Академический Документы

Профессиональный Документы

Культура Документы

Financial Markets and Risk Management Class Sheet 7

Загружено:

gujji1Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Markets and Risk Management Class Sheet 7

Загружено:

gujji1Авторское право:

Доступные форматы

Financial Markets and Risk Management Class Sheet 7

1. Explain the four key differences between forward and futures contracts

Forwards Futures

Customised Standardised

OTC Exchange Traded

Settled at Closing arked to arket

!o clearing "ouse Clearing "ouse

#. Explain how margins protect in$estors against the possibility of default.

% margin is a sum of money deposited by an in$estor with a broker. &t acts as a

guarantee that the in$estor can co$er any losses on the futures contract. The balance

in the margin account is ad'usted daily to reflect gains and losses on the futures

contract. &f losses are abo$e a certain le$el( the in$estor is re)uired to deposit a further

margin. The system makes it unlikely that the in$estor will default. % similar system

of margins makes it unlikely that the in$estor*s broker will default on the contract it

has with the clearing house member and unlikely that the clearing house member will

default with the clearing house.

+. Explain what you understand by the term the basis.

The basis is the difference between the cash price of an underlying security and the

price of the futures contract relating to that underlying security. &t is gi$en as,

-asis . Spot price / Futures price

0. 1i$e reasons why a basis is likely to exist and identify the ma'or factor

influencing the si2e of the basis associated with stock index futures.

There may be uncertainty as to the exact date when the asset will be bought or sold.

The hedge may re)uire the futures contract to be closed out well before the expiration

date. %lthough we get spot and futures con$ergence at expiration( in practice most

contracts are closed out prior to the expiration date.

&t exists in stock index futures mainly because the portfolio being hedged( in practice(

isn*t the same as that underlying the futures contract.

&n almost all cases of hedging with stock index futures a cross hedge is in$ol$ed. This

means that the stock portfolio the in$estor wants to hedge differs from the portfolio

underlying the futures contract. 3ou wouldn*t normally hold 144 shares as in the

FTSE5144 or necessarily the same shares. &ndex tracking funds typically contain +45

04 shares. 3ou ha$e considerable basis risk because the portfolio differs from the

hedge. E$en where the portfolio matches the index there is still basis risk.

6. Explain the traditional 7na8$e9( beta( and minimum $ariance hedge ratios and

identify the main drawbacks of the latter.

The traditional hedge ratio in$ol$es taking a futures position which is e)ual in

magnitude but opposite in sign to the stock market position. &f there is perfect positi$e

correlation then all price risk is completely eliminated. -ut in practice there is not

perfect positi$e correlation.

The hedge strategy makes na8$e assumptions about changes in the basis: it assumes

the basis doesn*t change. -ecause the basis changes( the classic approach does not

guarantee a risk minimising position.

The beta hedge in$ol$es using the beta of the portfolio as the hedge ratio. Takes

account of the fact that portfolios may not exactly match the index on which the

futures contract is written. ;here there is perfect correlation and when the portfolio

beta is one( then the traditional( beta( and minimum $ariance hedge ratios are e)ual.

The <"= is the hedge ratio which minimises the $ariance of the hedged position.

That is( the position we hold in spot and futures contracts. ;e assume a pre5

determined stock position so must ad'ust the number of futures.

h> . 5co$7=

S

(=

F

9

$ar=

F

h> is the $alue of h which minimises risk.

The negati$e sign represents the fact that the two markets mo$e together. So( to hold

spot( futures must be sold.

% problem is that it ignores the risk5return trade5off. The aim is to minimise risk.

&mplicit in this is that you would be willing to gi$e up an infinite amount of return for

a tiny reduction in risk. "owe$er( different in$estors will ha$e different re)uirements

for risk and return.

&n practice( h> can be determined by regressing returns in the stock market on returns

in the futures market,

=

St

. a ? b=

Ft

b . 5h>

Slope in a regression e)uation . co$@$ar. This is a short5hand way of calculating the

hedge ratio. &t is backward5looking: what would ha$e been the best $alue of h o$er

that period.

A. ;hat is the difference between entering into a long forward contract when the

forward price is B64 and taking a long position in a call option when the strike

price is B64C

&n the case of the forward( the in$estor has an obligation to buy the asset for B64. 7The

in$estor does not ha$e a choice.9 &n the other case( the in$estor has an option to buy

the asset for B64. 7The in$estor does not ha$e to exercise the option.9

D. % trader enters into a short cotton futures contract when the futures price is 64

pence per kilo. The contract is for the deli$ery of 64(444 kilos. "ow much does

the trader gain or lose if the cotton price at the end of the contract is 7a9 0E.# pence

per kilo: 61.+ pence per kiloC

7a9 The in$estor is obliged to sell for 64p per kilo something that is worth 0E.#p

per kilo. 1ain . 74.64 5 4.0E#964(444 . BF44

7b9 The in$estor is obliged to sell for 64p per kilo something that is worth 61.+p

per kilo. Goss . 74.61+ 5 4.64964(444 . BA64

E. Suppose that you enter into a A5month forward contract on a non5di$idend5paying

stock when the stock price is H+4 and the risk5free interest rate 7with continuous

compounding9 is 1#I per annum. ;hat is the forward priceC

The forward price is,

F . Se

rT

. +4e

74.1#x4.69

H+1.EA

F. % 15year5long forward contract on a non5di$idend5paying stock is entered into

when the stock price is B04 and the risk5free rate is 14I per annum with

continuous compounding.

7a9 ;hat are the forward price and the initial $alue of the forward

contractC

The forward price( F . Se

rT

( is,

F . 04e

4.1

. 00.#1

The initial $alue of the forward contract is 2ero.

7b9 Six months later( the price of the stock is B06 and the risk5free interest

rate is still 14I. ;hat are the forward price and the $alue of the

forward contractC

The deli$ery price( J( in the contract is B00.#1. The $alue of the

contract( f( after six months is gi$en by,

f . S / Je

5r x T

f . 06 / 00.#1e

54.1 x 4.6

. B#.F6

The forward price is gi$en by,

F . 06e

4.1 x 4.6

. B0D.+1

14. % stock is expected to pay a di$idend of B1 per share in # months and again in 6

months. The stock price is B64 and the risk5free rate of interest is EI per annum

with continuous compounding for all maturities. %n in$estor has 'ust taken a short

position in a A5month forward contract on the stock.

7a9 ;hat are the forward price and the initial $alue of the forward

contractC

The present $alue( &( of the income from the security is gi$en by,

& . Ke

5rT

. e

54.4E x 4.1AAD

? e

54.4E x 4.01AD

. 1.F604

The forward price is gi$en by,

F . 7S / &9e

r x T

. 764 / 1.F609e

4.4E x 4.6

. B64.41

The fact that the forward price is $ery close to the spot price should come as no

surprise. ;hen the compounding fre)uency is ignored the di$idend yield on the stock

e)uals the risk5free rate of interest. The initial $alue of the contract is 7by design9

2ero.

7b9 Three months later( the price of the stock is B0E and the risk5free rate

of interest is still EI per annum. ;hat are the forward price and the

$alue of the short position in the forward contractC

&n three months

& . e

54.4E x 4.1AAD

. 4.FEAE

The deli$ery price( J( is 64.41.The $alue of the short forward contract( f( is gi$en by,

f . 57S / & / Je

5r x T

9

f . 570E / 4.FEAE / 64.41e

54.4E x 4.#6

. #.41

%nd the forward price F is gi$en by

F . 7S / &9e

r x T

F . 70E / 4.FEAE9e

4.4E x 4.#6

. B0D.FA

11. The risk5free rate of interest is DI per annum with continuous compounding and

the di$idend yield on a stock index is +.#I per annum. The current $alue of an

index is 164. ;hat is the A5month futures priceC

Lsing the following e)uation we can work out the A5month futures price,

F . Se

7r5)9T

F . 164e

74.4D54.4+#9x4.6

. B16#.EE

Вам также может понравиться

- Aglietta, M. (2000) - Shareholder Value and Corporate Governance Some Tricky Questions. Economy and Society, 29 (1), 146-159 PDFДокумент16 страницAglietta, M. (2000) - Shareholder Value and Corporate Governance Some Tricky Questions. Economy and Society, 29 (1), 146-159 PDFlcr89100% (1)

- 84 QuestionsДокумент6 страниц84 QuestionsSean RichardsonОценок пока нет

- Figlewski Basis Risk-2Документ14 страницFiglewski Basis Risk-2James LiuОценок пока нет

- Corporate Governance at L&TДокумент5 страницCorporate Governance at L&TmanjushreeОценок пока нет

- Answers To Chapter ExercisesДокумент4 страницыAnswers To Chapter ExercisesMuhammad Ibad100% (6)

- Seminar 8 - AnswersДокумент4 страницыSeminar 8 - AnswersSlice LeОценок пока нет

- Derivatives and Valuation of DerivativesДокумент7 страницDerivatives and Valuation of Derivativesswati.bhattОценок пока нет

- BMAN20072 Week 9 Problem Set 2021 - SolutionДокумент4 страницыBMAN20072 Week 9 Problem Set 2021 - SolutionAlok AgrawalОценок пока нет

- Hedging Strategies Using Futures PDFДокумент11 страницHedging Strategies Using Futures PDFRishabh GuptaОценок пока нет

- Ch06Hull Fund7eTestBankДокумент2 страницыCh06Hull Fund7eTestBankJulio InterianoОценок пока нет

- Practice QuestionsДокумент8 страницPractice QuestionschrisОценок пока нет

- Ch17 - Analysis of Bonds W Embedded Options.AДокумент25 страницCh17 - Analysis of Bonds W Embedded Options.Akerenkang100% (1)

- Answers For Chapter 5Документ2 страницыAnswers For Chapter 5Wan MP WilliamОценок пока нет

- Chapter 7 Futures and Options On Foreign Exchange Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsДокумент12 страницChapter 7 Futures and Options On Foreign Exchange Suggested Answers and Solutions To End-Of-Chapter Questions and ProblemsnaveenОценок пока нет

- Answers On Financial ManagementДокумент4 страницыAnswers On Financial ManagementArjunSharmaОценок пока нет

- Hedging Through Futures: Prof Mahesh Kumar Amity Business SchoolДокумент21 страницаHedging Through Futures: Prof Mahesh Kumar Amity Business SchoolasifanisОценок пока нет

- Chapter 5 - Pricing Forwards and Futures (S.V.)Документ39 страницChapter 5 - Pricing Forwards and Futures (S.V.)flippy23Оценок пока нет

- Financial Institutions Management - Chap024Документ20 страницFinancial Institutions Management - Chap024Wendy YipОценок пока нет

- Chapter 2 - AFM - UEH - F2023 - ExercicesДокумент3 страницыChapter 2 - AFM - UEH - F2023 - Exercicestoantran.31211025392Оценок пока нет

- Futures & Options MidtermДокумент12 страницFutures & Options MidtermLaten CruxyОценок пока нет

- MCQs On Options, JC HullДокумент22 страницыMCQs On Options, JC HullzalanipОценок пока нет

- Chapter 5: Answers To "Do You Understand" Text QuestionsДокумент4 страницыChapter 5: Answers To "Do You Understand" Text QuestionsTan Kar BinОценок пока нет

- An Introduction To Futures Markets-SДокумент4 страницыAn Introduction To Futures Markets-SmikeОценок пока нет

- Problem Set 3-Group 9Документ6 страницProblem Set 3-Group 9WristWork Entertainment100% (1)

- Testbank - Chapter 19Документ2 страницыTestbank - Chapter 19naztig_017Оценок пока нет

- Answer - CHAPTER 7 FUTURES AND OPTIONS ON FOREIGN EXCHANGEДокумент7 страницAnswer - CHAPTER 7 FUTURES AND OPTIONS ON FOREIGN EXCHANGETRÂM BÙI THỊ MAIОценок пока нет

- FRM Quiz 7Документ12 страницFRM Quiz 7my linhОценок пока нет

- Option Applications and Corporate Finance: 1. A. The Contract With The Highest Volume Is 16 Aug 165 CallДокумент4 страницыOption Applications and Corporate Finance: 1. A. The Contract With The Highest Volume Is 16 Aug 165 CallLeanne TehОценок пока нет

- Long Term LiabilitiesДокумент3 страницыLong Term Liabilitiescumar maxamuud samatarОценок пока нет

- Futures and Options Final TestДокумент15 страницFutures and Options Final TestCarolina SáОценок пока нет

- Hull Fund 9 e CH 05 Problem SolutionsДокумент10 страницHull Fund 9 e CH 05 Problem Solutionsnandkishore patankarОценок пока нет

- Chapter 5 Solutions Tamzidul IslamДокумент18 страницChapter 5 Solutions Tamzidul IslamTamzidul IslamОценок пока нет

- Chapter 10 Futures Arbitrate Strategies Test BankДокумент6 страницChapter 10 Futures Arbitrate Strategies Test BankJocelyn TanОценок пока нет

- FD ch5 PPT HullДокумент37 страницFD ch5 PPT HullBuller CatОценок пока нет

- Forex Qs AnsДокумент5 страницForex Qs AnsChoudhristОценок пока нет

- 4203 (Previous Year Questions)Документ7 страниц4203 (Previous Year Questions)Tanjid MahadyОценок пока нет

- Relationship Between Bond Prices and YieldsДокумент8 страницRelationship Between Bond Prices and YieldsMichael HorsmanОценок пока нет

- Levich Ch11 Net Assignment SolutionsДокумент16 страницLevich Ch11 Net Assignment SolutionsNisarg JoshiОценок пока нет

- International FinanceДокумент9 страницInternational FinancelawrelatedОценок пока нет

- Forward and Futures ContractsДокумент29 страницForward and Futures ContractsMaulik ShahОценок пока нет

- FIR 4770 Midterm Review Questions: StudentДокумент17 страницFIR 4770 Midterm Review Questions: Studentmanish7836Оценок пока нет

- Ch10 HW SolutionsДокумент43 страницыCh10 HW Solutionsgilli1trОценок пока нет

- CH 3 PDFДокумент7 страницCH 3 PDFShivansh AgarwalОценок пока нет

- Practice Questions Forwards and Futures: Problem 2.10Документ4 страницыPractice Questions Forwards and Futures: Problem 2.10Uzair Ahmed SoomroОценок пока нет

- Answers To End of Chapter QuestionsДокумент3 страницыAnswers To End of Chapter QuestionsDeepak KanojiaОценок пока нет

- Chapter 8Документ20 страницChapter 8Ersin AnatacaОценок пока нет

- Chapter 20 Interest Rate Risk: 1. ObjectivesДокумент14 страницChapter 20 Interest Rate Risk: 1. Objectivessamuel_dwumfourОценок пока нет

- Fundamentals of Multinational Finance 3Rd Edition Moffett Solutions Manual Full Chapter PDFДокумент25 страницFundamentals of Multinational Finance 3Rd Edition Moffett Solutions Manual Full Chapter PDFdanielaidan4rf7100% (11)

- Fundamentals of Multinational Finance 3rd Edition Moffett Solutions ManualДокумент4 страницыFundamentals of Multinational Finance 3rd Edition Moffett Solutions Manualkhuyenjohncqn100% (19)

- Chapter 3 - Exercises - DerivativesДокумент3 страницыChapter 3 - Exercises - Derivativesk61.2212150555Оценок пока нет

- Chapter 7Документ13 страницChapter 7fati159Оценок пока нет

- D. Basis Risk CalculationДокумент10 страницD. Basis Risk CalculationPRANJAL BANSALОценок пока нет

- 02 Lecture21Документ29 страниц02 Lecture21Ashi GargОценок пока нет

- Eiteman 178963 Im05Документ7 страницEiteman 178963 Im05Jane TitoОценок пока нет

- Summary of Freeman Publications's Iron Condor Options For BeginnersОт EverandSummary of Freeman Publications's Iron Condor Options For BeginnersОценок пока нет

- Can Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?От EverandCan Hoover Dam’s Design Principles Help Us Solve the Retirement Income Problem?Оценок пока нет

- OPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)От EverandOPTIONS TRADING: Mastering the Art of Options Trading for Financial Success (2023 Guide for Beginners)Оценок пока нет

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsОт EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsОценок пока нет

- Insurance Blokers - IndiaДокумент47 страницInsurance Blokers - Indiakingsing44Оценок пока нет

- Dissertation Topics in Corporate GovernanceДокумент8 страницDissertation Topics in Corporate GovernancePayToWritePaperYonkers100% (1)

- Tui Ar 201011Документ267 страницTui Ar 201011Gautam KshatriyaОценок пока нет

- 030919TCBReport2018ENG 9fcua PDFДокумент91 страница030919TCBReport2018ENG 9fcua PDFmtuấn_606116Оценок пока нет

- Ias1 International Accounting Standard 1: Presentation of Financial Statements or IAS 1 IsДокумент2 страницыIas1 International Accounting Standard 1: Presentation of Financial Statements or IAS 1 IsSabrina LeeОценок пока нет

- Bcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFДокумент3 страницыBcom 6 Sem Bi Fundamentals of Insurance 2 12403 2020 PDFDeepak KumarОценок пока нет

- New Microsoft Word DocumentДокумент3 страницыNew Microsoft Word DocumentShantam GulatiОценок пока нет

- Part B - Equitable Treatment of ShareholdersДокумент12 страницPart B - Equitable Treatment of ShareholdersYogaОценок пока нет

- Ifrs Issued Standards 2022 Part AДокумент6 страницIfrs Issued Standards 2022 Part ABhairaviОценок пока нет

- Statement of Account For The Period 01-Jun-2020 To 23-May-2021Документ23 страницыStatement of Account For The Period 01-Jun-2020 To 23-May-2021Chandrakanth KhannaОценок пока нет

- Corporate Governance Theory and Model: A Conceptual ObservationДокумент15 страницCorporate Governance Theory and Model: A Conceptual ObservationIJAR JOURNALОценок пока нет

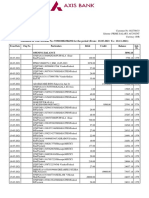

- Statement of Axis Account No:919010082384292 For The Period (From: 10-05-2021 To: 10-11-2021)Документ23 страницыStatement of Axis Account No:919010082384292 For The Period (From: 10-05-2021 To: 10-11-2021)Rohitpavan PuppalaОценок пока нет

- Analysis of Annual Report of Godrej IndustriesДокумент41 страницаAnalysis of Annual Report of Godrej IndustriesmadhuraОценок пока нет

- Strategic Management: GM 105 Dr. Lindle HattonДокумент94 страницыStrategic Management: GM 105 Dr. Lindle HattonDhinesh3693Оценок пока нет

- Has The Entity Transferred Its Rights To Receive The Cash Flows From The Asset?Документ9 страницHas The Entity Transferred Its Rights To Receive The Cash Flows From The Asset?Nico RobinОценок пока нет

- 01 NIC Annual Report 64-65Документ84 страницы01 NIC Annual Report 64-65Ronit KcОценок пока нет

- GROUP-6 Accounts JobsДокумент6 страницGROUP-6 Accounts JobsVarun DuggalОценок пока нет

- Y.S.P. Southeast Asia Holding Bhd. (Company No. 552781 X) Board CharterДокумент11 страницY.S.P. Southeast Asia Holding Bhd. (Company No. 552781 X) Board CharterNinerMike MysОценок пока нет

- Módulo 31: Hiperinflación: Fundación IFRS: Material de Formación Sobre La NIIFДокумент45 страницMódulo 31: Hiperinflación: Fundación IFRS: Material de Formación Sobre La NIIFAnna ReyesОценок пока нет

- Minutes of The Meeting of The Board of DirectorsДокумент3 страницыMinutes of The Meeting of The Board of DirectorsFibriaRIОценок пока нет

- Corporate Governance, Firm Size, and Earning Management: Evidence in Indonesia Stock ExchangeДокумент6 страницCorporate Governance, Firm Size, and Earning Management: Evidence in Indonesia Stock ExchangeCahdayani SaragihОценок пока нет

- E-Business Accor International Hotel R.2Документ28 страницE-Business Accor International Hotel R.2Ridas MikaОценок пока нет

- Codirlasu ExamenДокумент414 страницCodirlasu ExamenDan Grigore IvanОценок пока нет

- Spiritof: GrowthДокумент35 страницSpiritof: GrowthAli SyedОценок пока нет

- GSK Annual Report 2011Документ95 страницGSK Annual Report 2011Waseem AkramОценок пока нет

- Corporate Governance 5e Christine A. Mallin: The Role of Institutional Investors in Corporate GovernanceДокумент28 страницCorporate Governance 5e Christine A. Mallin: The Role of Institutional Investors in Corporate GovernanceMBОценок пока нет

- Banking Law and PracticeДокумент145 страницBanking Law and PracticeMbatiah M. JohnОценок пока нет