Академический Документы

Профессиональный Документы

Культура Документы

Alsbridge Procurement Sourcing White Paper - 2013

Загружено:

Vrajesh ShahИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Alsbridge Procurement Sourcing White Paper - 2013

Загружено:

Vrajesh ShahАвторское право:

Доступные форматы

A Research Paper

on Procurement

Outsourcing

The Time is Right?

Alsbridge Plc, 22-24 Ely Place, London, EC1N 6TE, +44 (0)20 7242 0666

www.alsbridge.eu

1

Organisations typically spend twice as much with their

suppliers as they do on staff costs. As a result, reducing

supplier spend can have a proportionally bigger effect

on earnings than the same percentage reduction in staff

or staff costs. This effect is often further amplied as

supplier savings have a direct earnings benets whereas

staff costs carry other overheads and so do not have a

direct one-to-one effect.

Supplier costs are thus an obvious area for organisations

to address. Despite this, in many cases, when prot

improvements are needed, the main focus has been on

staff numbers and staff costs.

We believe that reducing bought-in spend is the simplest

and least painful way to reduce cost. It also produces

less corporate stress and upheaval than reducing

headcount, can be quicker to realise benets with less

risk than other forms of outsourcing?

In order to achieve supplier cost savings, expertise in

areas such as procurement and change management are

required. And those are becoming increasingly difcult to

nd as competition among different organisations for the

same skills intensies.

One solution that achieves all these

aims is outsourcing or Right Sourcing

of procurement, either in its entirety or

for selected categories.

The growth in the procurement co-sourcing and

outsourcing markets demonstrates that the time has

come for Procurement Outsourcing.

The basic value proposition is very simple achieve

signicant bottom line savings by leveraging the core

competencies of sourcing and category management

(mainly but not exclusively in indirect categories) that

an external, specialist can provide and that a corporate

might not maintain in-house for a wide range of reasons.

This includes a range of value generating capabilities,

such as technology to support category management

and process compliance.

In line with the market, Alsbridge is seeing signicant

growth in Procurement Co-Sourcing and Outsourcing

deals and is advising an increasing number of clients in

this area. It is a concept at a tipping point in terms of

market acceptance and one, we believe, that has now

nally arrived. As a result Alsbridge believed that it

would be timely to carry out some unbiased, objective

research to understand what it means in practice, what

it can and cannot deliver and what the opportunities and

obstacles are. Potential clients will then have a sound

basis for considering whether it will work for them.

Weve researched data sources and weve spoken

to outsourcing service providers, their clients and

procurement specialists to prepare this research

paper, so that organisations can make up their own

mind about Procurement Outsourcing.

We hope you nd it useful.

Introduction

2

Summary of ndings

Procurement Outsourcing is actually a

combination of co-sourcing and outsourcing.

The former is the more prevalent but full

outsourcing is rapidly catching up both in the

number and total value of contracts.

1. Procurement Outsourcing does deliver

signicant benets

In the right circumstances, as a result of a well

implemented deal, clients can realise a 2 to 4 (or more)

times ROI on the service providers fee, or between 5%

and 20% of in-scope spend, with a payback of less than

12 months. This depends, however, on the size of the

in-scope spend. Larger service suppliers will say that

a minimum in-scope spend of 50-100m is required to

make an outsourcing deal really worthwhile, smaller

suppliers will be happy to work with less. But obviously,

the greater the in-scope spend the better.

Below are some indicative saving benets for

three categories:

2. The largest benet (usually about 40%) comes from

sourcing and category management

The chart below summarises the main sources of benets:

Improved compliance and prevention of value leakage

(often through introduction of technology) can also be a

signicant benet, depending on the client. Other benets

accrue from economies of scale across a business. The

other 10% comes from general efciencies and lower

cost processing but the labour arbitrage benet is very

small compared to other forms of outsourcing for the

reasons given above.

Aggregation of small deals into a larger deal may appear

to be an easy win but actually it delivers fewer benets

than might be supposed (and probably fewer than

smarter purchasing). Some years ago it was the accepted

wisdom that Procurement Outsourcers would consolidate

requirements from several clients and thereby get a

better price. However, complications such as difculties

in getting a common specication and different costs

to serve between different clients have meant this isnt

as straightforward as it seems. This isnt to say that

aggregation can never be successful, just that it is one of

several routes to savings and not necessarily the best.

3. Getting the right deal shape and commercial terms

is important

There is a wide range of options regarding pricing

models, with pure gainshare at one end of the spectrum

and xed price at the other. The chart below sets out our

ndings with regard to the basis of pricing mechanisms:

A minority of deals are gainshare only models (i.e. no gain,

no fee). Nearly 50% of deals are on a pure xed price basis

and about 30% include a performance bonus (gainshare

or risk/reward). Often negotiations with a new supplier

start out on a gainshare basis and nish up as risk/reward.

If the extent of realised benets drives pricing in any

way, it is important to consider their timing one client

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

IT/Telecoms Temporary Labour Marketing

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Sourcing

and category

management

Compliance Economies

of scale

Other

30%

Fee plus

performance

bonus

50%

Pure xed

price

20%

Gainshare

only

3

we came across had set the bar too low for benets and

the target was achieved very early on in a ve year deal,

with the result that the service provider wasnt obliged to

deliver any further savings beyond year two.

In general, Procurement Outsourcing deals are 3-5

years in deal term which is a little shorter than other

forms of outsourcing.

4. Procurement Outsourcing seems to be easier to

implement than other forms of BPO

There are lower set up costs, less in the way of transition

disruption (as often only the procurement department is

largely affected), and it seems that the benets dont have

to be worked at quite so hard. This is not to say it is easy

but it may be easier than other BPO options.

5. There is strong growth in the market

Our research indicates that there is signicant growth,

particularly for indirect and tail-end categories.

Everything we have seen and heard in the market backs

this up, especially from service providers already in this

space and perhaps more interestingly from those not

already in it but who are gearing up to enter the market.

Indeed, some service providers are very bullish about

the future and have predicted increases of over 40%,

with an average around 30%.

In terms of industry sectors, the trend of adoption of

procurement outsourcing has varied over recent years

but now seems to be fairly evenly divided amongst

Financial Services, Telecoms, Utilities and Manufacturing

companies. The most common categories of spend

outsourced appear to be IT, telecoms, facilities, HR related

(such as temporary staff) and marketing/sales. The most

active markets considering procurement outsourcing are

Consumer Packaged Goods (CPG) and Manufacturing.

It is also worth noting that within this overall upwards

trend there appears to be a move towards deals focused

on fewer categories, which is thought to indicate a

change in buyer approach rather than a lack of interest

in Procurement Outsourcing.

6. Outsourcing of strategic procurement took a dip in

the number of new contracts about 6 years ago

We suspect that this was because the contracts signed by

the early adopters ran into the problem that the suppliers,

while good at providing centralised transactional services,

were not able to use the same model for sourcing.

Category Managers need to be close to their customers

to understand requirements and to ensure that the supply

deals put in place work for the business (and are adopted).

As a result, two things happened. There was a growth of

co-sourcing where supplier and organisation staff worked

side-by-side in the same category teams ensuring

good expertise was available at the same time as good

client interfaces. Secondly, suppliers grew their regional

and local expertise organically, through TUPE of client

staff and through acquisition. The suppliers are now in a

position to offer regional and local client working and,

as a result, outsourcing is now rapidly growing again.

7. There is a wide and growing range of

service providers

In the course of this work we interviewed a wide

selection of current service providers. These providers

approach the market in different ways some tend to

major on sourcing and category management, others

provide a full set of services and technology applications.

Some promote the leverage of their own procurement

functions which are dealing with huge volumes of

transactions for other parts of their businesses, and for

others their expertise exists purely for client purposes.

Some develop one-t common category strategies for

all their clients; others develop strategies on a client by

client basis. Each option has its benets and drawbacks.

Some seek to provide a full service across multiple

geographies, from sourcing strategy through to

transaction processing, whilst at the other extreme some

specialise in category management in specic regions.

8. The market has matured signicantly over the

past couple of years

Although there are some very good examples of

Procurement Outsourcing, some experienced service

providers and strong demand, the fact is that the uptake

is still relatively low in absolute terms its about where

Finance & Accounting (F&A) Outsourcing was maybe

four or ve years ago. Since then, F&A Outsourcing has

experienced quite a boom in demand it is believed that

procurement will go the same way.

Clients also stated that the benets from sourcing and

category management (i.e. the largest part of the benets)

vary according to the service provider staff involved.

No provider is good at everything and it is important to

recognise this point, not necessarily as a weakness of the

Procurement Outsourcing model but as a fact. Different

categories may require different service providers.

Service providers told us that the main inhibitors to the

uptake of Procurement Outsourcing are a do it yourself

attitude on the part of clients, fear of a loss of control and

a lack of scale.

4

What is the value proposition

for Procurement Outsourcing?

The basic principle is simple the procurement service provider provides expert category management in areas

where the service provider is a specialist and the client organisation is not. This means that the categories in scope for

Procurement Outsourcing are usually indirect i.e. where procurement is not a core competence for the client.

Typical examples of indirect categories commonly in scope are set out below.

IT and Telecom spend

1. Network/Mainframe

infrastructure

2. Computer hardware

(Desktops, Servers)

3. Desktop Software

4. Infrastructure Software

(Mainframe, Network,

Systems management, etc.)

5. Telecom infrastructure

& services

6. Printing management &

Hardware (e.g. printers, copiers,

multifunction, etc.)

7. IT Outsourcing and out tasking

8. PDAs and cell phones

9. IT consulting and

software development

Marketing and Sales

related spend

1. Trade shows/Events

2. Marketing research/

ad-hoc studies

3. Advertising agencies

4. Public relations/

communications

5. Promotional/Direct/

Interactive Agencies

6. Mailing Fullment

7. Design/Pre-press agencies

and services

8. Experimental/

Niche marketing

Finance and

Corporate spend

1. Tax and audit services

2. Consulting services

3. Third party legal services

4. Technology related services

5. Third party outsourced

services

6. Contract labour

7. Facilities/Equipment &

Administrative services

8. Treasury related services

Direct materials

1. Corrugated/Line board

2. Poly lms/Bag

3. Folding cartons

4. Automotive parts/tiers

5. Fuel/Lubricants

6. Metals

7. Bulk and packaged gases

8. Chemicals

9. Fertilizers

10. Capital equipment

HR related spend

1. Executive search/

Recruitment/Relocation

agency management fees

2. HR Consulting

(workforce, benets planning,

compensation planning)

3. Temporary and

contingent stafng

4. Drug screening/job testing/

Background checks

5. Events and recruiting

logistics spend (displays,

collateral, materials)

5

It follows that the key benets are related to

the cost of the categories in scope, rather than

the cost of the people involved, and as a result

they can be very signicant. But this is not the

full story there are a number of different

ways in which Procurement Outsourcing can

generate value:

Expert market knowledge in defned categories

usually generates the largest part of the added value,

and this was conrmed by service providers and

clients alike. A good example is a category where an

organisation does a deal relatively infrequently but

where the market is relatively complex and constantly

changing for example, mobile phones. For many

organisations it is not feasible to maintain specialists

in this market. Procurement Outsourcing service

providers maintain specialists whose full time job is to

research and understand the mobile phone market and

whose knowledge can be leveraged whenever required.

Using technology to help ensure compliance and

to share knowledge. Several of the service providers

we spoke to cited much improved compliance

through technology as a key benet of Procurement

Outsourcing. Many of them provide technology either

as a core part of their offering or as an add on to

facilitate and control the end to end transactional

process from requisitioning goods or services at one

end to payment at the other. Which means that clients

have the ability to either prevent or to identify and deal

with rogue purchasing, resulting in signicant benets.

And clearly theres no point in having great deals if

the organisation doesnt know about them, so sharing

knowledge through technology is also key.

Leveraging economies of scale. Clients who are not

familiar with Procurement Outsourcing might think

that this yields the major part of the benets, but in

general this isnt the case. Although service providers

are able to negotiate deals in certain areas by using the

aggregated buying power of their client base, and in

some cases leveraging their own buying power (usually

derived from their other activities) for clients benet,

there are obstacles. For example, aggregation may

require clients to accept standard specications that

might not be quite right for them and in addition each

client will have a different cost to serve, which makes

it more difcult for the end supplier to provide better

terms. As a result, aggregation appears to be less of a

benet than it was thought to be, say, ten years ago.

Lower cost processes. In the scheme of things this

usually contributes the lowest proportion of the benets

and in most cases on its own is unlikely to be the sole

reason for outsourcing procurement. Nevertheless, over

time a Procurement Outsourcing service provider would

expect to achieve lower cost processes and efciencies

through automation, continuous improvement and the

use of lower cost locations

Indirect procurement is often not a clients

core competency :

Hiring category specialists may be uneconomic.

Why hire a mobile phone specialist when you only do

deals infrequently? Why hire an energy specialist for

the same reason?

Looking around for new technology can be

time consuming and distracting. Why take the

time and resources to research the market when

a Procurement Outsourcing service provider can

provide the technology that is measured on the

service it provides? In addition, many organisations

have already made an investment in e-Procurement

applications and believe that Procurement

Outsourcing means renewing their IT systems.

Putting greater focus on indirects might not be

the best way of management to spend its time.

Organisations might be able to win in the market

through their abilities in procuring direct materials

but no one ever wins because they got a great deal

on consumables.

Marketing Opportunities. In some cases, limited so

far but growing, a service provider has been used as

a back door opportunity for organisations in to start

to form strategic alliances. This can be both with

organisations in different industry sectors and also

the same sector.

6

So what is Procurement Outsourcing, exactly?

There are a number of different elements in Procurement

Outsourcing and clients can take all or (more commonly)

some of them. The diagram below sets out an overview of

the end to end procurement process and indicates the main

areas which can be outsourced.

To keep things simple we divide procurement services

into three functions:

Source

This covers all activities necessary to dene a sourcing

strategy for a category and to enable its implementation,

right up to the point before actual procurement. It covers

activities such as spend analysis, sourcing strategy, market

analysis, agreement of requirements, bid management,

contracting, vendor management and contract and

relationship management. Everything in fact to get a deal

in place that the organisation can use. Sourcing can cover

both strategic (longer term, high volume) and tactical (one

off, more infrequent) deals though Transactional or Spot

Buying falls between Source and Procure as it involves

some negotiating with suppliers. It is also process-driven

as seen in a Shared Service function. How best to handle

this is a key strategic decision to be made as part of the

Target Operating Model. We have also included Supplier

Relationship Management in this denition.

Procure

This function includes all the activities necessary to

requisition goods or services and enable the organisation

to consume them, in accordance with the agreed deal.

As it includes requisitioners communicating with service

providers, in many instances there can be a huge number

of interactions, so this part of the service is often heavily

technology-enabled. Technology can include online

catalogues, requisition management, order tracking and

fullment monitoring. This technology isnt just a way of

keeping track of everything that is happening; it performs

a vital function in disseminating the deal throughout the

organisation and helping to ensure compliance. There is no

point in negotiating a great deal if no one knows about it or

if no one uses it.

Pay

This function generally starts with a fullled order and

takes the transaction right the way through to payment,

including receiving and validating the invoice and making

the payment. As well as paying service providers, this

service also forms a key part of the compliance and

control feedback loop, as transactions with unauthorised

service providers should be picked up at this stage and

appropriate action taken. This part of the service is

more commonly thought of as Finance & Accounting

Outsourcing (FAO) rather than Procurement Outsourcing,

but nevertheless is important for completeness of the end

to end process.

By the way, in these difcult economic times it is worth

mentioning supply chain nance as a nal link in the

chain, although it isnt outsourcing in the usual sense.

Nevertheless it is something that a proactive service

provider could and should be proposing to clients and

even helping to arrange. It works like this:

Companies, especially large corporates, may well squeeze

suppliers by unilaterally extending payment terms,

which increases the possibility of suppliers going out of

business through lack of liquidity. As a result, there has

been increased interest in Supply Chain Finance i.e. how

to provide nance at the right place at the right time, at

the right cost. The obvious starting point for suppliers

is receivables discounting or factoring, which has been

around for a long time. However, more recently other

approaches have emerged whereby the good credit

rating of large corporate customers can be used for the

suppliers benet in funding receivables. Essentially, a

customer would provide visibility of approved invoices

on their system and would work together with a bank to

extend credit to the supplier against those invoices, which

would be at a lower rate of interest than the supplier could

obtain independently by leveraging their own credit rating.

The net effect is that the customer has extended their

payables without placing undue pressure on suppliers.

Spend analysis End user requisition

Day to day

purchasing

Category strategy

Supplier selection

and buying

Accounts payable

Contract and

relationship

management

Catalogue

content and order

management

Performance

management

Sourcing focused Procure to Pay

Source to Pay

Sample for services in a Procurement Outsourcing

Source Procure Pay

7

The commercial aspects of a

Procurement Outsourcing deal

Commercial terms can vary widely but as with any

outsourcing deal it is important to get this right.

It not only determines what the client will pay and

their business case but inevitably it will also drive

service provider behaviour.

Deal length

Typically, Procurement Outsourcing deals tend to be in

the region of three to ve years, which is a little shorter

than most BPO deals. This is because a lot of the

benet, certainly in terms of cost reduction, should have

been delivered within two to three years, after which

savings stabilise.

Commercial model

First of all, it is important to be clear on what kind of

service the client is buying and for example whether

it is outsourcing, co-sourcing or just consultancy

the distinction can be blurred. At one end of the scale,

transaction processing (processing requisitions or

purchase orders) is likely to be outsourcing. At the other

end the service provider may be providing advice that

the client may or may not choose to act on and thats

probably consultancy. In the middle, there is a wide

range of activities which may be repetitive, but which

all come under the heading of Business As Usual

when managing categories. As a result, Procurement

Outsourcing is generally more difcult to categorise

than some other types of BPO.

So how should commercial models work? There are two

main possibilities for Procurement Outsourcing and these

are described below.

Gainsharing Price Model

Given that one of the main objectives of Procurement

Outsourcing is to save costs, at rst sight it would appear

logical that a gainshare mechanism would be a good

approach. Indeed the rst deals in this space followed

this approach to a considerable extent. However, through

experience, a number of drawbacks became apparent.

From the service provider side, it quickly became

apparent that, although clients signed up for signicant

gainshare in the contract, when savings were realised

difculties were encountered in agreeing payments.

Arguments such as we could have done that and

we were going to do that anyway surfaced, along with

disputes about the baseline. In addition, some clients

didnt make provision in the accounts for the gainshare

and so had difculties getting signicant payments

approved. From the client side, there was a fear that,

if the service provider has the opportunity for signicant

reward through cost savings, then there is no surprise

that that is what they are going to focus on, despite other

controls such as quality, service and cost of ownership.

However, this is not to say that a gainshare model is

unworkable, just that it needs to be handled with care so

that both sides, client and service provider, achieve the

right outcomes.

The gainsharing model is strongly preferred by some

service providers, who believe that the perceived

downsides can be managed.

Fixed Price Model

At the other end of the scale from a gainshare model is

xed price, where the service is predened for the various

scopes of work, for example transactional or sourcing-

based. As the scope varies the fee will vary. In general

the fee will be higher in the initial term of contract (as

there is more sourcing) and reduces over time as deals

are set up and savings are realised.

In addition to the xed fee there is often (but not

necessarily) a performance bonus depending on certain

criteria such as savings, compliance, spend under

management and user satisfaction. The performance

bonus can be thought of as a low leverage gainshare

it should be big enough to be interesting but not so large

that it completely skews behaviour.

One senior executive from a service provider told us that

for them the advantage of xed fee plus a performance

bonus model is that it gives ample room for innovation

and gives enough incentive to think in terms of long

term savings. Their view point on gainsharing was that it

encourages short term behaviour as the provider tends to

seek much easier targets but the long term target might

be overlooked. Overleaf is a brief summary of the key

points of the two models.

8

Fixed Fee Pricing Model

(with or without Risk/Reward)

a Outsourcing provider has freedom to innovate

a Customer cannot determine providers prot-

margin and knows little about provider costs

a Negotiations are complex

a Customer offers many incentives to deliver

value-added services

a Relationships are trust-based, i.e., weaker

performance measures

a May cost more due to talent required to provide

added-value

a Issue like re-engineering and dealing with

stakeholders can be handled well

Gainsharing Pricing Model

a Outsourcing provider has freedom to innovate

a Customer cannot determine providers

prot-margin

a Customer offers few incentives to deliver

value-added services

a Customer knows provider costs

a Customer shares gain with provider

a Customer must closely track performance

a Provider might seek to gain some easy targets

Based on our research less than 20% of deals are

gainshare only models (i.e. no gain, no fee). Nearly 50%

are on a pure xed price basis and about 30% include a

performance bonus.

There are also some deals that involve a risk/reward

element where the fee can be put at risk if outcomes are

not achieved. This is a variant on gainshare and often

works well with CFOs who do not wish to share too much

of the benets with the service provider.

There are a couple of other points to note concerning

commercial models:

The rst is the distinction between identied and

realised savings. This may seem obvious but some

clients we spoke to noted that this is a key distinction

to make the commercial model should focus on the

latter, not the former.

Secondly, the timing of savings over the lifetime of the

deal is important. If there is a savings target over a multi-

year deal it is important not to be in the situation (as one

corporate was) where all of the savings were achieved in

the rst year of a ve year deal, because the bar was set

too low. As a result, the service provider wasnt obliged to

deliver any further savings beyond year two. The secret is

to set stretching annual targets to avoid this situation.

9

The challenges

why isnt everyone doing it?

We saw through our research how procurement

outsourcing can deliver real benets that a client could

not have realised for themselves. We also saw that set up

costs can be relatively low and that, per dollar or Euro or

pound saved, it probably causes the least upheaval within

an organisation than any other form of outsourcing.

So, on the face of it Procurement Outsourcing appears

to deliver a relatively painless win if a third party

can achieve sustainable cost savings through their

expertise, and there is relatively little upheaval involved

(at least, compared to shipping whole departments

off to India), why doesnt everyone do it? In difcult

economic times it would appear to be a godsend a

painless and victimless route to lower costs.

The main challenges we identied through our research

are as follows:

The Do It Yourself option. Most Procurement

Outsourcing service providers will say that this is their

main competitor. Because none of the approaches

and methodologies that a Procurement Outsourcing

service provider can bring are trade secrets or rocket

science, any organisation could deploy them, just as

they can mirror what an outsourcer could do in other

elds, such as moving to low cost locations. So, once a

service provider has done a feasibility review, the client

may well try to implement the actions themselves.

This option is of course perfectly valid but is not risk-

free can the client really deliver? Can they deliver in

the timescales? Can they deliver within a budget?

Fear of loss of control. Clients tend to have concerns

around losing control over procurement. This is an

interesting perspective because in fact outsourcing can

actually enhance control and compliance through the

implementation of new technology. We heard from all

sides of one way of mitigating this concern, which is

strong stakeholder management

Lack of scale. Larger service providers will say that a

minimum in-scope spend of 100m is required to make

an outsourcing deal really worthwhile, whilst smaller

service providers will be happy to work with less. But

obviously, the larger the in-scope spend, the better.

Confusion about the market. There is still a lot of

confusion as to what the service providers can offer,

who is good in which categories and which geographies

and also, what types of commercial deals are possible.

Alsbridge can help

If you are interested in exploring Procurement

Outsourcing but you dont have the experience,

Alsbridge can help. First of all we can help you

decide whether Procurement Outsourcing is

right for you and, if it is, how to ensure the deal

is a success. We do this by guiding you through

a process which ensures all of the relevant

operational and commercial issues are

addressed and the outcome is a sustainable

deal which meets your requirements.

Specically, Alsbridge can advise on:

Feasibility of Procurement Outsourcing and what your

business case might be

A strategy and Target Operating Model for your

procurement organisation

The key service providers of Procurement Outsourcing

services and what they can do

Which categories and activities should be in and out

of scope

Should you include transaction processing in the deal

or not?

How to put a Request for a Proposal together

How to evaluate responses and select a service provider

Contractual and commercial terms

Implementation and transition

In short, Alsbridge can help you generate real value from

Procurement Outsourcing.

To nd out more information or to discuss your

requirements in more detail, please contact:

David Eakin

Senior Manager

david.eakin@alsbridge.eu

+44 (0) 7884 183872

Вам также может понравиться

- Finance Business PartneringДокумент26 страницFinance Business PartneringPaulОценок пока нет

- Brain Station Course CurriculumДокумент21 страницаBrain Station Course CurriculumAliAbassi100% (1)

- Mid MonthДокумент4 страницыMid Monthcipollini50% (2)

- IncomeTax Banggawan2019 Ch14Документ12 страницIncomeTax Banggawan2019 Ch14Noreen Ledda0% (1)

- Project Report - JGB JCB Works and ServiДокумент10 страницProject Report - JGB JCB Works and Servinatraj kumarОценок пока нет

- Effective Working CapitalДокумент23 страницыEffective Working CapitalUmmed SinghoyaОценок пока нет

- Spring Week GuideДокумент32 страницыSpring Week Guidevimanyu.tanejaОценок пока нет

- Ebook 1 SiriusDecisions Demand Waterfall Marketing AutomationДокумент17 страницEbook 1 SiriusDecisions Demand Waterfall Marketing AutomationMubashsher SalimОценок пока нет

- How To Think Like A Strategy Consultant A Primer For General Managers1Документ3 страницыHow To Think Like A Strategy Consultant A Primer For General Managers1jexxicuhОценок пока нет

- Pega Ds Know Your Customer Kyc FrameworkДокумент2 страницыPega Ds Know Your Customer Kyc FrameworkAnuragОценок пока нет

- Athos Partners - Private Equity Intern Placement (January 2021)Документ2 страницыAthos Partners - Private Equity Intern Placement (January 2021)Sysy VizirОценок пока нет

- Factoring and Invoice Discounting Working Capital Management OptionsДокумент5 страницFactoring and Invoice Discounting Working Capital Management OptionsKomal ParikhОценок пока нет

- Group Project 2, S011Документ1 страницаGroup Project 2, S011Himanshu MalikОценок пока нет

- IveyMBA Permanent Employment Report PDFДокумент10 страницIveyMBA Permanent Employment Report PDFUmesh T NОценок пока нет

- $$Alvarez&Marsal PDFДокумент16 страниц$$Alvarez&Marsal PDFSourav DasОценок пока нет

- Apple Company's High Switching Cost To Enforce Customer Loyalty.Документ10 страницApple Company's High Switching Cost To Enforce Customer Loyalty.Diyaree FayliОценок пока нет

- Leland 1994Документ36 страницLeland 1994pedda60100% (1)

- Manual of Regulations For BanksДокумент840 страницManual of Regulations For Banksdyosangpinagpala100% (5)

- Capital Protected FundsДокумент37 страницCapital Protected FundssunnyzuluОценок пока нет

- Supply Chain Management (SCM) BPO - Beyond Procurement Outsourcing (PO)Документ10 страницSupply Chain Management (SCM) BPO - Beyond Procurement Outsourcing (PO)everestgrpОценок пока нет

- The Essentials Off Procure-To-Pay: EbookДокумент10 страницThe Essentials Off Procure-To-Pay: EbookSurendra PОценок пока нет

- Tail Spend Management How To Squeeze SavingsДокумент7 страницTail Spend Management How To Squeeze SavingsKhali Alaudeen100% (1)

- Tail Spend Management FundamentalsДокумент17 страницTail Spend Management FundamentalsToca DiscoОценок пока нет

- EY Treasury Management Services PDFДокумент16 страницEY Treasury Management Services PDFKathir KОценок пока нет

- Gyration Keyboard ManualДокумент24 страницыGyration Keyboard Manualichung819Оценок пока нет

- CRM ExplainedДокумент18 страницCRM Explainedadei667062Оценок пока нет

- Mobil UsmrДокумент2 страницыMobil UsmrSiddharth SrivastavaОценок пока нет

- Private Equity Performance Measurement Multiples PDFДокумент12 страницPrivate Equity Performance Measurement Multiples PDFvikas@davimОценок пока нет

- Deloitte Cracking The CaseДокумент41 страницаDeloitte Cracking The CaseArka DasОценок пока нет

- Axial - 7 MA Documents DemystifiedДокумент23 страницыAxial - 7 MA Documents DemystifiedcubanninjaОценок пока нет

- Digital P Ro Curement Maturity: Gelililng Liop. L!Ue F.Rom Itechnol!Og ND It L!EnitДокумент6 страницDigital P Ro Curement Maturity: Gelililng Liop. L!Ue F.Rom Itechnol!Og ND It L!EnitPaula Lande CoralОценок пока нет

- London 2011Документ32 страницыLondon 2011Amandine JayéОценок пока нет

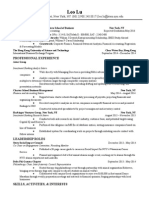

- Lu Leo ResumeДокумент2 страницыLu Leo ResumeLeo LuОценок пока нет

- Real-Time Data Analytics Case StudiesДокумент37 страницReal-Time Data Analytics Case StudiesHarrison HayesОценок пока нет

- EY Introduction To Financial ModellingДокумент8 страницEY Introduction To Financial ModellingMilin JainОценок пока нет

- 157 28235 EA419 2012 1 2 1 CH 08Документ38 страниц157 28235 EA419 2012 1 2 1 CH 08devidoyОценок пока нет

- Accenture Casebook PDFДокумент28 страницAccenture Casebook PDFnisargОценок пока нет

- BPO - Business Process OutsourcingДокумент18 страницBPO - Business Process Outsourcinggunjan tiwariОценок пока нет

- FM AnalysisДокумент62 страницыFM AnalysisSofiya BayraktarovaОценок пока нет

- Procurement Outsourcing BrochureДокумент2 страницыProcurement Outsourcing BrochureEnterprise Consulting And Business SolutionsОценок пока нет

- EDHEC Case Study 1 - QofE 2021Документ6 страницEDHEC Case Study 1 - QofE 2021Sysy VizirОценок пока нет

- Capital Budgeting Practices in Developing CountriesДокумент19 страницCapital Budgeting Practices in Developing CountriescomaixanhОценок пока нет

- Is Your Marketing Strategy Based On The Right DataДокумент6 страницIs Your Marketing Strategy Based On The Right DataParth VijayОценок пока нет

- Case Studies - StrategyДокумент186 страницCase Studies - Strategyamritam yadavОценок пока нет

- Payables Finance: A Guide To Working Capital OptimisationДокумент40 страницPayables Finance: A Guide To Working Capital Optimisationananth080864Оценок пока нет

- Vault Guide To Middle Market Investment BankingДокумент234 страницыVault Guide To Middle Market Investment Bankingkirihara95100% (1)

- Proposal Management Insights: A Collection of Selected Articles Based on Over 10 Years of Industry ExperienceОт EverandProposal Management Insights: A Collection of Selected Articles Based on Over 10 Years of Industry ExperienceОценок пока нет

- AA153501 1427378053 BookДокумент193 страницыAA153501 1427378053 BooklentinieОценок пока нет

- Client Onboarding Move To Channel of Choice and Reap RewardsДокумент28 страницClient Onboarding Move To Channel of Choice and Reap Rewardskk_sharingОценок пока нет

- Math Case PrepДокумент21 страницаMath Case Prepluli9999Оценок пока нет

- Bain & Company Cover LetterДокумент2 страницыBain & Company Cover Letterbenwilson_95Оценок пока нет

- Cover LetterДокумент1 страницаCover Lettermsultan000Оценок пока нет

- Digital Procurement For Lasting Value Go Broad and Deep PDFДокумент9 страницDigital Procurement For Lasting Value Go Broad and Deep PDFbilalsununu1097Оценок пока нет

- ILPA Best Practices Capital Calls and Distribution NoticeДокумент23 страницыILPA Best Practices Capital Calls and Distribution NoticeMcAlpine PLLCОценок пока нет

- Deloitte Uk Hints and Tips HRДокумент6 страницDeloitte Uk Hints and Tips HRJames CheungОценок пока нет

- Blackgarden M&a BrochureДокумент13 страницBlackgarden M&a BrochureEminKENОценок пока нет

- Finance Manager in Atlanta GA Resume Benjamin HughesДокумент3 страницыFinance Manager in Atlanta GA Resume Benjamin HughesBenjaminHughesОценок пока нет

- BCG Procurement ReportДокумент35 страницBCG Procurement ReportSowmya VisinigiriОценок пока нет

- Accelerating Shared ServicesДокумент41 страницаAccelerating Shared ServicesJordi PascualОценок пока нет

- 2009 AnnualReport EmailДокумент145 страниц2009 AnnualReport EmailDaniel Smart OdogwuОценок пока нет

- Project Finance SchemeДокумент7 страницProject Finance SchemeAndy Q SupriyanaОценок пока нет

- Aeb SM CH10 1 PDFДокумент27 страницAeb SM CH10 1 PDFAdi SusiloОценок пока нет

- Midterm Exam 2 - SolutionДокумент6 страницMidterm Exam 2 - SolutionbobtanlaОценок пока нет

- The Phonology of Pashto - Henderson 1998Документ4 страницыThe Phonology of Pashto - Henderson 1998Donna HallОценок пока нет

- GR No. 183374Документ1 страницаGR No. 183374Karen Gina DupraОценок пока нет

- Civ 2 pp8Документ2 страницыCiv 2 pp8Ren Irene D MacatangayОценок пока нет

- Lecture Notes On Receivable FinancingДокумент5 страницLecture Notes On Receivable Financingjudel ArielОценок пока нет

- Credit Card StatementДокумент4 страницыCredit Card StatementTrushar ParmarОценок пока нет

- Slna Govt. of Andhra PradeshДокумент24 страницыSlna Govt. of Andhra Pradeshk_sateeshОценок пока нет

- Pricing IRSДокумент13 страницPricing IRSswapnil6121986Оценок пока нет

- Chapter 8Документ66 страницChapter 8Jamaica Rose Salazar0% (1)

- Reviewer in Transportation Law - Finals PDFДокумент9 страницReviewer in Transportation Law - Finals PDFDiane Althea Valera Pena100% (1)

- Introduction To Insurance IndustriesДокумент37 страницIntroduction To Insurance IndustriesNishaTambeОценок пока нет

- Itl Cia3Документ25 страницItl Cia3Amrit DasguptaОценок пока нет

- US Internal Revenue Service: 2005p1212 Sect I-IiiДокумент168 страницUS Internal Revenue Service: 2005p1212 Sect I-IiiIRSОценок пока нет

- Student Debt: The Next Financial Crisis?: HalahtouryalaiДокумент3 страницыStudent Debt: The Next Financial Crisis?: HalahtouryalaiSimply Debt SolutionsОценок пока нет

- Iceland Catch SharesДокумент5 страницIceland Catch SharesFood and Water WatchОценок пока нет

- ZPPF RLДокумент5 страницZPPF RLMurali Krishna VОценок пока нет

- Non-Performing Loans (NPL)Документ12 страницNon-Performing Loans (NPL)Farhana KhanОценок пока нет

- Valutation by Damodaran Chapter 3Документ36 страницValutation by Damodaran Chapter 3akhil maheshwariОценок пока нет

- Mahesh Kadam Research PaperДокумент6 страницMahesh Kadam Research Paperपाँशुल जम्वाल राजपूतОценок пока нет

- Auditors Report For NBFCДокумент9 страницAuditors Report For NBFCamidclОценок пока нет

- Chapter Two: Asset Classes and Financial InstrumentsДокумент27 страницChapter Two: Asset Classes and Financial Instrumentsbilly93100% (1)

- CNMVTrimestreI07 Een PDFДокумент273 страницыCNMVTrimestreI07 Een PDFsolajeroОценок пока нет

- Piramal Glass - Rights Issue - Aug 2009Документ311 страницPiramal Glass - Rights Issue - Aug 2009vishmittОценок пока нет

- Accounts Paper Ii PDFДокумент6 страницAccounts Paper Ii PDFAMIN BUHARI ABDUL KHADERОценок пока нет