Академический Документы

Профессиональный Документы

Культура Документы

Voip Project

Загружено:

sinhavisАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Voip Project

Загружено:

sinhavisАвторское право:

Доступные форматы

Over the years, the traffic from wholesale market in voice calls have increased by 50% in 2012 from

2008 levels of 330 million minutes, the revenue remained flat and modestly declined to $13.4 billion in

2012. The major reason for revenue decline is reducing international call rates due to price war among

various players. Notably, the price decline is also the key driver for double digit growth over the past 20

years. However, after two decades of continuous price reductions, and with global mobile penetration

approaching 90 percent, the incremental effectiveness of further price cuts or mobile subscriber growth

is wearing off.

TeleGeography projects that retail prices will fall an average of 6 percent annually between 2013 and

2018, outstripping traffic growth, and causing global retail revenues to decline by about 2 percent

annually. At this pace, global traffic would increase 26 percent by 2018, to 688 billion minutes, while

retail revenues would fall 8 percent, to $88.8 billion.

These factors are compounded by the fact that OTT (over the top) services are siphoning off at least a

share of international voice traffic. Hundreds of millions of people now use over-the-top (OTT) voice,

video, and text communications on their computers and mobile devices for a growing share of their

calls. Skype, which launched its service in 2003, has long been the bellwether of this market.

TeleGeography estimates that Skypes on-net international traffic grew 36 percent in 2013, to 214 billion

minutes. While the volume of international telephone traffic remains far larger than international Skype

traffic, Skypes traffic is growing far more rapidly. Skype added approximately 54 billion minutes of

international traffic in 2013, 50 percent more than the combined volume growth of every carrier in the

world, combined. Given these immense traffic volumes, its difficult not to conclude that at least some

of Skypes growth is coming at the expense of traditional carriers.

While the use of OTT services will grow and number of international carriers will decline, PSTN will stay

for longer. We believe there is no threat to existence of PSTN. In coming year, we will see lot more

consolidation in international voice market. It is crowded, offers narrow margins, presents no easy

growth opportunities, and holds the prospect of a longer-term decline. Consequently, a growing number

of retail service providers, including many incumbents, will choose to get out of the business of

transporting and terminating international voice traffic. Others will seek to steadily reduce their

involvement in this market. While the international calling market will be around for many years to

come, the number of participants must contract.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- In Defense of Ecological Marxism - John Bellamy Foster Responds To A CriticДокумент16 страницIn Defense of Ecological Marxism - John Bellamy Foster Responds To A CriticJarren RichardsОценок пока нет

- Contoh Surat Perkenalan (Introduction Letter)Документ17 страницContoh Surat Perkenalan (Introduction Letter)Indah Larasati100% (2)

- Inequality, Stagnation, and Market PowerДокумент19 страницInequality, Stagnation, and Market PowerRoosevelt InstituteОценок пока нет

- About Australia: Australia in Brief PublicationДокумент15 страницAbout Australia: Australia in Brief PublicationAlejandro Andres Valdes ValenzuelaОценок пока нет

- Engineering Economy 3Документ37 страницEngineering Economy 3Steven SengОценок пока нет

- The Philippine Budget ProcessДокумент16 страницThe Philippine Budget ProcessMye Pintorera100% (2)

- 92 - San Miguel Corporation v. KhanДокумент1 страница92 - San Miguel Corporation v. KhanJoshua RiveraОценок пока нет

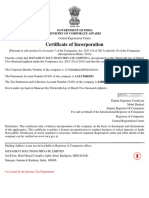

- Certificate of IncorporationДокумент1 страницаCertificate of Incorporationmohammad faizanОценок пока нет

- External Factor Evaluation ANalysisДокумент42 страницыExternal Factor Evaluation ANalysisSetyo Ferry WibowoОценок пока нет

- IFRS1Документ125 страницIFRS1Sergiu CebanОценок пока нет

- Nou B.Com. Part I, II and IIIДокумент22 страницыNou B.Com. Part I, II and IIIsufistories storiesОценок пока нет

- Lfu Financials 2017Документ8 страницLfu Financials 2017api-220450826Оценок пока нет

- Vertical Farming PDFДокумент193 страницыVertical Farming PDFdmlinux100% (1)

- Fin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Документ3 страницыFin - 515 - Smart - Chapter 1 Overview of Corporate Finance - Tute Solutions - 1Ray Gworld50% (2)

- SupercellДокумент6 страницSupercellkrofta EngineeringОценок пока нет

- Pyfa LK TW Iv 2016 PDFДокумент63 страницыPyfa LK TW Iv 2016 PDFRobert Chou0% (1)

- A Comparative Study ofДокумент95 страницA Comparative Study ofSami ZamaОценок пока нет

- Development TrendsДокумент4 страницыDevelopment TrendsMary Charisse SandroОценок пока нет

- Mazda Engines Including DITDДокумент6 страницMazda Engines Including DITDPavle MajstorovićОценок пока нет

- EC426 Option Meeting 29 September 2010Документ14 страницEC426 Option Meeting 29 September 2010Prathibha HaridasОценок пока нет

- MPDFДокумент2 страницыMPDFDPC PKS TENGGILIS MEJOYOОценок пока нет

- Environment and Conservation Management MilestoneДокумент6 страницEnvironment and Conservation Management MilestoneAndy John L. CatulinОценок пока нет

- Labor Standards Sem 1 2019Документ14 страницLabor Standards Sem 1 2019Charms QueensОценок пока нет

- (2012) A Greenhouse Gas Accounting Tool For Palm Products (RSPO - PalmGHG Beta Version 1)Документ56 страниц(2012) A Greenhouse Gas Accounting Tool For Palm Products (RSPO - PalmGHG Beta Version 1)anon_369860093Оценок пока нет

- Marco Glisson April 15Документ127 страницMarco Glisson April 15glimmertwinsОценок пока нет

- Trader Website Fund Details - W - SummaryДокумент1 430 страницTrader Website Fund Details - W - SummaryGtc Diaz CarlosОценок пока нет

- Assignment Week 1Документ10 страницAssignment Week 1victoriabhrОценок пока нет

- Design, Modelling and Development of Electric Walking Bike: Mr. Chetan KДокумент16 страницDesign, Modelling and Development of Electric Walking Bike: Mr. Chetan KNagabhushanaОценок пока нет

- The Marshall Plan and Its ConsequencesДокумент11 страницThe Marshall Plan and Its Consequencesgelebele100% (3)