Академический Документы

Профессиональный Документы

Культура Документы

WP 12030

Загружено:

brentk112Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

WP 12030

Загружено:

brentk112Авторское право:

Доступные форматы

Determinants of Margin in Microfinance

Institutions

Beatriz Cullar Fernndez, Yolanda Fuertes-

Calln, Carlos Serrano-Cinca and Begoa

Gutirrez-Nieto

Microfinance institutions (MFIs) lend to the poor, fostering these individuals

financial inclusion. However, microfinance clients suffer from high interest rates,

a type of poverty penalty. Reducing margins and lowering interest rates should

be a target for MFIs with a strong social commitment. This paper analyzes the

determinants of margin in MFIs. A banking model has been adapted to the case

of MFIs. This model has been empirically tested using 9-year panel data. Some

factors explaining bank margin also explain MFI margin, with operating expenses

being the most important factor. Specific microfinance factors are donations and

legal status, as regulated MFIs can collect deposits. It has also been found that

MFIs operating in countries with a high level of financial inclusion have low

margins.

JEL Classifications: G21, C23, R51

Keywords: Microfinance institutions, banking, net interest income, outreach,

financial inclusion.

CEB Working Paper N 12/030

October 2012

Universit Libre de Bruxelles - Solvay Brussels School of Economics and Management

Centre Emile Bernheim

ULB CP114/03 50, avenue F.D. Roosevelt 1050 Brussels BELGIUM

e-mail: ceb@admin.ulb.ac.be Tel. : +32 (0)2/650.48.64 Fax : +32 (0)2/650.41.88

Determinants of Margin in Microfinance Institutions

Beatriz Cullar Fernndez

Department of Accounting and Finance

University of Zaragoza, Spain

Yolanda Fuertes-Calln

Department of Accounting and Finance

University of Zaragoza, Spain

Carlos Serrano-Cinca

Department of Accounting and Finance

University of Zaragoza, Spain

Begoa Gutirrez-Nieto*

Department of Accounting and Finance

University of Zaragoza, Spain

This version: October 2012

ABSTRACT

Microfinance institutions (MFIs) lend to the poor, fostering these individuals

financial inclusion. However, microfinance clients suffer from high interest rates, a type of

poverty penalty. Reducing margins and lowering interest rates should be a target for MFIs

with a strong social commitment. This paper analyzes the determinants of margin in MFIs.

A banking model has been adapted to the case of MFIs. This model has been empirically

tested using 9-year panel data. Some factors explaining bank margin also explain MFI

margin, with operating expenses being the most important factor. Specific microfinance

factors are donations and legal status, as regulated MFIs can collect deposits. It has also

been found that MFIs operating in countries with a high level of financial inclusion have

low margins.

JEL classification: G21, C23, R51

Keywords: Microfinance institutions, banking, net interest income, outreach, financial

inclusion.

*

Corresponding author. Gran Va 2, 50005 Zaragoza, Spain. Telephone: +34 876 554643. Fax: +34 976 761

769. E-mail: bgn@unizar.es

Determinants of Margin in Microfinance Institutions

1. Introduction

Microfinance institutions (MFIs) lend to the poor, who are traditionally excluded

from financial services. Their presence has been a step forward in poverty alleviation as

well as the empowerment of women. However, many MFIs charge very high interest rates,

which is controversial. This practice is an example of poverty penalty: the poor pay high

interest rates to enter the credit market (Prahalad and Hammond, 2002). This paper,

adapting a banking model, studies the determinant factors of MFIs margin. The main

motivation of this paper is to identify the factors driving this margin. If these factors are

known, a way to reduce the margin will be available, and entities with a social mission will

be able to reduce their interest rates.

Since the seminal work by Ho and Saunders (1981), several studies have analyzed the

factors determining bank margin. Allen (1988) and Angbazo (1997) include factors such as

interest and credit risk; Maudos and Fernndez de Guevara (2004) include bank efficiency;

Saunders and Schumacher (2000) study solvency regulations and Carb and Rodrguez

(2007) or Lepetit et al. (2008) incorporate product diversification. Maudos and Sols (2009)

test in a comprehensive model the main additions to the Ho and Saunders (1981) model.

The research question in this paper is as follows: what are the margin determinants in

microfinance? To the best of our knowledge, this question has not been previously studied.

Financial margin is a MFIs performance measure and is included as an independent

variable in several works, such as Mersland and Strm (2008), Mersland and Strm (2009),

Mersland (2009) and Ahlin et al. (2011).

Commercial banks maximize profits. Profits can be maximized by reducing costs or

by increasing revenues. There is a consensus to reduce costs in MFIs. However, there is a

debate over whether to increase revenues in MFIs (Gulli, 1998), which is still unresolved

(Hermes and Lensink, 2011). The financial systems approach emphasizes the idea of MFI

sustainability: if MFIs are simply considered to be banks with poor clients, conventional

banking models could be directly applied to the MFIs case. The poverty lending approach

favors subsidized interest rates. It supports sustainability, but individuals sustainability, not

institutions sustainability.

MFIs have specific characteristics in their funding structure that may explain their

margin. Representing an example are donations, whose role has been widely discussed in

the microfinance literature since Morduch (1999). The relationship between donations and

margin must be studied.

Another specific aspect of microfinance is regulation (Hartarska and Nadolnyak,

2007). Many MFIs only lend; they do not collect deposits because they are not supervised

by the monetary authorities. They only perform half of the banking business. Regulation

allows them to access a cheap funding source: deposits. However, the collection of small

amounts implies high costs. It is important to study how deposits influence the margin.

Another potential thread of research is the study of the relationship between the type

of institution and margin. There are NGOs in the microfinance market, but there are also

conventional banks downscaling into the sector, credit cooperatives and Non-Banking

Financial Institutions (NBFI). Mersland and Strm (2009) and Servin et al. (2012) have

studied the relationship between the type of institution and efficiency.

The contribution of this paper is twofold. First, it formulates a model to explain

margin determinants in microfinance. Second, it empirically tests this model by using

standard panel data techniques with a 9-year sample of MFIs. It includes variables that

influence the margin in commercial banks. It also includes microfinance-specific variables:

funding-related variables, such as donations or deposits, social performance variables and

the type of institution.

The most recent debate in microfinance concerns mission drift. MFIs focused on

financial objectives run the risk of losing their social objectives, Mersland and Strm

(2010). Abnormally high margins can be a type of mission drift. Processing many small

loans can be a justification because the administrative costs of doing so are high. To shed

light on this question, the empirical study in this paper analyzes a subsample of MFIs that

only lend to the poorest; those with an average loan size under $300. These MFIs have not

drifted from their mission in terms of their target but may have drifted from their mission in

terms of their margins, which may go beyond reasonable limits. The model has been tested

with this subsample of pure MFIs as well as with the subsample of MFIs with an average

loan size over $300.

The next section presents the literature revision and describes the theoretical model.

Section 3 justifies the empirical model. Section 4 presents the empirical results. In the final

section, the conclusions are discussed.

2. Theoretical model

The interest margin model used in this paper is based on the original proposal by Ho

and Saunders (1981) and further extensions by Angbazo (1997) and Maudos and Fernndez

de Guevara (2004). The financial institution is considered a risk-averse agent that operates

as a financial intermediary in the loans and deposits market, with the aim of maximizing a

mean-variance objective function in end-of-period wealth. The wealth of the institution (W)

is obtained as the difference between its assets (loans, L and investments in the monetary

market, M) and its liabilities (deposits, D):

W

0

= L

0

-

0

+ H

0

(1)

A period later, this wealth can be expressed as follows:

W

1

= (1+r

I

+Z

I

)( L

0

-

0

) +H

0

(1+r

M

+Z

M

)C=W

0

(1 + r

w

) + (I

0

-

0

)Z

I

+ H

0

Z

M

C

(2)

Where r

I

=

L

L

0

-

D

0

L

0

-

0

represents the profitability of the net loan balance and r

w

=

r

I

L

0

-

0

W

0

+ r

M

M

0

W

0

represents the average profitability of the institution. Z

M

is the institutions

risk from interest rate volatility in the money market, distributed as a random variable

Z

M

_N(0,

M

2

). Z

I

= Z

L

L

0

L

0

-

0

+ Z

0

L

0

-

0

is credit risk with Z

0

L

0

-

0

= u. This risk also

follows a random distribution Z

L

_N(0,

L

2

). C are operating costs associated with loans and

deposits.

The bank sets its interest rates by incorporating a spread over its funds cost on the

money market (r

D

=r

M

-a and r

L

=r

M

+b). The sum of both margins (a+b) is the pure interest

margin. Deposits and loans arrive randomly according to Poisson processes influenced by

the spreads fixed by the entities in their operations.

L

= o - [b

= o + [o (3)

l,d

represents the probability of giving a loan or collecting a deposit. measures the

loans and deposits demand sensibility to margin variations.

First-order conditions for a and b in the utility function allow obtaining the optimal

interest margin (see Maudos and Fernandez de Guevara, 2004, for a full development of the

model):

s = o +b = [

u

L

[

L

+

u

D

[

D

+

1

2

R((I + 2I

0

)o

L

2

+(I + )o

M

2

+2(H

0

- I)o

LM

2

) +

1

2

[

C(L)

L

+

C()

(4)

The margin is obtained by three terms:

i) The first term, /, is a measure of the pure margin in a risk-neutral institution

(risk-neutral spread). Ho and Saunders (1981) interpret it as a measure of market power;

markets with the most inelastic demand may be monopolist and obtain higher margins than

a competitive market.

ii) The second term is the risk premium. Higher degrees of risk aversion (R=-1

2 u(w )u(w ) ), interbank interest rate volatility

credit risk (

L

) and a stronger

relationship between interest rate risk and credit risk (

ML

) imply higher margin. Moreover,

higher values of the institutions transaction amount (L+D), total loan volume (L+2L

0

) and

excess of funds kept in money markets over the new disbursed loans (M

0

-L) imply a higher

impact of risk on the margin, where M

0

represents the assets in monetary markets.

iii) Representing the last term are average operating costs, which increase the

institutions margin and are not affected by the low competitiveness or risk neutrality of the

markets.

3. Empirical model

The empirical model first includes the determinants of the financial margin

commonly used in commercial bank studies. Its applicability to microfinance is assessed.

The empirical model also adds exogenous variables to the theoretical model to consider

microfinance-specific characteristics.

NARu

t

= o

+ [

]

IH

t

]

]=1

+ y

k

HFIS

t

K

k=1

+e

t

(5)

t=1,T, T number of periods and i=1,.I, I number of MFIs. MARG is the

financial margin, TM are the margin determinants according to the theoretical model and

MFIS are the specific microfinance margin determinants.

Table 1 shows each variable definition. The dependent variable is Net Interest

Margin, calculated as the difference between Financial Income and Financial Expenses in

relation to Total Assets. The independent variables are defined as measured as follows:

***Table 1***

Operating costs. Its inclusion is justified from the theoretical and empirical points of

view. In fact, according to Maudos and Sols (2009), operating costs are the most relevant

determinant of the intermediation margin. The operating costs ratio is defined as Operating

Expense/Total Assets. Operating costs are expected to positively influence MFIs margin.

Risk aversion. Solvency has been related to the degree of risk aversion (McShane and

Sharpe, 1985). The relationship between solvency and margin is positive in banks. The

same relationship is expected in MFIs. Following McShane and Sharpe (1985), Maudos

and Fernndez de Guevara, (2004) and Maudos and Solis (2009), the Capital Assets Ratio

(CAR), defined as Equity/Total Assets, is used to measure the risk aversion.

Credit risk. The model applied in banks predicts a positive relationship between

margin and credit risk and the same could be expected in MFIs. The default probability of

MFI borrowers must be correctly managed to minimize its impact on the margin. Giving

loans to poor people without a credit history was the main innovation of the Grameen Bank

by Yunus (1999), who implemented the proverb: the poor always pay back. MFIs

monitor risk by using alternative systems to secure repayment, such as solidarity groups or

peer monitoring (Krauss and Walter, 2009). This makes the relationship between risk and

margin unclear. The variable Loan Loss Rate is used to measure credit risk, defined as

(Write-offs - Value of Loans Recovered)/ Loan Portfolio.

Size and age. Recently created MFIs are improving their systems and reducing costs.

When MFIs mature and their loan portfolio grows, they gain efficiency, among other

issues, by reducing information asymmetries, Behr (2011). Large and mature MFIs are

expected to have low margins. The Gross Loan Portfolio is chosen to measure size. The

number of years elapsed since the MFIs creation date is chosen to measure age.

Risk neutral spread. Competition is a key margin determinant in the financial sector.

Banks that face higher competition within a given country have lower margins (Demirg-

Kunt and Huizinga, 1999). This paper proposes the degree of financial inclusion as a

measure of competition. In developed countries, most adults report that they have an

account at a formal financial institution. In developing countries, where MFIs operate, the

level of financial inclusion is low, indicating a low level of financial culture and a low level

of banking competence. The World Banks Development Research Group has developed

the Global Financial Inclusion Database (Demirg-Kunt and Klapper, 2012), which

measures the populations use of financial services in a given country. The paper uses the

variable Account at a Formal Financial Institution to measure financial inclusion.

The specific margin determinants for MFIs are as follows:

Average loan size. The average loan balance per borrower is an outreach indicator in

microfinance (Navajas et al., 2000). Small loans retain high fixed administrative costs.

MFIs giving small loans are expected to have high margin due to fixed costs. Average loan

size is measured as Loan Portfolio Gross / Number of Active Borrowers and is corrected by

per capita GNI. This variable is commonly used as a social performance indicator to

measure MFI mission drift.

% Women borrowers. Many MFIs include in their mission the empowerment of

women. Women are associated with poverty in the countries where MFIs operate;

consequently, the percentage of women borrowers is considered a social performance

indicator. Alesina et al. (2008) find that women pay a higher interest rate, although women

are not riskier than men. Bellucci et al. (2010) and Beck et al. (2011) also demonstrate that

female entrepreneurs face tighter credit availability. A high percentage of women

borrowers is expected to be associated with a high financial margin.

Donations. Donations are a key difference in the capital structure of MFIs. Not all

MFIs receive donations. Start-up MFIs are usually funded with grants and when maturing,

they are more commercially oriented. Many of them are regulated and reduce donations in

favor of deposits, long-term loans or private equity. Bogan (2011) affirms that MFIs

accessing donor funds have pressure to obtain financial sustainability, which implies low

operational efficiency. Many MFIs use donations to serve their poorest clients in rural

areas, which also reduces the margin (Armendariz and Morduch, 2005). A negative

relationship is expected between margin and donations. The variable is Donations/Income.

% Deposits. MFIs must be regulated to capture deposits. They also suffer from high

external pressure to operate under financial sustainability criteria, Bogan (2011). According

to de Sousa-Shields and Frankiewicz (2004), deposit-taking MFIs finance their growth by

efficient management and not by charging high interest rates on the loans to the poor. A

negative relationship between margin and deposits is expected. The variable is

Deposits/Loans.

Type of entity. MFIs can operate as Non-Governmental Organizations (NGOs), Credit

Unions, Non-Bank Financial Institutions (NBFI) or Commercial Banks. It can be expected

that NGOs, more socially driven than banks, charge higher interest rates and operate with

lower margins. However, they target the poorest and their small loans have high costs,

which would justify high margins. Credit cooperatives, whose members are co-

proprietaries, generally do not attempt to maximize profits unconditionally (Smith et al.

1981). By contrast, it is expected that NBFI, which do not capture deposits, have high

margins.

4. Sample and results

Data come from the MixMarket database, which provides the annual statements of

the microfinance sector. The panel includes data from 2002 (322 MFIs) to 2010 (1,035

MFIs). Only the 2011 financial inclusion data were available because the World Banks

Global Financial Inclusion Database was recently built. The MFIs sample was divided into

two groups, according to the average loan size: under or over $300. The group under $300

(ALS < $300) contained pure MFIs, those that had not drifted from their mission due to

only serving poor clients. MFIs in the other group (ALS > $300) are more similar to

commercial banks, at least with regard to the type of clients served. These firms are

expected to be more market oriented.

Table 2 presents the exploratory analysis, which shows the mean of each variable, for

every year, for the two groups of MFIs. A T-test for means was performed to identify the

differences between the two groups.

*** Table 2***

The margin was higher in the ALS < $300 group than in the ALS > $300 group and

the differences are statistically significant for every year. The operating costs are higher in

the ALS < $300 group than in the ALS > $300 group and the differences are statistically

significant for every year. Margins and operating costs decrease each year, especially in the

ALS < $300 group.

There are significant differences in size, and MFIs with ALS < $300 are smaller than

MFIs with ALS > $300. Differences in risk are significant for only two years. Differences

in age are significant for five years. There are significant differences in the percentage of

women borrowers; MFIs with ALS < $300 serve a higher percentage of women and are

more mission centered than MFIs with ALS > $300. Donations only have data available

from 2006. MFIs with ALS < $300 receive more donations than MFIs with ALS > $300,

but MFIs receive fewer donations each year. There are significant differences in deposits;

MFIs with ALS < $300 capture fewer deposits than MFIs with ALS > $300. The last row

shows the profitability results, measured by the return on assets (ROA). This variable has

not been included in the model because it is not a determinant but a result of margin. It is

remarkable that MFIs with ALS < $300 have negative ROA, except for the last year.

Table 3 shows the pooled Pearsons correlation coefficients. The correlation

coefficient for each group of MFIs is shown. Both groups present positive correlations

between margin and operating costs, between margin and solvency and between margin

and ROA. There are negative correlations between margin and size, margin and age,

margin and donations, and margin and deposits. The correlation between risk and margin is

zero; MFIs with ALS < $300 have the same delinquency level as MFIs with ALS > $300.

All the results are coherent with the theoretical model. Some differences can be

appreciated between both groups of MFIs, explained by their social commitment. For

example, the group with ALS > $300 presents a negative correlation between margin and

loan size; that is, a smaller loan is associated with a higher margin (-0.21). However, in the

group with ALS < $300, a smaller loan is associated with a lower margin, although the

correlation coefficient is low (0.1). A similar pattern is observed in the other social

indicator. In the group with ALS > $300, a higher percentage of women borrowers implies

a higher margin (0.20); however, the other group, with ALS < $300, does not present a

significant correlation (0.03). An explanation can be based on the social character of pure

MFIs, which give small loans, mainly directed at women. They try to keep their margins

low with the aim of not charging high interest rates to their clients. They can do this

because they receive donations. Significant differences can be found here: in MFIs with

ALS < $300, higher donations lead to lower margin. The group of MFIs with ALS > $300

does not present significant correlations.

In MFIs with ALS > $300, higher deposits imply lower margin. The other group

hardly shows any correlation. This finding may be interpreted as a difficulty of gaining

profitability from small deposits.

*** Table 3***

McShane and Sharpe (1985) and Angbanzos (1997) approaches are followed to

estimate the explanatory model. The variables in the theoretical model and the exogenous

variables are estimated in a single step. The equation is estimated including the random

effects with robust errors, according to the panel data methodology. The random model has

been chosen because of the dichotomous nature of some variables; a fixed effects model

cannot include them. Moreover, and according to Bhargava and Sargan (1983), in panels

with a large number of individual units (MFIs) who are observed only for a few time

periods, random effects model estimation may be the most appropriate, and fixed effects

estimation may be inconsistent.

Table 4 shows the 8 analyzed models. Each model displays the results obtained in

both groups of MFIs. A Chow test is performed to assess whether the explained variance of

the variables is different in each group and a Smith-Satterthwaite test is performed to

measure the differences between the estimated coefficients in each regression. Both tests

will show whether the variables behavior is identical between the group of MFIs with ALS

> $300 (market oriented MFIs) and the group of MFIs with ALS < $300 (pure MFIs).

*** Table 4***

Model 1 contains the variables of the banking theoretical model. The results show

that the most determining factor is operating costs, in line with the theoretical model and

previous evidence. High operating costs imply high margin, but the effect is lower in MFIs

with ALS < $300. The beta coefficient is 0.63 in the group of MFIs with ALS > $300 and

0.25 in the other group. The Smith-Satterthwaite test shows statistically significant

differences on this variable in both groups.

A higher solvency implies a higher margin, in line with the theoretical model and the

results of other empirical studies. No relationship is found between credit risk and margin, a

finding consistent with the exploratory analysis.

Age has a negative relationship with margin but is only significant in entities with

high loan size. A higher loan size and a higher age of the MFI imply a lower margin. This

finding means that in this sector, maturity contributes to reduce the margin. Age and size

are correlated; therefore, to avoid multicollinearity problems, size has not been included in

the regression model.

Finally, financial inclusion presents a negative and significant relationship with

margin in both groups. This finding means that a higher degree of financial inclusion is

associated with a lower margin, as the model establishes.

The R2 of Model 1 is 0.57 for MFIs with ALS > $300, those closest to banks.

However, it is only 0.33 for the other group, with pure MFIs. The Chow test confirms the

statistically significant differences in the models explanatory capacity for both groups. It

seems clear that for pure MFIs, which are more different from commercial banks than the

other group of MFIs, the classical model has less explanatory power. This finding justifies

the inclusion of specific variables.

Model 2 incorporates donations. Higher donations are associated with a lower margin

in both groups. Donations effectively lower the margin. The inclusion of this variable is

especially relevant in the group of MFIs with ALS < $300, as the models R2 increases

from 0.33 to 0.44. In the other group, the increase is less pronounced, from 0.57 to 0.60.

Donations matter in the case of pure MFIs.

Model 3 includes deposits. A higher value of deposits to loans implies a lower

margin. Not every MFI can collect deposits; only those that are regulated can. The model

confirms that the decision of being regulated to capture deposits would lead to a reduction

in margin, which may represent a means of reducing the poverty penalty.

Model 4 includes an outreach measure, the percentage of women borrowers. A

positive and significant relationship has been found in the group of MFIs with ALS > $300,

meaning that a higher percentage of women borrowers is associated with a higher margin.

This does not happen in the other group, the one with pure MFIs. Notice that this variable is

significant according to the Smith-Satterthwaite test of differences.

Finally, the rest of the models, from 5 to 8, include the MFIs legal status. Neither

NGOs nor banks present a significant relationship with the margin. Credit cooperatives

have the lowest margin, which is coherent with their type of ownership, which is composed

of members. By contrast, the margin is high in NBFI.

Some final reflections may be made in an attempt to answer the research question

posed in the introduction. The poverty penalty exists: the margin is higher in those MFIs

with ALS < $300 than in the other group. However, this finding is not necessarily

associated with mission drift but rather to high operating costs, which are the main margin

determinants. The microfinance sector does not obtain high returns; in fact, most MFIs

have a negative ROA. MFIs willing to reduce their margin and thus the poverty penalty can

follow different strategies. The first one is to follow a turnover strategy, maximizing their

outreach by offering many small loans while improving their efficiency. This strategy is

consistent with the social mission of many MFIs and represents a means of achieving self-

sustainability because profitability can be broken down into two factors: margin and

turnover. Technologies to reduce operating costs in small loans should play a key role. The

sector is already doing so because the margin is decreasing each year. The growth of MFIs

leads to scale and learning economies. The second strategy is related to donations. Its role

is positive because donations contribute to reduce the margin. Although many claim self-

sustainability, MFIs serving the poorest with very small loans are those receiving

donations. In our opinion, donations are totally justified for MFIs fighting on the front lines

against financial exclusion. The third possibility is to reduce the margin by capturing

deposits through regulation, which represent a cheap funding source. Again, efficient

technology to reduce the high administrative costs of small deposits should be

implemented.

4. Conclusions

MFIs provide loans to the financially excluded. Because they are financial

institutions, their margin an important issue to keep in mind. However, unlike commercial

banks, which try to maximize their margin, many MFIs are socially oriented, with the aim

of maximizing outreach. This characteristic makes it necessary to adapt the banking models

explaining the margin to this special case, which may present different margin

determinants. This paper attempts to develop an explicative model for the microfinance

margin.

An empirical study has been performed with panel data from over one thousand MFIs

over 9 years. The sample has been divided into two groups: those with an average loan size

over $300, and those with an average loan size under $300. This figure represents a

threshold separating pure poverty orientation from market orientation.

The presence of a poverty penalty is confirmed: MFIs with low loans have high

margins. This fact does not imply mission drift because this high margin is caused by high

operating costs. These operating costs are the key variable determining margin, which is in

line with studies on commercial banks. If MFIs wish to lower their margin to alleviate the

poverty penalty suffered by their clients, the best way is by reducing these operating costs.

MFIs can choose a turnover strategy, giving many small loans. In addition, in every

turnover-based business, keeping costs under control and being efficient and productive are

key factors. It has also been found that solvency ratios follow the same pattern in

microfinance as in commercial banks.

The study has discovered differences in size and age with respect to commercial

banks previous studies. A larger and more mature bank has a higher margin. However,

microfinance is a young sector with an average life of less than 10 years in the dataset

analyzed. MFIs are still in a learning process, lowering their costs, and it has been observed

that the oldest and largest ones have the lowest margin, which is good news for these

socially oriented institutions.

The role of donations remains important, and in general, entities receiving donations

use them correctly because their margin is low. The same happens with deposits, which are

a cheap funding source, and those regulated entities capturing deposits have low margin.

However, the effect of deposits on the margin is less important than that of operating costs,

according to the regression coefficient.

The legal status matters because it is often associated with the social character of

MFIs. Credit cooperatives, owned by their members, operate with the lowest margin. Non-

Bank Financial Institutions operate with the highest margin.

Finally, where the level of accessibility of banking services is low, the margin is high.

As the populations financial literacy grows and the spread of financial services leads to

competition, the margin will decrease, as will the poverty penalty. This phenomenon

represents an invitation to make microcredit more accessible and more affordable.

Acknowledgements: The work reported in this paper was supported by grant ECO2010-

20228 of the Spanish Ministry of Education and Science and the European Regional

Development Fund and by grant Ref. S-14 (3) of the Government of Aragon.

References

Ahlin, C., Lin, J., Maio, M., 2011. Where does microfinance flourish? Microfinance

institution performance in macroeconomic context, Journal of Development

Economics 95 (2), 105-120.

Alesina, A., Lotti, F., Mistrulli, P., 2008. Do Women Pay More for Credit? Evidence from

Italy. NBER Working Paper 14202, Cambridge, MA: National Bureau of Economic

Research.

Allen, L., 1988. The determinants of bank interest margins: A note. Journal of Financial

and Quantitative Analysis 23, 231235.

Angbazo L., 1997. Commercial bank net interest margins, default risk, interest-rate risk,

and off-balance sheet banking. Journal of Banking & Finance 21, 55-87.

Armendariz, B. and Morduch, J., 2005. The economics of microfinance. MIT Press,

Cambridge, MA.

Beck, T.H.L., Behr, P., Madestam, A., 2011. Sex and Credit: Is There a Gender Bias in

Microfinance? Discussion Paper 2011-101, Tilburg University, Center for Economic

Research.

Behr, P., Entzian, A., Gttler, A., 2011. How do lending relationships affect access to credit

and loan conditions in microlending? Journal of Banking & Finance 35(8), 2169-2178.

Bellucci, A., Borisov, A., Zazzaro, A., 2010. Does gender matter in bankfirm

relationships? Evidence from small business lending, Journal of Banking & Finance

34(12), 2968-2984.

Bhargava A., Sargan, J.D., 1983. Estimating dynamic random effects models from panel

data covering short time periods. Econometrica 51, 1635-1660.

Bogan, V.L., (2011). Capital Structure and Sustainability: An Empirical Study of

Microfinance Institutions. Review of Economics and Statistics, forthcoming, DOI

10.1162/REST_a_00223.

Carb, S., Rodriguez, F., 2007. The determinants of bank margins in European banking.

Journal of Banking & Finance 31, 20432063

De Sousa-Shields, M., and Frankiewicz, C., 2004. Financing Microfinance Institutions: The

Context for Transitions to Private Capital. Micro Report 32, Accelerated

Microenterprise Advancement Project, USAID.

Demirg-Kunt A., Huizinga, H., 1999. Determinants of Commercial Bank Interest

Margins and Profitability: Some International Evidence. World Bank Economic

Review 13(2), 379-408.

Demirg-Kunt, A., Klapper, L.F., 2012. Measuring Financial Inclusion: The Global

Findex Database. World Bank Policy Research Working Paper 6025.

Gulli, H., 1998. Microfinance and Poverty: Questioning the Conventional Wisdom. Inter-

American Development Bank, Washington D.C.

Hartarska, V., Nadolnyak, D., 2007. Do regulated microfinance institutions achieve better

sustainability and outreach? Cross-country evidence. Applied Economics 39, 1207

1222.

Hermes, N., Lensink, R., 2011. Microfinance: Its Impact, Outreach, and Sustainability.

World Development 39(6), 875-881.

Ho, T., Saunders, A., 1981. The determinants of banks interest margins: theory and

empirical evidence. Journal of Financial and Quantitative Analysis XVI (4), 581600.

Krauss, N., Walter I., 2009. Can Microfinance Reduce Portfolio Volatility? Economic

Development and Cultural Change 58 (1), 85-110.

Lepetit L., Nys, E., Rous, P., Tarazi, A., 2008. The expansion of services in European

banking: Implications for loan pricing and interest margins. Journal of Banking &

Finance 32, 23252335.

Maudos, J., Fernndez de Guevara, J., 2004. Factors explaining the interest margin in the

banking sectors of the European Union. Journal of Banking & Finance 28, 2259-2281.

Maudos, J., Sols, L., 2009. The determinants of net interest income in the Mexican

banking system: An integrated model. Journal of Banking & Finance 33, 1920-1931.

McShane, R.W., Sharpe, I.G., 1985. A time series/cross section analysis of the

determinants of Australian trading bank loan/deposit interest margins: 19621981.

Journal of Banking & Finance 9, 115136.

Mersland, R., 2009. The Cost of Ownership in Microfinance Organizations. World

Development 37(2), 469-478.

Mersland, R., Strm, R.., 2008. Performance and trade-offs in Microfinance

Organisations-does ownership matter? Journal of International Development 20(5),

598-612.

Mersland, R., Strm, R.., 2009. Performance and governance in microfinance institutions.

Journal of Banking & Finance 33, 662-669.

Mersland, R., Strm, R.., 2010. Microfinance Mission Drift? World Development 38(1), 28-

36.

Morduch, J., 1999. The role of subsidies in microfinance: Evidence from the Grameen

Bank. Journal of Development Economics 60, 229-248.

Navajas, S., Schreiner, M., Meyer, R L., Gonzlez-Vega, C., 2000. Microcredit and the

poorest of the poor: Theory and evidence from Bolivia. World Development 28(2),

333-346.

Prahalad, C.K., Hammond, A., 2002. Serving the world's poor, profitably. Harvard

Business Review 80(9), 4857.

Saunders, A., Schumacher, L., 2000. The determinants of bank interest rate margins: an

international study. Journal of International Money and Finance 19(6), 813-832.

Servin, R., Lensink, R., van den Berg, M., 2012. Ownership and technical efficiency of

microfinance institutions: Empirical evidence from Latin America. Journal of Banking

& Finance 36(7), 2136-2144.

Smith, D.J., Cargill, T.F., Meyer, R.A., 1981. Credit Unions: An Economic Theory of a

Credit Union. Journal of Finance 36(2), 519-528.

Yunus, M. (1999): Banker to the poor: Microlending and the battle against world poverty.

Public Affairs, New York

Variable Definition

Margin MARG Net Interest Margin =(Financial income Financial Expenses) / Total Assets

Operating costs OE Operating Expense / Total Assets

Solvency CAR Capital Assets Ratio =Equity / Total Assets

Risk LLR Loan Loss Rate =(Write-offs - Value of Loans Recovered)/ Loan Portfolio

Size lnGLP Gross Loan Portfolio Logarithm

Age YEARS The number of years elapsed since the MFIs creation date

Financial inclusion FIN Account at a formal financial institution (% age 15+)

Outreach

ALS

Average Loan Balance per Borrower =Loan Portfolio Gross / Number of Active

Borrowers corrected by the per capita GNI.

WB % Women Borrowers

Donations DON Donations / Income

Deposits DEP Deposits / Loans

Type of entity TYPE Dummy variables on the legal status

NGO: Non-Governmental Organization

BANK: Commercial Bank

COOP: Cooperative / Credit Union

NFBI: Non-Bank Financial Institution

Profitability ROA Return on Assets =(Net Operating Income - Taxes) / Period Average Assets

Table 1. Variables and their definitions.

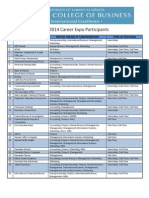

Table 2. Descriptive statistics. Each column contains the mean for both groups (ALS > $300 for Average Loan Size over $300 and

ALS < $300 for Average Loan Size under $300). It also shows the results from a T-test for means and its significance. ** significant at

5% level; *** significant at 1% level.

2002 2003 2004 2005 2006 2007 2008 2009 2010

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

ALS

>$300

ALS

<$300

Margin

N 178 144 292 240 445 323 546 415 624 440 680 388 772 391 713 387 697 338

Mean 0.22 0.26 0.21 0.23 0.21 0.25 0.21 0.24 0.21 0.23 0.20 0.22 0.21 0.24 0.21 0.23 0.21 0.23

T-test 3.48 *** 2.76*** 3.14*** 3.16*** 2.41** 2.44** 3.04*** 2.81*** 1.97**

Operating

costs

N 178 144 292 240 445 323 545 416 626 440 681 389 776 395 713 387 698 340

Mean 0.19 0.26 0.18 0.24 0.18 0.25 0.17 0.22 0.17 0.23 0.16 0.22 0.18 0.24 0.17 0.23 0.17 0.21

T-test 4.93*** 5.18*** 6.34*** 5.91*** 7.63*** 7.39*** 6.00*** 5.48*** 3.51***

Solvency

N 302 150 459 279 607 375 687 453 750 527 775 521 875 441 797 477 723 447

Mean 0.41 0.47 0.38 0.45 0.37 0.44 0.33 0.39 0.34 0.35 0.33 0.33 0.32 0.31 0.33 0.32 0.34 0.31

T-test 3.48*** 2.76*** 3.14*** 3.16*** 2.41** 2.44** 3.04*** 2.81*** 1.97**

Size

N 304 280 468 382 612 457 695 533 759 533 791 445 888 483 819 464 774 394

Mean 13E6 4E6 10E6 5E6 12E6 6E6 20E6 7E6 27E6 9E6 36E6 10E6 42E6 13E6 67E6 19E6 73E6 24E6

T-test 8.61*** 9.31*** 11.33*** 10.40*** 9.70*** 8.53*** 7.41*** 6.75*** 5.94***

Risk

N 159 128 285 235 429 303 525 392 613 427 674 378 760 377 709 387 710 353

Mean 0.015 0.029 0.014 0.019 0.061 0.018 0.033 0.029 0.012 0.013 0.012 0.019 0.013 0.018 0.020 0.021 0.022 0.016

T-test 1.56 0.59 1.22 0.30 0.38 2.51** 1.93 0.02 2.00**

Age

N 276 250 421 345 552 412 629 478 678 477 691 395 749 409 680 384 625 323

Mean 9.87 8.86 10.16 9.78 11.10 10.39 11.37 10.24 11.72 10.10 11.87 10.29 12.98 11.04 13.69 12.14 14.30 13.06

T-test 0.40 0.04 1.00 1.88 3.04*** 3.22*** 3.35*** 2.53** 2.00**

Average Loan

per borrower

N 304 280 468 382 612 457 695 533 759 533 791 445 888 483 819 464 774 394

Mean 953 116 1213 123 1234 119 1256 127 1586 138 1922 148 1968 151 1960 155 2053 162

T-test 9.93*** 11.76*** 12.72*** 12.26*** 13.85*** 14.06*** 15.62*** 17.72*** 17.05***

Women

borrowers

N 254 252 387 343 504 412 609 489 657 493 653 411 718 386 651 365 677 368

Mean 0.64 0.77 0.61 0.78 0.62 0.81 0.61 0.80 0.59 0.80 0.56 0.81 0.53 0.82 0.53 0.84 0.54 0.85

T-test 10.50*** 13.58*** 17.45*** 18.70*** 18.89*** 18.67*** 21.45*** 22.28*** 22.31***

Donations

N - - - - - - - - 680 477 694 396 762 418 689 397 638 334

Mean - - - - - - - - 0.14 0.40 0.13 0.36 0.14 0.23 0.07 0.22 0.08 0.09

T-test - - - - - - - - 4.97*** 4.49*** 1.24 1.77 0.31

Deposits

N - - 171 124 251 153 352 234 525 324 662 357 846 459 809 453 757 388

Mean - - 0.39 0.28 0.33 0.20 0.45 0.33 0.44 0.31 0.40 0.29 0.44 0.30 0.43 0.29 0.40 0.26

T-test - 2.03** 3.22*** 2.02** 2.97*** 3.29*** 4.20*** 4.14*** 4.10***

ROA

N 178 144 292 240 445 323 547 416 627 441 681 388 778 395 713 387 698 340

Mean 0.01 -0.02 0.00 -0.03 0.01 -0.03 0.02 -0.01 0.02 -0.02 0.02 -0.03 0.01 -0.02 0.01 -0.03 0.02 0.00

T-test 2.05** 3.10*** 4.17*** 3.62*** 5.87*** 6.19*** 4.03*** 3.05*** 1.51

M

a

r

g

i

n

O

p

e

r

a

t

i

n

g

c

o

s

t

s

S

o

l

v

e

n

c

y

S

i

z

e

R

i

s

k

A

g

e

A

v

e

r

a

g

e

L

o

a

n

p

e

r

b

o

r

r

o

w

e

r

W

o

m

e

n

b

o

r

r

o

w

e

r

s

D

o

n

a

t

i

o

n

s

D

e

p

o

s

i

t

s

R

O

A

Margin 1

Operating

costs

0.63

1

[0.54]

Solvency

0.27 0.17

1

[0.30] [0.20]

Size

-0.19 -0.31 -0.28

1

[-0.09] [-0.28] [-0.19]

Risk

0.00 0.02 0.03 -0.05

1

[0.03] [0.04] [0.00] [-0.06]

Age

-0.19 -0.21 -0.18 0.31 -0.03

1

[-0.09] [-0.18] [-0.13] [0.39] [-0.03]

Average Loan

per borrower

-0.21 -0.20 -0.01 0.19 0.00 -0.01

1

[0.10] [-0.01] [0.00] [0.21] [-0.03] [0.01]

Women

Borrowers

0.20 0.23 0.02 -0.20 -0.02 -0.02 -0.31

1

[0.03] [-0.01] [-0.11] [0.09] [0.00] [0.12] [-0.25]

Donations

-0.06 0.21 0.13 -0.14 0.01 -0.08 -0.01 0.01

1

[-0.12] [0.30] [0.04] [-0.14] [0.05] [-0.09] [-0.07] [0.01]

Deposits

-0.27 -0.18 -0.39 0.10 0.00 0.22 0.02 -0.14 -0.04

1

[-0.06] [-0.04] [-0.20] [-0.07] [0.00] [0.05] [0.02] [-0.15] [-0.04]

ROA

0.23 -0.57 0.09 0.15 -0.03 0.07 0.01 -0.06 -0.33 -0.05

1

[0.22] [-0.67] [0.05] [0.23] [-0.02] [0.14] [0.09] [0.04] [-0.45] [0.00]

Table 3. Pooled Pearsons correlation coefficients for both groups. The top figures

correspond to ALS > $300 group, with Average Loan Size over $300, and the figures in

brackets correspond to the ALS < $300 group, with Average Loan Size under $300.

Table 4. Dependent variable: net interest margin. Panel data, random model. ** significant

at 5% level; *** significant at 1% level

Variable

(1) (2) (3) (4)

ALS>$300 ALS<$300 ALS>$300 ALS<$300 ALS>$300 ALS<$300 ALS>$300 ALS<$300

Operating

costs

0.6315*** 0.2466*** 0.6534*** 0.3305*** 0.6577*** 0.3999*** 0.6357*** 0.3311***

(14.12) (3.31) (15.09) (3.67) (14.89) (3.52) (13.93) (3.44)

Solvency 0.1006*** 0.0483*** 0.1077*** 0.0578*** 0.0957*** 0.0579*** 0.0926*** 0.0539***

(6.82) (2.71) (6.49) (3.1) (5.47) (3.18) (5.16) (2.84)

Risk -0.0241 -0.0602 -0.0409 -0.0324 -0.0339 -0.0191 -0.0446 -0.1017

(-0.62) (-0.69) (-1.12) (-0.33) (-0.9) (-0.14) (-1.18) (-0.99)

Age -0.0013*** 0.0003 -0.0012*** -0.0007 -0.0011*** -0.0005 -0.0012*** -0.0005

(-4.81) (0.59) (-4.94) (-1.18) (-4.78) (-0.88) (-5.03) (-0.87)

Financial

inclusion

-0.0005*** -0.0008*** -0.0004*** -0.008*** -0.0004*** -0.0008*** -0.0004** -0.0008**

(-3.13) (-3.22) (-2.71) (-2.99) (-2.74) (-2.95) (-2.86) (-2.82)

Donations -0.0432*** -0.0281*** -0.0430*** -0.0281*** -0.0385*** -0.0282***

(-5.65) (-5.20) (-4.60) (-5.22) (-5.23) (-5.08)

Deposits -0.0099*** -0.0174*** -0.0106** -0.0180***

(-2.73) (-3.32) (-2.55) (-3.38)

Women

borrowers

0.0336*** -0.0130

(3.24) (-0.91)

Constant 0.1045*** 0.1889*** 0.0995*** 0.1799*** 0.1062*** 0.1815*** 0.0835*** 0.1737***

(9.36) (7.39) (9.05) (5.95) (8.61) (5.64) (7.49) (5.77)

N obs

R

2

3028 1810 2523 1445 2500 1431 2267 1341

0.5671 0.3257 0.6031 0.4362 0.6123 0.4365 0.6086 0.4294

Wald Chi

2

400.68 68.05 372.61 105.77 499.20 120.45 545.73 65.88

p-value

0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000

Chow test 134.34 46.40 39.90 37.21

p-value 0.000 0.000 0.000 0.000

Variable

(5) (6) (7) (8)

ALS>$300 ALS<$300 ALS>$300 ALS<$300 ALS>$300 ALS<$300 ALS>$300 ALS<$300 S-S Test

Operating

costs

0.6343*** 0.3265*** 0.6314*** 0.3255*** 0.6211*** 0.3238*** 0.6266*** 0.3265***

2.87***

(13.83) (3.39) (13.77) (3.39) (13.42) (3.37) (13.63) (3.41)

Solvency

0.0942*** 0.0538** 0.0918*** 0.0527** 0.0895*** 0.0522*** 0.0928*** 0.0529** 1.50

(5.17) (2.78) (5.12) (2.79) (4.98) (2.76) (5.22) (2.80)

Risk

-0.0438 -0.1026 -00463 -0.1004 -0.0521 -0.1033 -0.0484 -0.1029 0.52

(-1.17) (-1.00) (-1.23) (-0.97) (-1.39) (-1.01) (-1.31) (-1.00)

Age

-0.0011*** -0.0005 -0.0012*** -0.0006 -0.0013*** -0.0007 -0.0009*** -0.0002 1.10

(-4.87) (-0.90) (-5.06) (-1.07) (-4.89) (-1.14) (-4.14) (-0.36)

Financial

inclusion

-0.0004** -0.0008** -0.0004** -0.0008** -0.0004** -0.0009** -0.0003** -0.0009*** 1.15

(-2.86) (-2.9) (-3.00) (-2.92) (-2.46) (-3.07) (-2.42) (-3.08)

Donations

-0.0377*** -0.0282*** -0.0379*** -0.0283*** -0.0378*** -0.0283*** -0.0377*** -0.0281***

1.04

(-5.15) (-5.12) (-5.08) (-5.13) (-5.16) (-5.14) (-5.27) (-5.11)

Deposits

-0.1402*** -0.0189*** -0.0111** -0.0181*** -0.0071* -0.1629*** -0.0087** -0.0165** 1.08

(-3.23) (-3.54) (-2.64) (-3.38) (-1.72) (-3.31) (-2.07) (-2.93)

Women

borrowers

0.0386*** -0.0131 0.0351*** -0.0152 0.0339*** -0.0157 0.0362*** -0.0116 2.72**

(3.58) (-0.87) (3.38) (-1.05) (3.28) (-1.08) (3.49) (-0.79)

NGO

-0.0135* -0.0047

0.67

(-1.9) (-0.42)

BANK

-0.0067 -0.0277

0.61

(-0.50) (-0.87)

COOP

-0.0271*** -0.0425**

0.82

(-4.61) (-2.41)

NBFI

0.0271*** 0.0305**

0.22

(3.83) (2.13)

Constant

0.0974*** 0.2033*** 0.0979*** 0.2041*** 0.1033*** 0.2088*** 0.0819*** 0.1911***

2.65**

(7.79) (5.51) (7.70) (5.50) 7.95 (5.51) (6.52) (5.30)

N obs 2265 1335 2265 1335 2265 1335 2265 1335

R

2

0.6140 0.4305 0.6107 0.4337 0.6148 0.4329 0.6187 0.4310

Wald Chi

2

587.46 117.7 541.71 111.75 628.01 117.68 554.81 109.87

p-value 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.000

Chow test 30.13 30.33 30.37 30.45

p-value 0.000 0.000 0.000 0.000

Table 4 (continued). Dependent variable: net interest margin. Panel data, random model.

S-S test: Smith-Satterthwaite test. * significant at 10% level ** significant at 5% level; ***

significant at 1% level

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- GMAT Real ExamДокумент37 страницGMAT Real Exambrentk112100% (2)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Online BankingДокумент46 страницOnline BankingNazmulHasanОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Registration of Domestic Corporation - SecДокумент6 страницRegistration of Domestic Corporation - SecJuan FrivaldoОценок пока нет

- Renovating For Profit PDFДокумент23 страницыRenovating For Profit PDFgreen1up100% (1)

- EMS Full ProjectДокумент31 страницаEMS Full ProjectSarindran RamayesОценок пока нет

- Logan Christopher - Guide To HandstandДокумент22 страницыLogan Christopher - Guide To Handstandbrentk112100% (1)

- Repo Vs Reverse RepoДокумент9 страницRepo Vs Reverse RepoRajesh GuptaОценок пока нет

- Risk Analysis of Project Time and Cost Through Monte Carlo MethodДокумент68 страницRisk Analysis of Project Time and Cost Through Monte Carlo MethoddeeptiОценок пока нет

- Hotel Financial Model 2013 Complete V6-Xls 2Документ59 страницHotel Financial Model 2013 Complete V6-Xls 2AjayRathorОценок пока нет

- Case 25-27Документ4 страницыCase 25-27Alyk Tumayan CalionОценок пока нет

- Free Cash Flow Waterfall TutorialДокумент5 страницFree Cash Flow Waterfall Tutorialbrentk112Оценок пока нет

- Tall FinДокумент8 страницTall Finbrentk112Оценок пока нет

- Wso Case Study For MF - PruДокумент23 страницыWso Case Study For MF - Prubrentk112Оценок пока нет

- Tall TallerДокумент10 страницTall Tallerbrentk112Оценок пока нет

- Korea TripДокумент5 страницKorea Tripbrentk112Оценок пока нет

- Spring 2014 Career Expo Participants: Company Name Specific Area (S) of Concentration Types of PositionsДокумент2 страницыSpring 2014 Career Expo Participants: Company Name Specific Area (S) of Concentration Types of Positionsbrentk112Оценок пока нет

- Deakin Research Online: This Is The Published VersionДокумент25 страницDeakin Research Online: This Is The Published Versionbrentk112Оценок пока нет

- Reading - Parable of Sadhu, Few Ques, 5pДокумент5 страницReading - Parable of Sadhu, Few Ques, 5pbrentk112Оценок пока нет

- Pera Pera Penguin 63Документ1 страницаPera Pera Penguin 63brentk112100% (1)

- Pera Pera Penguin 66Документ1 страницаPera Pera Penguin 66brentk112Оценок пока нет

- Fishes of Hawaii PDFДокумент14 страницFishes of Hawaii PDFbrentk112Оценок пока нет

- Article On Weather Index InsuranceДокумент3 страницыArticle On Weather Index InsuranceOmkar PandeyОценок пока нет

- Ch09.doc (2) Joint CostingДокумент37 страницCh09.doc (2) Joint CostingAnna CabreraОценок пока нет

- p3 Acc 110 ReviewerДокумент12 страницp3 Acc 110 ReviewerRona Amor MundaОценок пока нет

- MeaningДокумент2 страницыMeaningHappy BawaОценок пока нет

- Financial AccountingДокумент4 страницыFinancial AccountingManish KushwahaОценок пока нет

- Module 3 - Topic 3 - Topic NotesДокумент38 страницModule 3 - Topic 3 - Topic NotesHa Vi TrinhОценок пока нет

- Presentation On Secondary MarketДокумент18 страницPresentation On Secondary MarketAnonymous fxdQxrОценок пока нет

- Overview of Financial Statement Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedДокумент45 страницOverview of Financial Statement Analysis: Mcgraw-Hill/Irwin ©2007, The Mcgraw-Hill Companies, All Rights ReservedMutiara RamadhaniОценок пока нет

- USA CMA Part 1 2021 Syllabus in DetailДокумент4 страницыUSA CMA Part 1 2021 Syllabus in DetailHimanshu TalwarОценок пока нет

- IDBI Bank Schedule of Service Charges Home Loan Mortgage Loan 05112012Документ3 страницыIDBI Bank Schedule of Service Charges Home Loan Mortgage Loan 05112012Arijit DuttaОценок пока нет

- Final ITC Vs HULДокумент15 страницFinal ITC Vs HULpurvish13Оценок пока нет

- Philippine Association of Certified Tax Technicians: D. NoneДокумент2 страницыPhilippine Association of Certified Tax Technicians: D. Noneucc second yearОценок пока нет

- FIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedДокумент26 страницFIN-1149-Finance For Non-Finance Managers-Module HANDBOOK - 2022-23 - UpdatedTyka TrầnОценок пока нет

- Spaze TowerДокумент1 страницаSpaze TowerShubhamvnsОценок пока нет

- Investment BKG - SyllabusДокумент3 страницыInvestment BKG - SyllabusAparajita SharmaОценок пока нет

- BBTX4203 Taxation II - Eaug20Документ296 страницBBTX4203 Taxation II - Eaug20MUHAMMAD ZAKI BIN BASERI STUDENTОценок пока нет

- FS DescriptionДокумент4 страницыFS DescriptionAlfonso Elpedez PernetoОценок пока нет

- The Anonymous CallerДокумент2 страницыThe Anonymous CallerMardhiana FilzaОценок пока нет

- 1 Objectives and Scope of Financial ManagementДокумент5 страниц1 Objectives and Scope of Financial ManagementShayneОценок пока нет

- Treasury Management Presentation Group 6Документ24 страницыTreasury Management Presentation Group 6David AkoОценок пока нет

- MBA731 Class Activity Question 2 CashflowДокумент5 страницMBA731 Class Activity Question 2 CashflowWisdom MandazaОценок пока нет

- A Study of Derivatives Market in India and Its Current Position in Global Financial Derivatives MarketДокумент11 страницA Study of Derivatives Market in India and Its Current Position in Global Financial Derivatives MarketAvishekОценок пока нет

- AON Kelompok 5Документ39 страницAON Kelompok 5Berze VessaliusОценок пока нет