Академический Документы

Профессиональный Документы

Культура Документы

162 DBSVickers SuperGroup140520145b15d

Загружено:

Invest StockОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

162 DBSVickers SuperGroup140520145b15d

Загружено:

Invest StockАвторское право:

Доступные форматы

www.dbsvickers.

com

ed: TH / sa: JC

HOLD S$3.23 STI : 3,222.43

Price Target : 12-Month S$ 3.26 (Prev S$ 4.09)

Reason for Report : Earnings/TP downgrade

Potential Catalyst: Better margins from lower raw material prices

DBS vs Consensus: In line

Analyst

Alfie YEO +65 6682 3717

alfieyeo@dbs.com

Price Relative

Forecasts and Valuation

FY Dec (S$ m) 2012A 2013A 2014F 2015F

Revenue 519 557 565 612

EBITDA 96 107 108 113

Pre-tax Profit 91 115 94 99

Net Profit 79 100 80 85

Net Pft (Pre Ex.) 75 81 80 85

EPS (S cts) 14.2 17.9 14.4 15.2

EPS Pre Ex. (S cts) 13.5 14.5 14.4 15.2

EPS Gth (%) 28 26 (19) 6

EPS Gth Pre Ex (%) 49 7 (1) 6

Diluted EPS (S cts) 14.2 17.9 14.4 15.2

Net DPS (S cts) 7.1 9.0 7.2 7.6

BV Per Share (S cts) 71.6 83.8 91.0 98.6

PE (X) 22.8 18.0 22.4 21.2

PE Pre Ex. (X) 23.9 22.2 22.5 21.2

P/Cash Flow (X) 21.0 28.7 17.8 28.6

EV/EBITDA (X) 17.8 16.1 15.7 14.9

Net Div Yield (%) 2.2 2.8 2.2 2.4

P/Book Value (X) 4.5 3.9 3.6 3.3

Net Debt/Equity (X) CASH CASH CASH CASH

ROAE (%) 20.6 23.1 16.5 16.1

Earnings Rev (%): (5) (8)

Consensus EPS (S cts): 16.4 18.4

Other Broker Recs: B: 23 S: 3 H: 5

ICB Industry : Consumer Goods

ICB Sector: Food Producers

Principal Business: Manufacturer distributor and brand owner of

instant beverages and convenience food

Source of all data: Company, DBS Bank, Bloomberg Finance L.P

At A Glance

Issued Capital (m shrs) 558

Mkt. Cap (S$m/US$m) 1,801 / 1,440

Major Shareholders

Lay Hoon Teo (%) 12.1

Kee Bock Teo (%) 11.7

YHS Invest Pte Ltd (%) 11.7

Free Float (%) 30.8

Avg. Daily Vol.(000) 673

14 May 2014

Singapore Company Focus

Super Group

Bloomberg: SUPER SP

|

Reuters: SPGP.SI Refer to important disclosures at the end of this report

A slow start to the year

1Q14 figures fell short on disappointing sales,

higher opex.

Outlook will be challenging; management to

diversify into new products

Lower FY14F/FY15F earnings by 5%/8%

Maintain HOLD with lower TP of S$3.26

Sales disappointed, costs higher. 1Q14 core

earnings came in at S$17.8m (-19% y-o-y), missing our

S$21m expectations. Both Food Ingredients and

Branded Consumer sales declined by 6%. While gross

margins were maintained (37.5%), higher opex from

expanded production facilities resulted in lower net

margins (14.3%, -2.4ppts).

Challenging outlook, but management will

strengthen its business model. We believe that key

markets have become challenging based on recent

quarters results. Management is taking steps to

strengthen its business model including rebranding and

improving marketing/distribution, as well as developing

new product categories to diversify into new coffee and

tea products. We expect these initiatives to take time

to develop, leading to higher near-term expenses but

translating into longer-term benefits.

Expect flat core earnings growth in FY14F. We cut

FY14F/FY15F earnings by 5%/8% as we moderate

revenue growth expectations on the back of weak

trading in key markets. We also factor in higher opex

as management implements new initiatives.

Maintain HOLD with lower S$3.26 TP. We believe

the operating environment for Super has intensified.

Along with the earnings downgrade, we cut Supers TP

to S$3.26 based on a lower valuation peg of 22x

FY14F/FY15F earnings, in line with its average PE

valuations. Maintain HOLD.

83

133

183

233

283

333

383

433

483

533

0.7

1.2

1.7

2.2

2.7

3.2

3.7

4.2

4.7

5.2

May-10 May-11 May-12 May-13 May-14

Relative Index

S$

Super Group (LHS) Relative STI INDEX (RHS)

Page 2

Company Focus

Super Group

1Q14 results below expectations

Affected by lower topline growth from both business

segments. 1Q14 core earnings came in at S$17.8m (-19% y-

o-y), missing our S$21m expectations. Revenue contracted

6% y-o-y to S$125m, as a result of sales declines in both Food

Ingredients and Branded Consumer segments. Food

Ingredients sales shrinkage of 6% (S$89m) was attributed to

lower sales in Indonesia and China, offset by higher sales in

Taiwan. Branded Consumer sales decline (S$36m, -6% y-o-y)

was due to lower sales in Southeast Asian markets, especially

in Thailand.

Thailands Branded Consumer sales volume declines. Thailand,

which contributes 30% of Branded Consumer sales,

experienced a 10% decline in sales, affected by reduction in

sales volumes and weaker THB. While volumes for northern

territories have grown, demand in southern Thailand region

has slowed. Supers distributors and wholesalers have

withheld stocking activities amid poorer consumption and

social unrest.

Food Ingredients sales in China and Indonesia decline. The

milk tea segment in China remains soft, which affected both

sales volumes and sales value demand for ingredients.

Management also attributed the decline in Chinas sales to its

current initiative to restructure and establish a distribution

team to insource distribution activities. Tepid demand was

also seen in Indonesia as the rupiah remained weak and

customers are well-stocked.

Higher opex dampens net margins. While gross margins were

maintained (37.5%), higher opex from expanded production

facilities resulted in lower net margins (14.3%, -2.4ppts).

1Q14 met 20% of our full-year forecast. Net cash declined

marginally to S$95m.

Expect outlook to be challenging

Key markets have become challenging. Recent quarters

results have shown that Supers key markets are weakening,

with slow consumer demand and less favourable exchange

rates the main factors affecting the results. As competition in

the 3-in-1 instant coffee space remains keen, we believe

management has to find new avenues to supplement growth

going forward.

Transitioning for the future. Management is now taking steps

to strengthen its business model through rebranding, product

innovation and better product portfolio management. It will

also reinforce its organisational structure by improving its

distribution and product development teams. Going forward,

the team will explore new product categories and diversify into

new coffee and tea products, and new ingredients such as

Botanical Herbal Extract and Liquified Glucose Syrup Solids.

We expect these initiatives to take time to develop, leading to

higher near-term expenses but translating into longer-term

benefits.

Margins under pressure. For now, we believe that even as

demand continues to be soft, costs will be a challenge going

forward. Commodity prices have trended higher since the

second half of last year and prices of robusta coffee beans,

sugar and palm oil have risen YTD by a further 24%, 2% and

2% respectively. Along with new initiatives and new

manufacturing capacities coming on, we expect relatively

higher opex and lower margins from FY13.

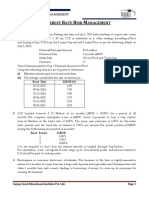

Raw material prices have increased from 2H13

Source: DBS Bank

50

60

70

80

90

100

110

120

Apr-11 Jul-11 Oct-11 Jan-12 Apr-12 Jul-12 Oct-12 Jan-13 Apr-13 Jul-13 Oct-13 Jan-14 Apr-14

Sugar Coffee Palm Oil

Page 3

Company Focus

Super Group

Share price to be halved upon bonus issue at end-May

Ex-date for bonus issue is 26 May. Super announced a "1-for-

1 bonus issue" post-release of FY13 results in February. Ex-

date for this corporate action will be 26 May. The theoretical

EPS and share price will be halved and the number of shares is

due to double from 557.5m to 1,115m. Expected impact is

outlined below.

Bonus issue impact

1-for-1 bonus issue Before After Theoretical change

Share base (m) 558 1,115 Share base doubles

Price (S$) 3.23 1.615 Price halves

Mkt Cap (S$m) 1,801 1,801 Nil

FY14F earnings (m) 80 80 Nil

EPS (Scents) 14.4 7.2 EPS halves

FY14F PE 22.5 22.5 Nil

Source: DBS Bank

Cut FY14F/FY15F earnings by 5%/8%

Expect flat core earnings growth in FY14F. We now expect

core earnings growth to be flat. Further to our previous

earnings downgrade in November 2013, we have lowered:

1)Revenue growth expectations on the back of weak trading in

key markets; and 2) Account for higher opex as management

embarks on new initiatives. This results in earnings cut of

5%/8% to FY14F/FY15F earnings. While we have factored in

impact of higher raw material costs, higher than expected

commodity price increase could present further risks to our

gross margin expectations.

Valuation

Maintain HOLD with lower S$3.26 TP. We recognise that the

operating environment for Super has changed as outlook in

key markets weakens. As such, we are lowering our 26x

forward earnings peg to 22x. Along with the earnings

downgrade, we cut Supers TP to S$3.26. This is based on 22x

blended FY14F/FY15F earnings, pegged to average valuations.

Maintain HOLD.

Super currently trades at 22x forward PE

Source: DBS Bank

5.0

10.0

15.0

20.0

25.0

30.0

35.0

40.0

J

a

n

-

1

2

M

a

r

-

1

2

M

a

y

-

1

2

J

u

l

-

1

2

S

e

p

-

1

2

N

o

v

-

1

2

J

a

n

-

1

3

M

a

r

-

1

3

M

a

y

-

1

3

J

u

l

-

1

3

S

e

p

-

1

3

N

o

v

-

1

3

J

a

n

-

1

4

M

a

r

-

1

4

M

a

y

-

1

4

(x)

+1 sd

+2 sd

-1 sd

-2 sd

Avg

Page 4

Company Focus

Super Group

Results Summary and Comparison

FY Dec (S$m) 1Q13 4Q13 1Q14 YoY Chg QoQ Chg

Sales 132.4 153.3 124.6 -6% -19%

Cost of Goods Sold (83.3) (95.6) (77.9) -6% -19%

Gross Profit 49.1 57.7 46.7 -5% -19%

Other Operating Income 0.4 3.0 0.5 40% -83%

Distribution Costs (13.0) (19.4) (13.3) 2% -32%

Administration Expenses (12.2) (14.9) (13.5) 11% -9%

Other Operating Expenses (25.2) (34.3) (26.8) 6% -22%

EBIT 24.2 26.4 20.4 -16% -22%

Non-Operating Income 2.6 (1.2) 0.2 n/m n/m

Interest Income 0.1 0.2 0.1 -39% -61%

Interest Expense (0.0) (0.2) (0.0) -53% -95%

Share of Associates' or JV Income (0.7) (0.9) (0.3) -60% -69%

Exceptional Gains/(Losses) (0.2) 2.0 0.4 n/m -79%

Pretax Profit 26.0 26.3 20.8 -20% -21%

Tax (3.1) (2.7) (2.1) -31% -20%

Minority Interests (0.8) (1.0) (0.8) 6% -18%

Net Profit 22.1 22.6 17.8 -19% -21%

Margins (%)

Gross Margin 37.1 37.6 37.5

SGA % Sales 19.1 22.4 21.5

EBITDA Margin 20.4 19.2 19.3

EBIT Margin 18.3 17.2 16.4

Pre-tax Margin 19.6 17.1 16.7

Net Margin 16.7 14.7 14.3

Source: Company, DBS Bank

Page 5

Company Focus

Super Group

Key Assumptions

FY Dec 2011A 2012A 2013A 2014F 2015F

Consumer goods 318.6 355.1 364.5 370.8 400.4

Ingredients 122.4 164.1 192.5 194.4 211.9

Total 441.0 519.2 557.0 565.2 612.3

Segmental Breakdown

FY Dec 2011A 2012A 2013A 2014F 2015F

Revenues (S$ m)

Singapore 102 102 105 107 116

South East Asia 248 293 338 316 343

East Asia 91 124 115 141 153

Elimination N/A N/A N/A N/A N/A

Total 441 519 557 565 612

Operating profit (S$ m)

Singapore 22 30 57 31 34

South East Asia 37 60 71 63 69

East Asia 29 28 24 32 35

Elimination (29) (31) (54) (32) (37)

Total 59 88 98 95 100

Operating profit Margins

Singapore 21.3 29.4 54.4 29.0 29.0

South East Asia 15.0 20.4 21.0 20.0 20.0

East Asia 31.7 22.9 21.2 23.0 23.0

Elimination N/A N/A N/A N/A N/A

Total 13.3 16.9 17.6 16.8 16.4

Income Statement (S$ m)

FY Dec 2011A 2012A 2013A 2014F 2015F

Revenue 441 519 557 565 612

Other Opng (Exp)/Inc (83) (94) (111) (112) (120)

Operating Profit 59 88 98 95 100

Other Non Opg (Exp)/Inc 0 (1) 0 0 0

Associates & JV Inc 1 0 (2) (2) (2)

Net Interest (Exp)/Inc 0 1 0 0 0

Exceptional Gain/(Loss) 11 4 19 0 0

Pre-tax Profit 70 91 115 94 99

Tax (6) (9) (11) (10) (10)

Minority Interest (2) (4) (3) (4) (4)

Preference Dividend 0 0 0 0 0

Net Profit 62 79 100 80 85

Net Profit before Except. 51 75 81 80 85

EBITDA 65 96 107 108 113

Growth

Revenue Gth (%) 25.3 17.8 7.3 1.5 8.3

EBITDA Gth (%) 1.9 46.1 11.9 0.7 5.1

Opg Profit Gth (%) 5.9 49.0 12.1 (3.5) 5.9

Net Profit Gth (%) 6.1 27.7 26.4 (19.5) 5.6

Margins & Ratio

Gross Margins (%) 32.2 34.9 37.6 36.6 36.0

Opg Profit Margin (%) 13.3 16.9 17.6 16.8 16.4

Net Profit Margin (%) 14.0 15.2 17.9 14.2 13.9

ROAE (%) 17.8 20.6 23.1 16.5 16.1

ROA (%) 13.0 15.1 17.5 12.9 12.6

ROCE (%) 14.3 19.4 19.3 16.5 16.1

Div Payout Ratio (%) 52.2 50.1 50.2 50.0 50.0

Net Interest Cover (x) NM NM NM NM NM

Source: Company, DBS Bank

Margins Trend

12.0%

13.0%

14.0%

15.0%

16.0%

17.0%

18.0%

19.0%

2011A 2012A 2013A 2014F 2015F

Operating Margin % Net Income Margin %

Expect flat core earnings

growth

Page 6

Company Focus

Super Group

Quarterly / Interim Income Statement (S$ m)

FY Dec 1Q2013 2Q2013 3Q2013 4Q2013 1Q2014

Revenue 132 138 133 153 125

Other Oper. (Exp)/Inc (25) (29) (26) (31) (26)

Operating Profit 24 24 23 26 20

Other Non Opg (Exp)/Inc 3 0 (1) (1) 0

Associates & JV Inc (1) (1) 0 (1) 0

Net Interest (Exp)/Inc 0 0 0 0 0

Exceptional Gain/(Loss) 0 17 0 2 0

Pre-tax Profit 26 41 21 26 21

Tax (3) (4) (2) (3) (2)

Minority Interest (1) (1) (1) (1) (1)

Net Profit 22 36 19 23 18

Net profit bef Except. 22 19 19 21 17

EBITDA 29 27 24 27 24

Growth

Revenue Gth (%) (14.9) 4.5 (3.9) 15.3 (18.7)

EBITDA Gth (%) 9.7 (8.1) (8.5) 12.4 (12.2)

Opg Profit Gth (%) 3.2 1.0 (5.5) 14.1 (22.5)

Net Profit Gth (%) 4.2 64.9 (48.7) 20.7 (21.1)

Margins

Gross Margins (%) 37.1 38.8 36.8 37.6 37.5

Opg Profit Margins (%) 18.3 17.7 17.4 17.2 16.4

Net Profit Margins (%) 16.7 26.4 14.1 14.7 14.3

Balance Sheet (S$ m)

FY Dec 2011A 2012A 2013A 2014F 2015F

Net Fixed Assets 166 212 251 281 276

Invts in Associates & JVs 16 15 19 18 29

Other LT Assets 14 13 3 3 3

Cash & ST Invts 125 115 101 130 140

Inventory 93 83 102 94 112

Debtors 78 96 95 97 105

Other Current Assets 11 9 29 29 29

Total Assets 502 543 599 651 694

ST Debt 2 1 0 0 0

Creditor 36 40 37 45 41

Other Current Liab 74 80 69 69 69

LT Debt 0 0 0 0 0

Other LT Liabilities 9 5 7 7 7

Shareholders Equity 367 399 467 507 550

Minority Interests 15 18 20 23 27

Total Cap. & Liab. 502 543 599 651 694

Non-Cash Wkg. Capital 72 67 120 106 135

Net Cash/(Debt) 123 115 101 130 140

Debtors Turn (avg days) 61.6 61.1 62.3 61.7 59.9

Creditors Turn (avg days) 39.8 41.9 41.8 43.6 41.9

Inventory Turn (avg days) 101.7 97.4 100.2 104.0 99.6

Asset Turnover (x) 0.9 1.0 1.0 0.9 0.9

Current Ratio (x) 2.7 2.5 3.1 3.1 3.5

Quick Ratio (x) 1.8 1.7 1.9 2.0 2.2

Net Debt/Equity (X) CASH CASH CASH CASH CASH

Net Debt/Equity ex MI (X) CASH CASH CASH CASH CASH

Capex to Debt (%) 4,324.0 8,909.7 N/A N/A N/A

Z-Score (X) 12.0 15.3 13.0 12.0 12.4

Source: Company, DBS Bank

Revenue Trend

Asset Breakdown (2013)

-25%

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

0

20

40

60

80

100

120

140

160

180

4

Q

2

0

1

1

1

Q

2

0

1

2

2

Q

2

0

1

2

3

Q

2

0

1

2

4

Q

2

0

1

2

1

Q

2

0

1

3

2

Q

2

0

1

3

3

Q

2

0

1

3

4

Q

2

0

1

3

1

Q

2

0

1

4

Revenue RevenueGrowth%(QoQ)

Net Fixed

Assets -

44.4%

Assocs'/JVs -

3.4%

Bank, Cash

and Liquid

Assets -

17.4%

Inventory -

18.0%

Debtors -

16.7%

Gross margins maintained on

efficient cost management

Page 7

Company Focus

Super Group

Cash Flow Statement (S$ m)

FY Dec 2011A 2012A 2013A 2014F 2015F

Pre-Tax Profit 70 91 115 94 99

Dep. & Amort. 7 8 12 15 15

Tax Paid (4) (7) (11) (10) (10)

Assoc. & JV Inc/(loss) (1) 0 2 2 2

Chg in Wkg.Cap. (7) (4) (36) 1 (42)

Other Operating CF (6) (3) (19) 0 0

Net Operating CF 59 86 63 101 63

Capital Exp.(net) (73) (60) (46) (45) (10)

Other Invts.(net) 0 0 0 0 0

Invts in Assoc. & JV 23 (3) 8 13 0

Div from Assoc & JV 0 0 0 0 0

Other Investing CF 4 5 0 0 0

Net Investing CF (47) (58) (38) (32) (10)

Div Paid (31) (32) (40) (40) (42)

Chg in Gross Debt (1) (1) 0 0 0

Capital Issues 0 0 0 0 0

Other Financing CF 0 0 (2) 0 0

Net Financing CF (33) (33) (42) (40) (42)

Currency Adjustments 1 (5) 4 0 0

Chg in Cash (19) (10) (13) 29 11

Opg CFPS (S cts) 11.8 16.0 17.7 18.0 18.9

Free CFPS (S cts) (2.5) 4.7 3.0 10.1 9.5

Source: Company, DBS Bank

Capital Expenditure

Target Price & Ratings History

Source: DBS Bank

0

10

20

30

40

50

60

70

80

2011A 2012A 2013A 2014F 2015F

Capital Expenditure (-)

S.No. Da te

Cl osi ng

Pri c e

Ta rge t

Pri c e

Ra ti ng

1: 14 May 13 4.76 5.35 Buy

2: 12 Aug 13 4.90 5.35 Buy

3: 12 Nov 13 3.57 3.97 Hold

4: 25 Feb 14 3.82 4.09 Hold

Not e : Share price and Target price are adjusted for corporate actions.

1

2

3

4

2.95

3.45

3.95

4.45

4.95

May-13 Sep-13 Jan-14

S$

Assume 50% dividend

payout

Page 8

Company Focus

Super Group

DBS Bank recommendations are based an Absolute Total Return* Rating system, defined as follows:

STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame)

BUY (>15% total return over the next 12 months for small caps, >10% for large caps)

HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps)

FULLY VALUED (negative total return i.e. > -10% over the next 12 months)

SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Bank Ltd. This report is solely intended for the clients of DBS Bank Ltd and DBS Vickers Securities (Singapore) Pte

Ltd, its respective connected and associated corporations and affiliates (collectively, the DBS Vickers Group) only and no part of this document

may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBS Bank Ltd.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS

Bank Ltd., its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents

(collectively, the DBS Group)) do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed

are subject to change without notice. This document is prepared for general circulation. Any recommendation contained in this document does

not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for

the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain

separate independent legal or financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss

(including any claims for loss of profit) arising from any use of and/or reliance upon this document and/or further communication given in

relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS

Group, along with its affiliates and/or persons associated with any of them may from time to time have interests in the securities mentioned in

this document. The DBS Group may have positions in, and may effect transactions in securities mentioned herein and may also perform or seek

to perform broking, investment banking and other banking services for these companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there

can be no assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk

assessments. The information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or

condensed and it may not contain all material information concerning the company (or companies) referred to in this report.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on

which the valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from

actual results. Therefore, the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE

RELIED UPON as a representation and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a) such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

(b) there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk

assessments stated therein.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies)

mentioned herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to

the commodity referred to in this report.

DBS Vickers Securities (USA) Inc ("DBSVUSA")"), a U.S.-registered broker-dealer, does not have its own investment banking or research

department, nor has it participated in any investment banking transaction as a manager or co-manager in the past twelve months.

ANALYST CERTIFICATION

The research analyst primarily responsible for the content of this research report, in part or in whole, certifies that the views about the companies

and their securities expressed in this report accurately reflect his/her personal views. The analyst also certifies that no part of his/her

compensation was, is, or will be, directly, or indirectly, related to specific recommendations or views expressed in this report. As of the date the

report is published,the analyst and his/her spouse and/or relatives who are financially dependent on the analyst, do not hold interests in the

securities recommended in this report (interest includes direct or indirect ownership of securities).

COMPANY-SPECIFIC / REGULATORY DISCLOSURES

1. DBS Bank Ltd., DBS Vickers Securities (Singapore) Pte Ltd (DBSVS), their subsidiaries and/or other affiliates do not have a

proprietary position in the securities recommended in this report as of 31 Mar 2014

2. DBS Bank Ltd., DBSVS, DBSVUSA, their subsidiaries and/or other affiliates may beneficially own a total of 1% of any class of

common equity securities of the company mentioned as of 31 Mar 2014.

3.

Compensation for investment banking services:

DBS Bank Ltd., DBSVS, DBSVUSA, their subsidiaries and/or other affiliates may received compensation, within the past 12

months, and within the next 3 months may receive or intends to seek compensation for investment banking services from the

company mentioned.

DBSVUSA does not have its own investment banking or research department, nor has it participated in any investment banking

transaction as a manager or co-manager in the past twelve months. Any US persons wishing to obtain further information,

including any clarification on disclosures in this disclaimer, or to effect a transaction in any security discussed in this document

should contact DBSVUSA exclusively.

Page 9

Company Focus

Super Group

RESTRICTIONS ON DISTRIBUTION

General This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or

located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be

contrary to law or regulation.

Australia This report is not for distribution into Australia.

Hong Kong This report is being distributed in Hong Kong by DBS Vickers (Hong Kong) Limited which is licensed and regulated by the

Hong Kong Securities and Futures Commission.

Indonesia This report is being distributed in Indonesia by PT DBS Vickers Securities Indonesia.

Malaysia This report is distributed in Malaysia by Alliance Research Sdn Bhd ("ARSB"). Recipients of this report, received from ARSB are

to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection with this report. In

addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report are advised that ARSB

(the preparer of this report), its holding company Alliance Investment Bank Berhad, their respective connected and associated

corporations, affiliates, their directors, officers, employees, agents and parties related or associated with any of them may

have positions in, and may effect transactions in the securities mentioned herein and may also perform or seek to perform

broking, investment banking/corporate advisory and other services for the subject companies. They may also have received

compensation and/or seek to obtain compensation for broking, investment banking/corporate advisory and other services

from the subject companies.

Bernard Ching, Head of Research, ARSB

Singapore

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn No.

198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the

Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its respective foreign

entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial

Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert

Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons

only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 6327 2288 for matters arising from,

or in connection with the report.

Thailand

This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. Research reports distributed are only

intended for institutional clients only and no other person may act upon it.

United

Kingdom

This report is being distributed in the UK by DBS Vickers Securities (UK) Ltd, who is an authorised person in the meaning of

the Financial Services and Markets Act and is regulated by The Financial Conduct Authority. Research distributed in the UK is

intended only for institutional clients.

Dubai

This research report is being distributed in The Dubai International Financial Centre (DIFC) by DBS Bank Ltd., (DIFC Branch)

having its office at PO Box 506538, 3

rd

Floor, Building 3, East Wing, Gate Precinct, Dubai International Financial Centre (DIFC),

Dubai, United Arab Emirates. DBS Bank Ltd., (DIFC Branch) is regulated by The Dubai Financial Services Authority. This

research report is intended only for professional clients (as defined in the DFSA rulebook) and no other person may act upon

it.

United

States

Neither this report nor any copy hereof may be taken or distributed into the United States or to any U.S. person except in

compliance with any applicable U.S. laws and regulations. It is being distributed in the United States by DBSVUSA, which

accepts responsibility for its contents. Any U.S. person receiving this report who wishes to effect transactions in any securities

referred to herein should contact DBSVUSA directly and not its affiliate.

Other

jurisdictions

In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for qualified,

professional, institutional or sophisticated investors as defined in the laws and regulations of such jurisdictions.

DBS Bank Ltd.

12 Marina Boulevard, Marina Bay Financial Centre Tower 3

Singapore 018982

Tel. 65-6878 8888

Company Regn. No. 196800306E

Вам также может понравиться

- Secura Group Limited 2 PDFДокумент12 страницSecura Group Limited 2 PDFInvest StockОценок пока нет

- Eindec Corporation Limited 2 PDFДокумент12 страницEindec Corporation Limited 2 PDFInvest StockОценок пока нет

- Anchor Resources Limited PDFДокумент545 страницAnchor Resources Limited PDFInvest StockОценок пока нет

- The Trendlines 2 PDFДокумент644 страницыThe Trendlines 2 PDFInvest StockОценок пока нет

- AxcelasiaДокумент12 страницAxcelasiaInvest StockОценок пока нет

- Jumbo Group Preliminary Offer Document (21 September 2015) PDFДокумент369 страницJumbo Group Preliminary Offer Document (21 September 2015) PDFInvest StockОценок пока нет

- Axcelasia 2 PDFДокумент408 страницAxcelasia 2 PDFInvest StockОценок пока нет

- Jumbo Group Limited FactsheetДокумент2 страницыJumbo Group Limited FactsheetInvest StockОценок пока нет

- Manulife US REIT Preliminary Prospectus Dated 29 June 2015 PDFДокумент538 страницManulife US REIT Preliminary Prospectus Dated 29 June 2015 PDFInvest StockОценок пока нет

- GCCP Resources Limited Offer Document (Part 1) PDFДокумент338 страницGCCP Resources Limited Offer Document (Part 1) PDFInvest Stock100% (1)

- Offer Doc (Clean) PDFДокумент344 страницыOffer Doc (Clean) PDFInvest StockОценок пока нет

- Preliminary Offer Document (12 May 2015) PDFДокумент329 страницPreliminary Offer Document (12 May 2015) PDFInvest StockОценок пока нет

- Alibaba Group - 12-May-2015 - US - CF PDFДокумент49 страницAlibaba Group - 12-May-2015 - US - CF PDFInvest StockОценок пока нет

- Silverlake-Financial Alchemy PDFДокумент42 страницыSilverlake-Financial Alchemy PDFInvest Stock0% (1)

- GCCP Resources Limited Offer Document (Part 4) PDFДокумент103 страницыGCCP Resources Limited Offer Document (Part 4) PDFInvest StockОценок пока нет

- Yelp Inc (Yelp-N) : Average ScoreДокумент12 страницYelp Inc (Yelp-N) : Average ScoreInvest StockОценок пока нет

- Gilead Sciences Inc (Gild-O) : Average ScoreДокумент12 страницGilead Sciences Inc (Gild-O) : Average ScoreInvest StockОценок пока нет

- (03a) LHN Offer Document (Clean) PDFДокумент614 страниц(03a) LHN Offer Document (Clean) PDFInvest StockОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Chapter 23Документ24 страницыChapter 23Nguyên BảoОценок пока нет

- Chapter 2 Capital MarketsДокумент9 страницChapter 2 Capital MarketsFarah Nader Gooda100% (1)

- No Dues Certificate - 19 - 47 - 18Документ2 страницыNo Dues Certificate - 19 - 47 - 18chenchu kuppaswamyОценок пока нет

- NOC SBI DocДокумент2 страницыNOC SBI DocSupratim Majumdar0% (1)

- Structuring Local Currency Transactions Case Studies v2 1Документ15 страницStructuring Local Currency Transactions Case Studies v2 1jai_tri007Оценок пока нет

- Interest Rate Risk NotesДокумент157 страницInterest Rate Risk Notesdaksh.agarwal180Оценок пока нет

- Op Transaction History 29!03!2018Документ2 страницыOp Transaction History 29!03!2018Avinash GuptaОценок пока нет

- Real Estate Financing: Notes and MortgageДокумент15 страницReal Estate Financing: Notes and MortgagePrabath Suranaga Morawakage100% (1)

- LS Sar Page50Документ1 страницаLS Sar Page50Ljubisa MaticОценок пока нет

- Giannini Final TranscriptДокумент32 страницыGiannini Final Transcriptmlieb737Оценок пока нет

- Q2 1 BM CommissionДокумент34 страницыQ2 1 BM CommissionAbbygail MatrizОценок пока нет

- Monitoring of Credit and Collection FundsДокумент24 страницыMonitoring of Credit and Collection FundsADALIA BEATRIZ ONGОценок пока нет

- Refund and Excess Payments (Credit Balances) Policy and Procedure PDFДокумент8 страницRefund and Excess Payments (Credit Balances) Policy and Procedure PDFMinh DuongОценок пока нет

- Partnership - FormationДокумент16 страницPartnership - Formationnaufal bimoОценок пока нет

- Marketing of Financial ServicesДокумент36 страницMarketing of Financial ServicesSajad Azeez0% (3)

- Lat 7 Knight&lesserДокумент5 страницLat 7 Knight&lesserNadratul Hasanah LubisОценок пока нет

- Bpi Savings: Mai, Michelle AДокумент21 страницаBpi Savings: Mai, Michelle AMimiОценок пока нет

- g1967 E PDFДокумент769 страницg1967 E PDFJAMF JFОценок пока нет

- Banking and FinancialДокумент8 страницBanking and FinancialBaby PinkОценок пока нет

- Laporan Cash Flow ANTAM KomengДокумент2 страницыLaporan Cash Flow ANTAM KomengNiky SuryadiОценок пока нет

- AML Transaction Monitoring Reports AlertsДокумент2 страницыAML Transaction Monitoring Reports AlertssvuhariОценок пока нет

- Usage Patterns of Credit Card Holders in AhmedabadДокумент141 страницаUsage Patterns of Credit Card Holders in AhmedabadAshraj_16Оценок пока нет

- Electrosteel Castings Result UpdatedДокумент8 страницElectrosteel Castings Result UpdatedAngel BrokingОценок пока нет

- Print ChallanДокумент1 страницаPrint ChallanSameer AsifОценок пока нет

- FI - Reading 44 - Fundamentals of Credit AnalysisДокумент42 страницыFI - Reading 44 - Fundamentals of Credit Analysisshaili shahОценок пока нет

- Kyriba SCF Solution Fact Sheet 2016 F 0Документ2 страницыKyriba SCF Solution Fact Sheet 2016 F 0RajatОценок пока нет

- Evolution of Money and BankingДокумент17 страницEvolution of Money and BankingUmar HayatОценок пока нет

- Finance Lecture 2: TVM: Time LineДокумент5 страницFinance Lecture 2: TVM: Time LinedfsdfsdfdsОценок пока нет

- Interest Rate Risk Management PDFДокумент2 страницыInterest Rate Risk Management PDFHARSHALRAVALОценок пока нет

- BIR Form 2307 - May2022Документ12 страницBIR Form 2307 - May2022Mae Ann Aguila100% (1)