Академический Документы

Профессиональный Документы

Культура Документы

Tariff Sheet (Trading) : Fixed Brokerage Plan

Загружено:

akhilsahu20040 оценок0% нашли этот документ полезным (0 голосов)

33 просмотров5 страницtariff

Оригинальное название

Tariff Sheet Ri

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документtariff

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

33 просмотров5 страницTariff Sheet (Trading) : Fixed Brokerage Plan

Загружено:

akhilsahu2004tariff

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

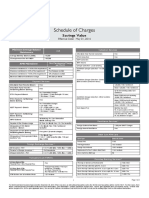

TARIFF SHEET (TRADING)

FIXED BROKERAGE PLAN

Product

Segment

Transaction Type Brokerage Securities

Transaction

Tax (STT)

Stamp

Duty

2

Exchange

Transaction

Charges

(%)

Equity Cash

3

, E-Margin 0.50% 0.1% 0.01% 0.00325%

Intraday/Cover Buy 0.05% Nil 0.002% 0.00325%

Intraday/Cover Sell 0.05% 0.025% 0.002% 0.00325%

Encash 1.00% 0.1% 0.01% 0.00325%

Futures

(Currency

1

,

Index and

Stock)

Buy 0.05% Nil 0.002% 0.0019%

Sell 0.05% 0.017% 0.002% 0.0019%

Intraday on each

leg

0.05% 0.017% 0.002% 0.0019%

Expiry Nil Nil 0.002% Nil

Options

(Currency

1

,

Index and

Stock)

Buy Rs.100.00 Nil 0.002% 0.05%

Sell Rs.100.00 0.017% 0.002% 0.05%

Intraday on each

leg

Rs.100.00 0.017% 0.002% 0.05%

Exercise

6

Nil 0.125% 0.002% 0.05%

Assignment

6

Nil Nil 0.002% 0.05%

MULTI-TIER (VARIABLE) PLAN MONTHLY TURNOVER

Products From

(Rupees)

To (Rupees) Brokerage Rate

Equity (Cash) and Emargin

(Sum of transaction values during

the month will be considered as

turnover. All Rates are as percent of

transaction value)

(Excluding Encash transaction

turnover)

0 300,000 0.60%

300,001 1,000,000 0.55%

1,000,001 2,500,000 0.45%

2,500,001 7,500,000 0.35%

7,500,001 20,000,000 0.25%

20,000,001 Any Value 0.20%

Intra-day, Cover, Futures, Intraday

Futures (Currency, Equity, Index)

(Sum of transaction values during

the month will be considered as

turnover. All Rates are as percent of

transaction value)

0 50,000,000 0.05%

50,000,001 100,000,000 0.04%

100,000,001 200,000,000 0.035%

200,000,001 Any value 0.03%

Options (Equity, Index, Currency)

(Sum of premium values as per

((Strike price+Premium)* lot size))

will be considered as turnover

during the month.Brokerage Rate is

on a per lot basis)

0 200,000 Rs.95

200,001 500,000 Rs.85

500,001 1,000,000 Rs.75

1,000,001 2,000,000 Rs.70

2,000,001 Any Value Rs.65

Additional terms applicable to Multi-Tier (variable) brokerage plan :-

A. Brokerage is charged at rates applicable for the minimum turnover slab, on a daily basis. At the

end of the month, refund amount if any, (difference between brokerage applicable for the slab

(based on monthly turnover), and actual brokerage charged) is credited to the client account.

B. Applicable Statutory charges are levied separately e.g. Service Tax, Education Cess, STT, Stamp

Duty, Exchange Transaction Charges, SEBI turnover charges etc.

C. Turnover is computed from start of the calendar month or date of enrolment for the plan

whichever is later. The last date for the month considered for brokerage purposes will always be

the last date of that calendar month.

D. Refund is limited to the amount of brokerage and no other charges will be refunded.

E. Equity-Encash transactions will be charged as per fixed brokerage plan.

Terms applicable to both Fixed and Multi-Tier (Variable) brokerage plans:

1. STT is currently not levied for Currency transactions.

2. Stamp duty is charged as per the rates applicable.

3. Cash/Delivery transactions squared off on the same day will be charged brokerage at rates

applicable for Intraday trades.

4. Intrinsic Value for call option is Spot Price Strike Price and for put options it is Strike Price

Spot Price.

5. Futures Expiry Charges : Futures Expiry charges (comprising of stamp duty etc.) are levied on

the value of outstanding position (Outstanding Position * Settlement Price)

6. Option Exercise /Assignment : Exercise/Assignment Charges (comprising of stamp duty, STT

etc.) are levied on the Settlement value of the option. Exchange Transaction Charges on Options

trades will be computed on premium amount.

Other Terms and Conditions:

1. Service Tax : Service tax is levied at 12.00% of the brokerage & Exchange

transaction charges

2. Education Cess : Education Cess is levied at 3.00%of the service tax amount

3. SEBI Turnover Charges : SEBI Turnover charges are levied at 0.0001%of turnover

4. Brokerage computation basis: Brokerage is computed on per share basis and is rounded off to

the nearest paise, subject to a minimum brokerage of 1 paise per share.

5. Minimum brokerage charged: Brokerage will be charged as per applicable rate subject to a

minimum of Rs.20/- per executed order and a maximum of 2.5%. In case the minimum

brokerage calculated comes to more than 2.5%, then the amount that will be charged as a

brokerage will be limited to 2.5%. For securities quoting upto Rs. 10.00 per share, brokerage will

be charged as per the following table.

Price of Securities

(in Rs.)

Brokerage Rate Per Share (Rs.) on each leg

From To Intraday/Delivery

- 0.40 0.01

0.41 0.80 0.02

0.81 1.20 0.03

1.21 1.60 0.04

1.61 2.00 0.05

2.01 10.00 0.06

7. The first ten calls to Trade on Phone service in a calendar month shall be free of any service

charge. All the subsequent calls to the Trade on Phone number will be charged @Rs.20.00 per

call and will be charged to the client account. Applicable Brokerage charges for the transactions

effected are extra.

8. The mode of sending Contract Notes shall be through emails and posting on website, by default.

If physical Contract Note is sent, then the charge will be Rs. 25/- per contract note towards

courier & other handling charges.

9. System abuse charges, if any, as levied by Exchange(s) will be recovered from the respective

clients.

10. All intraday and emargin transactions that are converted to delivery will be charged brokerages

as applicable to Cash/Delivery trades.

11. The rates provided in this schedule are subject to change with 15 (Fifteen) days prior intimation.

12. Any penalty levied by Exchanges on the client's positions shall be recovered fromthe client's

account (eg. penalty for short collection of margin).

Mutual Fund Transaction Charges

Mutual Funds Distribution (MFD)

Lumpsum Investment (Charge per transaction)

Purchase Redemption

Rs. 75/- Nil

SIP (Charge per transaction)

Purchase Redemption

Rs. 25 or 1.5%, whichever is lower NA

Mutual Funds Exchange (MFE)

Lumpsum Investment (Charge per transaction)

Purchase Redemption

Rs. 75/- Nil

Terms and Conditions:

1. Applicable Service tax and Education cess (currently 12.36%) will be charged in addition to the above

charges on per transaction basis.

2. Other statutory levies, if any, will be levied in addition to the above charges.

3. The above fee structure applies to all Mutual Fund purchase transactions. No fee would be levied on

purchase transactions ( SIP & Lumpsum ) in the liquid scheme.

4. ASL reserves the right to revise Mutual fund charge structure from time to time.

5. The above fee structure applies to all clients under various types of equity brokerage plans e.g.Fixed,

variable etc.

Trading Account opening charges:

The Account opening charges are Rs. 999/- (This includes recovery of charges incurred on

franking/stamping of documents).

Вам также может понравиться

- How To Start Trading The No BS Guide PDFДокумент38 страницHow To Start Trading The No BS Guide PDFAjazzshakeSh100% (1)

- Reverse Swing Trading StrategyДокумент39 страницReverse Swing Trading Strategylptuyen100% (17)

- 16 Points CPR Indicator Trading SystemДокумент17 страниц16 Points CPR Indicator Trading SystemPentesh NingaramainaОценок пока нет

- How To Make Money With Stocks Online 3 Books in 1 The Complete Beginners Guide For Learning How To Trade Options, Swing... (Jordan, Simon) (Z-Library)Документ199 страницHow To Make Money With Stocks Online 3 Books in 1 The Complete Beginners Guide For Learning How To Trade Options, Swing... (Jordan, Simon) (Z-Library)SamОценок пока нет

- Prepare for "How to Day TradeДокумент2 страницыPrepare for "How to Day TradeJack Tan100% (1)

- Binder1 PDFДокумент493 страницыBinder1 PDFThe599499100% (4)

- Prime Two Day-Trading ManualДокумент24 страницыPrime Two Day-Trading ManualRajasekaran RadhakrishnanОценок пока нет

- HTTP WWW - Tradingmarkets.c..9Документ5 страницHTTP WWW - Tradingmarkets.c..9pderby1Оценок пока нет

- Stock MarketДокумент69 страницStock MarketsamarosОценок пока нет

- Intraday: Trading With TheДокумент4 страницыIntraday: Trading With Thepetefader100% (2)

- Trader Profile - THE SCALPER Scalping Tools and Techniques: Information Is A Key ToolДокумент9 страницTrader Profile - THE SCALPER Scalping Tools and Techniques: Information Is A Key ToolAhmad Zamroni100% (1)

- Trade Like A Boss FINALДокумент74 страницыTrade Like A Boss FINALGoran KristanОценок пока нет

- Dear Sir/Madam,: Features of Angel BrokingДокумент6 страницDear Sir/Madam,: Features of Angel BrokingharishkumarsharmaОценок пока нет

- Jared Martinez - 10 Keys To Successful Forex TradingДокумент42 страницыJared Martinez - 10 Keys To Successful Forex Tradinglatnrythmz75% (4)

- Day Trading StrategiesДокумент3 страницыDay Trading Strategiesswetha reddy100% (2)

- Trading Strategies 4 Books in - Andrew RichДокумент363 страницыTrading Strategies 4 Books in - Andrew RichNabil BouraïmaОценок пока нет

- Detackting BreakoutsДокумент9 страницDetackting BreakoutsJay SagarОценок пока нет

- SAP FI Transaction Code List 1Документ10 страницSAP FI Transaction Code List 1akhilsahu2004Оценок пока нет

- BlockchainDecryptedFor2018 PDFДокумент46 страницBlockchainDecryptedFor2018 PDFPunjena Paprika100% (1)

- Art Collins - Beating The Financial MarketsДокумент15 страницArt Collins - Beating The Financial Marketsjonofs0% (1)

- Ibanq Pricing ScheduleДокумент8 страницIbanq Pricing ScheduleIPTV GangОценок пока нет

- Detecting Breakouts From Flags & PennantsДокумент9 страницDetecting Breakouts From Flags & PennantsdrkwngОценок пока нет

- My Low Range Bar Strategies To Anticipate Breakouts.: While Balancing Life, Day Job and TradingДокумент11 страницMy Low Range Bar Strategies To Anticipate Breakouts.: While Balancing Life, Day Job and Tradingsen2nat5693Оценок пока нет

- Algo Dma PreviewДокумент105 страницAlgo Dma PreviewAlchemy1100% (2)

- Brokerage in CashДокумент7 страницBrokerage in Cashrajp2099Оценок пока нет

- PlanДокумент4 страницыPlanrajritesОценок пока нет

- Idirect - Brokerage PlansДокумент7 страницIdirect - Brokerage PlansJitenОценок пока нет

- SUPERCARD Most Important Terms and Conditions (MITC)Документ14 страницSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilОценок пока нет

- Easy Equities Cost ProfileДокумент5 страницEasy Equities Cost ProfileKaka KuxОценок пока нет

- Fees and Charges GuideДокумент3 страницыFees and Charges GuideShashank AgarwalОценок пока нет

- SuperCard MITC PDFДокумент47 страницSuperCard MITC PDFPrudhvi RajОценок пока нет

- 3b.foreign Exchange ArithmeticДокумент9 страниц3b.foreign Exchange ArithmeticArpit KabraОценок пока нет

- Schedule of Charges: Savings ValueДокумент2 страницыSchedule of Charges: Savings ValueNavjot SinghОценок пока нет

- Citigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeДокумент1 страницаCitigold Account - Schedule of Charges: All Below Mentioned Benefits Are Now Free of ChargeNikhil RaviОценок пока нет

- Accounting Valuation and TaxationДокумент20 страницAccounting Valuation and TaxationSweta SinhaОценок пока нет

- Important Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inДокумент10 страницImportant Terms and Conditions: To Get The Complete Version, Please Visit WWW - Hsbc.co - inDeepak GuptaОценок пока нет

- July 2013: Current, Call and Savings AccountsДокумент1 страницаJuly 2013: Current, Call and Savings AccountsBala MОценок пока нет

- Fit DiyДокумент1 страницаFit DiyTRANSIT STRОценок пока нет

- Mitc RupifiДокумент13 страницMitc RupifiKARTHIKEYAN K.DОценок пока нет

- MITC Paytm First Card 2019Документ7 страницMITC Paytm First Card 2019viwaОценок пока нет

- Value Added Subscription PlansДокумент1 страницаValue Added Subscription PlansChetna SharmaОценок пока нет

- HSBC Credit Card T&C SummaryДокумент10 страницHSBC Credit Card T&C SummaryMohit AroraОценок пока нет

- Most Important Terms and Conditions - Citi Rewards Credit CardДокумент8 страницMost Important Terms and Conditions - Citi Rewards Credit CardneverОценок пока нет

- GFCBJJVDFBKKДокумент1 страницаGFCBJJVDFBKKHare KrishnaОценок пока нет

- Change of Broker - Marcellus PMSДокумент6 страницChange of Broker - Marcellus PMSDOLLY KHAPREОценок пока нет

- Fit Diy 1hДокумент1 страницаFit Diy 1hRahul PatilОценок пока нет

- Citi Rewards Card ChargesДокумент8 страницCiti Rewards Card ChargesHem Pushp MittalОценок пока нет

- BrokerageДокумент2 страницыBrokerageMASTX01051986Оценок пока нет

- Important TNCДокумент20 страницImportant TNCsanthoshsk3072002Оценок пока нет

- Most Important Terms and ConditionsДокумент7 страницMost Important Terms and ConditionsSignupОценок пока нет

- Simplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014Документ5 страницSimplified Nri Savings Account Tarrif Structure W.E.F April 01, 2014gaddipati_ramuОценок пока нет

- Fees and Charges Booklet: Version November 2020Документ5 страницFees and Charges Booklet: Version November 2020Amy Ong Ee HengОценок пока нет

- Schedule of Charges - Citi Rewards Credit Card: As On The Date of Levy of The ChargeДокумент2 страницыSchedule of Charges - Citi Rewards Credit Card: As On The Date of Levy of The ChargemurugesaenОценок пока нет

- Citi Rewards Card ChargesДокумент7 страницCiti Rewards Card ChargesLokesh SuranaОценок пока нет

- Axis Bank savings account chargesДокумент6 страницAxis Bank savings account chargesArnab Nandi100% (1)

- Mechanism of BrokerageДокумент5 страницMechanism of BrokerageVipin ChauhanОценок пока нет

- PremierMiles Terms and ConditionsДокумент7 страницPremierMiles Terms and ConditionsAnamika purohitОценок пока нет

- Brokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableДокумент2 страницыBrokerage Rates: If You Are Trade Free Plan Customer, Below Brokerage Rate Will Be ApplicableLaser ArtzОценок пока нет

- Most Important Terms and ConditionsДокумент8 страницMost Important Terms and ConditionsTHIMMAPPA KODAVATIОценок пока нет

- Schedule of Charges - Citi Prestige CardДокумент2 страницыSchedule of Charges - Citi Prestige CardVarun SidanaОценок пока нет

- Schedule of ChargesДокумент1 страницаSchedule of ChargesTarun AgarwalОценок пока нет

- Idfc First MitcДокумент12 страницIdfc First Mitcsrikanth reddyОценок пока нет

- Securities Transaction Tax: A.b.acharya Addl - Asst.directorДокумент7 страницSecurities Transaction Tax: A.b.acharya Addl - Asst.directorSantosh SarojОценок пока нет

- Zerodha Brokerage Charges and CalculatorsДокумент9 страницZerodha Brokerage Charges and CalculatorsMrugen ShahОценок пока нет

- Bajaj Tiger CC MITC NewДокумент12 страницBajaj Tiger CC MITC NewMinatiОценок пока нет

- Circular 026-2007Документ4 страницыCircular 026-2007Pramod BothraОценок пока нет

- Flipkart Axis Bank Credit Card Fee ChangesДокумент4 страницыFlipkart Axis Bank Credit Card Fee ChangesvarunchopОценок пока нет

- MANDATORY TARIFF SHEETДокумент1 страницаMANDATORY TARIFF SHEETIron XculptОценок пока нет

- PDS Equity Home Financing IДокумент10 страницPDS Equity Home Financing IsyahnooraimanОценок пока нет

- Schedule of Charges: Smart Salary ExclusiveДокумент2 страницыSchedule of Charges: Smart Salary ExclusivevedavakОценок пока нет

- Trad Free ChargesДокумент1 страницаTrad Free ChargesanimeshtechnosОценок пока нет

- MITC: Most Important Terms and Conditions for Citi Credit CardsДокумент7 страницMITC: Most Important Terms and Conditions for Citi Credit CardsDivya NaikОценок пока нет

- Most Important Terms and Conditions: As On The Date of Levy of The ChargeДокумент7 страницMost Important Terms and Conditions: As On The Date of Levy of The ChargeMohammed Tabrez ulla KhanОценок пока нет

- Annex 2 Super Savings AccountДокумент2 страницыAnnex 2 Super Savings AccountPhani BhupathirajuОценок пока нет

- EmiratesNBD Credit Card Fees ChargesДокумент2 страницыEmiratesNBD Credit Card Fees ChargesHanif MohammmedОценок пока нет

- SUPERCARD Most Important Terms and Conditions (MITC)Документ17 страницSUPERCARD Most Important Terms and Conditions (MITC)jinesh vgОценок пока нет

- Gratuity Plus Sales BrochureДокумент5 страницGratuity Plus Sales BrochurerupeshcinОценок пока нет

- Commission On Share CFDsДокумент2 страницыCommission On Share CFDsSohaib ElabidiОценок пока нет

- Indian Railway timetable BL PURI S F EXДокумент1 страницаIndian Railway timetable BL PURI S F EXakhilsahu2004Оценок пока нет

- No OneДокумент1 страницаNo Oneakhilsahu2004Оценок пока нет

- Late Punch DetailsДокумент1 страницаLate Punch Detailsakhilsahu2004Оценок пока нет

- Late Punch DetailsДокумент1 страницаLate Punch Detailsakhilsahu2004Оценок пока нет

- AnjДокумент2 страницыAnjakhilsahu2004Оценок пока нет

- Web AddДокумент1 страницаWeb Addakhilsahu2004Оценок пока нет

- RK Not inДокумент1 страницаRK Not inakhilsahu2004Оценок пока нет

- Raj Kapoor SongsДокумент1 страницаRaj Kapoor Songsakhilsahu2004Оценок пока нет

- No Claim CertificateДокумент1 страницаNo Claim Certificateakhilsahu2004Оценок пока нет

- Service Tax RateДокумент9 страницService Tax Rateakhilsahu2004Оценок пока нет

- Function SumifAMSДокумент1 страницаFunction SumifAMSakhilsahu2004Оценок пока нет

- Are A Vendo R Code Vendor's Name Cost Centre Last Servic e Entry Upto Month of ProvisionДокумент2 страницыAre A Vendo R Code Vendor's Name Cost Centre Last Servic e Entry Upto Month of Provisionakhilsahu2004Оценок пока нет

- LG Microwave Oven Recipes3Документ1 страницаLG Microwave Oven Recipes3akhilsahu2004Оценок пока нет

- Are A Vendo R Code Vendor's Name Cost Centre Last Servic e Entry Upto Month of ProvisionДокумент2 страницыAre A Vendo R Code Vendor's Name Cost Centre Last Servic e Entry Upto Month of Provisionakhilsahu2004Оценок пока нет

- Microwave Urad Dal RecipeДокумент1 страницаMicrowave Urad Dal Recipeakhilsahu2004Оценок пока нет

- LIST OF DISTRICTS OF ODISHAДокумент2 страницыLIST OF DISTRICTS OF ODISHAakhilsahu2004Оценок пока нет

- Are A Vendo R Code Vendor's Name Cost Centre Per Mont H Last Servi Ce Entry UptoДокумент2 страницыAre A Vendo R Code Vendor's Name Cost Centre Per Mont H Last Servi Ce Entry Uptoakhilsahu2004Оценок пока нет

- Solar LanternДокумент4 страницыSolar Lanternakhilsahu2004Оценок пока нет

- Nokia Lumia 925Документ3 страницыNokia Lumia 925akhilsahu2004Оценок пока нет

- Train Fares. - India Travel Forum - IndiaMikeДокумент18 страницTrain Fares. - India Travel Forum - IndiaMikeakhilsahu2004Оценок пока нет

- Nokia C2-03 Price in India 2013 11th June Is RsДокумент5 страницNokia C2-03 Price in India 2013 11th June Is Rsakhilsahu2004Оценок пока нет

- Gratuity - Payroll India (PY-In) - SAP LibraryДокумент2 страницыGratuity - Payroll India (PY-In) - SAP Libraryakhilsahu2004Оценок пока нет

- FN Hardman MicrowaveMagic1Документ21 страницаFN Hardman MicrowaveMagic1akhilsahu2004Оценок пока нет

- SBI Trade Finance PuneДокумент1 страницаSBI Trade Finance Puneakhilsahu2004Оценок пока нет

- Incometaxindia GovДокумент21 страницаIncometaxindia Govakhilsahu2004Оценок пока нет

- Clothing in 1840: Geneva Historical Society, 2005 1Документ3 страницыClothing in 1840: Geneva Historical Society, 2005 1akhilsahu2004Оценок пока нет

- 6 in 1 solar kitДокумент2 страницы6 in 1 solar kitakhilsahu2004Оценок пока нет

- Summer Internship ProjectДокумент34 страницыSummer Internship Projectpranayjaiswal56Оценок пока нет

- Daragan v. Short Term Trading AnalysisДокумент61 страницаDaragan v. Short Term Trading AnalysisOm PrakashОценок пока нет

- Fin 460 REPORTДокумент26 страницFin 460 REPORTMd. Iftekhar RahmanОценок пока нет

- Super BUY SELL Profit - Bes..Документ17 страницSuper BUY SELL Profit - Bes..Muhammad Muntasir AlwyОценок пока нет

- Project On Comparison Between Stock BrokersДокумент15 страницProject On Comparison Between Stock BrokersankitsawhneyОценок пока нет

- Money Zone 2.0 User GuideДокумент63 страницыMoney Zone 2.0 User GuidePRADEEP KUMARОценок пока нет

- Forex Trading System Series by Laurentiu DamirДокумент1 страницаForex Trading System Series by Laurentiu DamirMugo Karumba0% (1)

- Www-Altredo-com-Interactive Brokers Mt4 Bridge Trade CopierДокумент4 страницыWww-Altredo-com-Interactive Brokers Mt4 Bridge Trade CopierALTREDOОценок пока нет

- Arcesium Whitebook 2022Документ12 страницArcesium Whitebook 2022Srilekha BasavojuОценок пока нет