.1% 106.0 85.2

Shareholder's Funds 63.5 0.8% 63.0 49.7

Average RMIUS$ exchange rate 3.4318 3.3690 3.6100 KEY FINANCIAL AND OPERATIONAL RATIOS

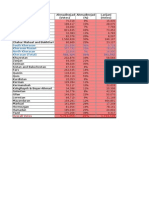

FINANCIAL YEAR ENDED 31 MARCH

2009 2008

Return on Revenue (PBT/Revenue) 33.7% 42.8%

Return on Assets (PBT/Total Assets) 23.0% 28.1%

Return on Average Capital Employed 37.1% 45.4%

Debt / Assets Ratio 0.11x 0.11x

Reserves Replacement Ratio

- Domestic 1.1x 0.9x

- International 4.1x 0.6x

- Total 1.8x 0.9x OVERVIEW

The financial year ended 31 March 2009 was a difficult and highly challenging year for the PETRONAS Group, as the global oil and gas industry was thrust into an environment of heightened volatility and uncertainty amidst the worst global economic crisis in more than 70 years.

The sharp and rapid contraction in global economic activity has led to an unprecedented erosion in global demand for oil, which eased from 86.2 million barrels per day in the previous year to 85.6 million barrels per day in the first half of the year before sliding further to 84.4 million barrels per day in the second half along with deteriorating economic conditions. Year-on-year, the world saw oil demand fell by over 1.2 million barrels per day to average 85.0 million barrels per day, the largest annual decline in nearly three decades. The destruction in demand led to a significant supply overhang, a reversal from the tight supply conditions in the previous year, despite successive production cuts by OPEC members.

These developments, aggravated by volatile market sentiments amidst intense speculative activity, swung crude oil prices to extremes, which reached record highs in the first half of the year before tumbling as the global economic crisis unfolded. The average price of West Texas Intermediate (WTI) and Brent crude oils increased by 47.1 % and 43.5% during the first half of the year to USD120.94 per barrel and USD118.14 per barrel respectively, before falling 57.9% and 57.8% to USD50.89 per barrel and USD49.81 per barrel respectively in the latter half of the year. The weighted average price of Malaysian Crude Oil (MCO) also moved in tandem, initially up 44.5% to USD125.45 per barrel before declining 59.6% to USD50.69 per barrel.

The fall in global oil demand and prices, however, has not been mirrored by a similar reduction in costs, which tend to lag prices. For example, despite an almost 60% decline in WTI crude price, the daily charter rates of drilling rigs (a significant component of upstream costs) moved up by 6.2% during the same period, while the average price of tubular steel strengthened by 11.0%. The combination of low prices and high costs that persisted during the second half of the year forced industry players to scale back investments, reduce manpower and cut costs to defend eroding margins.

In summary, the year in review was an exceedingly challenging one with weak market fundamentals, unprecedented price volatility and persistently-high costs testing the resilience of industry players across the board.

Despite the adverse business and economic environment, PETRONAS was able to mitigate the impact to its financial performance and operations largely due to its strategy to integrate, add value and globalise its operations which has successfully enhanced the Group's competitiveness, resilience and operational efficiency.

REVIEW OF FINANCIAL RESULTS

Highlights

• Strong revenue of RM264.2 billion, an 18.4% increase from RM223.1 billion recorded in the previous year, driven by higher sales volume and prices.

• Revenue from international operations surpassed the RM100 billion mark to RM111.3 billion and continues to be the biggest contributor to the Group's revenue.

Page 2

• Profit before taxation recorded a decline of 6.7% to RM89.1 billion due to the lowprice and high-cost environment that persisted during the second half of the financial year, but well within the decline recorded by the oil and gas majors which ranged between 6.4% and 25.7%, during the same period.

• Stronger balance sheet with total assets increasing by 14.4% to RM388.1 billion while shareholder's funds grew by 15.1 % to RM232.1 billion.

• Return on Total Assets and Return on Average Capital Employed stood at 23.0% and 37.1 % respectively, at par with the more established players in the industry.

• Export revenue represents about 16% of Malaysia's total exports.

The review period saw PETRONAS recording another year of robust performance with strong revenue of RM264.2 billion, an increase of 18.4%, primarily due to higher sales volume and prices in the first half of the year. However, similar to other oil and gas companies, PETRONAS' profitability was adversely affected by the low-price and high-cost environment which persisted during second half of the financial year. The Group's profit before taxation declined by 6.7% from RM95.5 billion to RM89.1 billion, but well within the decline recorded by the oil and gas majors which ranged between 6.4% and 25.7%. Nonetheless, PETRONAS' return on revenue remained amongst the highest in the industry at 33.7% compared to the average return on revenue of 17.7% recorded by other oil and gas companies globally.

Despite the lower profit, PETRONAS continued to make higher payments to governments. During the financial year, PETRONAS Group paid RM74.0 billion to governments, bringing the Group's total payments to governments to RM471.3 billion since its incorporation in 1974. Of the RM74.0 billion payment for the year, RM67.8 billion was paid to the Federal Government comprising RM30.0 billion of dividend, RM20.3 billion of petroleum income tax, RM9.1 billion of corporate income tax, RM2.2 billion of export duties and RM6.2 billion of royalty payment. Another RM6.2 billion was paid in royalty payments to the state governments of Terengganu (RM3.0 billion), Sarawak (RM2.3 billion) and Sabah (RMO.9 billion).

The RM74.0 billion total payment to governments for the year represents 71.4% of the PETRONAS Group profit before taxation, royalty and export duty, with the Group retaining only 21.1 % of its profits during the year for reinvestment and the balance 7.5% accounting for foreign taxes and minority interests. The reinvestment is necessary to ensure the Group's sustainable operations and growth in order to be able to continue to generate value for its stakeholders. PETRONAS' reinvestment during the year was significantly lower compared to other oil and gas companies: oil and gas majors reinvested an average of 57.1 % of profits while national oil companies reinvested an average of 72.9% of profits.

The Group continued to supply gas to the domestic power and non-power sectors at regulated rates. Despite revisions to the rates during the year, PETRONAS bore a subsidy of RM19.5 billion for the supply of gas to these sectors, marginally lower from the previous year's subsidy and bringing the cumulative gas subsidy to RM97.4 billion since regulated gas prices came into effect in May 1997. The subsidy to the power sector was reduced by 8% from RM13.8 billion to RM12.7 billion mainly due to lower gas offtake by the Independent Power Producers. However, gas subsidy to the non-power sector which includes small industrial, commercial, residential users and NGV, increased by 15.3% to RM6.8 billion.

Despite the volatility of the oil and gas industry, PETRONAS continued to invest to ensure sustainability and future growth of the operation. During the financial year, the Group increased its capital expenditure from RM37.6 billion to RM44.0 billion, an increase of 17%.

Page 3

Of this, RM26.2 billion was spent in Malaysia, representing about 60% of the Group's total capital expenditure. The Group incurred higher capital expenditure of RM33.8 billion in the Exploration and Production (E&P) sector, an increase of 63.3%, largely due to the acquisition of upstream assets of the Gladstone LNG project in Australia.

The Group's balance sheet continued to strengthen with total assets growing by 14.4% to RM388.1 billion while shareholder's funds grew by 15.1 % to RM232.1 billion. Return on Total Assets remained strong at 23.0% while Return on Average Capital Employed stood at 37.1 %, at par with the more established players in the industry, who averaged 19.1 % and 39.0% respectively.

The higher revenue of RM264.2 billion recorded during the year was driven not only by higher sales volume and prices but also improved operational efficiency and reliability achieved across the Group's businesses.

• Refined petroleum products remained the top revenue generator for the Group, with sales revenue amounting to RM91.7 billion and constituting about one-third of Group revenue. This represents a 19.2% increase from the previous year's revenue of RM76.9 billion. Sales volume grew by about 7% from 231.1 million barrels to 246.6 million barrels, mainly contributed by strong performance of trading activities by the Group.

• Revenue from sales of crude oil and condensates rose to RM64.4 billion as compared to RM59.0 billion in the previous year due to an increase in sales volume by 12% from 200.9 million barrels to 225.0 million barrels.

• Liquefied natural gas (LNG) sales contributed RM48.5 billion to the Group's revenue, higher by 38.2% as compared to the previous year. LNG sales volume was steady at 25.0 million tonnes but the Group benefited from higher LNG prices realised which rose from USD415.07 per tonne to USD564.37 per tonne, an increase of about 36%.

• Despite the volatility of petrochemical industry, the Group was able to maintain the production and sales of petrochemical products at 5.8 million tonnes, which translated to sales revenue of RM13.1 billion.

SALES VOLUME AT A GLANCE

2009 2008 2007 2006 2005

Crude Oil (million barrels) 225.0 200.9 192.4 184.9 207.1

Processed Gas (trillion btu) 703.9 724.3 720.8 690.6 622.0

LNG (million tonnes) 25.0 25.1 24.1 23.6 22.4

Petroleum Products (million barrels) 246.6 231.1 215.9 208.8 218.5

LPG (million tonnes) 3.9 3.9 3.2 3.2 2.6

Petrochemicals (million tonnes) 5.8 5.8 6.4 7.0 6.4 The Group remained focused on value adding activities to enhance the value of the nation's oil and gas resources. Revenue from the Group's manufacturing activities rose from RM120.5 billion to RM142.0 billion, an increase of about 18%. Through manufacturing activities, PETRONAS was able to add RM86.0 billion in value to the oil and gas resources, about 33% higher than the revenue that would be generated should PETRONAS have sold the crude oil and gas in their raw forms.

The Group continued to reap the benefits of its globalisation strategy. Revenue from international operations surpassed the RM100 billion mark to RM111.3 billion, an increase of

Page 4

23.7% from the previous year. International operations revenue represents 42.1 % of the Group's revenue and continues to be the biggest revenue contributor, reinforcing its importance to the Group.

Export revenue increased from RM86.8 billion to RM98.2 billion and represents about 16% of Malaysia's total exports over the same period, earning valuable foreign exchange revenue for the nation.

Revenue from the domestic market increased from RM46.3 billion to RM54.7 billion and represents only 20.7% of Group revenue.

REVIEW OF BUSINESS

EXPLORATION & PRODUCTION BUSINESS

Highlights

• Strong total reserves at 27.02 billion barrels of oil equivalent (boe). International reserves account for 25.3% of the Group's total reserves

• Reserves Replacement Ratio (RRR) of 1.8 times for the Group, with an RRR of 1.1 times in Malaysia and 4.1 times internationally, amongst the highest in the industry

• Total production of 1.80 million boe per day. International production rose to 629.0 thousand boe per day, equivalent to 35.0% of the Group's total production

• Acquisition of stake in Gladstone LNG project marked the Group's maiden venture in unconventional hydrocarbons

• Discovery of gas reserves from Malaysia's first High Pressure High Temperature (HPHT) well, paving the way for more exploration of the nation's deeper reservoirs

• Awarded six new Production Sharing Contracts (PSCs) in Malaysia

• Secured six new PSCs abroad, bringing the number of international upstream ventures to 66 in 22 countries

MALAYSIA'S RESERVES AND PRODUCTION AT A GLANCE

----------'

Reserves (billion boe) As at 1 January

Crude oil and condensates Natural Gas

2009 2008

20.18 20.13

5.52 5.46

14.66 14.67

FY 2009 FY 2008

1,659.0 1,673.5

678.8 691.6

980.2 981.9

1.1x 0.9x

Page 5 Production

('000 boe ~er day)

Crude oil and condensates Natural Gas

Reserves Replacement Ratio

Domestic Exploration & Production

As at 1 January 2009, Malaysia's total hydrocarbon reserves rose to 20.18 billion barrels of oil equivalent (boe) from 20.13 billion boe last year as a result of ongoing exploration efforts and field growth activities. Crude oil and condensates reserves grew by 1.1 % to 5.52 billion boe but natural gas reserves declined marginally by 0.1 % to 14.66 billion boe from 14.67 billion boe. The reserves replacement ratio (RRR) for the year was 1.1 times, as more reserves were added to the nation's resource base than were produced during the year.

Malaysia's total average production recorded a marginal decline of 0.9% to 1.66 million boe per day from 1.67 million boe per day previously, due to the maturity of our domestic fields, after years of steady and continuous production. Of this, production of crude oil and condensates amounted to an average of 678.8 thousand barrels per day while gas production averaged at 5.9 billion cubic feet per day (equivalent to 980.2 thousand boe per day). PETRONAS Group's entitlement inclusive of PETRONAS Carigali's production accounted for 1.17 million boe per day or 70.4% of total average national production, a slight increase from the previous year's share of 69.2%.

Malaysia's E&P sector remained vibrant despite the challenging environment characterised by a multitude of above and below-ground risks, including maturing hydrocarbon acreages, increasing geological complexity of remaining reserves, the sharp fall in crude oil prices and the continuing tightness in the supply of materials, equipment and experienced human capital.

Six new production sharing contracts (PSCs) were awarded during the year, namely for Block PM308A, Block PM308B, Block PM303 & 324, Block PM329, Block SK31 0 and Block SB303, bringing the total number of PSCs in operation to 71.

A key breakthrough was also achieved in Malaysia's upstream sector by PETRONAS Carigali with the discovery of gas reserves from the nation's first High Pressure High Temperature (HPHT) well in the Kinabalu field offshore Sabah. The discovery - at a total vertical depth of 4,800 metres, the deepest reservoir with proven hydrocarbons in Malaysia - is expected to open up new exploration prospectivity for deeper reservoirs in Malaysia, and serves to highlight the significant technical challenges faced by the industry moving forward.

Seven new oil fields and nine gas fields were also brought onstream during the year, increasing the total number of producing fields in Malaysia to 104 (68 oil and 36 gas fields).

A total of RM22.31 billion was spent in Malaysia's upstream sector during the year, about 3.6% higher than the previous year's expenditure of RM21.54 billion. Of this, RM12.01 billion or 53.8% was spent on development and production projects, RM2.54 billion or 11.4% was spent on exploration activities, and the balance on operations.

Page 6

INTERNATIONAL RESERVES AND PRODUCTION AT A GLANCE

2009 2008

Reserves (billion boe) 6.84 6.24

As at 1 January

Crude oil and condensates 2.20 2.42

Natural Gas 4.28 3.82

Coal Seam Gas 0.36

FY 2009 FY 2008

Production 629.0 615.1

('000 boe ~er day}

Crude oil and condensates 275.9 287.0

Natural Gas 353.1 328.1

Reserves Replacement Ratio 4.1x 0.6x

International Exploration & Production The Group's international E&P business delivered an excellent performance during the year despite the challenges in the global operating environment. The Group's international reserves stood at 6.84 billion boe, an increase of 9.6% from 6.24 billion boe last year. Crude oil and condensates reserves were lower by 9.1 % from 2.42 billion boe to 2.20 billion boe previously, largely due to downward revisions in condensate reserves. Natural gas reserves, however, rose by 12.0% from 3.82 billion boe to 4.28 billion boe due to a number of significant gas discoveries during the year, particularly in Turkmenistan and Mozambique.

The acquisition of a 40% equity stake in the Gladstone LNG project during the year marked the Group's maiden venture into unconventional hydrocarbons, with coal seam gas (CSG) equity reserves of 0.36 billion boe. With the inclusion of the CSG reserves during the year, the Group's international E&P operations achieved an exceptional RRR of 4.1 times, compared to 0.6 times in the previous year.

The Group's total average international production increased by 2.3% to 629.0 thousand boe per day due to higher gas production from the Group's operations in the Malaysia-Thailand Joint Development Area and Egypt. Crude oil and condensates production, however, declined from an average of 287.0 thousand boe per day to 275.9, mainly due to a fall in production from Block 1, 2 and 4 in Sudan.

Six (6) new international PSCs were secured by the Group during the year, namely the Surumana, Mandar and SE Palung Aru blocks in Indonesia; Block 3 & 6 and Block 16/19 in Mozambique; and the Urga Fields Production Sharing Agreement (PSA) in Uzbekistan. The new PSCs brought the Group's total international E&P ventures to 66 in 22 countries. Of this, PETRONAS is the operator for 28 ventures, joint operator for 14 and active partner in the other 24 ventures.

Four (4) of the Group's international upstream projects commenced production during the year, namely the Haraz, Canar and Suttaib development and the Kaikang development in Block 1, 2 & 4 in Sudan; the Gumry development in Block 3 & 7, also in Sudan; and in Block 46/02 (Song Doc) in Vietnam.

A total of RM13.90 billion was invested in international E&P ventures during the year, of which 57.3% was for new exploration, development and production, while the remaining 42.7% was for the operation of existing producing assets.

Overall, the Group's total reserves stood at 27.02 billion boe, compared to 26.37 billion boe in the previous year. International reserves grew from 23.7% to 25.3% of the Group's total reserves, reflecting the growing importance of international ventures to the Group's upstream

Page 7

portfolio. The Group's total average production also recorded an increase of 1.3% from 1.77 million boe per day to 1.80 million boe per day, with production from international operations remaining steady at 35.0% of combined production.

OIL BUSINESS

Highlights

• Expansion in the Group's crude oil marketing portfolio with the debut of Foreign Equity Crude Oil (FEC) Song Doc from Vietnam

• The capacity utilisation of the Group's domestic refineries improved to 97.3% while reliability was at 98.2%, resulting in higher throughput

• Strengthened retail market presence in Africa through acquisitions of competitors' operations in Lesotho, Gabon, Rwanda, Guinea Bissau and Burundi

• Higher crude and petroleum products trading of 47%, driven by expansion in trading portfolio in both crude oil and petroleum products

• Commissioned the first base oil plant in Malaysia, the Group III Base Oil (MG3) plant which produces ETRO - one of the world's highest quality Group III base oils

OIL BUSINESS AT A GLANCE

FY 2009

(in million barrels}

FY 2008

(in million barrels)

Marketing

Export of Malaysian Crude Oil (MCO) Exports of Petroleum Products

Sale of Foreign Equity Crude Oil (FEC) Crude Oil Refining

Processing of MCO

Processing of non-MCO

Petroleum Products Retail

Domestic (including commercial) International

Trading

Crude Oil

Petroleum Products

76.4 61.0 51.8

94.6 62.2 49.9

105.4 53.0

94.3 56.6

78.8 61.3

84.2 70.8

96.8 75.2

56.4 60.5

Crude Oil & Petroleum Products Marketing

PETRONAS exported 76.4 million barrels of its share of MCO (including condensates) during the year, lower by 19.2% due to lower production. Of this, 77% was exported to the Asian region with the balance sold to markets in Australia, New Zealand and the USA. The Group's exports of petroleum products were also lower by 1.9% at 61.0 million barrels, primarily due to lower liquefied petroleum gas (LPG) sales.

The Group's sales of Foreign Equity Crude Oil (FEC) increased by 3.8% to 51.8 million barrels mainly due to higher crude oil entitlement from the Group's Mauritania operations. The year also saw the introduction of a new crude from the Group's international E&P venture in Vietnam, the Song Doc crude oil.

Page 8

Crude Oil Refining

The Group's domestic refineries continue to playa strategic role in adding further value to the nation's petroleum resources. During the year, the Group's domestic refineries collectively delivered a higher throughput of 126.8 million barrels compared to 115.8 million barrels previously. Continuous Operational Performance Improvement (OPI) initiatives increased the domestic refineries' utilisation rates to 97.3%, while maintaining plant reliability at 98.2%.

The refineries' strong emphasis on HSE also continued to be recognised. During the year, all three domestic refineries won the Gold (Class 1) Award from the Malaysian Society of Occupational Safety and Health (MSOH).

The Group's refinery in Durban, South Africa, owned and operated by subsidiary Engen Ltd (Engen), recorded a 17.3% decline in production due to planned turnaround and inspection and unplanned shutdown as a result of fire. Consequently, the Group's combined utilisation rate of all its refineries fell from 91.6% to 86.2%.

The Group III Base Oil (MG3) plant in the Melaka Refinery was successfully commissioned in October 2008 with base oil production of 6,500 bpd. MG3 plant is the first base oil plant in Malaysia which produces one of the highest quality Group III base oils for top-tier automotive and industrial lubricant manufacturers in domestic and international markets.

Petroleum Products Retail

The Group's domestic retail arm, PETRONAS Dagangan Bhd (PDB), registered a lower sales volume of 78.8 million barrels of petroleum products compared to 84.2 million barrels in the previous year. Amidst the difficult operating environment, PDB maintained its leadership position to secure an estimated 42.5% share of the market compared to 44.1 % previously. PDB added 20 new stations during the year, bringing the number of total stations in its retail network to 912.

Total sales volume from the Group's international retail operations decreased from 70.8 million barrels to 61.3 million barrels as a result of the significant price increases experienced at the beginning of the year coupled with the economic downturn which impacted sales volume in general.

In South Africa, Engen maintained its market dominance despite aggressive competition from other players. Engen acquired 100% of Shell Oil Lesotho during the year to strengthen its position in sub-Saharan Africa. The year also saw the completion of Engen's acquisitions in Gabon, Rwanda, Guinea Bissau and Burundi, bringing the total number of Engen's stations to 1,4 73 across the African continent.

In Sudan, the Group expanded its retail network from 67 to 74 stations, with a market share of about 14%.

The Group's retail operation in Indonesia expanded its network to 19 stations, while in the Philippines, the autogas station network has been expanded from 52 to 54 stations.

Crude Oil & Petroleum Products Trading

The Group continued to be active in crude oil and petroleum products trading to optimise its position in the market and to enhance its value-adding capability. During the year, the total volume of crude oil traded by the Group increased by 71.6% from 56.4 million barrels to 96.8 million barrels, while petroleum products trading increased by 24.3% from 60.5 million barrels to 75.2 million barrels.

Page 9

The Group's crude oil trading portfolio was significantly strengthened with higher trade volumes of Asia Pacific, Persian Gulf/Red Sea, West Africa and Mediterranean/Caspian crude grades.

In petroleum products trading, the Group registered higher volume from increased trading activities for naphtha, gasoline and LPG. The Group also entered new markets for naphtha, jet fuel and gasoil trading in Europe and the US West Coast.

GAS BUSINESS

Highlights

• The volume of natural gas sold domestically increased marginally to 2,563 million standard cubic feet per day (mmscfd)

• Gas pipeline network achieved a reliability rate of 99.99%, exceeding the world class standard of 99.90%

• LNG sales volume of 25.0 million tonnes, with 22.3 million tonnes from PETRONAS LNG complex, 1.8 million tonnes from Egyptian LNG (ELNG) and 0.9 million tonnes from trading activities

• Acquired 40% of Santos Ltd's interest in the integrated LNG project in Gladstone, Australia, marking PETRONAS' first investment in coal seam gas (CSG) assets

GAS BUSINESS AT A GLANCE

FY 2009 2,563 2,146 25.0 22.3 1.8

0.9

FY 2008 2,560 2,170 25.1 22.5

1.6 1.0

Total Average Sales Gas Volume (mmscfd) Average Sales Gas through PGU (mmscfd) LNG Sales Volume (million tonnes)

Malaysia LNG (MLNG) Egyptian LNG (ELNG)

ASEAN LNG Trading Company Ltd (ALTCO)

Gas Processing & Transmission

During the review period, the average volume of gas sold by the Group in Malaysia increased slightly from 2,560 mmscfd to 2,563 mmscfd. Of that, an average of 2,146 mmscfd was sold through the Peninsular Gas Utilisation (PGU) system, a decrease of 1.1 % from last year's average volume of 2,170 mmscfd.

The Group had to increase gas imports from 21.9% to 23.8% into the PGU system during the year to meet demand and to make up for the lower supply from the fields offshore Terengganu. The gas imports were sourced from Indonesia, MT JDA and PM3 Commercial Arrangement Area (CAA) between Malaysia and Vietnam.

The power sector remained the largest consumer of gas, taking up about 60% of the total volume, with the Independent Power Producers (IPPs) consuming 57.6% of the gas supplied to the sector. The non-power sector, comprising industrial, petrochemical and other users, consumed an average of 732 mmscfd or 34.1 % of the total volume, an increase of 4.1 % compared to the previous year, while the balance was exported to Singapore.

Page 10

The Group's gas processing and transmission arm, PETRONAS Gas Berhad (PGB) sustained world class operations standards for its Gas Processing Plants and pipeline network with reliability rates of 99.5% and 99.99% respectively.

Liquefied Natural Gas

The Group's total LNG production for the year declined marginally to 25.0 million tonnes as a result of slightly lower production from the PETRONAS LNG Complex in Bintulu, which decreased from 22.5 million tonnes to 22.3 million tonnes due to an increase in unplanned downtime.

About 60% of production from Bintulu amounting to 13.4 million tonnes was exported to Japan, 27.4% or 6.1 million tonnes was sold to South Korea, 11.7% or 2.6 million tonnes to Taiwan, and the balance to China and India, mostly under long-term contracts. The Group's market shares in Japan, South Korea and Taiwan declined to 19%, 22% and 30% respectively.

The Group's LNG trading arm, ASEAN LNG Trading Company Ltd (AL TCO), sold a total of 14 LNG cargoes (equivalent to 0.9 million tonnes) from Egypt, Oman, Belgium and Trinidad & Tobago during the year.

The Group successfully maintained its LNG plant reliability at a high level of 96.1 %, and ensured a strong track record of deliveries to customers.

The de-bottlenecking of the MLNG Dua plant to increase the capacity by 1.2 million tonnes per annum (mtpa) is progressing well. Upon completion in Quarter 2 of the next year, the combined capacity of PETRONAS LNG Complex will increase to 24.2 mtpa.

Other Downstream Gas Ventures

In May 2008, PETRONAS acquired 40% of Santos Ltd.'s interest in the integrated CSG project in Gladstone, Australia. The acquisition marks PETRONAS' maiden investment in CSG assets, paving its entry into the Australian CSG gas industry and strengthening its position as a global LNG player.

PETROCHEMICAL BUSINESS

Highlights

• The Group's production of petrochemical products declined marginally to 9.2 million tonnes from 9.3 million tonnes

• Petrochemical plants continued to operate at a high reliability rate of 94.9%

• Successful commissioning of Mega Methanol Plant in Labuan with the production of its first commercial methanol in January 2009

Page 11

PETROCHEMICAL BUSINESS AT A GLANCE

FY 2009

FY 2008

Production Volume (million tonnes) Total

Subsidiaries

Associates

Sales Volume (million tonnes) Total

Marketing

Trading of third-party volumes

9.2 6.9 2.3

9.3 6.9 2.4

5.7 5.0 0.7

5.8 5.0 0.8

Overall plant reliability rate

94.9%

95.2%

Production of petrochemical products decreased slightly from 9.3 million tonnes to 9.2 million tonnes while the overall plant reliability rate remained high at 94.9% despite downtime associated with the unfavourable economic conditions faced by the petrochemical industry.

Sales volume recorded a marginal decline from 5.8 million tonnes to 5.7 million tonnes due to lower trading volume.

The Mega Methanol Project in Labuan was commissioned during the year with production of its first US Federal Spec Grade AA commercial methanol commencing in January 2009. The plant, with a production capacity of 1.7 million tonnes per year, is set to strengthen the Group's position as a major methanol supplier in Asia, increasing total production capacity from 2,000 tonnes per day to 7,000 tonnes per day.

LOGISTICS AND MARITIME BUSINESS

Highlights

• Strengthened position as the largest owner/operator of LNG carriers through delivery of three new LNG tankers - Seri Bijaksana, Seri Balhaf and Seri Balqis

• Maintained strong vessel utilisation of 97.2% during the year, despite a weakening in slot utilisation in the Liner Business

• Took delivery of three offshore facilities - one Floating Production, Storage and Offloading (FPSO) unit, FPSO Espirito Santo, and two Floating Storage and Offloading (FSO) units, FSO Puteri Dulang and FSO Orkid

LOGISTICS AND MARITIME BUSINESS AT A GLANCE

Fleet Numbers by Business

FY 2009 29

45

17

9

19

119

FY 2008 26

45

17

6

19

113

LNG Petroleum Chemical FPSO/FSO Liner

Total

Page 12

The Group's Logistics and Maritime Business, led by subsidiary MISC Berhad, delivered a solid performance amidst the difficult global environment characterised by declining trade volumes, softening freight rates and higher operating cost.

During the year under review, MISC took delivery of three new LNG carriers - Seri Hjaksana, Seri Balhaf and Seri Balqis - bringing its LNG fleet size to 29 and shipping capacity to more than two (2) million deadweight tonnes, further strengthening its position as the world's single largest owner-operator of LNG carriers.

Despite the challenging environment, the Group recorded a commendable vessel utilisation rate of 97.2%, compared to 98.9% in the previous year. In tandem with industry developments, the liner business was most affected by the reduction in global trading volumes and increased cost with slot utilisation falling to 67.5% during the year under review from 71.3% in the previous year.

The offshore business continued to chart progress with the delivery of two (2) Floating Storage and Offloading (FSO) units and one (1) Floating Production, Storage and Offloading (FPSO) unit during the year. FSO Puteri Dulang was deployed in the Dulang field in Block PM-305 offshore Peninsular Malaysia, while FSO Orkid was installed in the PM3 Commercial Arrangement Area (CAA), a joint development area between Malaysia and Vietnam. FPSO Espirito Santo was delivered to Shell Brazil and marks MISC's second FPSO in Brazil's deepwater offshore sector.

MISC is set to further expand its offshore business with the award of a contract for the lease of two (2) mobile offshore production units (MOPU) for the D30 and Dana field development projects located in Block SK305, offshore Sarawak in Malaysia. Construction of the MOPUs is progressing on schedule with delivery expected in June and September 2009 respectively.

MISC's subsidiary, Malaysia Marine and Heavy Engineering Sdn Bhd (MMHE) also sustained its performance in the marine and heavy engineering business. During the year, MMHE completed two fabrication projects, two marine conversion projects, as well as dry docking and repair works for 68 vessels.

CONCLUSION

The strong financial results and operational performance delivered amidst a volatile and uncertain global industry environment characterised by weak market fundamentals, unprecedented price volatility and persistently high costs demonstrated the resilience and capability of the PETRONAS Group to compete efficiently and effectively to generate value in a variety of market conditions.

Driving this performance excellence is the Group's proven strategy of integration, adding value and globalisation that has served the PETRONAS Group well in addressing the industry challenges, and enabled the organisation to evolve and grow into what it is today. The strategy is complemented by the Group's philosophy of mutually beneficial partnerships and alliances anchored on long term relationships based on mutual trust, respect and understanding.

One of the key enablers to the successful implementation of the Group's strategy and philosophy is its people, firmly guided by the organisation's Shared Values of Loyalty, Integrity, Professionalism and Cohesiveness in discharging their responsibility as trustees to the people and the nation. These values have become the soul of this organisation and are key differences between PETRONAS and many of its competitors, instilling in its people the resolve to deliver a superior performance and to leave a legacy for future generations.

Page 13

Going forward, the Group faces significant and growing challenges in an increasingly difficult and volatile industry environment compounded by the global economic crisis. Existing domestic acreages are maturing, with both reserves and production set to decline. New reserves are in harsher geological frontiers, technologically more demanding and costlier to exploit. Access to international reserves has also become more difficult with heightened geopolitical uncertainties in many parts of the world. The ongoing global economic crisis and the prevailing high-cost and low-price environment has prompted many industry players to scale back investments and cut costs, resulting in wide-scale retrenchments. The credit crunch has adversely impacted many companies' balance sheets and triggered another wave of industry consolidation. All of these factors combine to create a potent recipe for another supply crunch.

Despite these challenges and uncertainties, PETRONAS remains focused on the long-term. It will continue investing in building capacity and capability in this highly competitive and capital-intensive industry to develop the energy needed for economic development. The requirement for continuous re-investment is expected to increase as PETRONAS grows its international portfolio to supplement declining domestic resources.

PETRONAS has come a long way from its beginnings as a fledgling regulator of Malaysia's upstream sector to become a fully integrated oil and gas company with a global presence, ranked on the Fortune Global 500 list. Indeed, the national oil company (NOC) of Malaysia has been internationally acknowledged as one of the most successful and well managed NOCs. With an initial share capital of RM10 million, it has to date returned to its sole shareholder, the Government of Malaysia, a total of RM426.7 billion in the form of dividends, taxes, royalties and export duties. More significantly, it has become the single largest contributor to the Federal Government's revenue, standing at 45% last year.

PETRONAS was able to achieve all these as it has been allowed to operate commercially and independently, a distinguished foundation for the company established by its founding leaders. The foundation continues to be strengthened by its present leaders and dedicated workforce to sustain its success, and has become an enduring strength of the organisation. PETRONAS remains committed to this tested and proven formula, and will continue with its long-term strategy of integration, value adding and globalisation while investing in capacity and capability to ensure its sustainability. It will continue to forge mutually beneficial partnerships and alliances based on mutual trust, respect and understanding. With full support from its stakeholders, PETRONAS is ready to face the challenges and remains devoted to raising the level of its performance to not only meet but exceed the expectations of all its stakeholders.

Issued by PETRONAS 25 June 2009

Page 14

Вам также может понравиться

- Cisco 2800 Software GuideДокумент266 страницCisco 2800 Software Guidegoldenscreen100% (1)

- Preliminary Analysis of The Voting Figures in Iran's 2009 Presidential ElectionДокумент19 страницPreliminary Analysis of The Voting Figures in Iran's 2009 Presidential ElectiongoldenscreenОценок пока нет

- Iran Election Results by Region 2005 & 2009 (Source Guardian)Документ11 страницIran Election Results by Region 2005 & 2009 (Source Guardian)goldenscreenОценок пока нет

- Dewan Rakyat Order Paper June 2006Документ18 страницDewan Rakyat Order Paper June 2006goldenscreen100% (4)

- Novell Security PenetrationДокумент12 страницNovell Security Penetrationgoldenscreen100% (3)

- Q3/2008 Peninsular Malaysia Voter Opinion PollДокумент41 страницаQ3/2008 Peninsular Malaysia Voter Opinion Pollgoldenscreen100% (1)

- UNDP - Sabah Human Development StatisticsДокумент16 страницUNDP - Sabah Human Development Statisticsgoldenscreen100% (3)

- The Malay Ruler's Loss of ImmunityДокумент43 страницыThe Malay Ruler's Loss of Immunitygoldenscreen100% (8)

- Speech by Chan Kong Choy Congratulating PKFZ in 2004Документ12 страницSpeech by Chan Kong Choy Congratulating PKFZ in 2004goldenscreen100% (2)

- Musa and The Ma Tzu ScandalДокумент16 страницMusa and The Ma Tzu Scandalgoldenscreen100% (31)

- List of Privatisation Projects Approved in Principle (June 1998)Документ7 страницList of Privatisation Projects Approved in Principle (June 1998)goldenscreen100% (4)

- THE MEMOIRS OF DR GED LEWIS: Murder, Secret Societies and Merdeka Kuala LumpurДокумент17 страницTHE MEMOIRS OF DR GED LEWIS: Murder, Secret Societies and Merdeka Kuala Lumpurgoldenscreen100% (2)

- Making Ethnic Citizens: The Politics and Practice of Education in MalaysiaДокумент19 страницMaking Ethnic Citizens: The Politics and Practice of Education in Malaysiagoldenscreen100% (16)

- The Corridors of Power: Mexican Stand-OffДокумент6 страницThe Corridors of Power: Mexican Stand-Offgoldenscreen100% (2)

- Secret Societies and Politics in Colonial Malaya With Special Reference To The Ang Bin Hoey in PenangДокумент12 страницSecret Societies and Politics in Colonial Malaya With Special Reference To The Ang Bin Hoey in Penanggoldenscreen100% (1)

- Who Is The Next Chief Minister of Sabah?Документ7 страницWho Is The Next Chief Minister of Sabah?goldenscreen100% (1)

- The Political Economy of Horizontal Inequalities and The End of The New Economic Policy in MalaysiaДокумент20 страницThe Political Economy of Horizontal Inequalities and The End of The New Economic Policy in Malaysiagoldenscreen100% (5)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)