Академический Документы

Профессиональный Документы

Культура Документы

Non-Negotiable Promissory Note

Загружено:

aplawИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Non-Negotiable Promissory Note

Загружено:

aplawАвторское право:

Доступные форматы

EX-10.1.II 3 ex101-2.

htm NOTE

EXHIBIT 10.1 (ii)

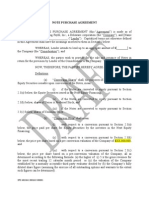

NON-NEGOTIABLE PROMISSORY NOTE

=====================================================================================

Borrower: Zion Oil & Gas, Inc. Lender Robert E. Render Trust U/A DTD 2-15-94

6510 Abrams Road, Suite 300

P. O. Box 809

Dallas, Texas 75231

Lewiston, MI 49756

U.S.A.

_______________

=====================================================================================

Principal Amount: $100,000 Date of Note: June 30, 2004

PROMISE TO PAY. Zion Oil & Gas, Inc. (the "Borrower") promises to pay Robert E. Render Trust U/A DTD 2-15-94 ("Lender"), or order, in lawful

money of the United States of America, the principal amount of One Hundred Thousand Dollar ($100,000.00) (the "Loan") or so much thereof as may be

outstanding, together with interest on the unpaid outstanding principal balance.

LOAN AGREEMENT. This Note is made pursuant to that certain Loan Agreement dated as of June 30, 2004 between Lender and Borrower (the "Loan

Agreement"). In the event of any discrepancy between this Note and the Loan Agreement, this Note shall prevail.

MATURITY AND PAYMENT OF PRINCIPAL. Borrower will pay the outstanding principal balance in accordance with the following payment

schedule, subject to the Extension Option as provided below:

Six (6) monthly payments (due on the rst day of each month) on account of principal of One Thousand Six Hundred and Sixty Six Dollars and 67/00

($1,666.67) each commencing September 1, 2004 and through and including February 1, 2005, with the remaining principal amount of Eighty-Nine

Thousand Nine Hundred and Ninety-Nine and 98/00 Dollars ($89,999.98) (the "Remaining Principal Amount") due on March 2, 2005.

OPTION TO EXTEND PRINCIPAL REPAYMENT: Lender shall have the option (the "Extension Option") to be exercised by written notice to

Borrower no later than February 15, 2005 to convert the Loan into a ve (5) year reducing principle term loan with nal payment due on August 1, 2009. If

the Extension Option is exercised, the Remaining Principal Amount shall be paid in fty-four (54) monthly payments on account of principal in the amount

of One Thousand Six Hundred and Sixty Six and 67/00 Dollars ($1,666.67) each commencing March 2, 2005 and terminating August 1, 2009.

INTEREST RATE AND PAYMENT. The interest rate to be applied prior to maturity to the unpaid principal balance of this Note shall be ten per cent

(10%) per annum, payable monthly in arrears commencing September 1, 2004. Interest shall be computed on the basis of a 360-day year consisting of

twelve (12) months of thirty (30) days each on the basis of the average daily principal balance during the preceding month. Interest for any partial monthly

period shall be calculated at the daily rate of 0.0278% of the average daily principal balance during said partial monthly period. NOTICE: Under no

circumstances will the interest rate on this Note be more than the maximum rate allowed by applicable law.

POST MATURITY RATE. Upon the occurrence of any Event of Default or if this Note is not paid at nal maturity, Lender, at Lender's option, may add

any unpaid accrued interest to principal and such sum will bear interest therefrom until paid at the Post Maturity Rate provided in this Note. The "Post

Maturity Rate" on this Note is the lesser of the maximum rate allowed by applicable law or twenty per cent (20%) per annum. Borrower will pay interest

on all sums due after nal maturity whether by acceleration or otherwise, at that rate.

DEFAULT. Upon Borrower's failure to cure any of the following events within (3) days written notice from Lender to Borrower, each of the following shall

constitute an event of default ("Event of Default") under this Note:

Payment Default. Borrower fails to make any payment when due under this Note.

Entry into Senior Credit Agreements. Except with the prior written agreement of Lender, Borrower shall enter into any credit agreement which by its

terms shall provide a security interest in any asset of the Borrower or provide that, in the event of the insolvency, dissolution or liquidation of the Borrower,

the creditor under such agreement shall have preference rights, other than as provided by law, over the rights of the Lender under this Note (such

agreements, "Senior Credit Agreements"); provided, however, that indebtedness of the Borrower outstanding on the date of issuance of this Note and

arrangements of Borrower with directors, employees and trade creditors in connection with salary, fees and trade debt shall not be considered Senior Credit

Agreements.

Other Defaults. Borrower fails to comply with or to pay or perform any other term, obligation, covenant or condition contained in this Note or the Loan

Agreement.

Transfer of Assets. Borrower leases, sells, or otherwise conveys, or agrees to lease, sell, or otherwise convey, a material part of its assets or business outside

of the ordinary course of business.

Judgments or Decrees. One or more judgments or decrees shall be entered against the Borrower in aggregate amounts exceeding $300,000, and such

NON-NEGOTIABLE PROMISSORY NOTE http://www.sec.gov/Archives/edgar/data/1131312/0001131312...

1 of 2 1/29/14 10:40 AM

judgments or decrees shall not have been vacated, discharged, stayed or bonded pending appeal.

Insolvency. The dissolution or termination of Borrower's existence as a going business, the insolvency of Borrower, the appointment of a receiver for any

part of Borrower's property, any assignment for the benet of creditors, or the commencement of any proceeding under any bankruptcy or insolvency laws

by or against Borrower.

Creditor or Forfeiture Proceedings. Commencement of foreclosure, repossession, attachment, levy, execution, or forfeiture proceedings, whether by

judicial proceeding, self-help, or any other method, by any creditor of Borrower, or by any governmental agency against any assets of Borrower. However,

this Event of Default shall not apply if there is a good faith dispute by Borrower as to the validity or reasonability of the claim that is the basis of the creditor

or forfeiture proceeding.

Failure to Comply with Laws. Borrower fails to comply with all applicable statutes, laws, ordinances and governmental rules, regulations and orders to

which it is subject or which are applicable to its business, property and assets, and such failure results in a material adverse consequence to Borrower.

LENDER'S RIGHTS. Upon the occurrence of any Event of Default, Lender may declare the entire unpaid principal balance on this Note and the

Indebtedness and all accrued unpaid interest immediately due, without notice (except that in the case of any Event of Default of the type described in the

DEFAULT - Insolvency section herein, such acceleration shall be automatic and not at Lender's option), and then Borrower will pay that amount.

ATTORNEY'S FEES. Lender may hire an attorney to help collect the Loan if Borrower does not pay, and Borrower will pay Lender's reasonable attorney's

fees. Borrower also will pay Lender all other amounts Lender actually incurs as court costs.

GOVERNING LAW. This Note will be governed by, construed and enforced in accordance with the laws of the State of Texas.

INDEBTEDNESS. The word "Indebtedness" means all principal, interest, and other amounts, costs and expenses payable under the Note or the Loan

Agreement, together with all renewals of, extensions of, modications of, consolidations of and substitutions for the Note or the Loan Agreement, together

with interest on such amounts as provided in this Note.

JURY WAIVER. THE UNDERSIGNED AND LENDER (BY ITS ACCEPTANCE HEREOF) HEREBY VOLUNTARILY, KNOWINGLY,

IRREVOCABLY AND UNCONDITIONALLY WAIVE ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE (WHETHER

BASED UPON CONTRACT, TORT OR OTHERWISE) BETWEEN OR AMONG THE UNDERSIGNED AND LENDER ARISING OUT OF OR IN

ANY WAY RELATED TO THIS NOTE OR THE LOAN AGREEMENT. THIS PROVISION IS A MATERIAL INDUCEMENT TO LENDERTO

PROVIDE THE FINANCING EVIDENCED BY THIS DOCUMENT AND THE LOAN AGREEMENT.

GENERAL PROVISIONS. If any part of this Note cannot be enforced, this fact will not affect the rest of the Note. Borrower does not agree or intend to

pay, and Lender does not agree or intend to contract for, charge, collect, take, reserve or receive (collectively referred to herein as "charge or collect") any

amount in the nature of interest or in the nature of a fee for this loan, which would in any way or event (including demand, prepayment, or acceleration)

cause Lender to charge or collect more for this loan than the maximum Lender would be permitted to charge or collect by the law of the State of Texas. Any

such excess interest or unauthorized fee shall, instead of anything stated to the contrary, be applied rst to reduce the principal balance of this loan, and

when the principal has been paid in full, be refunded to Borrower. The right to accelerate maturity of sums due under this Note does not include the right to

accelerate any interest which has not otherwise accrued on the date of such acceleration, and Lender does not intend to charge or collect any unearned

interest in the event of acceleration. All sums paid or agreed to be paid to Lender for the use, forbearance or detention of sums due hereunder shall, to the

extent permitted by applicable law, be amortized, prorated, allocated and spread throughout the full term of the loan evidenced by this Note until payment in

full so that the rate or amount of interest on account of the loan evidenced hereby does not exceed the applicable usury ceiling. It is agreed that any payment

which would otherwise for any reason be deemed unlawful interest under applicable law shall be deemed to have been applied to the unpaid principal

balance of this Note, or to other indebtedness. The unpaid balance owing on this Note at any time may be evidenced by endorsements on this Note or by

Lender's internal records. Lender may delay or forgo enforcing any of its rights or remedies under this Note without losing them. Borrower to the extent

allowed by law, waives presentment, demand for payment, notice of dishonor, notice of intent to accelerate the maturity of this Note, and notice of

acceleration of the maturity of this Note. Upon any change in the terms of this Note, and unless otherwise expressly stated in writing, no party who signs this

Note, whether as maker, guarantor, accommodation maker or endorser, shall be released from liability. Unless specically permitted otherwise by the terms

and conditions of this Note, no alteration of or amendment to this Note shall be effective unless given in writing and conditions of this Note, no alteration of

or amendment to this Note shall be effective unless given in writing and signed by the party or parties sought to be charged or bound by the alteration or

amendment. This Note is not assignable except with the prior written consent of the Borrower.

BORROWER

Zion Oil & Gas, Inc.

By: /s/ E A Soltero Attest: /s/ William H. Avery

Eugene A. Soltero, President William H. Avery, Assistant Secretary

NON-NEGOTIABLE PROMISSORY NOTE http://www.sec.gov/Archives/edgar/data/1131312/0001131312...

2 of 2 1/29/14 10:40 AM

Вам также может понравиться

- Loan AgreementДокумент3 страницыLoan AgreementInnah A Jose Vergara-Huerta85% (13)

- CP3P Foundation Exam - Sample QuestionsДокумент10 страницCP3P Foundation Exam - Sample QuestionsSaroosh Danish67% (6)

- Congressional Record 15641 15646 June 13 1967 Re 14th AmendmentДокумент6 страницCongressional Record 15641 15646 June 13 1967 Re 14th AmendmentgetsomeОценок пока нет

- Civil Law - FinalДокумент361 страницаCivil Law - FinalCzarina Yannah50% (2)

- Payment GuarantyДокумент9 страницPayment GuarantyconsultFLETCHERОценок пока нет

- Alters Charging LienДокумент5 страницAlters Charging LiensouthfllawyersОценок пока нет

- Affidavit For One and The Same PersonДокумент2 страницыAffidavit For One and The Same PersonUmar AlamОценок пока нет

- Convertible Bond Term SheetДокумент3 страницыConvertible Bond Term SheetGKОценок пока нет

- Standard Promissory Note TemplateДокумент3 страницыStandard Promissory Note Templateaplaw67% (3)

- California DMV REQUIRED by CALIFORNIA LAW To Issue CA EXEMPT License Plates To Non Commercial Automobile Users PDFДокумент5 страницCalifornia DMV REQUIRED by CALIFORNIA LAW To Issue CA EXEMPT License Plates To Non Commercial Automobile Users PDFaplawОценок пока нет

- Louisiana - Appealing An Eviction - What Rights Do I Have?Документ8 страницLouisiana - Appealing An Eviction - What Rights Do I Have?ForeclosureGate.org LibraryОценок пока нет

- 10000001667Документ79 страниц10000001667Chapter 11 DocketsОценок пока нет

- Pledge Agreement Secures $500K LoanДокумент9 страницPledge Agreement Secures $500K LoanDenise MathreОценок пока нет

- Trust AgreementДокумент2 страницыTrust AgreementEmma EyanaОценок пока нет

- Authority of SignatoryДокумент1 страницаAuthority of Signatorydonaldhax01Оценок пока нет

- Collateral Pledge AgreementДокумент6 страницCollateral Pledge AgreementI WAS The Loser Guy Pizza Pasta ChickenОценок пока нет

- Warranty Deed TemplateДокумент2 страницыWarranty Deed TemplateAngkora100% (1)

- Assignment of MortgageДокумент2 страницыAssignment of MortgageZohaib Shahid100% (1)

- MASTER TRSUT LTD LAS Form Annexure 07062016Документ10 страницMASTER TRSUT LTD LAS Form Annexure 07062016GOLD COINОценок пока нет

- Custodial AgreementДокумент4 страницыCustodial AgreementNicole SantoallaОценок пока нет

- Beneficiary Designation: Policy InformationДокумент2 страницыBeneficiary Designation: Policy Informationjaniceseto1Оценок пока нет

- Security Agreement For Borrowing Money: 1. NamesДокумент5 страницSecurity Agreement For Borrowing Money: 1. NamesRachelОценок пока нет

- BassDrill Alpha - Information MemorandumДокумент90 страницBassDrill Alpha - Information MemorandumAnbuОценок пока нет

- Deed of Trust FinalДокумент6 страницDeed of Trust FinalCraig M ShultsОценок пока нет

- Credit Notes On LiquidationДокумент7 страницCredit Notes On Liquidationpaulaplaza_7Оценок пока нет

- Commercial MortgageДокумент6 страницCommercial MortgagemirmoinulОценок пока нет

- Personal Bond of Indemnity FormДокумент4 страницыPersonal Bond of Indemnity Formsajeer n FORWARDОценок пока нет

- Company Name), A Delaware Corporation (The "Company"), and (Insert Name of Indemnitee)Документ17 страницCompany Name), A Delaware Corporation (The "Company"), and (Insert Name of Indemnitee)Rick SwordsОценок пока нет

- Secured Promissory Note: This Promissory Note Is Secured by Security Agreement of The Same DateДокумент1 страницаSecured Promissory Note: This Promissory Note Is Secured by Security Agreement of The Same DateFede CavalliОценок пока нет

- Contract AssignmentДокумент3 страницыContract AssignmentFindLegalForms100% (1)

- E - CREDIT LINE CERTIFICATEДокумент2 страницыE - CREDIT LINE CERTIFICATEsteelyannОценок пока нет

- Letters of CreditДокумент24 страницыLetters of CreditRounaq DharОценок пока нет

- Last Will and TestamentДокумент3 страницыLast Will and TestamentDarkJV TVОценок пока нет

- Loan and Security AgreementДокумент52 страницыLoan and Security Agreementbefaj44984Оценок пока нет

- Assignment of Promissory NoteДокумент1 страницаAssignment of Promissory NoteChicagoCitizens EmpowermentGroupОценок пока нет

- LAND TRUST AGREEMENT SampleДокумент4 страницыLAND TRUST AGREEMENT SampleTiggle MadaleneОценок пока нет

- General Durable Power of Attorney Effective Upon ExecutionДокумент5 страницGeneral Durable Power of Attorney Effective Upon Executionsable1234Оценок пока нет

- Texas MVD Surety Bond Sample FormДокумент2 страницыTexas MVD Surety Bond Sample FormBuySurety.com100% (2)

- Irrevocable Letter of Credit Sample - PDFДокумент1 страницаIrrevocable Letter of Credit Sample - PDFKim Thùy0% (1)

- Notice For AssignmentДокумент3 страницыNotice For AssignmentZaeem KhanОценок пока нет

- Promissory Note TermsДокумент1 страницаPromissory Note TermsGraeme SmithОценок пока нет

- The Three Certainties: Equity and Trusts Case ListДокумент7 страницThe Three Certainties: Equity and Trusts Case Listyadav007ajitОценок пока нет

- Grant of Life EstateДокумент2 страницыGrant of Life EstateDavid Eugene SmithОценок пока нет

- Definitions - Estoppel PDFДокумент4 страницыDefinitions - Estoppel PDFsrrockygОценок пока нет

- Note Purchase Agreement SummaryДокумент15 страницNote Purchase Agreement SummaryfrancisplaceОценок пока нет

- Standard Promissory Note: Page 1 of 3Документ3 страницыStandard Promissory Note: Page 1 of 3Ryano RahadianОценок пока нет

- Creation of Charges On SecuritiesДокумент32 страницыCreation of Charges On SecuritiesArftОценок пока нет

- Revocation of Special Power of AttorneyДокумент2 страницыRevocation of Special Power of Attorneytiray garciaОценок пока нет

- Power of Attorney Document TitleДокумент3 страницыPower of Attorney Document TitleJennifer PartidaОценок пока нет

- Indemnity Agreement For Surety Bail BondДокумент1 страницаIndemnity Agreement For Surety Bail Bondclayborn9100% (1)

- American Depositary System and Global Depositary SystemДокумент13 страницAmerican Depositary System and Global Depositary SystemDr. Shiraj SherasiaОценок пока нет

- Standard Promissory Note TemplateДокумент3 страницыStandard Promissory Note TemplateAntonie CollantesОценок пока нет

- SCL I Letters of CreditДокумент4 страницыSCL I Letters of CreditTerence Valdehueza100% (1)

- Fidiciarie State For MoroccoДокумент6 страницFidiciarie State For Moroccotieshea autumn brifil tmОценок пока нет

- Securitization SubprimeCrisisДокумент5 страницSecuritization SubprimeCrisisNiraj MohanОценок пока нет

- Apex Fully Paid Lending DisclosureДокумент19 страницApex Fully Paid Lending DisclosureErick Almestar ReyesОценок пока нет

- 3 Warranty DeedДокумент2 страницы3 Warranty DeedAsif Ahmed ShaikhОценок пока нет

- Promissory Note Secured FormДокумент3 страницыPromissory Note Secured Formsteve100% (1)

- Loan Agreement and Promissory NoteДокумент6 страницLoan Agreement and Promissory NoteDanielОценок пока нет

- Exported Durable Power of Attorney For Finances - Mario GaleanaДокумент10 страницExported Durable Power of Attorney For Finances - Mario GaleanaCOPIAS DELCENTROОценок пока нет

- Promissory NoteДокумент19 страницPromissory Notejim100% (2)

- 1-3 Power of Attorney - RDW09221985POA0001Документ2 страницы1-3 Power of Attorney - RDW09221985POA0001RICHARDDWASHINGTONОценок пока нет

- Secured Promissory Note TermsДокумент3 страницыSecured Promissory Note TermsPatbauОценок пока нет

- Constitution of the State of Minnesota — 1876 VersionОт EverandConstitution of the State of Minnesota — 1876 VersionОценок пока нет

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersОт EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersРейтинг: 5 из 5 звезд5/5 (1)

- Beneficial Ownership For Entities Control Person FidelityДокумент3 страницыBeneficial Ownership For Entities Control Person Fidelityaplaw100% (1)

- Cash Bond - SalesUseTaxIN - MF-134 - 20090205Документ3 страницыCash Bond - SalesUseTaxIN - MF-134 - 20090205aplawОценок пока нет

- ACH Quick Guide 0914Документ5 страницACH Quick Guide 0914aplawОценок пока нет

- Blank Promissory NoteДокумент2 страницыBlank Promissory NoteaplawОценок пока нет

- Banks - Loaning Money As Agent Ultra ViresДокумент3 страницыBanks - Loaning Money As Agent Ultra ViresaplawОценок пока нет

- Treasury Bond Claim Form Sav1048Документ7 страницTreasury Bond Claim Form Sav1048aplaw100% (1)

- Annavonreitz-Pay To USДокумент3 страницыAnnavonreitz-Pay To USaplawОценок пока нет

- Bond - USA Grand Corportation - 0007.f.cas.0761.2Документ11 страницBond - USA Grand Corportation - 0007.f.cas.0761.2aplawОценок пока нет

- Annavonreitz Finalendoffraud - Pay To Order of UsaДокумент4 страницыAnnavonreitz Finalendoffraud - Pay To Order of Usaaplaw100% (1)

- Motion To Dismiss Example PDFДокумент3 страницыMotion To Dismiss Example PDFaplawОценок пока нет

- ACH Quick Guide 0914Документ5 страницACH Quick Guide 0914aplawОценок пока нет

- Veritaseum Vertias On EthereumДокумент11 страницVeritaseum Vertias On EthereumaplawОценок пока нет

- Florida Case - Separation of PowersДокумент17 страницFlorida Case - Separation of PowersaplawОценок пока нет

- ACH Quick Guide 0914Документ5 страницACH Quick Guide 0914aplawОценок пока нет

- 2016 FTD Forget The Hague Convention Letter Rogatory Compass To Canadian DiscoveryДокумент2 страницы2016 FTD Forget The Hague Convention Letter Rogatory Compass To Canadian Discoveryaplaw100% (1)

- County Land Development Notice of AssignmentДокумент1 страницаCounty Land Development Notice of AssignmentaplawОценок пока нет

- GeneralObligationBondsBestPracticesДокумент14 страницGeneralObligationBondsBestPracticesaplawОценок пока нет

- Appearance Trap Peoples Rights AssociationДокумент7 страницAppearance Trap Peoples Rights AssociationaplawОценок пока нет

- HR 7161 June 13TH 1967Документ19 страницHR 7161 June 13TH 1967Truth Press Media100% (1)

- Mcdonald Convertible Bond Founder Ray Kroc As President Specimen 1968Документ1 страницаMcdonald Convertible Bond Founder Ray Kroc As President Specimen 1968aplawОценок пока нет

- Acquiescence and JurisdictionДокумент21 страницаAcquiescence and Jurisdictionmao999967% (3)

- IRS Nonresident Alien Individual SSN#Документ20 страницIRS Nonresident Alien Individual SSN#aplawОценок пока нет

- 40CFR51 W GeneralConformityДокумент12 страниц40CFR51 W GeneralConformityaplawОценок пока нет

- Agency and PartnershipДокумент24 страницыAgency and PartnershipaplawОценок пока нет

- General Obligation Bond Issuance Trends PDFДокумент20 страницGeneral Obligation Bond Issuance Trends PDFaplawОценок пока нет

- Public Works Payment BondДокумент3 страницыPublic Works Payment Bondaplaw83% (6)

- FijiTimes - Mar 23 2012 For Web PDFДокумент48 страницFijiTimes - Mar 23 2012 For Web PDFfijitimescanadaОценок пока нет

- The DataДокумент7 страницThe DatashettyОценок пока нет

- 14 Gibbs V RodriguezДокумент16 страниц14 Gibbs V RodriguezRes Ipsa NilloОценок пока нет

- Engecon ReviewerДокумент2 страницыEngecon Reviewerdaday el machoОценок пока нет

- Judicial Admissions Doctrine ExplainedДокумент2 страницыJudicial Admissions Doctrine Explaineddoraemoan100% (1)

- Cirelos V Hernandez GR 14652Документ13 страницCirelos V Hernandez GR 14652Emrys Pendragon100% (1)

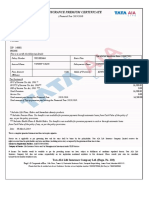

- Insurance Certificate SummaryДокумент32 страницыInsurance Certificate SummaryfaidzyОценок пока нет

- The Importance of Targeted UniversalismДокумент2 страницыThe Importance of Targeted UniversalismWendy AkeОценок пока нет

- Life Insurance Premium CertificateДокумент1 страницаLife Insurance Premium CertificatePardeep KumarОценок пока нет

- Dela Cruz, Airiz M. (16-166623)Документ18 страницDela Cruz, Airiz M. (16-166623)Air Dela CruzОценок пока нет

- Interest Table Code Education LoanДокумент2 страницыInterest Table Code Education LoanNanda KishoreОценок пока нет

- Lawskool - SG - Model Case NoteДокумент3 страницыLawskool - SG - Model Case NoteSevilla CheaОценок пока нет

- GABELO V CA Case DigestДокумент1 страницаGABELO V CA Case DigestMidzmar Kulani50% (2)

- Personal Loan PDS SummaryДокумент4 страницыPersonal Loan PDS SummaryMaryam UtutalumОценок пока нет

- Financial Environment DefinitionДокумент3 страницыFinancial Environment DefinitionHira Kanwal MirzaОценок пока нет

- Income Tax ReviewerДокумент99 страницIncome Tax ReviewerKarlo Marco Cleto100% (1)

- Banking Terminology Dutch EnglishДокумент5 страницBanking Terminology Dutch EnglishDavid KimОценок пока нет

- South Africa Bank Loans InformationДокумент3 страницыSouth Africa Bank Loans InformationFrancois Vd MerweОценок пока нет

- Bank Audit Checklist for Concurrent TransactionsДокумент14 страницBank Audit Checklist for Concurrent Transactionsrjamal566Оценок пока нет

- NBFC Report 2019 PDFДокумент440 страницNBFC Report 2019 PDFBani50% (2)

- Co-Op Society..docx BBДокумент86 страницCo-Op Society..docx BBbharti chalwadiОценок пока нет

- 2009 Leucadia Annual Meeting NotesДокумент7 страниц2009 Leucadia Annual Meeting Notesbenclaremon100% (4)

- Digest-Velasquez Vs GeorgeДокумент3 страницыDigest-Velasquez Vs GeorgeHazel BarbaronaОценок пока нет

- TPA Final DraftДокумент12 страницTPA Final DraftAyushi AgrawalОценок пока нет

- Pridhvi Asset Reconstruction and Securitisation Company Ltd.Документ8 страницPridhvi Asset Reconstruction and Securitisation Company Ltd.neetu0411Оценок пока нет

- Magna Financial Services Group V ColarasДокумент2 страницыMagna Financial Services Group V ColarasOzOzОценок пока нет

- Opening Doors - How To SquatДокумент6 страницOpening Doors - How To SquatMitchell R. ColbertОценок пока нет