Академический Документы

Профессиональный Документы

Культура Документы

Credit and Collection (CP&R)

Загружено:

Joe GarciaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Credit and Collection (CP&R)

Загружено:

Joe GarciaАвторское право:

Доступные форматы

Call Plan and Report

I. Highlights:

- Ms. Dela Cruz, owner of Venneth School of Cavite which started as a pre

school in 2003.

- In 2007 Ms. Dela Cruz decides to seek promise of DECS to include the

elementary curriculum due to the request from the parents. But before her

request is recognized she must first put an additional classroom for the Home

Economics Subject.

- She needs to borrow in order to put up additional classrooms for the Home

Economics Subject to comply with the DECS requirements.

- Offers were with Allied Bank but she is reluctant to borrow because of the

repayment terms. Also same with Rural Bank because of high interest rates

- She decides to assistance from a government bank.

- Allied Bank checked the credit record of Ms. Dela Cruz to put up the school by

granting a P500,00 loan for a term of 3years.that was settled one year in

advance.

II. Assumptions:

- Ms. Della Cruz decided to purchase the lot which is a foreclosed property by

Rural Bank of Imus but she will avail a loan from DBP. The reason for choosing

the lot is because it is just in front of the school.

- Interest rate of DBP is only 7%. The firm can offer lower interest rate because it

is a government bank whose mandate is to help those operating schools in

obtaining loans for their requirements.

- The repayment terms of DBP are up to 3 years.

- Ms. Dela Cruz has as outstanding loan with Allied Bank amounting to P

848,499.99. It represents the balance of the 3 year term loan with original

amount of P2, 545, 500 at 10% interest rate.

- Her P400, 000 loan with Allied used to purchased a vehicle for school service

bus a term of 3 years at a 8% interest rate.

Michael Gabriel O. Lazarte

III. Recommendations:

- As a credit analysts of the Development Bank of the Philippines. I will

recommend the granting of loans to Ms. Dela Cruz under the following terms:

- Amount: PHP 2.5 Million

- Purpose: to purchase the 391sqm lot offered by Rural bank of Imus

- Term: 3 years payable monthly (36 months)

- With an interest rate of 7 percent

- Collateral : lot to be purchase

IV. Based on the following Justification:

- Term of up to 3 years is reconnected to give Ms. Dela Cruz submit tones to repay

the loans. This is based on her cash flows with amount of

- Satisfactory credit dealings and history. Based on the information granted she

was able to repay her new loan with Allied Bank one year in advance in her

repayment terms of 3 years.

- Prudent in managing finances based on the information she availed only

P400,000 out of the P700,000 offered by Allied Bank. She uses the loan when

there is a need.

- She was able to establish a good trait reward in managing the school having

started since 2003. She is also competent because she has a Masters degree

in Arts and Education major in Child Psychology from a reputable school

Philippine Normal University.

- Her business is growing since 2003 the number of students has grown to 280

and there are requests from the parents to include the elementary curriculum.

- Based on the monthly revenues of the school the payment loan can be repaid in

3 years

Balance sheet: (in thousand pesos)

Assets:

- Cash 3,000.00

- Land with building [(391sqm with building) 2,500.00

- Land with building [(204sqm (P 5,500)] 1,122.00

- Land with building [(181sqm (P5,500)] 925.50

- Land with building [(281sqm (P5,500)] 2,545.50

- Vehicles 400.00

Total Assets: P 10,493.00

==========

Liabilities:

- Loan Allied Bank (Vehicle) 400.00

- Loan Allied Bank (281sqm lot with building) 2,545.50

- Loan DBP of (391sqm land with building) 2,550.00

Total Liabilities: 5,445.50

Capital: 5,047.50

Total Liabilities and Capital P 10,493.00

========

Income statement (summarized)

Revenue note 1: P 8,400,050

Income:

Less:

Operating expense:

- Salaries - note 2: P 2,992,000

- Utilities - note 3: 360,000

- Office supplies note 4: 36,000 3,388,000

-----------------

Total: P 5,012,000

Less:

Interest Expense - note 5: 389,926

---------------

Net Income: P 4, 622,038

Less:

Loan Amortization note 6 1,815,165

-----------------

Net income after principal payment on loans: P 2,806,873

==========

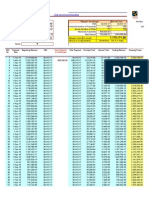

Income statement (computation of the summarized value)

Note 1 revenues: [280 students (P30, 000 tuition fee)] P8, 400,000

Income:

Note 2 salaries:

Teachers: P2, 400,000

[(10 teachers (P10, 000 salary/month) (12months)]

Office staff:

[(4 staff (P12, 000 salary/month) (12months)] 576,000

Utilities:

[(2utilities (P4, 000 salary/month) (12months)] 16,000

______________

P 2, 992,000

Note 3 utilities

Electricity:

(P24, 000/month x 12months) P288, 000

Water:

(P3, 000/month x 12months) 36,000

Telephone:

(P3, 000/month x 12months) 36,000

Total: P 360,000

Note 4 office supplies

Assumed at: (P3, 000/month x 12months) P36,000

Note 5 interest expenses:

- Loan DBP (please refer to loan amortization no.1) P147,857

- Loan Allied Bank (please refer to loan amortization no.2) 215,069

- Loan Allied Bank (please refer to loan amortization no. 3) 27,036

Total: P 389,962

Note 6 loan amortization

- Loan DBP (please refer to loan amortization no. 1) P 833,333

- Loan Allied Bank (please refer to loan amortization no.2) 848,499

- Loan Allied Bank (please refer to loan amortization no.3) 133,333

Total: P1, 815,165

Вам также может понравиться

- Swift Automatic Flor JunioДокумент2 страницыSwift Automatic Flor JunioJoe GarciaОценок пока нет

- Tor 50 50 3Документ1 страницаTor 50 50 3Joe GarciaОценок пока нет

- Formation of Stock PortfoliosДокумент11 страницFormation of Stock PortfoliosJoe Garcia50% (2)

- Fuel Economy Run 2016 PDFДокумент5 страницFuel Economy Run 2016 PDFJoe GarciaОценок пока нет

- Strategies For Investing in StocksДокумент9 страницStrategies For Investing in StocksJoe GarciaОценок пока нет

- Market Interest Rates AnalysisДокумент17 страницMarket Interest Rates AnalysisJoe GarciaОценок пока нет

- Options As An InvestmentДокумент6 страницOptions As An InvestmentJoe GarciaОценок пока нет

- Lego - Case AnalysisДокумент5 страницLego - Case AnalysisJoe GarciaОценок пока нет

- Portfolio Recordkeeping and ValuationДокумент6 страницPortfolio Recordkeeping and ValuationJoe GarciaОценок пока нет

- Internal ControlДокумент34 страницыInternal ControlJoe GarciaОценок пока нет

- ETFs and Hedge FundsДокумент15 страницETFs and Hedge FundsJoe GarciaОценок пока нет

- Performance Measurement and Information ManagementДокумент32 страницыPerformance Measurement and Information ManagementJoe GarciaОценок пока нет

- Private Equity and Venture CapitalДокумент10 страницPrivate Equity and Venture CapitalJoe GarciaОценок пока нет

- Session11 - Bond Analysis Structure and ContentsДокумент18 страницSession11 - Bond Analysis Structure and ContentsJoe Garcia100% (1)

- Investment in BondsДокумент14 страницInvestment in BondsJoe GarciaОценок пока нет

- Touro Infirmary CaseДокумент1 страницаTouro Infirmary CaseJoe GarciaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Sbi Maxgain CalculatorДокумент4 страницыSbi Maxgain CalculatorAnkit ChawlaОценок пока нет

- 2017-Annual Report Groep N.V PDFДокумент356 страниц2017-Annual Report Groep N.V PDFWilliam WatterstonОценок пока нет

- Sss Loan Form 2013Документ3 страницыSss Loan Form 2013John Carlo M. SamaritaОценок пока нет

- A Study On Customer Preferences Towards Retail BankingДокумент71 страницаA Study On Customer Preferences Towards Retail BankingDaman Deep Singh ArnejaОценок пока нет

- @@ Credit Risk Management On The Financial Performance of Banks in Kenya For The Period 2000 - 2006Документ9 страниц@@ Credit Risk Management On The Financial Performance of Banks in Kenya For The Period 2000 - 2006Rafiqul IslamОценок пока нет

- The Kolar CrisisДокумент37 страницThe Kolar Crisis998630Оценок пока нет

- GTU International Finance: Section AДокумент19 страницGTU International Finance: Section AcpriyacpОценок пока нет

- Jaju-Partnership DeedДокумент9 страницJaju-Partnership Deednaveen KumarОценок пока нет

- 16-15749 - All Docs PDFДокумент64 страницы16-15749 - All Docs PDFRecordTrac - City of OaklandОценок пока нет

- National Law University, Odisha: Macro-Economics M CДокумент21 страницаNational Law University, Odisha: Macro-Economics M CAstha Ahuja100% (1)

- Business Plan CreatingДокумент25 страницBusiness Plan CreatingTasnim Medha, 170061016Оценок пока нет

- Suggested Answers To The 2015 Remedial Law Bar Examination - RemДокумент12 страницSuggested Answers To The 2015 Remedial Law Bar Examination - RemNympa Villanueva100% (1)

- West Bengal Form No 34 AДокумент4 страницыWest Bengal Form No 34 Aবন্ধুপ্রিয় সরকার100% (1)

- MCQ - Unit 2Документ15 страницMCQ - Unit 2Niraj PandeyОценок пока нет

- Credit Management System of Uttara Bank Limited. 1 - PageДокумент73 страницыCredit Management System of Uttara Bank Limited. 1 - PageShakilОценок пока нет

- My Mortgage: Click Here FAQ'sДокумент1 страницаMy Mortgage: Click Here FAQ'smaria elenaОценок пока нет

- Assignment 5 - EL5732Документ2 страницыAssignment 5 - EL5732Sophia MorrisОценок пока нет

- Debt Management: Lecture No.10 Endrianur Rahman Zain, STP - MM Fundamentals of Engineering EconomicsДокумент14 страницDebt Management: Lecture No.10 Endrianur Rahman Zain, STP - MM Fundamentals of Engineering EconomicsFeni Ayu LestariОценок пока нет

- 7 BPI Investment Vs CA G.R. No. 133632Документ5 страниц7 BPI Investment Vs CA G.R. No. 133632Alexa Neri ValderamaОценок пока нет

- Statement On Changes in Implementation of The Uganda Women Entrepreneurship Programme (UWEP)Документ5 страницStatement On Changes in Implementation of The Uganda Women Entrepreneurship Programme (UWEP)African Centre for Media ExcellenceОценок пока нет

- iIIR - SHASHI PRABHAДокумент5 страницiIIR - SHASHI PRABHAprashashiОценок пока нет

- Project Report On Convergence of Banking Sector To Housing FinanceДокумент4 страницыProject Report On Convergence of Banking Sector To Housing FinanceHari PrasadОценок пока нет

- BAJFINANCE 26042023175921 BFL InvestorPresentation 26april2023Документ65 страницBAJFINANCE 26042023175921 BFL InvestorPresentation 26april2023Major LoonyОценок пока нет

- Garcia V LlamasДокумент2 страницыGarcia V LlamasAllen Windel BernabeОценок пока нет

- BCДокумент2 страницыBCKathrine CruzОценок пока нет

- Change Your Life PDF FreeДокумент51 страницаChange Your Life PDF FreeJochebed MukandaОценок пока нет

- Act ch01 l02 EnglishДокумент3 страницыAct ch01 l02 EnglishLinds RiveraОценок пока нет

- Chapter 17Документ23 страницыChapter 17Sahaya Grinspan0% (1)

- Banking & Finance - Answer: Bouncing of A ChequeДокумент6 страницBanking & Finance - Answer: Bouncing of A Chequekhanarif16Оценок пока нет

- Form No. Mgt-9 Extract of Annual Return: Annexure-VIIДокумент10 страницForm No. Mgt-9 Extract of Annual Return: Annexure-VIIAbhishekОценок пока нет