Академический Документы

Профессиональный Документы

Культура Документы

Ias-10: Events After The Reporting Period: Scope

Загружено:

nnwritiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Ias-10: Events After The Reporting Period: Scope

Загружено:

nnwritiАвторское право:

Доступные форматы

IAS-10: EVENTS AFTER THE REPORTING PERIOD

Scope

This standard shall be applied for accounting for and disclosure of the events after the

reporting period.

Key Definitions

Event after the reporting period: An event, which could be favorable or unfavorable, that

occurs between the end of the reporting period and the date that the financial statements

are authorized for issue.

Adjusting event: An event after the reporting period that provides further evidence of

conditions that existed at the end of the reporting period, including an event that indicates

that the going concern assumption in relation to the whole or part of the enterprise is not

appropriate.

Non-adjusting event: An event after the reporting period that is indicative of a condition

that arose after the end of the reporting period.

Date of authorization

There may be different date in between BS date and AGM. Authorization date is the date

Mgt authorizes the FS.

Recognition and Measurement

An entity shall adjust the amounts recognized in the financial statement to reflect

adjusting event after the period.

Examples of adjusting events are :

a) A court case that meet the definition of provision as per IAS 37.

b) Bankruptcy of a customer after the reporting period.

c) Do not adjust for non-adjusting events : events or conditions that arose after the

end of the reporting period. For example:

d) If an entity declares dividends after the reporting period, the entity shall not recognize

those dividends as a liability at the end of the reporting period. That is a non-adjusting

event.

Going Concern Issues Arising After End of the Reporting Period

An entity shall not prepare its financial statements on a going concern basis if

management determines after the end of the reporting period either that it intends to

liquidate the entity or to cease trading, or that it has no realistic alternative but to do so.

Disclosure

Non-adjusting events should be disclosed if they are of such importance that non-

disclosure would affect the ability of users to make proper evaluations and decisions. The

required disclosure is (a) the nature of the event and (b) an estimate of its financial effect

or a statement that a reasonable estimate of the effect cannot be made.

A company should update disclosures that relate to conditions that existed at the end of

the reporting period to reflect any new information that it receives after the reporting

period about those conditions.

Companies must disclose the date when the financial statements were authorized for issue

and who gave that authorization. If the enterprise's owners or others have the power to

amend the financial statements after issuance, the enterprise must disclose that fact.

Some example of events after BS:

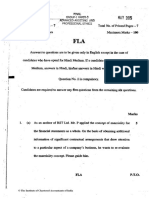

. For each of the following material items state whether adjustments or disclosure is

required as per IAS 10 in the 30th June 2008 financial statements. If adjustment is

required state the nature of the adjustments that is the effect on the elements of the

financial statements. In case of disclosure, write down the nature of the disclosure.

Directors approved the financial statements on July 20 and AGM date is August 10.

a) On July 2, 2008 directors proposed a cash dividend of Taka 10,000

b) On 3 July 2008, directors approved the sale of an off-shore agency to another entity at

a profit of Taka 30,000.

c) On 10 July 2008 the companys country warehouse was destroyed by fire. The

carrying value of the warehouse is Taka 300,000.

d) On July10, the final cost of the inventory shipped from the overseas was determined.

The inventory was received during June. The revised cost was Taka 90,000 greater than

the prior estimate.

e) A verdict was given in 15 July in high court in relation to a product liability case

brought by a customer against the company which costs a compensation of Taka 270,000

Вам также может понравиться

- Chapter 12 - Events After The Reporting PeriodДокумент3 страницыChapter 12 - Events After The Reporting PeriodFerb CruzadaОценок пока нет

- Tutorial Event After Reporting Period Week 7Документ10 страницTutorial Event After Reporting Period Week 7Anna RomanОценок пока нет

- Events After The Reporting Period (IAS 10)Документ16 страницEvents After The Reporting Period (IAS 10)AbdulhafizОценок пока нет

- IAS 10 Events After The Reporting Period-A Closer LookДокумент7 страницIAS 10 Events After The Reporting Period-A Closer LookFahmi AbdullaОценок пока нет

- NAS 10 IFRS Reference NoteДокумент11 страницNAS 10 IFRS Reference NoteSujan ShresthaОценок пока нет

- MFRS 110 After Reporting PeriodДокумент15 страницMFRS 110 After Reporting PeriodDont RushОценок пока нет

- Cfas Chapeter Exam Events After Reporting PeriodДокумент2 страницыCfas Chapeter Exam Events After Reporting PeriodCASTILLO, MA. CHEESA D.Оценок пока нет

- Session 8Документ12 страницSession 8Adil AnwarОценок пока нет

- IAS 10-Events After The Reporting PeriodДокумент15 страницIAS 10-Events After The Reporting Periodtmandikutse04Оценок пока нет

- Ias 10 Events After The Reporting Period SummaryДокумент2 страницыIas 10 Events After The Reporting Period Summaryanon_806011137Оценок пока нет

- Ias 10Документ12 страницIas 10Reever RiverОценок пока нет

- Realizable Value at The End of Reporting PeriodДокумент3 страницыRealizable Value at The End of Reporting PeriodJustine VeralloОценок пока нет

- PAS 10 UpdatedДокумент16 страницPAS 10 Updatedadulusman501Оценок пока нет

- MPRA Paper 36783Документ8 страницMPRA Paper 36783ksmuthupandian2098Оценок пока нет

- Events After The Reporting Period (MFRS)Документ14 страницEvents After The Reporting Period (MFRS)ShasabellaОценок пока нет

- 15 As4Документ7 страниц15 As4Selvi balanОценок пока нет

- NAS 10 - SummaryДокумент2 страницыNAS 10 - Summarysitoulamanish100Оценок пока нет

- Objective: Events After The Reporting PeriodДокумент3 страницыObjective: Events After The Reporting PeriodoussoussОценок пока нет

- Modul Xiv Audit Lanjutan Ing, 2020Документ20 страницModul Xiv Audit Lanjutan Ing, 2020Ismail MarzukiОценок пока нет

- Chapter 12 Events After The Reporting Period PDFДокумент4 страницыChapter 12 Events After The Reporting Period PDFAthena LansangОценок пока нет

- Events After The Reporting PeriodДокумент4 страницыEvents After The Reporting PeriodGlen JavellanaОценок пока нет

- Chapter 21 - Events After The Reporting PeriodДокумент2 страницыChapter 21 - Events After The Reporting PeriodNazrin HasanzadehОценок пока нет

- C12 - PAS 10 Events After The Reporting PeriodДокумент3 страницыC12 - PAS 10 Events After The Reporting PeriodAllaine Elfa100% (1)

- Pas-10 and Pas-24Документ8 страницPas-10 and Pas-24Karysse ArielleОценок пока нет

- Accounting Standards: 2.1 AS 4: Contingencies and Events Occurring After The Balance Sheet DateДокумент0 страницAccounting Standards: 2.1 AS 4: Contingencies and Events Occurring After The Balance Sheet DateThéotime HabinezaОценок пока нет

- Pas 10Документ10 страницPas 10Justine VeralloОценок пока нет

- Nas 10Документ11 страницNas 10anujnepal9595Оценок пока нет

- Events After The Reporting Period: By:-Yohannes NegatuДокумент13 страницEvents After The Reporting Period: By:-Yohannes NegatuEshetie Mekonene AmareОценок пока нет

- As 4Документ8 страницAs 4Rajiv JhaОценок пока нет

- Ias 10 & 37 - 1Документ4 страницыIas 10 & 37 - 1Abdullah QureshiОценок пока нет

- Toa Lecture 7 Ias 10Документ5 страницToa Lecture 7 Ias 10Rachel LeachonОценок пока нет

- Chapter 8 IAS 10 & 37Документ25 страницChapter 8 IAS 10 & 37Sundas UmairОценок пока нет

- Events After Reporting PeriodДокумент4 страницыEvents After Reporting PeriodSandia EspejoОценок пока нет

- Cape Accounting Unit 1 NotesДокумент27 страницCape Accounting Unit 1 NotesDajueОценок пока нет

- LKAS 10 Events After The Reporting Period LKAS 37 Provisions, Contingent Liabilities Contigent AssetsДокумент63 страницыLKAS 10 Events After The Reporting Period LKAS 37 Provisions, Contingent Liabilities Contigent AssetsKogularamanan NithiananthanОценок пока нет

- Indian Accounting Standard (Ind AS) 10 Events After The Reporting PeriodДокумент13 страницIndian Accounting Standard (Ind AS) 10 Events After The Reporting PeriodNikhil BabuОценок пока нет

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Документ23 страницыReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydОценок пока нет

- Ias 10Документ1 страницаIas 10Muhammad Farooq ZaheerОценок пока нет

- 1693016198provisions, Contingencies, and Events After The Reporting PeriodДокумент28 страниц1693016198provisions, Contingencies, and Events After The Reporting PeriodChamil SureshОценок пока нет

- 150.events After The Reporting PeriodДокумент6 страниц150.events After The Reporting PeriodMelanie SamsonaОценок пока нет

- 2022 Ias 10Документ4 страницы2022 Ias 10gmimranhossain996Оценок пока нет

- Chapter 3 - Events After The Reporting PeriodДокумент8 страницChapter 3 - Events After The Reporting PeriodNURKHAIRUNNISAОценок пока нет

- IPSAS 14 Events After ReportingДокумент13 страницIPSAS 14 Events After ReportingKibromWeldegiyorgisОценок пока нет

- Chap 21 - Events After The RPДокумент17 страницChap 21 - Events After The RPK60 Triệu Thùy LinhОценок пока нет

- IAS 10 Presentation. RecoveryДокумент16 страницIAS 10 Presentation. Recoverysaidkhatib368Оценок пока нет

- Chapter 13Документ2 страницыChapter 13Vince PeredaОценок пока нет

- Answer Key Week 3Документ15 страницAnswer Key Week 3Chin FiguraОценок пока нет

- Chapter 5 FA5Документ6 страницChapter 5 FA5ra raОценок пока нет

- Ias 10 Events After The Reporting Period: Fact SheetДокумент8 страницIas 10 Events After The Reporting Period: Fact SheetRJОценок пока нет

- Events After BS DATE Recognition and Measurement From WWWДокумент8 страницEvents After BS DATE Recognition and Measurement From WWWszn1Оценок пока нет

- IAS 10 - Events After The Reporting PeriodДокумент1 страницаIAS 10 - Events After The Reporting Periodm2mlckОценок пока нет

- Ias 10Документ15 страницIas 10hasan sohailОценок пока нет

- CAPE Accounting Unit 1 NotesДокумент27 страницCAPE Accounting Unit 1 Notessashawoody16779% (14)

- Module 017 Week006-Finacct3 Notes To The Financial StatementsДокумент5 страницModule 017 Week006-Finacct3 Notes To The Financial Statementsman ibeОценок пока нет

- Events After The Reporting PeriodДокумент18 страницEvents After The Reporting PeriodShara Mae SameloОценок пока нет

- Tutorial 8 Q & AДокумент3 страницыTutorial 8 Q & Achunlun87Оценок пока нет

- Chapter 18Документ49 страницChapter 18John TomОценок пока нет

- 18 Completing The AuditДокумент7 страниц18 Completing The Auditrandomlungs121223Оценок пока нет

- Answer Key Week 3Документ14 страницAnswer Key Week 3Luigi Enderez Balucan100% (2)

- Nirma and HLLДокумент20 страницNirma and HLLSrivastav GauravОценок пока нет

- Working Capital ManagementДокумент63 страницыWorking Capital ManagementVimala Selvaraj VimalaОценок пока нет

- Identification and Dating of Japanese Glass Beverage BottlesДокумент11 страницIdentification and Dating of Japanese Glass Beverage BottlesdukegarrikОценок пока нет

- Ecgc BrochureДокумент12 страницEcgc BrochureSankara NarayananОценок пока нет

- 2800 Horizontal Split Case Pumps PerformanceДокумент40 страниц2800 Horizontal Split Case Pumps PerformanceEsteban Calderón Navarro100% (1)

- GSCG Casebook (Oct 2015)Документ150 страницGSCG Casebook (Oct 2015)yahya_c100% (3)

- Callmate TelipsДокумент3 страницыCallmate TelipsMuhammad UmarОценок пока нет

- FIДокумент74 страницыFIIndianhoshi HoshiОценок пока нет

- Code of Conduct MahindraДокумент38 страницCode of Conduct MahindradhaneshОценок пока нет

- HCHCHDH/BCJCДокумент82 страницыHCHCHDH/BCJCSapna BishnoiОценок пока нет

- Marca Hellmann'sДокумент6 страницMarca Hellmann'sCata MilleОценок пока нет

- Form CHG-1-16032017 Signe Cfil CДокумент6 страницForm CHG-1-16032017 Signe Cfil CsunjuОценок пока нет

- 1Документ8 страниц1neelamОценок пока нет

- Commissioner of Internal Revenue vs. McGeorge Food Industries, Inc.Документ7 страницCommissioner of Internal Revenue vs. McGeorge Food Industries, Inc.Jonjon BeeОценок пока нет

- The Integrated Report FrameworkДокумент5 страницThe Integrated Report FrameworkteslimsОценок пока нет

- Synopsis ON "Role and Need of Merchant Bankers in Ipo: M.Rajashekar (REG NO. 11SLCMA104)Документ7 страницSynopsis ON "Role and Need of Merchant Bankers in Ipo: M.Rajashekar (REG NO. 11SLCMA104)shiva7363Оценок пока нет

- Introduction and DefinitionsДокумент7 страницIntroduction and DefinitionsmandeepОценок пока нет

- Maldives SME Development ProjectДокумент109 страницMaldives SME Development ProjectAdam KhaleelОценок пока нет

- Application For Certificate of Compliance General RequirementsДокумент3 страницыApplication For Certificate of Compliance General RequirementsDan SantosОценок пока нет

- Returns To Alternative Savings VehiclesДокумент18 страницReturns To Alternative Savings VehiclesDownloadОценок пока нет

- Wheel of Retailing and Accordian TheoryДокумент11 страницWheel of Retailing and Accordian TheoryKarthick PОценок пока нет

- J K Family TreeДокумент6 страницJ K Family TreeSurinder VermaОценок пока нет

- Economic SurveyДокумент4 страницыEconomic SurveyPAPAGRAND MOVERS CORP.Оценок пока нет

- BSP GSSM MatrixДокумент13 страницBSP GSSM MatrixSahr33nОценок пока нет

- Problem 1246 Dan 1247Документ2 страницыProblem 1246 Dan 1247Gilang Anwar HakimОценок пока нет

- Grant Thornton Dealtracker Q1 2016Документ59 страницGrant Thornton Dealtracker Q1 2016sherwinmitraОценок пока нет

- 2013.09.20 Letter To SEC Chair WhiteДокумент4 страницы2013.09.20 Letter To SEC Chair WhiteJoe WallinОценок пока нет

- East West Bancorp SWOT Analysis 1Документ2 страницыEast West Bancorp SWOT Analysis 1Dioner RayОценок пока нет

- Study Case - HavaianasДокумент15 страницStudy Case - HavaianasIsabela MattosОценок пока нет

- Database - Abu DhabiДокумент28 страницDatabase - Abu Dhabimarketing0% (1)