Академический Документы

Профессиональный Документы

Культура Документы

Market Technician No 68

Загружено:

ppfahd0 оценок0% нашли этот документ полезным (0 голосов)

95 просмотров16 страницMarket Technician No43

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документMarket Technician No43

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

95 просмотров16 страницMarket Technician No 68

Загружено:

ppfahdMarket Technician No43

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 16

MARKET TECHNICIAN

THE SOCIETY OF TECHNICAL ANALYSTS

A professional network for technical analysts

THE JOURNAL OF THE STA

ISSUE 68 DECEMBER 2010

IN THIS ISSUE

T. Pelc The rhythm of time....................................................................................................1

R. Miller Point and figure charting...........................................................................................5

J. Monfort Acute monthly reversals (AMRs) .............................................................................7

D. McMinn DJIA peaks, seasonality and market outcomes..................................................10

D. Watts Bytes and Pieces......................................................................................................13

STA Diploma results ....................................................................................................................................6

FOR YOUR DIARY

TUESDAY January 11th

Panel Discussion

Commodities............................................................................................Brenda Sullivan, Sucden Financial

Equities.......................................................................................................................Peter Goodburn, Wavetrack

Fixed income.........................................................................................................Tim McCullough, Lloyds TSB

Foreign exchange...................................................................................................................William Moore, RBS

TUESDAY February 8th

Market analysis using the

Elliott Wave Theory ...................................................................Thomas Anthonj, JP Morgan Chase

TUESDAY March 8th

The 3T methodology

(trend, targets, timing)...........Jean-Francois Owczarczak, Management Joint Trust, Geneva

Welcome to the new look journal. We have tried to give it a more 21st-century

style and to tie it in with our website. If anyone has any comments or

suggestions please e-mail them to Katie at info@sta-uk.org

This year's IFTA conference was held in Berlin in the week that the city was

celebrating the 20th anniversary of the Wall coming down. As usual it

provided an excellent forum for technical analysts around the world to meet

and exchange views. One day of the conference was devoted to the energy

markets and we hope that some of the speakers will submit articles to the

journal in the coming months. Next year's conference will be held in Sarajevo

on 6-8 October.

THE SOCIETY OF TECHNICAL ANALYSTS

www.sta-uk.org

COPY DEADLINE FOR THE NEXT ISSUE FEBRUARY 2011

PUBLICATION OF THE NEXT ISSUE MARCH 2011

MARKET TECHNICIAN

1 ISSUE 68 DECEMBER 2010

Looking for when markets may turn,

using cycles gives us the timing element

for strategic activity (50% of the

equation, the other half is focusing on

price). The premise is that we, as

people, manipulate our measurement of

time (and the calendar) and the

suggestion is maybe we should use

external influences such as planetary

movements, or lunar cycles, or the

actual natural Earth cycle for timing

events. The argument is there may be

little dualism between natural events

and the reactions of the financial

markets.

There is a lot of speculation about the

2012 date generally; it is significant in

the natural cycle of the Earth. If we take

a top down approach (big picture to

small picture), as we should in technical

analysis, we see the Earth has roughly a

26,000 year cycle (25,820 years). This

is how long it takes to complete the

procession of the Equinoxes (for the

Earth to travel past all 12 signs of the

Zodiac).

We are currently in Pisces (the Fish)

moving to Aquarius (Water). Arguably

an indication of major change in our

spiritual belief systems/behaviour, but

definitely a cycle change period in late

2012 (December) for the Earth.

Splitting this grand cycle into sub

structures we can see 5 smaller cycles

(5,125 years each from the Mayans),

with our current sub structure starting

around 3113BC and finishing around 21

Dec 2012.

5,125 years =

13 smaller cycles called Baktuns

1 Baktun =

394 tropical years

(144,000 days Fibonacci no.)

Thus we are in the 13th Baktun

cycle 1618-2012 according to the

Mayan calendar.

The Grand Cycle The Heavens

and the Earth

But measuring time is an interesting

exercise since humans have manipulated

our measurement of it in history. Today

we use the Gregorian calendar (still out

by 26 seconds a year) which was a

product of its predecessor the Roman

calendar. Why do we have 28 days in

February and 31 in July and August? It

is thanks to Augustus Caesar. But 90

countries today use the alternative lunar

calendar in their culture namely the 13

months calendar with 28 days per

month.

65% of US publicly traded companies

use January to measure the fiscal

year.

In the UK, pre-government owned

companies eg, BT Group and National

Grid, continue to use the

governments financial year which

ends on the last day of March.

Many universities have a fiscal year

ending in summer months

The rhythm of time

By Tom Pelc MSTA CFTe

The key theme of my talk to the STA earlier this year was the third tenet of

technical analysis History repeats itself. There is a cyclical nature to

financial market oscillations mainly because what we are actually analysing is

human investment behaviour. This is arguably driven by three primary

emotions fear, greed and hope, whatever the culture you look at. People

react to a predictable series of emotions in their investments from being

cautious about investing to eventually facing fear and disgust, (being closely

linked to Dow Theory) and this forms the basis of a simple Sine wave, which

in turn is one cycle. The cycle repeats itself over time in a similar rhythm but

maybe not exactly in the same way.

Conviction

Enthusiasm

Confidence

Growing recognition

Hope

Disbelief

Disdain

Surrender

Disgust

Caution

Skepticism

Apprehension

Shock & fear

G

r

e

e

d

F

e

a

r

P

r

i

c

e

D

e

v

e

l

o

p

m

e

n

t

Time

DOW THEORY

Accumulation

Participation

Distribution

Chart 1: The Grand Cycle The Heavens and the Earth

Grand Cycle

Procession of the Equinoxes = 25,820 yrs

We enter the age of Aquarius in 2012 We enter the age of Aquarius in 2012

Earth transits through each of the 12 Zodiac signs

= 2152 yrs approx each

This article is an abridged version of a talk given to the STA on 8th June

2

MARKET TECHNICIAN

ISSUE 68 DECEMBER 2010

In Australia and New Zealand the

fiscal year runs from 1st July to 30th

June

Whatever the measure, the cycle is still

the same namely driven by the

primary emotions. If we can get the

data of an instrument going back we can

look for the three cyclic principles to

measure forward the next cycle. We

need the amplitude (how big a cycle

gets), the period, (distance between

cycle troughs), and phase distance

between varying cycle troughs. (Chart 2)

When the cycle is not exactly rhythmic

we can use various cyclic principles to

smooth the pattern from summation

to synchronicity and we can use

the concept of proportionality. The

amplitude of a 20 day cycle should, in

theory, be roughly double a 10 day

cycle. The best situation is if you have a

cycle which has a turn confirmed by a

price pattern or you could try summation

to generate pattern signals. (Chart 3).

A 36 week cycle for GBP/USD (chart 4)

sees technical patterns signal turns on

cycle dates using Japanese candlesticks

and added to this is a Lucas table (using

ratios of 7 compared to range extremes

and added to a sequence low key is the

results column on the table far right.)

This is a simple example of just

measuring time as a static cycle, but we

can use more esoteric techniques such

Chart 4

1.6904 1.3682 0.32 0.32 1.00 7.00 7.00

1.7441 1.3682 0.38 0.32 1.17 6.00 7.00

1.8193 1.3682 0.45 0.32 1.40 5.00 7.00

1.9321 1.3682 0.56 0.32 1.75 4.00 7.00 0.32 Total

2.1200 1.3682 0.75 0.32 2.33 3.00 7.00 1.3682 01/06/2001

2.4959 1.3682 1.13 0.32 3.50 2.00 7.00 1.6904 01/06/2003

3.6236 1.3682 2.26 0.32 7.00 1.00 7.00 Low

Objectives Low R*(C/S) Range R C/S Sequence S Constanct C minus

Add Given Multiply Given Divide Additive RULE OF 7 High

Upside Upside Upside Upside Upside Upside Upside Subtract Cable

Long legged Doji & Sankawayoi no myojyo

Kirikomi

Takuri

Yo-sentsutsumi

Doji

Kenuki

Simple example = next cycle

date end of July 2010

S S

NL

H

Cycle

Chart 3

Chart 2: Three cycle principles

The best situation, is if you have a

cycle which has a turn confirmed by

a price pattern, you could also try

summation to generate pattern

signals eg. previous Double Top.

Chart 5

When the Earth is at the mid-point betwixt two

planets 45, 90, 135 and 180 degrees are

considered as difficult angles and tough for

stocks.

Aug 24 1987 five planets were on the same

ecliptic longitude, this last happened 800 years

ago

Aug 6 2008 Mars-Uranus crash cycle

AUG 1 2010- +/- 1 week 5 planets

aligned Cardinal Climax not happened in 1,000

years watch out stock market and the

world

Monthly Dow Jones

Aug 1987

Aug 2008

MARKET TECHNICIAN

3 ISSUE 68 DECEMBER 2010

as sunspot activity or lunar cycles

or even in some cases planetary

alignments.

Professor Tchijevsky in the 1920s

suggested that, as sunspot activity

approaches its maximum, the number

of important mass historical events,

taken as a whole increases, approaching

its maximum during the sunspot

maximum and decreasing to its

minimum during the periods of the

sunspot minimum. Sunspots reach a

maximum about every 11 years, but

successive maxima have spots with

reversed magnetic polarity, thus the

whole cycle is 22.2 years long. We are in

a quiet period at the moment but huge

activity could come between 2011 and

2012 be warned.

When China revalued the Renminbi on

21st July 2005, it was the closest the

Moon was to the Earth in eight years.

My suspicion is that, as a result of their

cultural heritage, they are extremely

aware of important natural dates. On

the Summer Solstice, 21st June 2010,

another China story hit the market.

The authorities announced they were

adopting a more flexible exchange

rate policy, moving from the US dollar

peg.

The charts 6, 7 and 8 are examples of

some of the cycles I have observed. The

optimal cycle across many markets is

the 37.33 week cycle as my studies have

concluded between 36-39 weeks is

where most cycles for many assets

cluster. Martin Armstrong is a strong

proponent of this 37.33 week cycle and

I dedicated a slide in my presentation to

his invaluable work.

To conclude, I illustrated two major

cycles, one for fixed income products

and the other the decennial cycle of the

stock market in years ending with a 7

based on Ganns original observations.

For the fixed income example, calendar

weeks 32-34 in 2005 since 1980 were

88% time positive for long bonds i.e.

yields fell for that three week period on

a net basis. I gave numerous examples

of how this cycle is still going on; not

only has the curve in 2s30s in Swaps

flattened overall in that time period but

also the butterfly trade 2s10s30s was

lower (which is like trading 2s10s vs

10s30s).

39 week cycle

Chart 7: USD Index Weekly chart with 39 week cycle

KENUKI TOP

Chart 8: Nymex Oil 25.8 months cycle (sub cycle = 8.6 months x3)

Very simplified E-Wave count with the cycle on

a logarithmic chart

Chart 6: UK 10 Year generic yield weekly and 39 week cycle

4 ISSUE 68 DECEMBER 2010

MARKET TECHNICIAN

-8bp to -21bp in weeks 32 -34

2006

7

th

Aug

Chart 9: US 2s10s30s fly (using Swaps) Daily chart 2006

Chart 10: Dow Daily chart

New Moon 11

th

Oct 2007 and a bearish key

day reversal

Full Moon

Fall was 20.5% from Oct 11, 2007- Jan 22, 2008

Chart 10a

1887 Dec 3 1886 Apr 2, 1888 -20.1%

1897 Sept 10, 1897 Mar 25, 1898 -24.6%

1907 Jan 19, 1906 Nov 15, 1907 -48.5%

1917 Nov 21, 1916 Dec 19, 1917 -40.1%

1927 Oct 3, 1927 Oct 22, 1927 -10.2%

1937 Mar 10, 1937 Mar 31, 1938 -49.1%

1947 May 29, 1946 June 13, 1949 -24.0%

1957 Apr 6, 1956 Oct 22, 1957 -19.4%

1967 Feb 9, 1966 Oct 7, 1966 -25.4%

1977 Sep 21, 1976 Feb 28,1978 -26.9%

1987 Aug 25 1987 Dec4 1987 -35.1%

1997 Aug 6, 1997 Nov 12, 1997 -13.2%

2007 ?????? YTD (05/10/07) +12.52% post payrolls

Chart 10b

1887 September 19 (-2.24%) and October 12 (-2.29%)

1897 September 21 (-3.95%) and October 12 (-3.90%)

1907 March 14 (-8.29%). Major banking panic October 22

1917 November 01 (-4.16%) and November 08 (-4.21%)

1927 October 8 (-3.65%)

1937 October 18 (-7.75%) Panic/depression

1947 April 14 (-2.95%)

1957 October 21 (-2.48%) Credit crunch

1967 No fall =>2.00% recorded

1977 July 27 (-2.17%)

1987 October 19 (-22.61%) Black Monday

1997 October 27 (-7.18%) Blue Monday

One example of this fixed income cycle

which is still on going and relevant for

this August calendar weeks 32-34.

(Chart 9)

Finally the decennial cycle for the

Dow Jones with bear markets, years

ending with a 7 (Chart 10a)

So what about 2007?

What actually happened thereafter

It did not add up the market should

have turned South or a new cycle was

building (Chart 10b).

The Dow did, indeed, turn a week

afterwards on the 11th October. The

initial impulse decline until January 2008

was 20.5% = a bear market. The lunar

dates tied in with examples I gave that

the decennial cycle has turned on major

lunar dates either New and Full moons

or awkward angles. (Chart 10)

Conclusion

Seasonality plays a part in many

peoples analysis (including economists).

The longer the history with reliable data,

the more powerful the argument is if it

ties in with technical signals. There are

cycles within cycles so first look for the

big picture then work smaller. Use the

rule of multiple techniques.

Some suggested key dates to look

out for:

March 11 2011 and April 4th 2011.

These are likely to be a positive time for

stocks but increased periods of volatility.

More important is mid-June 2011. This

is a major cycle period using 4.3years

sub cycle from long term 51 year cycle.

8th-26th Aug 2011 very bullish

rebound period for US long bonds

(calendar weeks 32-34).

Picks for future investment based on

long term cycles are nuclear energy and

African stock markets South Africa,

Kenya and Egypt. Others to watch going

forward long term are food EDF (PF) and

Mitsubishi heavy industries (MITS).

Millionaires dont use astrology,

Billionaires do J.P. Morgan

5

MARKET TECHNICIAN

ISSUE 68 DECEMBER 2010

From my studies, the P&F chart purist

concluded that the only data which can

be used effectively for the construction

of P&F charts is tick-data [i.e., the

concept of data based on the old ticker

tape, trade by trade, reporting].

There is no doubt, of course, that only

tick-data can provide the basis for a

totally correct P&F chart construction.

However, in today's markets there is

just too much tick-data and the

process of storing all this data to

construct P&F charts, which will

inevitably date back over a period of

time, would be hugely cumbersome

and beyond the scope of all but the

larger computers.

In stepping away from tick-data, there

are two other methods which are used,

namely: close-only construction; and,

high/low construction.

With close-only construction the close

price only for each chosen time period is

added to the chart. This method works

well in certain markets, but it does not

take into account the intra-time-period

highs and lows. This can leave a major

data gap, especially when analysing

volatile markets. This data gap can, of

course, be overcome by using the

high/low data for each chosen time

period thereby taking into account the

full range of price movement. In short,

one can say, for example, that a 1

minute high/low P&F chart is extremely

close to using tick-data.

The main problem with using the

high/low construction method is, to

state the obvious, that there are two

pieces of price data for each time period.

This problem can, of course, be

overcome by applying a trend biased

system. The normal application of this

trend bias works in the following

manner, namely: when there is an

existing column of X's the high takes

priority; when there is an existing

column of O's the low takes priority. This

maintains the correct support/resistance

levels on the P&F chart until an outside

price period occurs where the high and

Point and figure charting

By Richard Miller

Over many years I have studied various charting techniques but, as time went

by, I found that 3-box reversal Point and Figure charts (P&F charts) were the

most suitable method to use for the analysis of movements in market prices.

The objective nature of P&F charts definitely gives a significant advantage

over other forms of charting which, in general, rely heavily upon a subjective

input in order to achieve a clear result from interpretation. With a 3-box

reversal P&F chart, 45 degree trend lines can be drawn objectively from the

first thrust away from the top or bottom, vertical and horizontal counts are

also taken objectively. Again, it is purely the product of an objective

observation, whether a market is in upward or downward trend.

Chart 1 Chart 2

6

MARKET TECHNICIAN

ISSUE 68 DECEMBER 2010

STA Diploma

Results

DISTINCTION

Pretesh Bhayani

Bruno Vignoto

Woo Fook Mun

PASS

Joy Basford

Magnus F Becher

Dmytro Bondar

Sammy Chammas

Kyriakos Charilaou

Jack Davidson

Jamie Davis

Daljit Dhaliwal

Yeo Kam Fai

Peter S Fox

Goay Chia Chia

Philip Heurich

Leona Gomez-Lopez

Peng Kong Mah

James Maitland

James Kenneth Seymour

Andrew Stone

Amresh Subramaniam

Eu-Gene Toh

Emily Chu-Chun Tseng

Samuel Utere

Luke John Warren

Low Ley Yee

Date of next STA

Diploma Exam

Wednesday 13 April 2011

the low are both significant. The

problem in such a case is this: which

price should be recorded?

Some experts say that because it is

impossible to tell whether the high or

low came first during the time period,

the basic rule should be maintained,

namely: that in a column of X's the high

takes priority; and, in a column of O's

the low takes priority. Thus, in short, the

other prices should then be discarded.

This basic method works in most cases

because the market invariably catches

up and consequently the full price

movement is recorded in the following

columns. In short, the market confirms

upwards or downwards movement.

However, on some occasions this is not

the case and the P&F chart is left with

potentially incorrect support/resistance

levels. Indeed, some well known experts

in this field have said that although this

is a problem it should be ignored as it is

insurmountable.

Well, after years of study and a sudden

moment of realisation, I believe that I

have found a workable solution to this

insurmountable problem and I wish to

share my idea with colleagues. By

sharing my idea, I am hoping to see

whether my idea is robust enough to

withstand the scrutiny of others who are

also users of P&F charts. For simplicity, I

have called my idea the "RM Dot".

The "RM Dot"

The clear major advantage of P&F charts

is the ability to remove noise from the

market and give clear, unambiguous

indications of support/resistance and

entry/exit points. Because of these

significant advantages of P&F analysis

over and above other forms of analysis,

it is imperative that nothing is added to

the P&F chart which would detract from

these advantages or add in noise that

has been so successfully removed.

Now referring to the given example

charts [see chart Nos. 1 and 2]: as P&F

chart users will clearly see, Day 5 causes

the problem [i.e., an outside price

period the problem which has in the

past been described as insurmountable].

This is because in standard P&F charting

there is no record of the fact that the

price reached 90 and rallied to 125. The

reader of the chart could therefore make

the mistake of assuming that there is

support at 95. Thus, when the price

reaches 90 on Day 7, this could be a P&F

double bottom sell signal.

However, with the simple addition of the

"RM Dot", which shows 2 "Dots" in the

2nd column, we have a record of the

price reaching 90 and, thus, the P&F

double bottom sell signal could be

ignored until confirmation at, say, 85.

The great advantage, short of recording

full price movements, is that the addition

of "RM Dots" play no other part in the

P&F analysis; save the simple record that

the price, e.g., in my given example,

dropped to 90. The addition of the "RM

Dot" should, of course, only be made if

there is a blank box in the opposite

direction. If there is an "X" or "O" in

these boxes, then support/ resistance

has already been recorded and the prices

have no impact on support/resistance.

I trust that this brief introduction to the

"RM Dot", which I believe provides the

missing factor in the great value of P&F

analysis, is sufficient for you to

understand why I am enthusiastic about

its value and why I am keen to share the

idea with colleagues. I would welcome

all comments and further discussion.

Please feel free to email me on

Richard@rmmarketpredictions.com.

Even better, it would be great to see

some discussion played out in the

columns of this Journal.

The STA

Diploma Course

The STA Diploma Course will

commence in the New Year. The

course runs for one evening a

week over an 11 week period,

commencing 12 January 2011. The

course also includes an Exam

Preparation Day. The cost of the

January 2011 course is 2,695. The

course fee includes membership of

the STA for one year, the course

itself, the Exam Preparation Day

and Exam.

For further information, please

contact Katie Abberton on

info@sta-uk.org

7

MARKET TECHNICIAN

ISSUE 68 DECEMBER 2010

It has been noted that major trend

changes often exhibit an early

characteristic which distinguishes them

from mere corrections of the prevailing

trend. This is not true all the time but

many times it is. This characteristic is

that major trend reversals tend to occur

with an initial explosive change in price.

This is the initial lift-off stage.

Corrections can have this characteristic

too but it is more often the case that it

accompanies stronger longer term

cyclical market moves.

Expressed in another way, it is the angle

of ascent or descent compared to the

angle of the established trend which

helps differentiate the two types of

market activity. In a reversal, the angle

tends to be sharper in the direction of

the new trend than in the direction of

the dying trend. This is illustrated in the

diagram below:

The diagram above represents idealised

price activity during the tail-end of a

bear market. The price has been falling

but then bottoms out and rises again in

a countertrend rally. The major change

in trend is signalled by the rapid sudden

rise after the low. The y and z degrees

represent the angles of ascent and

descent and the odds favour the

occurrence of a reversal when y is

higher than z over the same period of

time. This can be represented

mathematically as:

Reversal = y degrees > z degrees (over

same time period).

Corrections tend to exhibit the opposite,

which means the angle of the main

trend tends to remain the more acute as

shown graphically below:

In this case the mode of market

behaviour could be represented

mathematically as

Correction = y degrees < z degrees

(over same time period).

In a way this makes perfect sense given

the initial drive required to change an

established trend. I found that where

this initial thrust was absent the odds

favoured the anticipation of merely a

corrective phase before resumption of

the existing trend.

The AMR works best on a longer term

monthly timescale. Looking at new highs

or lows and the bars on either side, it is

possible to make judgement about the

strength of a correction or reversal and

which category the market activity

might fall into.

Whilst it could be possible to measure

angles in real time and compare them,

this approach would be complicated to

develop although it provides an

exciting area for further research.

There is, however, a much simpler way

which avoids complex trigonometry and

yet encapsulates the core principle of

the idea of a sudden explosive change in

direction.

By simplifying the application of the

principle it can be adopted quite easily

as a strategy technique. Using the

height of price bars as a guide and using

monthly bars it is possible to measure

the rate of ascent and descent of a move

quickly and easily. At market turns,

where the price bar in the opposite

direction to the established trend is

stronger and higher then the preceding

bar it signals that the ascent is an AMR.

Where the bar is weaker it signals a

correction.

The charts below show how the principle

is applied in practice. Fig 1a represents

the initial green bar. The next

requirement is for another bar which

makes a new low/high, and a third bar

which fails to make a new high or low

and actually breaks down to below or

above the low/high of the first bar. This

signals a reversal. Figs 1a, b and c show

the progression of the bearish version of

the setup. The trigger for the analysis

techniques signal occurs at point a on

figure 1c.

Acute monthly reversals

(AMRs)

By Joaquin Monfort

Staying with the trend is the oft-stated goal of many an investment strategy

and this article proposes a long-term strategy technique applicable across

most markets which will aid investors in achieving precisely that. The results

below show a solid track record back-tested over the last eight to 30 years,

with consistent returns (see results below).

Fig 1a Fig 1c

Fig 1b

8

MARKET TECHNICIAN

ISSUE 68 DECEMBER 2010

shooting star produces a more likely

reversal opportunity and we would

move our stops and short trigger up

once again to the October lows but,

once again, the market remains bullish

and keeps rising. The next major

opportunity to go short occurs in March

08 but although there is a move down

the market fails to take out the February

lows so our long trades are still running.

Eventually in July 08 there is an acute

enough reversal to trigger the stops on

both our longs and open a short order.

After the devastating bear of 2008 the

market reverses in 09 but there is no

AMR to close out our shorts and open

any longs. Eventually in November 09

there is another acute decline which

opens a second short order so we are

short 2 contracts. Junes hammer

created another AMR set up which would

The bullish version is the inverse of the

above setup and is shown below:

The bullish buy signal would be

triggered at the high of candle 1: point b

on the diagram. A correction is

anticipated where the market fails to

break above either points a or b.

Variations

Apart from the classic set-ups described

above, I have included a variation.

Obviously the main principle is that the

market rebounds in a more acute move

to that which it preceded and so I have

widened the definition to include

monthly key reversals too. A monthly

key reversal is a bar which posts a new

high or low and then during the same

bar reverses posting a new low or high

respectively. Chart 1 shows a bearish

key reversal from the chart of the

GBP/USD.

The signal for the key reversal variant

works a little differently from that of the

classic 3-bar setup. Given that the usual

signal point has already been surpassed

by the 2nd key reversal bar, the signal

is given at the low/high of the key

reversal bar and is triggered when the

3rd bar passes below or above that

point.

Chart 2 is an illustration of some real

examples of AMRs using EUR/USD.

Trading the signals

The trading system derived from this

analysis technique is illustrated above

and derives its signals from the set-ups

themselves. This is because the

triggering of stops means de facto that

the reverse signal has been given and a

new order in the opposite direction is

triggered at the same time, thus the

trader is kept in the market for most of

the time. The monthly time-scale

reduces the number of whipsaws.

Were trading the signals in the above

chart of the EUR/USD, we would start by

placing a buy trigger order at the May

07 candle highs and our initial stop loss

at the June 07 candlestick lows. July

would have triggered our buy order

since it broke the May highs. August set

up another buy order with a lower low

and Septembers long marabuzo candle

would have triggered another buy order

at the July highs. We would now place

stops for both orders at the August lows.

At the end of October we would move

our stop up to the September lows in

the unlikely event that the market

turned around and came back down

rapidly triggering a short. Novembers

Fig 2a Fig 2c

Fig 2b

Chart 1: GBP/USD

Chart 2: Real examples of AMRs

MARKET TECHNICIAN

9 ISSUE 68 DECEMBER 2010

require a breach of Mays highs of

1.3342 a considerable reversal.

As can be seen from the example above,

this trading system is a simple low

maintenance turn-key style strategy

which is also quite good at keeping a

trader in the trend. All that is required

to operate the system is to check the

monthly charts at the end of each month

and move the stop-and-reverse orders

to the high or low of the last candle.

What is more, back-tested for major

currency pairs it has proven profitable

particularly for the dollar pairs.

Strategy notes

The signal created by the AMR can

either be used in conjunction with

other indicators or as a stand alone

investment strategy. The signal works

best in volatile markets so it could be

optimised using Average True Range to

avoid losing signals in sideways

markets.

If being used as a stand alone

investment strategy, the following

additional rules apply:

1) If a key reversal occurs, go back a

month before the first month to find

out the direction of the trend. If up

then the key reversal is bearish, if

down then bullish.

2) Allow for pyramiding: if multiple

signals occur in the same direction,

which is a feature of this strategy,

allow pyramiding. When a signal in

the opposite direction is triggered

then close all the trades in the

pyramid. Use the most recent trade

entry point for stop placement and

remember to make the stop/buy to

cover orders for all the contracts in

the pyramid!

Results

The table shows the results for various

periods up until July 2010. The start

dates were between 8 and 35 years

back, depending on the security in

question. The euro, for example, it is

eight years because it has a shorter

history compared to the others. The

results included a 1% commission cost

and 3% slippage costs.

Capital Requirements

Although trade size was set at 100,000

currency units, given that margin is

quite generous in the foreign exchange

market, the capital requirement varied

depending on the maximum drawdown

for the particular security. At the time of

writing (in Oct 2010) these maximum

draw-downs stood at $15,433.97 for the

USD/JPY, $10,551.00 for EUR/USD,

$48,430 for the GBP/USD and

$28,616.80 for the USD/CHF.

Risk/Reward

There was no strict constant static

risk/reward because the size of the

initiating candlestick could vary. Given

the moving stop beyond the first month,

the risk/reward varied after that too.

The results showed however that on

average the rewards far exceeded the

risks. But the actual probability success

rate hovered around the 50% or just

below and it was the greater reward that

made the strategy profitable rather than

a higher probability success rate. This

lends weight to the principle

underpinning the strategy that the AMR

is good at determining changes in trend

at an early stage. It is also highlights the

importance of overlaying any trading

system with a disciplined money

management approach i.e. letting

profits run and cutting losses.

Carry Trade Considerations

Interest accrued or deducted because of

interest rate differentials were also not

included or calculated although interest

for periods out of the market was set at

2% in the broker account. Brokers do

vary quite a lot however on what they

will pay you. Calculating carry trade

profit or loss would be a necessary

exercise to any serious application of the

strategy given the long periods in the

market.

Comparison with 5%

interest/annum

Taking the minimum capital

requirements above from the maximum

draw-down figures we can also assess

what the money would have earned had

it been placed in a savings account to

make a comparison. Below are the

results for an annual 5% return.

EUR/USD = $15,588.53

USD/JPY = $85,134.02

GBP/USD = $267,140.60

USD/CHF = $157,850.70

These show that, apart from the

EUR/USD pair which far outperformed a

regular savings account, the other pairs

spread over 35 years only beat the 5%

savings account by quite small amounts,

particularly in the case of GBP/USD but

crucially they did outperform the savings

account. This is particularly attractive in a

low interest rate environment when it is

increasingly hard to find assets yielding a

5% return.

Joaquin Monfort is an analyst for the

internet Forex broker

www.Forex4you.com

Results:

July 2010 EUR/USD USD/JPY GBP/USD USD/CHF

In US Dollars ($)

Gross Profit 58,691 281,570.00 528, 143.00 276,263.03

Gross Loss 10,711 79,069.00 156,491.50 99,933.35

Net Profit 47,980 202,501.00 371,651.50 176,329.68

Total no of trades 8 54 61 51

Profitable trades 4 24 27 25

Unprofitable trades 4 30 34 25

Avg winning trade 14,672.75 11,732.10 19,560.85 11,050.53

Avg losing trade 2,677.75 2,635.65 4,602.69 3,843.89

largest winning trade 21,477 58,332.60 83,210.00 59,031.09

largest losing trade 3,928 5,569.88 16,000.00 12,534.88

Open position P/L 48,920 0 0 2,189.23

Trading Period 8 yrs 35yrs 35yrs 35yrs

3 months, 1 day 3mon, 29 days 3mon, 29 days 3mon,29 days

Tradesize 100,000 100,000 100,000 100,000

(In units of currency)

MARKET TECHNICIAN

If major peaks form around the same

month, they will often be followed by

similar peak-panic intervals and market

outcomes, a trend that has held up very

well since 1895. Numerous examples

may be given of this phenomenon in US

financial history. The peaks in the Dow

Jones Industrial Average (DJIA) were

considered in relation to the ensuing

biggest one day rises and falls. The

annual one day post peak (AODPP) rise

and AODPP fall were taken as the

biggest one day percentage DJIA rise or

fall in the year after a major market top.

Seasonality was also appraised for DJIA

peaks and subsequent panics and

rallies. The timing of major DJIA peaks

by month and day (year ignored) is

hypothesised to have relevance on how

subsequent market trends develop.

On a technical note, the DJIA data are

based on closing values throughout

this article. Peaks at the beginning of a

bear market were sourced from

fiendbear.com for the 100 years to

1996, with additional DJIA peaks in

1998, 2000 and 2007 being inserted by

the author.

Peak AODPP Fall Intervals

If DJIA highs occurred near the same

month and day, then close parallels can

arise on how the ensuing market

unfolded. The September 3, 1929 and

August 25, 1987 record peaks provided

the best example, as both were followed

55 days later by the most spectacular

October panics in US history. The violent

market decline lasted only a few

months, with the DJIA hitting bottom on

November 13, 1929 and December 4,

1987.

An overall summary of peak AODPP

fall intervals for the DJIA is given in

Table 1 and Appendix 1. Some of the

parallels were quite remarkable as, for

example, the highs in 1895 1899,

1901 1946, 1906 2000 and 1929

1987.

Anomalies. DJIA peaks occurring at the

same time of the year will not always be

followed by comparable market

outcomes. Trends after the secular high

of September 3, 1929 aligned with those

experienced after August 25, 1987.

Comparisons could not be made with

outcomes after the September 4, 1895

or September 5, 1899 tops. Other peak

DJIA pairs did not produce parallelism:

The peak at the beginning of a bear market can be a key indicator for predicting

US market outcomes. This paper considers two key factors the intervals between

the peaks and ensuing panics, as well as the seasonal timing of these events.

DJIA peaks, seasonality

and market outcomes

By David McMinn

Table 1 DJIA peak pairs and market outcomes

High High Comments

Sep 04, 1895* Sep 05, 1899 AODPP rises and falls took place between Dec 18 and

Dec 23. The final lows were recorded on Aug 08, 1896

and Sep 24, 1900.

Jun 12, 1901 May 29, 1946 Two major one day falls six days apart occurred in early

September after each of the respective highs in June and

May. AODPP rises were recorded on Sep 16, 1901 and

Oct 15, 1946. The protracted bear markets persisted

until Nov 1903 and Jun 1949. Black Thursday occurred

on May 9, 1901 prior to the 1901 top, but this dramatic

spring event had no counterpart in 1946.

Jan 19, 1906 Jan 14, 2000 AODPP rises and falls occurred in the 7 weeks to May 4.

The parallels continued into the subsequent year, with

stock market tremors on Mar 14, 1907 (-8.29%) & Mar

12, 2001 (-4.10%) and major autumn panics in 1907

and 2001. Bear market lows took place on Nov 15, 1907

and Sep 21, 2001.

Nov 19, 1909 Nov 21, 1916 AODPP falls were experienced a few months later on Feb

07, 1910 and Feb 01, 1917. The final lows were reached

on Sep 25, 1911 and Nov 19, 1917.

Sep 30, 1912 Oct 09, 2007 Panics happened on Jan 20, 1913 and Jan 21, 2008. Both

bear markets were drawn-out and severe. In 1914, the

New York stock market was closed after the outbreak of

WWI, while the world financial system neared complete

collapse during Black October in 2008.

Nov 03, 1919 Nov 12, 1938 The AODPP falls were experienced on May 21, 1920 and

Apr 08, 1939. The parallels extended in the subsequent

year with major one day rises and falls taking place in

the two months to July 15.

Sep 03, 1929 Aug 25, 1987 The biggest stock market crashes in US history took

place some 55 days after these peaks. The dramatic

slumps were brief with post crash lows on Nov 13, 1929

and Dec 04, 1987.

Apr 06, 1956 Apr 27, 1981 There were no notable AODPP falls over -2.25% after

these peaks. Even so, similarities were experienced in

the subsequent year, with key falls on Oct 21, 1957 and

Oct 25, 1982. Final lows were recorded on Oct 22, 1957

and Aug 12, 1982.

Jan 05, 1960 Jan 10, 1973 The AODPP falls occurred on Sep 19, 1960 and Nov 26,

1973. Otherwise there were no resemblances between

the 1960 correction and the severe 1973-74 bear market.

Jul 16, 1990 Jul 17, 1998 AODPP falls were experienced on Aug 06, 1990 and Aug

31 1998 respectively. Both markets declined by around

-20% and the financial distress was short-lived with

lows on Oct 11, 1990 and Aug 31, 1998.

* High based on the 12 Stock Average index.

ISSUE 68 DECEMBER 2010 10

MARKET TECHNICIAN

11 ISSUE 68 DECEMBER 2010

September 12, 1939 and September

21, 1976; January 5, 1960 and January

10, 1973; December 13, 1961 and

December 3, 1968; January 10, 1973

and January 14, 2000.

The obvious question arises as to

whether the approach was valid or due

to coincidence. Statistical testing would

be very difficult to undertake to help

clarify this point. However, it seems

improbable that the numerous examples

in Table 1 would take place collectively

by chance. When the peak-panic

parallels do arise, they can be very

precise (eg: 1895 1899, 1901 1946,

1912 2007, 1929 1987 and so

forth). Importantly, some years cannot

be appraised because they contained no

significant AODPP falls over about -

2.25% (eg: after the 1956, 1968, 1976

and 1981 peaks).

The April 23, 2010 DJIA high marked

the beginning of yet another market

collapse and aligned most closely with

peaks on April 6, 1956 and April 27,

1981. No one day falls over -2.25%

were experienced in the year after the

tops in 1956 or 1981. Even so in the

month to June 5, 2010, there were

three days that registered falls

between -3.10% and -3.60%. (This

included the May 6 Flash Crash, when

the intra-day low plunged by over -

9.00%.) Given such inconsistencies,

the 2010 market decline may not follow

other historic DJIA bear markets that

commenced in April.

Seasonality

For all highs between February 1 and

September 10, the 23 ensuing AODPP

rises and falls (=> 2.00%) happened in

the half year commencing August 5,

with NO EXCEPTIONS (see Appendix 2).

This would be very unlikely to arise by

chance. For the DJIA peaks between

September 11 and January 31, most

ensuing AODPP rises and falls occurred

in the 6.5 months commencing January

20. (Table 2)

Remarkably, DJIA peaks between

February 1 and September 3 nearly

always had ensuing AODPP falls (=> -

2.00%) in the three months to October

31. The corresponding AODPP rises (=>

+2.00%) happened in September and

October, with two anomalies in January.

(Table 3)

Since 1910, major September-October

annual one day falls (=> -3.60%) were

preceded by a peak in one of three

ways:

A record high happened between

September 5 and October 31 and was

followed by an AODPP fall within 10

days. The associated downturn was a

brief correction (1927, 1955, 1986

and 1989).

If the record high occurred from July

15 to September 3, a major AODPP

fall took place some months later and

the market decline was usually

severe but only lasted a few months

(1929, 1987, 1997 and 1998).

If the market peak for the calendar

year happened between February 24

and May 31 and was not a record

high, then the ensuing autumn

AODPP fall was within a protracted

bear market (1931, 1937, 1946,

2001 and 2008).

NB: The annual one day fall is taken as

the biggest % one day fall in the year

commencing March 1.

Curiously, four autumn panics occurred

after market highs between May 1 and

June 12. Each consisted of two major

one day percentage falls six days apart.

The autumn panic of 1901 was triggered

by the assassination of President

McKinley and has been included,

together with the 1946, 2001 and 2008

events. (Table 4)

Conclusions

There was a notable propensity for

peak-panic intervals to be similar for

those bear markets beginning at the

same time of the year. As a trend it was

quite reliable surprising given the

simplicity of the approach. When the

peak-panic parallels do arise, they can

Table 2 DJIA highs, seasonality and AODPP falls

DJIA Highs DJIA AODPP Rises and Falls (a) No

Feb 01 Sep 10 Aug 05 Feb 05 23

Anomalies - -

Sep 11 Jan 31 Jan 20 Aug 05 22

Anomalies Nov 13, 1919, Sep 19, 1960, 4

Nov 26, 1973 & Dec 22, 1916

(a) AODPP rises and falls => 2.00%

Table 3

DJIA Highs AODPP Falls No AODPP Rises No

Feb 01 Sep 03 Aug 01 Oct 31 9 Sep 05 Oct 31 7

Anomalies Feb 01, 1982 1 Jan 28, 1982 Jan 17, 1991 2

Sep 04 Sep 10 Dec 18 23 2 Dec 18-23 2

Anomalies - - - -

Table 4

DJIA Peak 1st OD Fall % 2nd OD Fall % OD Rise %

Jun 12, 1901 Sep 07, 1901 -4.43 Sep 13, 1901 -4.27 Sep 16, 1901 +4.10

May 29, 1946 Sep 03, 1946 -5.56 Sep 09, 1946 -4.41 Oct 15, 1946 +3.58

May 21, 2001 * Sep 11, 2001 na Sep 17, 2001 -7.13 Sep 24, 2001 +4.47

May 02, 2008 * Oct 09, 2008 -7.33 Oct 15, 2008 -7.87 Oct 13, 2008 +11.08

(a) These intra bear market peaks were the high for the calendar year.

Abbreviation: OD One Day.

12 ISSUE 68 DECEMBER 2010

MARKET TECHNICIAN

be very precise. Unfortunately, the

peak-AODPP rise intervals had a poor

track record and only worked well on a

few occasions (eg: 1895-1899 and

1929-1987-1997). Thus it would be

spurious to use them as an indicator of

future AODPP rises.

Seasonality in the timing of major DJIA

tops and AODPP rises and falls was the

other notable finding. The peaks from

February 1 to September 3 were often

followed by AODPP rises and falls in the

three months to October 31. Peaks

taking place between September 11 and

January 31 usually had the ensuing

AODPP rise and falls in the 6.5 months

commencing January 20.

From the findings, major DJIA peaks

can be a useful indicator, when the

subsequent AODPP falls were most likely

to occur. The month and day when a

major peak formed at the beginning of a

bear market are crucial for comparisons

to be made to historic trends. However,

the relationship was not 100% accurate,

with historical anomalies being evident.

McMinn (2006, 2009) established strong

links between Moon-Sun cycles and

market cycles. Given the importance of

DJIA peak seasonality, the position of

the Sun on the ecliptical circle could be

hypothesised to be highly relevant in the

timing of US stock market peaks and

panics. (The Sun is at the same position

on the ecliptical circle at the same time

of the solar year.) Alas, the Moon-Sun

mathematics involved in market timing

is extremely complex and impossible to

unravel based on current knowledge.

References

fiendbear.com. DJIA Bear Markets of the

Past 100 Years.

www.fiendbear.com/bearenc1.htm

McMinn, David. Market Timing By The

Moon & The Sun. Twin Palms Publishing.

2006.

McMinn, David. Market Timing Moon

Sun Research 2006-2009. Privately

Published. 2009.

Appendix 1 DJIA peak AODPP fall intervals

1895 and 1899 Peaks

DJIA Peak AODPP Fall % AODPP Rise % BM Low

Sep 04, 1895 (a) Dec 20, 1895 -6.61 Dec 23, 1895 +4.37 Aug 08, 1896

Sep 05, 1899 Dec 18, 1899 -8.72 Dec 19, 1899 +4.72 Sep 24, 1900

1901 and 1946 Peaks

DJIA Peak AODPP Fall % OD Fall % AODPP Rise %

Jun 12, 1901 Sep 07, 1901 -4.43 Sep 13, 1901 -4.27 Sep 16, 1901 +4.10

May 29, 1946 Sep 03, 1946 -5.56 Sep 09, 1946 -4.41 Oct 15, 1946 +3.58

1906 and 2000 Peaks

DJIA Peak AODPP Fall % AODPP Rise % BM Low

Jan 19, 1906 Apr 27, 1906 -2.76 May 04, 1906 +3.04 Nov 15, 1907

May 01, 1906 -2.73

Jan 14, 2000 Apr 14, 2000 -5.64 Mar 16, 2000 +4.98 Sep 21, 2001

OD Fall % OD Rise % Panic

Jan 19, 1906 Mar 15, 1907 -8.72 Mar 16, 1907 +6.69 Oct 22, 1907

Jan 14, 2000 Mar 22, 2001 -4.08 Mar 26, 2001 +3.28 Sep 11, 2001

1909 and 1916 Peaks

DJIA Peak AODPP Fall % AODPP Rise %

Nov 19, 1909 Feb 07, 1910 -3.44 Jun 07, 1910 +2.99

Jul 28, 1910 +3.01

Nov 21, 1916 Feb 01, 1917 -7.24 Dec 22, 1916 +5.49

1912 and 2007 Peaks

DJIA Peak AODPP Fall % AODPP Rise %

Sep 30, 1912 Jan 20, 1913 -4.90 Jun 12, 1913 +3.01

Oct 09, 2007 Jan 21, 2008 (b) Mar 11, 2008 (c) +3.55

Mar 17, 2008 (c) +3.41

1919 and 1938 PEAKS

DJIA Peak AODPP Fall % AODPP Rise % OD Fall % OD Rise %

Nov 03 May 19 -4.22 Nov 13 +3.30 Jun 20 -3.49 Jul 06 +3.18

1919 1920 1919 1921 1921

Nov 12 Apr 08 -3.86 Sep 05 +7.26 May 14 -6.76 Jun 12 +4.74

1938 1939 1939 1940 1940

May 21 -6.78

1940

1929, 1987 and 1997 Peaks

DJIA Peak AODPP Fall % AODPP Rise % PC Low

Sep 03, 1929 Oct 28, 1929 -12.83 Oct 30, 1929 +12.24 Nov 13,1929

Aug 25, 1987 Oct 19, 1987 -22.61 Oct 21, 1987 +10.17 Dec 04, 1987

Aug 06, 1997 Oct 27, 1997 -7.18 Oct 28, 1997 +4.71 Nov 12, 1997

1956 and 1981 Peaks

DJIA Peak OD Fall % OD Rise % BM Low

Apr 06, 1956 Oct 21, 1957 -2.48 Oct 23, 1957 +4.12 Oct 22, 1957

Apr 27, 1981 Oct 25, 1982 -3.52 Aug 17, 1982 +4.90 Aug 22, 1982

1990 and 1998 Peaks

DJIA Peak AODPP Fall % AODPP Rise % PC Low

Jul 16, 1990 Aug 06, 1990 -3.32 Jan 17, 1991 +4.57 Oct 11, 1990

Jul 18, 1998 Aug 31, 1998 -6.63 Sep 08, 1998 +4.98 Sep 10, 1998

(a) Peak based on the 12 Stock Average index.

(b) Worldwide stock market panics occurred on January 21, 2008. However, the US market was

closed on the day due to Martin Luther King Jnr holiday. Even so, this date was taken as the

DJIA AODPP fall for 2007.

(c) The two biggest percentage one day rises in the 11 months after the Oct 09, 2007 high.

Abbreviations: BM Low Bear Market Low; PC Low Post Crash Low.

AODPP annual one day; OD one day.

Source: McMinn, 2009.

Bytes and

Pieces

Maximize your profits with

Omnitrader 2011

Nirvana Systems Omnitrader now

comes with a new dynamic profits

module that maximises the potential

profit in every trade by allowing

optimisation of systems, filters,

confirmers and stop exits. This uses

the adaptive reasoning module to

derive the optimal parameters via

a dynamic optimisation that can

constantly adapt to new market

conditions. For details, see:

http://www.omnitrader.com/up

grade/OT2011.pdf

Trade with Precision

Head trader Nick McDonald presents

free training online to those who

open an account with the brokerage

firm ICE Futures. He aims to give

people a real feel for trading the

markets. So, for the price of a trade,

you get free training. For those with

a large enough brokerage account,

two complimentary trading videos

are available via the following link.

http://www.tradewithprecision.

com/ice_market_outlook.

Tick-Tock

ProRealTime is an excellent online

charting and technical analysis

program that allows system testing

using real-time data down to tick

level for stocks, futures, indices and

currencies. The integrated data

handling makes this pack a pleasure

to use.

www.prorealtime.com/

Gannalyst Pro 5.0 is now free

It is not often that you get a

$500 technical analysis program

(especially one that has a set of

Gann Tools) free of charge

although donations are welcome.

This is a firm favourite technical

analysis package as its professionally

programmed. There is also free

training available with a Gann slant

no doubt.

http://www.gannalyst.com/

MARKET TECHNICIAN

13 ISSUE 68 DECEMBER 2010

Appendix 2 DJIA peaks and ensuring AODPP rises and falls (a)

DJIA High DJIA AODPP Fall % Fall DJIA AODPP Rise % Rise

Feb 09, 1966 Oct 03, 1966 -2.10 Oct 12, 1966 +2.58

Mar 10, 1937 Oct 18, 1937 -7.75 Oct 20, 1937 +6.07

Apr 06, 1956 (b) - (b) -

Apr 27, 1981 (c) Aug 24, 1981 -2.23 Jan 28, 1982 +2.56

Feb 01, 1982 -2.22

May 29, 1946 Sep 03, 1946 -5.56 Oct 15, 1946 +3.58

Jun 12, 1901 Sep 07, 1901 -4.43 Sep 16, 1901 +4.10

Jul 16, 1990 Aug 06, 1990 -3.32 Jan 17, 1991 +4.57

Jul 17, 1998 Aug 31, 1998 -6.63 Sep 08, 1998 +4.98

Aug 25, 1987 Oct 19, 1987 -22.61 Oct 21, 1987 +10.17

Sep 03, 1929 Oct 28, 1929 -12.83 Oct 30, 1929 +12.34

Sep 04, 1895 (d) Dec 20, 1895 -6.61 Dec 23, 1895 +4.73

Sep 05, 1899 Dec 18, 1899 -8.72 Dec 19, 1899 +4.72

Sep 12, 1939 (c) May 14, 1940 -6.76 Jun 12, 1940 +6.73

May 21, 1940 -6.78

Sep 21, 1976 (b) - (b) -

Sep 30, 1912 Jan 20, 1913 -4.90 Jun 12, 1913 +3.01

Oct 09, 2007 (e) Jan 21, 2008 (f) Mar 11, 2008 +3.55

Mar 17, 2008 +3.51

Nov 03, 1919 May 21, 1920 -4.21 Nov 13, 1919 +3.30

Nov 12, 1938 Apr 08, 1939 -3.86 Jul 17, 1939 +3.41

Nov 19, 1909 Feb 07, 1910 -3.44 Jul 28, 1910 +3.01

Nov 21, 1916 Feb 01, 1917 -7.24 Dec 22, 1916 +5.49

Dec 03, 1968 (b) - (b) -

Dec 13, 1961 May 28, 1962 -5.71 May 29, 1962 +4.68

Jan 05, 1960 Sep 19, 1960 -2.56 (b) -

Jan 11, 1973 Nov 26, 1973 -3.40 May 24, 1973 +3.27

Jan 14, 2000 Apr 14, 2000 -5.64 Mar 16, 2000 +4.98

Jan 19, 1906 (c) Apr 27, 1906 -2.76 May 04, 1906 +3.04

May 01, 1906 -2.73

(a) The ensuing AODPP rise and AODPP fall were taken as the biggest one day percentage

change in the year after the peak at the beginning of a DJIA bear market.

(b) No AODPP rise and/or AODPP fall over 2.00% took place in the year after the peak.

(c) Two almost identical percentage AODPP falls occurred after the highs in 1906, 1939 and

1981.

(d) Based on the 12 Stock Average index.

(e) Two AODPP rises of about +3.50% were recorded in mid-March. They were the biggest one

day rises in the 11 months after the Oct 9, 2007 peak.

(f) Major one day falls were recorded worldwide on January 21, 2008. However, the US stock

market was closed due to the Martin Luther King Jr holiday. Even so, this date was taken as

the DJIA AODPP fall for 2007.

Source: McMinn, 2009.

NETWORKING

CHAIRMAN

Deborah Owen.....................................................................................................editor@irc100.com

VICE-CHAIRMAN

Axel Rudolph.........................................................................axel.rudolph@commerzbank.com

TREASURER

Simon Warren ....................................................................................................warrens@bupa.com

PROGRAMME ORGANISATION

Axel Rudolph.........................................................................axel.rudolph@commerzbank.com

Mark Tennyson-d'Eyncourt...............................................................deynvest@hotmail.co.uk

LIBRARY

John Douce: .........................................................................................................jdmjd@tiscali.co.uk

Clive Lambert..........................................................................................clive@futurestechs.co.uk

EDUCATION

Axel Rudolph.........................................................................axel.rudolph@commerzbank.com

Guido Riolo............................................................................................guidoriolo@bloomberg.net

IFTA LIAISON

Robin Griffiths................................................................robin.griffiths@cazenovecapital.com

MARKETING

Karen Jones.............................................................................karen.jones@commerzbank.com

Clive Lambert..........................................................................................clive@futurestechs.co.uk

Adam Sorab................................................................................................adam.sorab@cqsm.com

MEMBERSHIP

Simon Warren ....................................................................................................warrens@bupa.com

REGIONAL CHAPTERS

SCOTLAND: Alasdair McKinnon............................................................AMcKinnon@sit.co.uk

IRELAND: Robert Reid...................................................................robertreid64@gmail.com

COMPANY SECRETARY

Mark Tennyson-dEyncourt...............................................................deynvest@hotmail.co.uk

STA JOURNAL

Editor, Deborah Owen......................................................................................editor@irc100.com

WEBSITE

David Watts.........................................................................................................DWattsUK@aol.com

Simon Warren ....................................................................................................warrens@bupa.com

Deborah Owen.....................................................................................................editor@irc100.com

Please keep the articles coming in the success of the Journal

depends on its authors, and we would like to thank all those who

have supported us with their high standard of work. The aim is to

make the Journal a valuable showcase for members research as

well as to inform and entertain readers.

The Society is not responsible for any material published in The Market

Technician and publication of any material or expression of opinions does not

necessarily imply that the Society agrees with them. The Society is not

authorised to conduct investment business and does not provide investment

advice or recommendations.

Articles are published without responsibility on the part of the Society, the editor

or authors for loss occasioned by any person acting or refraining from action as

a result of any view expressed therein.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Market Technician No 54Документ13 страницMarket Technician No 54ppfahdОценок пока нет

- Market Technician No 56Документ16 страницMarket Technician No 56ppfahd100% (1)

- Market Technician No 51Документ12 страницMarket Technician No 51ppfahd100% (3)

- Market Technician No38Документ16 страницMarket Technician No38ppfahdОценок пока нет

- Market Technician No42Документ16 страницMarket Technician No42ppfahdОценок пока нет

- Market Technician No 55Документ12 страницMarket Technician No 55ppfahd100% (2)

- Market Technician No 45Документ20 страницMarket Technician No 45ppfahd100% (2)

- Market Technician No 48Документ12 страницMarket Technician No 48ppfahdОценок пока нет

- Market Technician No40Документ20 страницMarket Technician No40ppfahd100% (1)

- Market Technician No 44Документ16 страницMarket Technician No 44ppfahdОценок пока нет

- Market Technician No 46Документ16 страницMarket Technician No 46ppfahdОценок пока нет

- Channel Centred Ma2Документ9 страницChannel Centred Ma2ppfahdОценок пока нет

- Bowel Detox (2009)Документ114 страницBowel Detox (2009)Thompson E Ighalo100% (3)

- Cogen17 CДокумент2 страницыCogen17 CppfahdОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Squirrel Cage Induction Motor Preventive MaintenaceДокумент6 страницSquirrel Cage Induction Motor Preventive MaintenaceNishantPareekОценок пока нет

- Getting StartedДокумент45 страницGetting StartedMuhammad Owais Bilal AwanОценок пока нет

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEДокумент1 страницаMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VОценок пока нет

- How To Control A DC Motor With An ArduinoДокумент7 страницHow To Control A DC Motor With An Arduinothatchaphan norkhamОценок пока нет

- 450i User ManualДокумент54 страницы450i User ManualThượng Lê Văn0% (2)

- Republic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1Документ4 страницыRepublic of The Philippines National Capital Judicial Region Regional Trial Court Manila, Branch 1brendamanganaanОценок пока нет

- Level 3 Repair: 8-1. Block DiagramДокумент30 страницLevel 3 Repair: 8-1. Block DiagramPaulo HenriqueОценок пока нет

- ACIS - Auditing Computer Information SystemДокумент10 страницACIS - Auditing Computer Information SystemErwin Labayog MedinaОценок пока нет

- Electricity 10thДокумент45 страницElectricity 10thSuryank sharmaОценок пока нет

- Ludwig Van Beethoven: Für EliseДокумент4 страницыLudwig Van Beethoven: Für Eliseelio torrezОценок пока нет

- 48 Volt Battery ChargerДокумент5 страниц48 Volt Battery ChargerpradeeepgargОценок пока нет

- Shubham RBSEДокумент13 страницShubham RBSEShubham Singh RathoreОценок пока нет

- CI Principles of EconomicsДокумент833 страницыCI Principles of EconomicsJamieОценок пока нет

- Executive Summary - Pseudomonas AeruginosaДокумент6 страницExecutive Summary - Pseudomonas Aeruginosaapi-537754056Оценок пока нет

- Sourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyДокумент58 страницSourcing Decisions in A Supply Chain: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiОценок пока нет

- CS321 Computer ArchitectureДокумент160 страницCS321 Computer ArchitectureAnurag kumarОценок пока нет

- Astm E53 98Документ1 страницаAstm E53 98park991018Оценок пока нет

- 2.1 Components and General Features of Financial Statements (3114AFE)Документ19 страниц2.1 Components and General Features of Financial Statements (3114AFE)WilsonОценок пока нет

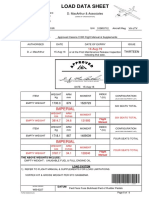

- Load Data Sheet: ImperialДокумент3 страницыLoad Data Sheet: ImperialLaurean Cub BlankОценок пока нет

- HandloomДокумент4 страницыHandloomRahulОценок пока нет

- Gabby Resume1Документ3 страницыGabby Resume1Kidradj GeronОценок пока нет

- Everlube 620 CTDSДокумент2 страницыEverlube 620 CTDSchristianОценок пока нет

- Building and Other Construction Workers Act 1996Документ151 страницаBuilding and Other Construction Workers Act 1996Rajesh KodavatiОценок пока нет

- Richards Laura - The Golden WindowsДокумент147 страницRichards Laura - The Golden Windowsmars3942Оценок пока нет

- Information Security Chapter 1Документ44 страницыInformation Security Chapter 1bscitsemvОценок пока нет

- Introduction To Motor DrivesДокумент24 страницыIntroduction To Motor Drivessukhbat sodnomdorjОценок пока нет

- The Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and CountriesДокумент13 страницThe Effectiveness of Risk Management: An Analysis of Project Risk Planning Across Industries and Countriesluisbmwm6Оценок пока нет

- Gardner Denver PZ-11revF3Документ66 страницGardner Denver PZ-11revF3Luciano GarridoОценок пока нет

- Cic Tips Part 1&2Документ27 страницCic Tips Part 1&2Yousef AlalawiОценок пока нет

- Apm p5 Course NotesДокумент267 страницApm p5 Course NotesMusumbulwe Sue MambweОценок пока нет