Академический Документы

Профессиональный Документы

Культура Документы

Money & Banking Final Report

Загружено:

80kilorabbitИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Money & Banking Final Report

Загружено:

80kilorabbitАвторское право:

Доступные форматы

1 Small & Medium Enterprises

12/12/2013

IOBM

SMALL & MEDIUM ENTERPRISES

Submitted To Sir Yousuf Razzak

Submitted By Hussain Lalji 11350

Salman Khan 11463

M.Zain Ghanchi 11419

Rabee Chhapra 11312

Syed Azam Raza 11266

2 Small & Medium Enterprises

Table Of Content

Introduction ...................................................................................................................................1

Difference between Small Medium Enterprises and Micro-Finance Institutions ...............................1

Small Medium Enterprises in Pakistan ............................................................................................2

Role of SME in Pakistan ..................................................................................................................3

Problems with SMEs in Pakistan .....................................................................................................5

Current SME Policy-Pakistan ..........................................................................................................7

Recommendations & Remedies ......................................................................................................7

General Measures: ................................................................................................................................................... 7

Policy Measures: ...................................................................................................................................................... 9

SMEDA-Small & Medium Enterprises Development Authority .........................................................9

SMEDA Development Projects ...................................................................................................... 10

Distribution of SMEs in Pakistan ................................................................................................... 12

Small Medium Enterprises Sector Briefs ........................................................................................ 14

Meat Sector: ........................................................................................................................................................... 14

Fisheries Sector: ..................................................................................................................................................... 14

Dairy Sector: ........................................................................................................................................................... 14

Furniture Sector: .................................................................................................................................................... 15

Horticulture ............................................................................................................................................................ 15

Textile Sector: ......................................................................................................................................................... 15

Spinning: ................................................................................................................................................................. 15

Employment in SMEs .................................................................................................................... 16

SME FINANCING PRODUCTS ......................................................................................................... 16

Working Capital Financing Needs ........................................................................................................................... 16

Asset Acquisition / Business Expansion:................................................................................................................. 17

Trade Financing: ..................................................................................................................................................... 17

CEO Interview Regarding SME in Pakistan ..................................................................................... 22

Bibliography ................................................................................................................................ 23

1 Small & Medium Enterprises

Introduction

Small Medium Enterprises (SMEs) are the key driving mechanism of an

economy. The abbreviation SME is frequently used in European Union countries

as well as in International Organizations like IMF and World Bank. They are

defined as a project that is engaged in economic development and are an

essential source of jobs, create entrepreneurial skills and innovations in an

economy and thus are crucial for encouraging competitiveness and employment.

According to Cressy and Olofsson (1997) European commissions definition

states that company which provides work to a lesser than 250 workers is called

SME. Knight (2000) specifies that the Small Medium Enterprise build up large

employment opportunities that thus assure future growth and development of that

country. Small Medium Enterprises play an essential role in development of any

under-developed country as well as developed country. Small Medium

Enterprises also have a key role in the progress of any nation as well as its

modernization. According to Frankfurt School of Finance & Management

Every government whose economic policy is rooted in market principles regards

promotion of the SME sector as a key objective. Robson and Bennett (2000)

pointed out that since SME have started growing, governments are beginning to

support and sustain SMEs growth through their soft and flexible policies.

Customarily a SME, (a small and/ or medium venture) is characterized as an

endeavor and is acknowledged to be any substance occupied with a monetary

action, independent of its authoritative document. This incorporates specific,

independently employed persons and family organizations occupied with art or

other exercises, and organizations or acquaintanceships customarily occupied

with an investment movement.

Difference between Small Medium Enterprises and Micro-

Finance Institutions

Micro finance is a form of financial service organization for people that require

access to banking services. Microfinance is the provision of financial services

including Credit, Savings, Insurance etc, to those sectors of economy, which are

not serviced by traditional formal financial institutions viz. commercial banks and

non-banking financial institutions.

1

The main objective of a microfinance

1

SBP-Banking Supervision Department

2 Small & Medium Enterprises

institution is to make people self-sufficient by providing financial services.

Microfinance employs fewer than 30 people. On the other hand, SMEs normally

employee between 10-200 workers and are smaller in size. Their differences go

beyond mere size. Microfinance institutions concentrate largely in trade sector of

an economy and operate usually in local market. Thus microfinance needs

mostly working capital. In contrast, SMEs operate usually in formal sectors of an

economy and thus tend to be fully independent institutions. They focus more on

their growth and the growth of individuals associated with them. Thus their

activities go beyond the borders. Thus they need working capital as well as

investment finance. It is also believed that providers of finances to microfinance

institutions are NGOs whereas providers of finance to SME are proper banking

business. Also, SMEs are for small enterprises willing to start-up their own

business and thus provide finances of 1-1.5million whereas Microfinance usually

satisfies niche level needs. Their maximum credit limit is a hundred thousand.

Small Medium Enterprises in Pakistan

Pakistan have developed and designed policies for the upliftment and

development of SME sector. According to a study, the small scale sector of

Pakistan recorded an impressive growth rate of 5.06% from 1950 to 2003 and

that too without getting any benefit from macro-economic policies that large-

scale manufacturing sector was obtaining.

According to official key figures, SME show an astonishing growth of 14.7% from

1987-1996.

2

Neithammer et al., (2007) supported the basic idea of SME and

points out that the institution has been favorable in the development of Pakistans

economy. According to Small Medium Enterprises Development Authority

(SMEDA), 9/10 of businesses in Pakistan are running as small and medium

enterprises and SMEs contribute of 4/5 of employment of the country and 2/5 of

total GDP of whole national economy

3

.

In Punjab an industry is ordered as a SME in the event that its repaired venture

comprises to Rs 20 million barring its property and building. In any case, in the

territory of Sindh, a SME is characterized as any element occupied with handling

handiworks or in the assembling business with an altered capital not more than

Rs 10 million incorporating its altered speculations.

2

SME DEVELOPMENT IN PAKISTAN: ISSUES AND REMEDIES

3

ENTREPRENEURSHIP AND SMEs IN PAKISTAN

3 Small & Medium Enterprises

In Pakistan, house or family commercial ventures hold a significant position in

rustic set-up. Generally villages are independent in the essential necessities of

life. They have their own woodworkers, blacksmiths, potters, skilled workers and

cotton weavers. Numerous families hinge on upon house commercial enterprises

for wage. The industry has huge potential. It includes in the sum GDP

development of the nation. However because of the absence of monetary

chances and other deterrents the little scale organizations are unable to work in

its full potential and subsequently just makes up to 5% of the aggregate GDP

development. Extraordinary measures need to be taken for the change in the

advancement of such commercial ventures in the economy since such

commercial ventures specifically have made extensive scale occupation

chances. Since the industry is work concentrated in nature 25% of the Pakistani

work energy is at present employed in the diverse SMEs particularly in the

distinctive regions of Punjab like Sailkot, Faisalabad and Gujranwala. Zones of

Sindh incorporate Hyderabad and Karachi in specific. Separated from these

significant downtown areas, there exist numerous diverse little scale ventures in

the remote zones of KPK and Kashmir.

Role of SME in Pakistan

Pakistan is the second biggest developing economy in Asia after China, in 2004

2005, as ensured by government and fairly recognized by worldwide rater's and

budgetary organizations. According to the Economic Survey of 2004-05 the

extension in correct GDP is the possibility of uncommon execution of extensive

scale collecting and organizations section. As the advancement of the

considerable scale part was 15.4% still and medium endeavors (SMEs) was the

center issue in the country's progression and flourishing of the masses in view of

which Pakistan ranks 135th out of 174 nations on the Human Development

Index.

The part of SMEs in Pakistan is of crucial criticalness. Sometimes we have

shinny figures and data concerning economy like GDP advancement or for each

capita pay however these could be misleading in light of the way that the earners

of this colossal improvement are not the masses yet the businesspersons in the

country.

In Pakistan SME division is not only the minor sharer work yet, the reality is that

Pakistan's whole economy is exceedingly dependable on the pace and additions

of SMEs. Out of Pakistan's 3.2 million endeavors 95% are the people who have,

4 Small & Medium Enterprises

99% agents in the private mechanical region and 78% use of non green work

vigor. SME helps 25% admission of gathering items and 30% of GDP is the

aftereffect of business efforts of SMEs.

SMEs will be the essential wellspring of desperation abatement in Pakistan that

will make the quality and advancement in the country in the days to come. The

thing that without a doubt needs real thought is to clear the unnecessary

bureaucratic systems. It is key to make it possible that the chances for aspiring

individuals should not be wasted through wealth arranging of cash procurements

or other official terms. Back to SMEs is deficient; the assembly and particular

money related and specific associations should just stayed as accessories of and

medium specialists, this is the principle way that the cash identified

establishment can recover their stores with yield. The governing body could

perform its destination of dejection lessening, monetary progress or more all the

worth creation plan by promoting the social order of SMEs. This is the primary

way that can figure out the poor masses of Pakistan may not leave poor any

more extended.

Like other propelling countries, lacking financing of SMEs in Pakistan is an

eventual outcome of disequilibrium in the SME credit market. This recommends

that ask for and supply of SME financing don't clear each one in turn due to

confound of issues of both sides. On supply side, banks meek a long way from

advancing to SMEs in view of; (i) wonderfully risky division as a consequence of

its more spectacular affectability to fiscal progressions; (ii) unlucky deficiency of

security; (iii) nonappearance of bona fide data on business area appraise; (iv)

credit supervisors' high look for cost4; (v) high taking care of expense, et cetera.

On premium side, SME industry can't address concerns of banks in light of; (i)

humbler measure; (ii) confined organization capabilities; (vii) compelled holdings

in keeping business account with keeping cash necessities, et cetera. These

concerns of both sides show that banks are threat unwilling and are reluctant to

grow credit to SMEs while SMEs can't deal with the expense of assembling

keeping cash essentials. In the later log stick of the economy, the blunder

between premium and supply of credit market of SME may compound further

importance the need for mediation.

All around the present fiscal downturn in the country, budgetary pointers portray

a declining example in SME financing. On the backing of SME potential,

institutional limit and recorded example, the State Bank of Pakistan motioned in

2007 that the keeping cash credit for the division needed to be extended up to Rs

5 Small & Medium Enterprises

1000 billion in 2012 to be relentless with the expected macro-speculation centers

of improvement and employment5. Be that as it may, the negative advancement

rate in the unprecedented credit measure of the territory and its falling knowledge

all in all development portfolio sometime during the latest two years have made

the target troublesome to be accomplished. The striking credit measure has

declined from Rs 361 billion in 2005 to Rs 348 to whip the test of obliged

financing for SMEs.

Problems with SMEs in Pakistan

The following is a quotation from Independent Organization Evaluation of

Small Medium Enterprise Development Authority (SMEDA) which highlights

the key issues of SMEs in Pakistan

The country which is the closest in terms of population, level of development

and demographics is Brazil. Their organization, SEBRAE, is getting funding of

$7.24 per capita (which is dedicated capital base of 0.3% of payroll taxes), which

is an immense amount when compared to Pakistan. Brazil, like Pakistan, is an

emergency economy and its SME agency employs 4500 direct workers and has

over 9000 external consultants helping the SMEs. In contrast, SMEDA employs

only 125 workers and a handful of consultants. SEBRAE runs 788 service

centers, has presence in 2000 municipalities, supports 200 clusters and runs 377

incubators. In contrast, SMEDA has 4 provincial offices and 18 regional offices. If

SMEDA were to acquire enough funding, with a proper organization structure

and good management in place, Pakistan would take the first step towards

energizing the SME sector for industrial development of Pakistan.

4

Due to the short investments and financial assistance available to entrepreneurs

of SMEs, there prevails large number of barriers for the proper functioning of

such industries. Some problems highlighted are:

Due to the low investments, the business isnt as developed which results

in low revenues that tend to have low monetary worth. Thus the profits

generated are too low.

The issues to be addressed for this sectors development falls within

Ministries and Departments at Federal, Provincial and Local Government

level and SMEDA has no institutional jurisdiction with such institutions.

4

Ibid.

6 Small & Medium Enterprises

In SMEs of Pakistan, there lacks consistency and quality measures

because of which, they cannot compete or participate in international

markets.

There also lacks synchronization and coordination between different

industries thus different prices prevail in the market.

The budgets of SMEs in Pakistan are at a very lower stage thus they the

technology and production methods are obsolete and old fashioned.

SMEs also lack Economies of scale. This is the very reason they cannot

compete locally. They also cannot compete with the wholesalers which sell

at cost price thus exploiting SME industry.

Another problem for the effective functioning of SME is the power

outrages. Electricity is not provided thus its difficult to setup SME in rural

areas. Also, the rise in power tariff by 70pc has adversely influenced the

functioning of SME and made them uncompetitive by adding up costs to

their cost of production.

The free trade policies have contributed to uneasiness for SMEs and has

inversely affected their growth of trade, commerce and economic activity.

SMEs in Pakistan work with obsolete technologies. The workers are

deficient in technical skills. There is a general absence of information on

opportunities for technological up gradation.

The incomes created have a tendency to have an extremely little fiscal

esteem because of which the distinctive benefits produced is less to the

point that a large portion of it is used in the every day uses. Additional

capital is not accessible for extension purposes.

There is an absence of institutionalization and quality control. In a few

cases they don't meet the benchmarks of outside business sectors. An

absence of coordination between various commercial ventures likewise

makes contrasts in costs.

Because of the low ability rate of the speculators, the preparation systems

and innovation utilized is old fashioned

The specialist and artisans study their abilities and processing systems

from their seniors. The procurement of specialized guidance and further

preparing is restricted.

Because of the absence of exchange obstructions and the advancement of

unhindered commerce, the businesses are overflowing with universally

processed merchandise which overshadow the locally transformed yield so

as to use the full potential of the SMEs in Pakistan there are unique

7 Small & Medium Enterprises

measures that are required to be taken by the administration which might

secure and push the presence of such businesses.

Current SME Policy-Pakistan

There does not exist, a proper definition of Small and Medium Enterprises.

Each agency uses its own definition which makes it complicated to target

them and give development programs.

The labor, fiscal and enterprise regulations of the Federal and Provincial

Governments dont provide for a focus on SMEs that is in line with their

specific needs.

5

Banks provide 8% of SMEs funding base.

6

Access to finance is SMEs

most important obstruction to growth according to Barriers to SME Growth

in Pakistan: An Analysis of Constraints by LUMS.

SMEs lack proper human resource. Most human resource is unaware of

SME needs which hinder in SMEs innovation and value-addition.

Pakistan lacks entrepreneurial potential and the youth does not prefer

entrepreneurship as a career option. The past government programs (Self

Employment Scheme, Youth Investment Promotion Society and Yellow

Cab Scheme) were limited and werent properly endorsed.

Investors lack financial support and managerial support. They are short in

visioning the potential and future prospects of this sector. There lacks

proper explicit policies for investors.

Recommendations & Remedies

General Measures:

The Government of Pakistan must take some special measures in order to make

use of full potential of Small Medium Enterprises (SMEs) and also to protect

5

SME policy 2007

6

Investment Climate Assessment 2003

8 Small & Medium Enterprises

promote the existence of SMEs in Pakistan. Lack of long term financing is one of

the major problems faced by SMEs in Pakistan. Lack of finance acts as a barrier

to many producers and entrepreneurs in fulfilling their basic production

requirements. In order to reduce the risk of default, the banking regulations

require borrowers to provide security deposits or collaterals for obtaining long

term loans from the banks. Many owners of SMEs in Pakistan are unable to fulfill

these requirements and thus they are not given financing by any bank which as a

result prevents these production units from any further production.

9 Small & Medium Enterprises

Policy Measures:

Government should adopt a single definition. It should be then used by all

the authorities. According to SEM policy 2007, the policy should contain:

o Employment Size: up to 250 people,

o Paid-up Capital: up to 25Mn and

o Annual sales: up to 250Mn.

According to SME policy The Task Force recommends promulgation of an

SME Act that provides for identification of fiscal, registration, labor and

inspection laws that may be simplified for Small and/or Medium

Enterprises. Businesses may be licensed as a SME unit by a simple

process. SME desks should be established with a Complaint Cell.

Regulatory regime for specialized sectors may also be set-up.

SMEs credit should be added up to Budgets of SBP and GoP. Evaluation of

Prudential Regulations, Founding of Credit Guarantee and Credit Insurance

agencies to help banks facilitate SME financing and giving of new

bankruptcy laws should be implemented.

SMEs human resource need should be identified along with its

technological up gradation. Also, encouragement should be given for

investing in emerging sectors and skills up gradation.

Higher education curriculum should be amended. New Entrepreneurship

courses should be adjoined so as to promote entrepreneurship. Among

youth.

There should be proper explicit policies by GoP to cater to the investors.

GoP should design proper Labor Laws, Finance and Credit policies and

should directly supervise this sector to function efficiently and effectively.

SMEDA-Small & Medium Enterprises Development Authority

Small and Medium Enterprises Development Authority (SMEDA) is a premier

government organization of Pakistan under Ministry of Industries. It was

established in October 1998 with the objective of developing SMEs in Pakistan.

The SMEDA focuses on providing development services and an enabling

business environment for the SMEs operating in Pakistan. SMEDA not only

works as an SME policy-advisory body for the Pakistan government but it also

acts as a representative of SMEs in Pakistan. The SMEDA addresses various

issues, problems and agendas of SMEs to facilitate the stakeholders.

10 Small & Medium Enterprises

SMEDA Objectives

The main objectives of SMEDA are as follows:

1. To facilitate the SMEs by providing business development services.

2. To formulate such policies for SMEs which encourage the SMEs growth in

Pakistan.

3. To advise the Government of Pakistan on different fiscal and monetary

issues regarding SMEs in Pakistan.

4. To facilitate the development and growth of SMEs in the country.

5. To assist the SMEs in Pakistan in the process of obtaining different

international certification for their products and services.

6. To facilitate the SMEs in obtaining long term financing from the banks.

7. To strengthen the SMEs in Pakistan by arranging different seminars,

workshops and training programs for the employees of SMEs.

8. To provide donor assistances to the SMEs in Pakistan by through several

programs and projects.

9. To provide a performance report to different sectors of SMEs by

conducting sector studies.

10. To facilitate the SMEs by maintaining a database of service provider.

SMEDA Development Projects

Some important development projects undertaken by SMEDA are:

In the textile sectors the following projects being started

Ginning Technology Up-Gradation

Program Lending For Power Looms

Computer Aided Design Centre (Common Facility Centre-Sialkot)

Designing Institute for Garments (Peshawar)

Development of Handloom Cluster

In the Horticulture:

Establishment of Cool-Chain Agriculture Export Processing Zone

Fruit Processing Facility (NWFP in Collaboration with EPB)

Assistance to Set Up Horticulture Export Board

11 Small & Medium Enterprises

Revitalization of Sunflo Cit-Russ for Citrus Cluster Development.

Apple Treatment Plant in Balochistan (Co-Ordination with EPB)

In Fisheries:

Program Lending Boat/Engine Modification, Gwadar District

Establishment Of Shrimp Farms

Fish Processing Facility In Gwadar (Feasibility Study)

Export Warehouse Marble (Azakhel NWFP)

Establishment of Model Quarry and Training Institute Marble

Joint Ventures and Technology Transfer Arrangements (NWFP)

In Gems:

Five New Gem Mines To Be Operationalized (NWFP)

Lapidaries Program Lending (NWFP)

Glass & Ceramics

Ceramics Kiln Up-Gradation: Common Facility Centre, Gujrat

Sanitary Ware & Pottery Sector Kiln Up-Gradation

Bangles Kiln Up-Gradation (Hyderabad)

In Agriculture:

Agri-Mall One Stop Shop for Agriculture Inputs

Support Services for Agricultural Credit (SSAC)

Establishment of 3 Private Sector Warehousing & Trade Promotion

Facilities in Afghanistan

Public Sector Development Projects

Agro Food Processing Facilities - Multan

CFTC for Light Engineering Cluster - Mardan

Chromite Beneficiation Plant - Khanozai

Dyeing , Washing & Pressing CFC for Silk Cluster - Mingora Swat

Establishment of Spinning CFC - Islampur Swat

Foundry Service Centre - Lahore

Glass Products Design & Manufacturing Center - Hyderabad

Gujranwala Business Center

12 Small & Medium Enterprises

Honey Processing & Packaging Common Facility Center - Mingora Swat

Juice Producing and Packaging Line for Fresh Fruits & Vegetables - Multan

Khadi Crafts Development Company (KCDC) - Multan

Leather Crafts Development Company (LCDC) - Multan

Meat Processing & Training Company (MPTC ) - Multan

Policy & Project Implementation, Monitoring & Evaluation Unit (PPIMEU)

Lahore

Red Chilies Processing Centre - Kunnri/ District Umerkot

Revival of Cutlery Institute of Pakistan (CIP) - Wazirabad

Revival of Hyderabad Leather Footwear Center - Hyderabad

Revival of Multani Blue Pottery - Multan

Sialkot Business and Commerce Centre

SME Subcontracting Exchange - Gujranwala

Sports Industries Development Centre - Sialkot

Spun Yarn Research and Development (R&D) Company - Multan

Washing & Pressing Unit - Matta Mughal Kheal, Charsada

Women Business Development Centre - Karachi

Women Business Development Centre - Mingora, Swat

Women Business Development Centre - Peshawar

Women Business Development Centre - Quetta

Distribution of SMEs in Pakistan

According to the Economic Census of Pakistan (2005):

There were 2.96 million SME units in Pakistan. For convenience, the SMEs in Pakistan

are categorized into 2 groups:

1. Establishment Units

2. Household Units

Out of 2.96 million SME units in Pakistan:

13 Small & Medium Enterprises

2.8 Million units i.e. 93.9% of the total SME units in Pakistan were Establishment

Units; and

0.18 Million SME units i.e. 6.1% units were Household Units.

Punjab constituted the largest share of 65.26% in the total of 2.8 million Establishment

units in Pakistan. Sindh had the 17.82% share. Whereas, the shares of Khyber

Pakhtoon Khuwa (KPK) and Balochistan, in the total Establishment units, were 14.21%

and 2.09% respectively.

Out of total 2.96 million SME units in Pakistan:

53% units were in the major sector of Wholesale and Retail Trade and

Hotels/Restaurants,

22.3% units in Community, Social and Personal Services sector; and

the remaining 24.7% units in different industries and sectors.

Among 0.18 million Household SME units in Pakistan:

66.5% units were in the Manufacturing sector,

20.5% units in the Community, Social and Personal Services sector,

8.7% units in the Agriculture, Poultry Farming, Fishing sector; and

4.3% units in the Wholesale and Retail Trade sector.

The data of the manufacturing firms shows that out of 583,329 units taken in the

census, 466,153 units were in the category of Establishment units which means that

about 80% of the manufacturing units in Pakistan fell under the category of

Establishment SME units. Out of this 80% units:

43.2% units were in the Textile Wearing, Apparel and Leather industries,

20.9% units in the Food, Beverages and Tobacco industries,

10.8% units in the Wood and Wood Products industries,

10% units in the Fabricated Metal Products, Machinery and Equipment

industries,

8.9% units the other Manufacturing Industries and Handicrafts industries; and

The remaining 11.1% units in the other different sectors.

14 Small & Medium Enterprises

Small Medium Enterprises Sector Briefs

Meat Sector:

Asian countries export bulk quantity of meat. The major meat importers are

Japan, Saudi Arabia, Korea and UAE (Figure 1). Countries like Saudi Arabia,

Egypt and Iran are good prospects for Pakistan as they import Halal meat. The

volume of the meat market at present in Pakistan is 2,185,000 metric tons. Meat

demand is growing at almost 6% per annum while supply is growing at 1.8%

7

. SMEDA

is working towards the upliftment of meat export sector. They are introducing healthy

measures to make local industry compete with the international sector.

Figure 1

Fisheries Sector:

Major fish exporting countries incorporate Thailand, China, Norway and Canada. On the

other hand, major fish importers are Japan and USA. In terms of Pakistan, the majority

of the fishes produced are exported and not consumed domestically. Major buyers for

Pakistani fish species are US, Japan, Europe and Middle Eastern countries. According

to the news, the exports of fish surged by 14.69% during (2011-12) against the

corresponding period of last year. The fish exports were around at $195.284 million

during (2011-12).

Dairy Sector:

The Livestock/Dairy sector plays a vital role in the economy of Pakistan. According to

SMEDA, milk production is the single-largest commodity with value of around 160bn

rupees. When it comes to production, Pakistan ranks 7

th

however, we have to import

powered milk to meet local needs. Even with more animals, we lack the specialties to

7

SMEDA

15 Small & Medium Enterprises

product more liters of milk as compared to Western nation. SMEDA has recommended

setting up Punjab Dairy Authority (PDA).

Furniture Sector:

During 1996 to 2001, the exports of Pakistan increased by more than 130%. The office

furniture exports only accounted for $24000 in 2000-01 whereas the bedroom furniture

exports were $9000 and the kitchen furniture accounted for $607000.

8

Horticulture

Horticulture has a great likelihood of growth. Due to our ignorance, the exports and

quality are suffering. SMEDA has developed a broad horticulture export strategy in

which the research work is included. The finalized plan in association with the EPB is

made. SMEDA, in collaboration with EPB, has started working for the formation of a

Horticulture Export Board (HEB). SMEDA is also working for establishment of cold

storage facilities.

Textile Sector:

Pakistan has one of the largest shares of bed ware and linen in International market. In

the year 1999, bed wear & linens accounted for $681 million in foreign exchange

earnings. The bed wear & linen market has increased by an annual average of 16% in

last five years. In the year 2000-01, the exports rose to $752.53million.

In 1999, the revenue from blankets were $9.92million. This market has increased by

annual average of 20%.

The Apparel accounted to $1.74bn exports which were 34% of total textile exports for

the year 1999-2000. In apparel segment, the total number of small units in 2000-01 was

3600. This sector also has a huge potential. Back in 2000-01, it employed around

700,000 people as it was labor-intensive.

Spinning:

In turning fragment, Pakistan ranks the third biggest. Pakistan's turning limit is 5% of the

aggregate planet and 7.6% of the limit in Asia. Pakistan's development rate has been

6.2% and is second just to Iran around the real players. Pakistan is the fourth biggest

maker of cotton yarn in the world.

8

SMEDA

16 Small & Medium Enterprises

Employment in SMEs

According to the Economic Census of Pakistan (2005):

There were 2.96 million SME units in Pakistan and a total of 6.58 million persons

got employment due to these SME units. The employment pattern was as

follows:

2.85 million (96.6%) units employed 1-5 persons,

0.079 million (2.67%) units employed 6-10 persons,

26,000 (0.87%) units employed 11-50 persons; and

1617 (0.054%) units employed over 50 persons.

Out of total employment of 6.58 million persons:

Around 5% (0.34 million) persons got employment in the Household SME

units; and

Remaining 95% (6.24 million) persons were employed in the

Establishment SME units in Pakistan.

Around 0.46 million (i.e. 7%) females were given employment out of the total of

6.58 million persons employed. Among these 0.46 million females:

15% females were self-employed/proprietors,

30% females were unpaid family helpers; and

The remaining 55% females were employees.

SME FINANCING PRODUCTS

The State Bank of Pakistan (SBP) has played a vital role in the development of

SMEs in the country by promoting financing to the SMEs through Commercial

Banks. The Commercial Banks in Pakistan offer different types of SME financing

products according to the needs of the business of SMEs.

The SME financing products offered by the banks are classified into three major

categories which are then further sub-divided as follows:

Working Capital Financing Needs

In order to meet the running day to day affairs of business working, the SMEs

can obtain a number of number of financing facilities from the banks. The

17 Small & Medium Enterprises

following financing facilities/products are designed by banks for the SMEs to

meet their capital requirements of business:

Running Finance

Demand Finance

Cash Finance

Factoring

Asset Acquisition / Business Expansion:

Every business requires different fixed assets in order to operate. The SMEs can

acquire fixed assets for their business by availing the following provided financing

facilities provided by the banks.

Term Loans

Leasing

Trade Financing:

The Commercial Banks also provide financing facilities to the SMEs involved in

the business of import and export of products or raw materials. These financing

facilities are as follows:

Bank Guarantee

Letter of Credit

Export Credit financing

Bills of Exchange Purchased

Trust Receipts

The SME Financing Products provided by the big 5 banks of Pakistan are

discussed below.

HABIB BANK LIMITED

The Habib Bank Limited (HBL) provides the following facilities to the SMEs

operating in Pakistan:

i. Running Finance facility,

ii. Demand Finance facility, and

iii. Cash Finance facility.

18 Small & Medium Enterprises

These facilities are targeted towards all the sectors and any type of SME in

Pakistan can avail these facilities. The amount of finance provided in these

facilities ranges from 0.5 Million to 75 Million and the tenure of this financing is

maximum 1 year. The time period required for the approval of these facilities is 9

days. All these financing facilities are Cash Flow based or Collateral based. The

Cash Finance is paid back on Revolving basis. The Running Finance is paid

back on Quarterly basis or in Flexible modes of repayment. Whereas, the

Demand Finance is paid back on Quarterly or Monthly basis, or in Equal

installments, or in Flexible modes of repayment.

MCB BANK LIMITED

The MCB Bank Limited (MCB Bank) provides the following facilities to the SMEs

operating in Pakistan:

i. Demand Finance facility,

ii. Lease Financing facility, and

iii. Working Capital facilities

These facilities are targeted towards all the sectors and any type of SME in

Pakistan can avail these facilities. The amount of finance provided in these

facilities ranges from 0.5 Million to 75 Million. The tenure of loan is 1 year to 5

years in case of Demand Finance facility, 3 years to 5 years in Lease Financing

facility and maximum 1 year, on the basis of renewal, in Working Capital

Facilities. The time period required for the approval of these facilities is maximum

37 days. All these financing facilities are Cash Flow based or Collateral based or

Program based except for Lease Financing facility which is only Cash Flow or

Collateral based. The mode of repayment in Working Capital facility varies

according to different facilities. The Running Finance is paid back on Quarterly

basis or in Flexible modes of repayment. The Lease Financing is paid back on

Quarterly or Monthly or Half-yearly basis, or in Equal installments. Land, Building,

Inventory, PGs, Current Assets etc can be kept as collateral.

UNITED BANK LIMITED

The United Bank Limited (UBL) provides the following facilities to the SMEs

operating in Pakistan:

i. NICF/FAPE facility,

ii. NIDF facility,

19 Small & Medium Enterprises

iii. Rice/Paddy Advances facility,

iv. Cotton Ginners Advances facility,

v. Credit facilities against Liquid Securities, and

vi. Running Finance facility

The above facilities, except for Rice/Paddy Advances and Cotton Ginners

Advances facility, are targeted towards all the sectors and any type of SME in

Pakistan can avail these facilities. Rice/Paddy Advances facility is only targeted

towards Rice growing sectors and it can be availed by only manufacturing SMEs

in this sector. Similarly, Cotton Ginners Advances facility is only targeted towards

Cotton growing sectors and it can be availed by manufacturing as well as trading

SMEs in this sector. The amount of finance provided in these facilities ranges

from 0.5 Million to 75 Million except for Rice/Paddy Advances facility where the

maximum amount of loan is 20 Million. The tenure of loan provided is 1 year in

case of NICF/FAPE facility and Running Finance facility, 3 years to 7 years in

case of NIDF facility and Rice/Paddy Advances facility, 1 year to 3 years in case

of Credit facilities against Liquid Securities and only 9 months in case of Cotton

Ginners Advances facility. The time period required for the approval of

NICF/FAPE and NIDF facilities is 4-5 weeks, 2 weeks for Rice/Paddy Advances,

Cotton Ginners Advances and Credit facilities against Liquid Securities and only

40 days in case of Running Finance facility. NICF/FAPE and NIDF facilities are

Cash Flow or Collateral based. Running Finance facility is Collateral based and

the remaining 3 facilities are Collateral or Program based. Rice/Paddy Advances,

Cotton Ginners Advances, Credit facilities against Liquid Securities and Running

Finance facilities are paid back on Quarterly basis. The mode of repayment in

case of NICF/FAPE facility is flexible. The repayment mode in case of NIDF

facility is either Quarterly basis or as allowed by the business cash flows.

BANK ALFALAH LIMITED

The Bank Alfalah Limited provides the following facilities to the SMEs operating

in Pakistan:

i. Alfalah Karobar Finance facility, and

ii. Alfalah Milkiat finance facility

These facilities are specifically designed for the SMEs. The Alfalah Karobar

Finance facility is designed for working capital requirements and the Alfalah

Milkiat finance facility is designed for the purpose of infrastructure capacity

20 Small & Medium Enterprises

building. These facilities are targeted towards all the sectors and any type of

SME in Pakistan can avail these facilities. The minimum amount of loan provided

in both the facilities is 0.5 Million but the maximum amount is 10 Million in the

case of Alfalah Karobar Finance facility and 20 Million in the case of Alfalah

Milkiat finance facility. These facilities are Cash Flow or Collateral based. The

tenure of Alfalah Milkiat finance facility ranges from 2 years to 12 years.

Whereas, the tenure of loan in Alfalah Karobar Finance facility is maximum 1

year. The time period required for the approval of Alfalah Karobar Finance facility

is 30 days and 45 days in the Alfalah Milkiat finance facility. The Alfalah Karobar

Finance facility is paid back on either Quarterly basis or in Flexible modes and

the Alfalah Milkiat finance facility is repaid in Equal Monthly Installments. These

financing facilities can be availed from the specific branches of Bank Alfalah in

different cities.

STANDARD CHARTERED BANK LIMITED

The Standard Chartered Bank (SCB) Limited provides the following facilities to

the SMEs operating in Pakistan:

i. Tana Bana facility,

ii. Rang Hi Rang facility,

iii. Kissan Card facility,

iv. Agri Deal facility,

v. Business Power facility, and

vi. Business Installment Loan facility

The Tana Bana facility is designed for Textile Weavers sector and the

Manufacturing concerns can avail this facility. The amount of finance provided in

this facility ranges from minimum 0.5 Million to maximum 20 Million. This facility

is Evergreen and renewed on annual basis. The time period required for the

approval of Tana Bana facility is 16 days. This facility is Secured Program or

Collateral based and the repayment mode of this financing facility is Monthly

Markup Payment.

The Rang Hi Rang facility is designed for Textile Dyers and Printers sector and

the Manufacturing concerns can avail this facility. The amount of finance

provided in this facility ranges from minimum 0.5 Million to maximum 20 Million.

This facility is Evergreen and renewed on annual basis. The time period required

for the approval of Rang Hi Rang facility is 16 days. This facility is Secured

21 Small & Medium Enterprises

Program or Collateral based and the repayment mode of this financing facility is

Monthly Markup Payment.

The Kissan Card facility is designed for Agriculture sector and the Farmers can

avail this facility. The amount of finance provided in this facility ranges from

minimum Rs. 32,000 to maximum Rs. 125,000. This facility is Evergreen and

renewed on annual basis. The time period required for the approval of Kissan

Card facility is 16 days. This facility is Unsecured Program based and the

repayment mode of this financing facility is Bi-Annual Markup Payment.

The Agri Deal facility is designed for Dealers of Agricultural Inputs, Fertilizers,

Pesticides and the Traders can avail this facility. The amount of finance provided

in this facility ranges from minimum 0.5 Million to maximum 30 Million. This

facility is Evergreen and renewed on annual basis. The time period required for

the approval of Agri Deal facility is 16 days. This facility is Secured Program or

Collateral based and the repayment mode of this financing facility is Monthly

Markup Payment.

The Business Power facility is designed for all sectors and the any type of SME

in Pakistan can avail this facility. The amount of finance provided in this facility

ranges from minimum 1 Million to maximum 20 Million. This facility is Evergreen

and renewed on annual basis. The time period required for the approval of

Business Power facility is 16 days. This facility is Secured Program or Collateral

based and the repayment mode of this financing facility is Monthly Markup

Payment.

The Business Installment Loan facility is designed for all sectors and the any type

of SME in Pakistan can avail this facility. The amount of finance provided in this

facility ranges from minimum 0.5 Million to maximum 2 Million. The tenure of this

facility is 1 year to 3 years. The time period required for the approval of Business

Installment Loan facility is 14 days. This facility is Unsecured Program based and

it is a Clean Lending. The Business Installment Loan facility is repaid in Equal

Monthly Installments.

22 Small & Medium Enterprises

CEO Interview Regarding SME in Pakistan

A brief summary of interviews with CEOs regarding SMEs in Pakistan is given below:

According to President of SME Bank, Mr. Kaiser Naseem, the main reason for failure of Small

Business Finance Corporation (SBFC) and Regional Development Finance Corporation (RDFC)

were Government and political interventions, in adequate skills in the institutions, weak internal

controls and corruptions. He said SME bank is established to promote SMEs in Pakistan and

actions have been taken to address the above issues and to solve them. He also said that

private sector FIs failed to finance SMEs properly so Government of Pakistan took the initiative

to set-up SME bank under it to help it get access to credit on time. Also, this intervention by

GoP is short-term. According to him, SME Bank works closely with SMEDA to identify eligible

SMEs and enhance SMEs capacity.

According to Atif Bajwa, CEO Alfalah Bank, SME banking and agri-finance are the backbone of

economy of Pakistan. SME sector contributes to 30% Pakistans GDP. Also, it employs more

than 70% of non-agricultural workforce and it accounts to 35% of value-added in the

manufacturing industry and also generates 25% of foreign earnings. According to him, most

SMEs are informally managed thus faces issues like lack of formal business running skills, poor

maintenance of accounts and low business planning. Banks are undertaking a pilot project

together with IFC to make a new strategy for SME sector of Pakistan.

23 Small & Medium Enterprises

Bibliography

Retrieved from Pakistan and Gulf Economist :

http://www.pakistaneconomist.com/issue2002/issue5/f&m.htm

BlueChip. (n.d.). Retrieved from Blue Chip Magazine: http://bluechipmag.com/bank-alfalah-

forward-looking-client-driven-and-focused-on-excellenceatif-bajwa-ceo-bank-alfalah/

Faaruq, Y. (n.d.). Small and Medium Enterprises in Pakistan. Retrieved from Youth Parliament:

http://www.youthparliament.pk/YP2012/Verbatim%20Reports/Session%204%20-

%20Aug%2027%20to%20Aug%2031%202012/Portable%20Document%20Format%20-

%20PDF/CommitteeReport/Small%20and%20Medium%20Enterprises%20in%20Pakistan%20by

%20Finance%20Committee.pdf

Lesikar. Basic Business Communication. McGraw Hills.

Mr. Mansoor Hassan Siddiqui, M. A. (n.d.). Retrieved from Sbp :

http://www.sbp.org.pk/sme/pdf/smebooklet-05-jul-08.pdf

News, E. Z.-T. (n.d.). The News. Retrieved from http://www.thenews.com.pk/Todays-News-3-

153604-Bank-Alfalah-focusing-on-SME-banking-&-agri-finance

Saeed, S. O. (n.d.). Role of SME. Retrieved from http://www.bizomer.com/role-of-smes-in-

pakistan.html

SME DEVELOPMENT IN PAKISTAN. (n.d.). Retrieved from

http://www.gcu.edu.pk/publications/vc-sme.pdf

SME Growth in Pakistan: Addressing Access to Finance Issue. (n.d.). Retrieved from Sbp:

http://www.sbp.org.pk/reports/quarterly/fy10/Second/SpecialSection.pdf

SMEDA. (n.d.). SME Policy 2007. Retrieved from

http://www.pakboi.gov.pk/pdf/Sectoral%20Policies/SME%20Policy%202007.pdf

Вам также может понравиться

- Original PDF Global Problems and The Culture of Capitalism Books A La Carte 7th EditionДокумент61 страницаOriginal PDF Global Problems and The Culture of Capitalism Books A La Carte 7th Editioncarla.campbell348100% (41)

- Sme Research ReportДокумент15 страницSme Research ReportRajesh ChavanОценок пока нет

- Labour Laws Applicable To SMEs - WIRC 28112009Документ26 страницLabour Laws Applicable To SMEs - WIRC 28112009Divya MewaraОценок пока нет

- The Role of Government in The Growth of Small and Medium IndustriesДокумент12 страницThe Role of Government in The Growth of Small and Medium Industriesdeepika Chowdary0% (1)

- Prospects and Challenges of Sme's in IndiaДокумент16 страницProspects and Challenges of Sme's in IndiaBharath Pavanje100% (5)

- Ruqyah With Transliteration Roman AlphabetДокумент30 страницRuqyah With Transliteration Roman Alphabet80kilorabbit88% (8)

- The Role of SMEs in Economic DevelopmentДокумент39 страницThe Role of SMEs in Economic Developmentarman_277276271Оценок пока нет

- Small and Medium-Sized Enterprises - WikipediaДокумент14 страницSmall and Medium-Sized Enterprises - WikipediaFilopeОценок пока нет

- Role of Micro Finance Institutions in Development of Microenterprises (Msmes) in Mumbai - An Empirical StudyДокумент12 страницRole of Micro Finance Institutions in Development of Microenterprises (Msmes) in Mumbai - An Empirical StudyManju MessiОценок пока нет

- Submitted By: Khawaja Uzair Safdar Roll #: 109 Class: Bba 8 Subject: SME Submitted To: Zaheer AlamДокумент8 страницSubmitted By: Khawaja Uzair Safdar Roll #: 109 Class: Bba 8 Subject: SME Submitted To: Zaheer AlamFaisal AwanОценок пока нет

- DocumentДокумент7 страницDocumentAkashОценок пока нет

- Ed Unit-IiДокумент70 страницEd Unit-IiSäi DäťťaОценок пока нет

- Temba - DissertationДокумент69 страницTemba - Dissertationdeo847Оценок пока нет

- SME & Consumer BankingДокумент34 страницыSME & Consumer BankingRajib AdnanОценок пока нет

- ProjectДокумент16 страницProjectKrishna AhujaОценок пока нет

- Dena Bank DenaДокумент40 страницDena Bank DenaRashmi ShettyОценок пока нет

- SME & Consumer BankingДокумент35 страницSME & Consumer BankingFaysal HaqueОценок пока нет

- Financing Options For Small and Medium Scale Enterprises in Nigeria Suleiman A.S. AruwaДокумент13 страницFinancing Options For Small and Medium Scale Enterprises in Nigeria Suleiman A.S. AruwaAigbokhaoode MathiasОценок пока нет

- BMT Development and Islamic MarketingДокумент23 страницыBMT Development and Islamic MarketingElsha Dwi AngganisОценок пока нет

- A Study On Effects of Micro Financing On Msmes in KarnatakaДокумент9 страницA Study On Effects of Micro Financing On Msmes in KarnatakaPavithra GowthamОценок пока нет

- MarketingДокумент22 страницыMarketingZillay HusnainОценок пока нет

- Growth of Micro, Small and Medium Enterprises in ManipurДокумент5 страницGrowth of Micro, Small and Medium Enterprises in Manipurinventionjournals0% (1)

- Thaker&Sakaran - Discussion On Islamic Finance and Small MediumДокумент38 страницThaker&Sakaran - Discussion On Islamic Finance and Small Mediummuhamad abdul azis ramdaniОценок пока нет

- Exploring Muslim Entrepreneurs Knowledge and Usage of Islamic FinancingДокумент26 страницExploring Muslim Entrepreneurs Knowledge and Usage of Islamic FinancingBadiu'zzaman Fahami100% (1)

- SME Management - 2Документ20 страницSME Management - 2MaQsud AhMad SaNdhuОценок пока нет

- Sidbi-A Successful Financial Institution in Sme Financing: Manasvi MohanДокумент12 страницSidbi-A Successful Financial Institution in Sme Financing: Manasvi MohanmanasvimohanОценок пока нет

- Annexure V Cover Page For Academic TasksДокумент9 страницAnnexure V Cover Page For Academic TasksAbhijeet BhardwajОценок пока нет

- Small & Medium Enterprise & BusinessДокумент7 страницSmall & Medium Enterprise & Businessmusfiqur rahmanОценок пока нет

- Development Finance Institutions Support Economic GrowthДокумент164 страницыDevelopment Finance Institutions Support Economic GrowthcaportОценок пока нет

- Modernization Strategies for Small Scale Industries in IndiaДокумент6 страницModernization Strategies for Small Scale Industries in IndiaMukesh ManwaniОценок пока нет

- Enhancing MSMEs through improved access to financingДокумент12 страницEnhancing MSMEs through improved access to financingminakshichhikaraОценок пока нет

- Vikas MGNДокумент15 страницVikas MGNAbhijeet BhardwajОценок пока нет

- Small and Medium Enterprises: Submitted By: Nishant Kr. Oraon Cuj/I/2011/Imba/18Документ13 страницSmall and Medium Enterprises: Submitted By: Nishant Kr. Oraon Cuj/I/2011/Imba/18nishant oraon100% (1)

- Sources of Finance SMEДокумент11 страницSources of Finance SMEakram balochОценок пока нет

- SMEs in BangladeshДокумент32 страницыSMEs in BangladeshM Hossain AliОценок пока нет

- Submitted To Madurai Kamaraj University in Partial Fulfilment of The Requirement For The Degree ofДокумент6 страницSubmitted To Madurai Kamaraj University in Partial Fulfilment of The Requirement For The Degree ofChasity MorseОценок пока нет

- ARTIKEL SATRIA Peran Lembaga Keuangan Syariah Dalam Pemberdayaan Usaha KecilДокумент8 страницARTIKEL SATRIA Peran Lembaga Keuangan Syariah Dalam Pemberdayaan Usaha KecilSatriaОценок пока нет

- Small Business Definition in IndiaДокумент28 страницSmall Business Definition in IndiaJatin PahujaОценок пока нет

- Internship Report FinalДокумент54 страницыInternship Report FinalGulzar Ahmad RawnОценок пока нет

- Financing Options For Small and Medium ScaleДокумент15 страницFinancing Options For Small and Medium Scalepintu_brownyОценок пока нет

- Role of Gov't and Financial Institutions in SME DevelopmentДокумент14 страницRole of Gov't and Financial Institutions in SME DevelopmentPriya PatelОценок пока нет

- Notes On Small Scale IndustriesДокумент19 страницNotes On Small Scale IndustriesAli SaifyОценок пока нет

- The Role of Smes in Employment Creation and Economic Growth in Selected CountriesДокумент12 страницThe Role of Smes in Employment Creation and Economic Growth in Selected CountriesAkashОценок пока нет

- Role of Financial Institutions in The Development of EnterpneurshipДокумент14 страницRole of Financial Institutions in The Development of EnterpneurshipVasim AhmadОценок пока нет

- 3 Theoritical FrameworkДокумент21 страница3 Theoritical FrameworkAnshu9999Оценок пока нет

- Impact of small businesses on economiesДокумент6 страницImpact of small businesses on economiesQasim KhanОценок пока нет

- Small & Medium EntrepriseДокумент2 страницыSmall & Medium EntreprisekhaleelkhanzОценок пока нет

- Fundraising and Budgeting Practices For SMEsДокумент11 страницFundraising and Budgeting Practices For SMEsTabi WilliamОценок пока нет

- English Economics Paper Group 7Документ13 страницEnglish Economics Paper Group 7Wanda SinagaОценок пока нет

- Marcoz 2 CompleteДокумент50 страницMarcoz 2 Completemaaz bangiОценок пока нет

- Micro, Small and Medium Enterprises Development Act, 2006: Role of Msmes in Economic DevelopmentДокумент9 страницMicro, Small and Medium Enterprises Development Act, 2006: Role of Msmes in Economic DevelopmentSoumya JainОценок пока нет

- Small Industries Development Bank of India (SIDBI)Документ3 страницыSmall Industries Development Bank of India (SIDBI)Surbhi SamdaniОценок пока нет

- Factors Influencing Development of Microenterprises in BangladeshДокумент11 страницFactors Influencing Development of Microenterprises in BangladeshSuborna BaruaОценок пока нет

- NGO Msme Registration Company in DelhiДокумент4 страницыNGO Msme Registration Company in DelhiNgo PartnerОценок пока нет

- Compile Information about Government Agencies that will help you set up your Business EnterpriseДокумент4 страницыCompile Information about Government Agencies that will help you set up your Business EnterpriseHKK 169Оценок пока нет

- Electa 1-4Документ64 страницыElecta 1-4OSSMANOU MUSTAPHAОценок пока нет

- Role of Micro, Small and Medium Enterprises in Indian Economic DevelopmentДокумент6 страницRole of Micro, Small and Medium Enterprises in Indian Economic DevelopmentKarthik AbhiОценок пока нет

- Document PDFДокумент52 страницыDocument PDFBharat SharmaОценок пока нет

- Importance and Definition of Small and Medium Enterprises (SMEsДокумент42 страницыImportance and Definition of Small and Medium Enterprises (SMEsAshish LakwaniОценок пока нет

- Importance and Challenges of Smes: A Case of Pakistani Smes: EmailДокумент8 страницImportance and Challenges of Smes: A Case of Pakistani Smes: EmailDr-Aamar Ilyas SahiОценок пока нет

- MM Munafiq KaunДокумент8 страницMM Munafiq Kaun80kilorabbitОценок пока нет

- 43 Business Mistakes Presentation On Entrepreneurship FailuresДокумент17 страниц43 Business Mistakes Presentation On Entrepreneurship Failures80kilorabbitОценок пока нет

- Background and HistoryДокумент98 страницBackground and History80kilorabbitОценок пока нет

- Compensation Management Session 2Документ18 страницCompensation Management Session 280kilorabbitОценок пока нет

- Determinants of Inflation Rate in PakistanДокумент21 страницаDeterminants of Inflation Rate in Pakistan80kilorabbitОценок пока нет

- The Elephant in The Room Part II and The Lost Protocols of Salafiyah1 PDFДокумент37 страницThe Elephant in The Room Part II and The Lost Protocols of Salafiyah1 PDF80kilorabbitОценок пока нет

- The Elephant in The Room Part 3Документ25 страницThe Elephant in The Room Part 3Faheem LeaОценок пока нет

- The Elephant in The Room Part OneДокумент31 страницаThe Elephant in The Room Part OneFaheem Lea100% (3)

- Fazail e Ahle BaytДокумент46 страницFazail e Ahle Bayt80kilorabbit100% (2)

- Y Musharaff FailedДокумент15 страницY Musharaff FailedFarhan SarwarОценок пока нет

- Karbala-When Was Hazrat Husayn Martyred?Документ42 страницыKarbala-When Was Hazrat Husayn Martyred?ImranMatanatОценок пока нет

- Sunna Rejection of Rafidi and Nasibi Verisons of KarbalaДокумент11 страницSunna Rejection of Rafidi and Nasibi Verisons of Karbala80kilorabbitОценок пока нет

- How Many Daughters Did The Prophet HaveДокумент35 страницHow Many Daughters Did The Prophet Haverevivingalislam100% (1)

- BSA Handbook - SetonДокумент212 страницBSA Handbook - SetonMaGaRongОценок пока нет

- Ramadhan PlannerДокумент1 страницаRamadhan Planner80kilorabbitОценок пока нет

- Concept of God in HinduismДокумент5 страницConcept of God in HinduismShadab AnjumОценок пока нет

- The Evil Consequences of AdulteryДокумент15 страницThe Evil Consequences of AdulteryZamir AhmedОценок пока нет

- Ahmad Ibn Hanbal's Treatise On PrayerДокумент27 страницAhmad Ibn Hanbal's Treatise On PrayerAbu Ikrimah100% (5)

- Oxylane Supplier Information FormДокумент4 страницыOxylane Supplier Information Formkiss_naaОценок пока нет

- Company accounts underwriting shares debenturesДокумент7 страницCompany accounts underwriting shares debenturesSakshi chauhanОценок пока нет

- Find payment channels in Aklan provinceДокумент351 страницаFind payment channels in Aklan provincejhoanОценок пока нет

- Research Article StudyДокумент2 страницыResearch Article StudyRica Mae DacoyloОценок пока нет

- No Plastic Packaging: Tax InvoiceДокумент12 страницNo Plastic Packaging: Tax Invoicehiteshmohakar15Оценок пока нет

- Green HolidaysДокумент5 страницGreen HolidaysLenapsОценок пока нет

- G20 Leaders to Agree on Trade, CurrencyДокумент5 страницG20 Leaders to Agree on Trade, CurrencysunitbagadeОценок пока нет

- Marico's Leading Brands and Targeting StrategiesДокумент11 страницMarico's Leading Brands and Targeting StrategiesSatyendr KulkarniОценок пока нет

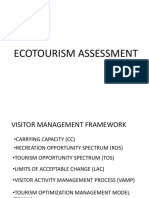

- Ecotourism Visitor Management Framework AssessmentДокумент15 страницEcotourism Visitor Management Framework AssessmentFranco JocsonОценок пока нет

- University Grants Commission Bahadurshah Zafar Marg NEW DELHI-110 002Документ10 страницUniversity Grants Commission Bahadurshah Zafar Marg NEW DELHI-110 002Arun PrakashОценок пока нет

- Silver Producers A Call To ActionДокумент5 страницSilver Producers A Call To Actionrichardck61Оценок пока нет

- EH101 Course InformationДокумент1 страницаEH101 Course InformationCharles Bromley-DavenportОценок пока нет

- Hong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Документ19 страницHong, P. and Kwon, H.B., 2012. Emerging Issues of Procurement Management A Review and Prospect. International Journal of Procurement Management 4, 5 (4), pp.452-469.Anonymous BJNqtknОценок пока нет

- Marketing Plan - NikeДокумент32 страницыMarketing Plan - NikeHendra WijayaОценок пока нет

- Commercial Banks Customer Service EssentialДокумент6 страницCommercial Banks Customer Service EssentialGopi KrishzОценок пока нет

- BCG MatrixДокумент5 страницBCG MatrixAliza AliОценок пока нет

- The Communistic Societies of The United StatesFrom Personal Visit and Observation by Nordhoff, Charles, 1830-1901Документ263 страницыThe Communistic Societies of The United StatesFrom Personal Visit and Observation by Nordhoff, Charles, 1830-1901Gutenberg.org100% (2)

- Activity 2 Applied Economics March 12 2024Документ1 страницаActivity 2 Applied Economics March 12 2024nadinebayransamonte02Оценок пока нет

- Risk Assessment For Grinding Work: Classic Builders and DevelopersДокумент3 страницыRisk Assessment For Grinding Work: Classic Builders and DevelopersradeepОценок пока нет

- Irctcs E Ticketing Service Electronic Reservation Slip (Personal User)Документ2 страницыIrctcs E Ticketing Service Electronic Reservation Slip (Personal User)Anonymous Pog15DОценок пока нет

- TutorialActivity 3Документ7 страницTutorialActivity 3Adarsh AchoyburОценок пока нет

- Common Rationality CentipedeДокумент4 страницыCommon Rationality Centipedesyzyx2003Оценок пока нет

- Comparative Analysis of Broking FirmsДокумент12 страницComparative Analysis of Broking FirmsJames RamirezОценок пока нет

- Blackout 30Документ4 страницыBlackout 30amitv091Оценок пока нет

- GEAR PPT Template OverviewДокумент14 страницGEAR PPT Template OverviewAmor MansouriОценок пока нет

- Bank Chalan PDFДокумент2 страницыBank Chalan PDFIshita SharmaОценок пока нет

- Aditya Birla Sun Life Insurance SecurePlus Plan Sales IllustrationДокумент7 страницAditya Birla Sun Life Insurance SecurePlus Plan Sales Illustrationkunjal mistryОценок пока нет

- Pay - Slip Oct. & Nov. 19Документ1 страницаPay - Slip Oct. & Nov. 19Atul Kumar MishraОценок пока нет

- Liberal View of State: TH THДокумент3 страницыLiberal View of State: TH THAchanger AcherОценок пока нет