Академический Документы

Профессиональный Документы

Культура Документы

1Q14 Presentation of Results

Загружено:

MillsRI0 оценок0% нашли этот документ полезным (0 голосов)

14 просмотров16 страниц1Q14 Presentation of Results

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ1Q14 Presentation of Results

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

14 просмотров16 страниц1Q14 Presentation of Results

Загружено:

MillsRI1Q14 Presentation of Results

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 16

May 7, 2014

Presentation of 1Q14 Results

Ramon Vazquez

1Q14 Results

2

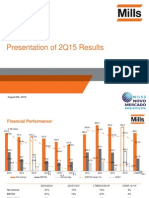

Mills - Financial Performance

Reclassified excluding the Industrial Services business unit, for comparison.

ROIC: Return on Invested Capital. Until 2010, ROIC was calculated considering the effective income tax rate for the period, while from 2011 onwards ROIC was calculated considering a

theoretical 30% income tax rate.

1Q14/1Q13 1Q14/4Q13 LMT1Q14/2013 CAGR 10-13

Net Revenue +10% -1% +2% +33%

EBITDA +12% +5% +3% +34%

Net Earnings -14% -26% -3% +19%

Presentation of 1Q14 Results 05/07/2014

In R$ millions

187,5 188,4

211,8

222,0

210,1

207,8

83,3

95,7

98,9

106,1

102,4

107,5

41,7 39,3

48,1

39,6

45,6

33,9

44,4%

50,8%

46,7%

47,8%

48,7%

51,7%

14,5%

14,9%

14,2% 13,9%

13,4%

11,5%

4Q12 1Q13 2Q13 3Q13 4Q13 1Q14

Net Revenue EBITDA Net Earnings EBITDA Margin ROIC

354,5

462,8

665,5

832,3

851,7

168,4

217,4

339,0

403,1

414,9

103,3 92,2

151,5

172,6

167,2

47,5%

47,0%

50,9%

48,4%

48,7%

21,0%

12,3%

14,7%

14,1% 13,9%

2010 2011 2012 2013 LTM1Q14

Rental

85%

Technical

support

services

1%

Sales

8%

Others

6%

By service category

Heavy

Construction

29%

Real Estate

24%

Rental

47%

By business unit

3

Presentation of 1Q14 Results 05/07/2014

Net revenues totaled R$ 207.8 million in 1Q14

4

We launched an expense reduction program to minimize the

effect of higher G&A allocated in the remaining business units

after the sale of Industrial Services

13,9

16,7

12,6

16,5

15,9

21,9

22,3

22,9

20,8 22,0

15,5

16,0

18,3

19,5

19,6

8,8

8,9

12,5

9,6

1,1

1Q13 2Q13 3Q13 4Q13 1Q14

Industrial Services

Rental

Real Estate

Heavy Construction

-12%

+3%

63.8

66.4

66.4

58.5

51.3

54.9

53.9

56.8

Excluding capital gain from the sale of the Industrial Services business unit

60.1

Presentation of 1Q14 Results 05/07/2014

In R$ million

1Q14/1Q13 1Q14/4Q13 LTM1Q14/2013 CAGR 10-13

Net Revenue +8% -13% +2% +12%

EBITDA +5% -12% +1% +14%

Heavy Construction Financial Performance

5

* Excluding the positive effect of tax reversal in the amount of R$ 1.5 million in 3Q13.

1

ROIC: Return on Invested Capital. Until 2010, ROIC was calculated considering the effective income tax rate for the period, while from 2011 onwards ROIC was calculated considering a

theoretical 30% income tax rate.

Presentation of 1Q14 Results 05/07/2014

47,3

47,5

55,1

55,7 55,7

58,6

51,0

20,2

24,3

25,1

29,4

28,2 29,3

25,6

42,7%

51,3%

45,5%

52,8%

50,6%

49,9%

50,2%

14,8%

18,6%

17,8%

20,9%

19,7%

19,1%

14,0%

4Q12 1Q13 2Q13 3Q13 3Q13* 4Q13 1Q14

Net Revenue EBITDA EBITDA Margin ROIC

154,3

131,6

174,1

217,0

220,5

73,6

57,8

84,3

108,1 109,4

47,7%

43,9%

48,5%

49,8%

49,6%

24,1%

12,1%

17,2%

19,2%

17,9%

2010 2011 2012 2013 LTM1Q14

Transposition of the

So Francisco river*

Comperj refinery*

Subway line 5 SP*

Raposo Tavares

highway

Belo Monte

hydroelectric power

plant*

Norte-Sul railroad*

Jurong shipyard

Olympic park

Silver monorail line-

SP*

Gold monorail line-

SP*

Pulp mill expansion-

RS*

E

v

o

l

u

t

i

o

n

o

f

r

e

v

e

n

u

e

g

e

n

e

r

a

t

i

o

n

(

B

a

s

i

s

1

0

0

=

M

a

x

i

m

u

m

m

o

n

t

h

l

y

r

e

v

e

n

u

e

i

n

t

h

e

l

i

f

e

o

f

c

o

n

s

t

r

u

c

t

i

o

n

)

Length of time of Mills participation in the construction work average cycle is 24 months

Belo Monte hydroelectric

power plant

Vales S11D project

Norte-Sul railroad

Oeste-Leste railroad

North beltway

Subway lines 4 e 5 SP

Companhia Siderrgica

do Pecm steel mill

Paraguau shipyard

Salvador subway

Goinia airport

Confins airport

Pulp mill expansion- RS

Colder and Teles Pires

hydroelectric power plants

Comperj refinery

Transposition of the So Francisco

river

Cais das Artes

Vale projects

East beltway- SP

Gold monorail line- SP

Subway line 4 RJ

BRT Transcarioca

Libra terminal

Cuiab light rail

Jacu-Pssego highway

Jirau hydroelectric power

plants

Abreu e Lima refinery

Natal airport

Fortaleza airport

Viracopos and Guarulhos

airport

Braslia airport

Confins airport

Metropolitan Arch RJ

Surroundings of

Maracan

Gerdau projects

Minas-Rio pipeline

New

contracts*

Contracts with growing

volume of equipment

Contracts with high volume

of equipment

Contracts in the

demobilization process

* New streches

Important contracts per stage

1

in the evolution of monthly

revenue from Heavy Construction projects

6

1

In 1Q14

Presentation of 1Q14 Results 05/07/2014

7

New products that offer gains of productivity and security

Mills Light

Lifting carts

Presentation of 1Q14 Results 05/07/2014

1Q13/1Q14 1Q14/4Q13 LTM1Q14/2013 CAGR 10-13

Net Revenue -8% +10% -2% +35%

EBITDA -15% +37% -5% +29%

Real Estate Financial Performance

8

1

ROIC: Return on Invested Capital. Until 2010, ROIC was calculated considering the effective income tax rate for the period, while from 2011 onwards ROIC was calculated considering a

theoretical 30% income tax rate.

Presentation of 1Q14 Results 05/07/2014

In R$ million

66,0

64,9

66,5

72,4

54,2

59,5

26,1

27,7

24,6 24,4

17,1

23,5

39,6%

42,8%

37,0%

33,7%

31,5%

39,4%

12,6%

12,8%

9,3%

8,2%

3,2%

6,6%

4Q12 1Q13 2Q13 3Q13 4Q13 1Q14

Net Revenue EBITDA EBITDA Margin ROIC

105,1

155,8

238,0

258,0

252,6

43,9

66,0

113,4

93,8

89,5

41,7%

42,4%

47,7%

36,4%

35,4%

23,5%

14,3%

15,7%

8,1%

6,7%

2010 2011 2012 2013 LTM1Q14

9

3,5

2,9 3,0

4,6

-18,6%

3,8%

55,3%

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

-

0,5

1,0

1,5

2,0

2,5

3,0

3,5

4,0

4,5

5,0

1Q11 1Q12 1Q13 1Q14

Y

o

Y

(

%

)

L

a

u

n

c

h

e

s

(

i

n

R

$

m

i

l

l

i

o

n

s

)

1

Cyrela, Direcional, Even, Eztec, Gafisa, Helbor, MRV and Rodobens

Source: Operational reports from companies and Mills

Total launches

1

in R$ billion

Launches were up 55.3% in the 1Q14, while sales expanded

25.7%

3,8

3,5

3,8

4,8

-7,6%

10,6%

25,7%

-60%

-40%

-20%

0%

20%

40%

60%

80%

100%

-

1,0

2,0

3,0

4,0

5,0

6,0

1Q11 1Q12 1Q13 1Q14

Y

o

Y

(

%

)

S

a

l

e

s

(

i

n

R

$

m

i

l

l

i

o

n

s

)

Total sales

1

in R$ billion

Presentation of 1Q14 Results 05/07/2014

1Q13/1Q14 1Q14/4Q13 LTM1Q14/2013 CAGR 10-13

Net Revenue +28% +0.1% +6% +55%

EBITDA +34% +4% +7% +58%

Rental Financial Performance

10

1

ROIC: Return on Invested Capital. Until 2010, ROIC was calculated considering the effective income tax rate for the period, while from 2011 onwards ROIC was calculated considering a

theoretical 30% income tax rate.

Presentation of 1Q14 Results 05/07/2014

In R$ million

74,2

76,1

90,1

93,9

97,2 97,3

36,9

43,6

49,3

52,3

56,0

58,4

49,8%

57,3%

54,7%

55,7%

57,7%

60,1%

16,9%

19,1%

18,5% 18,1%

17,5%

17,1%

4Q12 1Q13 2Q13 3Q13 4Q13 1Q14

Net Revenue EBITDA EBITDA Margin ROIC

95,1

175,4

253,5

357,3

378,5

51,0

93,6

141,2

201,2

216,1

53,6% 53,4%

55,7%

56,3%

57,1%

19,2%

16,5% 18,2%

18,1% 17,8%

2010 2011 2012 2013 LTM1Q14

Award - IPAF training center of the year

11

Source: Mills

Presentation of 1Q14 Results 05/07/2014

IAPA Award

ceremony

England

April 2014

In the first quarter of this year 1,500 motorized access

equipment units came onto the Brazilian market

12

Motorized access equipment fleet

In thousands of units

Source: Mills

Presentation of 1Q14 Results 05/07/2014

+5%

8

11

16

21

30

31

0

5

10

15

20

25

30

35

2009 2010 2011 2012 2013 1Q14

Growth Plan

74

47

51

106

15

104

185

60

90

4

131

163

161

267

73

15

18

20

36

10

324

413

292

499

102

2010 2011 2012 2013 1Q14

Rental

Real Estate

Heavy Construction

In R$ million

Capex

Realized 1Q14 /

2014 Capex Budget

(%)

41%

18%

43%

Mills invested R$ 93 million in rental equipment in 1Q14

14

Reclassified excluding the Industrial Services business unit, for comparison.

Presentation of 1Q14 Results 05/07/2014

Total 40%

Rental equipment

Mills - Investor Relations

Tel.: +55 21 2123-3700

E-mail: ri@mills.com.br

www.mills.com.br/ri

Вам также может понравиться

- Buffett's Rules For Your DIY Fund - Eureka ReportДокумент4 страницыBuffett's Rules For Your DIY Fund - Eureka ReportPanot JitgaroonОценок пока нет

- Corporate Finance Cheat SheetДокумент3 страницыCorporate Finance Cheat Sheetdiscreetmike50Оценок пока нет

- Wells Fargo Combined Statement of AccountsДокумент6 страницWells Fargo Combined Statement of AccountsEstrada Pence HoseaОценок пока нет

- Accounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreДокумент6 страницAccounting For Business Combinations Final Examination: Name: Date: Professor: Section: ScoreCyrine Miwa Rodriguez100% (2)

- KPIT Technologies: IT Services Sector Outlook - NeutralДокумент9 страницKPIT Technologies: IT Services Sector Outlook - NeutralgirishrajsОценок пока нет

- L&T 4Q Fy 2013Документ15 страницL&T 4Q Fy 2013Angel BrokingОценок пока нет

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОт EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosОценок пока нет

- Interface of Pandapos CounterДокумент63 страницыInterface of Pandapos CountersnadminОценок пока нет

- Cusdec Final SADДокумент5 страницCusdec Final SADSamantha Swift0% (1)

- 2Q14 Presentation of ResultsДокумент27 страниц2Q14 Presentation of ResultsMillsRIОценок пока нет

- 4Q13 Presentation of ResultsДокумент24 страницы4Q13 Presentation of ResultsMillsRIОценок пока нет

- BRF - Deutsche Paris Jun15Документ30 страницBRF - Deutsche Paris Jun15PedroShawОценок пока нет

- 2Q15 Presentation of ResultsДокумент30 страниц2Q15 Presentation of ResultsMillsRIОценок пока нет

- Presentation of 4Q11 ResultsДокумент20 страницPresentation of 4Q11 ResultsMillsRIОценок пока нет

- Third Quarter Report March 31 2014Документ36 страницThird Quarter Report March 31 2014Salman MohiuddinОценок пока нет

- Talgo 1H2015 Results PresentationДокумент18 страницTalgo 1H2015 Results PresentationTail RiskОценок пока нет

- Presentation (Company Update)Документ25 страницPresentation (Company Update)Shyam SunderОценок пока нет

- 2Q16 Presentation of ResultsДокумент19 страниц2Q16 Presentation of ResultsMillsRIОценок пока нет

- Fiscal Management Report 2016Документ123 страницыFiscal Management Report 2016Ada DeranaОценок пока нет

- Communication To Investors - June 2015 (Company Update)Документ11 страницCommunication To Investors - June 2015 (Company Update)Shyam SunderОценок пока нет

- Sun Microsystems Q107 Quarterly Results Release: Investor RelationsДокумент39 страницSun Microsystems Q107 Quarterly Results Release: Investor RelationsjohnachanОценок пока нет

- Telecom Egypt Full Year 2014 EarningДокумент10 страницTelecom Egypt Full Year 2014 EarningMohamed YahiaОценок пока нет

- Fourth Quarter FY 2012-13 Performance Reportt 09-10-13Документ10 страницFourth Quarter FY 2012-13 Performance Reportt 09-10-13L. A. PatersonОценок пока нет

- Apresenta??o Corporativa - BTG Pactual V LatAm CEO Conference - Outubro 2014Документ32 страницыApresenta??o Corporativa - BTG Pactual V LatAm CEO Conference - Outubro 2014LightRIОценок пока нет

- 1Q15 Presentation of ResultsДокумент20 страниц1Q15 Presentation of ResultsMillsRIОценок пока нет

- 3Q15 PresentationДокумент16 страниц3Q15 PresentationMultiplan RIОценок пока нет

- 2Q15 PresentationДокумент16 страниц2Q15 PresentationMultiplan RIОценок пока нет

- Presentation 3Q14Документ16 страницPresentation 3Q14Multiplan RIОценок пока нет

- 2014 12 FY - PresentationДокумент23 страницы2014 12 FY - PresentationAnkit SawhneyОценок пока нет

- Premier Cement Mills: Group 20Документ29 страницPremier Cement Mills: Group 20Milon SahaОценок пока нет

- 1H15 PPT - VFДокумент29 страниц1H15 PPT - VFClaudio Andrés De LucaОценок пока нет

- V-Guard Industries: CMP: INR523 TP: INR650 BuyДокумент10 страницV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaОценок пока нет

- Itnl 4Q Fy 2013Документ13 страницItnl 4Q Fy 2013Angel BrokingОценок пока нет

- Hup Seng AnalysisДокумент7 страницHup Seng AnalysisWillson Chong100% (1)

- JM Financial Consolidated Performance Q4 FY14Документ29 страницJM Financial Consolidated Performance Q4 FY14Ankita NirolaОценок пока нет

- FY 2015 Results - 31 Dec 2015 - tcm130-93768Документ18 страницFY 2015 Results - 31 Dec 2015 - tcm130-93768Zeeshan AliОценок пока нет

- Presentation (Company Update)Документ29 страницPresentation (Company Update)Shyam SunderОценок пока нет

- 3Q14 Presentation of ResultsДокумент18 страниц3Q14 Presentation of ResultsMillsRIОценок пока нет

- Presentation 1Q15Документ14 страницPresentation 1Q15Multiplan RIОценок пока нет

- Digi Q412 Earning ReportДокумент29 страницDigi Q412 Earning ReportharimaucapitalОценок пока нет

- Bank of Kigali Announces Q1 2010 ResultsДокумент7 страницBank of Kigali Announces Q1 2010 ResultsBank of KigaliОценок пока нет

- Presentation ? 4Q14 ResultsДокумент21 страницаPresentation ? 4Q14 ResultsLightRIОценок пока нет

- Q4 Review OGX 2012Документ6 страницQ4 Review OGX 2012france3902Оценок пока нет

- Investors' Brief For The 2 ND Quarter FY 2014-15 Ended Sep 30, 2014 (Company Update)Документ17 страницInvestors' Brief For The 2 ND Quarter FY 2014-15 Ended Sep 30, 2014 (Company Update)Shyam SunderОценок пока нет

- Group Assignment 01: Accounting For Managers PBA4807Документ15 страницGroup Assignment 01: Accounting For Managers PBA4807dkОценок пока нет

- Presentation 4Q13Документ25 страницPresentation 4Q13Multiplan RIОценок пока нет

- Presentation of 1Q12 ResultsДокумент20 страницPresentation of 1Q12 ResultsMillsRIОценок пока нет

- BDO Strama FinancialsДокумент4 страницыBDO Strama FinancialsCamille PerenaОценок пока нет

- Emir 2013 PresentationДокумент69 страницEmir 2013 PresentationohitshimОценок пока нет

- Sun TV, 1Q Fy 2014Документ11 страницSun TV, 1Q Fy 2014Angel BrokingОценок пока нет

- IRB Infra, 1Q FY 14Документ14 страницIRB Infra, 1Q FY 14Angel BrokingОценок пока нет

- Infotech Enterprises-1Q FY 2014Документ13 страницInfotech Enterprises-1Q FY 2014Angel BrokingОценок пока нет

- Investor Presentation (Company Update)Документ34 страницыInvestor Presentation (Company Update)Shyam SunderОценок пока нет

- Investor Presentation: Q2FY13 & H1FY13 UpdateДокумент18 страницInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjОценок пока нет

- LUKY 1st Quarter 2013Документ32 страницыLUKY 1st Quarter 2013sikanderjawaidОценок пока нет

- Petronet LNG: Performance HighlightsДокумент10 страницPetronet LNG: Performance HighlightsAngel BrokingОценок пока нет

- Simplex Infrastructures: Performance HighlightsДокумент11 страницSimplex Infrastructures: Performance HighlightsAngel BrokingОценок пока нет

- Morgan Stanley - Latin America Mid-Cap Corporate Access DaysДокумент36 страницMorgan Stanley - Latin America Mid-Cap Corporate Access DaysMillsRIОценок пока нет

- Sadbhav Engg, 1Q FY 2014Документ13 страницSadbhav Engg, 1Q FY 2014Angel BrokingОценок пока нет

- Punj Lloyd 4Q FY 2013Документ11 страницPunj Lloyd 4Q FY 2013Angel BrokingОценок пока нет

- Huhtamaki PresentationДокумент50 страницHuhtamaki PresentationNitinMuthaОценок пока нет

- AnnualReport2014 2015Документ173 страницыAnnualReport2014 2015charlesОценок пока нет

- A Grade SampleДокумент25 страницA Grade SampleTharindu PereraОценок пока нет

- Results Briefing For The Fiscal Year Ended March 31, 2014Документ32 страницыResults Briefing For The Fiscal Year Ended March 31, 2014NguyenHieuLinhОценок пока нет

- Punj Lloyd, 1Q FY 14Документ11 страницPunj Lloyd, 1Q FY 14Angel BrokingОценок пока нет

- Results Conference CallДокумент14 страницResults Conference CallLightRIОценок пока нет

- Reference Form 2016Документ270 страницReference Form 2016MillsRIОценок пока нет

- Reference Form 2015Документ271 страницаReference Form 2015MillsRIОценок пока нет

- Calendar of Corporate Events 2016Документ2 страницыCalendar of Corporate Events 2016MillsRIОценок пока нет

- Mills Announces The Loss of Political Rights by AxxonДокумент1 страницаMills Announces The Loss of Political Rights by AxxonMillsRIОценок пока нет

- CVM 358 July 2016Документ4 страницыCVM 358 July 2016MillsRIОценок пока нет

- Calendar of Corporate Events 2017Документ2 страницыCalendar of Corporate Events 2017MillsRIОценок пока нет

- CVM 358 July 2016Документ4 страницыCVM 358 July 2016MillsRIОценок пока нет

- Mills 3Q16 ResultsДокумент17 страницMills 3Q16 ResultsMillsRIОценок пока нет

- BTG Pactual VII Latin American CEO ConferenceДокумент36 страницBTG Pactual VII Latin American CEO ConferenceMillsRIОценок пока нет

- 3Q16 Conference Call TranscriptionДокумент7 страниц3Q16 Conference Call TranscriptionMillsRIОценок пока нет

- Calendar of Corporate Events 2016Документ2 страницыCalendar of Corporate Events 2016MillsRIОценок пока нет

- Corporate Presentation 3Q16Документ36 страницCorporate Presentation 3Q16MillsRIОценок пока нет

- Corporate Presentation 3Q16Документ36 страницCorporate Presentation 3Q16MillsRIОценок пока нет

- CVM 358 February 2016Документ5 страницCVM 358 February 2016MillsRIОценок пока нет

- 3Q16 Presentation of ResultsДокумент20 страниц3Q16 Presentation of ResultsMillsRIОценок пока нет

- Mills Announces Reduction of OwnershipДокумент2 страницыMills Announces Reduction of OwnershipMillsRIОценок пока нет

- Reference Form 2016Документ270 страницReference Form 2016MillsRIОценок пока нет

- CVM 358 July 2016Документ4 страницыCVM 358 July 2016MillsRIОценок пока нет

- Calendar of Corporate Events 2016Документ2 страницыCalendar of Corporate Events 2016MillsRIОценок пока нет

- Corporate Presentation 2Q16Документ36 страницCorporate Presentation 2Q16MillsRIОценок пока нет

- BTG Pactual VII Latin American CEO ConferenceДокумент36 страницBTG Pactual VII Latin American CEO ConferenceMillsRIОценок пока нет

- Mills Announces The Release Date For Its 2Q16Документ1 страницаMills Announces The Release Date For Its 2Q16MillsRIОценок пока нет

- CVM 358 July 2016Документ4 страницыCVM 358 July 2016MillsRIОценок пока нет

- 2Q16 Presentation of ResultsДокумент19 страниц2Q16 Presentation of ResultsMillsRIОценок пока нет

- Mills 2Q16 ResultsДокумент17 страницMills 2Q16 ResultsMillsRIОценок пока нет

- Calendar of Corporate Events 2016Документ2 страницыCalendar of Corporate Events 2016MillsRIОценок пока нет

- 2Q16 Conference Call TranscriptionДокумент10 страниц2Q16 Conference Call TranscriptionMillsRIОценок пока нет

- CVM 358 July 2016Документ4 страницыCVM 358 July 2016MillsRIОценок пока нет

- 2Q16 Quarterly Financial ReportsДокумент45 страниц2Q16 Quarterly Financial ReportsMillsRIОценок пока нет

- Reference Form 2016Документ270 страницReference Form 2016MillsRIОценок пока нет

- Report APOL Konsol - Des 2018 PDFДокумент138 страницReport APOL Konsol - Des 2018 PDFCitra DianaОценок пока нет

- Risk of Money Laundering Version 2 Completo PDFДокумент244 страницыRisk of Money Laundering Version 2 Completo PDFRian HidayatОценок пока нет

- Suggested Solutions - Chapter 12Документ3 страницыSuggested Solutions - Chapter 12Seo ChangBinОценок пока нет

- Narayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, HyderbadДокумент65 страницNarayana Engineering College: Nellore: A Study On Capital Budgeting in Sagar Cements PVT LTD, Hyderbadsaryumba5538Оценок пока нет

- A Using The Financial Statements Shown Here For LanДокумент2 страницыA Using The Financial Statements Shown Here For LanAmit PandeyОценок пока нет

- Functions of Commercial BankingДокумент22 страницыFunctions of Commercial Bankingparth sharmaОценок пока нет

- Chapter 05 - AnswerДокумент36 страницChapter 05 - AnswerAgentSkySkyОценок пока нет

- 06a. Information MemoДокумент116 страниц06a. Information Memolector_961Оценок пока нет

- Financial Accounting Assignment Company: Bajaj Finserv LTDДокумент2 страницыFinancial Accounting Assignment Company: Bajaj Finserv LTDShreyanshi AgarwalОценок пока нет

- Problems On Bond and Equity ValuationДокумент3 страницыProblems On Bond and Equity ValuationVishnu PrasannaОценок пока нет

- HSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsДокумент41 страницаHSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsfaridajirОценок пока нет

- Module - 2 PDFДокумент11 страницModule - 2 PDFKeyur PopatОценок пока нет

- Revision Test 2 Accountancy XiiДокумент2 страницыRevision Test 2 Accountancy Xiisakshamagnihotri0Оценок пока нет

- Naira Redenomination The Nigerians Perspective 2375 4389 1000297Документ10 страницNaira Redenomination The Nigerians Perspective 2375 4389 1000297Kingsley IdogenОценок пока нет

- Fourth Quarter - Module 5 Week 5Документ11 страницFourth Quarter - Module 5 Week 5Marco UmbalОценок пока нет

- NBM PLC ANNUAL REPORT 2022Документ101 страницаNBM PLC ANNUAL REPORT 2022Takondwa MsosaОценок пока нет

- FIN 460-END OF Chap 2 - AmendedДокумент5 страницFIN 460-END OF Chap 2 - AmendedBombitaОценок пока нет

- 2257 Chapter 21Документ3 страницы2257 Chapter 21melody shayanwakoОценок пока нет

- Dissertation On Home LoanДокумент6 страницDissertation On Home LoanHelpWritingAPaperCanada100% (1)

- Fin ManДокумент3 страницыFin ManDonna Mae HernandezОценок пока нет

- PAN Card ApplicationДокумент2 страницыPAN Card ApplicationKishore PotnuruОценок пока нет

- LeveragesДокумент9 страницLeveragesShrinivasan IyengarОценок пока нет

- 67-1-1Документ22 страницы67-1-1bhaiyarakeshОценок пока нет

- Senior Credit Analyst in Houston TX Resume Mark TerkaДокумент2 страницыSenior Credit Analyst in Houston TX Resume Mark TerkaMarkTerkaОценок пока нет