Академический Документы

Профессиональный Документы

Культура Документы

Review Paper On Credit Card Fraud Detection

Загружено:

seventhsensegroup0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров9 страницDue to the theatrical increase of fraud which

results in loss of dollars worldwide each year,

several modern techniques in detecting fraud are

persistently evolved and applied to many business

fields. Fraud detection involves monitoring the

activities of populations of users in order to

estimate, perceive or avoid undesirable behavior.

Undesirable behavior is a broad term including

delinquency, fraud, intrusion, and account

defaulting. This paper presents a survey of current

techniques used in credit card fraud detection and

telecommunication fraud. The goal of this paper is

to provide a comprehensive review of different

techniques to detect fraud.

Оригинальное название

Review Paper on Credit Card Fraud Detection

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDue to the theatrical increase of fraud which

results in loss of dollars worldwide each year,

several modern techniques in detecting fraud are

persistently evolved and applied to many business

fields. Fraud detection involves monitoring the

activities of populations of users in order to

estimate, perceive or avoid undesirable behavior.

Undesirable behavior is a broad term including

delinquency, fraud, intrusion, and account

defaulting. This paper presents a survey of current

techniques used in credit card fraud detection and

telecommunication fraud. The goal of this paper is

to provide a comprehensive review of different

techniques to detect fraud.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

36 просмотров9 страницReview Paper On Credit Card Fraud Detection

Загружено:

seventhsensegroupDue to the theatrical increase of fraud which

results in loss of dollars worldwide each year,

several modern techniques in detecting fraud are

persistently evolved and applied to many business

fields. Fraud detection involves monitoring the

activities of populations of users in order to

estimate, perceive or avoid undesirable behavior.

Undesirable behavior is a broad term including

delinquency, fraud, intrusion, and account

defaulting. This paper presents a survey of current

techniques used in credit card fraud detection and

telecommunication fraud. The goal of this paper is

to provide a comprehensive review of different

techniques to detect fraud.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 9

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2206

Review Paper on Credit Card Fraud Detection

1

Suman

Research Scholar,

GJUS&T Hisar

HCE Sonepat

2

Nutan

Mtech.CSE ,HCE Sonepat

Abstract

Due to the theatrical increase of fraud which

results in loss of dollars worldwide each year,

several modern techniques in detecting fraud are

persistently evolved and applied to many business

fields. Fraud detection involves monitoring the

activities of populations of users in order to

estimate, perceive or avoid undesirable behavior.

Undesirable behavior is a broad term including

delinquency, fraud, intrusion, and account

defaulting. This paper presents a survey of current

techniques used in credit card fraud detection and

telecommunication fraud. The goal of this paper is

to provide a comprehensive review of different

techniques to detect fraud.

Keywords: Fraud detection, data mining, support

vector machine, anomalies.

Introduction

Credit card fraud can be defined as Unauthorized

account activity by a person for which the account

was not intended. Operationally, this is an event

for which action can be taken to stop the abuse in

progress and incorporate risk management

practices to protect against similar actions in the

future. In simple terms, Credit Card Fraud is

defined as when an individual uses another

individuals credit card for personal reasons while

the owner of the card and the card issuer are not

aware of the fact that the card is being used. And

the persons using the card has not at all having the

connection with the cardholder or the issuer and

has no intention of making the repayments for the

purchase they done. Fraud detection involves

identifying Fraud as quickly as possible once it has

been perpetrated. Fraud detection methods are

continuously developed to defend criminals in

adapting to their strategies. The development of

new fraud detection methods is made more

difficult due to the severe limitation of the

exchange of ideas in fraud detection. Data sets are

not made available and results are often not

disclosed to the public. The fraud cases have to be

detected from the available huge data sets such as

the logged data and user behavior. At present,

fraud detection has been implemented by a number

of methods such as data mining, statistics, and

artificial intelligence. Fraud is discovered from

anomalies in data and patterns. The different types

of methods for committing credit card frauds are

described below.

Types of Frauds :Various types of frauds in this

paper include credit card frauds,

telecommunication frauds, and computer

intrusions, Bankruptcy fraud, Theft

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2208

fraud/counterfeit fraud, Application fraud,

Behavioral fraud [2].

Credit Card Fraud: Credit card fraud has been

divided into two types:

(1) Offline fraud and On-line fraud. Offline

fraud is committed by using a stolen

physical card at call center or any other

place

(2) . On-line fraud is committed via internet,

phone, shopping, web, or in absence of card

holder.

Telecommunication Fraud: The use of

telecommunication services to commit other forms

of fraud. Consumers, businesses and

communication service provider are the victims.

Computer Intrusion: Intrusion Is Defined As The

act of entering without warrant or invitation; That

means potential possibility of unauthorized

attempt to access Information, Manipulate

Information Purposefully. Intruders may be from

any environment, An outsider (Or Hacker) and an

insider who knows the layout of the system [1].

Bankruptcy Fraud: This column focuses on

bankruptcy fraud. Bankruptcy fraud means using a

credit card while being absent. Bankruptcy fraud is

one of the most complicated types of fraud to

predict [1].

Theft Fraud/ Counterfeit Fraud: In this section,

we focus on theft and counterfeit fraud, which are

related to one other. Theft fraud refers using a card

that is not yours. As soon as the owner give some

feedback and contact the bank, the bank will take

measures to check the thief as early as possible.

Likewise, counterfeit fraud occurs when the credit

card is used remotely; where only the credit card

details are needed [2].

Application Fraud: When someone applies for a

credit card with false information that is termed as

application fraud. For detecting application fraud,

two different situations have to be classified. When

applications come from a same user with the same

details, that is called duplicates, and when

applications come from different individuals with

similar details, that is termed as identity fraudsters.

Phua et al. [3] describes application fraud as

demonstration of identity crime, occurs when

application forms contain possible, and synthetic

(identity fraud), or real but also stolen identity

information (identity theft).

Credit card fraud detection methods

On doing the literature survey of various methods

for fraud detection we come to the conclusion that

to detect credit card fraud there are multiple

approaches like [11] [2].

Gass algorithm

Bayesian networks

Hidden markov model

Genetic algorithm

A fusion approach using dempster-shafer

theory and bayesian learning.

Decision tree

Neural network

Logistic Regression

Gass algorithm

This algorithm is a combination of genetic

algorithm and scatter search [11]. In this section,

we first describe the basic operating principles of

genetic algorithms and scatter search and then

explain the steps of the suggested GASS algorithm.

Genetic algorithms are inspired from natural

evolution. The basic idea is that the survival

chance of stronger members of a population is

larger than that of the weaker members and as the

generations evolve the average fitness of the

population gets better. Normally the new

generations will be produced by the crossover of

two parent members. However, sometimes some

random mutations can also occur on individuals

which in turn increase the diversity in the

population. It starts with a number of initial

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2209

solutions which act as the parents of the current

generation. New solutions are generated from these

solutions by the cross-over and mutation operators.

The less fit members of this generation are

eliminated and the fitter members are selected as

the parents for the next generation. This procedure

is repeated until a pre-specified number of

generations have passed, and the best solution

found until then is selected. The SS is another

evolutionary algorithm which shares some

common characteristics with the GA. It operates on

a set of solutions, the reference set, by combining

these solutions to create new ones. The main

mechanism for combining solutions is such that a

new solution is created from the linear combination

of two other solutions [21].In SS diversity in the

reference set is very important and next time it will

be determined again first a number of best

solutions are selected and then these are coupled

with a number of most diverse solutions to form

the new reference set. Unlike the population of the

GA, the reference set of SS is usually kept smaller

as each solution in it is desired to be subjected to

the recombination operator.

The suggested GASS algorithm basically follows

the steps of GA but it has some components from

SS. As compared to typical GA implementations

we kept the size of the population smaller and we

made sure some minimum level of diversity is

attained at each generation. Also, for the

reproduction we used a standard recombination

operator rather than the classical cross-over

operator of GA. We also used the mutation

operator which is common to both GA and SS

implementations. The steps of the GASS and the

parameter values used are detailed below:

(a) Number of parent solutions (size of the

reference set): Number of starting solutions which

also equal to the number of parents selected for

each generation is an important parameter which

can influence the convergence speed of the

procedure. The population size is determined

according to the size of the problem, i.e. bigger

population for larger problem. We have taken this

to be 50 where three of them are determined

as to be the solutions which will generate the

maximum number of alerts (MAX), the one that

will generate the minimum number of alerts (MIN)

and the one currently used in the production

(PRD). The remaining 47 solutions are obtained by

producing random numbers for all 43 parameters.

Note that, MAX and MIN bring a certain level of

diversity to the reference set.

(b) Number of children: For the ease of

implementation we decided to recombine every

possible pair of parents and this way we obtained

1225 children in each generation.

(c) Reproduction (recombination): We took the

weighted average of the

parameter values of the two parent solutions and

obtained the child solution. For each generation a

random number between zero and one is

determined and this number is used as the weight

of the first parent in all recombination operators

used in that generation. The weight of the second

parent is equal to one minus the determined

random number. This type of reproduction is not

common in GA implementations but it can be

regarded as a typical operator for SS.

(d) Mutation operator: One of the 43 parameters is

picked up randomly and its value is changed

randomly within its allowable range.

(e) Recombination and mutation probabilities: All

children are generated by the recombination

operator. Then, one of the children solutions is

randomly picked up and mutation operator is

applied to it.

(f) Fitness function: As described above, the fitness

value of an individual solution is determined as the

total amount of savings incurred from fraud losses.

(g) Selection: The best three members of the

generation are automatically selected. To keep

having diversity in all generations, the three named

solutions, MAX, MIN and PRD are also

automatically transferred to the next generation.

The remaining 44 solutions are determined by the

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2210

roulette selection procedure.

(h) Termination criterion: We decided to run the

generations until no improvements are observed

for at least 10 generations.

Bayesian networks

For the purpose of fraud detection, two Bayesian

networks to describe the behavior of user are

constructed. First, a Bayesian network is

constructed to model behavior under the

assumption that the user is fraudulent (F) and

another model under the assumption the user is a

legitimate (NF). The fraud net is set up by using

expert knowledge. The user net is set up by using

data from non fraudulent users. During operation

user net is adapted to a specific user based on

emerging data. By inserting evidence in these

networks and propagating it through the network,

the probability of the measurement x less than two

above mentioned hypotheses is obtained. This

means, it gives judgments to what degree observed

user behavior meets typical fraudulent or non

fraudulent behavior. These quantities we call

p(XNF) and p (XF).

By postulating the probability of fraud P (F) and P

(NF) =1-P(F) in general and by applying Bayes

rule, it gives the probability of fraud, given the

measurement x,

(|) =

()(|)

(|)

----- - (1)

Where the denominator p(x) can be calculated as

P(x) =P (F) p (XF) + P (NF) p (XNF)

--------- (2)

The fraud probability P (FX) given the observed

user behavior x can be used as an alarm level. On

the one hand, Bayesian networks allow the

integration of expert knowledge, which we used to

initially set up the models [4]. On the other hand,

the user model is retrained in an unsupervised way

using data. Thus our Bayesian approach

incorporates both, expert knowledge and learning.

Hidden markov model

A Hidden Markov Model is a double embedded

stochastic process with used to model much more

complicated stochastic processes as compared to a

traditional Markov model. If an incoming credit

card transaction is not accepted by the trained

Hidden Markov Model with sufficiently high

probability, it is considered to be fraudulent

transactions. HMM[5], Baum Welch algorithm is

used for training purpose and K-means algorithm

for clustering.HMM sores data in the form of

clusters depending on three price value ranges low,

medium and high[6].

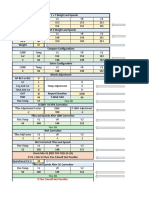

Fig.2: HMM for credit card fraud detection

The probabilities of initial set of transaction have

chosen and FDS checks whether transaction is

genuine or fraudulent. Since HMM maintains a log

for transactions it reduces tedious work of

employee but produces high false alarm as well as

high false positive[7]. The initial choice of

parameters affects the performance of this

algorithm and, hence, they should be chosen

carefully. We consider the special case of fully

connected HMM in which every state of the model

can be reached in a single step from every other

state, as shown in Fig. 2. Gr, El, Mi, etc., are

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2211

names given to the states to denote purchase types

like Groceries, Electronic items, and miscellaneous

purchases. Spending profiles of the individual

cardholders are used to obtain an initial estimate

for probability matrix B

Genetic algorithm

Genetic algorithms, inspired from natural evolution

were first introduced by Holland (1975). Genetic

algorithms are evolutionary algorithms which aim

at obtaining better solutions as time progresses.

Fraud detection problem is classification problem,

in which some of statistical methods many data

mining algorithms have proposed to solve it.

Among decision trees are more popular. Fraud

detection has been usually in domain of E-

commerce, data mining [8].

GA is used in data mining mainly for variable

selection [9] and is mostly coupled with other DM

algorithms [10]. And their combination with other

techniques has a very good performance. GA has

been used in credit card fraud detection for

minimizing the wrongly classified number of

transactions [10]. And is easy accessible for

computer programming language implementation,

thus, make it strong in credit card fraud detection.

But this method has high performance and is quite

expensive.

A fusion approach using Dempster-Shafer

theory and Bayesian learning.

As mentioned in [19] First approach i.e. Dempster-

Shafer Theory basically proposes Fraud Detection

System using information fusion and Bayesian

learning in which evidences from current as well as

past behavior are combined together and

depending on certain type shopping behavior

establishes an activity profile for every cardholder.

It has advantages like: - high accuracy, processing

speed, reduces false alarm, improves detection rate,

applicable in E-commerce. But one disadvantage

of this approach is that it is highly expensive.

DempsterShafer theory and Bayesian learning is a

hybrid approach for credit card fraud detection

[18][11] which combines evidences from current

as well as past behavior. Every cardholder has a

certain type of shopping behavior, which

establishes an activity profile for them. This

approach proposes a fraud detection system using

information fusion and Bayesian learning of so as

to counter credit card fraud.

The FDS system consists of four components,

namely, rule-based filter, DempsterShafer adder,

transaction history database and Bayesian learner.

In the rule-based component, the suspicion level of

each incoming transaction based on the extent of

its deviation from good pattern is determined.

DempsterShafers theory is used to combine

multiple such evidences and an initial belief is

computed [20]. Then the initial belief values are

combined to obtain an overall belief by applying

DempsterShafer theory. The transaction is

classified as suspicious or suspicious depending on

this initial belief. Once a transaction is found to be

suspicious, belief is further strengthened or

weakened according to its similarity with

fraudulent or genuine transaction

Decision tree

Decision trees are statistical data mining technique

that express independent attributes and a dependent

attributes logically AND in a tree shaped structure.

Classification rules, extracted from decision trees,

are IF-THEN expressions and all the tests have to

succeed if each rule is to be generated [11].

Decision tree usually separates the complex

problem into many simple ones and resolves the

sub problems through repeatedly using [11][12].

Decision trees are predictive decision support tools

that create mapping from observations to possible

consequences. There are number of popular

classifiers construct decision trees to generate class

models.

Decision tree methods C5.0,C&RT and CHAID.

The work demonstrates the advantages of applying

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2212

the data mining techniques including decision trees

and SVMs to the credit card fraud detection

problem for the purpose of reducing the banks

risk. The results show that the proposed classifiers

of C&RT and other decision tree approaches

outperform SVM approaches in solving the

problem under investigation.

Neural network

Fraud detection methods based on neural network

are the most popular ones. An artificial neural

network [13][14] consists of an interconnected

group of artificial neurons .The principle of neural

network is motivated by the functions of the brain

especially pattern recognition and associative

memory [15]. The neural network recognizes

similar patterns, predicts future values or events

based upon the associative memory of the patterns

it was learned. It is widely applied in classification

and clustering. The advantages of neural networks

over other techniques are that these models are

able to learn from the past and thus, improve

results as time passes. They can also extract rules

and predict future activity based on the current

situation. By employing neural networks,

effectively, banks can detect fraudulent use of a

card, faster and more efficiently. Among the

reported credit card fraud studies most have

focused on using neural networks. In more

practical terms neural networks are non-linear

statistical data modeling tools. They can be used to

model complex relationships between inputs and

outputs or to find patterns in data.

There are two phases in neural network [16]

training and recognition. Learning in a neural

network is called training. There are two types of

NN training methods supervised and unsupervised.

In supervised training, samples of both fraudulent

and non fraudulent records are used to create

models. In contrast, unsupervised training simply

seeks those transactions, which are most dissimilar

from the norm. On other hand, the unsupervised

techniques do not need the previous knowledge of

fraudulent and non fraudulent transactions in

database. NNs can produce best result for only

large transaction dataset. And they need a long

training dataset.

Logistic regression

Two advanced data mining approaches, support

vector machines and random forests, together with

the well known logistic regression [18], as part of

an attempt to better detect (and thus control and

prosecute) credit card fraud. The study is based on

real-life data of transactions from an international

credit card operation. It is well-understood, easy to

use, and remains one of the most commonly used

for data-mining in practice. It thus provides a

useful baseline for comparing performance of

newer methods. Supervised learning methods for

fraud detection face two challenges. The first is of

unbalanced class sizes of legitimate and fraudulent

transactions, with legitimate transactions far

outnumbering fraudulent ones. For model

development, some form of sampling among the

two classes is typically used to obtain training data

with reasonable class distributions. Various

sampling approaches have been proposed in the

literature, with random oversampling of minority

class cases and random under sampling of majority

class cases being the simplest and most common in

use; others include directed sampling The second

problem in developing supervised models for fraud

can arise from potentially undetected fraud

transactions, leading to mislabeled cases in the data

to be used for building the model. For the purpose

of this study, fraudulent transactions are those

specifically identified by the institutional auditors

as those that caused an unlawful transfer of funds

from the bank sponsoring the credit cards. These

transactions were observed to be fraudulent ex

post. Our study is based on real-life data of

transactions from an international credit card

operation. The transaction data is aggregated to

create various derived attributes.

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2213

Support vector machine

The basic idea of SVM classification algorithm is

to construct a hyper plane as the decision plane

which making the distance between the positive

and negative mode maximum [17]. The strength of

SVMs comes from two important properties they

possess - kernel representation and margin

optimization. Kernels, such as radial basis function

(RBF) kernel, can be used to learn complex

regions. A kernel function represents the dot

product of projections of two data points in a high

dimensional feature space. In SVMs, the

classification function is a hyper-plane separating

the different classes of data. The basic technique

finds the smallest hyper sphere in the kernel space

that contains all training instances, and then

determines on which side of hyper sphere a test

instance lies. If a test instance lies outside the

hyper sphere, it is confirmed to be suspicion. SVM

can have better prediction performance than

BPN(Back propagation network ) in predicting the

future data.

SVMs are set of related supervised

learning methods used for classification and

regression they belong to a family of generalized

linear classification. A special property of SVM is,

SVM Simultaneously minimize the empirical

classification error and maximize the geometric

margin. So SVM called Maximum Margin

Classifiers. SVM is based on the Structural risk

Minimization (SRM). SVM map input vector to a

higher dimensional space where a maximal

separating hyper plane is constructed. Two parallel

hyper planes are constructed on each side of the

hyper plane that separate the data. The separating

hyper plane is the hyper planes that maximize the

distance between the two parallel hyper planes. An

assumption is made that the larger the margin or

distance between these parallel hyper planes the

better the generalization error of the classifier will

be .We consider data points of the form

{(X

1

, Y

1

), (X

2

, Y

2

), (X

3

Y

3

), (X

4

,Y

4

)., (X

n

,

Y

n

)}.

Where Y

n

=1 / -1, a constant denoting the class to

which that point Xn belongs.

n =number of sample. Each X

n

is P -dimensional

real vector. The scaling is important to guard

against variable (attributes) with larger variances.

We can view this training data, by means of the

dividing hyper plane, which takes

W. X +b =O ----- (1) Where b is scalar and W is

p-dimensional Vector. The vector W points

perpendicular to the separating hyper plane.

Adding the offset parameter b allows us to increase

the margin. Absent of b, the hyper plane is forced

to pass through the origin, restricting the solution.

As we are interesting in the maximum margin, we

are interested SVM and the parallel hyper planes

[11]. Parallel hyper planes can be described by

equation

W.X +b =1

W.X +b =-1

If the training data are linearly separable, we can

select these hyper planes so that there are no points

between them and then try to maximize their

distance.

Random forests

The popularity of decision tree models in data

mining arises from their ease of use, flexibility in

terms of handling various data attribute types, and

interpretability. Single tree models, however, can

be unstable and overly sensitive to specific training

data. Ensemble methods seek to address this

problem by developing a set of models and

aggregating their predictions in determining the

class label for a data point. A random forest model

is an ensemble of classification (or regression)

trees. Ensembles perform well when individual

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2214

members are dissimilar, and random forests obtain

variation among individual trees using two sources

for randomness: first, each tree is built on separate

bootstrapped samples of the training data;

secondly, only a randomly selected subset of data

attributes is considered at each node in building the

individual trees. Random forests thus combine the

concepts of bagging, where individual models in

an ensemble are developed through sampling with

replacement from the training data, and the random

subspace method, where each tree in an ensemble

is built from a random subset of attributes. Given a

training data set of N cases described by B

attributes, each tree in the ensemble is developed

as follows:

- Obtain a bootstrap sample of N cases

- At each node, randomly select a subset of bbB

attributes. Determine the best split at the node from

this reduced set of b attributes

- Grow the full tree without pruning

Random forests are computationally efficient since

each tree is built independently of the others. With

large number of trees in the ensemble, they are also

noted to be robust to over fitting and noise in the

data.

Conclusion

Credit card fraud has become more and more

rampant in recent years. To improve merchants

risk management level in an automatic and

effective way, building an accurate and easy

handling credit card risk monitoring system is one

of the key tasks for the merchant banks. One aim

of this study is to identify the user model that best

identifies fraud cases. There are many ways of

detection of credit card fraud. If one of these or

combination of algorithm is applied into bank

credit card fraud detection system, the probability

of fraud transactions can be predicted soon after

credit card transactions by the banks. And a series

of anti-fraud strategies can be adopted to prevent

banks from great losses before and reduce risks.

This paper gives contribution towards the effective

ways of credit card fraudulent detection.

References

[1] Linda Delamaire (UK), Hussein Abdou

(UK), J ohn Pointon (UK), Credit card

fraud and detection techniques: a review,

Banks and Bank Systems, Volume 4, Issue

2, 2009 .

[2] Khyati Chaudhary, J yoti Yadav, Bhawna

Mallick, A review of Fraud Detection

Techniques: Credit Card, International

J ournal of Computer Applications (0975

8887) Volume 45 No.1, May 2012 .

[3] Vladimir Zaslavsky and Anna Strizhak,

credit card fraud detection using

selforganizing maps, information &

security. An International Journal,

Vol.18,2006.

[4] L. Mukhanov, Using bayesian belief

networks for credit card fraud detection, in

Proc. of the IASTED International

conference on Artificial Intelligence and

Applications, Insbruck, Austria, Feb. 2008,

pp. 221 225.

[5] Abhinav Srivastava, Amlan Kundu, Shamik

Sural and Arun K. Majumdar, "CreditCard

Fraud Detection Using Hidden Markov

Model" IEEE, Transactions On Dependable

And Secure Computing, Vol. 5, No 1. ,

J anuary-March 2008

[6] V. Bhusari, and S. Patil, Study of Hidden

Markov Model in Credit Card Fraudulent

Detection, International J ournal of

Computer Applications (0975 8887)

Volume 20 No.5, April 2011

[7] V.Bhusari ,S.Patil ," Study of Hidden

Markov Model in Credit Card Fraudulent

Detection ",International J ournal of

Computer Applications (0975 - 8887)

Volume 20- No.5, April 2011

International Journal of Computer Trends and Technology (IJCTT) volume 4 Issue 7July 2013

ISSN: 2231-2803 http://www.ijcttjournal.org Page 2215

[8] K.RamaKalyani, D.UmaDevi, Fraud

Detection of Credit Card Payment System

by Genetic Algorithm, International

Journal of Scientific & Engineering

Research Volume 3, Issue 7, J uly-2012

[9] Bidgoli, B. M., Kashy, D., Kortemeyer, G.

& Punch, W. F Predicting student

performance: An Application of data

mining methods with the educational web-

based system LON-CAPA. In Proceedings

of ASEE/IEEE frontiers in education

conference. . (2003).

[10] Ekrem Duman, M. Hamdi Ozcelik

Detecting credit card fraud by genetic

algorithm and scatter search. Elsevier,

Expert Systems with Applications, (2011).

38; (1305713063).

[11] S. Benson Edwin Raj, A. Annie

Portia, Analysis on Credit Card Fraud

Detection Methods, International

Conference on Computer, Communication

and Electrical Technology ICCCET2011,

18th & 19th March, 2011

[12] Y. Sahin and E. Duman, Detecting

Credit Card Fraud by Decision Trees and

Support Vector Machines, International

Multiconference of Engineers and

computer scientists March, 2011.

[13] S. Benson Edwin Raj, A. Annie

Portia Analysis on Credit Card Fraud

Detection Methods. IEEE-International

Conference on Computer, Communication

and Electrical Technology; (2011). (152-

156).

[14] Ray-I Chang, Liang-Bin Lai, Wen-

De Su, J en-Chieh Wang, J en-Shiang Kouh

Intrusion Detection by Backpropagation

Neural Networks with Sample-Query and

Attribute-Query. Research India

Publications; (2006). (6-10).

[15] Raghavendra Patidar, Lokesh

Sharma Credit Card Fraud Detection

Using Neural Network. International

J ournal of Soft Computing and Engineering

(IJ SCE), (2011). Volume-1, Issue; (32-38).

[16] Tao Guo, Gui-Yang Li Neural

Data Mining For Credit Card Fraud

Detection. IEEE, Proceedings of the

Seventh International Conference on

Machine Learning and Cybernetics; (2008).

(3630-3634).

[17] J oseph King-Fung Pun,Improving

Credit Card Fraud Detection using a Meta-

Learning Strategy, Chemical Engineering

and Applied Chemistry University of

Toronto 2011

[18] Siddhartha Bhattacharyya, Sanjeev

J ha, Kurian Tharakunnel, J . Christopher

Westland, Data mining for credit card

fraud: A comparative study, Decision

Support Systems 50 pp. 602613,2011.

[19] Sandeep Pratap Singh, Shiv

Shankar P.Shukla,Nitin Rakesh and Vipin

Tyagi "Problem Reduction In Online

Payment System Using Hybrid Model"

International J ournal of Managing

Information Technology (IJ MIT) Vol.3,

No.3, August 2011

[20] Amlan Kundu, Suvasini Panigrahi,

Shamik Sural and Arun K. Majumdar,

"Credit card fraud detection: A fusion

approach using Dempster-Shafer theory

and Bayesian learning," Special Issue on

Information Fusion in Computer Security,

Vol. 10, Issue no 4, pp.354- 363, October

2009 .

[21] Hung, W. N. N., Song, X.,

Aboulhamid, E. M., & Driscoll, M. A.

(2002). BDD minimization by scatter

search. IEEE Transactions on Computer-

Aided Design on Integrated Circuits and

Systems, 21(8), 974979.

Вам также может понравиться

- Comparison of The Effects of Monochloramine and Glutaraldehyde (Biocides) Against Biofilm Microorganisms in Produced WaterДокумент8 страницComparison of The Effects of Monochloramine and Glutaraldehyde (Biocides) Against Biofilm Microorganisms in Produced WaterseventhsensegroupОценок пока нет

- Experimental Investigation On Performance, Combustion Characteristics of Diesel Engine by Using Cotton Seed OilДокумент7 страницExperimental Investigation On Performance, Combustion Characteristics of Diesel Engine by Using Cotton Seed OilseventhsensegroupОценок пока нет

- Optimal Search Results Over Cloud With A Novel Ranking ApproachДокумент5 страницOptimal Search Results Over Cloud With A Novel Ranking ApproachseventhsensegroupОценок пока нет

- Application of Sparse Matrix Converter For Microturbine-Permanent Magnet Synchronous Generator Output Voltage Quality EnhancementДокумент8 страницApplication of Sparse Matrix Converter For Microturbine-Permanent Magnet Synchronous Generator Output Voltage Quality EnhancementseventhsensegroupОценок пока нет

- Ijett V5N1P103Документ4 страницыIjett V5N1P103Yosy NanaОценок пока нет

- Fabrication of High Speed Indication and Automatic Pneumatic Braking SystemДокумент7 страницFabrication of High Speed Indication and Automatic Pneumatic Braking Systemseventhsensegroup0% (1)

- Extended Kalman Filter Based State Estimation of Wind TurbineДокумент5 страницExtended Kalman Filter Based State Estimation of Wind TurbineseventhsensegroupОценок пока нет

- Design, Development and Performance Evaluation of Solar Dryer With Mirror Booster For Red Chilli (Capsicum Annum)Документ7 страницDesign, Development and Performance Evaluation of Solar Dryer With Mirror Booster For Red Chilli (Capsicum Annum)seventhsensegroupОценок пока нет

- An Efficient Model of Detection and Filtering Technique Over Malicious and Spam E-MailsДокумент4 страницыAn Efficient Model of Detection and Filtering Technique Over Malicious and Spam E-MailsseventhsensegroupОценок пока нет

- Comparison of The Regression Equations in Different Places Using Total StationДокумент4 страницыComparison of The Regression Equations in Different Places Using Total StationseventhsensegroupОценок пока нет

- Color Constancy For Light SourcesДокумент6 страницColor Constancy For Light SourcesseventhsensegroupОценок пока нет

- A Multi-Level Storage Tank Gauging and Monitoring System Using A Nanosecond PulseДокумент8 страницA Multi-Level Storage Tank Gauging and Monitoring System Using A Nanosecond PulseseventhsensegroupОценок пока нет

- An Efficient Expert System For Diabetes by Naïve Bayesian ClassifierДокумент6 страницAn Efficient Expert System For Diabetes by Naïve Bayesian ClassifierseventhsensegroupОценок пока нет

- FPGA Based Design and Implementation of Image Edge Detection Using Xilinx System GeneratorДокумент4 страницыFPGA Based Design and Implementation of Image Edge Detection Using Xilinx System GeneratorseventhsensegroupОценок пока нет

- Implementation of Single Stage Three Level Power Factor Correction AC-DC Converter With Phase Shift ModulationДокумент6 страницImplementation of Single Stage Three Level Power Factor Correction AC-DC Converter With Phase Shift ModulationseventhsensegroupОценок пока нет

- Ijett V4i10p158Документ6 страницIjett V4i10p158pradeepjoshi007Оценок пока нет

- The Utilization of Underbalanced Drilling Technology May Minimize Tight Gas Reservoir Formation Damage: A Review StudyДокумент3 страницыThe Utilization of Underbalanced Drilling Technology May Minimize Tight Gas Reservoir Formation Damage: A Review StudyseventhsensegroupОценок пока нет

- High Speed Architecture Design of Viterbi Decoder Using Verilog HDLДокумент7 страницHigh Speed Architecture Design of Viterbi Decoder Using Verilog HDLseventhsensegroupОценок пока нет

- Review On Different Types of Router Architecture and Flow ControlДокумент4 страницыReview On Different Types of Router Architecture and Flow ControlseventhsensegroupОценок пока нет

- An Efficient Encrypted Data Searching Over Out Sourced DataДокумент5 страницAn Efficient Encrypted Data Searching Over Out Sourced DataseventhsensegroupОценок пока нет

- Non-Linear Static Analysis of Multi-Storied BuildingДокумент5 страницNon-Linear Static Analysis of Multi-Storied Buildingseventhsensegroup100% (1)

- An Efficient and Empirical Model of Distributed ClusteringДокумент5 страницAn Efficient and Empirical Model of Distributed ClusteringseventhsensegroupОценок пока нет

- Design and Implementation of Height Adjustable Sine (Has) Window-Based Fir Filter For Removing Powerline Noise in ECG SignalДокумент5 страницDesign and Implementation of Height Adjustable Sine (Has) Window-Based Fir Filter For Removing Powerline Noise in ECG SignalseventhsensegroupОценок пока нет

- Key Drivers For Building Quality in Design PhaseДокумент6 страницKey Drivers For Building Quality in Design PhaseseventhsensegroupОценок пока нет

- Separation Of, , & Activities in EEG To Measure The Depth of Sleep and Mental StatusДокумент6 страницSeparation Of, , & Activities in EEG To Measure The Depth of Sleep and Mental StatusseventhsensegroupОценок пока нет

- A Comparative Study of Impulse Noise Reduction in Digital Images For Classical and Fuzzy FiltersДокумент6 страницA Comparative Study of Impulse Noise Reduction in Digital Images For Classical and Fuzzy FiltersseventhsensegroupОценок пока нет

- Study On Fly Ash Based Geo-Polymer Concrete Using AdmixturesДокумент4 страницыStudy On Fly Ash Based Geo-Polymer Concrete Using AdmixturesseventhsensegroupОценок пока нет

- A Review On Energy Efficient Secure Routing For Data Aggregation in Wireless Sensor NetworksДокумент5 страницA Review On Energy Efficient Secure Routing For Data Aggregation in Wireless Sensor NetworksseventhsensegroupОценок пока нет

- Free Vibration Characteristics of Edge Cracked Functionally Graded Beams by Using Finite Element MethodДокумент8 страницFree Vibration Characteristics of Edge Cracked Functionally Graded Beams by Using Finite Element MethodseventhsensegroupОценок пока нет

- Performance and Emissions Characteristics of Diesel Engine Fuelled With Rice Bran OilДокумент5 страницPerformance and Emissions Characteristics of Diesel Engine Fuelled With Rice Bran OilseventhsensegroupОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- NFA To DFA Conversion: Rabin and Scott (1959)Документ14 страницNFA To DFA Conversion: Rabin and Scott (1959)Rahul SinghОценок пока нет

- Rules of the Occult UndergroundДокумент247 страницRules of the Occult UndergroundIsaak HillОценок пока нет

- Atuador Ip67Документ6 страницAtuador Ip67Wellington SoaresОценок пока нет

- Instructions: Hmems80 2020 Semester 1 Assignment 01 (Unique Number: 873964) Due Date: 9 March 2020Документ8 страницInstructions: Hmems80 2020 Semester 1 Assignment 01 (Unique Number: 873964) Due Date: 9 March 2020Matshele SerageОценок пока нет

- Grade 3 Unit 3 (English)Документ1 страницаGrade 3 Unit 3 (English)Basma KhedrОценок пока нет

- Bio Mini IA Design (HL)Документ7 страницBio Mini IA Design (HL)Lorraine VictoriaОценок пока нет

- Ausa 300-RH - en Parts ManualДокумент93 страницыAusa 300-RH - en Parts ManualandrewhОценок пока нет

- Oxford Exam Trainer: Oetmintaunit PDFДокумент2 страницыOxford Exam Trainer: Oetmintaunit PDFКатерина ПетрушевськаОценок пока нет

- Format Question Bank RevisedДокумент21 страницаFormat Question Bank RevisedkhananuОценок пока нет

- A320 Flex CalculationДокумент10 страницA320 Flex CalculationMansour TaoualiОценок пока нет

- Department Electrical Engineering Management IV Assignment 1 Semester 1, 2020Документ2 страницыDepartment Electrical Engineering Management IV Assignment 1 Semester 1, 2020samuelОценок пока нет

- Friction WedgesДокумент7 страницFriction Wedgespericharla ravivarmaОценок пока нет

- Industrial Wire Cutting Machine: A Senior Capstone Design ProjectДокумент17 страницIndustrial Wire Cutting Machine: A Senior Capstone Design ProjectTruta IonutОценок пока нет

- Article 680 Swimming Pools, Spas, Hot Tubs, Fountains, and Similar InstallationsДокумент13 страницArticle 680 Swimming Pools, Spas, Hot Tubs, Fountains, and Similar InstallationsDocente 361 UMECITОценок пока нет

- Follow The Directions - GR 1 - 3 PDFДокумент80 страницFollow The Directions - GR 1 - 3 PDFUmmiIndia100% (2)

- Trip WireДокумент19 страницTrip Wirepinky065558100% (2)

- Chapter 2 - Key Themes of Environmental ScienceДокумент34 страницыChapter 2 - Key Themes of Environmental ScienceJames Abuya BetayoОценок пока нет

- 桌球比賽裁判自動系統Документ69 страниц桌球比賽裁判自動系統ErikОценок пока нет

- Diagrama Montacargas AlmacenДокумент8 страницDiagrama Montacargas AlmacenMiguel Gutierrez100% (1)

- 1.4 Solved ProblemsДокумент2 страницы1.4 Solved ProblemsMohammad Hussain Raza ShaikОценок пока нет

- Volume 5 Issue 1Документ625 страницVolume 5 Issue 1IJAET Journal0% (1)

- TFT-LCD TV/MONITOR SERVICE MANUALДокумент54 страницыTFT-LCD TV/MONITOR SERVICE MANUALhimkoОценок пока нет

- Ch05 - Deformation - HamrockДокумент14 страницCh05 - Deformation - HamrockMuhammad Mansor BurhanОценок пока нет

- Mechanical Vapor RecompressionДокумент9 страницMechanical Vapor Recompressionnarayana reddy0% (1)

- Audit ComplianceДокумент1 страницаAudit ComplianceAbhijit JanaОценок пока нет

- 38-13-10 Rev 2Документ128 страниц38-13-10 Rev 2Gdb HasseneОценок пока нет

- Automatic Helmet DetectДокумент4 страницыAutomatic Helmet Detectvasanth100% (1)

- Big Data Analytics and Artificial Intelligence inДокумент10 страницBig Data Analytics and Artificial Intelligence inMbaye Babacar MBODJОценок пока нет

- Accomplishment Report - English (Sy 2020-2021)Документ7 страницAccomplishment Report - English (Sy 2020-2021)Erika Ikang WayawayОценок пока нет

- Fc6a Plus (MQTT)Документ44 страницыFc6a Plus (MQTT)black boxОценок пока нет