Академический Документы

Профессиональный Документы

Культура Документы

Final CRM Anshul 2

Загружено:

Samuel DavisОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Final CRM Anshul 2

Загружено:

Samuel DavisАвторское право:

Доступные форматы

DISSERTATION REPORT

ON

CUSTOMER RELATIONSHIP MANAGEMENT

STRATEGIES AND ITS IMPLICATION- A STUDY OF

SOME SELECTED INSURANCE ORGANISATION IN

DEHRADUN

SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS

FOR THE MASTERS DEGREE IN BUSINESS ADMINISTRATION

OF

UTTARAKHAND TECHNICAL UNIVERSITY, DEHRADUN

SUBMITTED TO: SUBMITTED BY:

Mrs. Amita Sharma Anshul Bhatt

(FACULTY GUIDE) M.B.A.-4 Sem

UTTARANCHAL INSTITUTE OF TECHNOLOGY

PREMNAGAR, DEHRADUN (U.K.)

BATCH (2012-2014)

CERTIFICATE

I have the pleasure in certifying that Mr. Anshul Bhatt is a bonafide student of

IVth Semester of the Masters Degree in Business Administration (Batch 2012-

2014), of Uttaranchal Institute of Technology, Dehradun under Uttarakhand

Technical University.

He has completed his dissertation report entitled CUSTOMER

RELATIONSHIP MANAGEMENT STRATEGIES AND ITS

IMPLICATION- A STUDY OF SOME SELECTED INSURANCE

ORGANISATION IN DEHRADUN under my guidance.

I certify that this is his/her original effort & has not been copied from any other

source. This project has also not been submitted in any other Institute /

University for the purpose of award of any Degree.

This project fulfils the requirement of the curriculum prescribed by this Institute

for the said course. I recommend this project work for evaluation &

consideration for the award of Degree to the student.

Signature :

Name of the Guide : Mrs. Amita Sharma

Designation :

Date :

ACKNOWLEDGEMENT

Every study requires a guidance of someone who is working in that field. Firstly

I would like to thank Director Sir Dr. Pradeep Suri for providing an opportunity

of preparing a Project Report and allowing to use the resources of the

institution during this project.

I am extremely thankful to my Project Guide Mrs. Amita Sharma ,for her

precious guidance regarding the preparation of the dissertation . Her guidance

has proved to be useful and without him, the preparation of this report might not

have been possible.

I am also thankful to the other faculty members of UIM for extending their

valuable support for this project.

I also extend my sincere thanks to the Respondents, who helped me during the

course of project and for their gracious attitude.

I would like to take this opportunity to extend my warm thoughts to those who

helped me in making this project a wonderful experience.

Anshul Bhatt

TABLE OF CONTENT

CHAPTER 1

INTRODUCTION

COMPANY PROFILE

SIGNIFICANCE OF THE STUDY

LIMITATION OF THE STUDY

CHAPTER 2

LITERATURE REVIEW

CHAPTER 3

OBJECTIVES OF THE STUDY

SCOPE OF THE STUDY

RESEARCH METHODOLOGY

SOURCES OF DATA

SAMPLE SIZE

METHOD OF SAMPLING

o AREA OF WORK

PARAMETERS OF STUDY

o TOOLS

CHAPTER 4

DATA ANALYSIS AND INTERPRETATION

RESEARCH FINDINGS

CONCLUSION

RECOMMENDATION

REFERENCES

APPENDIX

INTRODUCTION

Customer relationship management is an imperative measure in any service

sector. It is the main tool in marketing management to acquire more numbers of

customers and to create one to one interaction with transparency and honesty.

Today the companies have to move from managing a market, to managing

specific customers. But managing the customers and retaining them for long

time is not easy task in a competitive market. Besides coping with changing

psychology, preferences and needs of the customers is becoming challenging

one. So the business organizations now a day are taking the help of data base

management system for customer retention and e-CRM is the out come of such

system. The requirement of relationship marketing is prominent in the service

sectors especially in Indian market to create trust and valuable strategic

customer care. This will definitely raise the concept of customer relationship

management for long term relationship and value added service. This study will

focus on CRM application for insurance sector related to their communicating

channels for customers, customer satisfaction and customer retention. Insurance

is an upcoming sector, in India the year 2000 was a landmark year for life

insurance industry. In this year the life insurance industry was liberalized after

more than 50 years. Insurance sector was once a monopoly, with LIC as the

only company, a public sector enterprise. But now-a-days the market is opened

up and there are many private players competing in the market. There are above

30 private life insurance companies have entered the industry. After the entry of

these private players, the market share of LIC has been considerably reduced. In

the last five years the private players are able to expand the market (growing at

30% per annum) and also have improved their market share to above 18%.For

the past five years private players have launched many innovations in the

industry in terms of products, market channels and advertisement of product,

agent training and customer services etc.

In todays dynamic environment, the insurance industry has witnessed many

spectacular changes in terms of advancement in technology, strengthening of

the existing customer base and acquiring new customers. In this age of

information and uncertainty, more and more people have started recognising the

importance of insurance. However, the present situation in the insurance

industry is characterised by complexity and competitive situations. At present,

insurance industry is one of the leading industry in India. There are about 30

players operating in both life and non-life segments and one is reinsurer. Today,

the main challenge before insurance companies is the attraction and retention of

customers to its various policies.

On a global scale a number of insurers are competing and offering the

customers a plethora of products. The knowledge-savvy customer is demanding

greater flexibility and better service from the service providers. For the

insurance companies to survive competition, succeed and profit, there is only

one option to learn from and actively respond to customer expectations.

Insurers are focusing on retaining customers by analyzing, understanding and

predicting customer behavior and improving sales efforts.

In the Indian context, since the 90s, successive governments have embarked on

ushering in liberalization to keep pace with a rapidly changing global scenario.

The doors for private participation were opened in a number of sensitive sectors,

insurance being one of them. For the past few decades, insurance was looked

upon as a plain vanilla tax-saving investment product.

Currently, the Insurance Industry is in a state of change where today's industry

field is becoming extremely complex and more competitive. As the industry

continues to search for growth, obtaining clients has become difficult due to

large market share ownership by the big insurance providers. Economic

downturn is making it a problem to realize top-line growth, placing a higher

emphasis on improving profits by way of cost management. It seems like today,

anyone who is able to form some sort of insurance products, is. They are

marketing, selling it, and in turn creating even more competition. Banks have

begun to become the main cause of this new insurance surge, and there are a

larger percentage of people out there buying this insurance that really is not as

beneficial as buying coverage from a true insurance carrier. Today's customer is

capable of doing their own research on the Internet, comparing who is the best

buy for the right amount of money, adding to the increases pressure of reaching

target margins, return of equity and capture the wanted market share.

Compounding the problem over all of this is the recent blast of mergers and

acquisitions, which have taken place. Regulations have also impacted how

business is run, causing the insurance world to be additionally complicated. The

sluggish economy, regulatory changes and the ever changing state of transitions

technologies are in, is reshaping the insurance industries dynamics.Insurance

organizations have now found themselves caught in the race to continually

enhance products, adjust to new challenges, while trying to use this change as

an opportunity. These once 'product-centric' business's are finding the need to

turn into a 'customer-centric' operation in the attempt to achieve business goals,

retain customer retention, reduce operation costs, to hopefully in the end see

some revenue growth. This transition can seem straightforward, but is a

substantial implementation requiring good preparation and careful planning. It

seems that to become and remain customer centric, success can only be found

when supported by the right, on demand, enterprise-wide, small business CRM

(customer relationship management) deployment. Customers have made service

an issue for Insurance organizations, and to support your customers with

everything they need to be and stay satisfied is a huge challenge on top of all the

ones mentioned above.The difficulty of providing quality service in order to set

themselves apart from competitors is a challenging task because of the low

frequency of client interactions due to the nature of insurance products. The

need now is to make every interaction with the client count become important

because of the direct correlation with the bottom line impact it creates.Today, in

order to gain the needed knowledge and comprehensive view of small business

to better manage customers, brokers and agents, the insurance leaders are

swiftly and aggressively deploying small business CRM solutions that have

been specifically tailored to meet the needs of the insurance company. These

insurers are looking for small business CRM implementations that are designed

to help them reach small business goals, improve client retention and lower

costs across the board, while remaining efficient. The undisputed need to find a

flexible tool that is easy to utilize to support small business operations, create

opportunities to leverage and integrate the future's technology is a top concern.

Insurance is a complex product where personalized service-achieved through an

intimate knowledge of customers and their histories with an insurance

company-is critical to making sales. As insurance options broaden and products

grow more complex, customers seek superior, personalized service more than

ever. Most insurance companies understand the virtues of a single, complete,

real-time enterprise view of individual customers, and they have made great

progress towards providing this view at customer touch-points throughout the

enterprise. But it's critical to note that this view should not be regarded as an

end in and of itself-rather, it is a rich foundation to be used as a basis for a

deeper, more advanced level of customer understanding. Customer Relationship

Management is a comprehensive strategy and process of acquiring, retaining

and partnering with selective customers to create superior value for the

company and the customer. In an organization relationships exist between

employees, clients, customers, citizens and enterprise itself. An organization

could succeed only if it implements the strategy of CRM in right manner. CRM

helps businesses use technology and human resources to gain insight into the

behavior of customers and the value of those customers. There are many aspects

of CRM which were mistakenly thought to be capable of being implemented in

isolation from each other. From the outside of the organization, a customer

experiences the business as one entity operating over extended periods of time.

Thus piecemeal CRM implementation can come across to the customer as

unsynchronized where employees and web sites and services are acting

independently of one another, yet together represent a common entity.

With the repeal of the Glass-Steagal Act in 1999, insurance companies face

increased competition from banks and brokerages. With the enactment of the

Patriot Act, insurance companies need to ensure that they "know their customs."

To maintain competitive edge and viability, insurance companies are focusing

intently on delivering superior customer service. A comprehensive customer

relationship management (CRM) strategy addresses three imperatives: Sum

providing a unified enterprise customer view; Sum retaining customers with

great services; and Sum controlling costs as the insurance company in question

expands.

HOW CAN CRM HELP INSURANCE COMPANIES?

CAMPAIGN MANAGEMENT- Companies need to identify customers, tailor

products and services to meet their needs and sell these products to them. CRM

achieves this through Campaign Management by analyzing data from

company's internal applications or by improving data from external applications

to evaluate customer profitability and designing comprehensive customer

profiles, they can identify the most lucrative customers and customer segment,

and execute targeted, personalized multi-channel marketing campaigns to reach

these customers and maximize the lifetime value of those relationships.

CUSTOMER INFORMATION CONSOLIDATION- Instead of customer

information being stored in product centric silos, with CRM the information is

stored in a customer centric manner covering all the services/products of the

company. CRM integrates various channels to deliver a host of services to

customers, while aiding the functioning of the company.

MARKETING ENCYCLOPEDIA- Central repository for products, pricing

and competitive information as well as internal training material, sales

presentations, proposal templates and marketing collateral.

360-DEGREE VIEW OF COMPANY- This means whoever the employees

speak to, irrespective of whether the communication is from sales, finance or

support, the company is aware of the interaction. Removal of inconsistencies of

data makes the client interaction processes smooth and efficient, thus leading to

enhanced customer satisfaction.

PERSONALIZED SALES HOME PAGE- CRM can provide a single view

where sales managers and agents can get all the most up-to-date information in

one place, including opportunity, account, and news and expense report

information. This would make sales decision fast and consistent.

LEAD AND OPPORTUNITY MANAGEMENT- This enable organizations

to effectively manage leads and opportunities and track the leads through deal

closure, the required follow-up and interaction with the prospects.

ACTIVITY MANAGEMENT- It helps managers to assign and track the

activities of various members. Thus improved transparency leads to improved

efficiency.

CONTACT CENTER- It enables customer service agent uniform service

across multiple channels such as phone, Internet, Email & Fax.

OPERATIONAL INEFFICIENCY REMOVAL- CRM can help in strategy

formulation to eliminate current operational inefficiencies. An effective CRM

solution supports all channels of customer interaction including telephone, fax,

e-mail, the online portals, wireless devices, and face-to-face contacts with

company personnel. It also links these customer touch points to an operations

center and connects the operations center with relevant internal and external

business partners. 10.

ENHANCED PRODUCTIVITY- CRM can help in enhanced productivity of

customers, partners and employees.

CRM WITH BUSINESS INTELLIGENCE- Companies need to analyze the

performance of customer relationships, uncover trends in customer behavior,

and understand the true business value of their customers. CRM with business

intelligence allows companies to assess customer segments, which help them

calculate the net present value (NPV) of a customer segment over a given period

to derive customer lifetime value. Customer can be evaluated within a scoring

framework. Combining the behavior

How CRM Meets the Insurance Industries Needs

So most insurers now are automated or in the process of becoming so, but these

systems are still geared towards being product-centric. They can meet the call

for claims management, billing, policy admin, actuary systems and so on, but

are falling short in the capability to be customer-centric. Not being fully

integrated in all of the small business processes, companies cannot improve

efficiencies, resolution times or accuracy of responses. Many years have gone

by where insurance businesses believed that customer management was directly

connected with service delivery and paying broker commissions on time. No

longer is this infrastructure sufficient enough to support a pure customer centric

operation. The forward thinking insurance companies have started to realize

small business CRM ventures are the catalyst to delivering the high quality

service clients are looking for and reduce operation costs all at once. Small

business CRM has become a very powerful tool in the goals to satisfy current

customers and win over new ones. Nothing else directly affects loyalty or the

ability to consolidate accounts like relationship building activities. If you

implement an operational small business CRM solution, well-defined,

quantifiable effects will happen to the institution that is choosing this as a

strategy.

There are four crucial customer centric areas that will be affected by a small

business CRM solution, creating long-term relationships.

porated, multi-channel services and sales

Importance of CRM:

The focus in CRM is not to try to mold the customers to the companys goals

but to listen to the customers and trying to create opportunities beneficial to

each. It is important to offer customers what they are currently demanding and

anticipating and what they are likely to demand in the future. This can be

achieved by providing a variety of existing access channels for customers, such

as e-mail, telephone and fax, and by preparing future access channels such as

wireless communication.

Provides Greater efficiency and cost reduction: Data mining, which is the

analysis of data for exploring possible relationships between sets of data, can

save valuable human resources. Integrating customer data into a single database

allows marketing teams, sales forces, and other departments within a company

to share information and work towards common corporate objectives using the

same underlying statistics (epiphany.com, 2001).

Improved customer service and support: An E-CRM system provides a

single repository of customer information. This enables a company to serve

according to customer needs quickly and efficiently at all potential contact

points, eliminating the customers frustrating and time-consuming hunt for

help (epiphany.com, 2001a).

More effective marketing: Having detailed customer information from an E-

CRM system allows a company to predict the kind of products that a customer

is likely to buy as well as the timing of purchases. In the short to medium term,

this information helps an organization to create more effective and focused

marketing/sales campaigns designed to attract the desired customer audience

(epiphany.com, 2001). ECRM allows for more targeted campaigns and tracking

of campaign effectiveness. Customer data can be analyzed from multiple

Perspectives to discover which elements of a marketing campaign had the

greatest impact on sales and profitability (Greenberg, 2001). In addition,

customer segmentation can improve marketing efforts. Grouping customers

according their need similarities allows a company to effectively market

specific products to members of the group.

Increasing Market Share: Customer relationship management techniques are

also used to increase the overall market share of the business. Essentially,

treating customers well adds to the value of the business products and services.

If the business impresses customers, it tends to attract more people, increasing

its pool of customers. Loyal customers will then attract others through word of

mouth.

Online Business: Online business is a popular and often necessary component

for many companies; the CRM tool can be responsible to respond the customers

who are trying to purchase the products through online.

FIVE KEY STRATEGIES WITH CRM

But what exactly does CRM enable and what are the potential benefits? While

there are surely many approaches being espoused in the market today, we

believe there are five main strategies that companies can employ to survive and

thrive during uncertain economic conditions:

1. Focus on existing customers

2. Maximize revenue opportunities

3. Do more with less

4. Reduce operational costs

5. Optimize existing IT assets

BAJAJ AND CRM

Customer portal

Pay online renewal premium

Fund switch and apportionment

Download account statement

Make partial withdrawal

Download it certificates

View all previous transaction details

Download previous online payment receipt

Change premium frequency

Change address request

Online customer service desk

1. They can download various policy servicing and claim forms

2. Life insurance customer can check NAV history and performance of all

funds

3. The customer can raise their grievance online

4. Bajaj alianz health insurance customer can view details network hospital

5. A gprs enabled app also helps them to locate the closet bajaj Allianz

branches

Customer focus unit

The CRM system has been customized to guide the CSE to most

appropriate answer for queries raise by customers/business partners

Every inbound call is passed through a verification process before

providing any information to the customer

Language based auto routing of call based on the customers preferred

language

Mobile application

Insurance on the move is a mobile app developed by bajaj Allianz for its

customers. with the insurance app one can manage the life insurance policy any

time any where .

ICICI AND CRM

ICICI prudential; ICICI prudential has ambitious plans for its retail business

and has implemented the CRM software by the help of SAS and Teradata

solutions. It is implementing various modules of CRM to establish world class

CRM practices for the sake of better customer relationship management. ICICI

prudential life insurance company is using the CRM project properly by

integrating front office, back office and the analytical system.

The bank currently has the ability to process 0.27 million cheques per day and

Manage 7000 concurrent users.

The bank has successfully leveraged the power of Finacle and has deployed the

solution in the areas of core banking, consumer e-banking, corporate e-banking

and CRM. With Finacle, ICICI Bank has also gained the flexibility to easily

develop new products targeted at specific segments such as ICICI Bank Young

Stars- a product targeting children, Women's Account addressing working

women and Bank@campus targeting students

Call centers

ICICI Bank is certainly juggling some interesting numbers. Its Bombay call

centre handles 25 different products, for 10 million customers, with 620

positions. Now ICICI Banks branch network handles less than half of all

transactions a shift which has taken an axe to the companys costto- serve.

ICICI appreciated early on that by centralizing their service infrastructure, and

centralizing their service expertise, they created a new level of service for

customers. The call centre has played a leading role in transforming the banks

value proposition for its customers: The call centre also provides an opportunity

to shift the qualitative nature of the relationship between bank and customer to a

new level. Much of the extra leverage with customers that the call centre brings

is tactical. A customer is a lot more receptive to up selling and cross selling

when theyre phoning ICICI. The humble call centre is ICICI Banks means of

shifting away from a market share based product-as-commodity mindset, to

those stresses the importance of deepening exiting customer relationship.

E-marketing

The e-initiatives of the ICICI group have not been limited to customer servicing.

The marketing activities for its various products are also taking the online route.

In April 2000, through tie-ups with Orange and Airtel, ICICI started offering

limited WAP based services for customers on the move. A month later, on its

way towards a full-fledged online mobile commerce service, the company

commenced offering services like balance updation, request for cheque book,

details of last 5 transactions, request for statement etc. Corresponding services

are also available for the banks credit card customers. On the anvil are personal

banking services, payment services for utilities, travel and ticketing information

etc.

The processes for delivering CRM-The tools and the processes are as follow

Customer application form

Centralized software where the whole data is collected.

Wide range of offering

Cross selling and

Feedback forms

OBJECTIVE OF CRM

CRM is an organizational strategy to develop mutually profitable life

long relationship with the customer

The primary objective of CRM are to build and maintain a base of

committed customer who are profitable for the organization

Use technology and human resources to understand the need and behavior

of present and potential customers

Acquire, retain and establish mutually rewarding one to one relationship

with customer

Provide better customer service to customer

Identify high value customer so that the organization can serve them

better with differential service

Increase customer revenues by cross selling and up selling

Simplify marketing and sales processes

Collect customer information at all possible points and making this

information available to the entire organization

NEED OF CRM IN INSURANCE INDUSTRY

Insurance products are becoming more commoditized

Presence of numerous players

Advertising efforts are being countered by comparison portals, insurance

advisors and corporate alignments

A large share of business is driven through intermediaries where

information challenges exist for effective management

Companies continue to face stiff revenue targets spread across too many

stakeholders

Stakeholders struggle to deal with too many processes, system and

geographies

Speedy documentation and processes at the time of issue of policies

Prompt redressal of customer grievance

COMPANY PROFILE

Bajaj Allianz General Insurance Company Limited

Bajaj Allianz General Insurance Company Limited is a joint venture between

Bajaj Finserv Limited (recently demerged from Bajaj Auto Limited) and Allianz

SE. Both enjoy a reputation of expertise, stability and strength.

Bajaj Allianz General Insurance received the Insurance Regulatory and

Development Authority (IRDA) certificate of Registration on 2nd May, 2001 to

conduct General Insurance business (including Health Insurance business) in

India. The Company has an authorized and paid up capital of Rs 110 crores.

Bajaj Finserv Limited holds 74% and the remaining 26% is held by Allianz, SE.

As on 31st March 2013 Bajaj Allianz General Insurance maintained its premier

position in the industry by achieving growth as well as profitability. Bajaj

Allianz has made a profit before tax of Rs.421 Crores and has become the only

private insurer to cross the Rs.100 crore mark in profit before tax in the last two

years. The profit after tax was Rs.295 Crores, 138.5% higher than the previous

year.

Bajaj Allianz today has a countrywide network connected through the latest

technology for quick communication and response in over 200 towns spread

across the length and breadth of the country. From Surat to Siliguri and Jammu

to Thiruvananthapuram, all the offices are interconnected with the Head Office

at Pune

Vision

To be the first choice insurer for customers

To be the preferred employer for staff in the insurance industry

To be the number one insurer for creating shareholder value

Mission

As a responsible, customer focused market leader, we will strive to understand

the insurance needs of the consumers and translate it into affordable products

that deliver value for money.

A Partnership Based on Synergy

Bajaj Allianz General Insurance offers technical excellence in all areas of

General and Health Insurance as well as Risk Management. This partnership

successfully combines Bajaj Finserv's in-depth understanding of the local

market and extensive distribution network with the global experience and

technical expertise of the Allianz Group. As a registered Indian Insurance

Company and a capital base of Rs. 110 crores, the company is fully licensed to

underwrite all lines of general insurance business including health insurance.

Our Achievements

Bajaj Allianz has received iAAA rating, from ICRA Limited, an associate of

Moody's Investors Service, for Claims Paying ability. This rating indicates

highest claims paying ability and a fundamentally strong position.

Bajaj Allianz General Insurance has received the prestigious "Business Leader

in General Insurance", award by NDTV Profit Business Leadership Awards

2008. The company was one of the top three finalists for the year 2007 and

2008 in the General Insurance Company of the Year award by Asia Insurance

Review.

OUR CORE VALUE

Bajaj Finserv Limited

Bajaj Finserv Limited has been recently demerged from Bajaj Auto Limited

which is the largest manufacturer of two and three-wheelers in India. As a

promoter of Bajaj Allianz General Insurance Company Ltd., Bajaj Finserv Ltd;

has the following to offer:-

Vast distribution network through its group companies.

Knowledge of Indian consumers.

Financial strength and stability to support the insurance business.

Allianz SE, Germany

Allianz SE is in the business of General (Property & Casualty) Insurance; Life

& Health Insurance and Asset Management and has been in operation for over

110 years. Allianz is one of the largest global composite insurers with

operations in over 70 countries. Further, the Group provides Risk Management

and Loss Prevention Services. Allianz has insured most of the world's largest

infrastructure projects (including Hong Kong Airport and Channel Tunnel

between UK and France), further Allianz insures majority of the fortune 500

companies. Besides being a large industrial insurer, Allianz has a substantial

portfolio in the commercial and personal lines sector, using a wide variety of

innovative distribution channels.

Allianz SE has the following to offer Bajaj Allianz General Insurance Company

Ltd:-

Set up and running of General insurance operations

New and improved international products

One of the world's leading insurance companies

More than 700 subsidiaries and 2 lac employees in over 70 countries

worldwide

Provides insurance to almost half the Fortune 500 companies

Technology

Other similar businesses

The promoters have also incorporated a Life insurance Company in India, called

Bajaj Allianz Life Insurance Company Limited to provide life insurance

solutions.

Visit Bajaj Allianz Life Insurance

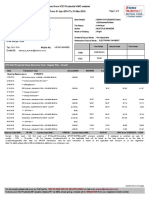

FINANCIAL HIGHLIGHT

Particulars

2012-13

Rs.

Millions

2011-12

Rs.

Millions

2010-11

Rs.

Millions

2009-10

Rs.

Millions

2008-09

Rs.

Millions

2007-08

Rs.

Millions

2006-07

Rs.

Millions

2005-06

Rs.

Millions

2004-05

Rs.

Millions

Gross Written

Premium

41094 36759 31294 27249 28662 25780 18033 12846 8561

Net Written

Premium

32031 26957 23105 19717 20066 17526 10398 6987 4793

Net Earned

Premium

29243 24747 21497 18842 18913 14154 8385 5864 3709

Net Incurred

Claims

-21181 -19079 -17013 -13866 -13599 -9457 -5556 -4100 -2263

Net

Commissions

-991 -747 -404 -318 -238 188 786 622 419

Management

Expenses

-7687 -6722 -6461 -5485 -5988 -5195 -3454 -2156 -1456

Underwriting

Results

-617 -1777 -2193 -502 -727 -210 254 230 409

Income from

Investments

4877 3726 2793 2207 2061 1896 895 520 389

Non Recurring

Investment

Income

-45 -9 20 93 164 -7 21 68 29

Profit Before

Tax

4215 1940 619 1798 1498 1679 1170 818 770

Provision for

Tax

1265 -703 -186 -590 -546 -623 -417 -303 -299

Profit After Tax 2951 1237 433 1208 952 1056 754 516 471

Claim's Ratio 72% 77% 79% 74% 72% 67% 66% 70% 61%

Commission 3% 3% 2% 2% 1% -1% -9% -11% -11%

Ratio

Management

Expenses Ratio

26% 27% 30% 29% 32% 36% 41% 37% 40%

Combined Ratio 102% 107% 111% 104% 105% 102% 98% 96% 90%

Return on

Equity

27% 14% 5% 16% 15% 23% 22% 23% 34%

Shareholder's

Equity

12553 9587 8356 7928 6725 5748 4116 2,767 1824

Assets Under

Management

56818 46088 38523 27456 23683 20103 14305 7973 6127

Number of

Employees

3582 3473 3654 3506 3973 3603 2540 1371 924

Best Insurance Company in the Private Sector 2014

Bajaj Allianz General Insurance has won the award for "Best Insurance

Company in the Private Sector - General" by ABP News - Banking, Financial

Services & Insurance Awards.

The BFSI Awards 2014 recognizes the best performances of various Banking,

Finance & Insurance Services. The award focuses on the best practices in the

BFSI Industry based on their strategy, security, customer service, and the future

technology challenges and innovations. This award recognizes our

organizational values and contribution.

Claims Awards Asia 2013

Bajaj Allianz General Insurance has won the Claims Awards Asia 2013 in the

category Claims Innovation of the Year in the Asia Pacific Region for its Tablet

based claims module application.

This award is instituted by Insurance Insight, a prominent Insurance magazine

in Asia and a part of Post, UK. Insurance Insight's Claims Club Asia, is an

award that recognizes the Asian general insurance claims and risk management

sectors by rewarding the dedicated teams and individuals for their achievements

over the last 12 months.

General Insurance Company of the Year 2013

The Indian Insurance Awards 2013 was conducted by Fintelekt, part of SP

Media Pvt Ltd, a specialist in research, consulting and conferences in the

financial services industry.

Claims Service Company of the Year 2013

The Indian Insurance Awards 2013 was conducted by Fintelekt, part of SP

Media Pvt Ltd, a specialist in research, consulting and conferences in the

financial services industry.

Personal Lines Growth Leadership Award Year 2013

The Indian Insurance Awards 2013 was conducted by Fintelekt, part of SP

Media Pvt Ltd, a specialist in research, consulting and conferences in the

financial services industry.

General Insurance Provider of the Year

General Insurance Provider of the Year at the Money Today FPCIL Awards

2012

Best General Insurance Provider- Private Sector

Best General Insurance Provider- Private Sector at the CNBC TV18 India Best

Bank and Financial Institution Award FY 11 and 12.

Bajaj Allianz General Insurance Co. Ltd.

Head Office:

Add. : GE Plaza 1 st Floor, Airport Road, Yerawada,Pune 411006

Tel : +91-020-66026666

Fax : +91-020-66026667

Email : info@bajajallianz.co.in

Putting Motor Insurance on the right track

One important parameter that has always differentiated insurers is service. Be it

during the period when the tariff based regime

was going out of phase or now when a new de-tariff scenario is emerging, this is

one parameter which has always remained the same. At Bajaj Allianz, we have

always believed in delivering quality service to our clients. This philosophy has

spawned several initiatives. Some of them are as below:

1. Bajaj Allianz pioneered the cashless model in motor repair claims by

tying up with over 1800 garages/ workshops across India. This enabled our

customers to simply drive-in and drive-out of a garage after paying the nominal

difference of admissible claims

2. Bajaj Allianz is still the only company to automate SMS alerts on the

progress of the claims status to its customers. Four to five SMS alerts are sent

from the time the claim is registered to the issuance of final claim cheque. This

unique service is being offered only by Bajaj Allianz General Insurance to all

its motor insurance clients (provided they have registered their cell numbers).

It delivers total transparency to claims process

Bajaj Allianz Mobile Settlement (BAMS) was recently launched whereby the

claim assessment and payment is made at the customer's doorstep. The

process followed is simple - the customer intimates a claim, the in-house

service engineer armed with all necessary accessories reaches the customer's

doorstep to assess and pay the claim cheque onthe-spot. In addition to this,

suitable advice is given to choose good workshop/ garage and to help resolve

the problem then and there itself. This approach shortens the claim settlement

process and helps in addressing the proble m at an emotional level also. In

most of the cases, the claim cheque is issued on the same day. The service has

been rolled out in all the prominent cities where the company has its offices

4.Bajaj Allianz Drive-In Centre (BADIC), is yet another initiative launched by

the company. Here, the customer is required to drive the vehicle to the

designated office where the in-house service engineer assesses the claim and

the claim cheque is paid instantly.In both of these services, the customers are

at an advantageous position. They get the claim instantly and besides that they

have the liberty to bargain the best price with a workshop or garage of their

choice

5. Bajaj Allianz offers adequate assistance services to its customers during the

claim process. They can call the 24x7 call centre for on-the-spot assistance.

Depending on the nature of the claim, assistance is accordingly provided to

help with and coordinate any claim procedure that the customer may require

on the spot.

6.The company ensures total transparency throughout the claim settlement

procedure. In case of a cashless settlement, a Claim Amount Confirmation

(CAC) sheet is sent to the customer to inform the rates charged under various

heads. This is to ensure that the customer is not conned by the workshop/

garage. In case the workshop/ garage refuses cashless mode, the company

makes an up-front payment of at least 75% of the admissible claim. The

balance is paid after the survey is completed

ICICI PRUDENTIAL LIFE INSURANCE

OVERVIEW

ICICI Prudential Life Insurance Company is a joint venture between ICICI

Bank, a premier financial powerhouse, and Prudential plc, a leading

international financial services group headquartered in the United Kingdom.

ICICI Prudential was amongst the first private sector insurance companies to

begin operations in December 2000 after receiving approval from Insurance

Regulatory Development Authority (IRDA).

ICICI Prudential Life's capital stands at Rs. 4,793 crores (as of March 31, 2013)

with ICICI Bank and Prudential plc holding 74% and 26% stake respectively.

For the financial year 2013, the company has garnered total premium of Rs

13,538 crores. The company has assets held over Rs. 77,393.09 crores as on

December 31, 2013.

For the past decade, ICICI Prudential Life Insurance has maintained its

dominant position (on new business retail weighted basis) amongst private life

insurers in the country, with a wide range of flexible products that meet the

needs of the Indian customer at every step in life.

Vision & Values

Our vision:

To be the dominant Life, Health and Pensions player built on trust by world-

class people and service.

This we hope to achieve by:

Understanding the needs of customers and offering them superior products and

service

Leveraging technology to service customers quickly, efficiently and

conveniently

Developing and implementing superior risk management and investment

strategies to offer sustainable and stable returns to our policyholders

Providing an enabling environment to foster growth and learning for our

employees

And above all, building transparency in all our dealings

The success of the company will be founded in its unflinching commitment to 5

core values -- Integrity, Customer First, Boundaryless, Humility and Passion.

Each of the values describe what the company stands for, the qualities of our

people and the way we work.

We do believe that we are on the threshold of an exciting new opportunity,

where we can play a significant role in redefining and reshaping the sector.

Given the quality of our parentage and the commitment of our team, there are

no limits to our growth.

Our values :

Every member of the ICICI Prudential team is committed to 5 core values:

Integrity, Customer First, Boundaryless, Humility, and Passion. These values

shine forth in all we do, and have become the keystones of our success.

AWARDS

ICICI Prudential Life Insurance has been pronounced winner in the 2nd

Excellence Awards and Recongnition for Shared Services, 2012. We won the

award in the category - Shared Services in India - Insurance Domain.

These awards have been instituted by All India Management Association

(AIMA) & Delhi Management Association (DMA), in collaboration with

Rvalue Consulting as knowledge partners, to honour,recognize & promote

trasformative strategies for shared services.

Bronze Effie in the Financial services category for the campaign "Life

Insurance in just 10 Minutes"

ICICI Pru iCare has been voted the Product of the Year 2012*

*A survey by Nielsen for Insurance Category that included 30,000 people

ICICI Prudential Life Insurance has been pronounced winner in the 2nd

Excellence Awards and Recongnition for Shared Services, 2012. We won the

award in the category - Shared Services in India - Insurance Domain.

These awards have been instituted by All India Management Association

(AIMA) & Delhi Management Association (DMA), in collaboration with

Rvalue Consulting as knowledge partners, to honour,recognize & promote

trasformative strategies for shared services.

Bronze Effie in the Financial services category for the campaign "Life

Insurance in just 10 Minutes"

ICICI Prudential Life Insurance has been conferred the 'Insurance Company of

the Year Award 2011' and Company of the Year Award 2011 Life Insurance at

The Indian Insurance Awards 2011 instituted by the reputed insurance journal

of India Insurance Review, in association with Celent, a research and consulting

firm.

ICICI Prudential Life Insurance has been awarded the prestigious award for the

Best Leading Private Player Life Insurance 2011 at the CNBC TV18 Best Bank

and Financial Institution Awards for FY11.

PROMOTERS

ICICI Bank (taken from the press release of ICICI Bank)

ICICI Bank Limited (NYSE:IBN) is India's one of the leading private sector

bank and the second largest bank in the country, with consolidated total assets

of US$ 111 billion at June 30, 2012. ICICI Bank's subsidiaries include India's

one of the leading private sector insurance companies and among its largest

securities brokerage firms, mutual funds and private equity firms. ICICI Bank's

presence currently spans 19 countries, including India.

About Prudential Plc (taken from the press release of Prudential Plc)

Prudential plc is incorporated in England and Wales, and its affiliated

companies constitute one of the world's leading financial services groups. It

provides insurance and financial services through its subsidiaries and affiliates

throughout the world. It has been in existence for over 160 years and has 363

billion in assets under management (as at 30 June 2012).

LITERATURE REVIEW

The insurance industry has the highest new customer acquisition costs of any

industry,

According to "Rough Notes" magazine. This makes customer retention one of

the top priorities of any insurance company that wants to remain competitive.

Insurance companies accomplish this by creating a personal connection to

customers, pricing competitively and trying to sell each customer multiple

policies to make it a more complex decision to switch insurance providers.

Swift 2002; stated that companies can gain many benefits from CRM

implementation. Such as lower cost of acquiring customers, to acquire so many

customers to preserve a steady volume of business. CRM can help to retain the

customers for long range. Apart from this he stated, the cost regarding selling

are reduced owing to existing customers are usually more responsive. In

addition with better knowledge of channels and distributions, the relationship

becomes more effective as well as that cost for marketing campaign is reduced.

According to Maoz 2003, Research director of CRM for the Gartner group,

CRM is a strategy by which companies optimize profitability through enhanced

customer satisfaction and retention. CRM is a business strategy, not a

technology, says Maoz.It involves process, technology and people issues. All

three together really captures what CRM is.

The Indian insurance industry is in a booming phase. In the post-liberalization

phase, due to the opening up of industry for private players, there is greater

exposure to various products and customers have started demanding for world-

class facilities and services. This has forced the companies to rethink on their

customer service strategy by adopting a customer-centric approach.

According to a report by independent market analyst data monitor, the insurance

sector is all set to become a front-runner in the adoption of Service Oriented

Architecture (SOA).

Wilson 2001; claimed that organizations are becoming increasingly aware of the

importance of moving closer to their customers and extending their enterprise

units. CRM objectives are to; improve the process to communication with the

right customers, providing the right offer for each customer, providing the right

offer through the right channel for each customer, providing the right offer at

the right time for each customer. By doing this, organizations can receive the

following benefits; like increasing customer retention and loyalty, higher

customer profitability, creating value for customer. Greenberg 2001 stated that

the following objectives seem reasonable for an organization implementing

CRM such as; it focuses the sales force on increasing organizational revenues

through better information and better incentives to drive top line growth, it

improves global forecast and pipeline management to improve organization.

As CRM evolves richer definitions are emerging with an emphasis on the goals,

logistics and complex character of CRM . According to light (2001) CRM

evolved from business processes such as relationship marketing and the

increased emphasis on improved customer retention through the effective

management of customer relationship. Relationship marketing emphasizes that

customer retention affects company profitability in that it is more efficient to

maintain an existing relationship with a customer than create a new one.

Furthermore peppard (2000) suggests that technological in global networks,

convergence and improved interactivity are key to explain the growth of E-

Business and CRM .the increasing use of digital technologies by customers

particularly the internet is changing what is possible and what is expected in

terms of customer management. The appropriate use of automation technologies

such as interactive voice response system and web based frequently asked pages

could be popular with customers and highly cost effective. peppard said that in

reality CRM is a complex combination of business and technological factors

and thus strategies should be formulated accordingly.

Although decision made during this phase are critical to the eventual success or

failure of a CRM initiative , there is a paucity of research exploring these

adoption issues (markus and tanis 2000) classified CRM research directions

into:

concept level

model level

process level.

The review of literature ranges from 1972 to 2013 includes around 1000

reference. It was the pioneering working of the researchers that provided the

much needed impetus in the process of understanding and formulating the sector

wise CRM comparison parameter for analysis.

Another measure is Bartletts test of sphericity which measure the presence of

correlations among the variables. It provide the statistical probability that the

correlation matrix has significant correlations among at least some of variables.

Thus a significant Bartletts test of sphericity is required because we could

proceed with the factors such as CRM goals ,CRM principles technology

consideration, technology implementation effects, customer satisfaction , CRM

benefits before and after CRM implementation

Several scholars studying buyer-seller relationships have enriched the literature

with relevant CRM concepts and constructs.

(Gundlatch and Cadotte 1974; Doney and Cannon 1997; Kumar and Jha 2002;

Smith 2004). A compelling business case and success stories continue to attract

business interest and investment in CRM. These works focused on the adoption

phase (Rapp and Collins 1991) of a technology based innovation in CRM where

decision- making and planning activities are conducted to address whether,

why, and how to implement the innovation in CRM initiatives (Merlin 2001).

Although decisions made during this phase are critical to the eventual success or

failure of a CRM initiative, there is a paucity of research exploring these

adoption issues (Markus and Tanis 2000). Wilson (1995) classified CRM

research directions into concept level, model level and process research.

Several scholars have enriched this literature through model level research

(Liljander and Strandvik 1996; Smith 1997; Donney 2000), concept level

research (Anderson and Hakanson 1994; Berson 1996; Light 1998; Han 2000)

and process level research (Anderson and Narus 2002; Schurr and Oh 2003).

Several studies have been conducted on the impact of CRM programmes on the

performance of banks, hospitals and insurance sector (Aulakh and Kotabe 1997;

Nevin 1998; Souder 2001; Zahay 2004).

Previous researchers have addressed the intellectual alignment (strategy,

structure, goal and principles), social alignment (culture, customer interaction

and domain knowledge) and technology alignment (IT capability and

Knowledge Management) of CRM implementation

(Mulligan 1990; Payne 1994; Reich and Benbasat 2000; Battista 2000).

This body of research generally finds that these CRM alignments enable a firm

to maximize its IT investments and achieve harmony with its business strategies

and plans, leading to greater profitability. Several authors have established that

by looking at the relationship development process, one could identify which

CRM constructs would actively impact the outcome considerations and which

of them would have latent influence and this will help in establishing a

comparison of CRM parameters (McKie 1992; Simonian and Ruth 1996;

Sodano

1996; Wilson 2006) and insurance sector is no exception.

The review of literature ranges from 1972 to 2006 and includes around 245

references. It was the pioneering work of Rudi (2003), Hewson (2003), Crook

(2002), Schmitt (2006) and Schellong (2005) that provided the much needed

impetus in the process of understanding and formulating the sector wise CRM

comparison parameters

Most of the academics discussing CRM Systems Implementation were

inspired with several researches that prove low percentage of successful CRM

implementation cases. Bygstad, for example, draws on Tafti, (2002) research

that revealed 70% failure rate of CRM projects, as did Bull 2003 citing

Giga,(2001) research. On the other hand statistics show growing expenditures

on corporate CRM and big growth rate of CRM software sales (Bull 2003,

Rigby, 2004).

Citing Marble (2000) paper that suggests an implied dynamic between user

function and IS function as two main parties engaged in IS implementation,

Corner and Hinton (2002) argue that, at least, in CRM system implementation

dynamic is much more complex and engage other parties, such as extra-

company contributors and project managers. These extra parties, in tandem with

higher sensitivity of organizational politics surrounding sales and marketing or

customer service systems, require consideration of new risks, resulting from this

complexity.(Corner and Hinton, 2002)

Gefen (2002) add to this complexity by comparing CRM to ERP systems and

arguing that customer relationship activities are not as standardized as other

business activities, such as accounting or procurement. Hence CRM

implementation calls for much more complex and flexible approach. (Gefen,

2002).

Another specifics of CRM that is brought forward by Rygielski, Wang and Yen

(2002), calls for increased responsibility by CRM implementers in terms of

privacy rights. The authors urge 3 implementers to balance between respect

towards the privacy of consumers and economic gains from using CRM and

establish privacy policy to make sure the CRM doesnt gain opposite results.

(Rygielski, Wang and Yen, 2002)

The diversity of users in CRM systems implementation is also emphasized by

Fjermestad and Romano (2003), who claim that compared to homogeneous

users of other traditional information systems, users of CRM may include all

levels of management, permanent and temporary field customer service

representatives and customers themselves. Hence the CRM should be designed

to cross much more organizational boundaries and contain broader

functionalities that would be used by both known and unknown users.

(Fjermestad and Romano, 2003).

In a hope to help practitioners to adopt better implementation procedures,

Corner and Hinton build their idea by examining eight sets of CRM specific

implementation risks asserted by Hewson and McAlpine (1999), differing them

from other IS implementations. Hewson and McAlpine (1999) present 25 risks

grouped in eight sets that cover quite wide range of aspects of IS

implementation including users, processes, speed of change, politics, need for

mobility and need for change, funding and reliance on methodology.

The case study that Corner and Hinton (2002) used to examine the theoretical

risks is based on a software developer company that adopted and used CRM.

The paper however concludes that most of the risks mentioned by Hewson and

McAlpine were not viable and that other areas need to be examined that can

undermine the CRM implementation process as well as, need to discover how

various risk categories may impact each other. (Corner, Hinton 2002)The paper

also provides with quite valuable insight into technological, economic and

organizational risks to be considered while implementing a CRM system,

however its controversial conclusion leaves little hope for usage by practitioners

as most of the risk

OBJECTIVE OF THE STUDY

To analyze the customer relationship strategies adopted by insurance

companies

To identify the factor that result in retention of customer

To study how customer relationship management helps in building better

service management

SCOPE OF THE STUDY

This study is conducted in DEHRADUN city where major insurance companies

like BAJAJ ALLIANZ AND ICICI PRUDENTIAL have been taken. They

have managed their customer relationship through E-CRM

RESEARCH METHODOLOGY

Research design stands for advance planning of methods to be adopted for

collecting the relevant data and the techniques to be used in their analysis

keeping in the view the objective of research and the availability of time and

money research design in fact has a great bearing on reliability of result arrived.

The research study carried out is descriptive and diagnostic in nature.

Descriptive rearch includes surveys and fact finding and enquiries of different

kinds. The major purpose of these types of rearch is description of states of

affairs as it exits at present .the main characteristic of this method is that the

researcher has no control over the variables he can only report what has

happened or what is happening

Data Source: the study will be based on primary data as well as on secondary

data

Primary Data: data collected from respondents of insurance organization

Research Instrument: Questionnaires

DATA COLLECTION METHOD:

PRIMARY DATA : for collecting primary data these are main two important

methods

*NON-probability sampling and convenience sampling

*Questionnaires method

SECONDARY DATA: will be collected from websites and magazines

SAMPLING METHOD: Non probability method

CONVENIENCE SAMPLING METHOD: convenience sampling attempts to

obtain a sample of convenient elements .often respondent are selected because

they happen to be in the right place at the right time

Contact: personally

Sample size: 100

50: ICICI

50: Bajaj Allianz

Universe: DEHRADUN CITY

STATISTICAL TOOL: factor analysis and SPSS

HYPOTHESIS

H0: customer relationship management in insurance sector doesnt helps in

developing better service management

H1: customer relationship management in insurance sectors helps in developing

better service management

DATA ANALYSIS AND INTERPRETATION

Q.1.Do you agree that your insurance company offer variety of products?

ICICI PRU BAJAJ ALLIANCE

Yes 90 80

No 10 20

INTERPRETATION

45% of the respondents from icici and 35 respondents from Bajaj Allianz are agree that

company offer variety of the products where as only 5% respondents from icici and 15%

respondents from Bajaj Allianz are not agree. Both organizations offer the variety of the

products such as:

Health insurance

General insurance

Life insurance

Motor insurance etc.

0

10

20

30

40

50

60

70

80

90

ICICI PRU BAJAJ ALLIANCE

90

80

10

20

Yes

No

Q.2.Did you get sufficient information about the customer while selling?

ICICI PRU BAJAJ ALLIANCE

Yes 80 70

No 20 30

INTERPRETATION

32 %of the respondents from icici and 28% from bajaj are agree that they get sufficient

information where as only 18% respondents from icici and 22% of respondents from bajaj

Allianz are not agree. This information is collected from the past purchase of the customer

crm helps in the lead generation it helps to advisors to know about the buying behavior of

customer, income of the customer etc. In case of new customer the sufficient information is

not available

0

10

20

30

40

50

60

70

80

ICICI PRU BAJAJ ALLIANCE

80

70

20

30

Yes No

Q.3.How many times you have contacted existing customers?

ICICI Bajaj

Once a week 20 15

Once a month 30 25

once in 6 month 20 20

Once in a year &above 15 30

As and when required 15 10

INTERPRETATION

20 respondents from ICICI are agreed that they contact their customer once in a week 30

respondents from Bajaj are agreed for once in a month, 10% respondents from ICICI are

agreed for Once in a Six Month and 20% Respondents from ICICI are agreed as and when

required. Whereas 20% respondent from Bajaj are agreed that they contact their customers

once in a year and Above.

0

5

10

15

20

25

30

Once a week Once a

month

once in 6

month

Once in a

year

&above

As and when

required

20

30

20

15 15 15

25

20

30

10

ICICI Bajaj

Q.4. Which CRM Strategy is adopted by your organization?

ICICI BAJAJ

Marketing and customer service 10 5

CRM in customer contact centers 5 10

Sales force transformation 5 10

CRM in B2B market 10 10

Mobile sales automation 17 55

Contact center optimization 53 10

INTERPRETATION

48% of the respondents from ICICI are agreed that company has adopted contact center

optimization. Its Bombay call centre handles 25 different products for 10 million customers. The

call centre provides an opportunity to shift the qualitative nature of the relationship between

company and their customer to a new level

35% of respondents from BAJAJ Allianz said that they have adopted the Mobile sales

automation strategy. Pay online renewal premium, fund switch and apportionment

Download account statement, make partial withdrawal, download IT certificates, view all

0

10

20

30

40

50

60

10

5 5

10

17

53

5

10 10 10

55

10

ICICI BAJAJ

pervious transaction details, download pervious online payment receipt, change address

request .Where as 5 respondents from bajaj are agreed Marketing and customer service

CRM in customer contact centers 7 Bajaj Sales force transformation 3 Bajaj CRM in B2B

market 2 ICIC

Q5.which CRM strategies is more effective in customer retention?

ICICI BAJAJ

Marketing and customer service 10 10

CRM in customer contact centers 10 20

Sales force transformation 20 15

CRM in B2B market 10 5

Mobile sales automation 14 45

Contact center optimization 36 5

0

20

40

60

10 10

20

10

14

36

10

20

15

5

45

5

ICICI BAJAJ

INTERPRETATION

Marketing and customer service

Bajaj 5

CRM in customer contact centers

Bajaj 5

Sales force transformation

Bajaj 10

CRM in B2B market

ICICI 15

Mobile sales automation

Bajaj 30

Contact center optimization

ICICI 35

5 respondents from Bajaj are agreed that Marketing and customer services CRM strategies is

more effective in customer retention 5% Respondents from Bajaj are agreed that CRM in

customer contact centers and 10% from Bajaj agreed sales force transformation and 30%

respondents from Bajaj are agreed that Mobile sales automation CRM strategies is more

effective in customer retention. 15% respondents from ICICI are agreed that CRM in B2B

Market and 35% respondents from ICICI are agreed that Contact centre optimization.

Q6.How does the company keeps in touch with the customers ?

ICICI BAJAJ

SMS 70 65

Email 20 30

greetings 10 5

0

10

20

30

40

50

60

70

SMS Email greetings

70

20

10

65

30

5

Chart Title

ICICI

BAJAJ

INTERPRETATION

SMS 38 30

Email 10 10

Greetings 2 10

38% respondents from ICICI and 30% respondent from Bajaj are agreed that the company

keeps in touch with the customers through SMS facility. whereas 10% respondent from ICICI

and 10% of respondent from Bajaj are agreed that the company keeps in touch with the

customers. 2% respondents from ICICI and 10 % respondent from Bajaj are agreed that the

company keeps in touch with the customers

Q7. Do you take feedback from your customers?

ICICI BAJAJ

YES 90 80

No 10 20

INTERPRETATION

0

10

20

30

40

50

60

70

80

90

ICICI BAJAJ

90

80

10

20

YES

No

47% of the respondents from ICICI and 43% of respondents from BAJAJ are agreed that they

take feedback from customer and 3 of respondents from ICICI and 7% of respondents from

BAJAJ agreed that the they dont take the feedback from customer

Q8. Do you customize your product or services according to the customer?

ICICI BAJAJ

YES 75 85

NO 25 15

INTERPRETATION

0

10

20

30

40

50

60

70

80

90

ICICI BAJAJ

75

85

25

15

YES

NO

47% of the respondents from ICICI and 38% of respondents from Bajaj Allianz are agree

that they customize product or services according to the customer and 3% respondents from

ICICI and 12% respondents from BAJAJ ALLIANZE were not agreed that they customize

their product.

Q9. How much is the role of computers in serving the customers?

a) Plays a big role 75

b) Not much role to play 20

c) No role to play 5

INTERPRETATION

Plays a big role 46 26

Not much role to play 2 14

No role to play 2 10

46% of respondent from ICICI and 26% from Bajaj are agreed that the computers plays a

big role in serving the customers where as 2% of respondents from ICICI and 14% from

Bajaj are Agreed that computers has not much role to play in serving the customers. 2%

respondent from ICICI and 10% from Bajaj are agreed computer has no role to play in

serving the customers.

Plays a big role Not much role to

play

No role to play

46

2 2

26

14

10

ICICI Bajaj

Q10. Do you have centralized database for customer information?

.. ICICI BAJAJ

Yes 80 70

No 20 30

0

10

20

30

40

50

60

70

80

ICICI BAJAJ

80

70

20

30

Yes

No

INTERPRETATION

46% of the respondents from ICICI and 44% respondents from the BAJAJ Allianz are

agreed and only 6% respondents from BAJAJ Allianz and 4% from ICICI are not agreed that

they have centralized database for customer information.

Q11. Do you get proper training for CRM?

ICICI BAJAJ

Yes 80 20

b. No 20 80

INTERPRETATION

0

10

20

30

40

50

60

70

80

icici bajaj

80

20

80

Yes

No

48% of the respondents from ICICI and 32% of respondents from Bajaj Allianz have agreed

that they get proper training for CRM. Whereas 2% of respondents from ICICI and 18% of

respondents from Bajaj Allianz were not agreed that they get proper training for CRM

Q12. Do you think the company is maintaining good customer relationship management

through its services?

icici bajaj

Yes 89 78

b. No 11 22

INTERPRETATION

47% of the respondents from ICICI and 43%from Bajaj Allianz are agree that the company

is maintaining good customer relationship management through its services where as only 3%

0

10

20

30

40

50

60

70

80

90

icici bajaj

89

78

11

22

Yes

b. No

respondents from icici and 7 % of respondents from Bajaj Allianz are not agree. Both the

companies have adopted different CRM strategies to maintain good customer relationship

management

Q13. How do you get customer comments and complaints?

icici bajaj

Face to face interview. 35 15

Toll free numbers, formal surveys. 45 50

Others means 20 35

INTERPRETATION

25% of the respondents from ICICI and 35%from Bajaj Allianz are agreed for toll free

numbers and formal surveys to solve the customer comments and complaints and 10% of

respondents from ICICI and 10% from Bajaj Allianz are agree with other means where as

only 15% respondents from ICICI and 5% respondents from Bajaj Allianz agreed with face

to face interview for their complaints and comments. Both the companies have their toll free

numbers and their service advisors go through survey time to time. The other means are

websites customer can register their complaints on the website

0

5

10

15

20

25

30

35

40

45

50

Face to face

interview.

Toll free

numbers, formal

surveys.

Others means

35

45

20

15

50

35

icici

bajaj

Q14. Do you communicate results of your customer satisfaction surveys regularly throughout

the company?

icic bajaj

Yes 85 79

No 15 21

INTERPRETATION

47% of the respondents from ICICI and 43% respondents from Bajaj Allianz are agreed that

they communicate results of your customer satisfaction surveys regularly throughout the

company. Whereas 3% of respondents from ICICI and 2% of respondents from Bajaj Allianz

are not agreed. Both the companies conduct meetings in monthly basis and the monthly

reports are been send to the corporate office to the senior level manager. Past month report

and other changes are discussed in these meetings

0

10

20

30

40

50

60

70

80

90

icic bajaj

85

79

15

21

Yes

No

Q15.Is there any improvement in customer response rate to the marketing activities?

icici bajaj

yes 79 86

no 21 14

INTERPRETATION

25% of the respondents from ICICI and 15% of respondents from Bajaj Allianz are agreed

that that there is improvement in customer response rate where as 25% respondent from icici

and 35% respondents from Bajaj Allianz are not agreed that there is improvement in

customer response rate to the marketing activities. Both the companies conduct several

marketing activities programs in malls petrol pumps and other places but customers hardly

response for those activities.

0

10

20

30

40

50

60

70

80

90

icici bajaj

79

86

21

14

yes

no

Q16.CRM HELPS IN?

icici bajaj

reduce cost of service 20 16

effective use of customer`s data 20 14

up selling 50 50

cross selling 10 20

INTERPRETATION

35% of the respondents from icici and 25 respondents from Bajaj Allianz are agree that CRM

helps in Up selling and 2% respondents from ICICI and 10% from Bajaj Allianz agreed in

cross selling where as 6% respondent from ICICI and 5% from Bajaj are agreed that CRM

help in effective use of customers data and 7% respondents from ICICI and 10% from Bajaj

are agreed that CRM help in reduce cost of service.

0

5

10

15

20

25

30

35

40

45

50

A. reduce

cost of

service

B. effective

use of

customer`s

data

C. up selling D. cross

selling

20 20

50

10

16

14

50

20

icici

bajaj

Q17. Do you agree that mobile application helps in maintaining better customer relationship

management?

icici bajaj

yes 85 79

no 15 21

INTERPRETATION

30% of the respondents from icici and 45% respondents from bajaj Allianz are agree that

mobile application helps in maintain better customer relationship management where as only

20% respondent from ICICI and 5% respondent from Bajaj are not agreed that mobile

application helps in maintain Better customer relationship management.

0

10

20

30

40

50

60

70

80

90

icici bajaj

85

79

15

21

yes

no

Q18. Does the company policy provide better tax benefit as compared to its competitors?

icici bajaj

Yes 78 87

no 22 13

INTERPRETATION

40% of the respondents from ICICI and 35% of respondents from Bajaj Allianz are agreed

that the company policy provide better tax benefit as compared to its competitors where as

only 10% respondent from ICICI and 15% respondents from Bajaj Allianz are not agreed that

the company policy provide better tax benefit as compared to its competitors

0

10

20

30

40

50

60

70

80

90

icici bajaj

78

87

22

13

Yes

no

Q19 on a scale of 1 to 5 kindly rate the following CRM strategies which are as follow?

S

no

Strategies Least

consider

Less

considered

Not

considered

More

considered

Most

considered

1 Marketing and

customer service

2 CRM in

customer

contact

centers

3 Sales force

transformation

4 CRM in B2B

market

5 Mobile sales

automation

6 Contact center

optimization

0

1

2

3

4

5

6

M

a

r

k

e

t

i

n

g

a

n

d

c

u

s

t

o

m

e

r

s

e

r

v

i

c

e

C

R

M

i

n

c

u

s

t

o

m

e

r

c

o

n

t

a

c

t

c

e

n

t

e

r

s

S

a

l

e

s

f

o

r

c

e

t

r

a

n

s

f

o

r

m

a

t

i

o

n

C

R

M

i

n

B

2

B

m

a

r

k

e

t

M

o

b

i

l

e

s

a

l

e

s

a

u

t

o

m

a

t

i

o

n

C

o

n

t

a

c

t

c

e

n

t

e

r

1 2 3 4 5 6

Least consider

Less considered

Not considered

More considered

Most considered

O

p

t

i

m

i

z

a

t

i

o

n

FINDINGS