Академический Документы

Профессиональный Документы

Культура Документы

Impact of Exports and Foreign Exchange Reserves On Rupee Valuation of Pakistan

Загружено:

Fayazshah23Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Impact of Exports and Foreign Exchange Reserves On Rupee Valuation of Pakistan

Загружено:

Fayazshah23Авторское право:

Доступные форматы

IMPACT OF EXPORTS AND FOREIGN EXCHANGE RESERVES OF THE RUPEE

VALUATION (EXCHANGE RATE) OF PAKISTAN

ARM spring 2014

Master of Science in Management Science

Shaheed Zulfiqar Ali Bhutto Institute of Science and Technology

SZABIST, ISLAMABAD

By

MUHAMMAD FAYAZ SHAH

Research Supervisor: Sir Dr. Bakhtiar Ali

Table of Contents

Abstract .............................................................................................................................. 5

1. Introduction ............................................................................................................ 6

1.1 Background ......................................................................................................... 6

1.2 Introduction .......................................................................................................... 6

1.3 The case of Pakistan ............................................................................................. 9

1.4 Research gap ...................................................................................................... 11

1.5 Significance of the study .................................................................................... 12

1.6 Delimitation of the study .................................................................................... 13

2. Literature review ................................................................................................. 15

2.1 Literature review ................................................................................................ 15

2.2 Research questions ............................................................................................. 19

2.3 Research objectives ............................................................................................ 20

3. Theoretical framework ........................................................................................ 20

3.1 Theoretical framework ....................................................................................... 20

3.2 Research model .................................................................................................. 21

3.3 Hypotheses ......................................................................................................... 21

3.4 Operational definition of foreign exchange reserves ......................................... 22

3.4.1 Operational definitions of exports .............................................................. 22

3.4.2 Operational definition of currency valuation .............................................. 22

4. Research design .................................................................................................... 23

4.1 Research design .................................................................................................. 23

4.2 Study type ........................................................................................................... 23

4.3 Researcher interference ...................................................................................... 24

4.4 Unit of analysis................................................................................................... 24

4.5 Sampling design ................................................................................................. 24

4.6 Time horizon ...................................................................................................... 25

5. Data Analysis ........................................................................................................ 26

5.1 Testing hypothesis: regression analysis Model....................................................... 26

5.1.1 Descriptive statistics ................................................................................... 27

5.1.2 Correlation ..................................................................................................... 27

5.1.3 Regression Analysis Summary ................................................................... 28

6. Conclusion and Recommendation ...................................................................... 31

6.1 Causes of rupee devaluation ............................................................................... 31

6.1.1 Sharp rise in oil prices................................................................................. 31

6.1.2 Expansionary monetary policies ................................................................. 32

6.1.3 Fiscal deficit and government borrowings .................................................. 32

6.1.4 Weak financial system of Pakistan ............................................................. 32

6.1.5 Capital flight ............................................................................................... 33

6.1.5 IMF demand of devaluating rupee .............................................................. 33

6.2 Policy suggestions and Recommendations ........................................................ 34

6.3 Conclusion .......................................................................................................... 38

6.4 future research recommendations....................................................................... 39

7. References ............................................................................................................. 40

Abstract

The present study is about the impact analysis of exports and foreign exchange reserves

of Pakistan of its currency appreciation and depreciation. This implies that the exports and for-ex

reserves have close relation and increase in one cause increase in other. Annual data about the

variables from the year 1994 to2012 was taken from different reliable secondary sources.

Through regression analysis, however, results showed contrary results. In case of Pakistan, rupee

valuation does not depend on its exports and foreign exchange reserves. Rather other broad

macro-economic variables are responsible for the currency ups and downs in Pakistan. Taking

bold and in time economic measures can surely strengthen our currency.

1. Introduction

1.1 Background

Currency; the elementary unit of exchange and the most leading medium of purchasing

goods and services, is the basis of economy and economic activities of any state. In Pakistan, the

currency is something that functions as a medium of exchange, a mass of value, and a standard

through which trade activities are carried out. Currency is used as a proxy for money and vice

versa. The Pakistani currency is Rupee, and it literally means a stamped coin.

The Pakistan, the rupee was introduced as a state currency and then immediately put into

circulation after the inauguration of State Bank of Pakistan (SBP), to end up the dependence on

Indian Federal Reserve bank, just after the separation of indo-Pak subcontinent in 1947. The new

coins and notes were introduced in 1948. The Pakistan Rupee bears sign: ; ISO 4217

Alphabetic Code: PKR; ISO 4217 Numeric Code: 586. ISO stands for the international

standardization organization, which is responsible for assigning special codes to the currencies of

each country, to make their dealing easy for international trade, banking sectors and other related

monetary organizations. 1.2 Introduction The world economic wheel is run by the exports and

imports of goods and services among the comity of nations across the globe, who in pursuit of

money sells their surplus goods to other countries and also buy those goods which are necessary

and demanded by its people and the land. World trade is an ever existing process, through which

exchange of goods and services in terms of other goods and something of value (commonly

called money) takes place. The inter dependencies of the inhabitance of this world over its fellow

being has gotten a systematic shape of world trade.

There are many components of an economy; exports, imports, currency, exchange rates,

reserves, prices, investments and the like. Currency is a basic tool through which the whole

trading system of the world is based. Apart from local currency, all nation states hold a

considerable amount of foreign currency reserves, so to have nonstop trade with their trading

partner countries around the globe. Foreign exchange reserves are like the economic back bone

of a country. Every nation state holds foreign reserves at its disposal to feed its economy and to

do trade and other financial businesses with the world. In simple terms, foreign reserves means

foreign currency (currency of another country) held by the central banks or other dominant

financial institutions of a country as a source to pay off international/foreign debt obligations and

liabilities, or to influence directly and indirectly their domestic exchange rate of currencies.

A large number of financial and non-financial commodities, such as gold, silver, crude oil

etc. are commonly priced and kept as the foreign reserves, and also causing other nation states to

hold this currency to pay for or to buy these goods. More interestingly, (O Meier, 2013)

advanced countries, as those who are part of the nuclear supply group, like US, Japan, Australia,

Germany, Canada, India and France, are also keeping enriched as well as non-enriched uranium

as part of their reserves, so that; that could be readily sold out to other countries to meet the

needs of dollar money for their economies. Apart from these, the foreign exchange reserves of a

country also comprises of special drawing rights (SDRs) and International Monetary Fund (IMF)

reserve position, because this total figure, which is usually more precisely regarded

as documented reserves or international reserves or official international reserves, are also share

of the foreign reserves of a country. SDRs are not currency in actual terms, but a pool of funds

kept with the IMF by the member countries, and in the time of acute use, the members go for

that. They are like the most liquid assets, which can be converted into ready cash instantly.

Keeping stores of foreign currency reserves, thus, decreases the exchange rate risk of currencies,

as the purchasing nation does not need to exchange their local currency for the current reserve

currency in order to make the purchase of goods and commodities.

Foreign-exchange reserves are also known as for-ex reserves or F-X reserves. These are

like assets which are held by central banks and monetary authorities/institutions of a country,

usually in different reserve currencies, mostly the US dollar and other currencies like in Euros,

Pound sterling, and in the Yen (Japanese currency). A foreign reserve of a state is a barometer

for its exports earning and economic growth. Increase in foreign reserves over a time readily

shows the increase in exports and inflow of money in the state market, which is a positive

indicator for better economic growth. For sound imports and exports, a nation should have ample

amount of foreign exchange reserves at its disposal, as foreign reserves accelerate and retardates

the balance of payments of a country during imports and exports. Stability of the local currency

is also directly linked with the foreign exchange reserves, apart from the exports of a country. In

economics terms, local currency increases in its value (appreciation of currency) due to increase

in exports, because the demand for the local currency increases.

When the local currency of a country is devalued (depreciation of the currency) with

respect to the currency of the exporting country, the importing country requires more money

(due to the devaluation effect) than before to import the same quantity of commodities. When the

local currency is strong, less money is required to import same quantity of commodities from the

other countries. This is the reasons, as why some countries adopt the policy of intentional

currency devaluation; they officially devalue their currencies in the hope of increasing their

exports and stabilizing their economies with greater exports and cheap labour availability. China,

Japan, and India are the typical examples where the governments have devalued their local

currencies, and this has created a positive impact on the increase in total exports of the countries.

Exports means when a country sells its products or services to a foreign country in terms of

dollar money, and imports means when a country buy something from a foreign country for cash

or exchange of something. Exports and imports are the essence of world trade and no nation can

survive without these.

1.3 The case of Pakistan

Pakistan like other countries of the world also holds foreign exchange reserves but has

not a bright record of having rich foreign reserves and having increased exports than imports,

which could appreciates its rupee and prevent it from successive devaluation. Over a period of

time, rupee de-valued in relation to US dollar, which put increased burden on import bill and

prices of commodities in local markets went up sharply. Pakistan started amassing the foreign

exchange reserves unusually in 2001and continued this practice till the end of 2007. It was the

period when Pakistan was the ally of the coalition in the ongoing war against terrorism, and

received multi-billion dollar aid from US and other countries. This strategy proved very

supportive for the overall economy and has shown a number of significant positive impacts on

economic growth rate, increase in exports, foreign direct investments, fiscal and current account

deficit, and has also contributed in stabilizing many macroeconomic indicators including

currency exchange rate and its volatility.

But after that, the overall economy faced a sheer decline, as a result of which foreign

exchange reserves declined sharply and rupee became devalued with every passing day as

against US dollar. Recently, Pakistani rupee depreciated to an all-time low Rs 109 against per

dollar due to high demand for import payments. Depreciation of the rupee further blowup import

bill and it led to increases domestic market price levels, thus reducing the purchasing power of

people and causing inflation in the country. As a matter of fact, the total exports of Pakistan

should have to be increased, but that didnt occurred.

Pakistan is an agriculture based economy, and its major exports are agriculture based.

Moreover, her exports also comprised of selling manufacturing products, various raw materials,

merchandises, and also sell its technologies to other countries. She exports textile products,

sports goods, marine foods, fruits, surgical instruments, vegetables and the like. Talking about

the services sector, (Hussain, 2013) (Iqbal and Sattar, 2005) she exports her technical services,

man power, intellectual services and armed force services (UN missions in some African and

Arab countries). But these all are fruitless if broad economic measures are lacking and problems

are increasing each day with an accelerating pace.

Above all the power shortage wrecked the very nerves of the industrial owners and

exporters, who were unable to export their products due to less production. Over the period, the

exports became less and less, foreign exchange reserves lesser and lesser and rupee made its

century ($1= PKR100+) against dollar in the interbank exchange market. Its overall impact was

hard to consider. Due to decreased mount of foreign exchange reserves, there was a fear of

country bankruptcy, and government was compelled by the acute economic circumstances to

knock at the doors of IMF and World Bank once again; to acquire loan at stringent conditions

and high interest rates.

It is a harsh reality that for whatever reason Pakistani currency is depreciated, its

consequences are weakening in the economy as compared to that of other countries.

Furthermore, the excessive depreciation in currency in the recent past has adversely affected our

credit ranking in the international market, which is evident from the fact that from March 2008 to

March 2013, 1 US dollar rose to almost Rs 100, as against Pakistani rupee, which shows clear

signs of weak economy and poor financial health of our country.

1.4 Research gap

Foreign exchange is an important topic for research from the last fifty years. Different

scholars discuss and analyze the exchange rate from different angles; they tried to find out the

variables which truly reflect the variation in exchange rate. But problem is, that different factors

affect differently across different countries. It is interesting to note that, some major economies

of the world are depreciating their currencies intentionally, so to have greater exports and huge

fo-rex reserves (Zhang, 1999). Mostly they discussed factors like export, interest rate, inflation

and foreign exchange reserves and tried to find out that how much is the effects of these

variables. In case of Pakistan, the rupee exchange rate is not too much sensitive to interest rate

and inflation (Rashid and Rehman, 2001).

So in this study, we want to explore the effects of the most important two factors exports

and foreign reserves on the currency exchange rate of Pakistan. We mostly hear and see in the

front and electronic media that the main causes of Pakistani currency devaluation is the low level

of exports and low level of foreign exchange reserves. This will enable us to quantify that how

much the fluctuation in exchange rate in Pakistan is caused by foreign exchange reserves and

exports.

1.5 Significance of the study

The exchange rate is a very important factor for any economy and contributing towards a

stable, and sustainable economic environment, where the investors and business peoples dont

have concerns about loses due to volatility of the local currency. There has been an abrupt

fluctuation in the foreign exchange reserves of Pakistan on one hand, and export-import

imbalance on the other. It was only in early 2008 when country foreign exchange reserves

reached a record level of 16.6 billion dollars (SBP annual report 2009) and after a couple of

months this figure dropped down to round about 4 billion dollars. At that time, the rupee stood

against US dollar at $1: Rs60, but this did not sustained on stable grounds for long.

This sharp decline was surely an alarming phenomena for many as due to continuous

decline in foreign reserves badly affected the exports, and ultimately the rupee declined at an

accelerated pace. Above all, the acute power shortage, poor law and order situation and bad

governance added fuel to the fire of already deteriorated economic situation of the country,

resulting in increased prices of basic necessities of life and poverty level in the country.

This study is an attempt to find the significance of having ample foreign reserves and

large exports on the valuation of Pakistani rupee. It will definitely provide fruitful insights to

those who are directly or indirectly linked with foreign exchange rates and exporters and

importers. This paper will also suggest some possible policy measures to the monetary

authorities of Pakistan, as how foreign exchange reserves can be maintained on sound footings

that can appreciate the rupee. This paper will also discuss how rupee devaluation and

appreciation affect the general prices of basic commodities of common people. Apart from

analyzing the thesis question through past data and statistical tools, suggestions will also be

given as how exports can be increased, so that there could be an inflow of foreign exchange

reserves in the weak economy of Pakistan.

1.6 Delimitation of the study

The currency valuation is a very complex phenomena, its value fluctuate with the change

in macroeconomic fundamentals. A lot of factors have effects on the exchange rate of a country

currency, even some time different factors affect quite differently the exchange rate in different

countries. The delimitation of this study is that due to the lack of time we just target to check the

effect of two factors, foreign exchange reserves and exports on the exchange rate of Pakistani

currency. Although other factors like interest rate, internal stability and inflation also have

effects on the exchange rate of Pakistan.

This study has focused on two very important factors that affect the valuation of Pakistani

rupee, i.e. foreign exchange reserves and exports. Of course there are multi factors for this

phenomena including inflation rate, intentional currency devaluation by certain countries, foreign

debts, less foreign investments, high prices of general commodities, foreign donations as well as

financial aid and many others. The scope of this study is not so wide to include all the possible

variables of the proposed topic. Moreover, broad economic perspectives like economic growth

and fiscal as well as monetary policies of Pakistan which directly affect the Rupee valuation are

also not included in the variables under study. This is because of the time constraints and lack of

proper advanced level research skills, which comes into play at later stages of the study program.

Furthermore, all the data has been accumulated from secondary sources for analyzing and

passing through statistical tests.

2. Literature review

2.1 Literature review

There has been a good deal of research work about the macroeconomic and

microeconomic factors relating to exports and imports of a country and its possible implications

on the valuation of its currency. Evidences suggest that having ample amount of foreign reserves

readily boost up the confidence of exporters, as they feel it as a backup to states economy.

When exports increase, it results in increasing the demand for that country local currency, which

means the value of that currency increases (appreciation). Theoretical connection between

foreign exchange reserves, its volatility signs, macroeconomic variables and other financial

determinants of any country are systematically discussed in many research studies, but first-hand

investigation shows no such agreement about it because of mixed pattern of results found in

those studies.

Take a simple example when there is one hundred paisas fall in the rupees value against

the US dollar, which adds Rs one billion to the external debt of one billion dollars. This does not

stop here as there is a multiplier effect of any decrease in the Pakistani rupee: it adds Rs 60

billion, to the countrys overall external debt and liabilities of around $60+ billion, as proposed

in the accounting standards. If price of exports of Pakistan rises by a smaller proportion than that

of its overall imports, the currencys value (rupee) will decrease in relation to its trading partners

(the exporting countries)

Zhang, (2000) examined Chinas foreign exchange reforms introduces in mid-eighties

and analyzed their overall impact on the balance of trade and inflation rate in China. He found

that how Chinese massively increased their exports by devaluing the currency (Chinese yen)

intentionally. He maintains that although the prices of commodities in China have increased for

local people, but the massive exports has earned hundreds of billions of US dollars for china.

Chaudhary and shabbier, (2004) also analyzed that excess demand for money of a country leads

to inflow of reserves into that country and excess money supply leads the reserves outflow. On

the other hand, the state governments yearly budget deficit leads to superfluous credit

expansion. They also argue that the unevenness between money demand and money supply in a

country had significantly affected foreign reserves.

In order to achieve internal and external balance, monetary policy could play important

role. It means demand for a states currency is finest object for her valuation. However, there are

contradictions among researchers about the de-valued currency and exports parameters. Rajan

and Pontine, (2011) found that decrease in foreign exchange reserves may devalue the currency,

but it also increases the country exports, as a devalued currency is considered a healthy sign for

the exporters. Bukhari et al, (2006) also found in their study that currency devaluation prospects

had statistically and economically noteworthy descriptive power in knowing the broad economic

fundaments of our economy and understanding its trends and behaviors.

But, it is a fact that exports of Pakistan didnt witness a sustainable boom in the past, in

relation to its continuously devaluing rupee. In economics terms, there should be optimal

increase in exports as the currency is falling again and again as against the US dollar, but this is

not the case. Chaudhary and Saleem, (2001) found evidences that main reasons behind rupee

devaluation are the exports instability (less exports and increase imports), insufficient foreign

receipts and ever-increasing burden of external debt. The same phenomena is also observed by

Chaudhary and Shabbir, (2002) that unwarranted credit enlargement creates excess of money

supply (in other words, inflation) over money demand, which leads to reserve outflows and

worsens the balance of payments of a state.

In the economic history of our country, there is only one occasion when the rupee

appreciated against US dollar, for the remaining years it is devalued or depreciated against the

US Dollar. This caused a temporary boost up of the exports because on the other hand, the price

level in the country is increased which takes away the temporary benefits from the boost up of

exports. Combes et al, (2011) analyzed the impact of exchange rate flexibility and capital inflows

on the actual exchange rate of currencies in developing countries. They concluded that there is

direct relationship between public and private inflows of foreign reserves and exchange rate

appreciation of a country. Linda and Goldberg, (2013) stated that excess for-ex reserves have

opportunity cost, and they become a liability if not properly invested further, for further investing

these will boost up economic activities, which is a healthy sigh for exports and currency

valuation (Eichengreen, 2012) expressed his fear that dollar and euro are no longer stable

international currencies and the world leading economies should set another more reliable

standard for exchange rate of their currencies. Domiguez et al, (2013) found evidence that selling

of portions of foreign exchange reserves on daily basis can appreciate the local currencies. Ali et

al, (2013) investigated the impact of exchange rate, inflation, foreign direct investment and

capital stocks on the economic growth rate of Pakistan using ordinary least square method.

Kamal and Ali, (2012) analyzed the balance of trade and its fluctuation due to currency

exchange rate volatility in Pakistan. Abbas and Zaidi, (2006) suggest that State Bank of Pakistan

should take concrete steps to stabilize foreign exchange reserves in order to hold further

devaluation of rupee and inflation rate in the country. It infers that state bank has the authority to

determine an optimal level of reserves which could curb the devaluation of rupee. Bushra et al,

(2011) found that in between 2002 and 2006, the foreign exchange reserves of Pakistan increased

due to excessive aid from her allies in war against terrorism, which proved helpful for the overall

economy. Coudert et al, (2012) analyzed a cyclic effect of the currency depreciation, exports,

and currency appreciation as well as amassing for-ex reserves. They argue that devaluation of a

currency can cause increase in exports, for which there can be an inflow of dollars money into

the country, which can drop back the depreciated rupee.

Eatzaz and Ahmed, (1999) goes some steps further and found multifactor causal model

for the decrease in the foreign exchange reserves and its ultimate effects on the valuation of

rupee valuation. They found in their research work that if the interest/rental rates on debt and

foreign capital, growth rates of real GDP, foreign capital, foreign exchange reserves, money

supply, price levels and exchange rate, and the parameters characterizing national saving rate and

productivity remain unchanged, then the debt crisis in Pakistan will worsen. One of the main

motives why countries go to have enough foreign exchange reserves is that the future and

economic situation of the world is uncertain. It is a fact that even if the monetary or financial

experts could forecast with utter faith, as when foreign receipts and payments would be made

due, still they will keep some reserves of foreign currencies.

The financial and monetary authorities knows that the patterns and the amounts of future

foreign exchange transactions are in large extent unknown and unpredictable, therefore, this

situation compels them to hold and maintain a sizeable amount of balances at all times at their

disposal. On the other hand, Javed, Z and Farooq, M (2009) holds the argument that idle reserve

money in access has negative impact on economic growth: Storing heaps of dollars without

investing it further will not appreciate the local currency, unless it accelerates the exports and

cope inflationary tendencies. It seems currency valuation is linked not only with just

accumulating foreign reserves but also on further using that money to boom the economy and

curb inflation as well as devaluation of the currency.

2.2 Research questions

Does foreign exchange reserve have a significant and positive relation with Pakistani

rupee valuation (exchange rate)?

Are there any positive and significant effects on Pakistani rupee valuation by exports?

2.3 Research objectives

To find out the relationship between Pakistani rupee valuation (exchange rate) and

foreign exchange reserves of Pakistan.

To find out the relationship between Pakistani rupee valuation (exchange rate) and

exports.

3. Theoretical framework

3.1 Theoretical framework

It is the process of identifying a core set of connectors within a topic and showing how

they fit together. It is a collection of interrelated concepts which shows and guides you that what

thing is measuring and what statistical relation you will look for. In this study, we use three

variables, exchange rate, foreign exchange reserves and exports of Pakistan. Among them

exchange rate is our dependent variable while foreign exchange reserves and exports are our

independent variables.

After going through a comprehensive literature review these independent variables were

selected for our study, because these were also used by other researchers, individually and

collectively, in some study separately or combine with other variables in some studies. Here we

will try to explore the effects of two important variables foreign reserves and exports on the

exchange rate of Pakistani Rupee. The regression analysis was used as an analytical tool.

3.2 Research model

Independent variable (IVs): Foreign Exchange reserves and Exports

Dependent variable (DV): Currency valuation

3.3 Hypotheses

H

1

: Foreign exchange reserve having a significant and positive relation with Pakistani rupee

valuation.

H

2

: Exports having a significant and positive relation with Pakistani rupee valuation.

Foreign exchange

reserves

Currency

valuation

(Exchange rate)

Exports

3.4 Operational definition of foreign exchange reserves

Foreign exchange reserves are currency and non-currency assets of a country, used for

payments and as medium of exchange in international trade: International monetary fund (IMF)

has recognized four currencies that can be used with liberty, (US dollar, Euro, Pound sterling and

Japanese Yen). Non currency reserves are those other than paper currency like gold, crude oil,

special drawing rights (SDR), and reserve tranche position (RTP), and euro bonds (Nunn, &

Finnerty, 1985; Connel, 2011).

3.4.1 Operational definitions of exports

The selling of goods and services by one country to another country in exchange of dollar

money; goods may be agricultural products, manufacturing goods, merchandise goods, raw

materials, or transfer of technology, while services may be technical services, intellectual

services and man power (Hussain, 2013; Chaudhry and kiyoshu, 1995; Dorosh et al, 2006;

Yousaf et al, 2008; Iqbal and sattar, 2005 ;Khurshaid, 2013)

3.4.2 Operational definition of currency valuation

The increase in the value (appreciation) or decrease in the value (depreciation) of a

currency over a period of time is called valuation of a currency. Appreciation may be due to

increase in value of local currency against foreign, when there is capital inflows into the country,

when domestic goods are cheaper for foreign exporters, and when employment and per capita

income in a country increases. Depreciation of currency is because of increase in the value of

local currency, inflation, and decrease in demand for currency, lower interest rate, foreign debts

and government borrowings Zhang (2000; Chaudhry & Shabbir, 2002).

4. Research design

4.1 Research design

Research design shows the overall frame work and road map of a research. It reflects the

structure followed during a research study. For this study, the Macroeconomics fundamentals of

Pakistan were the population of our study. Among these variables we picked up a sample of

three variables, currency exchange rate of Pakistan, foreign exchange reserves of Pakistan, and

exports of Pakistan for the last 10 years, and try to explore the effects of two variables, foreign

exchange reserves and exports on the exchange rate of Pakistani rupee. The data use in this study

is secondary in nature, through this secondary data will try to explore the past embedded pattern

and prevailing trend in data. The data will be collected from State Bank of Pakistan, World Bank

and IFS (International financial statistics). These two are the most authentic and reliable official

sources of data. They have the huge data bases of secondary data which is easily accessible.

4.2 Study type

This study examines a causal relationship between foreign exchange reserves, exports

and rupee valuation of Pakistan. The purpose of the study is to analyze the impacts of the exports

on the currency valuation, as how increase or decrease in exports causes valuation or de-

valuation in the currency of Pakistan. Furthermore, purpose of the study also contends ultimate

impact of the increase and decrease in for-ex reserves on the currency valuation. This is a

regression analysis of the variables and data has been collected for the variables for the last 10

years.

4.3 Researcher interference

Researcher interference is minimal. The basic objective of our study is to examine the

causal relationship of currency valuation and the impact of two important macroeconomic

variables foreign exchange reserves and imports on it. For this purpose we rely on secondary

data, thats why we dont have any interference and biasness in the data collection and research

process.

4.4 Unit of analysis

Our study population consists of overall macroeconomic fundamentals that affect the

rupee exchange rate (currency valuation). From that two variables are selected that has deep

impact on the currency valuation of Pakistan, i.e. exports of Pakistan and foreign exchange

reserves of Pakistan.

4.5 Sampling design

Sampling is the process of selection of representative data from the population when the

entire population is too large and it is difficult for the researcher to select data from the overall

population. In our this study we adopt convenience sampling techniques, the main reason for

using this method was the easy availability of data and the limited time of research. So the

convenience sampling technique was the best option to use.

4.6 Time horizon

Time horizon is a very important element of research studies, it show the particular

characteristics and attributes of the variables in a give specific period of time. In this research we

selected the period of 19 year from 1994 to 2012 and get data about our relevant variables on 6

months basis, so we record 20 observations about every variable.

5. Data Analysis

5.1 Testing hypothesis: regression analysis Model

In statistics, the regression equation is a very important tool for data analysis. Regression

is an effective tool when we try to investigate the cause and effects and impact of different

variables on each other. General equation for regression analysis is

Where Y represents dependent variable, X represents independent variable(s), is

the intercept and is the slope of regression line. Based on the above general equation, our

specified equation will be

rupee valuation =

t

+ f-x reserves 1 + exports 2+ t

The basic objective of this study is to investigate the causal relationship between dependent

variable that is currency valuation on independent variables which are exports and foreign

exchange reserves. Regression analysis will check the validity of hypotheses. Following are the

numerical results of our regression analysis which lead us to conclusion.

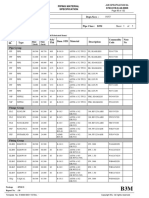

5.1.1 Descriptive statistics

Table 5.1

Descriptive Statistics

Mean Std. Deviation N

currency valuation .0181 .00563 19

Forex-reserves

8514785998.6842 5833191659.59875 19

Exports 15804278807.6842 6650383307.62236 19

First of all, we will discuss about descriptive statistics table in which the values of mean

and standard deviation are given. The descriptive statistics table shows that there is very high

standard deviation and volatility in each variable, this volatility is a sign of macroeconomic

instability in the country which directly or indirectly affect the currency valuation in Pakistan

5.1.2 Correlation

Table 5.2

Correlation

Rupee value F-x Reserves Export

Rupee Value 1

F-X Reserves -0.729 1

Export -0.762 0.881 1

The correlation table illustrates that there is a very high and strong correlation between

the two independent variables, the correlation between dependent and both independent variable

is negative which show that there they are moving in opposite direction; as when one get

increases, the other tend to decrease. The correlation of Foreign exchange reserves with currency

valuation is -.729, while correlation of exports with currency valuation is -.762. On the other

hand the correlation of foreign exchange reserves with export is .881 which shows a very strong

relationship between these variables.

5.1.3 Regression Analysis Summary

Table 5.3

Multiple Regression Analysis Summary

Variables B T P

constant

.027

10.544 1.30855E-08

F-x reserves -2.510E-013 -.773 0.450882004

Export -4.512E-013

-1.584

0.132751952

Notes: R

2

=0.548 , adj R

2

= 0.542, F(2, 157)=95.175, p<0.000,p0.01

The regression output is the main part out analysis portion, on the bases of this we decide

about our results of analysis. Form model summary we get very important information about

different indicators like R Square, Significance of F, Durban Watson test etc. The R Square value

show us the variation in dependent being explain by independent variables, in our model the

value

of R Square is .54 which indicate that the two independent variables explain 54% variation in

the dependent variable: currency valuation. The significance level of F is 0.001 which lies in

acceptance region, so our F value is significant. The Durban Watson value is too small which

indicate that there is something wrong with Durban Watson value.

The ANOVA analysis show us that either our model is significant or not at a given level

of confidence interval. We checked our data on 95% confidence interval, so the significant figure

up to .05 in an ANOVA model will be considered acceptable for the significance of model, here

the value of significance is .001 which means that the reliability of model is high.

The above analysis table shows that there is inverse relation between valuation of

Pakistani currency and two independent variables; foreign exchange reserves and exports. When

one unit change occurs in dependent variable (currency valuation) this is accomplished by -

2.53E-.015 changes in foreign exchange reserves and .4.55E -.015 variation in exports, which

clearly indicates that the changes in dependent and independent variables are not in the same

direction.

The beta show the relative sensitivity of the independent variables to the dependent, the

table value illustrate that relative sensitivity of exports is higher than foreign exchange reserves.

We see t value or p value to see either our results are valid or not. But it is better to see p

or significance value rather than the t value and thats why we use here p value as a

standard. It should be noted that the lower the p value the better it would be. But its acceptance

value depends on the chosen confidence interval. On 99 % confidence interval it should be less

than .01, on 95 % confidence interval it should be below .05 and on 90 % confidence interval it

should be less than .10. The t and P significance values of our two independent variables are

less than 2 and greater than 0.05 significance level respectively, this shows that our both

hypothesis were rejected.

Statistical results show that some other factors are responsible for the depreciation of

rupee. It is interesting to note that rupee devaluation in Pakistan is not directly affected by

decrease in foreign exchange reserves and her exports. The same result is also determined by

Shaheen, (2012) that exports have no effect on the currency valuation in Pakistan. From

literature, we identified some reasons (justifications in support of our findings) behind the

aforementioned phenomenon with rupee.

6. Conclusion and Recommendation

6.1 Causes of rupee devaluation

The findings of our study need elaboration as well justification. At first sight, it looks

somewhat strange that how, in Pakistan, its exports and foreign exchange reserves have no

positive and significant impact on its rupee exchange rate. Since the last decade, it is evident

from general observation and research studies that Pakistan witnessed an excellent performance

in amassing foreign reserves, and its rupee also stood stable against US dollar until 2008, but

later on numerous economical and financial events shaped the overall scenario from good to

worst. From literature, some reasons (justifications) have been found out, as why Pakistani rupee

appreciates and depreciates to external factors. These are as follows.

6.1.1 Sharp rise in oil prices

One of the main reasons behind currency depreciation is ever increasing oil prices in

international market, which causes decline in export goods prices and inclination in imports

goods prices. These tendencies readily put negative impacts on currency valuation. Malik. S,

(2014) found that increasing oil prices in international market is one of that major reason for

sharp decline in the value of rupee as against US dollar. Tahir et al, (2013) also analyzed

negative relationship of rupee valuation with increase oil prices, because it puts heavy burden on

the import bill of our country, and washes away any fruit of exports that comes to Pakistan. They

termed this phenomenon as anti-cyclic effect.

6.1.2 Expansionary monetary policies

The expansionary monetary policy introduced by Government of Pakistan in 2006-07, to

increase economic growth, by tax cutting, increased government spendings and rebates are also

responsible for devaluation of rupee, because it fueled inflation. Government bought bonds from

the market, lowered the interest rates, and injected money into the market, which caused

devaluation in rupee (Malik and Zakir, 2013).

6.1.3 Fiscal deficit and government borrowings

Ayub and Shaheen (2014) found that fiscal deficits in Pakistan led government to borrow

excessive amount of money from local as well as foreign financial institutions, to meet public

expenditure and budget deficits, which resulted to inflation, which proved fatal for the overall

export, because it disturbs prices. Generally, inflation tends to increase the input cost of export

goods, and they become less competitive for foreign markets. Fiscal deficit has a direct negative

impact on exchange rate of rupee and total debt servicing in Pakistan (Kalim and Hassan, 2013).

6.1.4 Weak financial system of Pakistan

Pakistan has not been able to construct a strong and stable economic system, which can

absorb economic and financial crisis, and which could achieve higher level of economic growth.

As a result, we witnessed currency crisis, increase in poverty, energy crisis and the like (Hussain

and Siddiqui, 2013). The same phenomena is also studied by Hye and Khan, (2003), that weak

financial structure is very prone to internal as well as external financial/economic crisis, which

led to currency crisis and imbalance between import-export balance.

6.1.5 Capital flight

It is also a major reason behind currency crisis, as foreign investors are becomes reluctant

to further invest their money in Pakistan and due to fragile political and economic situation, they

prefer to pull out their money back. The famous episode of khanani and kalia in 2008 added fuel

to the fire of already dertiorating economic situation of Pakistan. Fahim and Saddiqui, (2013)

found that khanani and kalia International (KKI) transferred billions of dollars through illegal

ways like hawala and hundi, which are banned by State Bank of Pakistan and Security and

Exchange Commission of Pakistan.

6.1.5 IMF demand of devaluating rupee

International Monetary Fund also demand from government of Pakistan to devaluate its

currency, so to have decrease the public spendings. According to Parere, S (2013) Pakistani

rupee will be devaluated further, to an all low position as 1 $ for PKR 110, as a condition

imposed by IMF to advance further loans to Pakistan. He also found that the main reasons

behind devaluation of Pakistani rupee is the smuggling of dollars from Pakistan, i.e. nearly $25

million a day or $9 billion a year, from different airports of Pakistan like Islamabad, Lahore,

Karachi etc.

From the above literature support, we inferred that in case of Pakistan, there are other

major economic fundamentals responsible for currency depreciation, other than we discussed in

this paper. This is quite strange as in case of so many countries like china, Japan, India,

Bangladesh and Thailand, (Zhang, 2000) where export-import imbalance has significant impact

on their currency valuation. Our results are different from those in the aforementioned countries.

This seems true, as to the grave and haunted problems, to which Pakistan is faced with; these are

not present in the countries mentioned above. This is understandable, for in case of our country,

the currency appreciation is very sensitive to a number of economic and political fundamentals,

which needs serious attention and policy measures on the part of the government of Pakistan.

6.2 Policy suggestions and Recommendations

The government should take serious steps to control the fiscal and budget deficits, as this

is killing for almost whole monetary structure. To overcome the deficits, government borrow

money from local as well as foreign financial institutes on stringent conditions, and to pay back

that loan with interest, it borrow more or print additional currency to fill the gap of deficits. The

printing of currency and borrowing money again and again lead to huge debts and inflation,

which depreciates the rupee, causing general price increase of commodities in local markets,

increase in poverty and increase in imports.

Oil imports bill is the another main cause for currency crisis, as approximately 80 % of

our imports are based on oil and oil products, to run power generators and for other purposes.

Any increase in oil prices in international markets washes away any benefits, if earned from the

sale of oil in local markets. Furthermore, concrete measures were not taken in the past to convert

the oil run machineries and power plants on natural gas or hydal power or solar energy. As a

result, our dependence on oil imports increased with each passing day, and now Pakistan is

paying a considerable portion of its hardly earned dollar money for its oil import bill, causing

drain of precious dollars from the country in no time.

Its a high time for Pakistan to break the so called begging bowl and start depending on

our own resources. Every successive government knocks at the doors of international monetary

fund and World Bank, to acquire loan on high interest rate, and today external debts of our

country are more than 65 billion dollars. Above all, to pay back the interest of the acquired loan,

more loans are acquired and this adds insult to injury. Self-dependency, cutting expenses,

overcoming budget deficits, and many such policy measures are the cry of the day, otherwise the

currency crisis will increase and will result country will proceed towards bankruptcy.

Those public organizations, like WAPDA, Pakistan Railways, PIA, which drains a lot of

hardly earned capital of the poor Pakistan, and which are liability instead of profit generating

asset, should be privatized in as the foremost priority. These organizations have taken a shape of

white elephants, eating more and more money in the form of circular debts, and output is zero.

So to save precious dollars and to avoid getting loans, these organizations should be privatized.

The government should take strict measures against those who are involved in illegal

transfer of dollar and other foreign currencies from Pakistan, causing currency crisis whenever

these black sheeps (money smugglers) wants so. The nation has not forgotten the criminal joke

which Khanani and Kalia group played with this poor nation by smuggling out nearly nine

billion dollars in those critical times when world economic crisis was haunting Pakistan, and

many people considered bankruptcy of our country imminent. Such national criminals should be

severely punished and be set an example for others. Moreover, government should block every

possible way for illegal money from Pakistan like hawala and hundi.

Government should provide incentives to local exporters, so that our exports increases

and foreign currency come to Pakistan. Government should identify new markets for country

products, and full benefit should be taken from the GSP+ status which is granted to Pakistan by

the European Union (EU).

Foreign direct investment should be encouraged, as it led to huge foreign currency influx

into a country. This not only accelerates different developmental projects in the country but also

expedites the economic activities. Currency influx and economic activities increases the value of

rupee. But for foreign investments, peaceful environment and investment conducive policies are

pre-requisites.

Government should adopt contractionary monetary policy if it wants to appreciate its

rupee. This will follow by increasing the interest rates, budget cuts, lessening expenses and

controlling the money supply. This will slow down the economic growth to some extent, but in

the long run currency will get appreciation, inflation will get lower and lower and commodities

prices will take a cheaper turn for the poor people.

Government should not compromise on currency depreciation, if required by the IMF or

WB, as this causes very negative effects on the overall economy. It causes inflation, and

multiplies the total debts of the country.

To avoid currency crisis, government should accumulate gold reserves, for gold prices

are relatively stable compared to US dollar. This will prevent the losses of the value of our

foreign exchange reserves.

To lessen our dependence on oil imports and oil imports bill, alternate energy sources

should be developed and encouraged. This can be very helpful in saving foreign exchange

reserves.

Policies should be adopted to increase the foreign remittances which overseas Pakistani

sends to Pakistan. This source is more powerful than any other in stabilizing our currency and

increasing foreign reserves in the form of different foreign currencies.

Government should demand its due share in coalition support fund (CSF) from its allies in war

against terrorism and aid which is promised to Pakistan in Carrey-Lugar bill, as this will inject

dollar money into our country.

Pakistan is fighting against terrorism side by side with the US and its allies, but from the

last two years, no funds have been advanced to her in the form of coalition support fund. This is

evident from the 1.5 billion dollar gift given to Pakistan by Saudi Arabia and money collected

from issuing euro bonds as well as auction of 3G and 4G, due to which dollar dropped down

from PKR 110 to PKR 97.4, in no time. This has really strengthened rupee against dollar.

6.3 Conclusion

This study is about the impact analysis of exports and foreign exchange reserves on the

rise and fall (valuation) of Pakistani rupee. Exports of Pakistan and its foreign exchange reserves

do not affect its currency valuation. Currency stability of Pakistan depends on some other

economic fundamentals other than mentioned above, which are evident in most of the countries.

Time series data of ten years ranging from 1994 to 2012 about exports of Pakistan, rupee

exchange rates against US dollar, and foreign exchange reserves of Pakistan was collected from

authentic sources like State Bank of Pakistan websites, World Bank site and IMF. Regression

technique was applied and the results show negative impacts of the variables.

An export of Pakistan does not have any impact on the rupee valuation and the same was

found for the foreign exchange reserves. To elaborate and justify the findings of the study,

various other factors were identified from the literature, like increase in oil prices, currency

smuggling, weak financial system, IMF conditions to devalue rupee, government borrowings and

external debts and the like were found that directly and indirectly affect the rupee valuation.

Suggestions were also given to government as how currency crisis can be avoided and rupee can

be strengthened.

6.4 future research recommendations

Due to the time constraints, in our research study, we just analyzed the impact of two, i.e.

exports and foreign exchange reserves variables on rupee valuation. Some other fundamental

variables which directly or indirectly affect the currency valuation like GDP growth rate, interest

rate, fiscal deficits, smugglings of goods and many others. A potential future research study can

be conduct to analysis the multi dimensional effect of these variables like GDP growth rate,

interest rate, fiscal deficits, smugglings of goods and many others.

7. References

Abbas Mirakhor, I. Zaidi, (2006). Islamabad Foreign Currency Deposits and International

Liquidity Shortages in Pakistan. The Pakistan Development Review, (Spring 2006), pp. 49-85

Ahmad, A., Ahmad, N., & Ali, S. (2013). Exchange Rate and Economic Growth in Pakistan (1975-

2011).

Ali, R. M., & Kamal, M. A. (2012). Examining how exchange rate fluctuation affects trade balances:

empirically establishing the correlation between exchange rate and balance of trade, the

marshall-lerner condition and J effect.

B. Egert, A. M. Zumaquero (2005). Exchange Rate Regimes, Foreign Exchange Volatility and Export

Performance in Central and Eastern Europe Just Another Blur Project?, (Oesterreichische

National Bank journal, 2009, pp. 53-72

Bukhari, S. A. H. A. S., Akmal, M. S., & Butt, M. S. (2006). Impact of Exchange Market Forces on Pak-

Rupee Exchange Rates during Globalization Period: An Empirical Analysis. Lahore Journal of

Economics, 11(1).

Bushra et al (2011).Pakistans Accumulation of Foreign Exchange Reserves during 2001-2006: Benign

or Hostile! Excessive or Moderate! Intent or Fluke!Pak. J. Commerce. Soc. Sci.2011, pp. 47-67

Chaudhry and shabbir (2004). The impact of domestic credit, deficit and changing exchange rate

regimes on foreign reserves of Pakistan. Pakistan Economic and Social Review, No. 1&2 (2004),

pp. 1-20

Combes, J. L., Kinda, T., & Plane, P. (2012). Capital flows, exchange rate flexibility, and the real

exchange rate. Journal of Macroeconomics, 34(4), 1034-1043.

Connell, C. M. (2011). Reforming the world monetary system: How Fritz Machlup built consensus

among business leaders and academics using scenario analysis. Journal of Management

History, 17(1), 50-65.

Coudert, V., Couharde, C., & Mignon, V. (2013). Pegging emerging currencies in the face of dollar

swings. Applied Economics, 45(36), 5076-5085.

Dominguez, K. M., Fatum, R., & Vacek, P. (2013). Do Sales of Foreign Exchange Reserves Lead to

Currency Appreciation?. Journal of Money, Credit and Banking, 45(5), 867-890.

Eatzaz and Ahmed (1999). A Simulation Analysis of the Debt Problem in Pakistan.

Eichengreen, B. (2012). When currencies collapse: will we replay the 1930s or the 1970s. Foreign

Aff., 91, 117.

Eichengreen, B. (2013). Currency war or international policy coordination?. Journal of Policy Modeling,

May/June.

Finnerty, J. E., & Nunn Jr, K. P. (1985). The determinants of yield spreads on US and

Eurobonds. Management International Review, 23-33.

Goldberg, L., Hull, C., & Stein, S. (2013). Do industrialized countries hold the right foreign exchange

reserves?. Current Issues in Economics and Finance, 19(1).

Hussain, T., & Siddiqi, M. W. (2013). Fiscal Policy, Institutions and Governance in Selected South

Asian Countries. Pakistan Journal of Commerce & Social Sciences, 7(2).

Husain, I. (2003, May). Pakistans Export Competitiveness in Global Markets. In seminar on export-led

growth strategy.

Iqbal, Z., & Sattar, A. (2010). The contribution of workers remittances to economic growth in

Pakistan. Working Papers & Research Reports, RR-No.

Javed, Z., & Farooq, M. (2009). Economic Growth and Exchange Rate Volatility in Case of

Pakistan. Pakistan Journal of Life and Social Sciences, 7(2), 112-118.

Khan, R. E. A., & Hye, Q. M. A. (2003). Financial Liberalization And Demand For Money: A Case of

Pakistan. The Journal of Developing Areas, 47(2), 175-198.

Kalim, R., & Hassan, M. S. (2013). WHAT LIES BEHIND FISCAL DEFICIT: A CASE OF

PAKISTAN. Transylvanian Review of Administrative Sciences.

M.Hasan and Ashfaque H. Khan (1994). Impact of Devaluation on Pakistan's External Trade: An

Econometric approach Source: The Pakistan Development Review, No. 4, pp. 1205-1215

Malik, S. U. (2014). Determinants of Currency Depreciation in Pakistan.

Meier, O. (2013). 6 India, the Nuclear Suppliers Group and the legitimacy of the nuclear non-

proliferation regime. Technology Transfers and Non-Proliferation: Between Control and

Cooperation, 116.

Perera, S. (2013, September 27). IMF imposes stringent austerity measures on Pakistan. World socialist

website. Retrieved from http://www.wsws.org

Shahbaz, M., Tiwari, A. K., & Tahir, M. I. (2013). Analyzing Time-Frequency Relationship between Oil

Price and Exchange Rate in Pakistan through Wavelets.

Shaheen, F. (2013). Fluctuations in Exchange Rate and its Impact on Macroeconomic Performance of

Pakistan. Dialogue (1819-6462), 8(4).

Shaheen, S., & Ayub, S. (2014). Impact of Government Debt and Basic Needs on Economic Growth in

Pakistan. Developing Country Studies, 4(3), 104-109.

Siddiqui, K., & Fahim, S. M. (2013). Khanani and Kalia International: Corporate Governance

Failure. IUP Journal of Corporate Governance, 12(4). The Pakistan Development Review, No. 4,

pp. 355-376

ur Rehman, H., & Rashid, H. A. (2006). The Balance of Payment Problem in Developing Countries,

Especially in Pakistan

Zakir, N., & Malik, W. S. (2013). Are the effects of monetary policy on output asymmetric

in Pakistan?. Economic Modeling, 32, 1-9.

Zhang, Z. (1999). Foreign exchange rate reform, the balance of trade and economic growth: an empirical

analysis for China. Journal of Economic Development, 24(2), 143-62.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Nama Peserta BPPДокумент53 страницыNama Peserta BPPInge Syahla KearyОценок пока нет

- Types of Economic SystemsДокумент14 страницTypes of Economic Systemsshaheen47Оценок пока нет

- Downtown Design ExhibitorsДокумент21 страницаDowntown Design ExhibitorsIan DañgananОценок пока нет

- Principles of Effective Governance ECOSOCДокумент3 страницыPrinciples of Effective Governance ECOSOCIsabella RamiaОценок пока нет

- Joint Stock CompanyДокумент2 страницыJoint Stock CompanybijuОценок пока нет

- ASEAN Association of Southeast Asian NationsДокумент3 страницыASEAN Association of Southeast Asian NationsnicolepekkОценок пока нет

- Economy of BangladeshДокумент22 страницыEconomy of BangladeshRobert DunnОценок пока нет

- Capacity Management in Service FirmsДокумент10 страницCapacity Management in Service FirmsJussie BatistilОценок пока нет

- Responsive Essay 1 ATM 634Документ2 страницыResponsive Essay 1 ATM 634Aditi BakshiОценок пока нет

- Business Taxation Made EasyДокумент2 страницыBusiness Taxation Made EasyNatsumi T. ViceralОценок пока нет

- Chapter 01 Ten Principles of EconomicsДокумент30 страницChapter 01 Ten Principles of EconomicsTasfia Rahman Riva100% (1)

- Historical Fuel Efficiencies of Regional AircraftДокумент26 страницHistorical Fuel Efficiencies of Regional AircraftBrian XistosОценок пока нет

- B5M ElДокумент3 страницыB5M ElBALAKRISHNANОценок пока нет

- Building Economics For Architecture PPT (F)Документ54 страницыBuilding Economics For Architecture PPT (F)vaidehi vakil100% (2)

- Interactive Future of Highways 2014 Final PDFДокумент31 страницаInteractive Future of Highways 2014 Final PDFHugo SilvaОценок пока нет

- Feminist Trade PolicyДокумент5 страницFeminist Trade PolicyMerckensОценок пока нет

- I. Convertible Currencies With Bangko Sentral:: Run Date/timeДокумент1 страницаI. Convertible Currencies With Bangko Sentral:: Run Date/timeLucito FalloriaОценок пока нет

- Digital Transformation A Road-Map For Billion-Dollar OrganizationsДокумент68 страницDigital Transformation A Road-Map For Billion-Dollar OrganizationsApurv YadavОценок пока нет

- International Economic (Group Assignment)Документ12 страницInternational Economic (Group Assignment)Ahmad FauzanОценок пока нет

- List of Cases by Justice PBДокумент37 страницList of Cases by Justice PBAirah MacabandingОценок пока нет

- Manta Aji Coroko Sungsang ASLIДокумент1 страницаManta Aji Coroko Sungsang ASLIFarhan HumamОценок пока нет

- Understanding ManagementДокумент35 страницUnderstanding ManagementXian-liОценок пока нет

- John Deere 6405 and 6605 Tractor Repair Technical ManualДокумент16 страницJohn Deere 6405 and 6605 Tractor Repair Technical ManualJefferson Carvajal67% (6)

- Soft Offer Canned Food-June10Документ3 страницыSoft Offer Canned Food-June10davidarcosfuentesОценок пока нет

- Steeple AnalysisДокумент2 страницыSteeple AnalysisSamrahОценок пока нет

- Fin 254 SNT Project Ratio AnalysisДокумент29 страницFin 254 SNT Project Ratio Analysissoul1971Оценок пока нет

- Financial and Physical Performance Report FORMATДокумент9 страницFinancial and Physical Performance Report FORMATJeremiah TrinidadОценок пока нет

- Chapter 6 - Product and Service StrategiesДокумент32 страницыChapter 6 - Product and Service StrategiesralphalonzoОценок пока нет

- Placement Report 2023Документ9 страницPlacement Report 2023Star WhiteОценок пока нет

- Buyer Questionnaire: General QuestionsДокумент3 страницыBuyer Questionnaire: General Questionsshweta meshramОценок пока нет