Академический Документы

Профессиональный Документы

Культура Документы

JSW Steel Equity Research Report

Загружено:

Nikhil Joshi100%(1)100% нашли этот документ полезным (1 голос)

301 просмотров20 страницThis is an equity research report of JSW Steel.

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis is an equity research report of JSW Steel.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

301 просмотров20 страницJSW Steel Equity Research Report

Загружено:

Nikhil JoshiThis is an equity research report of JSW Steel.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 20

8

JSW Steel Ltd

Beyond the Ban!!

Kunal Motishaw

+91 22 663 99138

kunal.motishaw@violetarch.com

Institutional Research

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

2

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Index

Executive Summary 3

Scenario Analysis 4

Key Assumptions 5

SWOT Analysis 6

Peer Valuation 7

Valuation 7

Key Investment Arguments 8-13

Key Risks and Concerns 14

Company Background 15

Industry Overview 16

Financial Summary 17

3

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

COMPANY REPORT

JSW Steel Ltd

Beyond the Ban!!

Equity Research l Metal

May 6, 2013

JSW Steel (JSTL) has been the best executor of projects in the domestic ferrous space. The

company has increased capacity from a 0.8MTPA in FY00 to 11MTPA (including 1MTPA at Salem)

in FY12 translating into a CAGR of 27%. Further, with the acquisition of ISPAT, JSW steel is now

the largest steel company in India with an installed capacity of 14.3MTPA. Also, with Supreme

Court lifting the iron ore mining ban on Category A & Category B mines, iron ore procurement

cost for JSW steel should come down gradually over a period of time. Further, with operational

efficiencies at JSW ISPAT expected in the coming quarters, the company is expected to report

healthier margins. We initiate coverage on JSW Steel with a BUY rating and a target price of Rs

972, providing a 39% upside from the current level.

Investment Argument

Efficient Converter with rich product mix

Despite no backward integration (earlier ~20% for iron ore), JSTL has been able to maintain

competitive operating margins due to its efficient operations. JSW steel has one of the lowest

conversion costs amongst large steel producers with conversion cost of around USD 150/tonne.

Further, being a non integrated player, the company is highly susceptible to change in raw

material prices thus making it the main beneficiary of falling raw material prices. Further, given

the companys continuous emphasis on value addition, share of semis in total volumes has come

down over the years from 22% in FY10 to 5% in FY12. Going forward, we expect the share of

semis to remain below 3%.

Lifting of mining ban to improve utilization levels

With the positive verdict from the Supreme Court of India on Category A & B iron ore mines

and auctioning of sub-grade ore along with an evolving regulatory framework we expect more

supply of ore and sub grade ore. This in turn should lead to a drop in ore prices and benefit steel

mills like JSW Steel with captive beneficiation and pelletisation facilities and also improve

utilization levels. However, the benefits of the same are expected only from the end of FY14E.

JSW-Ispat - Operating metrics set to improve

JSTL had outlined substantial cost savings at JSW Ispat to the tune of Rs3.5bn-5bn annually. As

per our understanding, while part of the synergy gains in marketing and power sourcing are

already being realized, we think the actual turnaround at JSW ISPAT is not too far, with the full

benefits of cost savings from the 55MW power plant fed on BF gas, 1MT coke oven battery 4MT

pellet plant and replacement of external gas with coke oven gas expected to gradually

contribute. We believe post completion of all these initiatives, JSW ISPAT could see cost savings

of ~USD75-80/tonne.

Valuation

JSTL has corrected 22% since the announcement of the mining ban in the Bellary district (and

16% YTD). At the current valuations of 4.4x FY15E EV/EBITDA, JSTL trades at a discount to its

historic EV/EBITDA of 6x, implying value in the stock. We value JSTL at 5xFY15 EV/EBITDA and

arrive at a SOTP target price of Rs 972/share, a discount to its historical average due to lack of

raw material integration and slow off-take of steel in the domestic market. Delays in securing

timely and adequate e-auction ore supplies and starting of mining operations in Category B

mines pose key downside risk to our estimates.

Particulars (Rs mn) FY12 FY13E FY14E FY15E

Revenues 341,237 363,874 376,525 421,121

EBITDA 58,575 65,025 66,686 79,018

EBITDA margins (%) 17.2 17.9 17.7 18.8

EBITDA growth (%) 25.6 11.0 2.6 18.5

Adj. Net profit 11,151 16,123 15,556 20,868

Adj. Net profit growth (%) (36.4) 44.6 (3.5) 34.1

Net Profit margins (%) 3.3 4.4 4.1 5.0

FDEPS (Rs) 50.0 66.7 64.4 86.3

FDEPS growth (%) (36.4) 33.5 (3.5) 34.1

P/E (x) 14.0 10.5 10.9 8.1

Source: Company, Violet Arch Research

Stock data

CMP Rs 700

Reuters Code JSTL.BO

Bloomberg Code JSTL IN

Equity Shares o/s (mn) 241.7

Market Cap (Rs bn) 160

Market Cap (USD bn) 3.2

Stock performance (%)

52-week high / low Rs 894 /566

1M 3M 12M

Absolute 4.7 (17.3) 1.5

Relative 1.2 (14.8) (11.1)

Shareholding pattern (%)

Relative stock movement

Promoter, 38

Public &

others, 37

FII, 20

DII, 5

80

90

100

110

120

130

A

p

r

-

1

2

M

a

y

-

1

2

J

u

n

-

1

2

J

u

l

-

1

2

A

u

g

-

1

2

S

e

p

-

1

2

O

c

t

-

1

2

N

o

v

-

1

2

D

e

c

-

1

2

J

a

n

-

1

3

F

e

b

-

1

3

M

a

r

-

1

3

A

p

r

-

1

3

JSW Steel Sensex

Absolute Rating

BUY

Target Price

Rs 972

Upside 39%

4

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Scenario Analysis

FY15E (Standalone) Bull Case Base Case Bear Case

Realisation (Rs/tonne) 43,922 41,920 39,732

Steel Sales Volumes (mn tonnes) 10 9.1 8.49

Exchange Rate (INR:USD) 49 51 55

EBITDA (Rs mn) 103,951 74,365 48,952

Inc / Dec from base case (%) 39.8 - (34.2)

EPS (Rs) 165.83 103.44 52.4

Inc / Dec from base case (%) 60.3 - (49.3)

CMP 700 700 700

Target Price 1,188 972 514

Upside % 69.7 38.9 (26.6)

Source: Violet Arch Research

Bull Case

Steel Realizations to be higher at Rs 43,922/tonne on the back of improved international

prices and increased domestic demand.

Sales volumes assumed at 10mn tonnes an increase of 10% from our base case assumption

and 16.3% over FY14E levels on the back of optimum capacity utilisation and higher

demand for steel domestically.

Exchange rate assumed at Rs49/USD.

Base Case

Steel Realizations to average at Rs 41,920/tonne on the back of subdued domestic demand

and import parity prices.

Sales volumes assumed at 9.1mn tonnes an increase of 6% from FY14E levels as domestic

demand expected to grow by ~7%.

Exchange rate assumed at Rs51/USD.

Bear Case

Steel realizations expected to fall from the current levels and average at Rs 39,732/tonne

on the back of a fall in international prices and weak demand.

Sales volumes at 8.49mn tonnes as iron ore supplies get delayed

Exchange rate assumed at Rs53/USD

Impact of 5% change of various Parameters on EBITDA & EPS

(FY15E) EBITDA EPS

Exchange rate 8.4% 17.8%

Iron ore 4.4% 9.3%

Coking coal 9.2% 14.9%

Steel Prices 21.4% 34.3%

Source: Violet Arch Research

5

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Key Assumptions

Steel Sales volumes expected to grow by 4.4% to 8.6mn tonnes in FY14E and 5.8% to 9.1mn

tonnes in FY15E.

Blended Realization/tonne expected to fall by 2.35% to Rs 39,584 in FY14E and increase by

5.9% to Rs41,920 in FY15E.

Iron ore cost on a per tonne basis expected to increase by 2.5% to Rs3,381/tonne in FY14E

and increase by 3.4% to Rs3,496/tonne in FY15E. It must be noted that iron ore costs

increased by 26% in FY13E due to the mining ban in Karnataka.

Blended Coking coal cost to decrease by 4.7% to Rs11,600/tonne in FY14E and increase by

5.8% to Rs12,271/tonne in FY15E.

Exchange rate expected to average at Rs53/USD in FY14E and Rs51/USD in FY15E.

Particulars FY11 FY12 FY13E FY14E FY15E

Steel Sales Volumes (mn tonnes) 6.11 7.77 8.24 8.60 9.10

Blended realization (Rs/tonne) 37,915 41,248 40,508 39,584 41,920

Iron Ore (Rs/tonne) 2,858 2,620 3,300 3,381 3,496

Blended coking coal (Rs/tonne) 10,673 13,412 12,173 11,600 12,271

Currency (INR/USD) 45.5 47.9 54.5 53.0 51.0

Source: Company, Violet Arch Research

Per tonne analysis (Standalone / Rs) FY11 FY12 FY13E FY14E FY15E

Net Sales 36,411 43,153 41,502 40,157 42,625

Less:-

Raw Material 22,179 28,074 26,365 25,506 27,069

Employee Cost 832 850 862 855 847

Power and Fuel 1,838 2,288 2,325 2,137 2,144

Other Expenses 4,076 4,677 4,395 4,275 4,390

TOTAL 28,925 35,889 33,948 32,773 34,450

EBITDA/tonne (Rs) 7,486 7,264 7,554 7,384 8,175

EBITDA/tonne (USD) 165 152 139 139 160

Source: Company, Violet Arch Research

6

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

SWOT Analysis

Source: Violet Arch Research

SWOT

Analysis

Strengths

1) JSW Steel is amongst the fastest growing

steel companies globally with steel

capacities increasing by 7x in just 10 years.

Besides, JSTL also features amongst the

most efficient steel producers globally.

2) This clearly illustrates the Companys

excellent brown field execution and cost

management skills.

Weaknesses

1) JSW Steel meets 100% of its coking coal

and iron ore requirement from external

sources. Lack of raw material sufficiency

would imply higher costs and in-turn

earnings volatility for the company.

Further, with the domestic iron ore mining

industry facing bans in certain regions,

prices domestically have increased as

supply has not been able to match

demand.

Opportunities

1) As Indias largest steel producer, JSTL will be

a key beneficiary of domestic growth and rising

steel demand. We estimate steel demand to

grow by 6% in FY14E and 7% in FY15E.

2) While the company has currently put its 10

MTPA plant in West Bengal on hold, land

acquisition for the same is complete. The

company is waiting for iron ore mine allocation

there until it puts some meaningful investment

into the same. Hence, if JSTL is successful in

commissioning of these projects, it will see the

company well placed to reap the benefits of

rising steel demand.

Threats

1) Sudden drop in steel demand and inability

to pass on raw material price increase to end

customers would result in a severe dent to

profitability on the back of negative impact of

higher operating leverage. It must be noted

that in FY13, steel demand grew by a mere 4%

YoY.

2) As per our understanding, 60% of Indias

capacity addition over the next few years is

expected to come in the flats segment, with

HRC accounting for over 50%. JSTL has high

exposure to the flats segment (HRC in

particular) which could imply pricing pressure

on the majority of its product offerings.

7

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Peer Valuation

Company Name

Mkt

Cap

(Rs bn)

Revenues (Rs bn) EBITDA (Rs bn) PAT (Rs bn) P/E (x) EV/EBITDA (x)

CY12/

FY13

CY13/

FY14E

CY14/

FY15E

CY12/

FY13

CY13/

FY14E

CY14/

FY15E

CY12/

FY13

CY13/

FY14E

CY14/

FY15E

CY12/

FY13

CY13/

FY14E

CY14/

FY15E

CY12/

FY13

CY13/

FY14E

CY14/

FY15E

Arcelor Mittal 1,044 4,501 4,563 4,488 681 638 671 (199) 167 189 - 18.1 16.0 6.1 5.6 4.9

China Steel Corp. 700 374 707 665 37 91 68 11 34 38 46.9 14.5 12.8 6.9 6.8 6.3

JFE Holdings Inc 671 2,102 2,030 1,725 154 186 136 26 (25) 21 23.9 - 30.4 7.6 7.7 6.3

SAIL 266 457 468 569 56 66 91 26 27 38 10.1 9.9 7.1 8.2 7.4 5.6

Tata Steel 310 1,363 1,439 1,380 113 158 155 (7) 31 27 - 7.7 6.0 8.0 5.8 5.6

JSW Steel 169 364 377 421 65 67 79 16 16 21 10.5 10.9 8.1 5.1 5.2 4.4

AVERAGE

7.0 6.4 5.5

Source: Bloomberg, Violet Arch Research

JSTL is trading at 4.4x FY15E EV/EBITDA as compared to its peers, which are trading at an

average 5.5xCY14E/FY15E EV/EBITDA. Further even other domestic players like SAIL &

Tata Steel are trading at a premium as compared to the company.

Valuation

JSW steel has corrected 22% since the announcement of the mining ban in the Bellary district

(and 16% YTD). At the current valuations of 4.4x FY15E EV/EBITDA, JSTL is trading at a discount

to its historic 5-year average EV/EBITDA of 6x, implying value in the stock. Further, with the

Chinese macro and bulk commodity outlook looking bleak, we believe that JSW Steels non-

integrated (direct beneficiary of a drop in international coking coal prices) nature and efficient

operations puts it a sweet spot.

Also, we like JSW Steel from a bottom-up approach, wherein we expect its iron ore

procurement costs to drop due to demand supply mismatch for iron ore fines in Karnataka, and

re-starting of Category B mines by end FY14E. In our view this along with increased domestic

off take and improvement in operating metrics at JSW Ispat would be the key drivers for the

stock going forward. We value JSW Steel based on EV/EBITDA methodology, as it captures the

operating dynamics of the business model and also its capital structure. We value JSTL at 5xFY15

EV/EBITDA and arrive at a SOTP target price of Rs 972/share, a discount to its historical average on

the back of lack of raw material integration and slow off-take of steel in the domestic market. Delays

in securing timely and adequate e-auction ore supplies and re-starting of mining operations in

Category B mines pose key downside risk to our estimates. We initiate coverage on the stock with a

BUY rating.

(Rs mn) Basis Multiple FY15E

JSW Steel (Consolidated) EBITDA 5.0 79,018

Enterprise Value

395,092

Less :- Net Debt

(176,065)

Add:- Investments

JSW Energy (5.6% stake) 30% discount to CMP 0.7 4,160

Ispat 0.5x invested equity 0.5 11,785

Target Market Cap

234,972

Fully Diluted Shares (mn)

241.7

Target Price (Rs)

972

CMP (Rs)

700

Upside (%)

38.9

Source: Company, Violet Arch Research

8

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Key Investment Argument

Efficient converter with rich product mix

Despite no backward integration (earlier ~20% for iron ore), JSTL has been able to maintain

competitive operating margins due to its efficient operations. JSW steel has one of the lowest

conversion costs amongst large steel producers with conversion cost of around USD 150/tonne.

Further, being a non integrated player, the company is highly susceptible to change in raw

material prices thus making it the main beneficiary of falling raw material prices. However due

to the recent iron ore ban in Karnataka which has just been lifted and will take miners some

time to increase output, domestic iron ore prices are expected to remain buoyant and the

company is not expected to benefit from falling iron ore prices globally as it will have to buy iron

ore at e-auction prices till end FY14. Nevertheless, decline in coking coal prices will benefit JSTL.

JSTL lowest conversion cost amongst domestic majors

Source: Company, Violet Arch Research

JSW Steel Units (Standalone)

Particulars Capacity (MTPA) Location

Crude Steel 11 Vijaynagar + Salem

Slabs 10 Vijaynagar

Billets 2.75 Vijaynagar + Salem

HRC + plates 6.7+0.32 Vijaynagar + Salem

Rolled Long 2.2 Vijaynagar + Salem

Cold rolled coils 1.8 Vijaynagar

Galvanised coils 0.9 Vasind

Colour Coated Sheets 0.2 Vasind

Captive Power plant (MW) 920 Vijaynagar + Salem + Vasind

Source: Company, Violet Arch Research

JSW Steel, through its timely capacity expansion, has delivered a staggering 27% CAGR in

volumes over FY00-FY12. JSTLs steel making capacity has increased ~4x over FY05-FY12 to

11mtpa, which after the ISPAT merger now stands at 14.3MTPA. With iron ore sourcing likely to

improve from end FY14E, we expect the company to benefit from the same. Given the

companys continuous emphasis on value addition, share of semis in total volumes has come

down over the years from 22% in FY10 to 5% in FY12. Going forward with value added capacity

540

369

280

150

339

419

-

100

200

300

400

500

600

700

800

JSW Steel SAIL Tata Steel

Raw Material Conversion Cost

9

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

coming on stream, we expect the share of semis to remain below 3%. Enhanced product mix has

also led to JSTLs realisation spread over landed HRC prices to remain at ~9% over the past few

years.

JSTLs capacity has grown at a staggering 30% CAGR over the years

Source: Company, Violet Arch Research

Lifting of mining ban to improve utilization levels

The blanket ban across the districts of Chitradurga, Tumkur and Bellary in Karnataka practically

left JSTL with NMDC as its supply source as procuring iron ore from Orissa and Chhattisgarh is

not a viable option due to high logistics costs. Also, this left JSTL highly exposed, given concerns

over NMDCs ability to ramp-up iron ore production in Karnataka (to 1mn tonnes/month).

However, with the Supreme Court decision to allow e-auction of iron ore gave the much needed

breathing space to JSTL. Now, after clearance by the Supreme Court of Category A & Category B

mines, few category A mines have restarted operations with 3 mines starting during 4QFY13, in

addition to 6 mines starting earlier. The combined capacity of the 3 new mines stands at ~5.5

MTPA. Further two more mines are expected to restart adding further ~1 mtpa. On the other

hand after the introduction of advance e-auction, the company expects NMDC also to supply

more iron ore (~9 mtpa) in Karnataka. As far as category B mines are concerned, R&R plans for

20 mines have been approved and are under preparation for other mines. Also, 12 mines have

accepted all the conditions stipulated by the Supreme Court to consider re-commencement of

mining.

Hence, all in all, the iron ore availability situation is likely to improve gradually. At 78%

utilization levels (our estimate for FY14E), the company would need ~15 mn tonnes of high

grade ore. As per our understanding, NMDC should contribute ~9 mn tonnes along with another

6 mn tonnes from category A mines. Considering JSW Steel buys ~65% of the fines auctioned,

the company can secure ~8 mn tonnes through this route. Further, the company has also has

been buying ~2.5 mn tonnes from Orissa and Chhattisgarh. Thus, total availability should be in

excess of ~15 mn tonnes giving us the confidence that even without dump ore and category B

mines, the company should not see a major problem in achieving our estimated utilization level

for FY14E.

0

2

4

6

8

10

12

FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13E FY14E FY15E

10

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Iron ore sourcing should not be a major problem going forward

Source: Company, Violet Arch Research

In 4QFY13, the Monitoring Committee had auctioned about 6.3 mn tonnes of low-grade ore

from the dumps of Mineral Enterprises Limited for an average price of Rs 650/tonne for 53% Fe

grade ore. Since the company has technology available to beneficiate low-grade iron ore, it has

so far used up to 52% Fe and for the first time the management plans to experiment with even

lower grade ore. However, recovery of iron would be in the range of 35-40% and the losses

around 60%.

Utilization Levels have steadily improved in recent times

Source: Company, Violet Arch Research

Also, as per data from Indian Bureau of mines (IBM), 56% of the Karnataka ore inventories have

Fe content lower than 62% and fines account for 60% of total inventory volumes. We expect

lower bidding for low grade fines/ lumps in the e-auction process given limited domestic

pelletisation/sintering facilities. With its captive 20mn tonnes beneficiation and 9mn tonnes

pelletisation facility, JSW Steel will be a key beneficiary of the favorable inventory mix.

JSTL (FY14E)

~15mn tonnes of

high grade ore

NMDC (9mn

tonnes)

Category 'A'

mines (6mn

tonnes)

Orissa &

Chattisgarh

(2.5mn tonnes)

Fines (8mn

tonnes )

50.0%

55.0%

60.0%

65.0%

70.0%

75.0%

80.0%

85.0%

1

Q

F

Y

0

9

2

Q

F

Y

0

9

3

Q

F

Y

0

9

4

Q

F

Y

0

9

1

Q

F

Y

1

0

2

Q

F

Y

1

0

3

Q

F

Y

1

0

4

Q

F

Y

1

0

1

Q

F

Y

1

1

2

Q

F

Y

1

1

3

Q

F

Y

1

1

4

Q

F

Y

1

1

1

Q

F

Y

1

2

2

Q

F

Y

1

2

3

Q

F

Y

1

2

4

Q

F

Y

1

2

1

Q

F

Y

1

3

2

Q

F

Y

1

3

3

Q

F

Y

1

3

11

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

JSW-Ispat - Operating metrics set to improve

JSW Ispat will get merged with JSTL and the swap ratio has been fixed at 1:72 implying Ispat

share holders will get one share of JSTL for 72 shares held in JSW Ispat. The merger will be

effective from 1st July 2012 and is expected to be completed anytime soon as JSTL had guided

of completion by end FY13. As part of the merger, JSTL will hive off the downstream capacities

of both the entities at Vasind Tarapur and Kalmeshwar into a 100% subsidiary. The total

collective capacity of downstream production units is ~1.2mtpa. The Dolvi plant of Ispat has the

potential to increase its capacity to ~7.5mtpa from the current 3.3mtpa. However, expansion

plans for this brownfield project expansion is at a very nascent stage.

Ispat Merger to make JSW Steel the largest steel company in India

JSW Steel JSW ISPAT Merged Entity

Crude Steel Capacity (MTPA) 11 3.3 14.3

Expansion Potential (MTPA) 5 4.2 9.2

Steel making route Corex - 1.6mtpa BF - 2mtpa

BF-BOF - 9.4mtpa DRI - 1.6mtpa

Source: Company, Violet Arch Research

While the benefits of marketing synergies (the result of VAT benefits and freight savings) along

with reduced power costs (sourcing from JSW Energy vs. MSEDCL) are already being realized,

we believe there is more in store on the cost savings front in the coming quarters. We expect

benefits from the 55MW captive power plant to flow in immediately, thereby leading to

annualized cost savings of around Rs1.8bn per annum. In addition, we expect material

improvement in operational metrics at JSW Ispat once its coke oven and pellet plant facilities

are commissioned over 2HFY14.

Cost Savings USD/tonne

55 MW Power plant 14

4 MTPA pellet plant 21

1 MTPA coke oven battery 25

Replacement of purchased gas with coke oven gas 22

Total Savings 82

Source: Company, Violet Arch Research

With boiler hydro testing, light up and chemical cleaning at the 55MW power plant already

done, we believe the power plant will be commissioned very soon. Waste heat gases recovered

from the blast furnace will be utilized to feed the 55MW power plant. And hence cost benefits

of the power plant will flow immediately, resulting in annual cost savings of Rs1.8bn ($14/T)

translating to a payback of less than two years. On the pellet plant front, JSW Ispat currently

procures ~50% of its ore requirement from domestic sources and the rest from imports. With a

1.6MT DRI dependent on pellet feed (~2.7MT) and 2MT BFs 15% ore requirement met via pellet

route (~0.5MT), JSW Ispat will require around 3.5mn tonnes of pellets annually. With

commissioning of the pellet plant, we expect JSW Ispat (a port- based facility) to have increased

leeway to import fines over domestic sourcing of lumps. With commissioning of the pellet plant,

we expect JSW Ispat to realize cost gains to the extent of USD21/t.

12

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Further, work at the coke oven batteries is in full swing, with the structural frames already in

place. We expect the first coke oven battery to be commissioned by the end of 2QFY14 and the

second battery by the end of 3QFY14. As per our estimates, the commissioning of the coke oven

batteries will see JSW Ispat realize cost gains up to USD25/tonne.

Sales Volumes and EBITDA/tonne set for improvement

Source: Company, Violet Arch Research

JSW Ispats installed steel capacity stands at 3.3MTPA, however given the volume-cost trade off

on gas supplies, the company prefers to operate the DRI facility at lower utilization (and BF at

full capacity), due to higher gas procurement costs. However, JSW Ispat is expected to increase

utilization levels at its DRI facility once it starts substituting the external gas with surplus coke

oven gas and once both coke oven batteries are commissioned by 3QFY14. This could result in

additional savings to the tune of US$ 22/tonne.

US subsidiaries still in red however operational improvement seen

While JSTL has a profitable steel business in India and has been the fastest growing steel

company in the world, in the last few years, it has invested USD900m in US plate & pipe mill,

USD250m in Chile iron ore mines, and USD100m in a US coking coal mine. While none of its

overseas acquisitions have been profitable and there is no visibility of turnaround, given the

global economic slowdown, high cost structure, and strategic / technological disadvantage, the

US Plate and pipe mill has shown some gradual improvement.

As per our understanding, we do not expect any major surprises from its overseas operations

barring the US plate and pipe mill as the company is trying to secure orders and is banking on

shale gas output there. Further, the company has been guiding iron ore production of 1- 1.2 mn

tonnes from Chile, while coking coal from US is not likely to materialize any time soon.

US Plate & Pipe mill

US Plate & Pipe mill FY09 FY10 FY11 FY12 FY13E FY14E FY15E

Plate sales (tonnes) 199,861 119,614 106,936 247,796 254,500 279,500 305,750

Pipe sales (tonnes) 143,608 72,508 45,217 68,010 74,063 80,136 86,627

Revenues (USD mn) 501 160 141 362 377 412 450

EBITDA (USD mn) 71 (41) 15 56 32 41 69

PAT (USD mn) (37) (70) (33) (18) (27) (23) (15)

Source: Company, Violet Arch Research

2

2.2

2.4

2.6

2.8

3

3.2

2,000

2,500

3,000

3,500

4,000

4,500

5,000

5,500

6,000

FY10* FY11 FY12 FY13E FY14E FY15E

EBITDA/tonne (INR) Sales Volume (Mn tonnes)

13

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

As far as the Chilean iron ore mine is concerned, JSTL has commenced shipments from Chilean

iron ore mines with FY12 shipments of 7,42,871 tonne. The mine has annual production

capacity of 1mn tonne, which the company is planning to augment to 2.5mn tonnes by FY15E.

Chilean iron ore mine is expected to generate EBITDA/tonne of $12/tonne in FY14E and

$16/tonne in FY15E as we expect iron ore prices to remain suppressed for next couple of years.

Chile Iron ore mine

FY12 FY13E FY14E FY15E

Production (mn tonnes) 742,871 727,724 873,269 1,030,458

Shipments (mn tonnes) 593,586 949,088 838,339 989,239

EBITDA/tonne (USD) 37.8 8.0 12.0 16.0

Source: Company, Violet Arch Research

In 4QFY10, JSTL acquired a coking coal mine in West Virginia State in USA. The acquisition

includes seven coal blocks with initial production capacity of 0.5mtpa. As per initial estimates,

the coking coal mine has 123mn tonnes of resource base along with railway load-out and barge

facility. While the company has undertaken drilling activities, shipments are yet to commence.

Coking coal shipped will be used for JSTLs Indian operations and as per our understanding,

landed cost should be around USD150-155/tonne. Initially, JSTL is expected to produce 0.5mn

tonne of coking coal, which will subsequently be increased to 3mn tonnes. We have not

factored in any shipments from the mines in our numbers.

14

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Key Risks and Concerns

Delay in resumption of mining activities in Karnataka

JSTL sources 100% of its ore (post mining ban imposed in Karnataka) and coking coal

requirement from external sources and remains exposed to volatile raw material costs. We

believe that despite Supreme Court lifting the ban on Category A and B mines, improvement in

the mining sector has clearly been far slower than anticipated, with only seven Category A

mines with a cumulative output of 3.3mn tonnes operational so far. While we remain hopeful

that by end FY14, higher ore production leading to increased ore availability will bring down

procurement costs for JSW Steel, if the same

Skewed product mix

JSTLs skewed product mix (83% of volumes are flats and semis) vis--vis more balance product

mix of its domestic peers like Tata Steel and SAIL leaves the company exposed to pricing

pressures.

Significant drop in steel prices

Global steel market has been looking sluggish for a while and prices have corrected significantly

across geographies. In India prices have held up largely due to stable demand and rupee

depreciation. However, local currencies of CIS origin countries has depreciated against dollar

and this might result in fall in dollar denominated prices there by putting pressure on domestic

prices.

Bloated balance sheet

At the end of 3QFY13, JSTLs standalone net debt stood at Rs202bn (as compared to net debt of

Rs183bn at the end of 1HFY13). Consolidated net debt including JSW Ispat stands at Rs265bn,

excluding acceptances of Rs80bn. Further, in-case the company is unable to turnaround ISPAT

to the extent desired and steel demand and prices weaken further, there could be a serious risk

to the companys balance sheet.

Excess supply from domestic sources and imports

Steel production in China and CIS origin countries has been on higher side. Due to suppressed

demand growth in these regions the excess steel might find its way in countries like India.

Further, around 18mn tonne of incremental capacity is coming up in India over next 18-24

months most of which will be in flat steel segment and could put pressure on prices.

15

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Company Background

JSW Steel is part of the O.P.Jindal Group. The group has a presence across various sectors

Steel, Energy, Minerals, Port & Infrastructure, Cement, Aluminium and IT. JSW Steel is Indias

largest and amongst the most efficient steel producers globally. JTLS has manufacturing facilities

located across three states in India and has a plate/pipe mill in USA. JSTL also acquired a stake in

Ispat Industries Ltd, with which it became Indias largest steel producer with a combined

capacity of 14.3 MTPA. It has tied up with JFE Steel Corp, Japan, to manufacture the high grade

automotive steel. JSWS has mining assets in Chile, USA and Mozambique. By 2020, it aims to

produce 34mt of steel annually with planned Greenfield integrated steel plants in West Bengal

and Jharkhand.

FY12 sales mix

Source: Company, Violet Arch Research

9.6%

50.5%

3.7%

7.5%

7.9%

1.3%

9.4%

10.2%

MS Slabs

HR Coils/Steel Plates/Sheets

HR Steel Plates

CR Coils/Sheets

Galvanised/Galvalum Coils/Sheets

Colour coating Coils/Sheets

Steel Billets & Blooms

Long Rolled Products

16

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Industry Overview

Slowdown in developed economies and China to weigh on steel demand

With major economies across the world facing slowdown, the demand for steel is expected to

remain sluggish. Demand scenario is particularly weak in developed economies; Euro Zone in

particular. China being the largest producer and consumer of steel is also witnessing its

economy cooling off after witnessing GDP growth in excess of 9% in past few years. The World

Steel Association (WSA) has recently cut steel demand growth estimates by 90bps to 1.2% for

CY12 and by 30bps to 2.9% for CY13 as EU27, CIS, Nafta and Middle East are now expected to

grow slower. We continue to believe that global steel demand growth will be even slower, with

growth rate of 1.6% for world, 2% for China and 2.5% for India in CY13.

Raw material prices to remain weak

In response to falling demand, coking coal and iron ore prices have come down by almost 50%

from their recent highs. Coking coal prices have come down from $335/tonne to $170-

180/tonne at present. Iron ore prices are now trading near $130/tonne as lower demand from

China and higher supplies from iron ore producing countries have put pressure on prices. In

absence of any meaningful pickup in steel demand, we expect iron price to remain soft and may

come down further in the event of increased supply from India, which has been limited due to

ongoing mining issues and 30% export tax.

Steel prices have corrected rupee depreciation keeping import parity in check

Combination of declining demand and falling raw material prices has resulted into decline in

steel prices globally. Steel prices world over have come down by 6-12% in CY12. Chinese HRC

export prices have come down by ~8%. However, steel prices in India have been resilient as

rupee depreciation has kept domestic to imported steel prices parity in check. Despite prices

holding firm as compared to a fall in global prices, domestic prices are still at marginal discount

to landed prices. We expect domestic flat steel prices unlikely to drop significantly, though they

may see marginal correction given the increased imports from countries like Japan and South

Korea with whom India has signed free trade agreement there by making imports cost

competitive.

Domestic steel consumption set to increase

Indias steel demand growth averaged at around 9.4% over FY03-FY11 but demand tapered

down to 6.5% in FY12 and further down to around 4% in FY13, largely due to higher interest

rates and slowing Indian economy. Historically, over FY98-FY2012, steel consumption to GDP

growth multiple has been 1.1x, with the highest being reported at 1.9x in FY03. As per our

understanding of the multiplier, the same gets higher when GDP growth is above 8% and goes

upto 1.6x the GDP, while during lower GDP growth phase up to 5% the multiplier dips to 0.5x.

Going forward, based on the GDP forecast of 5.8% in FY14E and 7% in FY15E, steel consumption

based on multiplier of 1.0x is expected to grow at ~6% in FY14E and 7% in FY15E respectively.

17

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

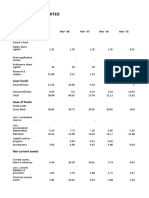

Financial Summary

Income Statement

Y/E 31 Mar (Rs mn) FY12 FY13E FY14E FY15E

Revenue 341,237 363,874 376,525 421,121

YoY growth (%) 42.8 6.6 3.5 11.8

EBITDA 58,575 65,025 66,686 79,018

YoY growth (%) 25.6 11.0 2.6 18.5

EBITDA margin 17.2 17.9 17.7 18.8

Depreciation 19,332 21,214 23,122 24,470

Interest expenses 14,273 19,065 20,618 23,577

Other non operating income 3,213 2,536 2,662 2,796

PBT 19,934 27,282 25,608 33,767

Provision for tax 5,002 8,331 7,618 10,556

Minority interest and ext. items

PAT (adjusted) 11,151 16,123 15,556 20,868

YoY growth (%) (36.4) 44.6 (3.5) 34.1

PAT margin 3.3 4.4 4.1 5.0

Balance Sheet

Y/E 31 Mar (Rs mn) FY12 FY13E FY14E FY15E

Equity Share Capital 2,231 2,417 2,417 2,417

Pref Shares 2,790 2,790 2,790 2,790

Reserves & surplus 162,081 173,656 185,052 200,157

Shareholders' fund 167,713 179,473 190,870 205,974

Total Debt 198,128 214,091 244,091 274,091

Deferred Tax Liability 30,412 30,412 30,412 30,412

Total Capital Employed 398,430 426,153 467,550 512,654

Gross Block 414,455 469,455 514,455 549,455

Less: Acc. Depreciation 88,451 109,665 132,787 157,257

Net Block 326,004 359,790 381,668 392,198

Capital WIP 28,018 28,018 33,018 38,018

Net Fixed Assets 354,022 387,808 414,687 430,217

Goodwill 12,440 10,932 10,932 10,932

Investments 20,896 20,896 20,896 20,896

Cash 32,916 48,423 64,572 98,027

Trade Receivables 15,394 14,954 15,474 17,306

Loans & Advances 47,900 29,110 30,122 33,690

Inventories 57,983 65,501 67,910 74,981

Total Current Asset 154,192 157,988 178,077 224,004

Current Liab. & Prov. 143,120 151,471 157,042 173,395

Net Current Asset 11,072 6,517 21,035 50,610

Total Assets 398,430 426,153 467,550 512,654

Cash Flow Statement

Y/E 31 Mar (Rs mn) FY12 FY13E FY14E FY15E

PBT 19,934 27,282 25,608 33,767

Interest 14,273 19,065 20,618 23,577

Depreciation 19,332 21,214 23,122 24,470

Change in working capital (4,265) 20,063 1,630 3,881

Tax 5,002 8,331 7,618 10,556

Cash flow from operations 41,872 76,465 60,926 72,796

Change in fixed assets 55,810 55,000 50,000 40,000

Change in investments (6,735) (1,508) - -

Cash flow from investments (49,075) (53,492) (50,000) (40,000)

Change in equity capital - 186 - -

Change in debt 28,995 15,963 30,000 30,000

Dividends paid 1,958 4,549 4,159 5,763

Interest paid 14,273 19,065 20,618 23,577

Cash flow from financing 12,722 (7,465) 5,222 659

Net cash flow 5,519 15,508 16,148 33,455

Opening cash balance 27,397 32,916 48,423 64,572

Closing cash balance 32,916 48,423 64,572 98,027

Financial Ratios

Y/E 31 Mar FY12 FY13E FY14E FY15E

Per share Ratios (Rs)

Basic EPS 50.0 66.7 64.4 86.3

Fully diluted EPS 50.0 66.7 64.4 86.3

Book value 751.7 742.5 789.7 852.2

Cash earnings per share 136.6 154.5 160.0 187.6

Dividend per share 7.5 16.1 14.7 20.4

Key Ratios

ROE 6.6 9.0 8.2 10.1

ROCE 9.8 10.3 9.3 10.6

ROIC 12.7 12.7 12.3 13.8

Gearing Ratio (x)

Debt-equity 1.2 1.2 1.3 1.3

Interest coverage ratio 2.7 2.3 2.1 2.3

Turnover Ratios

Asset turnover ratio (x) 0.9 0.9 0.8 0.8

Debtors (days) 16.5 15.0 15.0 15.0

Inventory (days) 74.9 80.0 80.0 80.0

Creditor (days) 184.8 185.0 185.0 185.0

Valuation (x)

P/E (Fully Diluted) 14.0 10.5 10.9 8.1

P/BV 0.9 0.9 0.9 0.8

EV/EBITDA 5.5 5.1 5.2 4.4

EV/Sales 0.9 0.9 0.9 0.8

M-cap/Sales 0.5 0.5 0.4 0.4

18

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Notes

19

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Notes

20

VIOLET ARCH Research

JSW Steel Ltd - Company Report

VIOLET ARCH Securities Pvt. Ltd. (Erstwhile Alchemy Share & Stock Brokers Pvt. Ltd.)

Upside >20% Buy

Upside between 0% and 20% Overweight

Downside up to 20% Underweight

Downside >20% Sell

Institutional Sales +91 22 6639 9153 / 58

Sales Trading +91 22 6639 9154

Research +91 22 6639 9136

HNI Desk +91 22 6639 9124

Disclaimer:

This report has been prepared by VIOLET ARCH Securities Pvt Ltd. VIOLET ARCH is regulated by the Securities and Exchange Board of India.

This report does not constitute a prospectus, offering circular or offering memorandum and is not an offer or invitation to buy or sell any securities, nor shall part, or all, of this presentation form the basis of, or be relied

on in connection with, any contract or investment decision in relation to any securities. The information, figures, graphs, charts, analysis and conclusions contained in this report are for information purposes only.

This report is for distribution only under such circumstances as may be permitted by applicable law. Nothing in this report constitutes a representation that any investment strategy, recommendation or any other

content contained herein is suitable or appropriate to a recipients individual circumstances or otherwise constitutes a personal recommendation.

All investments accept risks and investors should exercise prudence in making their investment decisions. The report should not be regarded by the recipients as a substitute for the exercise of their own judgement. Any

opinions expressed in this report are subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of VIOLET ARCH as a result of using different assumptions

and criteria. VIOLET ARCH is under no obligation to update or keep current the information contained herein.

The securities described herein may not be eligible for sale in all jurisdictions or to certain category of investors. Options, derivative products and futures are not suitable for all investors, and trading in these instruments

is considered risky. Mortgage and asset backed securities may involve a high degree of risk and may be highly volatile in response to fluctuations in interest rates and other market conditions. Past and current

performance is not necessarily indicative of future results. Foreign Currency rates of exchange may adversely affect the value, price or income of any security or related instrument mentioned in this report.

Any prices in this report are for information purposes only and do not represent valuations for individual securities or other instruments. There is no representation that any transaction can or could have been effected

at those prices and any prices do not necessarily reflect VIOLET ARCHs internal books and records or theoretical model based valuations and may be based on certain assumptions. Different assumptions, by VIOLET

ARCH or any other source, may yield substantially different results.

VIOLET ARCH makes no representation or warranty, express or implied, as to, and does not accept any responsibility or liability with respect to, the fairness, accuracy, completeness or correctness of any information or

opinions contained therein. Further, VIOLET ARCH assumes no responsibility to publicly amend, modify or revise any forward looking statements, on the basis of any subsequent development, information or events, or

otherwise.

Neither VIOLET ARCH nor any of its affiliates, directors, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this report. In no event shall VIOLET ARCH be liable for

any direct, special indirect or consequential damages, or any other damages including but not limited to loss of use, loss of profits, or loss of data, whether in an action in contract, tort (including but not limited to

negligence), or otherwise, arising out of or in any way connected with the use of this report or the materials contained in, or accessed through, this report. VIOLET ARCH and its affiliates and / or their officers, directors

and employees may have similar or an opposite positions in any securities mentioned in this document (or in any related investment) and may from time to time add to or dispose of any such securities ( or investment).

The disclosures contained in the reports produced by VIOLET ARCH shall be strictly governed by and construed in accordance with Indian Law. VIOLET ARCH specifically prohibits the redistribution of this material in

whole or part without the written permission of VIOLET ARCH and VIOLET ARCH accepts no liability whatsoever for the actions of third parties in this regard.

VIOLET ARCH Securities Pvt Ltd

1B, Gold Coin Premises, 407 Tardeo road, Mumbai 400 034

Tel: +91 22 6639 9100 Fax: +91 22 6639 9119

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Relationship Between Bonds Prices and Interest RatesДокумент1 страницаRelationship Between Bonds Prices and Interest RatesNikhil JoshiОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hotel Leela Ventures Equity ReportДокумент10 страницHotel Leela Ventures Equity ReportNikhil JoshiОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Scrum Process ExplanationДокумент32 страницыScrum Process ExplanationNikhil JoshiОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Bretton Woods Complete InformationДокумент1 страницаBretton Woods Complete InformationNikhil Joshi100% (1)

- Indian Film Industry PresentationДокумент35 страницIndian Film Industry PresentationNikhil JoshiОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Macro Economics Basics (For Beginners)Документ40 страницMacro Economics Basics (For Beginners)Nikhil JoshiОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- EDBM Workbook PDFДокумент59 страницEDBM Workbook PDFsnehachandan91Оценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Bank ManagementДокумент112 страницBank Managementsat237Оценок пока нет

- Honeypot PDFДокумент9 страницHoneypot PDFNikhil Joshi100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Financial Appraisal of ProjectДокумент22 страницыFinancial Appraisal of ProjectMahmudur RahmanОценок пока нет

- Excel Cash Book EasyДокумент51 страницаExcel Cash Book EasyMiniq ForondaОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyДокумент3 страницыQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Use The Following Information To Answer The Question(s) BelowДокумент36 страницUse The Following Information To Answer The Question(s) BelowOla PietruszewskaОценок пока нет

- Money and Inflation - Mankiw CH: 4Документ5 страницMoney and Inflation - Mankiw CH: 4Shiza NaseemОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Public Financial Management in GhanaДокумент6 страницPublic Financial Management in GhanaKwaku- Tei100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Audit of Inventories (Done)Документ19 страницAudit of Inventories (Done)Hasmin Saripada AmpatuaОценок пока нет

- Invoicediscounting Factsheet NW BusДокумент2 страницыInvoicediscounting Factsheet NW BusSinoj ASОценок пока нет

- Mastering Financial Modelling File ListДокумент1 страницаMastering Financial Modelling File ListNamo Nishant M PatilОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Portfolio RevisionДокумент11 страницPortfolio Revisionveggi expressОценок пока нет

- Executive SummaryДокумент2 страницыExecutive SummaryAshlindah KisakuraОценок пока нет

- Wells Fargo Statement - Oct 2022Документ6 страницWells Fargo Statement - Oct 2022pradeep yadavОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Accounting Cycle of A Merchandising Business What I KnowДокумент2 страницыThe Accounting Cycle of A Merchandising Business What I KnowAngela MortelОценок пока нет

- Dunlop India Limited 2012 PDFДокумент10 страницDunlop India Limited 2012 PDFdidwaniasОценок пока нет

- An Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)Документ37 страницAn Analysis of Security Management Strategies of Banks in Nigeria and Its Role in Banking Performance (A Case Study of Gtbank PLC)samson naantongОценок пока нет

- Chanda KochharДокумент39 страницChanda KochharviveknayeeОценок пока нет

- Indian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolДокумент44 страницыIndian Capital Market: Current Scenario & Road Ahead: Prof Mahesh Kumar Amity Business SchoolasifanisОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Ithrees's Whole Ion Finalyzed To PrintДокумент82 страницыIthrees's Whole Ion Finalyzed To PrintMohamed FayasОценок пока нет

- United States Securities and Exchange Commission Washington, D.C. 20549 Form 1-Z Exit Report Under Regulation A General InstructionsДокумент2 страницыUnited States Securities and Exchange Commission Washington, D.C. 20549 Form 1-Z Exit Report Under Regulation A General InstructionsAnthony ANTONIO TONY LABRON ADAMSОценок пока нет

- 28 - Swati Aggarwal - VedantaДокумент11 страниц28 - Swati Aggarwal - Vedantarajat_singlaОценок пока нет

- Case Study Assessment (Event 3 of 3) : CriteriaДокумент26 страницCase Study Assessment (Event 3 of 3) : CriteriaFiona AzgardОценок пока нет

- Reading Roy - 2010 - Poverty Capital - Microfinance and The Making of Development - CHДокумент15 страницReading Roy - 2010 - Poverty Capital - Microfinance and The Making of Development - CHgioanelaОценок пока нет

- Ray, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyДокумент20 страницRay, K - Crises, Crashes and Speculation. Hegemonic Cycles of Capitalist World-EconomyEEMОценок пока нет

- Chapter 11Документ23 страницыChapter 11narasimha50% (6)

- Bank of Mauritius Act Amended Fa 2022Документ57 страницBank of Mauritius Act Amended Fa 2022Bhavna Devi BhoodunОценок пока нет

- Corporate Finance Institute: Financial Modeling & Valuation Analyst (FMVA) Program OverviewДокумент39 страницCorporate Finance Institute: Financial Modeling & Valuation Analyst (FMVA) Program OverviewVictor CharlesОценок пока нет

- Redemption of Shares NotesДокумент14 страницRedemption of Shares Notesms.AhmedОценок пока нет

- Business Rules and Guidelines EVO NGTrans BCPДокумент50 страницBusiness Rules and Guidelines EVO NGTrans BCPVladimir ZidarОценок пока нет

- Act std4Документ3 страницыAct std4Helen B. EvansОценок пока нет

- Ed Thorp 3Документ56 страницEd Thorp 3toniОценок пока нет