Академический Документы

Профессиональный Документы

Культура Документы

ZylogSystems CRISIL 010312

Загружено:

didwaniasОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ZylogSystems CRISIL 010312

Загружено:

didwaniasАвторское право:

Доступные форматы

M

AKING

M

A

R

K

E

T

S

F

U

N

C

T

I

O

N

B

E

T

T

E

R

YEARS

Apollo Hospitals

Enterprise Ltd

CRISIL IERIndependent Equity Research

Enhancing investment decisions

Detailed Report

Detailed Report

Zyl og Systems Ltd

CRISIL IERIndependent Equity Research

Explanation of CRISIL Fundamental and Valuation (CFV) matrix

The CFV Matrix (CRISIL Fundamental and Valuation Matrix) addresses the two important analysis of an investment making process Analysis

of Fundamentals (addressed through Fundamental Grade) and Analysis of Returns (Valuation Grade) The fundamental grade is assigned on a

five-point scale from grade 5 (indicating Excellent fundamentals) to grade 1 (Poor fundamentals) The valuation grade is assigned on a five-

point scale from grade 5 (indicating strong upside from the current market price (CMP)) to grade 1 (strong downside from the CMP).

CRISIL

Fundamental Grade Assessment

CRISIL

Val uati on Grade Assessment

5/5 Excellent fundamentals 5/5 Strong upside (>25% from CMP)

4/5 Superior fundamentals 4/5 Upside (10-25% from CMP)

3/5 Good fundamentals 3/5 Align (+-10% from CMP)

2/5 Moderate fundamentals 2/5 Downside (negative 10-25% from CMP)

1/5 Poor fundamentals 1/5 Strong downside (<-25% from CMP)

Analyst Disclosure

Each member of the team involved in the preparation of the grading report, hereby affirms that there exists no conflict of interest that can bias

the grading recommendation of the company.

Disclaimer:

This Company-commissioned CRISIL IER report is based on data publicly available or from sources considered reliable. CRISIL Ltd.

(CRISIL) does not represent that it is accurate or complete and hence, it should not be relied upon as such. The data / report is subject to

change without any prior notice. Opinions expressed herein are our current opinions as on the date of this report. Nothing in this report

constitutes investment, legal, accounting or tax advice or any solicitation, whatsoever. The subscriber / user assume the entire risk of any use

made of this data / report. CRISIL especially states that, it has no financial liability whatsoever, to the subscribers / users of this report. This

report is for the personal information only of the authorised recipient in India only. This report should not be reproduced or redistributed or

communicated directly or indirectly in any form to any other person especially outside India or published or copied in whole or in part, for any

purpose.

Zyl og Systems Ltd

Crui si ng ahead with products and sol utions strategy

Fundamental Grade 3/5 (Good fundament al s)

Valuati on Grade 4/5 (CMP has upsi de)

Industry IT Services

1

MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Zylog Systems Ltd (Zylog) is an IT services and solutions provider deriving majority of its

revenues from the US and Canada. It forayed into the e-governance and wi-fi businesses in

FY10. While CRISIL Research expects Zylog to benefit from an increase in global IT spend,

we remain cautious of the macroeconomic conditions which may damp demand. We continue

to assign Zylog a fundamental grade of 3/5, indicating that its fundamentals are good relative

to other listed securities in India.

Ni che IT solutions player with a large bouquet of service off eri ngs

Zylog is a niche solution provider catering to verticals including BFSI, telecom, pharma,

healthcare and manufacturing. It also offers solutions like field service automation, inventory

management, recycling and reverse logistics and RFID applications for various verticals. This

coupled with a large bouquet of services has enabled it to log strong revenue and PAT

growth over the past few years.

Zylog has been abl e to int egrate al l acquisitions successf ully

Zylog has predominantly used the inorganic route for increasing domain expertise, expanding

service lines, accessing new markets and clients. It has acquired eight companies in the past

three years including Ducont FZ LLC in Dubai in FY09 and Brainhunter in Canada in FY10,

and has been able to gain foothold in geographies like Canada and the Middle East. It has

successfully integrated all acquisitions and is now focussing on cross-selling opportunities to

drive growth.

E-governance and wi-fi t o achi eve scal e over medi um term

Zylog entered the e-governance and wi-fi businesses in FY10. Till date, it has executed

e-governance projects for the Karnataka and Gujarat governments. For the wi-fi services,

Zylog is present in seven states and one union territory and has ~40,000 active clients. The

contribution of both these businesses to the total revenue is small and the wi-fi business is

yet to break even at the PAT level. While we expect these businesses to attain scale over the

medium term, the performance of both businesses remains a key monitorable.

Expect t wo-year revenue CAGR of 9.6% i n US$ t erms

We expect revenues to register a two-year CAGR of 9.6% to US$ 501 mn in FY13 (12% in

rupee terms to Rs 24 bn) driven by ~8% growth in IT services and ~13% growth in IT

solutions. Adjusted PAT margin is expected to increase by 40 bps to 8% in FY13.

Valuati ons the current market pri ce has upside

CRISIL Research has used the discounted cash flow method to value Zylog and maintains

the fair value of Rs 656 per share. This fair value implies P/E multiples of 6.4x FY12E and

5.6x FY13E earnings. We revise the valuation grade to 4/5 from 5/5 earlier, indicating that the

market price has upside from the current levels.

KEY FORECAST

(Rs mn) FY09 FY10 FY11 FY12E FY13E

Operating income 7,511 9,802 19,183 21,871 24,048

EBITDA 744 2,070 3,170 3,616 3,780

Adj PAT 849 1,028 1,453 1,692 1,918

Adj EPS-Rs 51.6 62.5 88.3 102.9 116.6

EPS growth (%) 2.7 21.0 41.3 16.5 13.4

Dividend yield (%) 3.8 1.5 1.8 1.7 1.8

RoCE (%) 9.6 21.1 23.6 20.9 18.3

RoE (%) 18.9 19.3 22.6 21.1 19.5

PE (x) 10.3 8.5 6.0 5.1 4.5

P/BV (x) 1.8 1.5 1.2 1.0 0.8

EV/EBITDA (x) 11.0 4.9 3.5 3.2 2.7

NM: Not meaningful; CMP: Current market price

Source: Company, CRISIL Research esti mat e

CFV MATRIX

KEY STOCK STATISTICS

NIFTY/SENSEX 5281/17446

NSE/BSE ticker ZYLOG

Face value (Rs per share) 10

Shares outstanding (mn) 16.4

Market cap (Rs mn)/(US$ mn) 8,711/178

Enterprise value (Rs mn)/(US$ mn) 11,217/229

52-week range (Rs)/(H/L) 580/330

Beta 1.1

Free float (%) 58.8

Avg daily volumes (30-days) 2,21,647

Avg daily value (30-days) (Rs mn) 112

SHAREHOLDING PATTERN

PERFORMANCE VIS--VIS MARKET

Returns

1-m 3-m 6-m 12-m

ZYLOG 23% 31% 34% 32%

NIFTY 1% 12% 11% 0%

ANALYTICAL CONTACT

Chetan Majithia (Head) chetanmajithia@crisil.com

Suresh Guruprasad sguruprasad@crisil.com

Kamna Motwani kmotwani@crisil.com

Client servici ng desk

+91 22 3342 3561 clientservicing@crisil.com

1 2 3 4 5

1

2

3

4

5

Valuat ion Grade

F

u

n

d

a

m

e

n

t

a

l

G

r

a

d

e

Poor

Fundamental s

Excellent

Fundamentals

S

t

r

o

n

g

D

o

w

n

s

i

d

e

S

t

r

o

n

g

U

p

s

i

d

e

36.7% 36.7%

41.2% 41.2%

0.7% 0.4%

0.4%

1.4%

3.2%

3.1%

3.8% 4.8%

59.5% 59.9%

54.6% 52.6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Mar-11 J un-11 Sep-11 Dec-11

Promoter FII DII Others

February 28, 2012

Fai r Val ue Rs 656

CMP Rs 530

CRISIL IERIndependent Equity Research

2

Tabl e 1: Zyl og Busi ness environment

Product / Segment IT Services Products and sol utions

New busi nesses: Wi -fi and

e-governance

Revenue contribution

(FY11)

63% 37%* NA

Revenue contribution

(FY13)

63% 37%* NA

Product / service off eri ng

ERP implementation, content

management, mobile computing,

data warehousing and business

analytics, IT consultation, migration

services, managed services,

testing, IT virtualisation and

staffing

Field service automation, inventory

management, recycling and reverse

logistics, RFID applications, products for

BFSI, pharma and healthcare

E-governance: implementation of

government IT projects related to road

transports, agriculture and healthcare

Wi-fi: providing wireless internet

connectivity in seven states and one

union territory in India

Geographic presence The US, Canada, Europe, the

Middle East, Asia Pacific

The US, Canada, Europe, the Middle

East, Asia Pacific

E-governance: India, the US, Asia

Pacific

Wi-fi : India

Market posit ion A relatively smaller player in

geographies other than Canada.

Third largest professional services

company in Canada

A relatively smaller player A relatively smaller player

End market BFSI, telecom, pharma, retail and

manufacturing

BFSI, telecom, pharma, retail and

manufacturing

E-governance: Governments of India

and the Middle East

Wi-fi: Retail and corporate clients

Sal es growth

(FY08-FY11 3-yr CAGR)

NA NA NA

Sal es f orecast

(FY11-FY13 2-yr CAGR)

7.8% 12.6%* NA

Demand drivers Increase in global IT spend on

services like ERP, CRM, mobile

computing

Cross-selling opportunities

Leverage on niche products and

solutions offerings

Cross-selling opportunities in

Canada

E-governance: Indian governments

thrust on IT leverage successfully

executed projects

Wi-fi: Expansion into more cities,

ways to beat increasing competition

Key competit ors Global: MTM Technologies, RWD

Technologies

Domesti c: Infosys Technologies,

Tata Consultancy Services, Wipro,

HCL Technologies

Global: Covansys Corp, Syntel Inc,

Trizetto Group, Clicksoft

Domesti c: Infosys Technologies, Tata

Consultancy Services, Wipro, HCL

Technologies

E-governance: TCS, Wipro, Oracle

Wi-fi: All integrated telecom players,

local and national internet services

providers

Key risks Competition from established

competitors

Reduction in IT spend due to

another round of slowdown

Increase in competition in niche

areas

Reduction in IT spend due to

another round of slowdown

E-governance: Low margins and high

debtor days

Wi-fi: Increase in competition which

would result in lower ARPUs, delay in

break even

* Includes revenue from wi-fi and e-governance businesses

Source: Company, CRISIL Research

3

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Grading Rationale

Niche IT solutions player with a large bouquet of service

offerings

Zylog is a mid-tier IT company providing IT services and solutions. The companys service

portfolio includes ERP implementation, mobile computing, data warehousing and business

analytics, IT consultation, managed services, testing and IT virtualisation. Zylogs solution

offerings are spread across verticals like banking and finance, insurance, telecom, pharma,

healthcare and manufacturing (please refer to page 19 for details of key offerings). Zylog also

offers niche solutions like field service automation, inventory management, recycling and

reverse logistics and RFID applications for various verticals. The large bouquet of services

and niche product offerings have enabled the company to significantly grow its revenue over

the past few years. Zylog also added staffing services to its portfolio through the acquisition of

Brainhunter, Canada in FY10. It also diversified into e-governance and internet services in the

same year.

By following the aforementioned strategies, Zylog has been able to grow its revenue at a pace

better than most of its peers. However, its profitability has been low post the acquisition of

Brainhunter in FY10, whose margins were significantly lower than that of Zylogs.

Fi gure 1: Zyl og s sales have shown robust growth over

FY07-11...

Fi gure 2: ... whi ch i s better than peers though at a l ower

base

Source: Company, CRISIL Research Source: Company, CRISIL Research

4,075 6,094 7,511 9,684 11,587

117

7,596

50.9%

49.6%

23.3%

30.5%

98.1%

0%

20%

40%

60%

80%

100%

120%

-

5,000

10,000

15,000

20,000

25,000

FY07 FY08 FY09 FY10 FY11

(Rs mn)

Zylog Revenue BH revenue Y-o-Y growth (RHS)

4

7

.

3

%

2

6

.

8

%

3

0

.

4

%

2

1

.

6

%

0

.

4

%

2

1

.

9

%

3

.

4

%

2

5

.

2

%

-

0

.

5

%

1

1

.

4

%

2

6

.

3

%

4

5

.

4

%

1

8

.

6

%

1

8

.

9

%

1

9

.

9

%

2

1

.

1

%

2

6

.

9

%

-10%

0%

10%

20%

30%

40%

50%

Z

y

l

o

g

M

i

n

d

t

r

e

e

M

p

h

a

s

i

s

I

n

f

o

t

e

c

h

e

n

t

e

r

p

r

i

s

e

H

e

x

a

w

a

r

e

K

P

I

T

c

u

m

m

i

n

s

S

a

s

k

e

n

P

e

r

s

i

s

t

e

n

t

s

y

s

t

e

m

s

H

c

l

I

n

f

o

s

y

s

t

e

m

s

P

o

l

a

r

i

s

S

o

f

t

w

a

r

e

I

n

f

i

n

i

t

e

C

o

m

p

u

t

e

r

s

O

m

n

i

t

e

c

h

I

n

f

o

s

o

l

u

t

i

o

n

s

I

n

f

o

s

y

s

T

a

t

a

C

o

n

s

u

l

t

a

n

c

y

W

i

p

r

o

C

o

g

n

i

z

a

n

t

T

e

c

h

H

c

l

t

e

c

h

n

o

l

o

g

i

e

s

FY07-FY11 revenue CAGR

A l arge bouquet of servi ces and

ni che product offeri ngs have

enabl ed Zyl og to gai n a foothol d i n

overseas market

CRISIL IERIndependent Equity Research

4

Fi gure 3: Average EBITDA margi n over FY07-11 i s l ower due

to l ower Brai nhunter margi ns

Fi gure 4: PAT growth over FY07-11 has been l ower due to

l everaged acqui sitions

Source: Company, CRISIL Research Source: Company, CRISIL Research

Regional presence in global markets has worked well

Zylog has been present in the US since inception and this geography continues to be the

main revenue contributor. It has also entered regions like Canada, Europe, Asia Pacific and

Middle East over the past two years. It functions predominantly on a global presence/onsite-

based model wherein onsite revenue contributes ~80% of total revenue. This is significantly

higher than that of most of its peers. While this model results in more expenses due to higher

employee cost, it also results in better client relationship management. Thus, Zylog has been

able to garner ~90% repeat business even though it is not a pure-play IT services company.

Fi gure 5: Hi gh gl obal/onsi te presence has resulted i n better

cl i ent management... Fi gure 6: ... whi ch has resulted i n hi gh repeat busi ness

Source: Company, CRISIL Research

* FY07 data was not available

Source: Company, CRISIL Research

Zylog has tried to reduce dependence on the US

In FY09, revenue from the US accounted for ~97% of total revenue. However, this dropped to

~54% in 9MFY12 mainly due to the acquisition of Brainhunter, Canada, which contributed

1

6

.

9

%

1

9

.

0

%

2

1

.

1

%

1

9

.

3

%

1

1

.

2

%

1

9

.

6

%

1

8

.

2

%

2

4

.

6

%

3

.

2

%

1

4

.

8

%

1

2

.

1

%

2

8

.

4

%

3

2

.

9

%

2

7

.

5

%

2

1

.

7

%

2

1

.

1

%

1

9

.

7

%

0%

5%

10%

15%

20%

25%

30%

35%

Z

y

l

o

g

M

i

n

d

t

r

e

e

M

p

h

a

s

i

s

I

n

f

o

t

e

c

h

e

n

t

e

r

p

r

i

s

e

H

e

x

a

w

a

r

e

K

P

I

T

c

u

m

m

i

n

s

S

a

s

k

e

n

P

e

r

s

i

s

t

e

n

t

s

y

s

t

e

m

s

H

c

l

I

n

f

o

s

y

s

t

e

m

s

P

o

l

a

r

i

s

S

o

f

t

w

a

r

e

I

n

f

i

n

i

t

e

C

o

m

p

u

t

e

r

s

O

m

n

i

t

e

c

h

I

n

f

o

s

y

s

T

a

t

a

C

o

n

s

u

l

t

a

n

c

y

W

i

p

r

o

C

o

g

n

i

z

a

n

t

T

e

c

h

H

c

l

t

e

c

h

n

o

l

o

g

i

e

s

5-year average EBITDA margi n

2

9

.

0

%

3

.

1

%

4

6

.

2

%

1

3

.

7

%

9

6

.

4

%

1

7

.

0

%

1

3

.

4

%

2

5

.

0

%

-

1

4

.

6

%

2

4

.

8

%

8

3

.

4

%

4

3

.

6

%

1

5

.

4

%

2

1

.

1

%

1

5

.

8

%

2

0

.

3

%

5

.

7

%

-40%

-20%

0%

20%

40%

60%

80%

100%

120%

Z

y

l

o

g

M

i

n

d

t

r

e

e

M

p

h

a

s

i

s

I

n

f

o

t

e

c

h

e

n

t

e

r

p

r

i

s

e

H

e

x

a

w

a

r

e

K

P

I

T

c

u

m

m

i

n

s

S

a

s

k

e

n

P

e

r

s

i

s

t

e

n

t

s

y

s

t

e

m

s

H

c

l

I

n

f

o

s

y

s

t

e

m

s

P

o

l

a

r

i

s

S

o

f

t

w

a

r

e

I

n

f

i

n

i

t

e

C

o

m

p

u

t

e

r

s

O

m

n

i

t

e

c

h

I

n

f

o

s

o

l

u

t

i

o

n

s

I

n

f

o

s

y

s

T

a

t

a

C

o

n

s

u

l

t

a

n

c

y

W

i

p

r

o

C

o

g

n

i

z

a

n

t

T

e

c

h

H

c

l

t

e

c

h

n

o

l

o

g

i

e

s

81.5

82.4

80.7

81.6

82.9

85

78

79

80

81

82

83

84

85

86

FY07 FY08 FY09 FY10 FY11 9MFY12

(%)

Global/onsite revenue

90.1

91.1

88.3

88.5

87.8

86

87

88

89

90

91

92

FY07* FY08 FY09 FY10 FY11 9MFY12

(%)

Repeat business

80% of Zyl og s revenue comes

from gl obal /onsite l ocati on

5

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

~37% to total revenue in 9MFY12. Also, the company has increased its presence in

geographies like the Middle East and Asia Pacific. Also, it has diversified into new India-based

businesses like e-government projects and wi-fi.

Fi gure 7: Dependence on the US has decli ned due to Brainhunter

acqui si ti on

Source: CRISIL Research

Client concentration is low

Unlike most other mid-tier IT companies, Zylog is not excessively dependent on the top

clients. It derives ~30% of its revenues from its top 10 clients. The company has chosen to

focus on SME clients where most big IT companies have less focus. It had 194 active clients

in FY09 and 583 active clients in FY10 (including Brainhunter clients). FY11 client details are

not available.

Fi gure 8: Dependence on top cl i ents i s l ow

Source: CRISIL Research

97.2 78.3 51.1 53.9

10.3

39.9

37

2.3

4.1 2.7

2.6

4.8 3.1 3

0.2 1.2

1.7

0.3 1.1 1.5

3.5

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

FY09 FY10 FY11 9MFY12

USA Canada Europe Middle East India Asia Pacific

3.8

4.2

5.3

5.8

7.0

6.5

15.4

17.1 17.3

18.7

22.9 23.2

25.7

26.8

27.4

29.1

30.6

31.3

0

5

10

15

20

25

30

35

FY07 FY08 FY09 FY10 FY11 9MFY12

(%)

Top client top 5 clients Top 10 clients

Zyl og deri ves ~30% of its

revenue from top 10 cli ents

CRISIL IERIndependent Equity Research

6

Inorganic route has proven to be fruitful

Zylog has predominantly used the inorganic route for increasing domain expertise, expanding

service lines, accessing new markets and clients. Over the past three years, it has acquired

eight companies including a strategic stake in a Malaysian company. These acquisitions were

funded through a mix of debt and internal accruals and except Brainhunter, all the acquisitions

were small ones. Each of these acquisitions has opened up a new avenue of growth for Zylog.

For instance, acquisition of the UK-based insurance solutions provider Anodas Software

added end-to-end core insurance solution to Zylogs offerings. It has also enabled Zylogs

entry into the UK through the existing clients of Anodas Software. The acquisition of Ducont

FZ LLC in Dubai in FY09 strengthened Zylogs presence in the Middle East. Importantly,

Zylog has been successfully able to integrate all the acquired companies, including

Brainhunter which was as big as Zylog in revenue terms.

Successful integration and turnaround of Brainhunter has strengthened

Zylogs presence in Canada

Zylog acquired Brainhunter Inc., Canadas third largest professional services company, in

February 2010 for an enterprise value of US$ 37 mn. Brainhunter was a staffing and

engineering consulting and professional services provider in Canada with a major presence in

government, telecom, banking, financial services and insurance (BFSI), and oil and gas

verticals. It had 1,860 employees and about 400 customers in the telecom, banking and

government verticals at the time of acquisition. In FY09, ~95% of its revenue came from

providing IT and engineering staffing consultants on a contract basis to its clients. It also sold

recruitment related software including applicant tracking systems (ATS) and vendor

management software.

At the time of acquisition, Brainhunters revenue was US$ 194 mn and it had been loss-

making during the five years before the acquisition. It had filed for bankruptcy protection in

2009 as it had invested heavily in IT solutions R&D at the time of global economic downturn

and had funded it through short term debt.

This acquisition was funded through US$ 10 mn cash accruals and balance debt which was

taken on the books of Brainhunter. Zylog has now merged Brainhunter with its other Canadian

operations under the subsidiary Zylog Systems (Canada) Ltd.

Synergies from Brainhunter acquisition

The acquisition gave Zylog entry into the Canadian markets along with access to 400

clients. Additionally, it gave Zylog inroad into the Canadian government business since

Brainhunter derived ~35% of its revenue from the federal government

Zylog added staffing services to its portfolio of offerings

Opportunity to cross-sell its products to Brainhunters clients

Cost benefit which would arrive from offshoring services to India

The company has acqui red

ei ght compani es i ncl udi ng a

strategi c stake i n the past three

years

Brai nhunter turned profi tabl e in

the first year of acqui si ti on

7

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Brainhunter has now turned profitable

Zylog has successfully been able to integrate and turn around Brainhunters operations

despite cultural challenges and a completely different business line, in ~1.5 years. The

company has retained the majority of the middle management at Brainhunter. However, it has

been able to achieve cost savings of only C$ 80,000 vs. C$ 6 mn as expected earlier.

For the first year, Zylog concentrated on Brainhunters existing clients and services. Zylog has

recently introduced the products and services of the parent company in Canada and are

cross-selling them to existing clients. Also, Zylog has exited, and not renewed, the low margin

contracts to improve profitability. The company has also taken some cost saving measures

like inducting a pre-sales team in Chennai to generate leads and is in the process of putting

together an offshore execution team in Hyderabad. According to the company, verticals like

healthcare, engineering, oil and gas have good growth potential in Canada.

Over the past two years, Zylog has not been able to offshore significantly as there are

concerns in Canada with respect to consumer privacy. Also, the federal government is not pro

offshore. According to the company, all incremental business coming from the private sector

in Canada can be offshored.

Zylog to benefit from growth in domestic IT services exports

CRISIL Research expects IT services exports to grow at a 16% CAGR to US$ 71 bn by FY16.

This industry bounced back in FY11 with a 23% growth up from a muted growth of 5% in

FY10. The growth over FY11-FY16 is expected to be driven by the following factors:

Shift in service mix to high value service-lines and consulting which are expected to drive

up billing rates

Introduction of new technologies like cloud, mobility services and other non-linear

business models

Increase in offshoring

Fi gure 9: Indi a s IT exports to grow at 16% CAGR i n FY11-16

Source: CRISIL Research

13.3

17.9

22.2

25.8

27.3

33.5

40

71

0

10

20

30

40

50

60

70

80

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

F

Y

1

1

F

Y

1

2

F

Y

1

6

(US$ bn)

Indian IT exports revenue

16% CAGR

Zyl og pl ans to offshore

i ncremental busi ness coming

from private sector i n Canada

Indian IT exports to grow at 16%

CAGR over FY11-16

CRISIL IERIndependent Equity Research

8

BFSI, telecom and manufacturing verticals are expected to continue to account for ~75% of

Indian IT services exports.

Zylog, which is predominantly an IT services exporter, is expected to see good traction driven

by this growth in the industry. Additionally, according to NASSCOM (National Association of

Software and Services Companies), IT service providers are looking at diversified delivery

locations to meet the client requirements and mitigate risks associated with labour markets

and currency movements. They are also increasing efforts to scale up their presence in the

onshore geographies to be able to serve the public sector and healthcare providers. This also

acts as a mitigation strategy against the rising anti-offshoring sentiments in the developed

nations. Zylog already follows a global delivery model and has execution teams in the US, the

UK, Middle East and Asia Pacific and is expected to benefit from this strategy.

Update on e-governance and wi-fi business

E-governance good opportunity, slow traction

Zylog ventured into the e-governance business in FY10 with projects related to the road

transport (RTO), agriculture and below poverty line (BPL). A common feature across all these

initiatives was collection of grassroot level information, creation of a database and issue of

smart cards with relevant information about individuals. Zylog is now the implementation

partner for smart card driving licenses for Karnataka and Gujarat. Also, the company has a

good global presence in this space in departments like home affairs, police and immigration,

healthcare, tourism and road transport sectors due to acquisition of Matrix Primus Partners in

the US and a strategic stake in Nova Berhad in Malaysia which are both e-governance service

providers.

This segment contributed Rs 500 mn to total revenues in FY11 vs. target of Rs 1 bn since

revenue from the Karnataka RTO project was not as high as expected. Going forward, the

company plans to use the projects executed in Karnataka and Gujarat as reference to

approach other state governments. Also, it has bagged projects in the healthcare segment

from the governments of Karnataka, Bihar and Haryana. While this business segment has

good growth potential, it comes with high debtor days and lower margins. Also, it requires high

upfront payment to hardware vendors. Hence, its impact on Zylogs overall profitability

remains a monitorable.

Wi-fi good traction but yet to break even; threat of competition remains

Zylog entered the wi-fi business in December 2009 and is currently present in seven states

and one union territory (Andhra Pradesh, Gujarat, Haryana, Karnataka, Punjab, Rajasthan,

Tamil Nadu and Pondicherry) covering 174 locations. At the end of Q3FY12, the company has

~40,000 active subscribers including 382 corporate connections. Since inception of this

business, Zylog has followed the strategy of focussing on the under-penetrated tier-II towns

and cities due to which it has been able to increase its subscriber base and achieve healthy

retail ARPUs of Rs 670. Zylog has invested ~Rs 800 mn in this business till date in setting up

infrastructure and plans to invest another Rs 1.2 bn over the next two years and ramp up the

Wi -fi busi ness i s yet to break

even at the net l evel

E-governance revenue stood at

Rs 500 mn i n FY11

9

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

subscriber base to 60,000 active clients by FY13. However, the business is yet to break even

at the net profit level and the management expects it to turn profitable by FY13.

While Zylog provides wi-fi services, it directly competes with service providers which provide

internet services through cables and data cards. Also, there are a number of local operators

which provide wi-fi services in the towns and cities where Zylog operates. Since the internet

services market is a highly price sensitive market without any significant switching cost, the

market is expected to get more competitive and Zylogs ARPUs are expected to be under

pressure. Considering the high investments that the company will be making in this business,

the ability to turn the business profitable remains a key monitorable.

CRISIL IERIndependent Equity Research

10

Key risks

Volatility in global economic environment could impact

revenues

The majority of Zylogs clients are based abroad. Consequently, in the event of any economic

slowdown in these countries, Zylogs clients could reduce or postpone their IT spends, which

would have a cascading impact on Zylogs revenues. Moreover, since the company derives its

revenues from export of products and services, it remains vulnerable to currency fluctuations.

However, the currency impact would be lesser as compared to the other players in the IT

industry as Zylog has higher global/onsite presence, which provides a natural hedge. Hence,

the company does not hedge its open position.

Promoters have increased shareholding through pledge of

shares

Zylogs promoters currently hold 41.22% stake in the company, up from 36.68% in Q1FY12.

The additional shares were acquired from the open market and were financed through

pledging of promoter shares. The current pledging is 53.33% of promoters stake (21.98% of

total share capital). While this amount is quite significant, we believe there is sufficient cushion

since the pledging is in the ratio of 2:1 as per the management. However, the level of pledging

remains a key monitorable since any unfavourable market condition will significantly impact

the stock price.

Zyl og wil l be adversel y

impacted i n case of another

round of gl obal slowdown si nce

maj ority of i ts revenue comes

from overseas

11

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Financial Outlook

Revenues to grow at two-year CAGR of 9.6% in US$

Consolidated revenues are expected to increase at a two-year CAGR of 9.6% in US dollar

terms to US$ 501 mn by FY13. In rupee terms, the consolidated revenue is expected to grow

at a CAGR of 12% to Rs 24 bn. IT services is expected to grow at a two-year CAGR of ~8% to

US$ 314 mn. Revenue from products and solutions (including e-governance and wi-fi

businesses) is expected to grow at a two-year CAGR of ~13% to US$ 187 mn. The EBITDA

margin is expected to decline by 80 bps to 15.7% in FY13. While revenue from the high-

margin products and solutions are expected to increase, and the company is expected to

increase offshoring, we believe that the increase in employee cost will keep the margins under

pressure. Also, while Zylogs top line will get boosted due to exchange rate depreciation,

there will be no significant impact on the PAT as majority of the costs are in US$.

Fi gure 10: Revenue i n rupee terms to grow at 12% Fi gure 11: IT servi ces - the l argest contri butor

Source: Company, CRISIL Research Source: Company, CRISIL Research

Adjusted PAT to grow at 2-year CAGR of ~15%, EPS to increase

to Rs 116.6 in FY13 from Rs 88 in FY11

Zylogs adjusted PAT is expected to grow at a two-year CAGR of ~15% to Rs 1.9 bn. Adjusted

PAT margin is expected to increase by 40 bps to 8% in FY13 despite the decline in EBITDA

margin mainly due to lower interest cost.

The tax rate for FY12 is expected to be ~39% which is higher compared to previous years

mainly as the Software Technology Park of India (STPI) benefits expired post March 31, 2011.

Also, historically, Zylog claimed tax credit in India for direct taxes paid in the US under the

Double Taxation Avoidance Agreement between the two countries. However, now the tax

credit is based on Indian tax rates (33.9%), which are lower than that in the US (at least 35%),

resulting in more tax outgo for Zylog. Tax rate is expected to be lower in FY13 as the

company starts operating from its SEZ facility in Chennai.

7,511 9,802 19,183 21,871 24,048

9.9%

21.1%

16.5% 16.5%

15.7%

0%

5%

10%

15%

20%

25%

-

5,000

10,000

15,000

20,000

25,000

30,000

FY09 FY10 FY11 FY12E FY13E

(Rs mn)

Revenue EBITDA margin (RHS)

62.8% 62.5% 63.1%

37.2% 37.5% 36.9%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

FY11 FY12E FY13E

IT services Products and solutions

Revenues li kel y to grow at a two-

year CAGR of 9.6% to US$ 501 mn

i n FY13 dri ven by growth across IT

services and sol utions

CRISIL IERIndependent Equity Research

12

Fi gure 12: PAT and PAT margin trend

Source: Company, CRISIL Research

Fi gure 13: EPS trend

Source: Company, CRISIL Research

849 1,028 1,453 1,692 1,918

11.3%

10.5%

7.6%

7.7% 8.0%

0%

2%

4%

6%

8%

10%

12%

-

500

1,000

1,500

2,000

2,500

FY09 FY10 FY11 FY12E FY13E

(Rs mn)

Adj. PAT Adj. PAT margin (RHS)

52

63

88

103

117

0

20

40

60

80

100

120

140

FY09 FY10 FY11 FY12E FY13E

(Rs)

Adj. EPS

PAT margin to i ncrease to 8%

i n FY13 from 7.6% i n FY11

13

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Management Overview

CRISIL's fundamental grading methodology includes a broad assessment of management

quality, apart from other key factors such as industry and business prospects, and financial

performance.

Business spearheaded by promoters

Mr Sudarshan Venkatraman, chairman, and Mr Ramanujan Sesharathnam, managing

director, are first-generation entrepreneurs and have close to two decades of experience in

the IT industry. Their insight has enabled the company to diversify its product and service

portfolio. The promoters have been instrumental for the strong growth achieved by the

company through organic and inorganic expansions. We believe they have a fair degree of

risk appetite given the acquisition of Brainhunter, which is larger than Zylog and was loss-

making at the time of acquisition. We gain comfort from the fact that the management has

successfully integrated all its acquisitions.

Strong second line of management

Operationally, each region and function has a head managing the overall delivery and

business development of the unit. As far as its new businesses wi-fi and e-governance are

concerned, individuals heading the businesses have relevant experience. Based on our

interactions, we believe the second line of management is equipped with domain expertise

and has been given fair degree of autonomy in decision making. In each of its acquired

companies, Zylog has allowed the existing management to run the operations.

Management has been proactive

Zylogs management has always been proactive in identifying business opportunities. They

have been able to grow Zylogs service lines and geographical footprint through organic as

well as inorganic routes. Additionally, they have diversified into new businesses like e-

governance and wi-fi.

Experienced promoters

supported by strong second

l i ne

CRISIL IERIndependent Equity Research

14

Corporate Governance

CRISILs fundamental grading methodology includes a broad assessment of corporate

governance and management quality, apart from other key factors such as industry and

business prospects, and financial performance. In this context, CRISIL Research analyses the

shareholding structure, board composition, typical board processes, disclosure standards and

related-party transactions. Any qualifications by regulators or auditors also serve as useful

inputs while assessing a companys corporate governance.

Overall, corporate governance at Zylog meets the minimum levels supported by reasonably

good board practices and an independent board.

Board composition

Zylogs board comprises seven members, including three independent directors and one

nominee director from UTI Ventures which currently holds a 7% stake in Zylog. This meets the

requirement under Clause 49 of SEBIs listing guidelines. Given the background of directors,

we believe the board is fairly diversified.

Boards processes

The companys quality of disclosure can be considered good judged by the level of

information and details furnished in the annual report, websites and other publicly available

data. The company has all the necessary committees audit, remuneration and investor

grievance - in place to support corporate governance practices. The audit committee is

chaired by an independent director, Mr S. Rajagopal.

Corporate governance

practi ces are good

15

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Valuation Grade: 4/5

We have used the discounted cash flow (DCF) method to value Zylog and maintain the fair

value of Rs 656 per share. This fair value implies P/E multiples of 6.4x FY12E and 5.6x

FY13E earnings. The stock is currently trading at Rs 530 per share. Consequently, we revise

the valuation grade to 4/5 from 5/5 earlier, indicating that the current market price has upside

from current levels.

Key DCF assumptions

We have considered the discounted value of the firms estimated free cash flow from

FY12 to FY22.

We have assumed a terminal growth rate of 4% beyond the explicit forecast period until

FY22.

We have used cost of equity of 16.4%.

One-year forward P/E band One-year forward EV/EBITDA band

Source: NSE, CRISIL Research Source: NSE, CRISIL Research

P/E premi um / di scount to NIFTY P/E movement

Source: NSE, CRISIL Research Source: NSE, CRISIL Research

0

100

200

300

400

500

600

700

800

900

1,000

A

u

g

-

0

7

N

o

v

-

0

7

M

a

r

-

0

8

J

u

n

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

M

a

r

-

1

0

J

u

n

-

1

0

S

e

p

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

N

o

v

-

1

1

F

e

b

-

1

2

(Rs)

Zylog 2x 4x 6x 8x

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

A

u

g

-

0

7

N

o

v

-

0

7

M

a

r

-

0

8

J

u

n

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

M

a

r

-

1

0

J

u

n

-

1

0

S

e

p

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

N

o

v

-

1

1

F

e

b

-

1

2

(Rs mn)

Zylog 2x 3x 4x

-90%

-80%

-70%

-60%

-50%

-40%

-30%

-20%

-10%

0%

A

u

g

-

0

7

N

o

v

-

0

7

M

a

r

-

0

8

J

u

n

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

M

a

r

-

1

0

J

u

n

-

1

0

S

e

p

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

N

o

v

-

1

1

F

e

b

-

1

2

Premium/Discount to NIFTY Median

0

2

4

6

8

10

12

14

16

A

u

g

-

0

7

N

o

v

-

0

7

M

a

r

-

0

8

J

u

n

-

0

8

O

c

t

-

0

8

J

a

n

-

0

9

A

p

r

-

0

9

A

u

g

-

0

9

N

o

v

-

0

9

M

a

r

-

1

0

J

u

n

-

1

0

S

e

p

-

1

0

J

a

n

-

1

1

A

p

r

-

1

1

J

u

l

-

1

1

N

o

v

-

1

1

F

e

b

-

1

2

(Ti mes)

1yr Fwd PE (x) Median PE

+1 std dev

-1 std dev

We maintain the fair value of

Rs 656 per share for Zyl og

CRISIL IERIndependent Equity Research

16

Peer comparison

M.cap

(Rs mn)

EPS (Rs) P/E (x) P/B(x) RoE (%)

FY11 FY12E FY13E FY11 FY12E FY13E FY11 FY12E FY13E FY11 FY12E FY13E

Mid cap compani es

Zylog * 8,711 88.3 102.9 116.6 6.0 5.1 4.5 1.2 1.0 0.8 22.6 21.1 19.5

Mindtree Ltd 18,511 25.5 47.8 50.9 17.8 9.5 8.9 2.3 2.0 1.6 14.0 23.2 20.1

Mphasis Ltd 87,232 39.1 38.3 37.8 10.6 10.8 11.0 2.2 1.9 1.7 22.8 18.8 17.2

Hcl Infosystems Ltd 9,627 7.7 5.2 6.0 5.6 8.4 7.2 0.5 0.5 0.5 8.9 5.6 6.8

Patni Computer Systems Ltd 64,503 30.1 33.2 36.2 15.8 14.3 13.1 1.7 1.4 0.9 11.5 11.5 7.4

Polaris Financial Technologies 15,315 20.4 22.2 24.9 7.5 7.0 6.2 1.5 1.3 1.1 21.3 19.1 18.4

KPIT Cummins Infosystems Ltd 14,066 11.8 15.7 18.8 13.5 10.1 8.4 2.3 2.0 1.6 19.1 20.0 19.9

Hexaware Technologies Ltd 31,464 9.1 10.0 11.0 11.7 10.7 9.8 3.1 2.6 2.2 26.9 26.3 25.6

Median 11.2 9.8 8.7 2.0 1.6 1.4 20.2 19.5 18.9

Large cap companies

Infosys Ltd 1,655,675 119.7 146.2 168.1 24.1 19.7 17.2 6.4 5.1 4.2 27.9 28.0 27.0

Tata Consultancy Services Ltd 2,450,539 46.3 54.6 64.1 27.1 22.9 19.5 10.0 7.8 6.1 42.4 37.1 35.0

Wipro Ltd 1,044,325 21.7 23.3 27.0 19.6 18.2 15.7 4.6 3.7 3.2 26.0 21.7 21.6

Hcl Technologies Ltd 335,331 24.1 32.4 37.8 20.1 15.0 12.8 4.4 3.3 2.8 23.6 24.1 23.0

Cognizant (US$) 21,807 2.9 3.6 4.2 24.8 20.0 17.0 5.5 4.3 3.5 23.4 23.1 21.7

Median

24.1 19.7 17.0 5.5 4.3 3.5 26.0 24.1 23.0

* CRISIL Research estimates

Source: CRISIL Research, Industry sources

CRISIL IER reports rel eased on Zyl og Systems Ltd

Date Nature of report

Fundamental

grade Fair value

Valuati on

grade

CMP

(on t he dat e of report)

07-May-10 Initiating coverage* 3/5 Rs 530 4/5 Rs 456

14-J un-10 Q4FY10 result update 3/5 Rs 530 4/5 Rs 463

09-Aug-10 Q1FY11 result update 3/5 Rs 530 3/5 Rs 534

27-Sep-10 Management meeting update 3/5 Rs 656 4/5 Rs 577

09-Nov-10 Q2FY11 result update 3/5 Rs 656 4/5 Rs 582

03-Mar-11 Q3FY11 result update 3/5 Rs 656 5/5 Rs 410

09-J un-11 Q4FY11 result update 3/5 Rs 656 5/5 Rs 406

31-Aug-11 Q1FY12 result update 3/5 Rs 656 5/5 Rs 405

28-Nov-11 Q2FY12 result update 3/5 Rs 656 5/5 Rs 415

10-Feb-12 Q3FY12 result update 3/5 Rs 656 5/5 Rs 500

28-Feb-12 Detai led report 3/5 Rs 656 4/5 Rs 530

* For detailed initiating coverage report please visit: www.i er.co.in

CRISIL Independent Equity Research reports are also available on Bloomberg (CRI <go>) and Thomson Reuters.

17

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Company Overview

Chennai-based Zylog is an IT services and products company catering mainly to the US and

Canadian markets. It was incorporated in 1995 and has since then grown its offerings portfolio

and geographical presence through both organic and inorganic routes. The company services

clients through a blend of onsite, offsite and offshore efforts and derives ~83% of its revenues

from global/onsite locations. In a bid to diversify its business, Zylog entered the e-governance

and internet services space (wi-fi) in J anuary 2010.

Zylog has clients across various verticals including BFSI, telecom, retail, manufacturing,

pharma and healthcare. BFSI is the main revenue contributor and accounts for ~23% of the

total revenue followed by telecom which accounts for ~22%. The government vertical has

become significant from FY11 onwards due to acquisition of Brainhunter, Canada which gets

~30% of its revenue from the Canadian government.

Verti cal -wise revenue contri buti on

Source: Company, CRISIL Research

The company has been concentrating on the overseas markets with specific focus on the US,

which contributed ~97% of total revenue till FY09. However, over the past two years, Zylog

has reduced its dependence on the US markets mainly by entering Canada through the

acquisition of Brainhunter in February 2010. In FY11, the US contributed ~54% of revenue

while contribution from Canada was ~37%. Zylog entered the Middle East through the

acquisition of Ducont in Dubai in FY09. It has also strengthened its position in the Middle

East, Asia Pacific and Europe where it operates through subsidiaries.

34.1

32.6

28.9

31.2

24.3 23.3

22.0 24.9

27.1

24.9

21.6 22.5

8.2

9.7

8.8 9.9

14.2 14.5

7.3

6.5

9.1 7.2

11.3 9.7

7.8

7.9

10.2

8.9

8.4

9.2

0.9

1.6

13.1 14.8

20.5

18.4

15.0 16.3

7.1 6.1

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

FY07 FY08 FY09 FY10 FY11 9MFY12

BFSI Telecom Retail Manufacturing Pharma/Healthcare Government Others

CRISIL IERIndependent Equity Research

18

Geography-wi se revenue contri buti on

Note: Data prior to FY09 was not available

Source: Company, CRISIL Research

Services and product offerings

Key product offerings

Products

Verti cal /end

users

Bri ef descri ption

Power Migrator NA Enables customers to migrate legacy systems to newer technologies like .net, J 2EE and J ava using tool centric

approach

FieldPower NA Enables scheduling of people, processes and materials thereby enabling customers to efficiently manage their costs

effectively

Bank

Companion

BFSI Mobile banking solution offering a complete suite of mobile banking solution across retail and corporate banking

customers with access to banking services through SMS, J 2ME, USSD, GPRS, WAP, BREW, iPhone, ipad, Android

and Blackberry supports leveraging a single common platform

Phoenix Insurance Customisable solution to electronically manage all key processes and information related to underwriting, broking,

claims, reinsurance and accounting. Ability to support TPA services, which is a complementary offering

Silvanus 360 NA A web-based software to manage internal operations, warehouse management, fleet and dispatch, contacts, orders,

shipments and forms. Available across recycler, collector and material handler versions

Source: Company, CRISIL Research

IT Services

Service off eri ng Bri ef descri ption

Application Development Legacy Modernization, Application Migration, Web Application Development, Mobile & Wireless Application Development,

Desktop Application

Enterprise Solutions Enterprise 2.0 Smartprise SOA, Enterprise Web 2.0 Services, Business Intelligence, Data Warehousing, Reporting &

Analysis Services

Managed Services Server & Database Management, Security Mangement, Network Monitoring, Managed Hosting, Desktop Computing

Services

Professional Services Contract & Permanent Services. Hiresafe Payroll and Consultant

Q & A and Testing Functionality Testing, Performance Testing, Compatibility Testing, White Box Testing, Product Testing, User Acceptance

Testing

Source: Company, CRISIL Research

97.2 78.3 51.1 53.9

10.3

39.9

37

2.3

4.1 2.7

2.6

4.8 3.1 3

0.2 1.2

1.7

0.3 1.1 1.5

3.5

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

FY09 FY10 FY11 9MFY12

USA Canada Europe Middle East India Asia Pacific

19

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Mil estones

1995 Incorporation of the company

1996 First offshore contract obtained from Rand Software Corporation, Vermont in mobile and wireless space to provide data synchronisation

between server and hand -held device

Opened the first offshore development centre (ODC) in Chennai

1998 Started SI / VAR partnership practice.

1999 Certified as ISO 9001:2000 for software development process by Det Norske Veritas (DNV)

2000 Launched products Z*Connect and Z*PRISM in the mobile and wireless space in Las Vegas International Convention of VAR Partnerships

2002 Acquired three businesses - Silver Spring Technologies (MD), Schumacher Consulting (MA) and Schmidt Systems (VA), primarily expanding

the business intelligence, data warehousing and application integration solutions

Incorporated a 100% wholly owned subsidiary Zylog Systems (UK) Ltd

2003 Strategic partnership with BCSIS (subsidiary of OCBC, Singapore) to market and implement their banking products in India

2004 Two more businesses acquired - Impeksoft, Inc and J DAN Systems, Inc

2005 Incorporated a 100% wholly owned subsidiary, Zylog Systems (India) Ltd to cater to domestic business

2006 Incorporated a 100% wholly owned subsidiary in Singapore to cater to APAC region

2007 Preferential allotment to Unit Trust of India Investment Advisory Services Ltd A/c Ascent India Fund and Argonaut Ventures

The company listed on the BSE and the NSE with an IPO of Rs 1.26 bn

2008 Inaugurated its own development centre in Sholinganallur, Chennai

Acquired UK-based Anodas Software and Chennai-based Ewak Creative Compusoft

2009 Pilot projects executed in the e-governance space and rollout of internet services in Tamil Nadu through wi-fi technology

Acquired Dubai-based Ducont FZ LLC (mobile wireless space), US-based FairFax (Content processing) and Malaysia-based

Nova Berhad, a healthcare content management company

2010 Acquired Canada-based consulting and engineering services firm Brainhunter

Source: Company, CRISIL Research

CRISIL IERIndependent Equity Research

20

Annexure: Details of acquisitions

Year Name of target Geography Considerati on Nature of business Benefits to Zylog

FY08 Anodas Software UK US$ 2.3 mn Insurance software solutions and third party

administration services

Added end-to-end core insurance

solution to Zylog's offerings

FY09 Fairfax Consulting

Inc

US US$ 7.5 mn Content management services firm with focus

on healthcare and pharmaceutical vertical

Strengthened Zylog's position in pharma

vertical. Strengthened presence in the

US and Europe

FY09 Ducont FZ LLC Dubai US$ 12 mn Application provider in wireless application

space. Its clients included a number of banks,

telecom operators and government bodies

Strengthened Zylog's position in the

Middle East. It also gave Zylog a mobile

banking solution

FY10 Brainhunter Inc. Canada US$ 37 mn Staffing (90% of revenues), consulting and

engineering services provider with the

government of Canada as the key client

Strengthened Zylog's position in

Canada and gave access to orders from

the Canadian government

FY10 Matrix Primus

Partners

US US$ 15.82 mn E-governance services Strengthened Zylog's e-governance

vertical

FY10 Algorithm

Solutions Pvt Ltd

India Rs 17.5 mn NA NA

FY10 Strategic stake of

10.64% in Nova

Berhad

Malaysia Rs 59.5 mn Specialist in healthcare and e-governance

products and solutions

Enhanced Zylog's healthcare offerings

including an integrated hospital

management offering and helped in

entry into e-governance vertical

FY11 Mindwire Inc. Canada C$ 1 mn Professional IT services and staffing company

with the government of Canada as the key

client

Increased business from the Canadian

government

Source: Company

21

Zyl og Systems Ltd MAKING MA

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

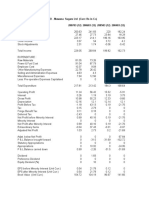

Annexure: Financials

Source: CRISIL Research

Income statement Balance Sheet

(Rs mn) FY09 FY10 FY11 FY12E FY13E (Rs mn) FY09 FY10 FY11 FY12E FY13E

Oper ating i ncome 7,511 9,802 19,183 21,871 24,048 Li abil iti es

EBITDA 744 2,070 3,170 3,616 3,780 Equity share capital 164 164 164 164 164

EBITDA mar gin 9.9% 21.1% 16.5% 16.5% 15.7% Reserves 4,728 5,623 6,924 8,820 10,555

Depreciation 211 337 515 641 749 Minorities - - - - -

EBIT 533 1,733 2,655 2,975 3,031 Net wor th 4,892 5,788 7,088 8,985 10,720

Interest (390) 463 619 390 403 Convertible debt - - - - -

Oper ating PBT 923 1,270 2,036 2,585 2,628 Other debt 1,569 4,152 5,503 6,839 6,589

Other income 47 44 24 90 93 Tot al debt 1,569 4,152 5,503 6,839 6,589

Exceptional inc/(exp) (4) (0) (4) 378 0 Deferred tax liability (net) 6 23 22 22 6

PBT 965 1,314 2,057 3,053 2,721 Tot al l iabil it ies 6,467 9,962 12,613 15,845 17,314

Tax provision 120 286 608 983 803 Assets

Minority interest - - (2) - - Net fixed assets 620 1,008 1,690 2,063 2,563

PAT (Repor t ed) 846 1,028 1,452 2,070 1,918 Capital WIP 102 277 537 229 229

Less: Exceptionals (4) (0) (4) 378 0 Tot al f ixed assets 722 1,285 2,227 2,292 2,792

Adjusted PAT 849 1,028 1,455 1,692 1,918 Invest ments 1 57 60 60 60

Cur r ent assets

Ratios Inventory - - 9 - -

FY09 FY10 FY11 FY12E FY13E Sundry debtors 2,795 3,909 5,455 6,591 6,588

Gr owth Loans and advances 719 1,262 2,048 2,898 3,275

Operating income (%) 23.3 30.5 95.7 14.0 10.0 Cash & bank balance 2,095 2,715 2,996 4,155 4,984

EBITDA (%) (34.9) 178.4 53.1 14.1 4.5 Marketable securities 0 0 0 0 0

Adj PAT (%) 2.7 21.0 41.3 16.5 13.4 Tot al cur r ent assets 5,610 7,885 10,509 13,644 14,848

Adj EPS (%) 2.7 21.0 41.3 16.5 13.4 Tot al cur r ent liabi lit ies 685 1,214 1,853 1,822 2,056

Net cur r ent asset s 4,925 6,671 8,656 11,823 12,792

Pr ofi tabil ity Intangibles/Misc. expendi tur e 820 1,950 1,671 1,671 1,671

EBITDA margin (%) 9.9 21.1 16.5 16.5 15.7 Tot al assets 6,467 9,962 12,613 15,845 17,314

Adj PAT Margin (%) 11.3 10.5 7.6 7.7 8.0

RoE (%) 18.9 19.3 22.6 21.1 19.5 Cash flow

RoCE (%) 9.6 21.1 23.6 20.9 18.3 (Rs mn) FY09 FY10 FY11 FY12E FY13E

RoIC (%) 12.9 26.6 25.1 20.5 20.2 Pre-tax profit 969 1,314 2,060 2,675 2,721

Total tax paid (120) (269) (608) (983) (819)

Valuati ons Depreciation 211 337 515 641 749

Price-earnings (x) 10.3 8.5 6.0 5.1 4.5 Working capital changes (515) (1,127) (1,703) (2,009) (140)

Price-book (x) 1.8 1.5 1.2 1.0 0.8 Net cash fr om oper ations 544 254 264 325 2,512

EV/EBITDA (x) 11.0 4.9 3.5 3.2 2.7 Cash fr om invest ment s

EV/Sales (x) 0.1 0.9 0.6 0.5 0.4 Capital expenditure (882) (2,030) (1,178) (706) (1,250)

Dividend payout ratio (%) 6.8 11.2 10.6 7.2 8.1 Investments and others 335 (56) (4) 0 -

Dividend yield (%) 3.8 1.5 1.8 1.7 1.8 Net cash fr om i nvestments (547) (2,086) (1,182) (706) (1,250)

Cash fr om fi nancing

B/S r ati os Equity raised/(repaid) - 0 - - -

Inventory days - - 0.2 - - Debt raised/(repaid) 1,001 2,583 1,351 1,335 (250)

Creditors days 33 51 35 34 35 Dividend (incl. tax) (58) (115) (153) (173) (183)

Debtor days 136 146 104 110 100 Others (incl extraordinaries) 12 (17) 1 378 0

Working capital days 125 126 91 111 117 Net cash fr om f inancing 955 2,451 1,199 1,540 (433)

Gross asset turnover (x) 7.6 7.1 8.7 6.5 5.2 Change in cash position 952 619 282 1,158 829

Net asset turnover (x) 12.5 12.0 14.2 11.7 10.4 Closing cash 2,095 2,715 2,996 4,155 4,984

Sales/operating assets (x) 11.5 9.8 10.9 9.7 9.5

Current ratio (x) 8.2 6.5 5.7 7.5 7.2

Debt-equity (x) 0.3 0.7 0.8 0.8 0.6 (Rs mn) Q3FY11 Q4FY11 Q1FY12 Q2FY12 Q3FY12

Net debt/equity (x) (0.1) 0.2 0.4 0.3 0.1 Net Sales 4,766 5,012 5,136 5,004 5,828

Interest coverage (1.4) 3.7 4.3 7.6 7.5 Change (q-o-q) 0% 5% 2% -3% 16%

EBITDA 889 819 876 843 939

Per share Change (q-o-q) 64% -8% 7% -4% 11%

FY09 FY10 FY11 FY12E FY13E EBITDA mar gi n 18.7% 16.3% 17.1% 16.8% 16.1%

Adj EPS (Rs) 51.6 62.5 88.3 102.9 116.6 PAT 266 338 450 491 545

CEPS 64.5 83.0 119.7 141.9 162.2 Adj PAT 384 340 364 373 371

Book value 297.5 351.9 431.0 546.3 651.8 Change (q-o-q) 2% -12% 7% 2% 0%

Dividend (Rs) 3.5 7.0 9.3 9.0 9.5 Adj PAT mar gi n 8.1% 6.8% 7.1% 7.4% 6.4%

Actual o/s shares (mn) 16.4 16.4 16.4 16.4 16.4 Adj EPS 23.3 20.6 23.3 22.7 22.6

Consolidated quarterly financials

CRISIL IERIndependent Equity Research

22

Focus Charts

Revenue and revenue growth trend EBITDA and EBITDA margi n trend

Source: Company, CRISIL Research Source: Company, CRISIL Research

Quarterl y sal es and EBITDA margin trend PAT and PAT margi n trend

Source: Company, CRISIL Research Source: Company, CRISIL Research

Fai r val ue movement si nce i ni ti ati on Sharehol di ng pattern over the quarters

Source: Company, CRISIL Research Source: Company, CRISIL Research

7,511

9,802

19,183

21,871

24,048

23.3%

30.5%

95.7%

14.0%

10.0%

0%

20%

40%

60%

80%

100%

120%

-

5,000

10,000

15,000

20,000

25,000

30,000

FY09 FY10 FY11 FY12E FY13E

(Rs mn)

Revenue Y-o-Y change (RHS)

744 2,070 3,170 3,616 3,780

9.9%

21.1%

16.5% 16.5%

15.7%

0%

5%

10%

15%

20%

25%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

FY09 FY10 FY11 FY12E FY13E

(Rs mn)

EBITDA EBITDA margin (RHS)

2,118 4,634 4,745 4,766 5,012 5,136 5,004 5,828

20%

15%

11%

19%

16%

17% 17%

16%

0%

5%

10%

15%

20%

25%

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

Q

4

F

Y

1

0

Q

1

F

Y

1

1

Q

2

F

Y

1

1

Q

3

F

Y

1

1

Q

4

F

Y

1

1

Q

1

F

Y

1

2

Q

2

F

Y

1

2

Q

3

F

Y

1

2

(Rs mn)

Quarterly revenue EBITDA margin (RHS)

849 1,028 1,453 1,692 1,918

11.3%

10.5%

7.6%

7.7% 8.0%

0%

2%

4%

6%

8%

10%

12%

-

500

1,000

1,500

2,000

2,500

FY09 FY10 FY11 FY12E FY13E

(Rs mn)

Adj. PAT Adj. PAT margin (RHS)

0

200

400

600

800

1,000

1,200

1,400

1,600

250

300

350

400

450

500

550

600

650

700

M

a

y

-

1

0

J

u

n

-

1

0

J

u

l

-

1

0

J

u

l

-

1

0

A

u

g

-

1

0

S

e

p

-

1

0

O

c

t

-

1

0

N

o

v

-

1

0

D

e

c

-

1

0

J

a

n

-

1

1

F

e

b

-

1

1

M

a

r

-

1

1

A

p

r

-

1

1

M

a

y

-

1

1

J

u

n

-

1

1

J

u

l

-

1

1

A

u

g

-

1

1

S

e

p

-

1

1

O

c

t

-

1

1

N

o

v

-

1

1

D

e

c

-

1

1

J

a

n

-

1

2

F

e

b

-

1

2

('000) (Rs)

Total Traded Quantity(RHS) CRISIL Fair Value Zylog

36.7% 36.7%

41.2% 41.2%

0.7% 0.4%

0.4% 1.4%

3.2% 3.1%

3.8%

4.8%

59.5% 59.9%

54.6%

52.6%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Mar-11 J un-11 Sep-11 Dec-11

Promoter FII DII Others

CRISIL Research Team

Senior Director

Mukesh Agarwal +91 (22) 3342 3035 magarwal@crisil.com

Analytical Contacts

Tarun Bhatia Director, Capital Markets +91 (22) 3342 3226 tbhatia@crisil.com

Prasad Koparkar Head, Industry & Customised Research +91 (22) 3342 3137 pkoparkar@crisil.com

Chetan Majithia Head, Equities +91 (22) 3342 4148 chetanmajithia@crisil.com

J iju Vidyadharan Head, Funds & Fixed Income Research +91 (22) 3342 8091 jvidyadharan@crisil.com

Ajay D'Souza Head, Industry Research +91 (22) 3342 3567 adsouza@crisil.com

Ajay Srinivasan Head, Industry Research +91 (22) 3342 3530 ajsrinivasan@crisil.com

Sridhar C Head, Industry Research +91 (22) 3342 3546 sridharc@crisil.com

Manoj Mohta Head, Customised Research +91 (22) 3342 3554 mmohta@crisil.com

Sudhir Nair Head, Customised Research +91 (22) 3342 3526 snair@crisil.com

Business Development

Vinaya Dongre Head, Industry & Customised Research +91 (22) 33428025 vdongre@crisil.com

Ashish Sethi Head, Capital Markets +91 (22) 33428023 asethi@crisil.com

CRISILs Equity Offerings

The Equity Group at CRISIL Research provides a wide range of services including:

Independent Equity Research

IPO Grading

White Labelled Research

Valuation on companies for use of Institutional Investors, Asset Managers, Corporate

Other services by the Research group include

Funds & Fixed Income Research

Mutual fund rankings

Wealth Tracking and Financial Planning tools for asset managers, wealth managers and IFAs

Valuation for all debt instruments

Developing and maintaining debt and hybrid indices

Consultancy and research support to retirement funds

Industry & Customized Research

Provide comprehensive research coverage across 65 sectors

Customised research on market sizing, demand modelling and entry strategies

Customised research content for Information Memorandum and Offer Documents

MAKING M

A

R

K

E

T

S

F

U

N

C

T

IO

N

B

E

T

T

E

R

YEARS

Contact us

Phone: +91 22 3342 3561/ 62

Fax: +91 22 3342 3501

E-mail: clientservicing@crisil.com | research@crisil.com

Our Office

Ahmedabad

706, Venus Atlantis

Nr. Reliance Petrol Pump

Prahladnagar,

Ahmedabad

Phone: 91 79 4024 4500

Fax: 91 79 2755 9863

Hyderabad

3rd Floor, Uma Chambers

Plot No. 9&10, Nagarjuna Hills,

(Near Punjagutta Cross Road)

Hyderabad - 500 482

Phone: 91 40 2335 8103 - 05

Fax: 91 40 2335 7507

New Del hi

The Mira, G-1,

1st Floor, Plot No. 1 & 2

Ishwar Nagar, Mathura Road,

New Delhi - 110 065

Phone: 91 11 4250 5100

Fax: 91 11 2684 2212

Bengal uru

W-101, Sunrise Chambers,

22, Ulsoor Road,

Bengalore - 560 042

Phone: 91 80 2558 0899

Fax: 91 80 2559 4801

Kol kata

Horizon, Block 'B', 4th Floor

57 Chowringhee Road

Kolkata - 700 071

Phone: 91 33 2289 1949 - 50

Fax: 91 33 2283 0597

Pune

1187/17, Ghole Road,

Shivaji Nagar,

Pune - 411 005

Phone: 91 20 2553 9064 - 67

Fax: 91 20 4018 1930

Chennai

Thapar House,

43/44, Montieth Road, Egmore,

Chennai - 600 008

Phone: 91 44 2854 6205 - 06

Fax: 91 44 2854 7531

About CRISIL Limi ted

CRISIL is a global analytical company providing ratings, research, and risk and policy advisory services. We are Indias leading ratings agency. We are also the foremost

provider of high-end research to the worlds largest banks and leading corporations.

About CRISIL Research

CRISIL Research is India's largest independent and integrated research house. We provide insights, opinions, and analysis on the Indian economy, industries, capital

markets and companies. We are India's most credible provider of economy and industry research. Our industry research covers 69 sectors and is known for its rich insights

and perspectives. Our analysis is supported by inputs from our network of more than 4,500 primary sources, including industry experts, industry associations, and trade

channels. We play a key role in India's fixed income markets. We are India's largest provider of valuations of fixed income securities, serving the mutual fund, insurance, and

banking industries. We are the sole provider of debt and hybrid indices to India's mutual fund and life insurance industries. We pioneered independent equity research in

India, and are today India's largest independent equity research house. Our defining trait is the ability to convert information and data into expert judgements and forecasts

with complete objectivity. We leverage our deep understanding of the macroeconomy and our extensive sector coverage to provide unique insights on micro-macro and

cross-sectoral linkages. We deliver our research through an innovative web-based research platform. Our talent pool comprises economists, sector experts, company

analysts, and information management specialists.

CRISIL Limited

CRISIL House, Central Avenue, Hiranandani Business Park,

Powai, Mumbai 400076. India

Phone: +91 22 3342 3561 Fax: +91 22 3342 3001

Email: clientservicing@crisil.com

CRISIL Ltd is a Standard & Poor's company

CRISIL Limited. All Rights Reserved.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)