Академический Документы

Профессиональный Документы

Культура Документы

May 2014, Global Mfg. Activity Indicator (PMI)

Загружено:

Eduardo PetazzeАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

May 2014, Global Mfg. Activity Indicator (PMI)

Загружено:

Eduardo PetazzeАвторское право:

Доступные форматы

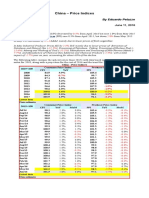

May 2014, Global Manufacturing Activity Indicator (PMI)

by Eduardo Petazze

In May 2014 the world's manufacturing activity continued to expand at a faster pace than in April 2014

Summary of surveys for May 2014 Purchasing Managers Index (PMI) of global manufacturing

Overview

Mfg.May 2014 Summary

Rate of change

Numbe r of countrie s

ne gative unchange positive

Expanding (PMI>50.09)

18

0

10

Stable (PMI~50.0)

0

0

0

Contracting (PMI<49.91)

8

0

3

Total

26

0

13

total

28

0

11

39

Breakdown by countries and links

Worldwide Manufacturing PMI (SA)

2013

2014

May14 vs. Apr14

weight

Reference links

Country

May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Chg. Direction

Rate of Chg

1.35% Australian Industry Group Australia

43.8 49.6 42.0 46.4 51.7 53.2 47.7 47.6 46.7 48.6 47.9 44.8 49.2 4.4 Contracting Slower

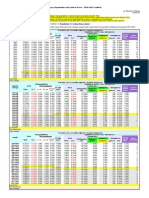

0.48%

Bank Austria

Austria

48.2 48.3 49.1 52.0 51.1 52.7 54.3 54.1 54.0 53.0 51.0 51.4 50.9 -0.5 Expanding Slower

3.24%

HSBC - May14 report

Brazil

50.4 50.4 48.5 49.4 49.9 50.2 49.7 50.5 50.8 50.4 50.6 49.3 48.8 -0.5 Contracting Faster

2.05%

See detail below

Canada

58.2 53.9 50.2 51.6 53.1 59.2 54.5 49.9 54.3 55.1 54.3 53.5 50.2 -3.3 Expanding Slower

18.94%

See detail below

China

50.0 49.2 49.0 50.6 50.7 51.2 51.1 50.8 50.0 49.4 49.2 49.3 50.1 0.8 Stable

from contracting

0.38%

HSBC - May14 Report

Czech Rep. 50.1 51.0 52.0 53.9 53.4 54.5 55.4 54.7 55.9 56.5 55.5 56.5 57.3 0.8 Expanding Faster

0.28%

DILF

Denmark

56.2 56.7 57.0 59.2 55.0 54.0 58.3 54.2 57.1 57.4 62.6 60.7 60.2 -0.5 Expanding Slower

0.74%

HSBC - May14 Report

Egipt

48.5 47.5 41.7 42.2 44.7 49.5 52.5 52.0 48.7 50.0 49.8 49.5 48.7 -0.8 Contracting Faster

3.03%

MARKIT

France

46.4 48.4 49.7 49.7 49.8 49.1 48.4 47.0 49.3 49.7 52.1 51.2 49.6 -1.6 Contracting from expanding

4.32%

MARKIT / BME

Germany

49.4 48.6 50.7 51.8 51.1 51.7 52.7 54.3 56.5 54.8 53.7 54.1 52.3 -1.8 Expanding Slower

0.35%

MARKIT

Greece

45.3 45.4 47.0 48.7 47.5 47.3 49.2 49.6 51.2 51.3 49.7 51.1 51.0 -0.1 Expanding Unchange

0.52% HSBC composite - Report Hong Kong 49.8 48.7 49.7 49.7 50.0 50.1 52.1 51.2 52.7 53.3 49.9 49.7 49.1 -0.6 Contracting Faster

0.27%

MLBKT (BMI)

Hungary

47.1 50.8 49.0 51.8 54.5 51.0 52.6 50.2 57.9 54.3 53.7 54.6 53.9 -0.7 Expanding Slower

7.03%

HSBC

India

50.1 50.3 50.1 48.5 49.6 49.6 51.3 50.7 51.4 52.5 51.3 51.3 51.4 0.1 Expanding Unchange

1.79%

HSBC - May14 report

Indonesia

51.6 51.0 50.7 48.5 50.2 50.9 50.3 50.9 51.0 50.5 50.1 51.1 52.4 1.3 Expanding Faster

0.25%

Investec

Ireland

49.7 50.3 51.0 52.0 52.7 54.9 52.4 53.5 52.8 52.9 55.5 56.1 55.0 -1.1 Expanding Slower

0.37% IPLMA - Bank Hapoalim Israel

47.1 46.0 47.6 47.6 44.9 46.6 44.5 46.8 49.5 50.0 48.9 51.4 55.6 4.2 Expanding Faster

2.39%

MARKIT / ADACI

Italy

47.3 49.1 50.4 51.3 50.8 50.7 51.4 53.3 53.1 52.3 52.4 54.0 53.2 -0.8 Expanding Slower

6.26%

MARKIT / JMMA

Japan

51.5 52.3 50.7 52.2 52.5 54.2 55.1 55.2 56.6 55.5 53.9 49.4 49.9 0.5 Stable

Slower

2.27%

HSBC - May14 report

Korea

51.1 49.4 47.2 47.5 49.7 50.2 50.4 50.8 50.9 49.8 50.4 50.2 49.5 -0.7 Contracting from expanding

0.09%

BLOMINVEST Bank

Lebanon

52.6 50.3 47.6 44.9 47.0 49.1 45.1 49.0 44.5 45.5 46.2 48.5 48.0 -0.5 Contracting Faster

2.49%

See detail below

Mexico

50.7 49.8 49.9 50.5 50.6 50.0 51.6 51.9 52.3 51.6 52.2 52.2 52.3 0.1 Expanding Unchange

0.93%

NEVI

Netherlands 48.7 48.8 50.8 53.5 55.8 54.4 56.8 57.0 54.8 55.2 53.7 53.4 53.6 0.2 Expanding Faster

0.19% Business NZ - May14 Rep. N. Zealand 57.6 54.7 59.3 57.3 54.6 56.4 57.3 56.6 56.3 56.2 58.3 54.4 52.7 -1.7 Expanding Slower

0.37%

NIMA - May14 Report

Norway

53.0 46.5 49.5 53.0 52.1 52.8 53.1 50.9 52.7 51.3 52.3 51.1 49.8 -1.3 Contracting from expanding

1.11%

HSBC - May14 report

Poland

48.0 49.3 51.1 52.6 53.1 53.4 54.4 53.2 55.4 55.9 54.0 52.0 50.8 -1.2 Expanding Slower

3.41%

HSBC

Russia

50.4 51.7 49.2 49.4 49.4 51.8 49.4 48.8 48.0 48.5 48.3 48.5 48.9 0.4 Contracting Slower

1.28% SABB HSBC - May14 report S. Arabia

57.3 56.6 56.6 57.5 58.7 56.7 57.1 58.7 59.7 58.6 57.0 58.5 57.0 -1.5 Expanding Slower

0.48%

SIPMM

Singapore

51.1 51.7 51.8 50.5 50.5 51.2 50.8 49.7 50.5 50.9 50.8 51.1 50.8 -0.3 Expanding Slower

0.80%

See detail below

S. Africa

50.7 50.1 51.9 53.4 49.9 51.1 52.0 50.2 50.1 51.6 50.3 48.4 47.0 -1.4 Contracting Faster

1.85%

MARKIT

Spain

48.1 50.0 49.8 51.1 50.7 50.9 48.6 50.8 52.2 52.5 52.8 52.7 52.9 0.2 Expanding Faster

0.54%

SILF - Report

Sweden

52.1 53.5 51.3 52.2 56.0 52.0 56.0 52.3 56.4 54.6 56.6 55.5 54.1 -1.4 Expanding Slower

0.50% SVME / CREDIT SUISSE Swiss

51.6 51.4 55.9 54.7 55.4 55.4 57.5 55.0 56.1 57.6 54.4 55.8 52.5 -3.3 Expanding Slower

1.26%

HSBC - May14 Report

Taiwan

47.1 49.5 48.6 50.0 52.0 53.0 53.4 55.2 55.5 54.7 52.7 52.3 52.4 0.1 Expanding Unchange

1.58%

HSBC - May14 Report

Turkey

51.1 51.2 49.8 50.9 54.0 53.3 55.0 53.5 52.7 53.4 51.7 51.1 50.1 -1.0 Stable

Slower

0.37%

HSBC

UAE

55.3 54.1 54.5 54.5 56.6 56.3 58.1 57.4 57.1 57.3 57.7 58.3 57.3 -1.0 Expanding Slower

3.23%

MARKIT / CIPS

UK

51.5 52.9 54.8 57.2 56.3 56.5 58.1 57.2 56.6 56.2 55.8 57.3 57.0 -0.3 Expanding Slower

22.70%

See detail below

USA

50.9 52.1 54.4 54.5 54.2 54.8 56.1 55.5 53.7 54.1 54.3 54.9 55.7 0.9 Expanding Faster

0.50%

HSBC - May14 Report

Vietnam

48.8 46.4 48.5 49.4 51.5 51.5 50.3 51.8 52.1 51.0 51.3 53.1 52.5 -0.6 Expanding Slower

100.0%

Worldwide Mfg PMI

see Note

50.4 50.7 50.9 51.6 51.9 52.5 53.0 52.7 52.6 52.5 52.2 52.0 52.2 0.1 Expanding Faster

MARKIT

Euro area

48.3 48.8 50.3 51.4 51.1 51.3 51.6 52.7 54.0 53.2 53.0 53.4 52.2 -1.2 Expanding Slower

HSBC EMI (Composite) Emerging

51.5 50.6 49.5 50.7 50.7 51.7 52.1 51.6 51.4 51.1 50.3 50.4 50.6 0.2 Expanding Faster

JP Morgan

Global

50.6 50.6 50.8 51.6 51.8 52.1 53.1 53.0 53.0 53.2 52.4 51.9 52.2 0.3 Expanding Faster

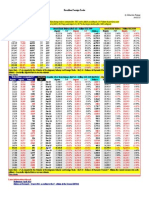

More than one PMI survey

Country May Jun Jul Aug Sep Oct Nov Dec Jan Feb Mar Apr May Chg. Direction

Rate of Chg

Markit - RBC

53.2 52.4 52.0 52.1 54.2 55.6 55.3 53.5 51.7 52.9 53.3 52.9 52.2 -0.7 Expanding Slower

IVEY

Canada

63.1 55.3 48.4 51.0 51.9 62.8 53.7 46.3 56.8 57.2 55.2 54.1 48.2 -5.9 Contracting from expanding

Canada average

58.2 53.9 50.2 51.6 53.1 59.2 54.5 49.9 54.3 55.1 54.3 53.5 50.2 -3.3 Expanding Slower

CFLP - Stats (Chinese)

50.8 50.1 50.3 51.0 51.1 51.4 51.4 51.0 50.5 50.2 50.3 50.4 50.8 0.4 Expanding Faster

HSBC - May14 report

China

49.2 48.2 47.7 50.1 50.2 50.9 50.8 50.5 49.5 48.5 48.0 48.1 49.4 1.3 Contracting Slower

China average

50.0 49.2 49.0 50.6 50.7 51.2 51.1 50.8 50.0 49.4 49.2 49.3 50.1 0.8 Stable

from contracting

INEGI - SA data:

52.3 51.1 51.0 51.0 51.2 51.2 52.4 52.4 52.5 52.4 52.5 52.9 52.7 -0.2 Expanding Slower

IIEEM report - SA data:

48.1 46.9 48.9 49.5 50.5 48.5 50.5 50.6 50.4 50.4 52.4 51.8 52.2 0.4 Expanding Faster

Mexico

HSBC - May14 Report

51.7 51.3 49.7 50.8 50.0 50.2 51.9 52.6 54.0 52.0 51.7 51.8 51.9 0.1 Expanding Unchange

Mexico average

50.7 49.8 49.9 50.5 50.6 50.0 51.6 51.9 52.3 51.6 52.2 52.2 52.3 0.1 Expanding Unchange

BER-KAGISO -May14 -xls

50.0 51.7 52.5 55.6 50.0 50.7 52.4 49.9 49.9 51.7 50.3 47.4 44.3 -3.1 Contracting Faster

HSBC

S. Africa

51.5 48.5 51.3 51.2 49.8 51.5 51.6 50.5 50.3 51.5 50.2 49.4 49.7 0.3 Contracting Slower

S. Africa Average

50.7 50.1 51.9 53.4 49.9 51.1 52.0 50.2 50.1 51.6 50.3 48.4 47.0 -1.4 Contracting Faster

Regional PMI (see below)

50.5 51.9 54.5 54.2 53.9 56.0 56.5 54.9 56.1 52.1 53.6 54.3 57.6 3.3 Expanding Faster

ISM Report On Business

50.0 52.5 54.9 56.3 56.0 56.6 57.0 56.5 51.3 53.2 53.7 54.9 53.2 -1.7 Expanding Slower

USA

MARKIT

52.3 51.9 53.7 53.1 52.8 51.8 54.7 55.0 53.7 57.1 55.5 55.4 56.4 1.0 Expanding Faster

US average

50.9 52.1 54.4 54.5 54.2 54.8 56.1 55.5 53.7 54.1 54.3 54.9 55.7 0.9 Expanding Faster

US Regional Average Manufacturing PMI 50.5 51.9 54.5 54.2 53.9 56.0 56.5 54.9 56.1 52.1 53.6 54.3 57.6 3.3 Expanding Faster

CHICAGO B. BAROMETER

58.4 51.9 52.6 53.6 56.3 66.2 62.9 60.8 59.6 59.8 55.9 63.0 65.5 2.5 Expanding Faster

Dallas Manufacturing as if it were PMI

51.0 53.3 53.1 50.7 51.7 53.0 52.8 51.0 53.0 53.4 55.8 57.5 50.9 -6.6 Expanding Slower

Kansas City Fed Mfg. (SA) as PMI

51.0 47.5 52.5 53.0 51.0 53.0 53.0 48.5 52.5 52.0 55.0 53.5 55.0 1.5 Expanding Faster

Richmond Mfg. Activity as PMI

49.4 53.6 44.5 56.8 50.0 50.2 56.5 56.4 55.9 47.2 46.7 53.5 53.6 0.1 Expanding Unchange

Philadelphia - Business Outlook Survey

49.2 57.2 59.0 56.6 60.0 57.8 54.6 53.2 54.7 46.9 54.5 58.3 57.7 -0.6 Expanding Slower

ISM - Milwaukee - (Bloomberg chart)

40.7 51.6 52.4 48.2 55.0 57.1 52.1 54.3 52.8 48.6 56.0 47.3 63.5 16.2 Expanding from contracting

ISM-NY - May14 Report

54.4 47.0 67.8 60.5 53.6 59.3 69.5 63.8 64.4 57.0 52.0 50.6 55.3 4.7 Expanding Faster

Empire State Mfg - Current conditions

50.1 53.5 54.4 54.2 53.4 51.6 50.4 51.1 56.3 52.2 52.8 50.6 59.5 8.9 Expanding Faster

Last data published in bold

Revised data in italics

Note: Worldwide Manufacturing PMI was weighted by GDP-PPP estimate by the IMF for 2014 (April 2014 estimate)

Also see:

Global

Week Ahead Economic Overview [23-27 Jun]: Flash PMI and US, UK GDP updates

Global tourism & recreation sector posts solid activity growth in May

Record outperformance of developed world over emerging markets

Global metals & mining output growth remains subdued

Food producers climb to top of global sector rankings in May

Global food output growth at post-crisis high in May

JPMorgan Global Composite PMI

JPMorgan Global Services PMI

China

HSBC China Services PMI

China - CFLP Manufacturing PMI

Euro area

Eurozone industry grows twice as fast as expected in April

Markit Eurozone Composite PMI

Other

Argentina Manufacturing PMI

Dansk Manufacturing PMI

Sales tax hike causes Japans economy to contract for second month running

Norsk Manufacturing PMI

Truck weight restrictions disrupt manufacturing supply chains in Vietnam

UK Economy

UK retailers enjoy best start to a year for a decade

Construction sector booms, Bank of England raises prospect of 2014 rate hike

UK - Regional Purchasing Managers' Index (PMI)

UK unemployment plunges on back of record increase in employment

UK manufacturing recovery gains further momentum

Bank of England policymakers hold off on rate rises again

UK job creation sustained at all-time high as economy continues to surge

Cost of living, energy bills & interest rates top UK household financial concerns

Nearly one-in-four UK households expect interest rates to start rising within the next six months

US

US Retailers on course for best calendar quarter for over three years

Markit US Services PMI

Вам также может понравиться

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaДокумент1 страницаChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeОценок пока нет

- Turkey - Gross Domestic Product, Outlook 2016-2017Документ1 страницаTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeОценок пока нет

- China - Price IndicesДокумент1 страницаChina - Price IndicesEduardo PetazzeОценок пока нет

- India - Index of Industrial ProductionДокумент1 страницаIndia - Index of Industrial ProductionEduardo PetazzeОценок пока нет

- Germany - Renewable Energies ActДокумент1 страницаGermany - Renewable Energies ActEduardo PetazzeОценок пока нет

- Reflections On The Greek Crisis and The Level of EmploymentДокумент1 страницаReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeОценок пока нет

- WTI Spot PriceДокумент4 страницыWTI Spot PriceEduardo Petazze100% (1)

- Highlights, Wednesday June 8, 2016Документ1 страницаHighlights, Wednesday June 8, 2016Eduardo PetazzeОценок пока нет

- Analysis and Estimation of The US Oil ProductionДокумент1 страницаAnalysis and Estimation of The US Oil ProductionEduardo PetazzeОценок пока нет

- México, PBI 2015Документ1 страницаMéxico, PBI 2015Eduardo PetazzeОценок пока нет

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Документ1 страницаCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeОценок пока нет

- U.S. Employment Situation - 2015 / 2017 OutlookДокумент1 страницаU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeОценок пока нет

- India 2015 GDPДокумент1 страницаIndia 2015 GDPEduardo PetazzeОценок пока нет

- U.S. New Home Sales and House Price IndexДокумент1 страницаU.S. New Home Sales and House Price IndexEduardo PetazzeОценок пока нет

- Singapore - 2015 GDP OutlookДокумент1 страницаSingapore - 2015 GDP OutlookEduardo PetazzeОценок пока нет

- South Africa - 2015 GDP OutlookДокумент1 страницаSouth Africa - 2015 GDP OutlookEduardo PetazzeОценок пока нет

- U.S. Federal Open Market Committee: Federal Funds RateДокумент1 страницаU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeОценок пока нет

- Japan, Population and Labour Force - 2015-2017 OutlookДокумент1 страницаJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeОценок пока нет

- US Mining Production IndexДокумент1 страницаUS Mining Production IndexEduardo PetazzeОценок пока нет

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesДокумент1 страницаUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeОценок пока нет

- Mainland China - Interest Rates and InflationДокумент1 страницаMainland China - Interest Rates and InflationEduardo PetazzeОценок пока нет

- China - Power GenerationДокумент1 страницаChina - Power GenerationEduardo PetazzeОценок пока нет

- Highlights in Scribd, Updated in April 2015Документ1 страницаHighlights in Scribd, Updated in April 2015Eduardo PetazzeОценок пока нет

- European Commission, Spring 2015 Economic Forecast, Employment SituationДокумент1 страницаEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeОценок пока нет

- Brazilian Foreign TradeДокумент1 страницаBrazilian Foreign TradeEduardo PetazzeОценок пока нет

- US - Personal Income and Outlays - 2015-2016 OutlookДокумент1 страницаUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeОценок пока нет

- Chile, Monthly Index of Economic Activity, IMACECДокумент2 страницыChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeОценок пока нет

- South Korea, Monthly Industrial StatisticsДокумент1 страницаSouth Korea, Monthly Industrial StatisticsEduardo PetazzeОценок пока нет

- United States - Gross Domestic Product by IndustryДокумент1 страницаUnited States - Gross Domestic Product by IndustryEduardo PetazzeОценок пока нет

- Japan, Indices of Industrial ProductionДокумент1 страницаJapan, Indices of Industrial ProductionEduardo PetazzeОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- I Could Easily FallДокумент3 страницыI Could Easily FallBenji100% (1)

- Relation of Sociology with other social sciencesДокумент4 страницыRelation of Sociology with other social sciencesBheeya BhatiОценок пока нет

- David Freemantle - What Customers Like About You - Adding Emotional Value For Service Excellence and Competitive Advantage-Nicholas Brealey Publishing (1999)Документ312 страницDavid Freemantle - What Customers Like About You - Adding Emotional Value For Service Excellence and Competitive Advantage-Nicholas Brealey Publishing (1999)Hillary Pimentel LimaОценок пока нет

- 4 5895601813654079927 PDFДокумент249 страниц4 5895601813654079927 PDFqabsОценок пока нет

- LEGAL STATUs of A PersonДокумент24 страницыLEGAL STATUs of A Personpravas naikОценок пока нет

- Madagascar's Unique Wildlife in DangerДокумент2 страницыMadagascar's Unique Wildlife in DangerfranciscogarridoОценок пока нет

- Love in Plato's SymposiumДокумент31 страницаLove in Plato's Symposiumac12788100% (2)

- Evoe Spring Spa Targeting Climbers with Affordable WellnessДокумент7 страницEvoe Spring Spa Targeting Climbers with Affordable WellnessKenny AlphaОценок пока нет

- Global GovernanceДокумент20 страницGlobal GovernanceSed LenОценок пока нет

- Apola Ose-Otura (Popoola PDFДокумент2 страницыApola Ose-Otura (Popoola PDFHowe JosephОценок пока нет

- January: DiplomaДокумент24 страницыJanuary: DiplomagwzglОценок пока нет

- Masters of Death: The Assassin ClassДокумент5 страницMasters of Death: The Assassin Classjbt_1234Оценок пока нет

- Lana Del Rey NewestДокумент11 страницLana Del Rey NewestDorohy Warner MoriОценок пока нет

- W220 Engine Block, Oil Sump and Cylinder Liner DetailsДокумент21 страницаW220 Engine Block, Oil Sump and Cylinder Liner DetailssezarОценок пока нет

- English 2Документ53 страницыEnglish 2momonunu momonunuОценок пока нет

- IAS 8 Tutorial Question (SS)Документ2 страницыIAS 8 Tutorial Question (SS)Given RefilweОценок пока нет

- The Emergence of India's Pharmaceutical IndustryДокумент41 страницаThe Emergence of India's Pharmaceutical Industryvivekgupta2jОценок пока нет

- PersonalDevelopment Q1 Module 2Документ7 страницPersonalDevelopment Q1 Module 2Stephanie DilloОценок пока нет

- Ass. No.1 in P.E.Документ8 страницAss. No.1 in P.E.Jessa GОценок пока нет

- PeripheralДокумент25 страницPeripheralMans FansОценок пока нет

- SWSP6033 00 2022T3 V1.0-1Документ14 страницSWSP6033 00 2022T3 V1.0-1ayman.abaidallah1990Оценок пока нет

- Alberta AwdNomineeDocs Case Circle BestMagazine NewTrailSpring2016Документ35 страницAlberta AwdNomineeDocs Case Circle BestMagazine NewTrailSpring2016LucasОценок пока нет

- FeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Документ45 страницFeistGorman - 1998-Psychology of Science-Integration of A Nascent Discipline - 2Josué SalvadorОценок пока нет

- Operations Management Dr. Loay Salhieh Case Study #1: Students: Hadil Mosa Marah Akroush Mohammad Rajab Ousama SammawiДокумент6 страницOperations Management Dr. Loay Salhieh Case Study #1: Students: Hadil Mosa Marah Akroush Mohammad Rajab Ousama SammawiHadeel Almousa100% (1)

- It - Unit 14 - Assignment 2 1Документ8 страницIt - Unit 14 - Assignment 2 1api-669143014Оценок пока нет

- Promotion From Associate Professor To ProfessorДокумент21 страницаPromotion From Associate Professor To ProfessorKamal KishoreОценок пока нет

- Restructuring ScenariosДокумент57 страницRestructuring ScenariosEmir KarabegovićОценок пока нет

- Food Processing & ClassificationДокумент3 страницыFood Processing & ClassificationAzrielle JaydeОценок пока нет

- HDFDJH 5Документ7 страницHDFDJH 5balamuruganОценок пока нет

- 13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsДокумент14 страниц13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsWillSmathОценок пока нет