Академический Документы

Профессиональный Документы

Культура Документы

IBM Strategy and Organization Design Report

Загружено:

Anuj Shrestha0 оценок0% нашли этот документ полезным (0 голосов)

423 просмотров20 страницIBM Strategy and Organization design report

Оригинальное название

IBM Strategy and Organization design report

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документIBM Strategy and Organization design report

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

423 просмотров20 страницIBM Strategy and Organization Design Report

Загружено:

Anuj ShresthaIBM Strategy and Organization design report

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 20

1

IBM Group Project

Strategy, Organization Design & Leadership

SM 80.53

Submitted by

Francisco Martins da Silva 114551

Mia Osawa 114566

Archana Sharma 115341

Anuj Shrestha 114554

Pattanun Rueangtrakarn 114282

2

1. Introduction .............................................................................................................................................. 3

2. Industry Analysis ....................................................................................................................................... 5

Threat of New Entrants ............................................................................................................................. 6

Supplier Bargaining Power ........................................................................................................................ 6

Buyer Bargaining Power ............................................................................................................................ 6

Threat of Substitutes................................................................................................................................. 6

Intensity of Rivalry .................................................................................................................................... 6

3. Environment Analysis ................................................................................................................................ 8

Political/Legal ............................................................................................................................................ 8

Economical ................................................................................................................................................ 8

Social ......................................................................................................................................................... 9

Technological ............................................................................................................................................ 9

Environmental ........................................................................................................................................... 9

4. Internal Analysis ...................................................................................................................................... 10

IBMs Value Chain ................................................................................................................................... 10

IBMs resources, capabilities and core competencies ............................................................................ 14

5. Strategy Formulation .............................................................................................................................. 15

SWOT Analysis......................................................................................................................................... 15

Value creation and pricing options: IBMs competitive advantage ........................................................ 16

Strategy formulation process.................................................................................................................. 16

Scenarios ................................................................................................................................................. 17

IBMs strategic sweet spot ...................................................................................................................... 18

6. Strategy implementation ........................................................................................................................ 19

CONCLUSION, LESSONS LEARNED & RECOMMENDATIONS ....................................................................... 20

3

1. Introduction

One of IBM's founder, Thomas J. Watson Sr. coined the slogan, Think, that appeared all over the

company in the 1930's. Since then IBM has been through a series of transformations. The early 1990's

saw IBM come close to bankruptcy with $8 billion losses and shares selling at $12 each. Lou Gerstner,

former chairman and CEO (1993-2002) saved Big Blue and his successor, Sam Palmisano, oversaw a

10.2% annual increase in its stock price during his nine years as IBMs chairman and CEO.

Gerstners strategy of listening to the clients proved him right: IBM being a large multi-faceted technology

company, it was ideally situated to provide integrated solutions to customers. In the process, IBM

discovered the joys of a blue ocean strategy: a big opportunity with little competition.

In 2002, Palmisano succeeded to Lou Gerstner, who brought struggling IBM back on its feet and put it on

a viable course. Palmisano saw IBM's unique strength as offering complete solutions tailored to

customers needs something no other company could match. This led to the formulation of a single

globally integrated enterprise strategy. Executing this strategy required seamless integration of IBMs

product capabilities with its geographic reach. This meant abandoning IBMs existing organizational

structure, in which product silos and geographic entities operated independently (frequently leading to

more competition than collaboration). Palmisano shifted IBM's focus from hardware to high-end software

services (see figure 1). To concentrate on customer solutions and enable an optimized focus strategy,

Palmisano spun off personal computers and sold IBM's PC business to China's Lenovo. He continued to

sell hardware and acquired many software and analytics companies.

In 2012, Virginia M. Rometty succeeded Sam Palmisano as IBMs CEO.

Figure 1: IBM income mix

IBMs mission:

As per IBMs statements, its mission is to strive to lead in the invention, development and manufacturing

of the industrys most advanced information technologies, including computer systems, software, storage

systems and microelectronics. In a nutshell, it seeks to translate advanced technologies into value for

their customers.

IBMs vision:

4

IBM is dedicated to each of its shareholders (cf. values below), and has consequently adopted a vision of

providing solutions for a small planet. This vision includes various perspectives: finding solutions to

make life easier, being efficient, satisfying stakeholders and helping in build a smarter planet.

IBMs values:

Both IBMs mission and vision translate into a set of values, which dictate each of the companys decision

and incentive. As a company, it bases itself on the following values:

- Dedication to every clients success

- Innovation that matters for the company and for the world

- Trust and responsibility in all relationships

- Building, maintaining and developing any thing that will differentiate IBM with clients, investors,

employees and communities.

- Adopt and implement the slogan: Our mission, our aspirations

- Base every decision on this set of values: how we make decisions at our company and how we

behave and act, collectively and individually).

IBMs objectives:

Today, to work its way through struggling times, IBM seeks to grow and develop its businesses by re-

shifting the focus on profitable sectors. This has to be operated within the framework of a leadership

respecting all the values IBM sets as its guiding principles.

5

2. Industry Analysis

The IT industry faces a big challenge of a continuously evolving technology. The competition being

intense as well, it forces companies to drive down costs while maintaining their innovativeness. Although

IBM holds the largest share of any one company (see Table1), it still does not hold a dominant position in

High

Low High/Low

THREAT OF NEW ENTRANTS

Lucrative industry attracts many

rivals

High threat on a specialized

front such as unique service or

product

Market is easy to enter with

increasing availability of labor

BARGAINING POWER OF

SUPPLIERS

Abundance of low-cost skilled

workers in emerging

economies that are employed

by companies.

BARGAINING POWER OF

BUYERS

High, if substitutes easily

available.

Low, if service is unique and

proprietary or vendor has close

relationship with the client

THREAT OF SUBSTITUTION

Low for the current product

portfolio and technology from

R&D.

Low, as IBM gives many products

free.

High, if service is copied or

provided by the competition

INTENSITY OF RIVALRY

IBM, large player in the

market; hence focus of

rivals.

Rivalry from small

companies which can

attack any weakness it has

High

High/Low

Figure 2: Porter's five forces analysis

6

this industry. Porter's five forces analysis (see figure 2) can be used to formulate the industry analysis for

IBM.

Threat of New Entrants

The IT and business consulting market attracts many new entrants in lieu of the new opportunities due to

the evolving technology market. This industry is a lucrative and global business where it is increasingly

easy to compete from any part of the world. This holds true, especially for emerging countries with an

increasing number of skilled and low-cost workers (like China and Vietnam), which are underbidding India

(once the leading low-cost bidder for Western outsourcing businesses). This opens up the opportunity for

new entrants who can provide the same business automation and cost saving services at lower prices.

Threat: High

Supplier Bargaining Power

The increasing popularity and ease of open source has created a plethora of open standards tools and

software. Hence, IBM can't rely on customer lock-ins as there are many alternatives. This has led IBM to

embrace many of its competitors products and even to acquire many competing companies (in the

objective of lowering suppliers bargaining power). By "Suppliers" we also mean IBM's consulting base,

employees who work for IBM, a competitor, or outsourced labor.

Threat: Low

Buyer Bargaining Power

This industry consists of mainly two types of segments: low-cost service on the one hand, leading edge IT

products and services on the other hand. Low-cost services reduce the overhead costs for clients, calling

for a larger and mature market, whereas leading edge clients seek for the best services and products for

which they are willing to pay a premium price, but the choices in such cases are limited. IBM positions

itself in the leading edge market and hence it has to constantly evolve its products and services to avail

premium charges. Otherwise the niche market could move to lower-margin competitive segment.

Threat: Medium

Threat of Substitutes

IBM has a wide range of products and services, which has helped it to cover the entire market and gain

the largest shares. There are many bundled products, which are offered free by IBM to create customer

loyalty and customer lock-in. However, due to the possibility of competition creating similar products

(giving customers more choices), the threat of substitution increases. In the meantime, IBM has a wide

range of acquisitions, which supplements its current arsenal of products, and hence reduces the eminent

threat of substitution. Last, the threat of substitutes is reduced by IBM as it is continuously engaging in

licensing or protected partnerships (in the past twenty years, IBM has been on the top US-patent

recipient), consequently minimizing the risk of learning opportunism of partners by protecting its

intellectual property.

Threat: Medium

Intensity of Rivalry

Competition in this industry is fierce, but IBM enjoys a large share of the leading edge IT consultancy

market. Many of IBMs products set the market standard, allowing IBM to control the direction and

progress of the market. Many of IBMs competition are either niche-oriented or cost-leaders, or are

complementary. This increases the threats of rivalry, as IBM represents the main rival for most of the

competitors and due to the breadth of IBM, such companies can chip away at the profits of IBM in

specialized areas where IBM is weak. Intense rivalry has decreased the profit margin for IBM in recent

7

months and has led to the lay-off of many employees in order to cut costs, enough to offset declining

sales.

Bloomberg quoted Laurence Balter, an analyst at Oracle Investment Research, who estimated that with

IBMs $1 billion restructuring charge, IBM would cut 6,000 to 8,000 jobs globally at most 1.8% of IBMs

total workforce of 434,246 at the end of 2012.

1

The table below lists IBMs main competitors:

Table1: Revenue of top 6 vendors

2

Threat: High

It is clear from Porters Five Forces model that the biggest problem for IBM is the existing rivalry; however

the market is growing, with a need of new innovative solutions from their suppliers. The key factor for

success will be attaining a high level of differentiation, which will guarantee profitability, and market

growth.

1

http://www.forbes.com/sites/petercohan/2013/06/14/as-it-shrinks-in-a-growing-market-does-ibm-have-a-

strategy/

2

Source: IDCs Worldwide Quarterly Server Tracker, August 2013

8

3. Environment Analysis

Drivers External Factors

Influence

on

Industry 0

to 10 (A)

Impact on

Company

-5 to 5 (B)

(A) * (B)

Probability

of change

Political/Legal Conflicting regulations between

different countries; compliance with

local laws vs. global operations.

Patent laws are in a flux in the US and

worldwide; patent reform changes

nature of competition.

4

8

-1

3

-4

24

Low

Medium

Economical Global recession from US economic

troubles

Shift away from US as primary market

9

7

-4

3

-36

21

High

High

Social Workforce growing older; fewer young

employees and more diverse workers

Workers separated geographically;

trend of employees working from home

or regional offices

6

8

2

3

12

24

High

High

Technological Technology quickly becomes

widespread / copied by low cost rivals

Disruptive technology; new invention

creates or destroys an industry quickly

(soon-to-be obsolescence)

8

9

-4

+/- 5

-32

+/- 45

High

Medium

Environmental Focus on green or low consumption

sustainable energy

Natural disasters

4

2

2

-4

8

-8

Medium

Low

Table 2: Environmental factors affecting IBM

Political/Legal

IBM is a multinational company operating in many countries, often resulting in IBM needing to navigate

between conflicting regulations. What may be legal in one country may not be in another; financial

practices may differ. In the same perspective, workers rights, patent law or export controls are all factors

that need to be taken to consideration.

Economical

Economic recessions can impact clients who may cut back on spending in IT and business operations.

IBM may find that it needs to rely less on US operations for profit than with emerging countries coming on

line (for example, Chinese companies looking for premium IT services).

9

Social

Workers are gradually graying, becoming older as baby boomers move toward retirement. Employee

needs and desires change as workforce becomes more diverse. Technology allows employees to

collaborate and work far away from each other; however downsides of isolation and separation need to

be addressed. The empowerment of the working class and rising inflation has increased the demands for

higher wages, which puts pressure on many IT companies (especially IBM) and also makes it hard to

retain quality employees. The collaboration of employees throughout the world also creates some

problems with collaboration due to the cultural differences and time differences. Despite the ranks of

skilled workers in India and other countries, competition has shrunk the pool of available candidates.

Employees work in a virtual organization, where location is no longer defined; employees are connected

to each other through networks and technology.

Technological

IBM is the trendsetter and market maker for new technology in IT automation and business. It is likely that

old standards can be disrupted overnight with the introduction of a new technology. IBM needs to

continuously innovate as anything can be copied or adopted by rivals. As competitors become adept at

duplicating the same types of services IBM develops, competition increases and profits drop. Because

IBM does not force clients to use any particular product, it is easy for clients to move to IBM, vice-versa at

the risk of them easily moving elsewhere (no customer lock-ins have the same pros and cons for any

competitor).

Environmental

Natural disasters can disrupt IBM operations, as facilities are located worldwide. The focus on green

technology is also an important issue as clients and governments try to address the rising global warming

issues.

10

4. Internal Analysis

IBMs Value Chain

The value chain designed by Porter plots an organizations activities depending on whether they are

primary or supporting activities. The combination of all these activities enables the transformation of

inputs into outputs. It is crucial for a company to assess its own value chain so as to understand how it

creates value: the bottom line of any company is to make profit by creating outputs of greater value than

the inputs. By describing this process, a company is able to put into words why it exists in the first place:

what is its leading objective, its reason to be? Put into an equation, it sums up to:

Value created / captured Cost of creating that value = Profit margin

Figure 3: Value chain

Figure 3 depicts Porter's value chain for IBM. The red arrows indicate weak linkages, while green arrows

show strong links.

The X-axis represents the supporting activities:

Organizations infrastructure

IBM was reorganized in a decentralized organization following Sam Palmisanos nomination as the

companys CEO. Today, it is organized in seven service lines

1. Strategy & Transformation

2. Business Analytics and Optimization

3. Application Management Services

4. Mid Market

5. SAP Applications

6. Microsoft Applications

11

With its close to half a million employees around the world, IBM is today the 18

th

largest firm in the USA.

Therefore, it requires frequent adaptations to maintain an optimal operational efficiency. The

decentralization process was enabled by the division of the company in numerous sub-companies,

divisions, etc. having each its own organizational structure. This translates in the periodic necessity to

restructure the company to maintain its full efficiency. The details of the organizational structure are

described below in figure 4.

Figure 4: IBMs organizational structure

HR management

To reduce any redundancy or overhead costs in the goal of maximizing the productivity, IBM has

integrated HRM in its supporting activities to improve the firms capacity to innovate. Thanks to a more

consistent HRM, IBM is able to provide an optimal environment to its employees, resulting in clear list of

key priorities, goals, and objectives. It led the organization to a sharper focus for the learning,

development, and knowledge sharing, but also to a shared strategy to which the employees are

committed. By adopting a pro-active (rather than a reactive) HR strategy, IBM has been able to

implement change successfully: for example, IBMs HRM has helped the company acquire smoothly 125

companies since 2000 and transform these acquisitions into a global integration (generating savings of $6

billion since 2005). Amongst others, IBMs HRM has notably developed three skills to promote an optimal

operational improvement:

1. Reinvent talent development with Global Enablement Teams (which consist of sending top people

from mature markets to growing markets to promote a two-sided learning).

2. Reinforce global teams (as contradictory as the formulation may seem, IBM is aiming at a centralized

decentralization) by reducing the barriers between each team across the world.

3. Link the HR activities to business results by creating a performance-orientated culture.

12

Technology development

The key differentiation between IBM and its competitors is the R&D. IBM spends approximately 5-6 billion

annually (including capitalized software costs), hence focusing its investments on high-growth

opportunities. The company also has some of the best technology registered in its account that made

revolutionary changes, such as the transfer of massive amounts of business data around the world.

- Procurement:

IBM has developed business partner relationships, which allows IBM to deliver products and services at a

competitive cost, all the while respecting customers demand of infrastructure security. The company also

did a various number of Merger and Acquisitions to transform its business into a high value offering

including a global service segment (such as network solutions, data storage or data transfer).

The Y-axis describes the primary activities:

Inbound logistics, Operations, and Outbound logistics

Since the organizational infrastructure of IBM is complex, it becomes harder to manage, and costlier to

run. In order to reduce costs all the while improving customer service, it is necessary for IMB to adopt an

optimized supply chain management by reducing any unnecessary steps. Moreover, IBMs Business

Performance Management allows the firm to visualize end-to-end processes across the entire

organization by the use of an IT system. IBM can analyze the actions execution in real time against goals

and make adjustments promptly when needed. Therefore, IBMs supply chain, manufacturing processes

and logistics are designed in the objective of minimizing inventory and improving the response to market

opportunities or external risks. This gives a competitive advantage to IBM.

Marketing / sales

The company has realigned its operations and organizational structure in 2005 to give more authority to

its sales and delivery teams. It allows an increased flexibility and a more efficient decision-making. The

company also broadened its services to other Asian countries to increase sales and gain a considerable

profit in some of the fastest growing economies (such as China, India, Taiwan, Hong Kong, Singapore,

Thailand, Indonesia or the Philippines).

Service

IBM provides technology and transformation services to clients and businesses; it also invests in

improving the ability to help its clients innovate. This gives IBM a high value-added resulting from

optimized internal logistics (with the implementation of profitable processes). Apart from these services,

IBMs remaining services can be categorized into three groups:

1. The IT technology services, which offer strategic outsourcing, integrated technology services, and

hosting.

2. IT infrastructure delivery, which is increasingly becoming strategic to drive productivity, efficiency and

margin improvement.

3. The transformation and high end business value such as consulting, systems integration, application

services, business transformation, outsourcing, asset innovation, and strategic business

development.

13

By analyzing IBMs Value Chain, we conclude that:

+ IBM's strength is its wide portfolio of end-to-end services, which is aligned by the strong link between

Technology Development, Procurement and Inbound Logistic. This can be explained by the fact that

IBM has aggressively acquired or developed a wide array of technology platforms that meet the

challenges of clients needs, as well as a willingness to support non-IBM products.

- However, IBM shows some signs of weakness when it comes to aligning its operational activities to

the organizations infrastructure, especially the HR management. This may result from the fact that

IBM emphasizes its activities related to the technology management (for the inbound logistics) and to

their customer service management (for the outbound logistics). Also, as Table 3 shows, IBM's

revenues have been declining gradually, compelling the company to resort to lay-offs and widening

margins to increase profits. Even such cost cutting measures have failed to show considerable

improvement to the income through the years. These minimalistic incremental profits are a result of

cutting overhead costs and improving efficiency, but there is a limit to how long this trend can

continue. There is a need for increased revenues to increase profits. The economic slowdown in most

parts of Europe and the slow recovery of the US market is partly the cause of declining revenues and

diminishing profits, along with the lack of differentiation between IBM's pool of consultants and the

same pool at IBM's close competitors. This is the outcome of the weak relationship the areas of

Human Resource Management, Organization's infrastructure and Operations, consequently indicated

in yellow.

3

Table 3: IBM 5-year financial results

3

http://www.marketwatch.com/investing/stock/ibm/financials

Fiscal year is January-December. All values USD millions. 2009 2010 2011 2012 2013

Sales/Revenue 95.76 99.87 106.92 104.51 99.75

Sales Growth - 4.29% 7.06% -2.25% -4.55%

Gross Income 43.38 45.68 49.88 49.84 48.51

Gross Income Growth - 5.31% 9.19% -0.08% -2.68%

Gross Profit Margin - - - - 48.63%

Operating Expenses 26.2 27.03 29.11 28.87 29.73

Research & Development 5.82 6.03 6.26 6.3 6.23

Other SG&A 20.38 21 22.85 22.57 23.5

SGA Growth - 3.13% 7.72% -0.82% 2.96%

Net Income 13.43 14.83 15.86 16.6 16.48

Net Income Growth - 10.49% 6.89% 4.72% -0.73%

Net Margin Growth - - - - 16.52%

14

IBMs resources, capabilities and core competencies

Resources & capabilities

Some of IBM Resources include:

The IBM family of mainframes includes the zEC12, zBC12 and Enterprise Linux Server

(ELS) platforms, which provides businesses with a high performance, extremely secure, resilient,

and efficient platform.

The new IBM DB2 11 for z/OS enables enterprises, amongst others, to take advantage of the

scale, performance and availability to integrate the results of Hadoop processing into its

enterprise data store.

Enterprises using IBM IMS 13 have the ability to combine integrated analytics with unstructured

and social data seamlessly, merging knowledge from various types of data and eliminating the

need for separate, siloed systems.

4

A few of IBM capabilities include IBM Commerce, IBM Digital Marketing Optimization.

Core Competencies:

Cloudant, Inc.: recently, IBM announced that it has completed the acquisition of Cloudant Inc., a

database-as-a-service (DBaaS) provider that enables developers to easily and quickly create

next generation mobile and web apps.

Aspera: IBM announced it has completed the acquisition of Aspera, Inc., a privately held

company that securely speeds the movement of massive data files around the world

The new IBM Capacity Management Analytics solution can help IT managers track, predict and

avert performance issues and unforeseen capacity requirements before they occur, ensuring the

availability of services for end customers

In 2013, IBM introduced new business analytics and cloud software solutions to help clients take

advantage of new workloads. Also, enhancements to IBM DB2 for z/OS and IBM IMS are prime

examples of how companies can manage big data to achieve a competitive edge.

IBM is introducing IBM Cognos tm1, which provides deep insight for Chief Financial Officers to

create, analyze and manage sophisticated financial plans, providing greater visibility into

enterprise profitability.

The latest enhancement to the cloud solution portfolio is the IBM Entry Cloud Configuration for

SAP Solution on zEnterprise v2. This cloud enablement offering combines high-performance

technology and services to automated, standardized and accelerated day-to-day SAP operations

for reduced operational costs and increased ROI.

4

http://www-03.ibm.com/press/us/en/pressrelease/42228.wss

15

5. Strategy Formulation

In this report, we have decided to directly link the SWOT analysis, the Value Creation and the pricing

options to the strategy formulation rather than separating these entities. This is motivated by the fact that

once the internal analysis done (part 4), these three elements can then be used as a basis to

understanding where IBM can create a sustainable niche in the market: it is therefore used here as a

stepping stone used to kick off the strategy formulation.

SWOT Analysis

Strengths

Industry Leadership

Abundant Resources

End-to-end enterprise

solutions

Quick Response

High Acquisitions

Brand name & reputation

Financial assets

Strategically innovative (ex:

backward integration)

Product diversification to

minimize risk

Weaknesses

Reliance on High Margins

High Operating cost

Weak Employee Value

proposition

Limited market (fast PLCs

where market saturation is

quickly reached)

Opportunities

Emerging Markets

Increasing demand of cloud

computing

Look for new emerging markets

and develop products and

services

Create demand through marketing

Streamline internal operating cost

Enter new markets to increase

revenues and profit margins

Threats

Cost Competition

Low Entry Barriers

Lack of Skilled workers

Slow global economy

Create strategy to create skills

hard to imitate

Create value for the clients by

increasing the value of its

services: acquire skilled

consultants to provide a

comprehensive end-to-end

solution.

Address skills building and create

a meaningful employee value

proposition.

Table 4: IBM SWOT Analysis

These statements about the internal environment enable the strategic managers to precise the corporate

strategy, which is to be set, formulated and then implemented. This is motivated by the necessity for a

company to achieve a strategic alignment (between its corporate strategy and its activities, its targets).

IBM is a pioneer in the IT industry and enjoys market leadership. It has quickly addressed the needs of

clients by providing complete business solutions and holds a deep cash reserve to spend as necessary.

As per IBM, its main strategy is to generate higher value: though these words may appear as quite vague

and general, it nonetheless stresses the importance of certain priorities IBM has set for itself, which may

be resumed as follows:

16

- Continuously strive for higher value, more profitable technologies

- Always look to tap into new markets

- Participate in the globalization process by being a truly international enterprise

- Ensuring the stakeholders interests

- Setting the bases to enable an optimized R&D (for a optimized future competitive advantage)

All these priorities have to be operated within the framework of IBMs own growth and leadership in the

high-tech industry.

The main weakness IBM faces is the growing competition with many small and large competitors going

for IBM's market share. Since IBM has a higher margin, clients are moving to cheaper providers who

provide the same quality of service. Another issue is the shortage of skills. The increasing demand for

skilled labors has provided the employees with the option to keep moving on between high paying jobs.

This has decreased loyalty to work for IBM among employees. In order to tackle this, IBM needs to create

a stronger and meaningful employee value proposition, which gives the appropriate rewards to

employees, based on their performance, satisfying both their intrinsic and extrinsic needs.

IBM has a huge base of fresh graduate hires, which puts a lot of stress on its ability to provide skilled

labor to its clients. Timing is critical, and spending time to bring its employees up to speed on the latest

technology puts IBM at risk of losing business to low-cost rivals. This represents a lack of competitive

advantage all the more when considering that retaining and deploying skilled employees shortens the

time (especially when IBM can't just count on the wide margins driving profits).

Value creation and pricing options: IBMs competitive advantage

With regards to IBMs business operating area, the strategy formulation must be the result of a value

creation strategy: to maintain its competitive advantage, should IBM conduct a cost-leadership or a

differentiation strategy? As per the value creation model, IBM must decide whether to create more value

or lower its costs.

However, as explained above (cf. value chain), their attempts to lower the operational costs have proven

to be of limited success. On the other hand, their main competitive advantage comes from relying on

their core competencies to attract customers with new products or services (cf. IBMs core competencies).

Consequently, IBM would be able to increase its profit margins by setting a premium price for unique

products. This goes along with the necessity of being a quick (if not the first) mover, to gain market

shares before competitors kick in a considerable threat in the high-tech industry where the product life

cycles are becoming shorter and faster.

Strategy formulation process

Against the rising competition, new entrants and the declining hardware business, IBM has registered a

decreased growth rate in the past decade, making the coming years crucial for the companys future.

Once all the elements analyzed in the industry, environment and internal analysis have been plotted in

the SWOT analysis, we may conclude that IBM needs to adapt an attack and differentiation strategy for

two reasons:

- Even if an unsuccessful attack strategy would bring the company down, it is the key to staying

afloat.

- A cost reduction strategy being a time-limited option, IBM needs to focus on creating a long-term

sustainable competitive advantage by differentiating its products.

17

Moreover, considering the nature of IBMs industry and products, it is crucial to attract, maintain and

retain the best talent: in a tacit knowledge environment, the path dependency theory is all the more strong

and employees represent one of IBMs most crucial assets. Should it be unable to retain its employees,

competitors or new entrants would quickly swipe them away and reduce IBMs competitiveness.

Therefore, IBMs organizational structure needs to be modified in a more HR-, employee-centered

approach (though some efforts have already been made in this perspective as explained in part 4: cf.

Porters Value Chain). This can be achieved by adopting a participative approach. Having fuelled the

R&D pipeline, IBM will be able to attack by pushing attractive new products or services onto the market.

Moreover, to fight efficiently against competitors like HP, IBM can orchestrate organic or inorganic growth

to support its own strength with the help of strategic partnerships and alliances. This goes along with

adapting to current trends: to ensure success in new markets or with new products, IBM must rely on the

expertise of specialized partners who will bring skills, knowledge, and capabilities to be added to IBMs

already vast portfolio of internal resources (cf. part 4: IBMs resources, capabilities and core

competencies). For example, IBMs major profits come from software and devices, out of which IBM

expects to generate at least 50% of its profits by 2015

5

but it also seeks to focus on the recently

emerging cloud computing business (which also has consistent profit margins). We may here note that

IBM has already engaged in that path by acquiring Softlayer and other cloud computing companies (in the

objective of building its own computing capability).

Hence, IBMs strategies involve creating a niche for itself rather than following a response strategy

against its competitors. After evaluating its current capabilities and weaknesses we have listed worst and

best case scenarios for IBM with its outcomes. The successful strategy implementation will rely on the

judicious application of these scenarios and IBMs ability to increase its capabilities through acquisitions.

Scenarios

The below scenarios can represent the worst and best case scenarios for IBM in the near future.

IBM's Worst Case: IBM may reach the limit to the improvements in operational efficiency and driving

profits through high margins, cost reduction and layoffs. Revenues may remain flat and decrease profit

growth. Competitors take advantage of IBM's de-motivated and isolated consultants/employees by

poaching them with higher salaries and giving an opportunity to work in focused teams. This decreases

IBM's niche advantages over its rivals.

IBM's Best case: IBM can increase profits by increasing revenues, lowering overhead cost and increasing

the differentiation of their consulting services to raise entry barriers for rivals. Figure 4 shows IBM's

strategic sweet spot as compared to its competitors. Identification of this spot will enhance IBM's market

leadership and strengthen the position of IBM's consulting and service offerings.

Option 1: improve the HR management. IBM leaves employees to find their own learning path based on

their position and industry understanding and devises a reward system to employees who successfully

attain the skills that clients demand.

Pros Cons

Align the strategy to the organizational structure

Promote employee innovation

Risk of employees leaving IBM

Costly to find, train and retain talent (time, money

and efforts)

5

http://www.fool.com/investing/general/2014/01/02/2014-will-be-a-big-year-for-ibm.aspx

18

Option 2: restructuring. IBM aggressively hires employees with high-demand skills, lays-off employees

with skills related to industries, which IBM plans to exit.

Pros Cons

Fast solution Bad organization climate

Hiring and firing processes are very costly

Option 3: a committed & aligned strategy. IBM counters the downsides of virtualization, bringing IBM

employees together to transform IBM into a Learning Organization:

A Shared Mindset

Speed of New Ideas

Learning And Knowledge Management

Accountability

Collaboration

Leadership

Pros Cons

Creates a sustainable competitive advantage

May open the door to new markets or unforeseen

opportunities

Risk of employees leaving IBM

Requires the most time, efforts and money

amongst the three options

IBMs strategic sweet spot

Options 1 and 2 are the easiest to implement and may use financial rewards as incentives for employees

to find the best solution to gain skills. The drawback to this approach is the threat of being copied by

competition, as it doesn't provide any distinct capabilities. Employees who achieve high skills

independently may not find any incentive to remain loyal to IBM, and can easily be poached by the

competitors.

Option 3 is the hardest to implement as it requires time and considerable change for IBM but it does

create a sustainable competitive advantage over time. This option makes the assumption that employees

can become capable in new skills, avoiding the problem of recruitment in a tight labor market.

Figure 4: IBM's strategic sweet spot

19

6. Strategy implementation

In order to implement the strategy as formulated above, IBM has to conduct a series of transformations

with regards to its organizational structure / design and its leadership.

To enable the revival of the organization against economical downturns and an increasingly aggressive

competition, IBM has to rely more consistently on its employees who are the sole source of their

competitive advantage: the delivery of new products and services coming out of their R&D pipeline in an

attack, differentiation perspective. This implies that IBM needs to switch from a relatively authoritarian

structure to a participative approach: by empowering employees, they will be able to answer to the rising

expectations of their customers by supporting AND being supported by an innovation-focused strategy.

This could imply a wide range of alternatives, such as the 3Ms 20% policy, which leaves each employee

20% of free time to work on whatever project he / she has interest in.

Nonetheless, these facts have to be taken into consideration within another perspective: the necessity to

optimize operational costs, as a result of the globalization process. Any competitor could easily overpass

IBM by lowering their costs hence increasing their profit margin; therefore IBM has to combine the

necessity of an intensified R&D pipeline to a cost-reduction strategy in the areas where it may apply,

without hindering the implementation of a differentiation strategy. This necessity sets the limit of a

participative strategy, which implies that no organization can be completely left to itself, or this would lead

to a state of chaos: the top management level needs to strike a balance between controlling the efficiency

and letting its employees reach their top performance level.

By conducting an employee-centered strategy for the purpose of a differentiation strategy, IBM could

successfully achieve its three main perspectives as defined by CEO Virginia Rometty 6:

1. Big Data Analytics: Data is the new competitive resource, but like any natural resource, it must

be refined, Rometty said. The advantage in eCommerce in the future might be determined by

milliseconds. Businesses must have tools to do that. IBM has invested $23 billion in analytic

software and had $16 billion in Big Data-related revenue in 2013.

2. Re-making enterprise IT in the cloud: IBM strategy is to build a cloud computing enterprise in

order to help companies adopt the new cloud computing strategies. IBM is mainly focusing its

investments on cloud and mobile computing.

3. Social Engagement: Rometty provided an energized view of the social enterprise as a strategic

centerpiece, tying the customer and employee experiences together.

6

http://www.businessesgrow.com/2014/02/11/ginni-rometty/#sthash.TIeIuVFw.Iv7IeaLD.dpuf

20

CONCLUSION, LESSONS LEARNED & RECOMMENDATIONS

The example of IBM offers an insightful approach to understand a companys organizational design,

leadership and strategy. Having been through ups and downs since its foundation in the beginning of last

century, IBM can be proud to have successfully maneuvered through these blows and still enjoy today a

considerable brand image with satisfying (though decreasing) profits. The keys to this success revolve

around two imperatives, apart from the indomitable Think, which sums up the motivation leading the

company forward: growth and leadership.

To fight against the slowing growth of its profits, this report aimed at conducting an industry, environment

and internal analysis to explain where IBM stands and try to understand where it should go. The key to

IBMs future success lies in continuously nurtured innovation, to protect the company against an

increasingly aggressive and widespread competition. The innovation should target mainly the R&D

pipeline to enable an innovative product line, but should also concern other areas of IBMs value chain

such as the HR or the strategy in itself.

In a nutshell, IBM needs to focus on what they do best by creating value (rather than lowering costs).

However, the creation of that value can occur in various fields and must be supported by growth (whether

organic or inorganic). As per Christine Dover, the Research Direction at IDCs Software Business

Solutions Group (one of IBMs partners), the best partners are no longer those who just drive revenue

numbers, best partners invest in trained and qualified staff, work to earn high customer satisfaction

ratings and sell value-added solutions.

The proposed strategy consists of identifying IBMs strategic sweet spot and investing the necessary

resources into achieving that spot. Though costly in time, money and efforts, it will allow IBM to have a

truly aligned strategy, mission and organizational structure. This requires identifying a balance point

between a participative and authoritarian leadership, a centralized and decentralized organizational

infrastructure, and a long-term attack and differentiation strategy. Let us quote IBMs former CEO for the

finishing statement: If theres no way to optimize IBM through organizational structure or by management

dictate, you have to empower people while ensuring that theyre making the right calls the right way. And

by right, Im not talking about ethics and legal compliance alone; those are table stakes. Im talking

about decisions that support and give life to IBMs strategy and brand, decisions that shape a culture.

Thats why values, for us, arent soft. Theyre the bases of what we do, our mission as a company

Youve got to create a management system that empowers people and provides a basis for decision

making that is consistent with who we are at IBM (Harvard Business Review Interview, Leading Change

when Business is good).

Вам также может понравиться

- Laboring Bodies and the Quantified SelfОт EverandLaboring Bodies and the Quantified SelfUlfried ReichardtОценок пока нет

- IBM Strategic AnalysisДокумент15 страницIBM Strategic Analysisrai_ankur142098% (49)

- Strategic Management: Case AnalysisДокумент28 страницStrategic Management: Case AnalysisMohsin BashirОценок пока нет

- Portes Five Forces On IBM in Software IndusrtryДокумент26 страницPortes Five Forces On IBM in Software Indusrtryavisek8586% (14)

- Waking Up IBM: How A Gang of Unlikely Rebels Transformed Big BlueДокумент17 страницWaking Up IBM: How A Gang of Unlikely Rebels Transformed Big BluelaurencabotОценок пока нет

- IBMДокумент72 страницыIBMSudhir KumarОценок пока нет

- Build Satya Nadella FINALДокумент27 страницBuild Satya Nadella FINALQuoc Tuan LeОценок пока нет

- Analysis of Amazon Customer Centric ApproachДокумент16 страницAnalysis of Amazon Customer Centric ApproachNalin KОценок пока нет

- Strategic Analysis of Apple Inc.: Brian MasiДокумент35 страницStrategic Analysis of Apple Inc.: Brian MasiRocking RidzОценок пока нет

- Airbnb Corporate Communication Strategy in Social MediaДокумент10 страницAirbnb Corporate Communication Strategy in Social MediaArdi GheaОценок пока нет

- IBM Vision and ValuesДокумент11 страницIBM Vision and ValuesSufian Tan100% (1)

- Elixir - A Fintech Banking Solution For MillennialsДокумент11 страницElixir - A Fintech Banking Solution For MillennialsFeruz AkbarovОценок пока нет

- IBM Case Study - PartaДокумент18 страницIBM Case Study - Partajv_anandОценок пока нет

- Infosys - Startegic AnalysisДокумент16 страницInfosys - Startegic AnalysisBindhya Narayanan NairОценок пока нет

- Apple's Business Strategy Revised VДокумент7 страницApple's Business Strategy Revised VOnyansi CalebОценок пока нет

- Porter's 5 Forces On IT IndustryДокумент26 страницPorter's 5 Forces On IT Industrytamal_query100% (1)

- AEON SWOT Analysis & MatricДокумент6 страницAEON SWOT Analysis & MatricJanet1403Оценок пока нет

- Inside The Buy One Give One ModelДокумент7 страницInside The Buy One Give One ModelMahmoud Abd El GwadОценок пока нет

- Organizational Culture Case on Nadella's Transformation of Microsoft CultureДокумент6 страницOrganizational Culture Case on Nadella's Transformation of Microsoft CultureJayesh MenashiОценок пока нет

- Can Nadella Survive and Create Legacy Like Gates at MicrosoftДокумент5 страницCan Nadella Survive and Create Legacy Like Gates at MicrosoftLawrenceОценок пока нет

- Apple's Mission and Steve Jobs' Leadership Through Cancer Battle and iPad 2 LaunchДокумент8 страницApple's Mission and Steve Jobs' Leadership Through Cancer Battle and iPad 2 Launchgemini_zee1233103100% (1)

- Cisco Grand StrategyДокумент12 страницCisco Grand StrategyKumar Kishore KalitaОценок пока нет

- About IBM PDFДокумент30 страницAbout IBM PDFadharav malikОценок пока нет

- Submitted By: Anupam Bandhu PoudelДокумент3 страницыSubmitted By: Anupam Bandhu PoudelBandhu AnupamОценок пока нет

- Microsoft SWOT AnalysisДокумент9 страницMicrosoft SWOT AnalysisAnasОценок пока нет

- 5 Forces & Vrine Apple and Starbucks CasesДокумент17 страниц5 Forces & Vrine Apple and Starbucks CasesIg Na0% (1)

- IbmДокумент59 страницIbmDarren_Fung_8729Оценок пока нет

- McKinsey 7S - Hard and Soft Elements of IBM's Structure and StrategyДокумент2 страницыMcKinsey 7S - Hard and Soft Elements of IBM's Structure and StrategyJack Molly67% (3)

- Kellogg SampleДокумент23 страницыKellogg SampleShubhangi Dhokane0% (1)

- BP's Digital Transformation JourneyДокумент3 страницыBP's Digital Transformation JourneySudhansuSekharОценок пока нет

- Final InfosysДокумент12 страницFinal Infosysshah_kinjal1990Оценок пока нет

- Diagrams - PPT - NetflixДокумент8 страницDiagrams - PPT - NetflixRamjan MakandarОценок пока нет

- BRM Group Presentation AppleДокумент16 страницBRM Group Presentation Applekarthik soraturОценок пока нет

- Ibm (Final)Документ69 страницIbm (Final)api-3696146100% (1)

- The Ten Types of Innovation (Doblin Inc.)Документ1 страницаThe Ten Types of Innovation (Doblin Inc.)Berry CheungОценок пока нет

- Competitive Analysis: Competitor 1:-Wework Competitor 2: - Regus Competitor 3:-HudДокумент2 страницыCompetitive Analysis: Competitor 1:-Wework Competitor 2: - Regus Competitor 3:-HudRaveendra SrnОценок пока нет

- APPLE VISION AND MISSIONДокумент9 страницAPPLE VISION AND MISSIONSana JavaidОценок пока нет

- IKEA Financial Risk in China CaseДокумент10 страницIKEA Financial Risk in China CaseErlinda SusilowatiОценок пока нет

- RIM Case StudyДокумент12 страницRIM Case StudyFelicia Yan II0% (1)

- Deloitte 2019 Global Impact ReportДокумент46 страницDeloitte 2019 Global Impact ReportDeloitte MaltaОценок пока нет

- Starbucks' Vision, Mission and StrategiesДокумент8 страницStarbucks' Vision, Mission and StrategiesAlexis Kliene HambreОценок пока нет

- Entrepreneurship Exam Case Study INS275-PDF-EnGДокумент15 страницEntrepreneurship Exam Case Study INS275-PDF-EnGanilОценок пока нет

- Home Assignment 1 (Strategic Profile Building) - Task 1 Company Name-Ibm - S Vergin Iruthaya Preethi 1.historyДокумент49 страницHome Assignment 1 (Strategic Profile Building) - Task 1 Company Name-Ibm - S Vergin Iruthaya Preethi 1.historypreethi PreethiОценок пока нет

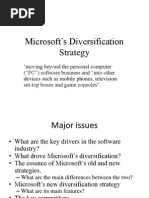

- Microsoft's Diversification StrategyДокумент12 страницMicrosoft's Diversification StrategypoijiОценок пока нет

- Problems With Mass CustomizationДокумент22 страницыProblems With Mass CustomizationmkauraОценок пока нет

- Mis of DELLДокумент3 страницыMis of DELLashutoshyadav007Оценок пока нет

- IBM CaseДокумент6 страницIBM CaseJahangir Ali100% (1)

- Uber's rise as a global service providerДокумент1 страницаUber's rise as a global service providerSaloni SharmaОценок пока нет

- IBMДокумент23 страницыIBMCyril ChettiarОценок пока нет

- Amazon vs Alibaba - Comparing the eCommerce GiantsДокумент11 страницAmazon vs Alibaba - Comparing the eCommerce Giantshaseeb ahmad100% (2)

- Managing Social Media Crises With Your Customers: The Good, The Bad and The UglyДокумент10 страницManaging Social Media Crises With Your Customers: The Good, The Bad and The UglyVasile PqОценок пока нет

- WeWork Competitive AnalysisДокумент1 страницаWeWork Competitive AnalysisRaveendra SrnОценок пока нет

- The World is Flat Book ReviewДокумент28 страницThe World is Flat Book ReviewNag28raj100% (1)

- The Three Stages of Disruptive InnovationДокумент23 страницыThe Three Stages of Disruptive InnovationSergio Luis SmidtОценок пока нет

- IBM Case Study Strategic Management Final ReportДокумент28 страницIBM Case Study Strategic Management Final ReportShazil Ahmad92% (38)

- RasedДокумент7 страницRasedMohammad Mahbubur Rahman KhanОценок пока нет

- Case Study of IBMДокумент9 страницCase Study of IBMAnisa_Rao89% (9)

- IBM Case Study Strategic Management Final ReportДокумент28 страницIBM Case Study Strategic Management Final ReportMinh HoàngОценок пока нет

- IEC 60050-151-2001 Amd2-2014Документ8 страницIEC 60050-151-2001 Amd2-2014mameri malekОценок пока нет

- TARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFДокумент25 страницTARIFFS AND POLITICS - EVIDENCE FROM TRUMPS Trade War - Thiemo Fetze and Carlo Schwarz PDFWilliam WulffОценок пока нет

- Demonetisation IndiaДокумент71 страницаDemonetisation IndiaVinay GuptaОценок пока нет

- F1 English PT3 Formatted Exam PaperДокумент10 страницF1 English PT3 Formatted Exam PaperCmot Qkf Sia-zОценок пока нет

- Intrepid Group Annual Report 2018Документ53 страницыIntrepid Group Annual Report 2018Andre Febrima100% (1)

- BP - Electrical PermitДокумент2 страницыBP - Electrical PermitDwinix John CabañeroОценок пока нет

- The Left, The Right, and The State (Read in "Fullscreen")Документ570 страницThe Left, The Right, and The State (Read in "Fullscreen")Ludwig von Mises Institute100% (68)

- Comillas Elementary Class Program Modular Distance LearningДокумент24 страницыComillas Elementary Class Program Modular Distance Learningbaldo yellow4Оценок пока нет

- The Last LeafДокумент6 страницThe Last LeafNam KhaОценок пока нет

- Irregular verbs guideДокумент159 страницIrregular verbs guideIrina PadureanuОценок пока нет

- How To Configure User Accounts To Never ExpireДокумент2 страницыHow To Configure User Accounts To Never ExpireAshutosh MayankОценок пока нет

- Growth of Royal Power in England and FranceДокумент6 страницGrowth of Royal Power in England and FrancecharliОценок пока нет

- New Funding Pushes Convoy Valuation To $3.8 BillionДокумент3 страницыNew Funding Pushes Convoy Valuation To $3.8 BillionTrang BùiОценок пока нет

- 24 Directions of Feng ShuiДокумент9 страниц24 Directions of Feng Shuitoml88Оценок пока нет

- MTWD HistoryДокумент8 страницMTWD HistoryVernie SaluconОценок пока нет

- Canned Words TFDДокумент2 страницыCanned Words TFDAi KaОценок пока нет

- Clia & Cap Regulatory TrainingДокумент23 страницыClia & Cap Regulatory TrainingWilliam David HommelОценок пока нет

- Vas Ifrs Event enДокумент2 страницыVas Ifrs Event enDexie Cabañelez ManahanОценок пока нет

- International HR Management at Buro HappoldДокумент10 страницInternational HR Management at Buro HappoldNishan ShettyОценок пока нет

- GLORIAДокумент97 страницGLORIAGovel EzraОценок пока нет

- Mobile Pixels v. Schedule A - Complaint (D. Mass.)Документ156 страницMobile Pixels v. Schedule A - Complaint (D. Mass.)Sarah BursteinОценок пока нет

- Understanding Culture, Society and PoliticsДокумент3 страницыUnderstanding Culture, Society and PoliticsแซคОценок пока нет

- Student Majoriti Planing After GrdaduationДокумент13 страницStudent Majoriti Planing After GrdaduationShafizahNurОценок пока нет

- Between The World and MeДокумент2 страницыBetween The World and Meapi-3886294240% (1)

- Quicho - Civil Procedure DoctrinesДокумент73 страницыQuicho - Civil Procedure DoctrinesDeanne ViОценок пока нет

- Nifty Technical Analysis and Market RoundupДокумент3 страницыNifty Technical Analysis and Market RoundupKavitha RavikumarОценок пока нет

- Mediocrity-The Unwated SinДокумент3 страницыMediocrity-The Unwated SinJay PatelОценок пока нет

- PÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Документ33 страницыPÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Mario Davi BarbosaОценок пока нет

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Документ2 страницыForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalОценок пока нет

- Sana Engineering CollegeДокумент2 страницыSana Engineering CollegeandhracollegesОценок пока нет