Академический Документы

Профессиональный Документы

Культура Документы

Will of Willa Willmaker

Загружено:

Adeel Afzal0 оценок0% нашли этот документ полезным (0 голосов)

73 просмотров4 страницыWilla Willmaker declares this document to be her last will and testament. She revokes all previous wills. She leaves her Boston terrier Clementine and $1,500 to Jenny Amigo for its care, or $2,000 to Bob Smith if Jenny does not survive. Her residuary estate is left to her spouse Bob Smith, or to her children Ricky and Gloria Willmaker in trust if Bob does not survive. The will names Bob Smith as executor and gives him powers to administer the estate.

Исходное описание:

Sample Will obtained from a law firms online repository

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документWilla Willmaker declares this document to be her last will and testament. She revokes all previous wills. She leaves her Boston terrier Clementine and $1,500 to Jenny Amigo for its care, or $2,000 to Bob Smith if Jenny does not survive. Her residuary estate is left to her spouse Bob Smith, or to her children Ricky and Gloria Willmaker in trust if Bob does not survive. The will names Bob Smith as executor and gives him powers to administer the estate.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

73 просмотров4 страницыWill of Willa Willmaker

Загружено:

Adeel AfzalWilla Willmaker declares this document to be her last will and testament. She revokes all previous wills. She leaves her Boston terrier Clementine and $1,500 to Jenny Amigo for its care, or $2,000 to Bob Smith if Jenny does not survive. Her residuary estate is left to her spouse Bob Smith, or to her children Ricky and Gloria Willmaker in trust if Bob does not survive. The will names Bob Smith as executor and gives him powers to administer the estate.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

Will of Willa Willmaker

Part 1. Personal Information

I, Willa Willmaker, a resident of the State of California, Alameda County, declare that this is my will.

Part 2. Revocation of Previous Wills

I revoke all wills and codicils that I have previously made.

[This provision makes clear that this is the will to be used -- not any other wills or amendments to those wills, called

codicils, that were made earlier. To prevent possible confusion, all earlier wills and codicils should also be physically

destroyed.]

Part 3. Marital Status

I am married to Bob Willmaker.

[Here you identify your spouse if you are married -- or your partner, if you are in a registered domestic partnership,

civil union or other marriage-like relationship recognized by your state. ]

Part 5. Pets

I leave my Boston terrier, Clementine, and $1,500 to Jenny Amigo, with the hope that the money will be used for

Clementine's care and maintenance. If Jenny Amigo does not survive me, I leave Clementine and $2,000 to Bob

Smith, with the hope that the money will be used for Clementine's care and maintenance.

[Here you can leave your pet to a trusted caretaker. You can also leave money to the caretaker with a request that

the caretaker use the money for your pet's care.]

Part 6. Disposition of Property

A beneficiary must survive me for at least 45 days to receive property under this will. As used in this will, the phrase

"survive me" means to be alive or in existence as an organization on the 45th day after my death.

[This language means that to receive property under your will, a person must be alive for at least 45 days after your

death. Otherwise, the property will go to whomever you named as an alternate. This language permits you to choose

another way to leave your property if your first choice dies within a short time after you do.

This will clause also prevents the confusion associated with the simultaneous death of spouses or domestic partners,

when it is hard to tell who gets the property they have left to one another. Property left to a spouse or domestic

partner who dies within 45 days of the other spouse or domestic partner, including a spouse or partner who dies

simultaneously, will go to the person or organization named as alternate.]

If I leave property to be shared by two or more beneficiaries, and any of them does not survive me, I leave his or her

share to the others equally unless this will provides otherwise.

[This clause states that if you leave a gift to two or more beneficiaries without stating the percentage each should

receive, the beneficiaries will share the gift equally. This clause is included as a catchall; you can determine the

shares for almost every shared gift.]

My residuary estate is all property I own at my death that is subject to this will that does not pass under a general or

specific bequest, including all failed or lapsed requests.

[This definition is included so that you and your survivors are clear on the meaning of "residuary estate."]

I leave $10,000 to Gary Johnson. If Gary Johnson does not survive me, I leave this property to Suzie White.

[This language leaves a specific item of property -- $10,000 -- to a named beneficiary, Gary Johnson. If Gary Johnson

does not survive the testator, then Suzie White will get the money.]

I leave my rare stamp collection to Jenny Amigo, Michael Swanson and Jose Gladstone as follows: Jenny Amigo

shall receive a 1/4 share. Michael Swanson shall receive a 1/4 share. Jose Gladstone shall receive a 1/2 share.

[This language leaves a specific item of property -- a stamp collection -- to three people in unequal shares.]

I leave my collection of Nash cars to the Big Sky Auto Museum and Marcus Stone in equal shares. If Marcus Stone

does not survive me, I leave his share of this property to Cyndy Stone.

[This will leaves specific property to an organization and a person equally. Since the testator here was concerned

about providing for the possibility that the person would not survive to take the property, she named an alternate for

him.]

I leave my residuary estate to my spouse, Bob Smith.

[This clause gives the residuary estate -- all property that does not pass under this will in specific bequests -- to the

testator's spouse. Your residuary estate may be defined differently depending on your plans for leaving your

property.]

If Bob Smith does not survive me, I leave my residuary estate to Ricky Willmaker and Gloria Willmaker in a children's

pot trust to be administered under the children's pot trust provisions.

[If the person named here to take the residuary estate does not survive the testator, the residuary estate will pass to

the two people named: the testator's children. The property will be put in one pot for the children to use as they

mature. Specifics of how this pot trust operates are explained later in the will. Keep in mind that, in this example, the

pot trust will come into being only if the testator's spouse does not survive the testator by at least 45 days.]

If both of these children are age 18 or older at my death, my residuary estate shall be distributed to them directly in

equal shares.

[This clause makes clear what should happen if the children are older than the age at which the testator specified the

pot trust should end. In this case, no pot trust will be created; the children will get the property directly and divide it

evenly.]

If either of these children does not survive me, I leave his or her share to the other child.

[This clause explains that if either child does not survive, the other will get the property directly.]

If Bob Smith, Ricky Willmaker and Gloria Willmaker do not survive me, I leave my residuary estate to Christine

Clemens.

All personal and real property that I leave in this will shall pass subject to any encumbrances or liens placed on the

property as security for the repayment of a loan or debt.

[This language explains that whoever gets any property under this will also gets the mortgage and other legal claims

against the property, such as liens. And anyone who takes property that is subject to a loan, such as a car loan, gets

the debt as well as the property.]

Part 7. Forgiveness of Debts

I wish to forgive all debts specified below, plus accrued interest as of the date of my death: Sheila Jenkins, April 6,

2007, $10,000.

[Forgiving a debt is equivalent to making a bequest of money. It is a common way to equalize what you leave to all

your children when you have loaned one of them some money -- that is, the amount that you would otherwise leave

that child can be reduced by the amount of the debt being forgiven.]

Part 8. Executor

I name Bob Smith to serve as my executor. If Bob Smith is unwilling or unable to serve as executor, I name Jenny

Amigo to serve as my executor.

No executor shall be required to post bond.

[This clause identifies the choices for executor and an alternate executor who will take over if the first choice is

unable or unwilling to serve when the time comes.]

Part 9. Executor's Powers

I direct my executor to take all actions legally permissible to have the probate of my will done as simply and as free of

court supervision as possible under the laws of the state having jurisdiction over this will, including filing a petition in

the appropriate court for the independent administration of my estate.

[This clause sets out the specific authority that the executor will need to competently manage the estate until it has

been distributed under the terms of the will. The will language expresses your desire that your executor work as free

from court supervision as possible. This will cut down on delays and expense.

When you print out your will, a second paragraph will list a number of specific powers that your executor will have, if

necessary. It also makes clear that the listing of these specific powers does not deprive your executor of any other

powers that he or she has under the law of your state. The general idea is to give your executor as much power as

possible, so that he or she will not have to go to court and get permission to take a particular action.]

Part 10. Payment of Debts

Except for liens and encumbrances placed on property as security for the repayment of a loan or debt, I direct that all

debts and expenses owed by my estate be paid using the following assets: Account #666777 at Cudahy Savings

Bank.

[This clause states how debts will be paid. Depending on your choice when making your will, your debts may be paid

either from specific assets you designate, or from your residuary estate -- all the property covered by your will that

does not pass through a specific bequest.]

Part 11. Payment of Taxes

I direct that all estate and inheritance taxes assessed against property in my estate or against my beneficiaries to be

paid using the following asset: Account #939494050 at the Independence Bank, Central Branch.

[This clause states how any estate or inheritance taxes owed by the estate or beneficiaries should be paid. You can

choose whether your taxes should be paid from all of your property, from specific assets you designate or by your

executor according to the law of your state.]

Part 12. No-Contest

If any beneficiary under this will contests this will or any of its provisions, any share or interest in my estate given to

the contesting beneficiary under this will is revoked and shall be disposed of as if that contesting beneficiary had not

survived me.

[This harsh-sounding clause is intended to discourage anyone who receives anything under the will from challenging

its legality for the purpose of receiving a larger share. Many states will not enforce a no-contest clause if the

challenger has a good reason for the contest. Other states have passed laws specifically stating that a no-contest

clause will not be enforced. If a court decides not to carry out the no-contest clause in your will, the rest of the

document will be enforced as written.]

Part 13. Severability

If any provision of this will is held invalid, that shall not affect other provisions that can be given effect without the

invalid provision.

[This is standard language that ensures that in the unlikely event that a court finds any individual part of your will to

be invalid, the rest of the document will remain in effect.]

SIGNATURE

I, Willa Willmaker, the testator, sign my name to this instrument, this ________________ day of ______________,

________, at ___________________________________. I declare that I sign and execute this instrument as my last

will, that I sign it willingly, and that I execute it as my free and voluntary act. I declare that I am of the age of majority

or otherwise legally empowered to make a will, and under no constraint or undue influence.

Signature: _______________________________________

WITNESSES

We, the witnesses, sign our names to this document, and declare that the testator willingly signed and executed this

document as the testator's last will.

In the presence of the testator, and in the presence of each other, we sign this will as witnesses to the testator's

signing.

To the best of our knowledge, the testator is of the age of majority or otherwise legally empowered to make a will, is

of sound mind and under no constraint or undue influence. We declare under penalty of perjury that the foregoing is

true and correct, this ________________ day of ______________, ________, at

___________________________________.

First Witness

Sign your name: __________________________________________________

Print your name: __________________________________________________

Address: ________________________________________________________

City, State: ______________________________________________________

Second Witness

Sign your name: __________________________________________________

Print your name: __________________________________________________

Address: ________________________________________________________

City, State: _____________________________________________________

Вам также может понравиться

- Sample WillДокумент21 страницаSample Willsterling2001Оценок пока нет

- Anatomy of A Will ComplexДокумент19 страницAnatomy of A Will Complexizzatahmad1980Оценок пока нет

- Will 2 (Example)Документ16 страницWill 2 (Example)pearlanderОценок пока нет

- LindaДокумент15 страницLindaMesko MehmedovicОценок пока нет

- The Tom Jones Living Trust SampleДокумент26 страницThe Tom Jones Living Trust Samplekevin.m.kirkpatrick90220% (1)

- Uncontested Probate Procedure in CaliforniaДокумент3 страницыUncontested Probate Procedure in CaliforniaStan BurmanОценок пока нет

- Will KitДокумент9 страницWill KitwitkerzОценок пока нет

- Last Will and TestamentДокумент3 страницыLast Will and TestamentDarkJV TVОценок пока нет

- New York Last Will and Testament FormДокумент8 страницNew York Last Will and Testament FormDEShif100% (1)

- Simple WillДокумент12 страницSimple WillYallana McgeeОценок пока нет

- How To Make A WillДокумент5 страницHow To Make A WillEdmundSubryanОценок пока нет

- 9502en Successor AffidavitДокумент12 страниц9502en Successor AffidavitDavid Mario100% (1)

- Sample of Will PDFДокумент11 страницSample of Will PDFParkEdJop100% (1)

- Law of Succession Tutorial QuestionsДокумент4 страницыLaw of Succession Tutorial QuestionsDanica DivyaОценок пока нет

- Last Will and Testament of (Testator) : DeclarationsДокумент8 страницLast Will and Testament of (Testator) : DeclarationsQuinciano MorilloОценок пока нет

- Last Will Of: Article I Description of Family A. Marital StatusДокумент11 страницLast Will Of: Article I Description of Family A. Marital StatusAj TactayОценок пока нет

- Newark City Mayor01Документ7 страницNewark City Mayor01david mickОценок пока нет

- Estate Planning For CanadiansДокумент3 страницыEstate Planning For CanadiansNoel Sunil100% (1)

- Last Will and Testament CAДокумент20 страницLast Will and Testament CACesar GuaninОценок пока нет

- Sample: THE Last Will and Testament OF John DoeДокумент24 страницыSample: THE Last Will and Testament OF John DoeSalomeОценок пока нет

- Sample WillДокумент4 страницыSample WillReynaldo ZavalaОценок пока нет

- New Jersey Last Will and Testament TemplateДокумент5 страницNew Jersey Last Will and Testament TemplateBig ShowОценок пока нет

- Last Will and Testament of John Doe NY Sample2 Eng15Документ23 страницыLast Will and Testament of John Doe NY Sample2 Eng15Pete DechaОценок пока нет

- Lecturer: Roy Poan: Faculty of Business, President UniversityДокумент21 страницаLecturer: Roy Poan: Faculty of Business, President UniversityAurelia Graciela WallaОценок пока нет

- Revocation of Power of Attorney, Declaration of Revocation & Rescission Public Notice/Public RecordДокумент2 страницыRevocation of Power of Attorney, Declaration of Revocation & Rescission Public Notice/Public Recordin1or93% (14)

- Revocation of Wills - How Accomplished and The EffectДокумент14 страницRevocation of Wills - How Accomplished and The EffectmordecainyangauОценок пока нет

- California Last Will and Testament Will - 2022 - 12 - 25Документ9 страницCalifornia Last Will and Testament Will - 2022 - 12 - 25mmpress009Оценок пока нет

- Will TemplateДокумент4 страницыWill TemplatecjОценок пока нет

- I Want My Bonds LTR (Edited)Документ4 страницыI Want My Bonds LTR (Edited)rhouse_197% (31)

- California Power of AttorneyДокумент5 страницCalifornia Power of Attorneyjames breno100% (1)

- Last Will and TestamentДокумент11 страницLast Will and TestamentAllen-nelson of the Boisjoli familyОценок пока нет

- Florida Last Will and Testament TemplateДокумент5 страницFlorida Last Will and Testament TemplateCarolОценок пока нет

- Alabama Last Will and Testament TemplateДокумент5 страницAlabama Last Will and Testament TemplateMuwonge Alex StevensОценок пока нет

- Request For Fiduciary Federal Tax Estimates, Returns, Forms Public Notice/Public RecordДокумент3 страницыRequest For Fiduciary Federal Tax Estimates, Returns, Forms Public Notice/Public Recordin1or100% (4)

- Divorce Deals Webinar - HandoutДокумент18 страницDivorce Deals Webinar - HandoutlonghornsteveОценок пока нет

- HJR 192Документ3 страницыHJR 192De oppresso liber Shahbaz BeyОценок пока нет

- Last Will and Testament MIDDLEBROOKSДокумент10 страницLast Will and Testament MIDDLEBROOKSLindy MiddlebrooksОценок пока нет

- Last Will and Testament - Single Adult With Minor Children, Including TrustДокумент5 страницLast Will and Testament - Single Adult With Minor Children, Including Trustaryabhave100% (2)

- Conditional AcceptanceДокумент9 страницConditional AcceptanceSpike Lee92% (12)

- Power Attorney General 1Документ4 страницыPower Attorney General 1Krupa DesaiОценок пока нет

- LawAccess General Information Wills Challenging A WillДокумент5 страницLawAccess General Information Wills Challenging A WillAnonymous nw5AXJqjdОценок пока нет

- Sample TrustДокумент5 страницSample TrustGerry DayananОценок пока нет

- General PoaДокумент4 страницыGeneral PoatwonОценок пока нет

- Last Will and TestamentДокумент10 страницLast Will and Testamentapi-317218918Оценок пока нет

- Last Will and TestamentДокумент9 страницLast Will and TestamentCynthia RoystonОценок пока нет

- Sample Will 3Документ4 страницыSample Will 3RV Lorraine ChoiОценок пока нет

- Accounting For Estates of A Deceased PersonДокумент12 страницAccounting For Estates of A Deceased PersonNicole TaylorОценок пока нет

- Virginia Last Will and Testament: Pursuant To Title 64.2 (Wills, Trusts, and Fiduciaries)Документ5 страницVirginia Last Will and Testament: Pursuant To Title 64.2 (Wills, Trusts, and Fiduciaries)david pohanОценок пока нет

- Massachusetts Last Will and Testament TemplateДокумент5 страницMassachusetts Last Will and Testament TemplateRamana DaliparthyОценок пока нет

- Texas WillДокумент5 страницTexas Willbarristers.centre.for.legal.skillsОценок пока нет

- INTRODUCTION To The Law of Succession in MalaysiaДокумент12 страницINTRODUCTION To The Law of Succession in MalaysiaOng Teck Chong100% (2)

- Last Will and Testament: Be It Known That IДокумент5 страницLast Will and Testament: Be It Known That IshendaiОценок пока нет

- Kansas Last Will and Testament: Pursuant To Chapter 59 (Probate Code)Документ5 страницKansas Last Will and Testament: Pursuant To Chapter 59 (Probate Code)Carlos Alberto RuizОценок пока нет

- Michigan Last Will and Testament TemplateДокумент5 страницMichigan Last Will and Testament TemplateLaura KhalilОценок пока нет

- Complete WillДокумент4 страницыComplete WillRocketLawyer100% (1)

- Quit Getting Stiffed: A Texas Contractor's Guide to Collections and Lien RightsОт EverandQuit Getting Stiffed: A Texas Contractor's Guide to Collections and Lien RightsОценок пока нет

- The Executor's Handbook: A Step-by-Step Guide to Settling an Estate for Personal Representatives, Administrators, and Beneficiaries, Fourth EditionОт EverandThe Executor's Handbook: A Step-by-Step Guide to Settling an Estate for Personal Representatives, Administrators, and Beneficiaries, Fourth EditionОценок пока нет

- G-202 Failure - PaniroДокумент2 страницыG-202 Failure - PaniroAdeel AfzalОценок пока нет

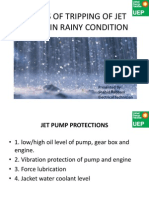

- Jet Pump Tripping Due To RainДокумент22 страницыJet Pump Tripping Due To RainAdeel AfzalОценок пока нет

- Hazardous Area ClassificationДокумент9 страницHazardous Area ClassificationAdeel Afzal100% (1)

- Volume Correction Factor DevelopmentДокумент29 страницVolume Correction Factor DevelopmentAbd74100% (2)

- DNFT TroubleshootingДокумент1 страницаDNFT TroubleshootingAdeel AfzalОценок пока нет

- Cat CDVRДокумент8 страницCat CDVRAdeel AfzalОценок пока нет

- Ol XP1252Документ1 страницаOl XP1252Adeel AfzalОценок пока нет

- Finley Peter DunneДокумент2 страницыFinley Peter DunneAdeel AfzalОценок пока нет

- COMSATS Institute of Information Technology: Application FormДокумент4 страницыCOMSATS Institute of Information Technology: Application Formshakeel_idealОценок пока нет

- Swat Trip - Details PDFДокумент8 страницSwat Trip - Details PDFAdeel AfzalОценок пока нет

- Product Features: The Industrial Network CompanyДокумент4 страницыProduct Features: The Industrial Network CompanyAdeel AfzalОценок пока нет

- Attributes of An Effective Clinical Teacher: A Survey On Students' and Teachers' PerceptionsДокумент5 страницAttributes of An Effective Clinical Teacher: A Survey On Students' and Teachers' PerceptionsAdeel AfzalОценок пока нет

- Vintage Pak PhotosДокумент34 страницыVintage Pak PhotosAdeel AfzalОценок пока нет

- Cardiac First Responder Guide CompleteДокумент35 страницCardiac First Responder Guide CompleteAdeel AfzalОценок пока нет

- Business Emails - Style and StructureДокумент4 страницыBusiness Emails - Style and StructureFall Eljed100% (1)

- Factoring Problems-SolutionsДокумент11 страницFactoring Problems-SolutionsChinmayee ChoudhuryОценок пока нет

- Spelling Power Workbook PDFДокумент98 страницSpelling Power Workbook PDFTinajazz100% (1)

- Yamaha TW 125 Service Manual - 1999Документ275 страницYamaha TW 125 Service Manual - 1999slawkomax100% (11)

- Four Year Plan DzenitaДокумент4 страницыFour Year Plan Dzenitaapi-299201014Оценок пока нет

- Fundamental of Transport PhenomenaДокумент521 страницаFundamental of Transport Phenomenaneloliver100% (2)

- Venetian Shipping During The CommercialДокумент22 страницыVenetian Shipping During The Commercialakansrl100% (1)

- Computer Science Past Papers MCQS SolvedДокумент24 страницыComputer Science Past Papers MCQS SolvedLEGAL AFFAIRS DIVISION100% (1)

- Prismatic Battery Pack Se-Mi Auto Production Line ProposalДокумент25 страницPrismatic Battery Pack Se-Mi Auto Production Line ProposalCheemaОценок пока нет

- VC++ Splitter Windows & DLLДокумент41 страницаVC++ Splitter Windows & DLLsbalajisathyaОценок пока нет

- Raiders of The Lost Ark - Indiana JonesДокумент3 страницыRaiders of The Lost Ark - Indiana JonesRobert Jazzbob Wagner100% (1)

- Swati Bajaj ProjДокумент88 страницSwati Bajaj ProjSwati SoodОценок пока нет

- Coca-Cola Femsa Philippines, Tacloban PlantДокумент29 страницCoca-Cola Femsa Philippines, Tacloban PlantJuocel Tampil Ocayo0% (1)

- Hop Movie WorksheetДокумент3 страницыHop Movie WorksheetMARIA RIERA PRATSОценок пока нет

- Soft Skills PresentationДокумент11 страницSoft Skills PresentationRishabh JainОценок пока нет

- Data Types of SQL (Oracle) : Provided By: - Pronab Kumar AdhikariДокумент1 страницаData Types of SQL (Oracle) : Provided By: - Pronab Kumar AdhikariMannan AhmadОценок пока нет

- LPP-Graphical and Simplex MethodДокумент23 страницыLPP-Graphical and Simplex MethodTushar DhandeОценок пока нет

- Naresh Kadyan: Voice For Animals in Rajya Sabha - Abhishek KadyanДокумент28 страницNaresh Kadyan: Voice For Animals in Rajya Sabha - Abhishek KadyanNaresh KadyanОценок пока нет

- Diec Russias Demographic Policy After 2000 2022Документ29 страницDiec Russias Demographic Policy After 2000 2022dawdowskuОценок пока нет

- Chap 1 WK 1Документ20 страницChap 1 WK 1kamarul azrilОценок пока нет

- Gardens Illustrated FernandoДокумент4 страницыGardens Illustrated FernandoMariaОценок пока нет

- Botswana Ref Ranges PaperДокумент7 страницBotswana Ref Ranges PaperMunyaradzi MangwendezaОценок пока нет

- LEGO Group A Strategic and Valuation AnalysisДокумент85 страницLEGO Group A Strategic and Valuation AnalysisRudmila Ahmed50% (2)

- Minneapolis Police Department Lawsuit Settlements, 2009-2013Документ4 страницыMinneapolis Police Department Lawsuit Settlements, 2009-2013Minnesota Public Radio100% (1)

- Republic of The Philippines Legal Education BoardДокумент25 страницRepublic of The Philippines Legal Education BoardPam NolascoОценок пока нет

- Douglas Boyz Release Bridging The Gap Via Extraordinary Collective Music GroupДокумент2 страницыDouglas Boyz Release Bridging The Gap Via Extraordinary Collective Music GroupPR.comОценок пока нет

- Catibog Approval Sheet EditedДокумент10 страницCatibog Approval Sheet EditedCarla ZanteОценок пока нет

- The Old Rugged Cross - George Bennard: RefrainДокумент5 страницThe Old Rugged Cross - George Bennard: RefrainwilsonОценок пока нет

- A Manual For A Laboratory Information Management System (Lims) For Light Stable IsotopesДокумент131 страницаA Manual For A Laboratory Information Management System (Lims) For Light Stable IsotopesAlvaro Felipe Rebolledo ToroОценок пока нет

- MKTG4471Документ9 страницMKTG4471Aditya SetyaОценок пока нет