Академический Документы

Профессиональный Документы

Культура Документы

Reliance MF

Загружено:

Aditya VardhanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Reliance MF

Загружено:

Aditya VardhanАвторское право:

Доступные форматы

RELIANCE MUTUAL FUND, HUBLI

KARNATAK UNIVERSITY

DHARWAD

Kaizen Eduplus Societys

INSTITUTE O E!"E##EN"E IN

$ANA%E$ENT S"IEN"E&

Ta'i(al Indust'ial A'ea& Ai'po't Road&

Hu)li*+,

-$ASTER O .USINESS AD$INISTRATION/

A

0RO1E"T RE0ORT

ON

A STUDY ON PERFORMANCE ANALYSIS OF RELIANCE MUTUAL FUND FOR

LAST 3 YEARS WITH REFERENCE TO HUBLI

SU.$ITTED .Y2

SUSH$A S YE#ISHIRUR

$3.3A3 IVt( SE$ESTER

KUD NO2 $.A45556575

+545*+54+

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 1

Internal Guide:

Prof.Veena

Angadi

Lecturer, IEMS

External Guide:

Mr. Manikand Kuttah

Sales anager

RELIANCE MUTUAL FUND, HUBLI

DECLARATION

I, SUSHMA S YELISHIRUR MBA 4th semester student of KESs Institute of

Excellence in mn!ement Science "IEMS#, Hu$li here$% declre tht &ro'ect (or)

entitled stud% on &erformnce nl%sis of relince mutul fund for lst * %ers (ith reference

to Hu$li su$mitted to Krnt) Uni+ersit%, ,hr(d- .his &ro'ect re&ort is $onfied (or)

&re&red $% me under the !uidnce of /rof- 0een An!di-

I here$% confirm tht this &ro'ect re&ort on 1 stud% on &erformnce nl%sis of relince mutul

fund for lst * %ers (ith reference to Hu$li2 hs $een undert)en $% me durin! the sid &eriod

s &rt of m% cdemic curriculum-

I further declre tht, to m% $est )no(led!e nd $eliefs the mtter &resented in this

&ro'ect re&ort is &re&red $% me nd of m% o(n efforts-

,te3 Sushm S Yelishirur

/lce3 Hu$li M.B.A II Sem

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 2

RELIANCE MUTUAL FUND, HUBLI

Acknowe!"emen#

.his &ro'ect (ould $e incom&lete (ithout the ex&ression of (ords of sim&le !rtitude to the

&eo&le (ho mde it &ossi$le, so I t)e this o&&ortunit% to thn) them ll (ho directl% or

indirectl% hel&ed me lot to com&lete this &ro'ect successfull%-

4irst of ll, I (ould li)e to thn) m% &ro'ect !uide M$. M%n&k%n! '(##%) w)o &* % Sles

Mn!er of Relince Mutul 4und, Hu$li for h+in! &ro+ided me n o&&ortunit% to undert)e

m% &ro'ect in their or!ni5tion nd lso for his co6o&ertion, (hich hel&ed me lot to com&lete

m% &ro'ect-

I (ould li)e to ex&ress m% !ret res&ect to D$. S)$&n&+%* P%#&, ,irector, KES Societ%s

Institute of Excellence in Mn!ement Sciences for his encour!ement-

I ex&ress m% hertil% !rtitude to our fcult% 7 internl !uide, P$o,.-een%.An"%!& for their

excellent !uidnce e+er6ende+orin! su&&ort to under!o 8 months &ro'ect (ith (hose su&&ort

mde me su$mit this &ro'ect re&ort-

Lst $ut not the lest I (ould ex&ress m% sincere thn) m% &rents m% friends nd ll the &eo&le

(ho h+e directl% indirectl% hel&ed me to com&lete this &ro'ect successfull%

S(*)m% S Ye&*)&$($

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 3

RELIANCE MUTUAL FUND, HUBLI

9:;.E;.S

CHAPTERS

INDE.

PA/E NO.

E.ECUTI-E SUMMARY

C)%0#e$ I

INTRODUCTION

Introduction $out the to&ic

:$'ecti+es of the stud%

Limittions of the stud%

H%&othesis

C)%0#e$ II OR/ANI1ATION2COMPANY PROFILE

C)%0#e$ III

RESEARCH METHODOLO/Y

Stud% re

.%&es of dt used in stud%

C)%0#e$ I- ANALYSIS AND INTERPRETATION

C)%0#e$ -

FINDIN/S3 SU//ESTION AND

CONCLUSION

4indin!s of the stud%

Su!!estions<Recommendtions of the stud%

9onclusion

BIBLIO/RAPHY

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 4

RELIANCE MUTUAL FUND, HUBLI

E8ecuti9e Su::a'y

;o( d%, there is tou!h com&etition in finncil +enues due to increse in the in+estment

&roducts- /eo&le cn !et mn% in+estment o&tions to in+est their s+in!s- Selectin! one from the

mn% +il$le o&tions considerin! mn% ssocited fctors is +er% com&lex &rocess so

in+estin! in mutul fund is the $est (% to select the in+estment o&tion ccordin! to their

in+estment o$'ecti+e-

Relince Mutul 4und "=RM4=< =Mutul 4und=# is one of Indis ledin! Mutul 4unds,

(ith A+er!e Assets Under Mn!ement "AAUM# of Rs- >, ?>,@AA 9rores nd n in+estor count

of o+er BB-A> Lc) folios- "AAUM nd in+estor count Cn6Mr 8?>>- In this &ro'ect I tried m%

$est to !i+e ide $out Mutul fund industr% in Indi, +rious Mutul fund com&n% +il$le

in Indi, $enefits from in+estin! in mutul fund nd re!ultor% $od% for controllin! the mutul

fund cti+ities- .o )no( the &erformnce of the scheme +rious fctor li)e ris) nd return,

in+estment &ttern, to& holdin!s fund lloction nd mn% other hs $een considered

.he stud% is conducted on 1A stud% on &erformnce nl%sis of relince mutul fund for

lst * %ers2 (ith reference to Hu$li-

In this &ro'ect I studied the schemes of Relince Mutul fund nd +rious schemes

+il$le in the com&n%, (hich hel&ed me in )no(in! ho( the schemes re &erformin! nd the

resons $ehind it-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 5

RELIANCE MUTUAL FUND, HUBLI

Topic o; t(e study2

-A study on pe';o':ance analysis o; 'eliance :utual ;und ;o' last < yea's =it(

'e;e'ence to Hu)li/

o)>ecti9es o; t(e study2

.o understnd the conce&t of mutul fund, (or)in! nd mechnism nd

t%&es of mutul fund trded in Indi-

.o )no( the &erformnce of Relince mutul fund scheme-

.o e+lute the &erformnce of mutul fund in the terms of ris) nd return-

.o &&rise in+estment &erformnce of mutul funds (ith ris) d'ustment 7

theoreticl &rmeters s su!!ested $% Shr&e nd .re%nors-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 6

RELIANCE MUTUAL FUND, HUBLI

$et(odolo?y

Sou'ce o; data collection

The data is collected in two form namely Primary data and secondary data.

0'i:a'y Data2

/rimr% ,t (s !thered from discussion (ith the clients of the com&n% nd the

com&n% officils

Seconda'y Data2

.he secondr% dt (s !thered from, internet nd m!5ine- Mutul 4und relted

m!5ines li)e Mutul 4und Re+ie(, Mutul 4und Insi!ht $% +lue reserchers, :utloo)

Mone%- 4ct Sheets of Relince Mutul 4und nd H,49 Mutul 4und

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 7

RELIANCE MUTUAL FUND, HUBLI

F&n!&n"* o, #)e *#(!4

In the $o+e cse the Relince !ro(th fund return is >?-* hs com&red to

$enchmr) return is @-D-

9om&red to other funds the stndrd de+ition of Relince Bn)in! fund is

4-?*D4 $% this (e cn conclude there is more fluctutions-

Relince di+ersified &o(er sector fund does not sho(s the !ood returns s it

Is under &erformin! its Shr&e rtio is 6?-??EA-

/erformnce rtio of Relince /hrm fund is in ne!ti+e 6?-88?>-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 8

RELIANCE MUTUAL FUND, HUBLI

Su??estions@Reco::endations

If the in+estors (nt to !o for minimum ris) then the% cn d&t Relince

/hrm fund- Ris) is ?-@4B>

In+estor hs to select Relince Bn)in! fund $ecuse the ris) is >->?@4 nd

the return is >*-

In+estors cn Fuit from Relince ,i+ersified /o(er sector fund nd Relince

/hrm fund $ecuse it is under &erformin!-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 9

RELIANCE MUTUAL FUND, HUBLI

"onclusions

Lot of &rcticl )no(led!e hs !ined $% me $% crr%in! m% &ro'ect in Relince

Mutul 4und Hu$li- It is one of the ledin! com&n%- 4inll% I cn conclude tht

Guidnce is n im&ortnt criterion for the in+estors to m)e them (re $out

mutul fund schemes nd their returns- Hence sset mn!ement com&nies should

strt &romotionl cm&i!ns for ex&lorin! the )no(led!e nd informtion $out

the mutul fund-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 10

RELIANCE MUTUAL FUND, HUBLI

9HA/.ER I

I;.R:,U9.I:;

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 11

RELIANCE MUTUAL FUND, HUBLI

In#$o!(c#&on

Mutul fund is +er% hot conce&t in t(o tier cities $ecuse these cities re !ro(in! t

fster rte- And t the eFul rte the stndrd of li+in! lso incresin!, &eo&le !ettin! hi!her

ex&osures in their 'o$s mens the% re !ettin! hi!her slries thts (h% the% re no( loo)in!

ne( in+estment o&&ortunities- .here for .his &ro'ect re&ort is (ritten in such (% tht the

reder of the &ro'ect !et cler understndin! of conce&t i-e- the mutul fund conce&t, t%&es of

mutul funds in Indi, ex&lins the &ros nd cons of the conce&t nd the four &hses of mutul

fund industr% in Indi-

MEANIN/ OF FINANCIAL PERFORMANCE ANALYSIS

Exmintion of +rious finncil &erformnce indictors in com&rison (ith the results chie+ed

$% the com&etin! firms of $out the sme si5e-

It is to e+lute mone% mn!er=s &erformnce $sed on &erformnce ttri$ution nl%sis- .his

t%&e of nl%sis fctors in num$er of elements tht cn ffect &erformnce such s mr)et

timin! nd securit% selection-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 12

RELIANCE MUTUAL FUND, HUBLI

O56ec#&+e* o, #)e *#(!47

.o understnd the conce&t of mutul fund, (or)in! nd mechnism nd

t%&es of mutul fund trded in Indi-

.o )no( the &erformnce of Relince mutul fund Relince mutul fund

scheme-

.o e+lute the &erformnce of mutul fund in the terms of ris) nd return-

.o &&rise in+estment &erformnce of mutul funds (ith ris) d'ustment

the theoreticl &rmeters s su!!ested $% Shr&e-

L&m&#%#&on* o, #)e *#(!47

.he dt collection (s strictl% confined to secondr% sources-

9ollectin! historicl ;A0 is +er% difficult-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 13

RELIANCE MUTUAL FUND, HUBLI

9HA/.ER II

:RGA;ISA.I:; < 9:M/A;Y /R:4ILE

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 14

RELIANCE MUTUAL FUND, HUBLI

P$o,&e o, Re&%nce m(#(% ,(n!

Relince 9&itl Asset Mn!ement Limited "R9AM# is n unlisted /u$lic Limited 9om&n%

incor&orted under the 9om&nies Act, >D@B on 4e$rur% 84, >DD@, h+in! its re!istered office

t HRelince HouseH, ;er- Mrdi /l5, :ff- 9-G- Rod, Ahmd$d, *E? ??B nd its

9or&orte :ffice t :ne Indi$ulls 9entre, .o(er >, >> >8 4loors, Cu&iter Mills 9om&ound ,

E4>, Sen&ti B&t Mr!, El&hinstone Rod, Mum$i 4?? ?>*- R9AM hs $een &&ointed s

the Asset Mn!ement com&n% of Relince Mutul 4und $% the .rustees of Relince Mutul

4und +ide In+estment Mn!ement A!reement "IMA# dted M% >8, >DD@ nd executed

$et(een Relince 9&itl .rustee 9o- Limited nd Relince 9&itl Asset Mn!ement Limited

nd mended on Au!ust >8, >DDA nd mended on Au!ust >8, >DDA, Cnur% 8?, 8??4 nd

4e$rur% >A, 8?>> in line (ith SEBI "Mutul 4unds# Re!ultions, >DDB-

/ursunt to this IMA, R9AM is ctin! s the In+estment Mn!er of the Mutul 4und- .he net

(orth of the Asset Mn!ement 9om&n% $sed unutdited finncils sttements s on

Se&tem$er *?, 8?>? is Rs- >,>*D-*8 9rore-

Relince Mutul 4und "=RM4=< =Mutul 4und=# is one of Indis ledin! Mutul 4unds, (ith

A+er!e Assets Under Mn!ement "AAUM# of Rs- >,?>,@AA 9rores nd n in+estor count of

o+er BB-A> L)h folios- "AAUM nd in+estor count Cn Mr 8?>>#-

Relince Mutul 4und, &rt of the Relince Grou&, is one of the fstest !ro(in! mutul funds

in Indi- RM4 offers in+estors (ell rounded &ortfolio of &roducts to meet +r%in! in+estor

reFuirements nd hs &resence in >@D cities cross the countr%- Relince Mutul 4und constntl%

ende+ors to lunch inno+ti+e &roducts nd customer ser+ice inititi+es to increse +lue to

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 15

RELIANCE MUTUAL FUND, HUBLI

in+estors- Relince 9&itl Asset Mn!ement Limited "IR9AM# is the sset mn!er of

Relince Mutul 4und- R9AM su$sidir% of Relince 9&itl Limited, (hich holds D*-*AJ of

the &id u& c&itl of R9AM, the $lnce &id u& c&itl $ein! held $% minorit% shreholders-

Relince 9&itl Ltd- is one of Indis ledin! nd fstest !ro(in! &ri+te sector finncil

ser+ices com&nies, nd rn)s mon! the to& * &ri+te sector finncil ser+ices nd $n)in!

com&nies, in terms of net (orth- Relince 9&itl Ltd- hs interests in sset mn!ement, life

nd !enerl insurnce, &ri+te eFuit% nd &ro&rietr% in+estments, stoc) $ro)in! nd other

finncil ser+ices-

S&onsor3 Relince 9&itl Limited

.rustee3 Relince 9&itl .rustee 9o- Limited

In+estment Mn!er < AM93 Relince 9&itl Asset Mn!ement Limited

Sttutor% ,etils3 .he S&onsor, the .rustee nd the In+estment Mn!er re incor&orted under

the 9om&nies Act >D@B-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 16

RELIANCE MUTUAL FUND, HUBLI

H&*#o$4 o, M(#(% ,(n!

.he mutul fund industr% in Indi strted in >DB* (ith the formtion of Unit .rust of Indi, t the

inititi+e of the Go+ernment of Indi nd Reser+e Bn)- .he histor% of mutul funds in Indi cn

$e $rodl% di+ided into four distinct &hses-

P)%*e* o, m(#(% F(n!

F&$*# P)%*e7 89:; 89<=

An Act of /rliment est$lished Unit .rust of Indi "U.I# on >DB*- It (s set u& $% the reser+e

Bn) of Indi nd functioned under the Re!ultor% nd dministrti+e control of the

Reser+e Bn) of Indi- In >DAE U.I (s de lin)ed from the RBI nd the Industril ,e+elo&ment

Bn) of Indi "I,BI# too) o+er the re!ultor% nd dministrti+e control in&lce of RBI- .he

first scheme lunched $% U.I (s Unit Scheme >DB4- At the end of >DEE U.I hd Rs-B,A??

crores of ssets under mn!ement-

Secon! P)%*e7 89<= 8993 >En#$4 o, P(5&c Sec#o$ F(n!*?

>DEA mr)ed the entr% of non U.I, &u$lic sector mutul funds set u& $% &u$lic sector $n)s nd

Life Insurnce 9or&ortion of Indi "LI9# nd Generl Insurnce 9or&ortion of Indi "GI9#-

SBI Mutul 4und (s the first non U.I Mutul 4und est$lished in Cune >DEA follo(ed $%

9nr $n) Mutul 4und ",ec EA#, /un'$ ;tionl Bn) Mutul 4und "Au! ED#, Indin Bn)

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 17

RELIANCE MUTUAL FUND, HUBLI

Mutul 4und ";o+ ED#, Bn) of Indi "Cun D?#, Bn) of Brod Mutul 4und ":ct D8#- LI9

est$lished its mutul fund in Cune >DED (hile GI9 hd set u& its mutul fund in ,ecem$er

>DD?- At the end of >DD*, the mutul fund industr% hd ssets under mn!ement of Rs-4A, ??4

crores-

T)&$! P)%*e7 8993 @AA3 >En#$4 o, P$&+%#e Sec#o$ F(n!*?

Kith the entr% of &ri+te sector funds in >DD*, ne( er strted in the Indin mutul fund

industr%, !i+in! the Indin in+estors (ider choice of fund fmilies- Also, >DD* (s the %er in

(hich the first Mutul 4und Re!ultions cme into $ein!, under (hich ll mutul funds, exce&t

U.I (ere to $e re!istered nd !o+erned- .he erst(hile Kothri /ioneer "no( mer!ed (ith

4rn)lin .em&leton# (s the first &ri+te sector mutul fund re!istered in Cul% >DD*-.he >DD*

SEBI "Mutul 4und# Re!ultions (ere su$stituted $% more com&rehensi+e nd re+ised Mutul

4und Re!ultions in >DDB-

.he industr% no( functions under the SEBI "Mutul 4und# Re!ultions >DDB- .he

num$er of mutul fund houses (ent on incresin!, (ith mn% forei!n mutul funds settin! u&

funds in Indi nd lso the industr% hs (itnessed se+erl mer!ers nd cFuisitions- As t the end

of Cnur% 8??*, there (ere ** mutul funds (ith totl ssets of Rs- >,8>,E?@ crores- .he Unit

.rust of Indi (ith Rs-44,@4> crores of ssets under mn!ement (s (% hed of other mutul

funds-

Fo($#) P)%*e B *&nce Fe5$(%$4 @AA3

In 4e$rur% 8??*, follo(in! the re&el of the Unit .rust of Indi Act >DB* U.I (s $ifurcted

into t(o se&rte entities- :ne is the S&ecified Undert)in! of the Unit .rust of

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 18

RELIANCE MUTUAL FUND, HUBLI

Indi (ith ssets under mn!ement of Rs-8D,E*@ crores s t the end of Cnur% 8??*,

re&resentin! $rodl%, the ssets of US B4 scheme, ssured return nd certin other schemes- .he

S&ecified Undert)in! of Unit .rust of Indi, functionin! under n dministrtor nd under the

rules frmed $% Go+ernment of Indi nd does not come under the &ur+ie( of the Mutul 4und

Re!ultions-

.he second is the U.I Mutul 4und Ltd, s&onsored $% SBI, /;B, B:B nd LI9- It is

re!istered (ith SEBI nd functions under the Mutul 4und Re!ultions- Kith the $ifurction of

the erst(hile U.I (hich hd in Mrch 8??? more thn Rs-AB,??? crores of ssets under

mn!ement nd (ith the settin! u& of U.I Mutul 4und, conformin! to the SEBI Mutul

4und Re!ultions, nd (ith recent mer!ers t)in! &lce mon! different &ri+te sector funds, the

mutul fund industr% hs entered its current &hse of consolidtion nd !ro(th- As t the end of

:cto$er *>, 8??*, there (ere *> funds, (hich mn!e ssets of Rs->8BA8B crores under *EB

schemes-

$eanin? o; :utual ;und

A mutul fund is nothin! more thn collection of stoc)s nd<or $onds- You cn thin) of

mutul fund s com&n% tht $rin!s to!ether !rou& of &eo&le nd in+ests their mone% in

stoc)s, $onds, nd other securities- Ech in+estor o(ns shres, (hich re&resent &ortion of the

holdin!s of the fund-

A!+%n#%"e* o, M(#(% F(n!*7

T)e %!+%n#%"e* o, &n+e*#&n" &n % M(#(% F(n! %$e7

D&+e$*&,&c%#&on3 .he $est mutul funds desi!n their &ortfolios so indi+idul in+estments

(ill rect differentl% to the sme economic conditions- 4or exm&le, economic conditions

li)e rise in interest rtes m% cuse certin securities in di+ersified &ortfolio to

decrese in +lue- :ther securities in the &ortfolio (ill res&ond to the sme economic

conditions $% incresin! in +lue- Khen &ortfolio is $lnced in this (%, the +lue of

the o+erll &ortfolio should !rdull% increse o+er time, e+en if some securities lose

+lue-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 19

RELIANCE MUTUAL FUND, HUBLI

P$o,e**&on% M%n%"emen#7 Most mutul funds &% to&fli!ht &rofessionls to mn!e

their in+estments- .hese mn!ers decide (ht securities the fund (ill $u% nd sell-

Re"(%#o$4 o+e$*&")#7 Mutul funds re su$'ect to mn% !o+ernment re!ultions tht

&rotect in+estors from frud-

L&C(&!+ It=s es% to !et %our mone% out of mutul fund- Krite chec), m)e cll,

nd %ou=+e !ot the csh-

Con+en&ence7 You cn usull% $u% mutul fund shres $% mil, &hone, or o+er the

Internet-

Low co*#7 Mutul fund ex&enses re often no more thn >-@ &ercent of %our in+estment-

Ex&enses for Index 4unds re less thn tht, $ecuse index funds re not cti+el%

mn!ed- Insted, the% utomticll% $u% stoc) in com&nies tht re listed on s&ecific

index-

!isad"antages of Mutual #unds

P$o,e**&on% M%n%"emen# 6 Mn% in+estors de$te (hether or not the &rofessionls re

n% $etter thn %ou or I t &ic)in! stoc)s- Mn!ement is $% no mens inflli$le, nd,

e+en if the fund loses mone%, the mn!er still !ets &id-

Co*#* 3 9retin!, distri$utin!, nd runnin! mutul fund is n ex&ensi+e &ro&osition-

E+er%thin! from the mn!ers slr% to the in+estors sttements cost mone%- .hose

ex&enses re &ssed on to the in+estors- Since fees +r% (idel% from fund to fund, filin!

to &% ttention to the fees cn h+e ne!ti+e lon!6term conseFuences- Remem$er, e+er%

dollr s&end on fees is dollr tht hs no o&&ortunit% to !ro( o+er time- "Lern ho( to

esc&e these costs in Sto& /%in! Hi!h Mutul 4und 4ees-#

D&(#&on 3 It=s &ossi$le to h+e too much di+ersifiction- Becuse funds h+e smll

holdin!s in so mn% different com&nies, hi!h returns from fe( in+estments often don=t

m)e much difference on the o+erll return- ,ilution is lso the result of successful

fund !ettin! too $i!- Khen mone% &ours into funds tht h+e hd stron! success, the

mn!er often hs trou$le findin! !ood in+estment for ll the ne( mone%-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 20

RELIANCE MUTUAL FUND, HUBLI

T%De* 3 Khen fund mn!er sells securit%, c&itl6!ins tx is tri!!ered- In+estors

(ho re concerned $out the im&ct of txes need to )ee& those concerns in mind (hen

in+estin! in mutul funds- .xes cn $e miti!ted $% in+estin! in tx6sensiti+e funds or

$% holdin! non6tx sensiti+e mutul fund in tx6deferred ccount, such s 4?>")# or

IRA- "Lern $out one t%&e of tx6deferred fund in Mone% Mr)et Mutul 4unds3 A

Better S+in!s Account-#

M(#(% F(n! O0e$%#&on Fow C)%$#

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 21

RELIANCE MUTUAL FUND, HUBLI

THE DIFFERENT TYPES OF MUTUAL FUNDS7

Sc)eme* %cco$!&n" #o M%#($ Pe$&o! 7

A mutul fund scheme cn $e clssified into o&en ended scheme or close ended scheme

de&endin! on its mturit% &eriod-

O0en en!e! F(n!2 Sc)eme

An o&en ended fund or scheme is one tht is +il$le for su$scri&tion nd re&urchse on

continuous $sis- .hese schemes do not h+e fixed mturit% &eriod- In+estors cn con+enientl%

$u% nd sell units t ;et Asset 0lue ";A0# relted &rices, (hich re declred on dil% $sis-

.he )e% feture of o&en end schemes is liFuidit%-

Co*e en!e! F(n!2 Sc)eme

A close ended fund or scheme hs sti&ulted mturit% &eriod e-!- @ A %ers- .he fund is o&en

for su$scri&tion onl% durin! s&ecified &eriod t the time of lunch of the scheme- In+estors cn

in+est in the scheme t the time of the initil &u$lic issue nd therefter the% cn $u% or sell the

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 22

RELIANCE MUTUAL FUND, HUBLI

units of the scheme on the stoc) exchn!es (here the units re listed- In order to &ro+ide n exit

route to the in+estors, some close ended funds !i+e n o&tion of sellin! $c) the units to the

mutul fund throu!h &eriodic re&urchse t ;A0 relted &rices- SEBI Re!ultions sti&ulte tht

t lest one of the t(o exit routes is &ro+ided to the in+estor i-e- either re&urchse fcilit% or

throu!h listin! on stoc) exchn!es- .hese mutul funds schemes disclose ;A0 !enerll% on

(ee)l% $sis-

Sc)eme* %cco$!&n" #o In+e*#men# O56ec#&+e7

A scheme cn lso $e clssified s !ro(th scheme, income scheme, or $lnced scheme

considerin! its in+estment o$'ecti+e- Such schemes m% $e o&en ended or close ended schemes

s descri$ed erlier- Such schemes m% $e clssified minl% s follo(s3

/$ow#) 2 EC( O$&en#e! Sc)eme

.he im of !ro(th funds is to &ro+ide c&itl &&recition o+er the medium to lon! term- Such

schemes normll% in+est m'or &rt of their cor&us in eFuities- Such funds h+e

com&rti+el% hi!h ris)s- .hese schemes &ro+ide different o&tions to the in+estors li)e di+idend

o&tion, c&itl &&recition, etc- nd the in+estors m% choose n o&tion de&endin! on their

&references- .he in+estors must indicte the o&tion in the &&liction form- .he mutul funds

lso llo( the in+estors to chn!e the o&tions t lter dte- Gro(th schemes re !ood for

in+estors h+in! lon! term outloo) see)in! &&recition o+er &eriod of time-

Income 2 De5# O$&en#e! Sc)eme

.he im of income funds is to &ro+ide re!ulr nd sted% income to in+estors- Such schemes

!enerll% in+est in fixed income securities such s $onds, cor&orte de$entures, Go+ernment

securities nd mone% mr)et instruments- Such funds re less ris)% com&red to eFuit% schemes-

.hese funds re not ffected $ecuse of fluctutions in eFuit% mr)ets- Ho(e+er, o&&ortunities of

c&itl &&recition re lso limited in such funds- .he ;A0s of such funds re ffected $ecuse

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 23

RELIANCE MUTUAL FUND, HUBLI

of chn!e in interest rtes in the countr%- If the interest rtes fll, ;A0s of such funds re li)el%

to increse in the short run nd +ice +ers- Ho(e+er, lon! term in+estors m% not $other $out

these fluctutions-

B%%nce! F(n!

.he im of $lnced funds is to &ro+ide $oth !ro(th nd re!ulr income s such schemes in+est

$oth in eFuities nd fixed income securities in the &ro&ortion indicted in their offer documents-

.hese re &&ro&rite for in+estors loo)in! for moderte !ro(th- .he% !enerll% in+est 4? B?J

in eFuit% nd de$t instruments- .hese funds re lso ffected $ecuse of fluctutions in shre

&rices in the stoc) mr)ets- Ho(e+er, ;A0s of such funds re li)el% to $e less +oltile com&red

to &ure eFuit% funds-

Mone4 M%$ke# o$ L&C(&! F(n!

.hese funds re lso income funds nd their im is to &ro+ide es% liFuidit%, &reser+tion of

c&itl nd moderte income- .hese schemes in+est exclusi+el% in sfer short term instruments

such s tresur% $ills, certifictes of de&osit, commercil &&er nd inter $n) cll mone%,

!o+ernment securities, etc- Returns on these schemes fluctute much less com&red to other

funds- .hese funds re &&ro&rite for cor&orte nd indi+idul in+estors s mens to &r) their

sur&lus funds for short &eriods-

/&# F(n!

.hese funds in+est exclusi+el% in !o+ernment securities- Go+ernment securities h+e no defult

ris)- ;A0s of these schemes lso fluctute due to chn!e in interest rtes nd other economic

fctor s is the cse (ith income or de$t oriented schemes-

In!eD F(n!*

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 24

RELIANCE MUTUAL FUND, HUBLI

Index 4unds re&licte the &ortfolio of &rticulr index such s the BSE Sensiti+e index, S7/

;SE @? index ";ift%#, etc .hese schemes in+est in the securities in the sme (ei!ht !e

com&risin! of n index- ;A0s of such schemes (ould rise or fll in ccordnce (ith the rise or

fll in the index, thou!h not exctl% $% the sme &ercent!e due to some fctors )no(n s

Htrc)in! errorH in technicl terms- ;ecessr% disclosures in this re!rd re mde in the offer

document of the mutul fund scheme- .here re lso exchn!e trded index funds lunched $%

the mutul funds, (hich re trded on the stoc) exchn!es-

Sec#o$ *0ec&,&c ,(n!*2*c)eme*

.hese re the funds<schemes, (hich in+est in the securities of onl% those sectors or industries s

s&ecified in the offer documents- E-!- /hrmceuticls, Soft(re, 4st Mo+in! 9onsumer Goods

"4M9G#, /etroleum stoc)s, etc- .he returns in these funds re de&endent on the &erformnce of

the res&ecti+e sectors<industries- Khile these funds m% !i+e hi!her returns, the% re more ris)%

com&red to di+ersified funds- In+estors need to )ee& (tch on the &erformnce of those

sectors<industries nd must exit t n &&ro&rite time- .he% m% lso see) d+ice of n ex&ert-

T%D S%+&n" Sc)eme*

.hese schemes offer tx re$tes to the in+estors under s&ecific &ro+isions of the Income .x Act,

>DB> s the Go+ernment offers tx incenti+es for in+estment in s&ecified +enues- e-!- EFuit%

Lin)ed S+in!s Schemes "ELSS#- /ension schemes lunched $% the mutul funds lso offer tx

$enefits- .hese schemes re !ro(th oriented nd in+est &re dominntl% in eFuities- .heir !ro(th

o&&ortunities nd ris)s ssocited re li)e n% eFuit% oriented scheme-

Lo%! o$ no o%! F(n!

A Lod 4und is one tht chr!es &ercent!e of ;A0 for entr% or exit- .ht is, ech time one

$u%s or sells units in the fund, chr!e (ill $e &%$le- .his chr!e is used $% the mutul fund

for mr)etin! nd distri$ution ex&enses- Su&&ose the ;A0 &er unit is Rs->?- If the entr% s (ell

s exit lod chr!ed is >J, then the in+estors (ho $u% (ould $e reFuired to &% Rs->?->? nd

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 25

RELIANCE MUTUAL FUND, HUBLI

those (ho offer their units for re&urchse to the mutul fund (ill !et onl% Rs-D-D? &er unit- .he

in+estors should t)e the lods into considertion (hile m)in! in+estment s these ffect their

%ields<returns- Ho(e+er, the in+estors should lso consider the &erformnce trc) record nd

ser+ice stndrds of the mutul fund, (hich re more im&ortnt- Efficient funds m% !i+e hi!her

returns in s&ite of lods- A no lod fund is one tht does not chr!e for entr% or exit- It mens the

in+estors cn enter the fund<scheme t ;A0 nd no dditionl chr!es re &%$le on &urchse

or sle of units-

O$"%n&E%#&on o, M(#(% F(n!* &n In!&%7F

.here re mn% entities in+ol+ed nd the di!rm $elo( illustrtes the or!ni5tionl set

u& of mutul fund3

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 26

RELIANCE MUTUAL FUND, HUBLI

S#$(c#($e o, M(#(% F(n!

SEBI "Mutul 4und# Re!ultions, >DDB re!ultes the Structure of Mutul 4unds in Indi- Mutul

4unds in Indi re constituted in the form of /u$lic .rust creted under the Indin .rusts Act,

>EE8- .his trust (ill $e creted $% s&onsor of the mutul fund- .he s&onsor (ill m)e initil

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 27

RELIANCE MUTUAL FUND, HUBLI

contri$ution in this trust nd (ill &&oint trustees to hold the ssets of the trust for the $enefit of

the unit holders, (ho re the $eneficir% of the trust- .he trustees (ill &&oint AM9 to ct s

in+estment mn!er of the ssets of the trust- .he AM9 then lunches schemes on $ehlf of

trustees in+itin! in+estors to contri$ute to the common &ool $% $u%in! units of the schemes-

AM9 t)es cre of ll the o&ertions of mn!in! the mone% of the in+estors-

As &er these re!ultions mutul funds should h+e the follo(in! structure3

>- S&onsor

8- .rust<trustee

*- Asset Mn!ement 9om&n%

4- 9ustodin-

S0on*o$

SEBI re!ultions define S&onsor s n% &erson (ho either itself or in ssocition (ith nother

$od% cor&orte est$lishes mutul fund- In sim&le (ords, S&onsor is n entit% tht sets u& the

mutul fund- S&onsor does the follo(in! im&ortnt cti+ities3

>- S&onsor cretes /u$lic .rust under the Indin .rust Act, >EE8

8- S&onsor &&oints trustees to mn!e the trust (ith the &&ro+l of SEBI

*- S&onsor cretes n Asset Mn!ement 9om&n% under the 9om&nies Act, >D@B-

4- S&onsor &&oints nd re!isters the trust s Mutul 4und (ith SEBI-

T$(*#ee

.rustees mn!e .rust- .rustees re res&onsi$le to the In+estors in the Mutul 4unds- .he%

t)e cre of the interests of In+estors in the Mutul 4unds- .rustees cn $e formed in either of

the follo(in! t(o (%s3

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 28

RELIANCE MUTUAL FUND, HUBLI

>- Bord of .rustees "Go+erned $% the &ro+isions of Indin .rust Act, >EE8#, nd

8- .rustee 9om&n% "Go+erned $% the &ro+isions of Indin .rust Act, >EE8 nd 9om&nies Act,

>D@B#

F(nc#&on* o, #$(*#ee*7

L .rustees ensure tht the cti+ities of the mutul fund re in ccordnce (ith SEBI "Mutul

4und # re!ultion >DDB-

L .rustees ensure tht the AM9 hs &ro&er s%stems nd &rocedures in &lce-

L .rustees ensure tht ll the other fund constituents re formed nd tht &ro&er due dili!ence

is exercised $% the AM9 in the &&ointment of constituents nd $usiness ssocites-

L All schemes floted $% the AM9 h+e to $e &&ro+ed $% the trustees-

L .rustees re+ie( nd ensure tht the net (orth of the AM9 is s &er the SEBI sti&ulted

norms-

L .rustees furnish to SEBI, on hlf %erl% $sis, re&ort on the cti+ities of AM9-

A**e# M%n%"emen# Com0%n4 >AMC?

An sset mn!ement com&n% is com&n% re!istered under the 9om&nies Act, >D@B-

S&onsor cretes the sset mn!ement com&n% nd this is the entit%, (hich mn!es the funds

of the mutul fund "trust#- .he mutul fund &%s smll fee to the AM9 for mn!ement of its

fund- .he AM9 cts under the su&er+ision of .rustees nd is su$'ect to the re!ultions of SEBI

too- At &resent there re some *? AM9 in Indi-

AM9 re minl% di+ided into * &rts- .hese re3

>- Bn) s&onsored

8- Institutions, nd

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 29

RELIANCE MUTUAL FUND, HUBLI

*- /ri+te Sector

Restrictions on the $usiness cti+ities of n AM9 Khen n AM9 cts s n In+estment Mn!er

to mutul fund, then it $ecomes +er% im&ortnt to see tht such n AM9 focuses 'ust on its core

$usiness- It lso $ecomes +er% im&ortnt for the re!ultor to ensure tht the cti+ities of AM9s

re not in conflict of ech other- Kith these o$'ecti+es, SEBI hs im&osed some restrictions on

the $usiness cti+ities of n AM9- .hese re3

L An AM9 shll not undert)e n% $usiness cti+it% exce&t in the nture of &ortfolio

mn!ement ser+ices, mn!ement nd d+isor% ser+ices to offshore funds etc, &ro+ided these

cti+ities re not in conflict (ith the cti+ities of the mutul fund-

L An AM9 cnnot in+est in n% of itso(n schemes unless full disclosure of its intention to in+est

hs $een mde in the offer document-

L An M;9 shll not ct s trustee of n% mutul fund-

C(*#o!&%n

.he most im&ortnt sset of n% mutul fund is &ortfolio- Hence it $ecomes +er% im&ortnt to

)ee& sfe the securities- .his res&onsi$ilit% of )ee&in! sfe the securities, (hich re in the

mteril form, re )e&t in sfe custod% (ith 9ustodin- 9ustodin &erforms +er% im&ortnt

$c) office o&ertion- .he% ensure tht deli+er% hs $een t)en of the securities, (hich re

$ou!ht, nd tht the% re trnsferred in the nme of mutul fund- .he% )ee& the in+estment

ccount of the mutul fund- .he% collect nd ccount for the di+idends nd interest recei+$les

on mutul fund in+estments- .he% lso )ee& trc) of +riouscor&orte ctions li)e $onus issue,

ri!ht issue, nd stoc) s&lit, $u% $c) offers, o&en offers etc-

Re!ultions :f Mutul 4unds Mutul 4unds in Indi re re!ulted $% SEBI "Securities nd

Exchn!e Bord of Indi#- All the mutul funds in Indi re re!ulted $% SEBI- SEBI hs frmed

the SEBI "Mutul 4unds# Re!ultions, >DDB, "hereinfter referred to s SEBI Re!ultions# (hich

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 30

RELIANCE MUTUAL FUND, HUBLI

&ro+ides the sco&e of the re!ultions of mutul fund in Indi- It is mndtor% for ll the mutul

funds to !et re!istered (ith SEBI-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 31

RELIANCE MUTUAL FUND, HUBLI

9HA/.ER III

ME.H,:L:GY

$et(odolo?y2

Study A'ea

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 32

RELIANCE MUTUAL FUND, HUBLI

Reliance Mutual Fund, HUBLI

Sou'ce o; data collection

The data is collected in two form namely Primary data and secondary data.

0'i:a'y Data2

/rimr% ,t (s !thered from discussion (ith the clients of the com&n% nd the

com&n% officils

Seconda'y Data2

.he secondr% dt (s !thered from, internet nd m!5ine- Mutul 4und relted

m!5ines li)e Mutul 4und Re+ie(, Mutul 4und Insi!ht $% +lue reserchers, :utloo)

Mone%- 4ct Sheets of Relince Mutul 4und-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 33

RELIANCE MUTUAL FUND, HUBLI

9HA/.ER I0

A;ALYSIS A;, I;.ER/RE.A.I:;

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 34

RELIANCE MUTUAL FUND, HUBLI

Tec)n&C(e* o, %n%4*&*7

8. Re#($n 7

Return on t%&icl in+estment consists of t(o com&onents- .he $sic is the &eriodic csh

recei&ts "or income# on the in+estment, either in the form of interest or di+idends- .he second

com&onent is the chn!e in the &rice of the ssets commonl% clled the c&itl !in or loss-

.his element of return is the difference $et(een the &urchse &rice nd the &rice t (hich the

ssets cn $e or is soldM therefore, it cn $e !in or loss-

.he return hs $een clculted s under3

Re#($n G >En! 0e$&o! NA-F 5e"&nn&n" 0e$&o! NA-?H!&+&!en! $ece&+e!? 25e"&nn&n"

0e$&o! NA-?I8AA

@. R&*k 7

Ris) is neither !ood nor $d- Ris) in holdin! securities is !enerll% ssocited (ith the

&ossi$ilit% tht reli5ed returns (ill $e less thn ex&ected returns- .he difference $et(een the

reFuired rte of returns on mutul fund in+estment nd the ris) free return is the ris) &remium-

Ris) cn $e mesured in terms of Bet 7 stndrd de+itions-

S#%n!%$! !e+&%#&on

It is used to mesure the +rition in indi+idul returns from the +er!e ex&ected returns

o+er certin &eriod- Stndrd de+ition is used in the conce&t of ris) of &ortfolio of

in+estments- Hi!her stndrd de+ition mens !reter fluctution in ex&ected return-

Stndrd de+ition "S,# N O +r

Khere 0r N +rince

0rN & "r

i

E"r##

8

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 35

RELIANCE MUTUAL FUND, HUBLI

3. Be#% 7

Bet mesures the s%stemtic ris) nd sho(s ho( &rices of securities res&ond to the

mr)et forces- It is clculted $% reltin! the return on securit% (ith return for the mr)et- B%

con+ention, mr)et (ill h+e $et >-?-Mutul fund is sid to $e +oltile, more +oltile or less

+oltile- If $et is !rter thn > the stoc) is sid to $e ris)ier thn mr)et- If $et is less thn

>,the indiction is tht stoc) is less ris)% in com&rison to mr)et- If $et is 5ero then the ris) is

the sme s tht of the mr)et- ;e!ti+e $et is rre-

N nx% 6"x#" %#

nx

8

"x#

8

Khere nN num$er of d%s

P Nrollin! returns of the ;SE index

YN rollin! returns of the schemes

;. S)%$0e &n!eD

Shr&e index mesures ris) &remium of &ortfolio, relti+e to the totl mount of ris) in

the &ortfolio- Shr&e index summri5es the ris) nd return of &ortfolio in sin!le mesure

tht cte!ori5es the &erformnce of funds on the ris) d'usted $sis- .he lr!er the Shr&es

index the &ortfolio o+er &erforms the mr)et nd +ice +ers-

Khere, s

t

N Shr&es index

R

&

N &ortfolio return

R

f

N Ris) free rte of return "A-@DJ#

SD= Standard Deviation of the port folio

The formula for Sharpe inde! = S

t $

%

P &

%

f

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 36

RELIANCE MUTUAL FUND, HUBLI

S.!

THE PERFORMANCE OF TOP J SCHEMES OF RELIANCE MUTUAL

FUND FOR LAST J YEARS.

Re&%nce /$ow#) F(n!

O+e$+&ew

In+e*#men# O56ec#&+e

.he &rimr% in+estment o$'ecti+e of the scheme is to chie+e lon! term !ro(th of c&itl $%

in+estin! in eFuit% nd eFuit% relted securities throu!h reserch $sed in+estment &&roch-

Sc)eme !e#%&*

F(n! T40e 7:&en6Ended

In+e*#men# P%n 7Gro(th

L%(nc) !%#e 7Se& ?E, >DD@

Benc)m%$k 7BSE6>??

A**e# S&Ee >R* c$? 7@,ABD-DE "Mr6*>68?>8#

M&n&m(m In+e*#men# 7Rs-@???

L%*# D&+&!en! 7;-A-

Bon(* 7;-A-

F(n! M%n%"e$ 7Sunil Sin!hni

Lo%! De#%&*

En#$4 Lo%! 7;-A-

ED&# Lo%! 7>-??J

Lo%! Commen#* 7Exit lod 6 >J if redeemed<s(itched out on or

$efore com&letion of > %rs from the dte of

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 37

RELIANCE MUTUAL FUND, HUBLI

Tec)n&C(e* (*e! &n me%*($&n" /$ow#) ,(n!

'eta

N nx% 6"x#" %#

nx

8

"x#

8

'eta $ (.)*+,

S#%n!%$! !e+&%#&on >SD? G K +%$

W)e$e -%$ G +%$&%nce

-%$G 0 >$

&

E>$??

@

S.!$ -.*..+/

Shar0e1s %atio

S

t $

%

P &

%

f

S!

Shar0e1s %atio $ (.(2-.

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 38

RELIANCE MUTUAL FUND, HUBLI

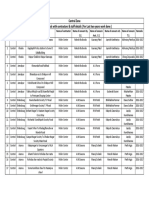

%eliance Gro3th fund

4a5le & *

Year 1 yr (%) 2 yr (%) 3 yr (%)

Fund Returns -8.9 -3.6 10.3

Benchar! returns -9.6 -1.6 ".9

Gra0h & *

I;.ER/RE.A.I:;3 .$le > re+els tht in the >

st

%er fund return is 6E-D nd $enchmr)

returns is 6D-B, in 8

nd

%er fund return is 6*-B nd $enchmr) is 6>-B, in the *

rd

%er fund return is

>?-* nd $enchmr) is @-D -

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 39

RELIANCE MUTUAL FUND, HUBLI

RELIANCE -ISION FUND

O+e$+&ew

In+e*#men# O56ec#&+e

.he &rimr% in+estment o$'ecti+e of the scheme is to chie+e lon!6term !ro(th of c&itl $% in+estment

in eFuit% nd eFuit% relted securities throu!h reserch $sed in+estment &&roch-

Sc)eme !e#%&*

F(n! T40e 7:&en6Ended

In+e*#men# P%n 7Gro(th

L%(nc) !%#e 7Se& ?A, >DD@

Benc)m%$k 7BSE6>??

A**e# S&Ee >R* c$? 78,888-AB "Mr6*>68?>8#

M&n&m(m In+e*#men# 7Rs-@???

L%*# D&+&!en! 7;-A-

Bon(* 7;-A-

F(n! M%n%"e$ 7Ash(ni Kumr

Lo%! De#%&*

En#$4 Lo%! 7;-A-

ED&# Lo%! 7>-??J

Lo%! Commen#* 7Exit lod 6 >J if redeemed<s(itched

out on or $efore com&letion of > %rs

from the dte of llotment

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 40

RELIANCE MUTUAL FUND, HUBLI

Tec)n&C(e* (*e! &n me%*($&n" -&*&on ,(n!

'eta

N nx% 6"x#" %#

nx

8

"x#

8

'eta $ (.).)2

S#%n!%$! !e+&%#&on >SD? G K +%$

W)e$e -%$ G +%$&%nce

-%$G 0 >$

&

E>$??

@

S.!$ -.(+62/

Shar0e1s %atio

S

t $

%

P &

%

f

S!

Shar0e1s %atio $ (.(7(+

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 41

RELIANCE MUTUAL FUND, HUBLI

%eliance Vision fund

4a5le 8 .

"ear

1 #r $%& ' #r $%& 3 #r $%&

Fund Returns

-8.6 -1." (.9

Benchar! returns

-9.6 -1.6 ".9

Gra0h 8 .

I;.ER/RE.A.I:;3 .$le 8 re+els tht in the >

st

%er fund return is 6E-B nd $enchmr) return

is 6D-B, in the 8

nd

%er fund return is 6>-@ nd $enchmr) return is 6>-B,in the *

rd

%er fund return

is A-D nd $enchmr) return is @-D -

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 42

RELIANCE MUTUAL FUND, HUBLI

Re&%nce 5%nk&n" ,(n!

O+e$+&ew

In+e*#men# O56ec#&+e

.he &rimr% in+estment o$'ecti+e of the scheme is to see) to !enerte continous returns $%

cti+el% in+estin! in eFuit% nd eFuit% relted or fixed income securities of com&nies in the

Bn)in! Sector-

Sc)eme !e#%&*

F(n! T40e 7:&en6Ended

In+e*#men# P%n 7Gro(th

L%(nc) !%#e 7M% 8>, 8??*

Benc)m%$k 7BA;K ;ift%

A**e# S&Ee >R* c$? 7>,BDA-A* "Mr6*>68?>8#

M&n&m(m In+e*#men# 7Rs-@???

L%*# D&+&!en! 7;-A-

Bon(* 7;-A-

F(n! M%n%"e$ 7Sunil Sin!hni < Shre% Loon)er <

Sn'% /re)h

Lo%! De#%&*

En#$4 Lo%! 7;-A-

ED&# Lo%! 7>-??J

Lo%! Commen#* 7 Exit lod 6 >J if redeemed<s(itched

out on or $efore com&letion of > %rs

from the dte of llotment-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 43

RELIANCE MUTUAL FUND, HUBLI

Tec)n&C(e* (*e! &n me%*($&n" B%nk&n" ,(n!

'eta

N nx% 6"x#" %#

nx

8

"x#

8

'eta $ *.*(6,

S#%n!%$! !e+&%#&on >SD? G K +%$

W)e$e -%$ G +%$&%nce

-%$G 0 >$

&

E>$??

@

S.!$ ,.(-),/

Shar0e1s %atio

S

t $

%

P &

%

f

S!

Shar0e1s %atio $ (.()*

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 44

RELIANCE MUTUAL FUND, HUBLI

%ealince 'anking fund

4a5le & -

"ear

1 #r $%& ' #r $%& 3 #r $%&

Fund Returns

-1'.1 '.1 13

Benchar! returns

-9.' 1." 10.(

Gra0h 8 -

I;.ER/RE.A.I:;3 .$le * re+els tht in the >

st

%er fund return is 6>8-> nd $enchmr)

return is 6D-8, in the 8

nd

%er fund return is 8-> nd $enchmr) return is >-@, in the *

rd

%er fund

return is >* nd $enchmr) return is >?-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 45

RELIANCE MUTUAL FUND, HUBLI

Re&%nce !&+e$*&,&e! 0owe$ *ec#o$ ,(n!

O+e$+&ew

In+e*#men# O56ec#&+e

.he &rimr% in+estment o$'ecti+e of the scheme is to see) to !enerte continous returns $%

cti+el% in+estin! in eFuit% nd eFuit% relted or fixed income securities of /o(er nd other

ssocited com&nies-

Sc)eme !e#%&*

F(n! T40e 7:&en6Ended

In+e*#men# P%n 7Gro(th

L%(nc) !%#e 7A&r >@, 8??4

Benc)m%$k 7BSE /:KER

A**e# S&Ee >R* c$? 78,4?@-E4 "Mr6*>68?>8#

M&n&m(m In+e*#men# 7Rs-@???

L%*# D&+&!en! 7;-A-

Bon(* 7;-A-

F(n! M%n%"e$ 7Sunil Sin!hni

Lo%! De#%&*

En#$4 Lo%! 7;-A-

ED&# Lo%! 7>-??J

Lo%! Commen#* 7Exit lod 6 >J if redeemed<s(itched out on or

$efore com&letion of > %rs from the dte of

llotment-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 46

RELIANCE MUTUAL FUND, HUBLI

Tec)n&C(e* (*e! &n me%*($&n" D&+e$*&,&e! Powe$ *ec#o$ ,(n!

'eta

N nx% 6"x#" %#

nx

8

"x#

8

'eta $ (.))).

S#%n!%$! !e+&%#&on >SD? G K +%$

W)e$e -%$ G +%$&%nce

-%$G 0 >$

&

E>$??

@

S.!$ -.,6.-/

Shar0e1s %atio

S

t $

%

P &

%

f

S!

Shar0e1s %atio $ &(.((+2

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 47

RELIANCE MUTUAL FUND, HUBLI

Re&%nce D&+e$*&,&e! Powe$ Sec#o$ ,(n!

4a5le & ,

"ear

1 #r $%& ' #r $%& 3 #r $%&

Fund Returns

-'3.8 -18.( -".'

Benchar! returns

-'(.8 -'1.) -1'.(

Gra0h8 ,

I;.ER/RE.A.I:;3 .$le 4 re+els tht in the > st %er fund return is 68*-E nd $enchmr)

return is 68A-E, in the 8

nd

%er fund return is 6>E-A nd $enchmr) return is 68>-4, in the *

rd

%er

fund return 6@-8 nd $enchmr) return is 6>8-A-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 48

RELIANCE MUTUAL FUND, HUBLI

Re&%nce P)%$m% F(n!

O+e$+&ew

In+e*#men# O56ec#&+e

.he &rimr% in+estment o$'ecti+e of the scheme is to see) to !enerte consistent returns $%

in+estin! in eFuit% nd eFuit% relted or fixed income securities of /hrm nd other ssocited

com&nies-

Sc)eme !e#%&*

F(n! T40e 7:&en6Ended

In+e*#men# P%n 7Gro(th

L%(nc) !%#e 7M% 8B, 8??4

Benc)m%$k 7BSE HEAL.H9ARE

A**e# S&Ee >R* c$? 7@B*-@B "Mr6*>68?>8#

M&n&m(m In+e*#men# 7Rs-@???

L%*# D&+&!en! 7;-A-

Bon(* 7;-A-

F(n! M%n%"e$ 7Silesh R' Bhn

Lo%! De#%&*

En#$4 Lo%! 7;-A-

ED&# Lo%! 7>-??J

Lo%! Commen#* 7Exit lod 6 >J if redeemed<s(itched out on

or $efore com&letion of > %rs from the dte

of llotment-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 49

RELIANCE MUTUAL FUND, HUBLI

Tec)n&C(e* (*e! &n me%*($&n" P)%$m% ,(n!

'eta

N nx% 6"x#" %#

nx

8

"x#

8

'eta $ (.6,7*

S#%n!%$! !e+&%#&on >SD? G K +%$

W)e$e -%$ G +%$&%nce

-%$G 0 >$

&

E>$??

@

S.DG @.;:J9L

Shar0e1s %atio

S

t $

%

P &

%

f

S!

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 50

RELIANCE MUTUAL FUND, HUBLI

Shar0e1s %atio $ &(...(*

Re&%nce P)%$m% ,(n!

4a5le & 6

"ear

1 #r $%& ' #r $%& 3 #r $%&

Fund Returns 3.' (.' 33.(

Benchar!

returns

10 1'.1 '6

Gra0h & 6

I;.ER/RE.A.I:; 3 .$le @ re+els tht in the >

st

%er fund return is *-8 nd $enchmr) return

is >?, in the 8

nd

%er fund return is A-8 nd $enchmr) return is >8->, in the *

rd

%er fund return is

**-A nd $enchmr) return is 8B-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 51

RELIANCE MUTUAL FUND, HUBLI

9HA/.ER 0

4I;,I;GS, SUGGES.I:;

A;,

9:;9LUSI:;

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 52

RELIANCE MUTUAL FUND, HUBLI

indin?s2

In the $o+e cse the Relince !ro(th fund return is >?-* hs com&red to $enchmr)

return is @-D-

Relince 0ision fund Bet is more "$et Q># i-e ?-D8DA it indictes it is less ris)%-

9om&red to other funds the stndrd de+ition of Relince Bn)in! fund is 4-?*D4 $%

this (e cn conclude there is more fluctutions-

Relince di+ersified &o(er sector fund does not sho(s the !ood returns s it Is under

&erformin! its shr&e rtio is 6?-??EA-

/erformnce rtio of Relince /hrm fund is in ne!ti+e 6?-88?>-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 53

RELIANCE MUTUAL FUND, HUBLI

Su??estion@Reco::endation2

If the in+estors (nt to !o for minimum ris) then the% cn d&t Relince

/hrm fund- Ris) is ?-@4B>

In+estor hs to select Relince Bn)in! fund $ecuse the ris) is >->?@4 nd

the return is >*-

In+estors cn Fuit from Relince ,i+ersified /o(er sector fund nd Relince

/hrm fund $ecuse it is under &erformin!-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 54

RELIANCE MUTUAL FUND, HUBLI

Conc(*&on7

Lot of &rcticl )no(led!e hs !ined $% me $% crr%in! m% &ro'ect in Relince

Mutul 4und Hu$li- It is one of the ledin! com&n%- 4inll% I cn conclude tht

Guidnce is n im&ortnt criterion for the in+estors to m)e them (re $out

mutul fund schemes nd their returns- Hence sset mn!ement com&nies should

strt &romotionl cm&i!ns for ex&lorin! the )no(led!e nd informtion $out

the mutul fund-

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 55

RELIANCE MUTUAL FUND, HUBLI

BIBLI:GRA/HY

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 56

RELIANCE MUTUAL FUND, HUBLI

BIBLI:GRA/HY

F&n%nc&% &n*#&#(#&on* M m%$ke#*

F&n%nc&% *e$+&ce* m%$ke#*

O,,&c&% Doc(men#*

B$oc)($e* %n! F%c#*)ee#* o, Re&%nce m(#(% ,(n!3 H(5&

O$"%n&E%#&on We5*&#e7 www.$e&%ncem(#(%.com

O#)e$ We5*&#e*7 www.mone4con#$o.com

www.%m,&&n!&%.com

Re,e$ence Book*

Sec($ An%4*&* %n! Po$#,o&o M%n%"emen#

F P(n&#)%+%#)4 P%n!&%n

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 57

RELIANCE MUTUAL FUND, HUBLI

INSTITUTE OF EXCELLENCE IN MANAGEMENT SCIENCE,

HUBLI 58

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Theo Hermans (Cáp. 3)Документ3 страницыTheo Hermans (Cáp. 3)cookinglike100% (1)

- Rele A Gas BuchholtsДокумент18 страницRele A Gas BuchholtsMarco GiraldoОценок пока нет

- DMemo For Project RBBДокумент28 страницDMemo For Project RBBRiza Guste50% (8)

- SEW Products OverviewДокумент24 страницыSEW Products OverviewSerdar Aksoy100% (1)

- International Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Документ5 страницInternational Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Raul CuarteroОценок пока нет

- Magnetic Effect of Current 1Документ11 страницMagnetic Effect of Current 1Radhika GargОценок пока нет

- DLL LayoutДокумент4 страницыDLL LayoutMarife GuadalupeОценок пока нет

- Employer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailsДокумент2 страницыEmployer'S Virtual Pag-Ibig Enrollment Form: Address and Contact DetailstheffОценок пока нет

- Materials System SpecificationДокумент14 страницMaterials System Specificationnadeem shaikhОценок пока нет

- First Aid General PathologyДокумент8 страницFirst Aid General PathologyHamza AshrafОценок пока нет

- Principles of Communication PlanДокумент2 страницыPrinciples of Communication PlanRev Richmon De ChavezОценок пока нет

- GemДокумент135 страницGemZelia GregoriouОценок пока нет

- Chapin Columbus DayДокумент15 страницChapin Columbus Dayaspj13Оценок пока нет

- (s5.h) American Bible Society Vs City of ManilaДокумент2 страницы(s5.h) American Bible Society Vs City of Manilamj lopez100% (1)

- International Covenant On Economic Social and Cultural ReportДокумент19 страницInternational Covenant On Economic Social and Cultural ReportLD MontzОценок пока нет

- Monastery in Buddhist ArchitectureДокумент8 страницMonastery in Buddhist ArchitectureabdulОценок пока нет

- Statistics NotesДокумент7 страницStatistics NotesAhmed hassanОценок пока нет

- Impact Grammar Book Foundation Unit 1Документ3 страницыImpact Grammar Book Foundation Unit 1Domingo Juan de LeónОценок пока нет

- Fry 2016Документ27 страницFry 2016Shahid RashidОценок пока нет

- ED Tox PGS.2021Документ4 страницыED Tox PGS.2021Jm uniteОценок пока нет

- Learner's Material: ScienceДокумент27 страницLearner's Material: ScienceCarlz BrianОценок пока нет

- Aero - 2013q2 Apu On DemandДокумент32 страницыAero - 2013q2 Apu On DemandIvan MilosevicОценок пока нет

- Order of Magnitude-2017Документ6 страницOrder of Magnitude-2017anon_865386332Оценок пока нет

- Steel and Timber Design: Arch 415Документ35 страницSteel and Timber Design: Arch 415Glennson BalacanaoОценок пока нет

- Outline - Criminal Law - RamirezДокумент28 страницOutline - Criminal Law - RamirezgiannaОценок пока нет

- All Zone Road ListДокумент46 страницAll Zone Road ListMegha ZalaОценок пока нет

- Project Report On ICICI BankДокумент106 страницProject Report On ICICI BankRohan MishraОценок пока нет

- BirdLife South Africa Checklist of Birds 2023 ExcelДокумент96 страницBirdLife South Africa Checklist of Birds 2023 ExcelAkash AnandrajОценок пока нет

- ISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCДокумент2 страницыISIS Wood Product Solutions Selects Cloud-Hosting Partner Real Cloud Solutions LLCdevaprОценок пока нет

- Panera Bread Company: Case AnalysisДокумент9 страницPanera Bread Company: Case AnalysisJaclyn Novak FreemanОценок пока нет