Академический Документы

Профессиональный Документы

Культура Документы

Jaiib Breakthrough

Загружено:

arpannath0 оценок0% нашли этот документ полезным (0 голосов)

40 просмотров3 страницыBanking and Finance

Авторское право

© © All Rights Reserved

Доступные форматы

TXT, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBanking and Finance

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате TXT, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

40 просмотров3 страницыJaiib Breakthrough

Загружено:

arpannathBanking and Finance

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате TXT, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 3

A bill was drawn on 23rd Dec 2005 for one month maturity.

what will be its due

date.

25th jan 2006

Wages of workmen employed for setting up new machinery should be debited to :

a) expenses account (b) wages a/c (c) machinery account (d) cash account

Ram is paid Rs 200 for repairs of a second hand machienry. The amount paid shoul

d be debited to

a) Ram a/c (b) Machinery a/c ( c) cash a/c (d) repairs a/c

Rajesh threw a party for Ashish. In the party Sachin sharma a top cricketer was

also present. Rajesh in the presence of Sachin told Mr Ashish that Mr sachin is

his longtime friend and also partner in the firm. impressed by this Ashish gave

loan of Rs 1 lkh to the firm.Later Rajesh went bankrupt and it came to be known

that Sachin was never partner in the firm, however Ashish filed a suit against

sachin for recovery of money.

(a) Sachin can not be held responsible as he is not partner in the firm

(b) Sachin is responsible as he did not protest or gave any indication to the co

ntrary when he was projected as partner in the firm

(c) Sachin is not responsible as he never asked Ashish to give loan.

(d) both (a) & (c)

(e) None of the above

Seema and Garima enter into a joint venture. If separate sets of books are maint

ained answer the following questions;

1. Seema bought goods for Rs 5000 , what entry will be passed

a. debit purchases a/c , credit cash account

b. debit seema a/c , credit cash account

c. debit joint venture a/c , credit Seema account

d. debit joint venture a/c , credit joint bank account

2. Goods worth Rs 3000, taken over by Garima

a. Debit drawings a/c, credit purchases a/c

b. Debit joint venture, credit Garima a/c

c. Debit joint bank a/c , credit joint venture a/c

d. Debit Garima a/c, credit joint venture a/c

3. Goods worth Rs 2000 sold by Seema and cash received

a. Debit seema a/c , credit cash a/c

b. Debit joint bank a/c , credit joint venture a/c

c. Debit joint venture a/c, credit joint bank a/c

d. Debit joint venture, credit seema a/c

Q1. A bill presented by your branch is dishonoured and you want to get its notin

g. The provision regardingnoting is described under section...of NI Act:

a: 100 b: 99 c: 85A d: 131 e 87

Q2.B is payee of a cheque, who endorses it to C. C lost the cheque which is foun

d by D, who endorses it in favour of A for valuable consideration by way of forg

ing C signatures. The cheque is dishonoured. A can recover from:

a: B

b: C

c: D

d: any of the previous parties

e None of the previous parties

Q3.As per section 45(ZA) of Banking Regulation Act 1949:

a: Nomination facility has been granted for bank deposits.

b: Guidelines have been laid down for election of Chairmen and Managing Director

s of the banks.

c: Guidelines have been given for providing working capital to big units.

d: nomination facility is available for locker accounts

e nomination facility for safe deposit vault

Q4.Your branch is having a partnership current account and a garnishee order in

the name of a partner in the firm, is received. It will:

a apply to all partners

b apply to firms account

c not apply to firms account

d not apply to any one.

e a and c

A Garnishee Order for Rs. 10,000 and income tax attachment order for Rs. 15,000

are received simultaneously in the branch in the account of Mr. Rohit who is hav

ing a clean OD limit of Rs.1 lac with debit balance of Rs. 15,000. Which one of

them will have preference?

a) Income Tax Attachment order will have preference as it is for recovery of sta

tutory dual

b) Garnishee order will have preference since it has been issued by the Court.

c) Amount will be shared proportationatly between Garnishee Order and Attachment

Order.

d) None of the above

Q1. Process of sale or purchase of government securities by RBI in the open mark

et ith a view to increase or decrease the liquidity in the banking system is kno

wn as................,...

Q2.....................means offering all types of financial products like banki

ng, insurance, mutual funds, capital market related products including share bro

king, commodity broking, investment type products like sale of gold/bullion, gov

ernment/corporate bonds, providing advisory services and Merchant Banking Activi

ties, etc., - all at one place

Q3. ..................is a type of negotiable (transferable) financial instrumen

t that is traded on a local stock exchange of a country but represents a securit

y, usually in the form of equity that is issued by a foreign publicly listed com

pany.

Q1.In relation to consignment accounts :

(A) Consignor sends Account Sale to consignee.

(B) Consignee sends Account Sale to consignor.

(C) Debtor sends Account Sale to consignor.

(D) Consignee sends Account Sale to customer

Q2.Amount of Abnormal Loss (cost price + proportionate expenses)

(A) Shall be debited to Consignment Account

(B) Shall be credited to Consignment Account

(C) Shall be credited to General Profit and Loss Account

(D) Shall be credited to Insurance Companys Account

'

Q3. A of Ahmedabad consigned goods of Rs.20,000 to M of Chennai and paid Rs.1000

for expense. The consignee paid Rs.200 for freight and Rs.100 for octroi. 80% o

f goods were sold and commission of Rs.1000 was paid, then thevalue of closing s

tock is Rs.................

(A) 4200

(B) 4000

(C) 4260

(D) 5200

Ram transported 4 bags of cotton from Indian Railways. The railway receipt was e

ndorsed by Ram in favour of his Bank. The goods were damaged in transit. Bank fi

led a suit against Railways for damages. Railways contended that Bank can not fi

le a suit against railways since Ram is the owner:

a) Railways is correct. Bank had only been endorsed railway receipt and has not

actually received delivery of goods thus Bank is not actual owner and thus can n

ot sue.

b) Ram has created valid pledge by endorsing railway receipt to Bank. For creati

ng a valid pledge constructive delievery is sufficient and thus Bank as pledgee

can sue.

c) Though valid pledge has been created in favour of Bank, Bank still does not g

et the right to sue.

d) None of the above

Ahana draws a bill of exchange of Rs 30000, payable 3 months after sight on Reha

na on 01.06.2009. The bill was accepted on 04.06.2009. Answer the following ques

tions:

1) Due date of the bill will be

a) 01.09.2009 (b) 04.09.2009 (c) 07.09.2009 (d) None of the above

2) The bill was endorsed to Suhana on 01.09.2009. Which account will be debited

in the books of Ahana.

a) Bills receivable a/c (b) Cash account (c) Suhana a/c (d) None of the above

3) In question no 2, which account will be debited in the books of rehana on end

orsement of the bill

a) Suhana a/c (b) Ahana a/c (c) Bills payable a/c (d) None of the above

4 ) On the due date of the bill was duly honoured. Which account will be debited

in the books of Ahana

a) Cash a/c (b) Suhana a/c (c) Rehana a/c ( d) None of the above

5) In the above ques no 4, which account will be debited in the books of Rehana

a) cash a/c (b) Bills payable a/c (c) rehana a/c (d) Suhana a/c

https://www.facebook.com/CivilServicesClub

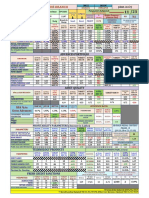

Drawing Power Calculation

Drawing power (DP) depends on value of stock (collateral) and sanctioned

limit. When Loan is sanctioned the value of security (stock), margin and limit

as decided by the Bank are taken into account to arrive at the customer drawing

power:

Drawing Power = Minimum (Stock Margin, Limit)

Drawing power can be changed due to change of stock value, margin and li

mit at any time.

Вам также может понравиться

- 5197 PDFДокумент1 страница5197 PDFarpannathОценок пока нет

- HSBC Technology Manifesto 1 0Документ15 страницHSBC Technology Manifesto 1 0arpannathОценок пока нет

- Amazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFДокумент4 страницыAmazon Copywriting Secrets How Everyone Can Use The Power of Words To Get More Clicks Sales and P20200309 62415 1he8taq PDFarpannath0% (3)

- Database InfoДокумент1 страницаDatabase InfoarpannathОценок пока нет

- Performance of The Branch: Advances PortfolioДокумент1 страницаPerformance of The Branch: Advances PortfolioarpannathОценок пока нет

- 5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19Документ1 страница5197-Car Hire 04 Dates-Ltr 157 DT 23.04.19arpannathОценок пока нет

- 1971 PDFДокумент339 страниц1971 PDFarpannathОценок пока нет

- Architecture of Aadhaar Enabled Payment System (AEPS)Документ1 страницаArchitecture of Aadhaar Enabled Payment System (AEPS)arpannathОценок пока нет

- 1st Round Training 2011Документ91 страница1st Round Training 2011arpannathОценок пока нет

- SLBCДокумент10 страницSLBCarpannathОценок пока нет

- Canara Bank: Human Resource Management Section Phone No 033-2283-1 ) OljДокумент1 страницаCanara Bank: Human Resource Management Section Phone No 033-2283-1 ) OljarpannathОценок пока нет

- Art Culture L2 IshaniДокумент103 страницыArt Culture L2 IshaniarpannathОценок пока нет

- E-Lock Installation GuideДокумент9 страницE-Lock Installation GuidearpannathОценок пока нет

- Subject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2Документ1 страницаSubject (01) ECONOMICS: Ugc - Net Exam June 2013 DATE OF EXAM:30/06/2013 Keys - Paper 2arpannathОценок пока нет

- LLP Master Data3Документ1 страницаLLP Master Data3arpannathОценок пока нет

- HasnuhanaДокумент2 страницыHasnuhanaarpannathОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 1801 SilvozaДокумент1 страница1801 SilvozaKate Hazzle JandaОценок пока нет

- Buffett On Japnese BusinessesДокумент2 страницыBuffett On Japnese Businessesaman.sarupОценок пока нет

- LCPC Assessment Form 001 AДокумент1 страницаLCPC Assessment Form 001 ABarangay MukasОценок пока нет

- DONE Sonedco Workers Free Labor Union (SWOFLU) vs. Universal Robina CorporationДокумент3 страницыDONE Sonedco Workers Free Labor Union (SWOFLU) vs. Universal Robina CorporationKathlene JaoОценок пока нет

- Example White KnightДокумент5 страницExample White KnightDeepshikha BandebuccheОценок пока нет

- AFM Module 1Документ8 страницAFM Module 1santhosh GowdaОценок пока нет

- Country Profile The BahamasДокумент4 страницыCountry Profile The Bahamasapi-307827450Оценок пока нет

- Sutability of Trade Unions For The 21st Century OДокумент13 страницSutability of Trade Unions For The 21st Century OMad75% (4)

- Axiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Документ5 страницAxiata Group Berhad: 1HFY10 Net Profit More Than Doubles - 26/08/2010Rhb InvestОценок пока нет

- Strategic Analysis Case Study 2009: Jarryd Phillips, Jermaine West, Spencer Jacoby, Othniel Hyliger, Steven PelletierДокумент47 страницStrategic Analysis Case Study 2009: Jarryd Phillips, Jermaine West, Spencer Jacoby, Othniel Hyliger, Steven PelletierDiksha GuptaОценок пока нет

- ImsДокумент74 страницыImstextile028Оценок пока нет

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Документ2 страницыOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengОценок пока нет

- Tugas GSLC Corp Finance Session 16Документ6 страницTugas GSLC Corp Finance Session 16Javier Noel ClaudioОценок пока нет

- Assignment No 1Документ6 страницAssignment No 1Hassan Raza0% (1)

- Effects of Globalization On Indian SocietyДокумент16 страницEffects of Globalization On Indian SocietyNavneet SinghОценок пока нет

- Buy Verified Revolut AccountsДокумент8 страницBuy Verified Revolut Accountskezjana dardhaОценок пока нет

- Super Bowl LI - BDO Tax Impact AnalysisДокумент67 страницSuper Bowl LI - BDO Tax Impact AnalysisLydia DePillisОценок пока нет

- Fed Rate Cut N ImplicationsДокумент8 страницFed Rate Cut N Implicationssplusk100% (1)

- Study Questions Risk and ReturnДокумент4 страницыStudy Questions Risk and ReturnAlif SultanliОценок пока нет

- Kel691 XLS EngДокумент10 страницKel691 XLS EngSuyash DeepОценок пока нет

- General Journal: Description Post Ref Dr. Cr. DateДокумент14 страницGeneral Journal: Description Post Ref Dr. Cr. DateRizki MuhammadОценок пока нет

- 54 - Donny LerilleДокумент17 страниц54 - Donny LerilleAnonymous vRG3cFNjAОценок пока нет

- The Credit Manager of Montour Fuel Has Gathered The FollowingДокумент1 страницаThe Credit Manager of Montour Fuel Has Gathered The Followingamit raajОценок пока нет

- Basel 2 NormsДокумент21 страницаBasel 2 NormsamolreddiwarОценок пока нет

- Petron Terminal PaperДокумент19 страницPetron Terminal PaperKamper DanОценок пока нет

- The Cooperative Development ProgramДокумент8 страницThe Cooperative Development ProgramDaeОценок пока нет

- BimДокумент180 страницBimBOOKSHELF123Оценок пока нет

- Assignment Entp Uzair Pathan 18330Документ4 страницыAssignment Entp Uzair Pathan 18330syed ali mujtabaОценок пока нет

- History of Banking in IndiaДокумент5 страницHistory of Banking in IndiamylahОценок пока нет

- Cfa - 2020 - R22 - L2V3 - SS8 - Corporate Finance 2 - Corporate Governance and EsgДокумент32 страницыCfa - 2020 - R22 - L2V3 - SS8 - Corporate Finance 2 - Corporate Governance and EsgMarco RuizОценок пока нет