Академический Документы

Профессиональный Документы

Культура Документы

IMPACT OF INTREST RATE ON NIFTY Report

Загружено:

Aditya VardhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IMPACT OF INTREST RATE ON NIFTY Report

Загружено:

Aditya VardhanАвторское право:

Доступные форматы

Stock broking ltd.

Executive summary

MBA10008008 KES IEMS, HUBLI Page 1

Stock broking ltd.

India is one of the countries among the fastest growing economic countries in the

world. It has emerged as the world's fastest growing wealth creator, thanks to a

buoyant stock market and higher earnings. A number of Indian companies

performing well which reflects an accelerated growth in corporate earnings.

Forty-four per cent of Top 1 Fortune ! companies are present in India.

The stock e"change comes in the secondary market. #tock e"change performs

acti$ities such as trading in %&uity share, securities, 'eri$ati$es etc. #tock

broking industry is growing at an enormous rate, as more and more people are

attracted towards stock e"changes with the hope of making profits. (rimary

in$estment ob)ecti$e of any indi$idual or organi*ation is to ma"imi*e the

+eturns and minimi*ing ,arket risk

The pro)ect deals with an introduction to stock market- how interest rate affect

on in$estment in stock market- as the in$estors are more concerned of returns

and they want to be far from risk - so I ha$e done the pro)ect on impact of

interest changes on nifty.

The core area of this pro)ect focuses on interest rate risk in$ol$ed in inde"

return of nifty indices. .hich tell an ad$isory about the risk le$el of inde"

return. This pro)ect contains some elementary statistics which are used in

calculation which help in drawing inferences.

The study is undertaken to assess /impact of interest changes on nifty0 at

1etworth 'irect, 'harwad 2ranch 34ocation Address- 5rishna ,ansion, 62

7ill +oad, 1ear 7ead (ost 8ffice, 'harwad9.

1etworth has been successfully pro$iding premium financial ser$ices and

information for more than a decade. 8ur aim has consistently been to

empower in$estors to take charge of their financial future : help them grow

their 1etworth.

1etworth has always endea$ored to make a difference in the financial ser$ices

space. It constantly focuses on scaling and upgrading the technology

infrastructure so as to pro$ide the best ser$ices to the in$estors. .e ha$e a

presence of o$er ; centers across India. .e are managed by a talented team

of o$er <=>! professionals and are ser$ing o$er 1, clients.

MBA10008008 KES IEMS, HUBLI Page <

Stock broking ltd.

Title of te !ro"ect

#Impact of interest changes on 1ifty$

%&"ective'

To understand why +2I has changed the interest rate fre&uently.

To study impact of interest rate changes on in$estment for last <

? years.

To suggest in$estors for taking better in$estment decision.

(ata )ollectio* Tools

!rimary (ata

Interaction with e"ternal and Internal @uide which helped to the study and gets right

direction to the pro)ect.

Seco*+ary (ata

Aollecting the data from 2ooks, and $arious .ebsites, this includes Alosing ,arket

$alue of stock inde" B#:( A1C 1iftyD.

Statistical Tools Use+

#tatistical tools are Arithmetic ,ean, #tandard 'e$iation, and Aorrelation.

Statistical Soft,are Use+

To calculate Arithmetic A$erage, #tandard 'e$iation, Aorrelation I am using

,#-%"cel software.

Limitatio*s

I ha$e chosen the impact interest rate changes on inde" return for last < ? year

from <1 - <1<.

The selected inde" is 1#% Bi.e. #:( A1C 1iftyD.

And I ha$e used three formulae to calculate impact interest rate change.

MBA10008008 KES IEMS, HUBLI Page ;

Stock broking ltd.

-i*+i*.s'

1. There is continuous decrease in market inde" returns due to higher interest rate

risk.

<. There is continuous increase in interest rate since last < ? year that affect the

security traders because cost of borrowing would increases so that leads to earn

less return and also continuous decreases in market indices.

;. And there is both positi$e and negati$e correlation between inde" returns- it

indicates high $ariation with high risk in inde" return.

=. The high interest rate affect on infrastructure, automobile, banking sector, because

these are the few which affects more when change in interest rate than other.

!. %$en though decrease in repo rate by ! points it is not helping stock market to

get refresh to mo$e upward.

E. %$en though decrease in repo rate by ! points it is not helping stock market to

get refresh to mo$e upward.

Su..estio*s'

1. Today stock market showing negati$e sign in market mo$ement and growth, so I

would like suggest in$estors to in$est their money in go$ernment bonds to get

assured rate of return.

<. In$est in banking sector because this sector performs well for longer term when

rate $aries.

MBA10008008 KES IEMS, HUBLI Page =

Stock broking ltd.

;. .hen interest rate is at peak, it is better to in$est in beaten down infrastructure,

real estate stocks for &uicker return.

.

I/(UST01

!0%-ILE

MBA10008008 KES IEMS, HUBLI Page !

Stock broking ltd.

Stoc2 Mar2et %vervie, '

The main function of the stock market is to enable trade in the shares of public

companies, which in turn reflect the performance of the companies whose shares are

traded in the stock market. 7ere is pro$iding you with a detailed #tock ,arket

8$er$iew. #tock markets are also a $ital part of an economy or the economic system

of a country. Today most economies around the world are )udged by the performance

of their stock markets. The stock markets ser$e a $ital purpose in the growth and

de$elopment of a company that wants to e"pand. #uch companies with e"pansion

plans and new pro)ects are in need of funding and the stock market ser$es as the best

platform from which a company can FsellG itself to the discerning public on the basis

of merit among other things. To trade in the stock market a company has to be

absolutely transparent about its $ital fundamentals such as re$enues, income, assets,

liabilities, infrastructure, etc. as this allows the in$esting public to make a fair

assessment of the said companyGs market worth.

.ith o$er < million shareholders, India has the third largest in$estor base in

the world after the 6#A and Hapan. 8$er I, companies are listed on the stock

e"changes, which are ser$iced by appro"imately >,! stockbrokers. The Indian

capital market is significant in terms of the degree of de$elopment, $olume of trading

and its tremendous growth potential.

There are <; recogni*ed stock e"changes in India, including the 8$er the

Aounter %"change of India B8TA%ID for small and new companies and the 1ational

#tock %"change B1#%D which was set up as a model e"change to pro$ide nation-wide

ser$ices to in$estors. 1#%, which in the recent past has accounted for the largest

trading $olumes, has a fully automated screen based system that operates in the

wholesale debt market segment as well as the capital market segment.

MBA10008008 KES IEMS, HUBLI Page E

Stock broking ltd.

India's market capitali*ation was amongst the highest among the emerging

markets. Total market capitali*ation of the 2#% as on Huly ;1, 1II> was +s !,!>;.>

billion growing by 1J percent o$er a period of twel$e months and as of August <!

was o$er K! billion Babout +s << lakh croresD.

India has emerged as the worldGs 1!th largest e&uity market after it added se$eral

companies to the billion dollar club in terms of capitali*ation in the last three months,

taking the total to J1 companies. India has become the third largest Asian market

Be"cluding Hapan and AustraliaD after ha$ing toppled 5orea, Ahina and #ingapore that

ha$e J, ! and => firms with billion-dollar market capitali*ation respecti$ely. India

is also inching closer to outpacing Taiwan that has J= such companies but lags far

behind 7ong 5ong which has 1>, the highest in Asia.

As of end-,arch <, the assets under management by the Indian ,F

industry stood at a staggering +s 1,1;,! crore. .hile income funds accounted for

assets of +s =J,= crore, growth funds had assets of +s ;,E11 crore. 2alanced funds

accounted for another +s <E,>!> crore of assets as of end-,arch <. 4i&uid funds

had +s 1,!<I crore, money market funds +s EIJ crore, gilt funds +s <,;> crore and

%4## with +s ;,;E crore made up the balance.

2ombay #tock %"change B2#%3, one of the oldest in the world, accounts for

the largest number of listed companies and has also started a screen-based trading

system with the introduction of the 2ombay 8n-4ine Trading system.

The number of companies listed on the 2#% at the end of 'ecember 1II= was

=,><. This was more than the aggregate total of companies listed in I emerging

markets B,alaysia, # .Africa, ,e"ico, Taiwan, 5orea, (hilippines, Thailand, 2ra*il

and AhileD. The number of companies was also more than the in de$eloped markets of

Hapan, 65, @ermany, France, Australia, #wit*erland, Aanada and 7ong 5ong.

There is a large presence of FIIs in the Indian capital market with o$er =!1

FIIs and ;J foreign brokers registered with #%2I. The cumulati$e in$estment of FIIs

in the Indian stock market stood at 6#K E.!I billion in Huly 1IIE and 6# K1< billion

in April <. #ince Hanuary <!, FII's ha$e pumped in KJ billion into Indian

MBA10008008 KES IEMS, HUBLI Page >

Stock broking ltd.

markets, compared to KJ.! billion in entire <= and KE.E billion in entire <;.

Foreign in$estors in$ested K=.< billion in Hune-August <!, which is much higher

than the K;.=1 billion flows India recei$ed between Hanuary and ,ay.

The recent decision of the go$ernment of easing limits on inward portfolio

in$estment, with an increase in the ceiling for FII and non-resident Indians from <=

percent to ;L, pro$ides a tremendous incenti$e to FII in$estment. FIIs are also

permitted to in$est self owned funds in the debt market and in unlisted securities.

Aurrent list of debt funds appro$ed by #%2I includes 62#, 7#2A, ,organ @renfell,

2uchanan Aapital, amongst others.

The capital markets in India are regulated by the #ecurities and %"change

2oard of India B#%2ID under the pro$isions of the #ecurities Aontracts B+egulationsD

Act, 1I!E and #ecurities and %"change 2oard of India Act, 1I<<. #%2I has issued

detailed guidelines for capital issues, disclosure by public companies and in$estor

protection.

Securities Exca*.e Boar+ of I*+ia 4SEBI3

#%2I was set up as an autonomous regulatory authority by the @o$ernment of India in

1IJJ /To protect the interest of the in$estors in the securities and to promote the

de$elopment of and to regulate the securities market and the matters connected

therewith or incidental thereto0. It is empowered by two acts namely FThe #%2I Act,

1II< and The #ecurities Aontract B+egulationD Act, 1I!E to perform the function of

protecting in$estorsG rights and regulating the capital markets.

0ole of )a5ital Mar2et

1. It is the indicator of the inherent health of the economy.

<. It is the largest source of funds with long or indefinite maturity for companies and

thereby enhances capital formation in the economy.

;. It offers a number of in$estment a$enues to the in$estors.

=. It helps in channeli*ing the sa$ings pool in the economy towards in$estments,

which are more efficient and gi$e a better rate of return thereby helping in optimum

allocation of capital in the country.

!rimary Mar2et'

MBA10008008 KES IEMS, HUBLI Page J

Stock broking ltd.

The primary market is the place where the new offerings by companies are made

either as Initial (ublic 8ffer BI(8D or +ights Issue. I(8s are offerings made by the

companies for the first time while rights are offerings made to the e"isting

shareholders. In$estors who prefer to in$est in the primary issues are called #tags.

Seco*+ary Mar2et'

#econdary market consists of stock e"changes where the buy orders and sell orders

are matched in the organi*ed mannerM there are at present <! recogni*ed stock

e"changes in India and are go$erned by the #ecurities Aontracts B+egulationD Act

B#A+AD.

Mar2et I*+ices

A stock market inde" should capture the beha$ior of the o$erall e&uity market.

mo$ements of the inde" should represent the returns obtained by /typical0 portfolios

in the country the )ob of the inde" is to purely capture the mo$ement of stock market

as a whole BI.e. news about the countryD and not the mo$ement of indi$idual stocks

due to news about the company Bi.e. product launchD.inde" helps us to know how the

market is fairing.

%6E06IE7 %- I/(IA I/(E8 SE06I)ES 9 !0%(U)TS LT(: 4IISL3

India Inde" #er$ices : (roducts 4td. BII#4D is a )oint $enture between the 1ational

#tock %"change of India 4td. B1#%D and A+I#I4 4td. Bformerly the Aredit +ating

Information #er$ices of India 4imitedD. II#4 has been formed with the ob)ecti$e of

pro$iding a $ariety of indices and inde" related ser$ices and products for the capital

markets. II#4 has a consulting and licensing agreement with #tandard and (oor's

B#:(D, the world's leading pro$ider of in$estible e&uity indices, for co-branding

II#4's e&uity indices.

/ATI%/AL ST%)K E8)HA/;E 4/SE3

The 1ational #tock %"change of India 4imited has genesis in the report of the 7igh

(owered #tudy @roup on %stablishment of 1ew #tock %"changes. It recommended

promotion of a 1ational #tock %"change by financial institutions BFIsD to pro$ide

access to in$estors from all across the country on an e&ual footing. 2ased on the

recommendations, 1#% was promoted by leading Financial Institutions at the behest

MBA10008008 KES IEMS, HUBLI Page I

Stock broking ltd.

of the @o$ernment of India and was incorporated in 1o$ember 1II< as a ta"-paying

company unlike other stock e"changes in the country.

8n its recognition as a stock e"change under the #ecurities Aontracts

B+egulationD Act, 1I!E in April 1II;, 1#% commenced operations in the .holesale

'ebt ,arket B.',D segment in Hune 1II=. The Aapital ,arket B%&uitiesD segment

commenced operations in 1o$ember 1II= and operations in 'eri$ati$es segment

commenced in Hune <.

The following years witnessed rapid de$elopment of Indian capital market with

introduction of internet trading, %"change traded funds B%TFD, stock deri$ati$es and

the first $olatility inde" N India OIC in April <J, by 1#%.

August <J saw introduction of Aurrency deri$ati$es in India with the launch of

Aurrency Futures in 6#' I1+ by 1#%. Interest +ate Futures was introduced for the

first time in India by 1#% on ;1st August <I, e"actly after one year of the launch of

Aurrency Futures.

.ith this, now both the retail and institutional in$estors can participate in

e&uities, e&uity deri$ati$es, currency and interest rate deri$ati$es, gi$ing them wide

range of products to take care of their e$ol$ing needs.

%ur Missio*

1#%'s mission is setting the agenda for change in the securities markets in India. The

1#% was set-up with the main ob)ecti$es ofP

%stablishing a nation-wide trading facility for e&uities, debt instruments,

%nsuring e&ual access to in$estors all o$er the country through an appropriate

communication network,

(ro$iding a fair, efficient and transparent securities market to in$estors using

electronic trading systems,

%nabling shorter settlement cycles and book entry settlements systems, and

,eeting the current international standards of securities markets.

Tere are t,o 2i*+s of 5layers i* /SE'

BaD Trading members and BbD (articipants.

MBA10008008 KES IEMS, HUBLI Page 1

Stock broking ltd.

+ecogni*ed members of 1#% are called trading members who trade on behalf

of themsel$es and their clients. (articipants include trading members and large

players like banks who take direct settlement responsibility.

Trading at 1#% takes place through a fully automated screen-based trading

mechanism which adopts the principle of an order-dri$en market. Trading members

can stay at their offices and e"ecute the trading, since they are linked through a

communication network. The prices at which the buyer and seller are willing to

transact will appear on the screen. .hen the prices match the transaction will be

completed and a confirmation slip will be printed at the office of the trading member.

1#% has se$eral ad$antages o$er the traditional trading e"changes. They are as

followsP

1#% brings an integrated stock market trading network across the nation.

In$estors can trade at the same price from anywhere in the country since inter-

market operations are streamlined coupled with the countrywide access to the

securities.

'elays in communication, late payments and the malpracticeGs pre$ailing in

the traditional trading mechanism can be done away with greater operational

efficiency and informational transparency in the stock market operations, with

the support of total computeri*ed network.

!romoters

1#% has been promoted by leading financial institutions, banks, insurance companies

and other financial intermediariesP

Industrial 'e$elopment 2ank of India 4imited

Industrial Finance Aorporation of India 4imited

4ife Insurance Aorporation of India

#tate 2ank of India

IAIAI 2ank 4imited

I4 : F# Trust Aompany 4imited

#tock 7olding Aorporation of India 4imited

#2I Aapital ,arkets 4imited

MBA10008008 KES IEMS, HUBLI Page 11

Stock broking ltd.

2ank of 2aroda

Aanara 2ank

@eneral Insurance Aorporation of India

1ational Insurance Aompany 4imited

The 1ew India Assurance Aompany 4imited

The 8riental Insurance Aompany 4imited

6nited India Insurance Aompany 4imited

(un)ab 1ational 2ank

8riental 2ank of Aommerce

Indian 2ank

6nion 2ank of India

Infrastructure 'e$elopment Finance Aompany 4td.

L%;%'

The logo of the 1#% symbolises a single nationwide securities trading facility

ensuring e&ual and fair access to in$estors, trading members and issuers all o$er the

country. The initials of the %"change $i*., 1, # and % ha$e been etched on the logo

and are distinctly $isible. The logo symbolises use of state of the art information

technology and satellite connecti$ity to bring about the change within the securities

industry. The logo symbolises $ibrancy

S9! )/8 /ifty

#:( A1C 1ifty is a well di$ersified ! stock inde" accounting for <! sectors of the

economy. It is used for a $ariety of purposes such as benchmarking fund portfolios,

inde" based deri$ati$es and inde" funds.

#:( A1C 1ifty is owned and managed by India Inde" #er$ices and (roducts 4td.

BII#4D, which is a )oint $enture between 1#% and A+I#I4. II#4 is India's first

speciali*ed company focused upon the inde" as a core product. II#4 ha$e a consulting

MBA10008008 KES IEMS, HUBLI Page 1<

Stock broking ltd.

and licensing agreement with #tandard : (oor's B#:(D, who are world leaders in

inde" ser$ices.

The a$erage total traded $alue for the last si" months of all 1ifty stocks is

appro"imately =>L of the traded $alue of all stocks on the 1#%

1ifty stocks represent about !JL of the total market capitali*ation as on

'ecember ;, <!.

Impact cost of the #:( A1C 1ifty for a portfolio si*e of +s.! million is

.>L

#:( A1C 1ifty is professionally maintained and is ideal for deri$ati$es

trading

MBA10008008 KES IEMS, HUBLI Page 1;

Stock broking ltd.

)%M!A/1

!0%-ILE

/ET7%0TH (I0E)T

,oney ,anagement Aentre

1etworth has been successfully pro$iding premium financial ser$ices and

information for more than a decade. 8ur aim has consistently been to empower

in$estors : business associates to take charge of their financial future : help them

grow their 1etworth

1etworth has always stri$ed to make a difference in the financial ser$ices

space. It constantly focuses on scaling and upgrading the technology infrastructure so

as to pro$ide the best ser$ices to its in$estors : business associates.

MBA10008008 KES IEMS, HUBLI Page 1=

Stock broking ltd.

.e ha$e a presence of o$er ; centers across India. 8ur network includes

o$er < business associates who share our success story. .e are managed by a

talented team of o$er <=>! professionals and are ser$ing o$er 1, clients.

www.networthdirect.com - an ad$anced, web based platform that enables us to

pro$ide you the con$enience 3one window all products9 : consolidation 3one

statement all in$estments9 which you can e"tend to all your clients.

.e pro$ide our business associates with some of the best a$ailable technology to

enhance their clients trading e"perience. 8ur online back offices my networth is

amongst the best in the industry and helps you track all updates on your clients

trading history. All in all.. it is one platform that will let you and your clients li$e a

world class in$estment e"perience .

7e are:::::

,embers of 2#%, 1#%, ,AC-#C, ,AC, 1A'%C, IA%C and '( of A'#4 :

1#'4.

.inners of A12A-TO1J's Financial Ad$isor Awards <J for 2est +egional

4e$el Financial Ad$isor B.estern +egionD.

(roclaimed amongst the most read research analysts by Thomson +euters

consistently o$er a period of time.

A Aharter member of Financial (lanning #tandards 2oard of India 3F(#29

%ur %&"ective'

To help indi$iduals set and achie$e their long-term financial goals through

in$estments, ta" planning, asset allocation, risk management and retirement planning.

.e pro$ide all the tools needed to increase our clientGs net worth and help the client

accomplish al of hisM her financial ob)ecti$es.

6isio*, Missio* 9 <uality !olicy

6isio*

/To empower our in$estors and business associates to take charge of their

financial future and help them to grow their net-worth0.

Missio*

MBA10008008 KES IEMS, HUBLI Page 1!

Stock broking ltd.

/%thical transparent technology dri$en performance oriented compliant customer

centric0.

<uality 5olicy

#tri$e to be a reliable source of $alue-added financial products and ser$ices

and constantly guide the indi$iduals and institutions in making a )udicious

choice of same.

#tri$e to keep all stake-holders Bshareholders, clients, in$estors, employees,

suppliers and regulatory authoritiesD proud and satisfied.

Aontinue to uphold the $alues of honesty : integrity and stri$e to establish

unparalleled standards in business ethics.

6se state-of-the art information technology in de$eloping new and inno$ati$e

financial products and ser$ices to meet the changing needs of in$estors and

clients.

/et,ort .rou5'

.e belie$e in mutual growth : benefit. All our offerings and systems are customi*ed

to achie$e growth for our associates, without whom we cannot claim success. 8ur

associates are present in all ma)or cities in India. .e also ha$e an e"tensi$e branch

network through which we can cater to all needs of our associates.

/et,ort .rou5 com5rises of = com5a*ies

1etworth #tock 2roking 4td. B7olding company - listed on the 2#% since

1II=D

1etworth Aommodities : In$estments 4imited Bfacilitates commodities

tradingD

1etworth .ealth #olutions 4td. B.holly owned subsidiary deli$ering

financial planning : ad$iceD

1etworth #oftTech 4td. BI#8 I1P< certified company pro$ides software

solutionsD

+a$isha Financial #er$ices ($t. 4td.B12FA engaged in financing, primarily it

pro$ides loan against securitiesD

/et,ort Stoc2 Bro2i*. Lt+: >/SBL?

MBA10008008 KES IEMS, HUBLI Page 1E

Stock broking ltd.

1#24 is a member of the 1ational #tock %"change of India 4td B1#%D and

the 2ombay #tock %"change 4td B2#%D in the Aapital ,arket and 'eri$ati$es

BFutures : 8ptionsD segment. 1#24 has also ac&uired membership of the currency

deri$ati$es segment with 1#%, 2#% : ,AC-#C. It is 'epository participants with

Aentral 'epository #er$ices India BA'#4D and 1ational #ecurities 'epository BIndiaD

4imited B1#'4D. .ith a client base of o$er 14 loyal customers, 1#24 is spread

across the country though itGs o$er <!Q branches. 1#24 is listed on the 2#% since

1II=.

/et,ort )ommo+ities 9 I*vestme*ts Limite+. >/)IL?

1#A4 is the commodities arm of 1#24. It is a member at the ,ulti

Aommodity %"change of India B,ACD, 1ational Aommodity : 'eri$ati$es %"change

B1A'%CD and IA%C : is backed by solid research : analytics in Aommodities.

/et,ort 7ealt Solutio*s Lt+: >/7SL?

1.#4 is into the business of deli$ery of Financial (lanning : Ad$ice. ItGs

$ision is to FAd$ice : %"ecute money related solutions toMfor our customers in the

most Aon$enient : Aonsolidated manner, while making sure that their e"perience

with us is always pleasant : memorable resulting in positi$e ad$ocacyG. The product

: #er$ices include Financial (lanning, 4ife Insurance, 8n-line Trading Account,

,utual Funds, 'ebenturesM2onds, @eneral Insurance, 4oans and 'epository #er$ices.

/et,ort Soft Tec Lt+: >/SL?

1#4 is an I#8 I1P< Aertified Aompany. It is into Application 'e$elopment :

maintenance. 2uilding : Implementation of packaged software across $arious

functions within the Financial #er$ices Industry is at its core. It also pro$ides data

center ser$ices which include hosting of websites, applications : related ser$ices. It

combines a uni&ue deli$ery model infused by a distinct culture of customer

satisfaction.

0avisa -i*a*cial Services !vt: Lt+: >0-SL?

+F#4 is a +2I registered 12FA engaged in financing, primarily it pro$ides loan

against securities.

!0%(U)T 9 SE06I)ES'

.ith greater choices comes greater $alue. 1etworth offers you more choices by

pro$iding a wide array of products and personali*ed ser$ices, so you can take charge

MBA10008008 KES IEMS, HUBLI Page 1>

Stock broking ltd.

of your financial future with confidence. #o whether you are a new in$estor or a

seasoned one, we ha$e the resources and ad$ice you would need to make smart, well-

researched in$estments and help you grow your 1etworth.

%&uity

'eri$ati$es

Aommodities

Aurrency 'eri$ati$es

I(8

(ortfolio ,anagement #er$ices

,utual Funds

4oans : 2onds

Insurance B4ife : @eneralD

'epository #er$ices

.ealth ,anagement #er$ices

8nline (latform

Aall : Trade

E@uity

8ur e"perienced trading consultants and ad$anced trading tools will pro$ide the

support you need to achie$e your long-term goals $ia the stock markets. .e trade on

the 2#%, 1#% and A1 and our website has facilities such as li$e stock tickers, news

updates, and more, to help our clients stay in the know. .e also pro$ide 1+I specific

ser$ices to meet the needs of our clients who li$e abroad.

(erivatives

'eri$ati$es are financial contracts whose $alueMprice is dependent on the

beha$ior of the price of one or more basic underlying assets Bsimply known as

underlyingD. These contracts are legally binding agreements, made on the trading

screen of stock e"changes, to buy or sell an asset in future. The asset can be a share,

inde", interest rate, bond, rupeeMdollar e"change rate, sugar, crude oil, soybean,

cotton, coffee etc.

)ommo+ities

MBA10008008 KES IEMS, HUBLI Page 1J

Stock broking ltd.

1etworth now offers to in$estors a platform to trade in A8,,8'ITR

F6T6+%#. As a member of the ,ulti Aommodity %"change of India 4td. and of the

1ational Aommodity and 'eri$ati$e %"change, we offer futures trading in 1

commodities Bgold, sil$er, castor, soya, canolaMmustard oil, crude palm oil, +2'

palmolein and cottonD 1A'%C and in gold, sil$er and castor seed, rubber through

,AC.

)urre*cy +erivatives

The launch of currency deri$ati$es in India, in ,ay this year opened one more

lucrati$e a$enue for trading. The recommendations were made )ointly by the #%2I

and the +2I. Aurrency deri$ati$es can be described as contracts between the sellers

and buyers, whose $alues are to be deri$ed from the underlying assets i.e. the

currency amounts.

I!%

Initial public offering BI(8D, also referred to simply as a Spublic offeringS, is the

first sale of stock by a pri$ate company to the public. I(8 is a way for a company to

raise money from in$estors for its future pro)ects and get listed to #tock %"change.

From an in$estor point of $iew, I(8 gi$es a chance to buy stocks of a company,

directly from the company at the price of their choice BIn book build I(8'sD. Although

an I(8 offers more control o$er the price at which the in$estor is willing to buy the

stock it is no less risky than buying a stock in the market.From a company

prospecti$e, the single most important use of an I(8 is the pro$ision of funds. I(8's

pro$ide capital for the companyGs future growth or for paying its pre$ious borrowings

and allows the companyGs stock to be traded publicly in the #tock ,arket.

!ortfolio Ma*a.eme*t Services

1%T.8+T7 (,# will help you achie$e your ob)ecti$e of preser$ing and

growing capital by conducting a thorough analysis of your in$estment needs, returns

e"pected and risk taking ability. 8ur focus is to craft a basket of #tocks, 2onds, and

,utual Funds through strong research and corporate interface, keeping in mind your

risk-profile in specific relation with the e$er-changing marketing dynamic.

I*vestme*t !iloso5y

.e focus on a 2ottom 6p approach to stock picking. The stock selection process

starts with fundamental analysis of companies and includes management meeting and

MBA10008008 KES IEMS, HUBLI Page 1I

Stock broking ltd.

plant $isits to get a first hand feel of the company, rather than depending solely on

&uantitati$e analysis. The in$estment process is fairly rigorous and includes

&ualitati$e as well as &uantitati$e criteria and builds upon the decade long e"perience

of 1etworth in Indian e&uity markets.

Be*efits of &ei*. ,it /et,ort !MS

(ortfolio ,anagement with a difference e$ery in$estor, whether indi$idual or

corporate, has uni&ue needs based on their ob)ecti$es and risk profiles. .e recogni*e

the difference and design tailored in$estment ad$ice to achie$e specific in$estment

ob)ecti$es.

!rofessio*al Ma*a.eme*tA .e offer professional management of your

e&uity portfolio with an aim to deli$er consistent returns while controlling risk.

)o*ti*uous Mo*itori*.A .e recogni*e that portfolios need to be constantly

monitored and periodically churned to optimi*e the results.

0is2 )o*trolA The portfolios are managed through a strong research dri$en

in$estment process with complete transparency and highest standards of ser$ice.

Tra*s5are*cyA Rou will get regular account statements and performance

reports on a monthly basisM That's not all- web-enabled access ensure that you are

)ust a click away from all information relating to your in$estment.

Hassle -ree %5eratio*A 8ur (ortfolio ,anagement #er$ice relie$es you from

all the administrati$e hassles of your in$estments. .e pro$ide periodic reporting

on the performance and other aspects of your portfolio.

(e+icate+ 0elatio*si5 Ma*a.erA 8ur +elationship ,anagers speciali*e in

pro$iding personal in$estment management ser$ices to achie$e your in$estment

ob)ecti$e.

Mutual fu*+s

,utual funds are in$estment companies that pool money from in$estors at large

and offer to sell and buy back its shares on a continuous basis and use the capital thus

raised to in$est in securities of different companies.

Loa*s

2anks are a type of financial intermediary whose principal ser$ice among many

others is to pro$ide loans to its customers who could be indi$idualsM corporationsM

self-employed (rofessionalsM publicM pri$ate companies etc. The loans are in turn

funded by the deposits of its e"isting customers

MBA10008008 KES IEMS, HUBLI Page <

Stock broking ltd.

(e5ository Services

.e offer 'epository facilities to facilitate a seamless transaction platform as a

part of our $alue-added ser$ices for our clients. 1etworth is a depository participant

with the Aentral 'epository #er$ices BIndiaD 4td. BA'#4D and 1ational #ecurities

'epository 4td. B1#'4D for trading and settlement of demateriali*ed shares.

7ealt Ma*a.eme*t Services

1etworth .ealth is into the business of deli$ery of Financial (lanning : Ad$ice.

.hate$er may be your goal, without a Financial (lan in place it's impossible to

achie$e. .e help you achie$e e"actly that through our proprietary Financial (lanning

(rocess - my plan it helps you achie$e your life goals. %$ery retail in$estor, in today's

fast paced world, is searching for con$enience and e"pecting consolidation for hisMher

in$estments.

%*li*e !latform

1etworth direct is not )ust a website, it is an online platform packed with

products : ser$ices that will pro$ide a magnificent customer e"perience for our

clients.

1etworth direct pro$ides clients access toP

eAtra*sact this is the platform where our customers can trade online in $arious

financial instruments. It is con$eniently integrated with multiple payment

gateways and our depository ser$ices to pro$ide a seamless transaction

capability.

My /et,ort This pro$ides access to your accounts and statements online

and with <=C> a$ailability. Rou can $iew your portfolio across all assets and

get a consolidated $iew. www.networthdirect.com is based on three pillars -

pace, web-based and shortest. !ace A In todayGs fast paced world, the

disposable time for e$eryone is getting s&uee*ed. In these kinds of stringent

times, customer is looking for less time consuming a$enues without

compromising on the ser$ice standards.

7e& &ase+ B

Internet penetration in India is rising at a $ery fast pace. ,ore and more people

are getting net sa$$y. .eb enables the customers to gain fle"ibility, pri$acy :

MBA10008008 KES IEMS, HUBLI Page <1

Stock broking ltd.

security. .eb is easy, knowledge hea$y, paperless, instant and pri$ate.Sortest

distance between us and our clients. This stems from the philosophy of customer care.

.e are in a ser$ice industry and thus the nearer we are to our clients the stronger will

be the differentiator.

/et ,ort Boar+ of (irectors

# ( Hain Ahairman M Ahair (erson

# ( Hain A%8

,anish A)mera %"ecuti$e director and AF8

#an)ay ,ohta Independent 'irector

,oheet Agrawal Independent 'irector

(ra$een Toshniwal Independent 'irector

1: S7%T A/AL1SIS

#.8T analysis in$ol$es e"amination of $arious factors affecting acti$ely on

the business en$ironment. The two most important parts of #.8T analysis are

drawing conclusions from the #.8T listings about the companyGs o$erall

situation and acting on those conclusions to better match the companyGs strategy

to its resource strengths and market opportunities, to correct the weaknesses and

to defend against threats.

ST0E/;TH

1etworth is one of the premier financial ser$ices organi*ation in India.

#trong market research which is backed by a highly &ualified team of research

analysts.

It is powered by a high distribution network maintained trough professional

management.

%fficient grie$ance handling.

Technology dri$en organi*ation.

MBA10008008 KES IEMS, HUBLI Page <<

Stock broking ltd.

@reater transparency.

Aompany offers hassle free operations.

1etworth offers in$estors more choices by pro$iding a wide array of products

and personali*ed ser$ices managed by top-notch professional employees.

7EAK/ESS

7igher o$erall unit costs relati$e to key competitors.

Training the workers take lots of time and money.

Aomple" terms and conditions of broking.

The firm is not so aggressi$e.

7igh employee turno$er.

%!!%0TU/ITIES

It can become more competiti$e by listing in either of the stock e"changes.

%"panding the companyGs product line to meet a broader range of customer

needs.

Ability to grow rapidly because of sharply rising clientGs demand for stocks.

It can increase its institutional client base by ac&uiring new business

brokerage.

@lobali*ation of productsMser$ices.

TH0EATS

Increasing intensity of competition among industry ri$als.

%ntry of potent new competitors.

Ahanging #%2I +ules and +egulations.

.rong )udgment of analysts.

MBA10008008 KES IEMS, HUBLI Page <;

Stock broking ltd.

Threat of +isk ,anagement.

)om5etitors I*formatio*

The 1etworth is sub)ect to nationwide competition with many stock broking

firms.

Few of them are listed belowP

I4 : F# Aompany

India Info line

2onan*a

Anand +athi

,otilal 8swal

5ar$y

Oentura

#hare 5han

+eliance money

5otak #ecurities 4td

+eligare #ecurities 4td

IAIAI direct

7#2A 'irect In$est

Angel financing

Acieveme*tsCA,ar+s

MBA10008008 KES IEMS, HUBLI Page <=

Stock broking ltd.

1etworthGs #oftware di$ision has achie$ed I#8 I1P< certification from

2#I.

1etworth @roup won A12A TO1JGs Financial Ad$isor Award <J, for the

categoryP /2est +egional 4e$el Financial Ad$isor0

+ated :+anked by A#IA ,81%R <! polls for o$erall country research

strategy.

A charter member of Financial (lanning #tandards 2oard 8f India 3F(#29.

/et ,ort %r.a*iDatio* )art at Bra*c Level

MBA10008008 KES IEMS, HUBLI Page <!

0elatio*si5 Ma*a.er 0elatio*si5 Ma*a.er 0elatio*si5 Ma*a.er

Mar2eti*.

Ma*a.er

Mar2eti*.

Ma*a.er

%ffice &oy

%5eratio*s

Ma*a.er

(ealer (ealer (ealer

Bra*c Ma*a.er

Stock broking ltd.

/ET7%0TH (I0E)T

(HA07A( B0A/)H

1etworth 'irect 'harwad 2ranch started on >

th

August <J.

2ranch codeP =1!

Address of 1etworth 'irect 'harwad 2ranchP-

T@4<-;, 5rishna ,ansion,

62 7ill +oad,

1ear 7ead (ost 8ffice,

'harwad - !J1

'harwad 5arnataka

(hone 1oP J;E-;<=E!! M J;E-<===E<1

2ranch ,anagerP - (ra$een 'anda$ati

%mployeesP-

1itin 1 @hatage BAash 'ealerD

,ohan 1adiger B,arketing %"ecuti$eD

Oi)ay 5umar 5ulkarni BF:8 dealerD

,allikar)un B8ffice 2oyD

Total 1umber of Alients in 1etworth 'irect 'harwad 2ranch isP - 1<= Alients

MBA10008008 KES IEMS, HUBLI Page <E

Stock broking ltd.

In 1etworth 'irect 'harwad 2ranch most of the Alients are traded in %&uities.

2rokerage 'etails in 1etworth 'irect

!ro+ucts Mar.i* 4I*tra+ay3 (elivery

%&uity .!L .!L

F:8 .!L .!L

Aommodities .EL .EL

THE%0%TI)AL

-0AME7%0K

MBA10008008 KES IEMS, HUBLI Page <>

Stock broking ltd.

Systematic 0is2'

The systematic risk affects the entire market. The economic conditions,

political situations and the sociological changes affect the security market. These

factors are beyond the control of the corporate and the in$estor. The in$estor cannot

a$oid them. This is subdi$ided intoP

i: ,arket +isk

ii: Interest +ate +isk

iii: (urchasing (ower +isk.

0ETU0/

The ,arket return is calculated by following formulaP-

TodayGs market returnU TodayGs inde" N ResterdayGs inde"

ResterdayGs inde"

4ike daily returns, weekly returns can be calculated by using this weekGs and last

weekGs price instead of todayGs and yesterdayGs prices in the abo$e mentioned

formula. ,onthly returns also can be calculated.

A0ITHMETI) A6E0A;E

MBA10008008 KES IEMS, HUBLI Page <J

Stock broking ltd.

The statistic familiar to most people is the arithmetic a$erage. The arithmetic mean of

a set of $alues is obtained by di$iding the sum of the $alues by the number of $alues

in the set, customarily designated by the symbol C BC-barD, isP

C U V"

1

STA/(A0( (E6IATI%/

6nderstanding the nature of the risk is not ade&uate unless the in$estor or analyst is

capable of e"pressing it in some &uantitati$e terms. ,easurement cannot be assured

of cent per cent accuracy because risk is caused by numerous factors such as social,

political, economic and managerial efficiency. ,easurement pro$ides an appro"imate

&uantification of risk. The statistical tool often used to measure and used as a pro"y

for risk is the standard de$iation.

It is a measure of the $alues of the $ariables around its mean or it is the s&uare root of

the sum of the s&uared de$iations from the mean di$ided by the number of

obser$ances. The standard de$iation helps to measure the $ariability of return.

W U XB" N"D

<

X1

)orrelatio*'

The Aorrelation coefficient measures the nature and the e"tent of relationship

between the stock market inde" return and the stock return in a particular period

+U n

MBA10008008 KES IEMS, HUBLI Page <I

Stock broking ltd.

I*+ia I*terest 0ate'

The benchmark interest rate in India was last reported at J percent. In India,

interest rate decisions are taken by the +eser$e 2ank of India's Aentral 2oard of

'irectors. The official interest rate is the benchmark repurchase rate. From <

until <1, India's a$erage interest rate was !.J< percent reaching an historical high

of 1=.! percent in August of < and a record low of ;.<! percent in April of

<I.

0BI 0e5o rate or 2ey sort term le*+i*. rate

.hen reference is made to the Indian interest rate this often refers to the repo

rate, also called the key short term lending rate. If banks are short of funds they can

borrow rupees from the +eser$e 2ank of India B+2ID at the repo rate, the interest rate

with a 1 day maturity. If the central bank of India wants to put more money into

circulation, then the +2I will lower the repo rate. The re$erse repo rate is the interest

rate that banks recei$e if they deposit money with the central bank. This re$erse repo

rate is always lower than the repo rate. Increases or decreases in the repo and re$erse

repo rate ha$e an effect on the interest rate on banking products such as loans,

mortgages and sa$ings.

MBA10008008 KES IEMS, HUBLI Page ;

Stock broking ltd.

MBA10008008 KES IEMS, HUBLI Page ;1

Stock broking ltd.

7y 0BI is i*crease+ i*terest rateE

-actors affecti*. i*terest rate moveme*t a*+ -orces &ei*+ I*terest 0ates

Inflation

4i&uidity

7igh 8il prices

#tock market conditions

International borrowings

Fiscal deficit and go$ernment borrowings

,onetary (olicy

@rowth in the economy

@lobal li&uidity

6ncertainty

#upply and 'emand

India Inflation +ate

MBA10008008 KES IEMS, HUBLI Page ;<

Stock broking ltd.

The inflation rate in India was recorded at >.<; percent in April of <1<. 7istorically,

Inflation rate refers to a general rise in prices measured against a standard le$el of

purchasing power. The most well known measures of Inflation are the A(I which

measures consumer prices, and the @'( deflator, which measures inflation in the

whole of the domestic economy

Implications of a rising inflation rate

+ising food prices Aommodity prices #timulus packages %"pensi$e borrowing

Impact on stock markets %ssential goods' prices

Rear P <1< -->.<;, <11-->.!, <1--I.=>, <I--1=.I>

Fiscal deficit

'ue to the higher than anticipated non-ta" re$enue from ; @ spectrum auction... I

ha$e brought down the fiscal deficit from !.! per cent to !.1 per cent of the @'( for

<1-11,S ,ukher)ee said in his <11-1< 2udget speech. India's fiscal deficit had

ballooned to E.; per cent of the @'( in <I-1 in $iew of stimulus spending worth

billions of dollars to combat global financial meltdown. the medium term fiscal

policy, ,ukher)ee pegged the rolling target of fiscal deficit at =.1 per cent for <1<-

1;, and ;.! per cent for <1;-1=.

#tock market condition

In <I the market was in a reco$ery mode- in <1 it consolidated. 1e"t year prices

will reflect the performance of the corporate sector and respond less to the e"ternal

shocks.In <1 stock prices increased <!L almost all the rise being in the second half

of the year though corporate performance was better in the first half. The difference

was the in$estment by FIIs to which the market is e"tremely sensiti$e. The +2I has

estimated that a 1L fluctuation in FII in$estment results in a ;!L $ariation in stock

prices. In the first half of <1 FII net in$estment was a mere +s. ; billion- in the

second fi$e months it rose to +s. 11 billion.

Ho, I*terest 0ates Affect te Stoc2 Mar2et'

%ssentially, interest is nothing more than the cost someone pays for the use of

someone elseGs money.D The interest rate that applies to in$estors is the +2I repo rate

MBA10008008 KES IEMS, HUBLI Page ;;

Stock broking ltd.

This is the cost that banks are charged for borrowing money from Indian +eser$e

banks. .hy is this number so importantY It is the way the central bank attempts to

control inflation. Inflation is caused by too much money chasing too few goods Bor

too much demand for too little supplyD, which causes prices to increase. 2y

influencing the amount of money a$ailable for purchasing goods, the +2I can control

inflation. 8ther countries' central banks do the same thing for the same reason.

2asically, by increasing the central repo rate, the central bank attempts to lower the

supply of money by making it more e"pensi$e to obtain

Effects of a* I*crease

.hen the central bank increases the repo rate, it does not ha$e an immediate

impact on the stock market. Instead, the increased federal funds rate has a single

direct effect - it becomes more e"pensi$e for banks to borrow money from the central

bank. 7owe$er, increases in the discount rate also cause a ripple effect, and factors

that influence both indi$iduals and businesses are affected.

The first indirect effect of an increased +2I repo rate is that banks increase the

rates that they charge their customers to borrow money. Indi$iduals are affected

through increases to credit card and mortgage interest rates, especially if they carry a

$ariable interest rate. This has the effect of decreasing the amount of money

consumers can spend. After all, people still ha$e to pay the bills, and when those

bills become more e"pensi$e, households are left with less disposable income. This

means that people will spend less money, which will affect businesses' top and

bottom lines Bthat is, re$enues and profitsD. Therefore, businesses are also indirectly

affected by an increase in the central bank rate as a result of the actions of indi$idual

consumers. 2ut businesses are affected in a more direct way as well. They, too,

borrow money from banks to run and e"pand their operations. .hen the banks make

borrowing more e"pensi$e, companies might not borrow as much and will pay a

higher rate of interest on their loans. 4ess business spending can slow down the

growth of a company, resulting in decreases in profit.

Stoc2 !rice Effects

Alearly, changes in the federal funds rate affect the beha$ior of consumers and

business, but the stock market is also affected. This price fluctuates as a result of the

MBA10008008 KES IEMS, HUBLI Page ;=

Stock broking ltd.

different e"pectations that people ha$e about the company at different times.

2ecause of those differences, they are willing to buy or sell shares at different prices.

If a company is seen as cutting back on its growth spending or is making less

profit - either through higher debt e"penses or less re$enue from consumers - then the

estimated amount of future cash flows will drop. All else being e&ual, this will lower

the price of the company's stock. If enough companies e"perience a decline in their

stock prices, the whole market, or the inde"es that many people e&uate with the

market, will go down

I*vestme*t Effects

For many in$estors, a declining market or stock price is not a desirable outcome.

In$estors wish to see their in$ested money increase in $alue. #uch gains come from

stock price appreciation, the payment of di$idends - or both Furthermore, in$esting in

stocks can be $iewed as too risky compared to other in$estments.

-ollo,i*. are te some sector ,ic affects more ,e* i*terest rate

ca*.e ta* oter

Ba*2i*. stoc2s

2anking stocks are the biggest hit by interest rate changes. A high interest rate blows

a double whammy to banks. (eople do not borrow because of high interest rate but

deposit because of the same reason. 5eeping money in $ault does no help to banks.

7ence when the interest rate goes up, banking stocks are hit first. The re$erse is true

too. 4ow interest rate pushes banking stocks higher and in$estors reap the benefits of

in$esting at the right time.

I*frastructure stoc2s

Infrastructure stocks are other interest rate sensiti$e stocks. Infrastructure sector

is highly le$eraged sector. 7ence rise in interest rate is de$astating for it. +eal estate

de$elopers depend on bank loan to build the properties and buyers too depend on

MBA10008008 KES IEMS, HUBLI Page ;!

Stock broking ltd.

home loan from banks to buy their home. A high interest rate is not feasible for both.

7ence in high interest rate regime, infrastructure stocks are hit hard.

#imilarly, when the interest rate is low, infrastructure stocks do well. 7ome buyers

get cheaper loan to buy home and builders de$elop properties to satisfy the demand

for properties. In case of infrastructure, it is not only the real estate sector that gets

impacted but infrastructure related stocks such as cement and steel.

Automotive Sector

Automoti$e sector depends, )ust like infrastructure, on the interest rate. ,ost of

the people take loan to buy their $ehicle. If the interest rate is high, the cost of

buying $ehicle is more and the %,I is higher. 7ence buyers postpone the decision to

buy $ehicle. The demand slows down, production falls, and profit goes down.

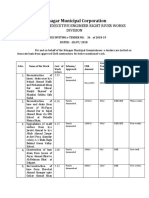

0BI 0ATE )HA/;ES 7ITH (ATE

April 1>, <1< J. L .

8ctober <!, <11 J.! L .

#eptember 1E <11 J.<! L .

Huly <E <11 J. L

Hune 1E <11 >.! L

,ay ; <11 >.<! L

,arch 1> <11 E.>! L

Hanuary <! <11 E.! L .

1o$ember < <1 E.<! L .

#eptember 1E <1 E. L .

Huly <> <1 !.>!L .

,arch 1I <1 !.!L

April < <1 !.<!L

Huly < <1 !.!L

MBA10008008 KES IEMS, HUBLI Page ;E

Stock broking ltd.

METH%(%L%;1

To5ic'

Implication of interest rate changes on nifty /

Stateme*t of 5ro&lem

%&"ective'

MBA10008008 KES IEMS, HUBLI Page ;>

Stock broking ltd.

To understand why +2I has changed the interest rate fre&uently.

To study impact of interest rate changes on in$estment for last < ? years.

To suggest in$estors for taking better in$estment decision.

(ata collectio* tools

!rimary (ata

Interaction with e"ternal which helped to learn some of the common terms used

in stock market. Interaction with internal guide and other professors helped this

pro)ect in clarifying doubts associated with the study and gets a right direction to the

pro)ect.

Seco*+ary (ata

Aollecting the data from 2ooks, 'ocuments and $arious .ebsites, which

includes Alosing ,arket price of selected scripts, closing price of #tock Inde" B#:(

A1C 1iftyD etc.

Statistical Tools use+' +isks of interest rate calculation done by using statistical

tools are Arithmetic ,ean, #tandard 'e$iation, and Aorrelation.

Statistical Soft,are use+' To calculate Arithmetic A$erage, #tandard 'e$iation,

2eta and Alpha I am using ,#-%"cel software. Formulas used in ,#-%"cel for

calculating are

A$erage-AO%+A@%

#tandard 'e$iation- #T'O%

Aorrelation- A8++%4

Limitatio*s'

I ha$e chosen the impact interest rate changes on inde" return for last < ? year

from <1 - <1<.

The selected inde" is 1#% Bi.e. #:( A1C 1iftyD.

And I ha$e used three formulae to calculate impact interest rate change.

MBA10008008 KES IEMS, HUBLI Page ;J

Stock broking ltd.

)AL)ULATI%/S

A/( A/AL1SIS

1: As o* 1FA0GAH010

MBA10008008 KES IEMS, HUBLI Page ;I

Stock broking ltd.

!articulars Before rate ca*.e After rate ca*.e

,ean

.;<< -.JJ

#tandard de$iation

.=I 1.<E

Aorrelation

.;

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .;<<L and

after hike in rate it has decreased to -.JJ .

<. The before rate change standard de$iation BriskD of the market inde" was

.=IL and after hike in rate it increases to 1.<EL.

;. Oalue of Aorrelation between returns of market inde" before rate change

and after hike in rate is .;L.

H: As o* H0A0IAH010

!articulars Before rate ca*.e After rate ca*.e

,ean

-.1E .!

#tandard de$iation

.JI 1.<1

Aorrelation

.=J

I*ter5retatio*'

1. The before rate change, returns of the market inde" was - .1EL and

after hike in rate it increases to .!L.

<. The before rate change standard de$iation BriskD of the market inde"

was .JIL and after hike in rate it increases to 1.<1L.

MBA10008008 KES IEMS, HUBLI Page =

Stock broking ltd.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .=L.

G: As o* HA0JAH010

!articulars Before rate ca*.e After rate ca*.e

,ean

-.;I .<

#tandard de$iation

1.J 1.1>

Aorrelation

.<!

I*ter5retatio*'

1. The before rate change, returns of the market inde" was - .;IL

and after hike in rate it increased to .<L.

<. The before rate change standard de$iation BriskD of the market

inde" was 1.JL and after hike in rate it increased to 1.1>L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .<!L.

I: As o* HJA0JAH010

!articulars Before rate ca*.e After rate ca*.e

,ean

.E .>!

#tandard de$iation

.=< .E;

Aorrelation

.1;

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .EEL

and after hike in rate it increased to .>!L.

MBA10008008 KES IEMS, HUBLI Page =1

Stock broking ltd.

<. The before rate change standard de$iation BriskD of the market

inde" was .=<L and after hike in rate it increased to .E;L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .1;L.

=: As o* 1KA0FAH010

!articulars Before rate ca*.e After rate ca*.e

,ean

.J< -.1>

#tandard de$iation

.>; 1.!J

Aorrelation

-.;J

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .J<L and

after hike in rate it decreased to -.1>L.

<. The before rate change standard de$iation BriskD of the market

inde" was .>;L and after hike in rate it increased to 1.!JL.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is -.;JL.

K: As o* 0HA11AH010

!articulars Before rate ca*.e After rate ca*.e

,ean

.>; -.!

#tandard de$iation

1.J 1.E

Aorrelation

-.1>

MBA10008008 KES IEMS, HUBLI Page =<

Stock broking ltd.

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .>;L and

after hike in rate it decreased to -.!L.

<. The before rate change standard de$iation BriskD of the market inde"

was 1.JL and after hike in rate it increased to 1.EL.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is -.1>L.

J: As o* H=A01AH011

I*ter5retatio*'

1. The before rate change, returns of the market inde" has -.<>L

and after hike in rate it increased to .JEL.

<. The before rate change standard de$iation BriskD of the market

inde" was 1.1IL and after hike in rate it increased to <.>JL.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .!JL.

8: As o* 1JA0GAH011

MBA10008008 KES IEMS, HUBLI Page =;

!articulars Before rate ca*.e After rate ca*.e

,ean

-.<> .JE

#tandard de$iation

1.1I <.>J

Aorrelation

.!J

Stock broking ltd.

I*ter5retatio*'

1. The before rate change, returns of the market inde" was -.1!L

and after hike in rate it increased to .!L.

<. The before rate change standard de$iation BriskD of the market

inde" was 1.EL and after hike in rate it increased to <.J1L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is -.1L.

F: As o* 0GA0=AH011

!articulars Before rate ca*.e After rate ca*.e

,ean

-.<I ..=1

#tandard de$iation

.I> 1.<>

Aorrelation

.>J

I*ter5retatio*'

MBA10008008 KES IEMS, HUBLI Page ==

!articulars Before rate ca*.e After rate ca*.e

,ean

-.1! .!

#tandard de$iation

1.EJ <.J1

Aorrelation

-.1

Stock broking ltd.

1. The before rate change, returns of the market inde" was -.<IL

and after hike in rate it increases to .=1L.

<. The before rate change standard de$iation BriskD of the market inde"

was .I>L and after hike in rate it increases to 1.<>L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .>L.

10:As o* 1KA0KAH011

!articulars Before rate ca*.e After rate ca*.e

,ean

-.<E .!=

#tandard de$iation

.=I <.;

Aorrelation

.;;

I*ter5retatio*'

1. The before rate change, returns of the market inde" was -.<EL and

after hike in rate it increased to .!=L.

<. The before rate change standard de$iation BriskD of the market inde"

was .=IL and after hike in rate it increased to <.;L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .;;L.

11: As o* HK:0JAH011

MBA10008008 KES IEMS, HUBLI Page =!

!articulars Before rate ca*.e After rate ca*.e

,ean

.11 -.1;

#tandard de$iation

.II <.>I

Aorrelation

-.E11

Stock broking ltd.

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .11L and

after hike in rate it decreased to -.1;L.

<. The before rate change standard de$iation BriskD of the market

inde" was .IIL and after hike in rate it increased to <.>IL.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is -.E1L.

1H: As o* 1KA0FAH011

!articulars Before rate ca*.e After rate ca*.e

,ean

.1! .<1

#tandard de$iation

1.<I <.;;

Aorrelation

-.;<

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .1!L and

after hike in rate it increased to .<1L.

<. The before rate change standard de$iation BriskD of the market inde"

was 1.<IL and after hike in rate it increased to <.;;L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is -.;<L.

1G: As o* H=A10AH011

MBA10008008 KES IEMS, HUBLI Page =E

Stock broking ltd.

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .<=L and

after hike in rate it decreased to .=>L.

<. The before rate change standard de$iation BriskD of the market

inde" was 1.1;L and after hike in rate it increased to 1.;L.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .=;L.

1I: As o* 1JA0IAH01H

!articulars Before rate ca*.e After rate ca*.e

,ean

.IE .<

#tandard de$iation

.J; 1.1=

Aorrelation

.<I

I*ter5retatio*'

1. The before rate change, returns of the market inde" was .IL and

after decrease in rate it decreased to .<L.

<. The before rate change standard de$iation BriskD of the market inde"

has 1.1=L and after decrease in rate it decreased to .J;L.

MBA10008008 KES IEMS, HUBLI Page =>

!articulars Before rate ca*.e After rate ca*.e

,ean

.<= .=>

#tandard de$iation

1.1; 1.;

Aorrelation

.=;

Stock broking ltd.

;. Oalue of Aorrelation between returns of market inde" before rate

change and after hike in rate is .<IL.

-I/(I/;S'

1. There was continuous raise in the interest rate since last < ? year due

to, inflation high oil prices, li&uidity etc.

<. There is continuous decrease in market inde" returns due to higher

interest rate risk.

;. There is continuous increase in interest rate since last < ? year that

affect the security traders because cost of borrowing would increases

so that leads to earn less return and also continuous decreases in

market indices.

=. And there is both positi$e and negati$e correlation between inde"

returns- it indicates high $ariation with high risk in inde" return.

!. The high interest rate affect on infrastructure, automobile, banking

sector, because these are the few which affects more when change in

interest rate than other.

E. %$en though decrease in repo rate by ! points it is not helping stock

market to get refresh to mo$e upward.

MBA10008008 KES IEMS, HUBLI Page =J

Stock broking ltd.

SU;;ESTI%/SC0E)%M%/(ATI%/'

1. Today stock market showing negati$e sign in market mo$ement and

growth, so I would like suggest in$estors to in$est their money in

go$ernment bonds to get assured rate of return.

<. In$est in banking sector because this sector performs well for longer

term when rate $aries.

;. .hen interest rate is at peak, it is better to in$est in beaten down

infrastructure, real estate stocks for &uicker return.

MBA10008008 KES IEMS, HUBLI Page =I

Stock broking ltd.

)%/)LUSI%/

.ith a rapid growth in capital market it becomes difficulty to in$estor to take the

wise in$est decision market is getting to much $olatile locally and globally which has

lot to do with in$estments.

The pro)ect being undertaken in at networth, 'harwad imports $arious things

about in$estments. .hile doing this pro)ect it came to know that why reser$e bank of

india do they changes in repo rate, how the increase or decrease in the interest rate

affects on inde" returns, and how it affects on stock market. This pro)ect helped me to

learn about the stock market.

In$estors should undertake effecti$e and timely analysis before in$esting into the

stock market, as most of the in$estors do not undertake any study before entering into

a in$estment. As interest rate is also one of a ma)or factor which affects on inde"

return. .hen you are deciding on in$esting in a security and it is important you

understand what kind of interest rate risk you can recei$e.

MBA10008008 KES IEMS, HUBLI Page !

Stock broking ltd.

BIBLI%;0A!H1

B%%KS

#ecurity Analysis : (ortfolio ,anagement N (unitha$athy (andian

7EBSITES

www.nseindia.com

www.networthdirect.com

www.moneycontrol.com

www.in$estopedia.com

www.global rates.com

www.tradingeconomics.com

www.blogs.reuters.comMindia..

www.stockforyouindia.com

MBA10008008 KES IEMS, HUBLI Page !1

Stock broking ltd.

A**exure'

date close Date Close date close date Close

1-Apr-10 5290.5 1-Jul-10 5251.4 1-Oct-10 6143.4 3-Jan-11 6157.6

5-Apr-10 5368.4 2-Jul-10 5237.1 4-Oct-10

6159.4

5 4-Jan-11

6146.3

5

6-Apr-10 5366 5-Jul-10 5235.9 5-Oct-10 6145.8 5-Jan-11 6079.8

7-Apr-10 5374.65 6-Jul-10 5289.05 6-Oct-10

6186.4

5 6-Jan-11

6048.2

5

8-Apr-10 5304.45 7-Jul-10 5241.1 7-Oct-10 6120.3 7-Jan-11 5904.6

9-Apr-10 5361.75 8-Jul-10 5296.85 8-Oct-10

6103.4

5

10-Jan-

11

5762.8

5

12-Apr-10 5339.7 9-Jul-10 5352.45

11-Oct-

10

6135.8

5

11-Jan-

11 5754.1

13-Apr-10 5322.95 12-Jul-10 5383

12-Oct-

10 6090.9

12-Jan-

11

5863.2

5

15-Apr-10 5273.6 13-Jul-10 5400.65

13-Oct-

10 6233.9

13-Jan-

11 5751.9

16-Apr-10 5262.6 14-Jul-10 5386.15

14-Oct-

10

6177.3

5

14-Jan-

11

5654.5

5

19-Apr-10 5203.65 15-Jul-10 5378.75

15-Oct-

10

6062.6

5

17-Jan-

11

5654.7

5

20-Apr-10 5230.1 16-Jul-10 5393.9

18-Oct-

10

6075.9

5

18-Jan-

11

5724.0

5

21-Apr-10 5244.9 19-Jul-10 5386.45

19-Oct-

10 6027.3

19-Jan-

11

5691.0

5

22-Apr-10 5269.35 20-Jul-10 5368

20-Oct-

10 5982.1

20-Jan-

11 5711.6

23-Apr-10 5304.1 21-Jul-10 5399.35

21-Oct-

10 6101.5

21-Jan-

11 5696.5

26-Apr-10 5322.45 22-Jul-10 5441.95

22-Oct-

10

6066.0

5

24-Jan-

11

5743.2

5

27-Apr-10 5308.35 23-Jul-10 5449.1

25-Oct-

10 6105.8

25-Jan-

11 5687.4

28-Apr-10 5215.45 26-Jul-10 5418.6

26-Oct-

10 6082

27-Jan-

11 5604.3

29-Apr-10 5254.15 27-Jul-10 5430.6

27-Oct-

10

6012.6

5

28-Jan-

11

5512.1

5

30-Apr-10 5278 28-Jul-10 5397.55

28-Oct-

10 5987.7

31-Jan-

11 5505.9

3-May-10 5222.75 29-Jul-10 5408.9 29-Oct- 6017.7 1-e!-11 5417.2

MBA10008008 KES IEMS, HUBLI Page !<

Stock broking ltd.

10

4-May-10 5148.5 30-Jul-10 5367.6 1-"o#-10

6117.5

5 2-e!-11 5432

5-May-10 5124.9 2-Au$-10 5431.65 2-"o#-10 6119 3-e!-11

5526.7

5

6-May-10 5090.85 3-Au$-10 5439.55 3-"o#-10 6160.5 4-e!-11

5395.7

5

7-May-10 5018.05 4-Au$-10 5467.85 4-"o#-10 6281.8 7-e!-11 5396

10-May-10 5193.6 5-Au$-10 5447.1 5-"o#-10

6312.4

5 8-e!-11

5312.5

5

11-May-10 5136.15 6-Au$-10 5439.25 8-"o#-10 6273.2 9-e!-11

5253.5

5

12-May-10 5156.65 9-Au$-10 5486.15 9-"o#-10

6301.5

5

10-e!-

11 5225.8

13-May-10 5178.9

10-Au$-

10 5460.7

10-"o#-

10 6275.7

11-e!-

11 5310

14-May-10 5093.5

11-Au$-

10 5420.6

11-"o#-

10

6194.2

5

14-e!-

11 5456

17-May-10 5059.9

12-Au$-

10 5416.45

12-"o#-

10

6071.6

5

15-e!-

11 5481

18-May-10 5066.2

13-Au$-

10 5452.1

15-"o#-

10 6121.6

16-e!-

11 5481.7

19-May-10 4919.65

16-Au$-

10 5418.3

16-"o#-

10 5988.7

17-e!-

11

5546.4

5

20-May-10 4947.6

17-Au$-

10 5414.15

18-"o#-

10 5998.8

18-e!-

11

5458.9

5

21-May-10 4931.15

18-Au$-

10 5479.15

19-"o#-

10 5890.3

21-e!-

11 5518.6

24-May-10 4943.95

19-Au$-

10 5540.2

22-"o#-

10 6010

22-e!-

11 5469.2

25-May-10 4806.75

20-Au$-

10 5530.65

23-"o#-

10

5934.7

5

23-e!-

11

5437.3

5

26-May-10 4917.4

23-Au$-

10 5543.5

24-"o#-

10

5865.7

5

24-e!-

11 5262.7

27-May-10 5003.1

24-Au$-

10 5505.1

25-"o#-

10

5799.7

5

25-e!-

11

5303.5

5

28-May-10 5066.55

25-Au$-

10 5462.35

26-"o#-

10

5751.9

5

28-e!-

11

5333.2

5

31-May-10 5086.3

26-Au$-

10 5477.9

29-"o#-

10 5830 1-Mar-11 5522.3

date close date Close date close

1-Apr-11

5826.0

5 1-Jul-11 5627.2 3-Oct-11 4849.5

4-Apr-11

5908.4

5 4-Jul-11 5650.5 4-Oct-11

4772.1

5

5-Apr-11

5910.0

5 5-Jul-11 5632.1 5-Oct-11 4751.3

6-Apr-11

5891.7

5 6-Jul-11

5625.4

5 7-Oct-11

4888.0

5

7-Apr-11 5885.7 7-Jul-11

5728.9

5 10-Oct-11 4979.6

8-Apr-11 5842 8-Jul-11

5660.6

5 11-Oct-11

4974.3

5

MBA10008008 KES IEMS, HUBLI Page !;

Stock broking ltd.

11-Apr-11 5785.7 11-Jul-11 5616.1 12-Oct-11 5099.4

13-Apr-11 5911.5 12-Jul-11

5526.1

5 13-Oct-11

5077.8

5

15-Apr-11

5824.5

5 13-Jul-11

5585.4

5 14-Oct-11 5132.3

18-Apr-11 5729.1 14-Jul-11 5599.8 17-Oct-11

5118.2

5

19-Apr-11

5740.7

5 15-Jul-11 5581.1 18-Oct-11 5037.5

20-Apr-11

5851.6

5 18-Jul-11

5567.0

5 19-Oct-11

5139.1

5

21-Apr-11 5884.7 19-Jul-11

5613.5

5 20-Oct-11 5091.9

25-Apr-11 5874.5 20-Jul-11

5567.0

5 21-Oct-11

5049.9

5

26-Apr-11 5868.4 21-Jul-11 5541.6 24-Oct-11

5098.3

5

27-Apr-11 5833.9 22-Jul-11

5633.9

5 25-Oct-11 5191.6

28-Apr-11

5785.4

5 25-Jul-11 5680.3 26-Oct-11 5201.8

29-Apr-11 5749.5 26-Jul-11

5574.8

5 28-Oct-11 5360.7

2-May-11 5701.3 27-Jul-11 5546.8 31-Oct-11 5326.6

3-May-11

5565.2

5 28-Jul-11

5487.7

5 1-"o#-11

5257.9

5

4-May-11

5537.1

5 29-Jul-11 5482 2-"o#-11

5258.4

5

5-May-11

5459.8

5 1-Au$-11 5516.8 3-"o#-11

5265.7

5

6-May-11

5551.4

5 2-Au$-11

5456.5

5 4-"o#-11 5284.2

9-May-11 5551.1 3-Au$-11 5404.8 8-"o#-11

5289.3

5

10-May-

11

5541.2

5 4-Au$-11 5331.8 9-"o#-11

5221.0

5

11-May-

11

5565.0

5 5-Au$-11

5211.2

5

11-"o#-

11

5168.8

5

12-May-

11

5486.1

5 8-Au$-11 5118.5

14-"o#-

11

5148.3

5

13-May-

11

5544.7

5 9-Au$-11

5072.8

5

15-"o#-

11 5068.5

16-May-

11 5499

10-

Au$11 5161

16-"o#-

11

5030.4

5

17-May-

11

5438.9

5

11-

Au$11 5138.3

17-"o#-

11

4934.7

5

18-May-

11 5420.6

12-

Au$11

5072.9

5

18-"o#-

11 4905.8

19-May-

11 5428.1

16-

Au$11 5035.8

21-"o#-

11

4778.3

5

20-May-

11

5486.3

5

17-

Au$11 5056.6

22-"o#-

11

4812.3

5

MBA10008008 KES IEMS, HUBLI Page !=

Stock broking ltd.

23-May-

11

5386.5

5

18-

Au$11

4944.1

5

23-"o#-

11

4706.4

5

24-May-

11

5394.8

5

19-

Au$11

4845.6

5

24-"o#-

11

4756.4

5

25-May-

11

5348.9

5

22-

Au$11 4898.8

25-"o#-

11

4710.0

5

26-May-

11

5412.3

5

23-

Au$11 4948.9

28-"o#-

11 4851.3

27-May-

11 5476.1

24-

Au$11 4888.9

29-"o#-

11 4805.1

30-May-

11 5473.1

25-

Au$11 4839.6

30-"o#-

11

4832.0

5

31-May-

11

5560.1

5

26-

Au$11 4747.8 1-Dec-11

4936.8

5

1-Jun-11 5592

29-

Au$11 4919.6 2-Dec-11

5050.1

5

2-Jun-11

5550.3

5

30-

Au$11 5001 5-Dec-11

5039.1

5

3-Jun-11

5516.7

5 2-%ep-11 5040 7-Dec-11 5062.6

6-Jun-11

5532.0

5 5-%ep-11 5017.2 8-Dec-11

4943.6

5

7-Jun-11

5556.1

5 6-%ep-11 5064.3 9-Dec-11 4866.7

8-Jun-11

5526.8

5 7-%ep-11

5124.6

5

12-Dec-

11 4764.6

9-Jun-11

5521.0

5 8-%ep-11

5153.2

5

13-Dec-

11 4800.6

10-Jun-11 5485.8 9-%ep-11

5059.4

5

14-Dec-

11

4763.2

5

13-Jun-11 5482.8

12-%ep-

11 4946.8

15-Dec-

11

4746.3

5

14-Jun-11 5500.5

13-%ep-

11

4940.9

5

16-Dec-

11 4651.6

15-Jun-11 5447.5

14-%ep-

11

5012.5

5

19-Dec-

11 4613.1

16-Jun-11

5396.7

5

15-%ep-

11 5075.7

20-Dec-

11 4544.2

17-Jun-11 5366.4

16-%ep-

11

5084.2

5

21-Dec-

11

4693.1

5

20-Jun-11 5257.9

19-%ep-

11

5031.9

5

22-Dec-

11

4733.8

5

21-Jun-11

5275.8

5

20-%ep-

11 5140.2

23-Dec-

11 4714

22-Jun-11 5278.3

21-%ep-

11

5133.2

5

26-Dec-

11 4779

23-Jun-11 5320

22-%ep-

11

4923.6

5

27-Dec-

11 4750.5

24-Jun-11

5471.2

5

23-%ep-

11

4867.7

5

28-Dec-

11 4705.8

27-Jun-11 5526.6

26-%ep-

11 4835.4

29-Dec-

11

4646.2

5

MBA10008008 KES IEMS, HUBLI Page !!

Stock broking ltd.

28-Jun-11 5545.3

27-%ep-

11

4971.2

5

30-Dec-

11 4624.3

29-Jun-11

5600.4

5

28-%ep-

11 4945.9

30-Jun-11 5647.4

29-%ep-

11

5015.4

5

30-%ep-

11

4943.2

5

1-Dec-10 5960.9

2-Dec-10 6011.7

3-Dec-10 5992.8

6-Dec-10

5992.2

5

7-Dec-10

5976.5

5

8-Dec-10 5903.7

9-Dec-10 5766.5

10-Dec-

10

5857.3

5

13-Dec-

10

5907.6

5

14-Dec-

10 5944.1

15-Dec-

10 5892.3

16-Dec-

10

5948.7

5

20-Dec-

10

5947.0

5

21-Dec-

10

6000.6

5

22-Dec-

10 5984.4

23-Dec-

10 5980

24-Dec-

10 6011.6

27-Dec-

10 5998.1

28-Dec-

10 5996

29-Dec-

10

6060.3

5

30-Dec-

10

6101.8

5

MBA10008008 KES IEMS, HUBLI Page !E

Stock broking ltd.

A!!E/(I8'

/SE' 1ational stock e"change

S9) )/8 /I-T1'

I!%' Initial public offering

IISL' I1'IA I1'%C #%+OIA%# : (+8'6AT# 4T'.

)0ISIL' Aredit rating information ser$ice india ltd

SEBI' #ecurity e"change board of india

MBA10008008 KES IEMS, HUBLI Page !>

Вам также может понравиться

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustОт EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustОценок пока нет

- Derivatives ProjectДокумент23 страницыDerivatives ProjectChirag RankjaОценок пока нет

- Sequrity AnalysisДокумент72 страницыSequrity AnalysisGanganiMehulОценок пока нет