Академический Документы

Профессиональный Документы

Культура Документы

Voluntary Certification Letter To Koskinen

Загружено:

jda_230 оценок0% нашли этот документ полезным (0 голосов)

1K просмотров4 страницыAn angry letter to IRS commissioner John Koskinen from the AICPA

Оригинальное название

Voluntary Certification Letter to Koskinen

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAn angry letter to IRS commissioner John Koskinen from the AICPA

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

1K просмотров4 страницыVoluntary Certification Letter To Koskinen

Загружено:

jda_23An angry letter to IRS commissioner John Koskinen from the AICPA

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

[Type text]

May 21, 2014

The Honorable J ohn A. Koskinen

Commissioner

Internal Revenue Service

1111 Constitution Avenue, NW

Washington, DC 20224

Dear Commissioner Koskinen:

In reaction to the recent court decisions in Loving v. I.R.S., you have indicated that the

IRS should consider a voluntary certification program. The American Institute of

Certified Public Accountants (AICPA) has deep concerns with regard to a voluntary

system, and the speed with which the IRS is moving to implement such a system. We

believe a voluntary program would create confusion regarding the relative proficiencies

of the various types of preparers. In addition, the proposed voluntary system would

undoubtedly leave the impression among most taxpayers that certain tax return preparers

are endorsed by the Internal Revenue Service (IRS). As a practical matter, any voluntary

regime constructed would still not address the problems with unethical and fraudulent tax

return preparers. Finally, we are concerned that that the IRS is rapidly moving forward

without widely disseminating the proposal or seeking public comments.

We think the IRS should focus its efforts on utilization of the current preparer tax

identification number (PTIN) program and increased taxpayer education, as discussed

below.

Marketplace Confusion

We believe a voluntary program would result in increased confusion with respect to tax

administration and the tax preparer community. The agency currently has a structured

and regulated program available for tax return preparers seeking IRS licensing (i.e.,

enrolled agents) who do not have the prerequisites or desire to obtain a license to practice

law or accounting. We think the IRS would undermine its existing program if the agency

decided to freely validate tax return preparers without the corresponding regulatory

responsibilities.

If the IRS adopts a voluntary certification regime, confusion between the different types

of preparers will become even more pronounced. We foresee a tremendous challenge in

explaining to taxpayers, as consumers, the difference between individuals with a PTIN,

those preparers who are authorized (enrolled) to prepare returns and represent clients

before the IRS, and individuals who have availed themselves of the voluntary regime.

The Honorable J ohn A. Koskinen

May 21, 2014

Page 2 of 4

Any attempt to explain the differences would invariably sound like an endorsement of

only that subset of individuals who availed themselves of the voluntary regime. In short,

we are concerned about the confusion that may be generated in the marketplace in an

environment where PTIN holders may prepare returns, but may not be persons who

subject themselves to an IRS voluntary program, and whether the consuming public

would be able to discern the difference.

Utilization of PTIN Program

We encourage the IRS to focus on the implementation of a comprehensive preparer

enforcement strategy as opposed to a voluntary regime. The registration of paid tax

return preparers and the issuance of unique PTINs remain in effect post-Loving.

Registration allows the accumulation of important data on activities of specific tax return

preparers as well as classes of preparers in a way that allows the IRS to tailor compliance

and education programs in the most efficient manner. We urge the IRS to utilize the

current PTIN program to track preparer activity, identify patterns of fraud and

incompetence across returns prepared by specific individuals, and to institute compliance

programs to deal with incompetent or unethical preparers. A voluntary system would not

accomplish this goal.

In addition, the IRS should more narrowly define the term preparer for PTIN purposes

to exclude certain supervised employees, to avoid subjecting the profession to over-

regulation. The current requirements in Treas. Reg. 1.6109-2 regarding who needs a

PTIN are overbroad due to the inclusion of non-signers who are appropriately supervised

by professional, licensed signing tax return preparers. As a state regulatory matter,

licensed professionals, such as CPAs, are responsible for work performed by unlicensed

staff persons who assist in any tax return preparation effort.

We also believe the IRS should administer the penalties and sanctions for which it

currently has authority to identify and hold accountable incompetent and unethical return

preparers. Specifically, we think the IRS should direct its efforts on enforcing the

following provisions against incompetent and unethical tax return preparers:

Section 6694 civil penalties for understatements due to unreasonable

positions or willful or reckless conduct.

Section 6695 civil penalties for (i) failure to furnish a copy of the return to

the taxpayer, (ii) failure to sign the return, (iii) failure to put the PTIN on the

return, (iv) failure to retain copies of returns prepared or a list of taxpayers for

whom returns have been prepared; and (v) failure to comply with due

diligence requirements relating to EITC claims.

Section 6701 civil penalties for aiding or abetting an understatement.

Section 6713 civil penalties for disclosing or using taxpayer-provided

information other than for return preparation.

The Honorable J ohn A. Koskinen

May 21, 2014

Page 3 of 4

Section 7206 criminal penalties, including imprisonment, for willfully

aiding or assisting in the preparation of a fraudulent return.

Section 7407 authority to seek injunctions against return preparers engaging

in specified behaviors, including fraudulent or deceptive conduct that

substantially interferes with proper administration of the tax laws.

Engagement with Stakeholders & Public

The IRS should seek an open dialogue on the proposed voluntary certification program as

well as more efficient measures to protect the public from unethical, fraudulent or

incompetent preparers. Prior to Loving, the IRS had devoted an unprecedented amount of

time listening to stakeholder concerns and suggestions regarding its rollout of a return

preparer program, and as a result made numerous changes and adjustments to the

program. We suggest that you take these same steps in assessing whether a voluntary

certification program is in the best interests of the public.

Taxpayer Education

The AICPA strongly supports a strategy to better inform the taxpaying public. The IRS

should implement a robust communications strategy to educate the public about the

preparers requirement to obtain a PTIN, renew the PTIN, and to include it on returns

they prepare. Increased public awareness might mitigate some of the problems of

preparers who do not have PTINs the so-called ghost preparers. The IRS should also

consider working with state tax authorities and the appropriate professional associations

on a joint public service campaign.

IRS Resources

Recently, National Taxpayer Advocate Nina Olson noted that it may take consecutive

years of public education on the value of the new type of preparer (e.g., individuals who

have availed themselves of the voluntary regime) before such an IRS program can show

at least some degree of success. However, we do not believe the expenditure of resources

for marketing such a voluntary program, that even the IRS has promoted as an interim

solution, is a prudent use of taxpayers dollars. As you are aware, the AICPA has long-

supported enhanced IRS funding to address taxpayer and preparer services. However, in

a world of limited resources, where the IRS has indicated that resources are insufficient

to fully cover services, we would encourage the application of the agencys appropriated

resources to more effective measures.

Annual PTIN User Fees

Finally, we would appreciate more transparency with regard to the utilization of the

annual PTIN user fees. Specifically, please explain how the user fees are currently

The H

May

Page

utiliz

of a v

The

profe

servin

tax m

memb

sized

If yo

Comm

Direc

Since

J effre

Chair

cc:

Honorable J o

21, 2014

4 of 4

zed and whet

voluntary cer

AICPA is

ession, with m

ng the public

matters, and

bers provide

d business, as

ou have any

mittee, at (3

ctor of Tax A

erely,

ey A. Porter,

r, Tax Execu

Members

Members

J ohn Dalr

Carol A. C

ohn A. Kosk

ther you ant

rtification pr

the worlds

more than 3

c interest. O

prepare inc

e services to

s well as Am

y questions,

304) 522-25

Advocacy, at

, CPA

utive Commi

of House W

of Senate F

rymple, Dep

Campbell, D

kinen

ticipate using

rogram in th

*

s largest me

94,000 mem

Our members

ome and oth

individuals,

mericas larg

, please con

553 or jpor

t (202) 434-9

ittee

Ways and Me

inance Com

uty Commis

Director, Retu

g the user fe

he future.

* * * * *

ember assoc

mbers in 128

s advise clie

her tax retu

, not-for-pro

est businesse

ntact J effrey

ter@porterc

9234 or mlab

Barr

AIC

eans Commit

mmittee

ssioner for S

urn Preparer

ees to fund o

ciation repr

8 countries an

ents on feder

urns for mill

ofit organizat

es.

y A. Porter

cpa.com or

bant@aicpa

ry C. Melanc

CPA, Preside

ttee

Services and

r Office, Inte

or partially f

resenting th

nd a 125-ye

ral, state and

lions of Am

tions, small

r, Chair, Ta

Melissa Lab

a.org.

con, CPA, C

ent & CEO

Enforcemen

ernal Revenu

fund any pa

he accountin

ar heritage o

d internationa

mericans. Ou

and medium

ax Executiv

bant, AICPA

CGMA

nt

ue Service

art

ng

of

al

ur

m-

ve

A

Вам также может понравиться

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Check My Ads - 12.31.21 990-N FiledДокумент1 страницаCheck My Ads - 12.31.21 990-N FiledGabe KaminskyОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Salary SleepДокумент1 страницаSalary Sleepdk_2k2002Оценок пока нет

- Tax Reviewer MonteroДокумент61 страницаTax Reviewer MonteroJan Ceasar ClimacoОценок пока нет

- Chapter Three Payroll Accounting 3.1. Importance of Payroll AccountingДокумент11 страницChapter Three Payroll Accounting 3.1. Importance of Payroll Accountingyebegashet100% (2)

- ITR-1 Acknowledgement for AY 2022-23Документ1 страницаITR-1 Acknowledgement for AY 2022-23VINAY verma100% (1)

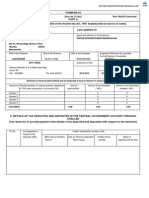

- Payslip To Print - Report Design 10-01-2020Документ1 страницаPayslip To Print - Report Design 10-01-2020martin avinaОценок пока нет

- Form 16 by Tcs PDFДокумент5 страницForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- 2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFДокумент2 страницы2008 BIR - Ruling - DA 128 08 - 20180320 1159 1heemgd PDFAleezah Gertrude RaymundoОценок пока нет

- MF Global V PWC 14-cv-02197-VMДокумент17 страницMF Global V PWC 14-cv-02197-VMjda_23Оценок пока нет

- 2014 Overall CPA Exam StatsДокумент2 страницы2014 Overall CPA Exam Statsjda_23Оценок пока нет

- KPMG Front Page PostДокумент3 страницыKPMG Front Page Postjda_23Оценок пока нет

- Top 10 Reasons To Join DeloitteДокумент1 страницаTop 10 Reasons To Join Deloittejda_23Оценок пока нет

- Select Auditing Considerations For The 2014 Audit CycleДокумент14 страницSelect Auditing Considerations For The 2014 Audit Cyclejda_23Оценок пока нет

- SJ Tax Office Hoteling FAQДокумент4 страницыSJ Tax Office Hoteling FAQjda_23Оценок пока нет

- Sametime SpatДокумент2 страницыSametime Spatjda_23Оценок пока нет

- Communication On Professional ResponsibilitiesДокумент2 страницыCommunication On Professional Responsibilitiesjda_23Оценок пока нет

- Cash Accounting LetterДокумент4 страницыCash Accounting Letterjda_23Оценок пока нет

- Pricewaterhousecoopers LLP Employment Agreement April 22, 2014Документ10 страницPricewaterhousecoopers LLP Employment Agreement April 22, 2014jda_23Оценок пока нет

- AICPA V IRSДокумент23 страницыAICPA V IRSjda_23Оценок пока нет

- Koltin Consulting Group, Inc. - Lateral Hiring Study - First Half 2014Документ8 страницKoltin Consulting Group, Inc. - Lateral Hiring Study - First Half 2014jda_23Оценок пока нет

- MF Global V PWCДокумент16 страницMF Global V PWCjda_23Оценок пока нет

- EY Male Leaders Making The Mix WorkДокумент27 страницEY Male Leaders Making The Mix Workjda_23Оценок пока нет

- Grant Thornton QC ReportДокумент28 страницGrant Thornton QC Reportjda_23Оценок пока нет

- Deloitte Motion To Dismiss Shamsky LawsuitДокумент32 страницыDeloitte Motion To Dismiss Shamsky Lawsuitjda_23Оценок пока нет

- PWC New Hire Arbitration AgreementДокумент4 страницыPWC New Hire Arbitration Agreementjda_23Оценок пока нет

- 2013 Overall NASBAДокумент3 страницы2013 Overall NASBAjda_23Оценок пока нет

- 2013 CohnReznick PCAOB Inspection ReportДокумент9 страниц2013 CohnReznick PCAOB Inspection Reportjda_23Оценок пока нет

- CohnReznick Hartford Press ReleaseДокумент2 страницыCohnReznick Hartford Press Releasejda_23Оценок пока нет

- AICPA Volunteer Recruitment LetterДокумент2 страницыAICPA Volunteer Recruitment Letterjda_23Оценок пока нет

- McGladrey 2012 PCAOB Inspection ReportДокумент14 страницMcGladrey 2012 PCAOB Inspection Reportjda_23Оценок пока нет

- Rothstein Kass KPMG Acquisition Rumor SurveyДокумент11 страницRothstein Kass KPMG Acquisition Rumor Surveyjda_23Оценок пока нет

- 2012 PCAOB Inspection of Crowe Horwath LLPДокумент13 страниц2012 PCAOB Inspection of Crowe Horwath LLPjda_23Оценок пока нет

- Investing in Africa Through MauritiusДокумент10 страницInvesting in Africa Through Mauritiusjda_23Оценок пока нет

- S.E.C. v. Davis, Et AlДокумент32 страницыS.E.C. v. Davis, Et AlDealBookОценок пока нет

- EY! Bathroom Etiquette For Feral MalesДокумент2 страницыEY! Bathroom Etiquette For Feral Malesjda_23Оценок пока нет

- Farewell E-Mail and Review Comments - RedactedДокумент1 страницаFarewell E-Mail and Review Comments - Redactedjda_23Оценок пока нет

- Farewell Letter Review CommentsДокумент1 страницаFarewell Letter Review Commentsjda_23Оценок пока нет

- Author Name: Shubham MishraДокумент17 страницAuthor Name: Shubham MishraShubham MishraОценок пока нет

- BIR Ruling Involving CGTДокумент3 страницыBIR Ruling Involving CGTGEiA Dr.Оценок пока нет

- 06 Taxation - Deferred s20 Final-1Документ44 страницы06 Taxation - Deferred s20 Final-150902849Оценок пока нет

- File TDS return online for property saleДокумент3 страницыFile TDS return online for property saleAnand JaiswalОценок пока нет

- Tax Deducted at SourceДокумент23 страницыTax Deducted at SourcePrathamesh ParkerОценок пока нет

- Steps Involved in Filing GST ReturnsДокумент9 страницSteps Involved in Filing GST ReturnssaranistudyОценок пока нет

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruДокумент1 страницаIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMahaОценок пока нет

- Forms of Business Organizations PDFДокумент2 страницыForms of Business Organizations PDFPhil SingletonОценок пока нет

- Nova Silky Shine 1200 W Hot and Cold Foldable NHP 8100/05 Hair DryerДокумент2 страницыNova Silky Shine 1200 W Hot and Cold Foldable NHP 8100/05 Hair DryerAkshayОценок пока нет

- uFELEKU AYENACHEWДокумент50 страницuFELEKU AYENACHEWamanualОценок пока нет

- 2013 2014Документ52 страницы2013 2014sayed126Оценок пока нет

- Preferential Quizers From ULДокумент21 страницаPreferential Quizers From ULFrie NdshipMaeОценок пока нет

- 1022 2021Документ15 страниц1022 2021nfk roeОценок пока нет

- Checklist To Be Enclosed Along With Final Bill: Sensitivity: LNT Construction Internal UseДокумент3 страницыChecklist To Be Enclosed Along With Final Bill: Sensitivity: LNT Construction Internal UseKannan GnanaprakasamОценок пока нет

- Abc LTD Pay Slip: Apartments, Ground Level, Santacruz (W), Mumbai - 54, India. Phone: 022Документ5 страницAbc LTD Pay Slip: Apartments, Ground Level, Santacruz (W), Mumbai - 54, India. Phone: 022Ashish JangidОценок пока нет

- Sesi 1 - Covid and Tax Avoidance - SubagioДокумент6 страницSesi 1 - Covid and Tax Avoidance - Subagioaslam hanifОценок пока нет

- ACCT 423 Cheat Sheet 1.0Документ2 страницыACCT 423 Cheat Sheet 1.0HelloWorldNowОценок пока нет

- House Budget Committee Republicans Letter On Debt LimitДокумент4 страницыHouse Budget Committee Republicans Letter On Debt LimitFox NewsОценок пока нет

- ACCA Result Statistics Jan-Jun 2014Документ16 страницACCA Result Statistics Jan-Jun 2014smedupeОценок пока нет

- Unit 3 (Income From House Property) - 1Документ5 страницUnit 3 (Income From House Property) - 1Vijay GiriОценок пока нет

- Income Tax Department Income Tax Department: Non-Filing of Return Non-Filing of ReturnДокумент1 страницаIncome Tax Department Income Tax Department: Non-Filing of Return Non-Filing of ReturnSarvesh SamantОценок пока нет

- TATA 1MG Healthcare Solutions Private LimitedДокумент1 страницаTATA 1MG Healthcare Solutions Private LimitedAmish JhaОценок пока нет