Академический Документы

Профессиональный Документы

Культура Документы

General Effect of The Exclusions: Section 201

Загружено:

inbox99990 оценок0% нашли этот документ полезным (0 голосов)

4 просмотров1 страницаrestr

Оригинальное название

480-2014 (7)

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документrestr

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

4 просмотров1 страницаGeneral Effect of The Exclusions: Section 201

Загружено:

inbox9999restr

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

Page 7

General effect of the exclusions

1.16

The general effect of the exclusions is that they remove from the special rules:

full-time working directors of any concerns

members of committees who are treated as directors of unincorporated

bodies or non-profit making concerns

directors of charities

provided that

the individuals are not remunerated at a rate of 8,500 or more a year

calculated in accordance with paragraph 1.7(b), and

they do not hold a material interest in the body or concern

employing them.

This paragraph should be read subject to the reservation in

paragraph 1.13 above.

Employees

1.17

The special provisions apply to an employee if, for the appropriate tax year,

the remuneration together with all expenses payments made to him or her

and benefits provided for him or her amounts in all to 8,500 or more a year

before deducting any expenses allowable for Income Tax. The special rules

also apply to any of the full-time working directors or directors of charities

or non-profit making concerns excluded under paragraphs 1.11 to 1.16

whose rate of remuneration is similarly 8,500 or more a year.

1.18

In this connection, all employments held by an individual under the same

employer are treated as a single employment for the purposes of the

8,500 remuneration limit. Similarly, where an individual holds a number

of employments with interconnected companies, these employments are

regarded as if they were one employment for the purpose of deciding

whether the individual is paid at a rate of 8,500 or more. And if any of

the individuals employments with the same employer or with an associated

employer is not an excluded employment, the individual will be within the

scope of the special rules in respect of all those employments.

Exclusion of certain employees from the special rules

1.19

If an employees remuneration does not amount to 8,500 or more a

year, the employment is a lower-paid employment. In this context the

term employee does not apply to a director (paragraph 1.8). A lower-paid

employment is an excluded employment to which the special rules in the

benefits code do not apply, with the exception of the provision of living

accommodation and vouchers or credit tokens.

Meaning of employment

1.20

The word employment as used in this booklet means any office or

employment whose earnings are chargeable as employment income.

Section 201(2)

Section 220

Section 63(4)

Section 216(1)

Section 63(2)

Section 66(3)

Вам также может понравиться

- Non Taxable Employee BenefitsДокумент7 страницNon Taxable Employee BenefitsGeomari D. BigalbalОценок пока нет

- A Practical Experience On PF, Esi, Pension, and GratuityДокумент16 страницA Practical Experience On PF, Esi, Pension, and GratuitySunil Aggarwal91% (11)

- Business Valuation of Qantas Airways LimitedДокумент4 страницыBusiness Valuation of Qantas Airways LimitedRyanОценок пока нет

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionОт EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionОценок пока нет

- Concept of Salary Under Income Tax ActДокумент29 страницConcept of Salary Under Income Tax ActMaaz Alam100% (1)

- Payment of Bonus ActДокумент7 страницPayment of Bonus Actarihant_219160175100% (1)

- Income From Salary-FinalДокумент42 страницыIncome From Salary-FinalPrathibha TiwariОценок пока нет

- Concept of Salary Under Income Tax ActДокумент30 страницConcept of Salary Under Income Tax ActChirag Madan100% (8)

- RajputДокумент19 страницRajputSANDEEP SINGH CHAUHANОценок пока нет

- Jamia Millia Islamia: Project On Salaries (Session-2018-2019)Документ21 страницаJamia Millia Islamia: Project On Salaries (Session-2018-2019)Harshit AgarwalОценок пока нет

- Top 500 Taxpayers in The Philippines 2012Документ8 страницTop 500 Taxpayers in The Philippines 2012Mykiru IsyuseroОценок пока нет

- Sections 336-338: Deductible ExpensesДокумент1 страницаSections 336-338: Deductible Expensesinbox9999Оценок пока нет

- Excelconsultancyservices - Co.in-Payment of Bonus - FAQsДокумент6 страницExcelconsultancyservices - Co.in-Payment of Bonus - FAQshello everyoneОценок пока нет

- Tax Law UTKARSHДокумент20 страницTax Law UTKARSHrishiraj singhОценок пока нет

- FAQ On Payment of Bonus ActДокумент4 страницыFAQ On Payment of Bonus Actchirag bhojakОценок пока нет

- Paymt of Bonus ActДокумент4 страницыPaymt of Bonus ActPriscilla Sherene MBAОценок пока нет

- BONUS (1)Документ29 страницBONUS (1)rishitsinghania1234Оценок пока нет

- Salient Features of The Payment of Bonus ActДокумент5 страницSalient Features of The Payment of Bonus ActbudhnabamОценок пока нет

- Question and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofДокумент6 страницQuestion and Answers Ques. No.1) Write Notes On: A.) Taxability of Deep Discount Bond - A Recent Move of The Central Board ofAnamika VatsaОценок пока нет

- 1.the Payment of Bonus ActДокумент2 страницы1.the Payment of Bonus ActAjay SharmaОценок пока нет

- The Payment of Bonus Act, 1965 ExplainedДокумент5 страницThe Payment of Bonus Act, 1965 ExplainedaddipolliОценок пока нет

- 13th Month Paw Law and Its Revised GuidelinesДокумент5 страниц13th Month Paw Law and Its Revised GuidelinesEi Ar TaradjiОценок пока нет

- 13TH MONTH PAY (Highlights)Документ3 страницы13TH MONTH PAY (Highlights)XIAОценок пока нет

- Payment of Bonus Act ExplainedДокумент9 страницPayment of Bonus Act ExplainedAkhil NautiyalОценок пока нет

- Substantially The Whole of His or Her Time To The Service of The Company in A Managerial or Technical CapacityДокумент1 страницаSubstantially The Whole of His or Her Time To The Service of The Company in A Managerial or Technical Capacityinbox9999Оценок пока нет

- Bonus and GratuityДокумент6 страницBonus and GratuityYousaf GillaniОценок пока нет

- Payment of BonusДокумент11 страницPayment of BonusVedha GiriОценок пока нет

- Payment of Gratuity Act 1972 ExplainedДокумент6 страницPayment of Gratuity Act 1972 Explainedabd VascoОценок пока нет

- P.D. 851 (13th Month Pay Law)Документ3 страницыP.D. 851 (13th Month Pay Law)Anonymous HWfwDFRMPsОценок пока нет

- Tax Law ProjectДокумент24 страницыTax Law ProjectDeepesh SinghОценок пока нет

- Ir 16Документ8 страницIr 16Uday TejaОценок пока нет

- THE PAYMENT OF BONUS ACT, 1965 (Compatibility Mode)Документ17 страницTHE PAYMENT OF BONUS ACT, 1965 (Compatibility Mode)ronakОценок пока нет

- Income From SalariesДокумент70 страницIncome From SalariesPratik AgrawalОценок пока нет

- 13th-MONTH PAY DECREEДокумент4 страницы13th-MONTH PAY DECREERodney S. ZamoraОценок пока нет

- Presidential Decree No. 851Документ4 страницыPresidential Decree No. 851Dianne BayОценок пока нет

- Payment of Bonus Act 1965 ExplainedДокумент18 страницPayment of Bonus Act 1965 ExplainedSHivani GuptaОценок пока нет

- Labour Laws 10Документ11 страницLabour Laws 10dskrishnaОценок пока нет

- 13th Month and Kasambahay LawДокумент14 страниц13th Month and Kasambahay Lawrico eugenioОценок пока нет

- Payment of Bonus Act 1965Документ38 страницPayment of Bonus Act 1965Prajapati Kalpesh BhagvandasОценок пока нет

- Employees Provident FundДокумент3 страницыEmployees Provident FundmaheshtimsrОценок пока нет

- Final Bonus ActДокумент23 страницыFinal Bonus ActvelocityfiendОценок пока нет

- The 13th Month Pay Decree: Key Provisions and GuidelinesДокумент13 страницThe 13th Month Pay Decree: Key Provisions and GuidelinesHardlyjun NaquilaОценок пока нет

- Employee Profit Sharing and Its Position in NepalДокумент7 страницEmployee Profit Sharing and Its Position in Nepalpratiksha bhattaraiОценок пока нет

- Complete Tax DetailsДокумент23 страницыComplete Tax DetailsAnish GuptaОценок пока нет

- 13th Month RuleДокумент8 страниц13th Month Rulej L.T.Оценок пока нет

- 11 Tax Exempt de Minimis Benefits To EmployeesДокумент2 страницы11 Tax Exempt de Minimis Benefits To EmployeesAdrian Mark GomezОценок пока нет

- 13th Month PayДокумент2 страницы13th Month PayRodel De GuzmanОценок пока нет

- 13THMONTH Revised by EkelДокумент7 страниц13THMONTH Revised by EkelEzekiel EnriquezОценок пока нет

- Bonus ActДокумент5 страницBonus ActPriya SonuОценок пока нет

- Revised Guidelines On The Implementation of The 13Th Month Pay LawДокумент4 страницыRevised Guidelines On The Implementation of The 13Th Month Pay Lawnhizza dawn DaligdigОценок пока нет

- Payment of Bonus Act, 1965 SummaryДокумент2 страницыPayment of Bonus Act, 1965 SummaryNidhi MallapadiОценок пока нет

- The Payment of Bonus Act, 1965Документ6 страницThe Payment of Bonus Act, 1965Ravi GuptaОценок пока нет

- Payment of Bonus Act 1965 ExplainedДокумент34 страницыPayment of Bonus Act 1965 ExplainedDhruti AthaОценок пока нет

- 13th-Month Pay LawДокумент2 страницы13th-Month Pay LawKim SalvoroОценок пока нет

- Income Tax KnowledgeДокумент5 страницIncome Tax KnowledgeAbhishekОценок пока нет

- Welcome To Presentation: Legal Framework On Compensation StructureДокумент30 страницWelcome To Presentation: Legal Framework On Compensation StructureVijay KishanОценок пока нет

- Compute Separation Pay and Special Leave BenefitsДокумент4 страницыCompute Separation Pay and Special Leave BenefitsRoy Arvin60% (5)

- Law of Taxation: Concept of Salary Under Income Tax Act, 1961Документ28 страницLaw of Taxation: Concept of Salary Under Income Tax Act, 1961Sapna RajmaniОценок пока нет

- Revised Guidelines On The Implementation of The 13th Month Pay LawДокумент4 страницыRevised Guidelines On The Implementation of The 13th Month Pay LawboysailorОценок пока нет

- Reporting 13 Mo Pay & KasambahayДокумент12 страницReporting 13 Mo Pay & KasambahayRegina CoeliОценок пока нет

- Bonus Act 2015Документ4 страницыBonus Act 2015bhumika kharelОценок пока нет

- Income From SalaryДокумент30 страницIncome From SalaryNicholas OwensОценок пока нет

- Docs Techtalkbudget 2017 04Документ24 страницыDocs Techtalkbudget 2017 04inbox9999Оценок пока нет

- RoyalMail 2016 PricesДокумент8 страницRoyalMail 2016 Pricesinbox9999Оценок пока нет

- Hadley Wood CAA Water PDFДокумент1 страницаHadley Wood CAA Water PDFinbox9999Оценок пока нет

- Blakeway ObituaryДокумент2 страницыBlakeway Obituaryinbox9999Оценок пока нет

- Hadley Wood CAA WaterДокумент1 страницаHadley Wood CAA Waterinbox9999Оценок пока нет

- Department of Planning and City Development Development Planning Services May 2004Документ2 страницыDepartment of Planning and City Development Development Planning Services May 2004inbox9999Оценок пока нет

- Hadley Wood CAA WaterДокумент1 страницаHadley Wood CAA Waterinbox9999Оценок пока нет

- Hadley Wood CAA WaterДокумент1 страницаHadley Wood CAA Waterinbox9999Оценок пока нет

- Opening of Hadley Wood Station and Early DevelopmentДокумент1 страницаOpening of Hadley Wood Station and Early Developmentinbox9999Оценок пока нет

- Hadley Wood CAA WaterДокумент1 страницаHadley Wood CAA Waterinbox9999Оценок пока нет

- Ledger StonesДокумент14 страницLedger Stonesinbox9999Оценок пока нет

- Hadley Wood CAA Water PDFДокумент1 страницаHadley Wood CAA Water PDFinbox9999Оценок пока нет

- Bnppre Housing The Economy - Winter 2014-15Документ1 страницаBnppre Housing The Economy - Winter 2014-15inbox9999Оценок пока нет

- Brtiish Scolars at AthensДокумент2 страницыBrtiish Scolars at Athensinbox9999Оценок пока нет

- Docs - Techtalk 2015 09Документ1 страницаDocs - Techtalk 2015 09inbox9999Оценок пока нет

- Lifetime Allowance Protection - : Ready For Another Round?Документ1 страницаLifetime Allowance Protection - : Ready For Another Round?inbox9999Оценок пока нет

- Workplace Pension Consultation RequirementsДокумент1 страницаWorkplace Pension Consultation Requirementsinbox9999Оценок пока нет

- Docs - Techtalk 2015 09Документ1 страницаDocs - Techtalk 2015 09inbox9999Оценок пока нет

- Equality Act 2010: 8 TechtalkДокумент1 страницаEquality Act 2010: 8 Techtalkinbox9999Оценок пока нет

- Docs - Techtalk 2015 09Документ1 страницаDocs - Techtalk 2015 09inbox9999Оценок пока нет

- Docs - Techtalk 2015 09 PDFДокумент1 страницаDocs - Techtalk 2015 09 PDFinbox9999Оценок пока нет

- Adequate and Inadequate Savers: 6 TechtalkДокумент1 страницаAdequate and Inadequate Savers: 6 Techtalkinbox9999Оценок пока нет

- Russian RailwaysДокумент5 страницRussian Railwaysinbox9999Оценок пока нет

- 10,00 Earnings A Year 30,000 Earnings A Year 50,000 Earnings A YearДокумент1 страница10,00 Earnings A Year 30,000 Earnings A Year 50,000 Earnings A Yearinbox9999Оценок пока нет

- Docs - Techtalk 2015 09 PDFДокумент1 страницаDocs - Techtalk 2015 09 PDFinbox9999Оценок пока нет

- Elizabeth Crawford of Gower StreetДокумент14 страницElizabeth Crawford of Gower Streetinbox9999Оценок пока нет

- A Record High For Savings - : THE Scottish Widows Retirement Report 2015Документ1 страницаA Record High For Savings - : THE Scottish Widows Retirement Report 2015inbox9999Оценок пока нет

- MFA Acquires Rare Snuff Boxes from Rothschild CollectionДокумент82 страницыMFA Acquires Rare Snuff Boxes from Rothschild Collectioninbox9999Оценок пока нет

- Elizabeth Crawford of Gower StreetДокумент1 страницаElizabeth Crawford of Gower Streetinbox9999Оценок пока нет

- Elizabeth Crawford of Gower StreetДокумент1 страницаElizabeth Crawford of Gower Streetinbox9999Оценок пока нет

- Mogadishu University Faculty of Economic & Management Sciences Department: Finance and Banking 4 YearДокумент2 страницыMogadishu University Faculty of Economic & Management Sciences Department: Finance and Banking 4 YearMoahmed sheikh abdullahi100% (1)

- Ethiopia: An Emerging Market Opportunity?: Batch 2020 22 Section DДокумент3 страницыEthiopia: An Emerging Market Opportunity?: Batch 2020 22 Section DShiksha SurekaОценок пока нет

- Unit 6 Task 1, 2 EVFTAДокумент3 страницыUnit 6 Task 1, 2 EVFTAK58 Trần Thị Thu HuyềnОценок пока нет

- Case Study 04/13/2021 Why Manufacturing MattersДокумент2 страницыCase Study 04/13/2021 Why Manufacturing MattersJerica LumboyОценок пока нет

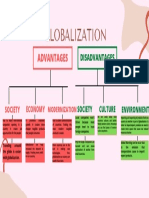

- Globalization Concept MapДокумент1 страницаGlobalization Concept MapDESIREMAE DURANОценок пока нет

- Real Estate PresentationДокумент23 страницыReal Estate PresentationTarun AnandОценок пока нет

- Sudarshan Herb & Health Care: Tax InvoiceДокумент1 страницаSudarshan Herb & Health Care: Tax InvoiceShreeshyam BabaОценок пока нет

- Case Study Exide BatteryДокумент3 страницыCase Study Exide BatterySeema KhanОценок пока нет

- John Steele Gordon Provides A Short History On The National Debt - WSJ - Com 2Документ3 страницыJohn Steele Gordon Provides A Short History On The National Debt - WSJ - Com 2Liliya PanayevОценок пока нет

- HTOO Group of Hotels Presentation For Banyan Tree HoldingsДокумент46 страницHTOO Group of Hotels Presentation For Banyan Tree HoldingsAnonymous qovWmecОценок пока нет

- Shoaib Ashraf - (228) - Dissertation PDFДокумент12 страницShoaib Ashraf - (228) - Dissertation PDFShoaib AshrafОценок пока нет

- Georgia Warehouse Market ReportДокумент29 страницGeorgia Warehouse Market ReportAhmed IbnoufОценок пока нет

- The GDP of The Kurdistan Regional Government (KRG)Документ2 страницыThe GDP of The Kurdistan Regional Government (KRG)balienniyazi2008Оценок пока нет

- Student Exam Questions Economics Development PlanningДокумент3 страницыStudent Exam Questions Economics Development Planningeto nvОценок пока нет

- SynopsisДокумент3 страницыSynopsisrohanОценок пока нет

- Treasury Bond ResultsДокумент4 страницыTreasury Bond ResultsDennis OndiekiОценок пока нет

- AfCFTAДокумент2 страницыAfCFTAeltonОценок пока нет

- National Branding MexicoДокумент2 страницыNational Branding MexicoLauraLindarteCastroОценок пока нет

- Asian Development Bank AdbДокумент14 страницAsian Development Bank AdbRakeshОценок пока нет

- Vietnams Investmant Abroad NowadaysДокумент5 страницVietnams Investmant Abroad NowadaysHằng NguyễnОценок пока нет

- Cement Industry in PakistanДокумент1 страницаCement Industry in PakistanSIDRA NAZEER SAIFОценок пока нет

- List of Lending Institutions Shortlisted To Be Partners of MUDRA Bank Name Public Sector BanksДокумент6 страницList of Lending Institutions Shortlisted To Be Partners of MUDRA Bank Name Public Sector BanksSANJAY SINGH RATHOREОценок пока нет

- Industrial Business Module 2Документ43 страницыIndustrial Business Module 2Deepa G N Binesh CОценок пока нет

- Important Questions on the Indian Economy on the Eve of IndependenceДокумент2 страницыImportant Questions on the Indian Economy on the Eve of IndependenceAnjali Vyas100% (1)

- Concept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Документ2 страницыConcept of Goods & Services Tax ? or Introduction To Goods & Services Tax ? or Explain Goods & Services Tax Act 2017 ?Ranjan BaradurОценок пока нет

- Tourism Volume Density or RatioДокумент3 страницыTourism Volume Density or RatioResha SahagonОценок пока нет

- Flipkart Labels 01 Dec 2020 04 37Документ1 страницаFlipkart Labels 01 Dec 2020 04 37pgpm20 SANCHIT GARGОценок пока нет