Академический Документы

Профессиональный Документы

Культура Документы

Microeconomics Study Sheet Microeconomics Study Sheet: More Free Study Sheet and Practice Tests at

Загружено:

anandsemails6968Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Microeconomics Study Sheet Microeconomics Study Sheet: More Free Study Sheet and Practice Tests at

Загружено:

anandsemails6968Авторское право:

Доступные форматы

Microeconomics Study Sheet

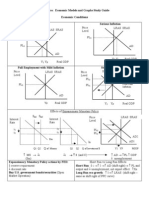

Economiic IIssues and Conceptts

Economic Is sues and Concepts

Econom c ssues and Concep s

The production possibility curve (PPC) illustrates

maximum combinations of outputs that can be

produced, given a countrys resources and technology.

The opportunity cost of a choice is the benefit of the

next best alternative given up. It is the slope of the PPC.

- For substitutes/complements, the cross elasticity is

positive/negative.

Price

($)

=9

= 2.33

Good X

Unattainable

=1

= 1/2.33

= 1/9

Attainable

D

Quantity

Good Y

= 1:

Total expenditure

is maximized

How Economiistts Worrk

How Economis ts Work

How Econom s s Wo k

Best affordable

point

The slope of a straight line is calculated as the change

in the value of the variable measured on the vertical

axis (y) divided by the change in the value of the

variable measured on the horizontal axis (x):

slope =

Budget line

y

x

> 1:

Price cut

increases total

expenditure

Value of an index in a given period

=

absolute value at given period

100

absolute value in base period

< 1:

Price cut

decreases total

expenditure

Demand,,,Supplly,,,and Prrice

Demand Supply and Priice

Demand Supp y and P ce

The higher the price of a good, the smaller the quantity

demanded (law of demand).

The demand curve is downward sloping.

The higher the price of a good, the higher the quantity

supplied (law of supply).

The supply curve is upward sloping.

Shortage (excess demand): quantity demanded >

quantity supplied

Upward pressure on the price.

Surplus (excess supply): quantity demanded < quantity

supplied

Downward pressure on the price.

The price adjusts until quantity demanded equals

quantity supplied (market equilibrium).

Quantity

Marrketts iin Acttion

Mark ets in Actiion

Ma ke s n Ac on

A price ceiling below equilibrium price results in

shortage (excess supply).

A price floor above equilibrium price results in surplus

(excess demand).

In the long run, rent controls result in a growing

housing shortage.

Farm policies are directed at stabilizing and raising

farm revenues.

Rent

($)

Relative price (-PM/PP) = MRS (budget line tangent to

indifference curve).

The effect of a price change can be divided into

substitution and income effect.

- (Hicksian) Substitution effect (effect of a change in

relative price, holding utility constant).

Increase (decrease) in the consumption of the good

whose price has fallen (risen).

Income effect (effect of a change in income, holding

relative price constant).

Normal good: Income effect reinforces the

substitution effect.

Inferior good: Income and substitution effects work

in opposite directions.

The income-consumption line traces out all utility

maximizing points for different levels of income.

- The price-consumption line traces out all utility

maximizing points for different levels of income.

Prroducerrs iin tthe Shorrt Run

Pro ducers in th e Shortt Run

P oduce s n he Sho Run

Blackmarket price

Price

($)

ConsumerrBehaviiourr

Consumer Behavio ur

Consume Behav ou

Total utility is maximized when all income is spent

and when the utility gained from the last dollar spent on

each product is equal:

MUi = MUj

Pi

Pj

A budget line marks the borderline between affordable

and unaffordable consumption bundles. It depends on

income and prices.

Slope of the budget line: -PM/PP

An indifference curve represents a certain level of

utility. Consumption bundles to the right are preferred,

consumption bundles to the left are not preferred.

MRS (slope of an indifference curve) diminishes as

we move down to the right along an indifference curve.

The best affordable point is the point at which the

budget line is tangent to the indifference curve:

Surplus

Price

ceiling

Shortage

- Short run (SR)

Quantities of at least one of the firms resources is

fixed.

- Long run (LR)

Quantities of all of the firms resources can be

varied, but its technology is fixed.

- Very long run

Quantities of all of the firms resources and its

technology can be varied.

- Economic profits = total revenues opportunity costs.

Total product (TP): Total output produced for various

levels of labour.

Marginal product (MP): Increase in total product

resulting from a one-unit increase in labour. Slope

of the TP curve (TP/L)

Average product (AP): Total product per unit of labor

(TP/L).

Total cost (TC) = Total fixed cost (independent of the

level of output) + Total variable cost (increases as

output increases).

Marginal cost (MC): Increase in total cost resulting

from a one-unit increase in output. Slope of the TC

curve (TC/Q).

Average total cost (ATC): TC per unit of output

(TC/Q).

ATC = AVC (average variable cost) + AFC (average

fixed cost).

More free study sheet and practice tests at:

D

Shortage

Quantity

Ellastticiity

Ela stiicitty

E as c y

% change in quantity

% change in price

change in quantity average quantity

=

% change in price average price

=

Quantity

Price

($)

Surplus

S

Price

floor

Q /Q

P / P

- If demand is (in-)elastic, a decrease in price results in

higher (lower) total expenditure (TE). TE doesnt

change due to a price-change for a unit-elastic demand.

- For inferior/normal goods, the income elasticity is

negative/positive.

Quantity

More free Study Sheets and Practice Tests at: www.prep101.com

More free study sheets and practice tests at

Because of initially increasing returns and eventually

decreasing returns, the average total cost curve is

u-shaped

MP & AP

(units)

Point of diminishing

marginal return

Point of diminishing

average returns

MP

AP

www.prep101.com

marginal revenue = average revenue = market price.

MR = AR = p

Short run economic profits (losses) induce firms to

enter (exit) the industry. Industry supply increases

(decreases), the market price falls (rises) and in the

long run, economic profits return to zero.

Shutdown point: p = AVCMIN

The marginal cost curve above the shutdown point

traces out the firms short run supply curve.

The short run industry supply is simply the sum of the

quantities supplied by all firms at each given price.

Long run equilibrium

- Economic profits are zero.

Labour

Price

Prroducerrs iin tthe Long Run

Pro ducers in th e Long Run

P oduce s n he Long Run

($)

In the long run, all factors are variable (plant size is

variable).

The long run average cost curve traces out the lowest

attainable average total cost at each output when both

capital and labour inputs can be varied.

Profit maximization is equivalent to cost minimization.

- Firms choose the combination of capital and labour

such that MPK = MPL

pK

Economic profit

Diminishing returns occur for any given quantity of

capital (labour) as the quantity of labour (capital)

increases.

MPK (MPL) decreases as more capital (labour) is

employed.

Economies of scale

- Fall in ATC as firms scale of production increases.

(increasing returns to scale).

Diseconomies of scale

- Rise in ATC as firms scale of production increases.

(decreasing returns to scale)..

Constant returns to scale

- Constant ATC as firms scale of production increases.

(constant returns to scale).

Minimum efficient scale

- Smallest quantity of output at which LRAC reaches its

lowest level.

Isoquant

- Whole set of technically efficient factor combinations

for producing a given level of output.

Marginal rate of substitution between two factors is

equal to the ratio of their marginal products.

- Slope of an isoquant at a particular point.

Isocost line shows alternative combinations of factors

that a firm can buy for given total cost.

- Slope = - (factor price ratio).

Cost minimization

($)

P* = TC*

D

Quantity

In oligopoly, firms are aware of interdependence

among the decisions made by the various firms in the

industy strategic behaviour.

Barriers to entry ensure that economic profits can

persist in the long run.

Economiic Efffiiciiency and Publlic Pollicy

Economic Efffic ie ncy and Publiic Poliicy

Econom c E c ency and Pub c Po cy

Quantity

pL

Price

Monopolly

Monopoly

Monopo y

A single price monopolist maximizes profit by producing

the output level at which marginal revenue = marginal

cost.

Note that marginal revenue < market price.

Compared to perfect competition, equilibrium output

is lower and equilibrium price is higher

(inefficient). Efficiency loss (deadweight loss).

Productive efficiency requires that total cost in an

industry is minimized.

Allocative efficiency p = MC for each product.

Industries in which firms have a certain degree of

market power result in allocative distortion

(inefficiency), because p > MC.

There exists income distortion when profits/losses

occur.

Imposing marginal cost pricing on a natural monopoly

results in allocative efficiency, but the monopolist

generally incurs economic profits or losses.

Imposing average cost pricing on a natural monopoly

results in zero economic profits, but the outcome is

generally allocatively inefficient.

Price

($)

Price

($)

MC

ATC

Economic

profit

ATC

Loss with MC pricing

MC

M

D

Quantity

Price-discriminating monopoly: Producer charges

different prices for different units of the same product for

reasons not associated with differences in cost.

A (perfectly) price discriminating monopolist

converts consumer surplus into profit by charging each

buyer the maximum amount that he is willing to pay.

The outcome is efficient, with smaller consumer

surplus and larger producer surplus.

Monopoly profits can persist in the long run if there

are effective barriers to entry.

Cartels as monopolies: Organization of producers

who agree to cooperate and act as a single seller.

Cartels are unstable due to incentive to cheat for each

firm.

D

Quantity

Price

($)

MC

More free study sheet and practice tests at:

pL MPL

=

pK MPK

Cost

($)

IImperrfecttCompettittion

Im perffect Competiitiion

mpe ec Compe on

AT

Minimum

efficient

scale

Economies

of scale

Constant

returns to scale

AT

Diseconomies

of scale

Output

Compettittive Marrketts

Competiitiive Mark ets

Compe ve Ma ke s

The profit maximizing output level is the quantity at

which

marginal revenue = marginal cost. (MR = MC)

In monopolistic competition there may be economic

profits in the short run. Each firm supplies its

differentiated product to a small segment of the

market. However, free entry/exit assures that in the

long run, economic profits are zero (at the quantity

where MC = MR, p = ATC).

ATC

Profit with MC pricing

D

Quantity

FacttorrPrriciing and FacttorrMobiiliity

Facto r Priicin g and Facto r Mobillitty

Fac o P c ng and Fac o Mob y

Factors of production are capital, land, an labour.

Factor demand is derived from the demand of the final

good or service that the factor produces.

A profit maximizing firm hires up the point where:

marginal cost(MC) = Marginal revenue product

(MRP) = MR*MP

Total factor income = factor price * level of employment.

= transfer earnings + economic rent.

Helping students since 1999

Microeconomics Study Sheet

is equal to the economys capital stock.

- Accumulation of capital leads to a decrease in the

equilibrium interest rate.

- Technological improvements lead to an increase in

the equilibrium interest rate.

Present value of a single future payment PV =

MRP/(1 + i)t

Present value of a stream of payments that continues

forever PV = MRP/i

Hotellings rule: The socially optimal rate of extraction

of any non-renewable resource is such that its price

increases at a rate equal to the interest rate.

Wage

($)

Unaffordable

Transfer

earning

D

Price

($)

Elastic

demand

S + tax

S

tax rev.

Excess burden

MarrkettFaiilurres///GoverrnmenttIIntterrventtion

Mark et Faillure s G overn ment In te rv entiion

Ma ke Fa u es Gove nmen n e ven on

Rent

($)

Markets fail to achieve allocative efficiency in presence

of market power, externalities, public goods,

asymmetric information, and missing markets.

With a positive externality, a competitive market will

produce too little of the good.

With a negative externality, a competitive market will

produce too much of the good.

MSC: Marginal social cost MSC = external cost

imposed on the beach resort).

Coase theorem: If property rights exist and

transaction costs are low, private transactions are

efficient, regardless of who has the property right.

Non-rivalrous goods: consumption by one person does

not reduce consumption by another person.

Marginal cost of an additional user is zero.

To reach allocative efficiency, the price should be

zero.

Non-excludable goods: impossible/extremely costly to

prevent someone from consuming a good.

Public goods (those which are non-rivalrous and nonexcldable) give rise to free-rider problem

S

Unaffordable

Econ. rent

D

Wage

($)

Unaffordable

Econ.

rent

Transfer

earning

Cost &

benefit

($)

LabourrMarrketts

Labour Mark ets

Labou Ma ke s

Wage differentials in competitive markets may result

from differences in working conditions, in inherited skill,

in human capital, or from some form of discrimination.

Two general cases that give rise to noncompetitive

labor markets are the presence of a union (monopoly

in selling labor) and / or of a monopsony (single buyer

of labor).

A binding minimum wage reduces employment in

competitive labor markets; however, it may lead to an

increase in employment in case employers have some

monopsony power.

Monopsony: a single buyer in the market

Wage

rate

($/h)

MC

Competitive

eqm.

Price

($)

Inelastic

demand

S + tax

S

tax rev.

Excess burden

Quantity

The Gaiins ffrom IIntterrnattionallTrrade

The Gain s frrom In te rn atiional Tra de

The Ga ns om n e na ona T ade

Gains from trade arise from different opportunity costs.

Specialization in the activity in which opportunity

costs are lowest.

Countries export goods for which they have a

comparative advantage.

Countries import goods for which they have a

comparative disadvantage.

Terms of trade: Ratio of the (average) price of a

countrys exports to the (average) price of its imports.

Index of Export Prices

Terms of Trade =

100

Index of Import Prices

Good X

D = MB

Country A

Quantity

EnviironmenttallPollicy

Envirronmenta l Poliicy

Env onmen a Po cy

Consumption

possibilities

with trade

Profit maximizing firms produce too much relative to the

allocatively efficient level of output if MC < MSC (due

to negative externality).

The allocatively efficient level of pollution is the level

where MC of further pollution abatement = MB of

pollution reduction.

Policies used to regulate pollution are direct controls,

emissions taxes, and tradable pollution permits.

Taxattion and Publlic Expendiiturre

Taxatiion and Publiic Expenditture

Taxa on and Pub c Expend u e

w2

w1

External

cost

Quantity

More free study sheet and practice tests at:

MC

w0

Efficient

outcome

Profit

Competitve

eqm

Monopsony

eqm

qM

qPC

MRP = D

Labour

Capiitalland NatturrallResourrces

Capittal and Natu ra l Resourc es

Cap a and Na u a Resou ces

Profit maximizing firms purchase new capital up to the

point where the present value of the stream of future

MRPs is equal to the purchase price of that unit.

The interest rate is determined in the capital market

and adjusts such that the quantity of capital demanded

The most important taxes in Canada are personal

income tax, corporate income tax, excise and sales

taxes, and property taxes.

Progressive tax: marginal tax rate increases as income

increases.

Proportional tax: marginal tax rate is the same for all

levels of income.

Regressive tax: marginal tax rate decreases as income

increases.

Efficiency and equity are often competing goals.

without trade;

Good Y

Good X

Country B

Consumption

possibilities

with trade

without trade;

Good Y

Law of one price: When a product which can be

cheaply transported is traded throughout the entire

world, it will tend to have a single world price.

More free Study Sheets and Practice Tests at: www.prep101.com

Вам также может понравиться

- Essential Graphs For MicroeconomicsДокумент12 страницEssential Graphs For MicroeconomicsSayed Tehmeed AbbasОценок пока нет

- Econ 301 Past Final Exams With SolutionsДокумент18 страницEcon 301 Past Final Exams With SolutionsmauveskiersОценок пока нет

- Microeconomics FormulasДокумент1 страницаMicroeconomics FormulasmarghebroganОценок пока нет

- Test Bank for Introductory Economics: And Introductory Macroeconomics and Introductory MicroeconomicsОт EverandTest Bank for Introductory Economics: And Introductory Macroeconomics and Introductory MicroeconomicsРейтинг: 5 из 5 звезд5/5 (1)

- Microeconomics Notes (Advanced)Документ98 страницMicroeconomics Notes (Advanced)rafay010100% (1)

- Principles of Microeconomics - SyllabusДокумент10 страницPrinciples of Microeconomics - SyllabusKatherine Sauer0% (1)

- Coach Huber AP Macroeconomics: Gross Domestic ProductДокумент18 страницCoach Huber AP Macroeconomics: Gross Domestic Productapi-255899090Оценок пока нет

- Microeconomics Summary NotesДокумент14 страницMicroeconomics Summary NotesNg Chai SheanОценок пока нет

- Microecon Cheat Sheet - FinalДокумент3 страницыMicroecon Cheat Sheet - FinalDananana100100% (3)

- Firms in Competitive MarketsДокумент43 страницыFirms in Competitive Marketsjoebob1230Оценок пока нет

- Exam Prep for:: Macro-Economics; Making Gender Matter Concepts, Policies and Institutional Change in Developing CountriesОт EverandExam Prep for:: Macro-Economics; Making Gender Matter Concepts, Policies and Institutional Change in Developing CountriesОценок пока нет

- Economics Cheat Sheet Maddogz43Документ2 страницыEconomics Cheat Sheet Maddogz43sh4dow.strid3r9581Оценок пока нет

- AP Macroeconomics - Models & Graphs Study GuideДокумент22 страницыAP Macroeconomics - Models & Graphs Study GuideLynn Hollenbeck Breindel100% (2)

- MicroeconomicsДокумент10 страницMicroeconomicsVishal Gattani100% (5)

- ECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsОт EverandECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsОценок пока нет

- 100 Questions On Economics PDFДокумент9 страниц100 Questions On Economics PDFPardeep Singh KadyanОценок пока нет

- AP Macroeconomic Models and Graphs Study GuideДокумент23 страницыAP Macroeconomic Models and Graphs Study GuideAznAlexT90% (21)

- Finance Formula SheetДокумент2 страницыFinance Formula SheetBrandon RaoОценок пока нет

- Essential Graphs For AP MicroeconomicsДокумент5 страницEssential Graphs For AP Microeconomicsjlvmrbd777100% (7)

- Discounts, Markup and MarkdownДокумент3 страницыDiscounts, Markup and MarkdownYannaОценок пока нет

- Microeconomics SummaryДокумент22 страницыMicroeconomics SummaryChristie Osarenren100% (1)

- Managerial Economics:: Perfect CompetitionДокумент43 страницыManagerial Economics:: Perfect CompetitionPhong VũОценок пока нет

- Macro Final Cheat SheetДокумент2 страницыMacro Final Cheat SheetChristine Son100% (1)

- Economics Edexcel AS Level Microeconomics GlossaryДокумент7 страницEconomics Edexcel AS Level Microeconomics Glossarymarcodl18Оценок пока нет

- Economics Cheat SheetДокумент2 страницыEconomics Cheat Sheetalysoccer449100% (2)

- 90,95,2000 Macro Multiple ChoiceДокумент37 страниц90,95,2000 Macro Multiple ChoiceAaron TagueОценок пока нет

- Elasticity Cheat SheetДокумент4 страницыElasticity Cheat Sheetnreid2701100% (2)

- ECN 2215 - Topic - 2 PDFДокумент54 страницыECN 2215 - Topic - 2 PDFKalenga AlexОценок пока нет

- Micro Formula PacketДокумент2 страницыMicro Formula Packetlhv48Оценок пока нет

- Cheat Sheet - CHE374Документ26 страницCheat Sheet - CHE374JoeОценок пока нет

- AP Macroeconomics Study SheetДокумент3 страницыAP Macroeconomics Study SheetepiphanyyОценок пока нет

- Macroeconomics FINAL Cheat SheetДокумент1 страницаMacroeconomics FINAL Cheat Sheetcarmenng1990Оценок пока нет

- Welfare EconomicsДокумент4 страницыWelfare EconomicsManish KumarОценок пока нет

- ECONOMICS - Consumer Surplus & Producer SurplusДокумент12 страницECONOMICS - Consumer Surplus & Producer SurplusManjunath Shettigar100% (1)

- Principles of MicroeconomicsДокумент85 страницPrinciples of MicroeconomicsHoi Mun100% (1)

- Public Finance Rosen 10th NotesДокумент87 страницPublic Finance Rosen 10th Notesmnm2pq0% (1)

- Basic Economic Ideas: Opportunity Cost.Документ37 страницBasic Economic Ideas: Opportunity Cost.huzaifathe007100% (2)

- Econ Cheat SheetДокумент3 страницыEcon Cheat SheetadviceviceОценок пока нет

- Ecn 1215 - Take - Home - Test - 06 - 05 - 2019-1 PDFДокумент2 страницыEcn 1215 - Take - Home - Test - 06 - 05 - 2019-1 PDFCaristo MumbaОценок пока нет

- National Income & Price DeterminationДокумент6 страницNational Income & Price DeterminationPinkyОценок пока нет

- Production Possibilities Frontiers: Antu Panini Murshid - Principles of MacroeconomicsДокумент17 страницProduction Possibilities Frontiers: Antu Panini Murshid - Principles of MacroeconomicslonlinnessОценок пока нет

- Intermediate Microeconomics Quiz 2Документ5 страницIntermediate Microeconomics Quiz 2paterneОценок пока нет

- Introduction To MacroeconomicsДокумент23 страницыIntroduction To Macroeconomicsabhishek_kumar_5Оценок пока нет

- Introduction To Microeconomics NotesДокумент26 страницIntroduction To Microeconomics NotesChristine Keh100% (2)

- Different Complex Multipliers - Government, Expenditure, Tax and Balanced Budget MultiplierДокумент15 страницDifferent Complex Multipliers - Government, Expenditure, Tax and Balanced Budget MultiplierArundhuti RoyОценок пока нет

- Economics Cheat SheetДокумент5 страницEconomics Cheat Sheetcaitobyrne341275% (4)

- Managerial Economics: Cheat SheetДокумент110 страницManagerial Economics: Cheat SheetSushmitha KanasaniОценок пока нет

- AP Macroeconomics Review Sheet 2013Документ7 страницAP Macroeconomics Review Sheet 2013Crystal Farmer100% (4)

- Mankiw PrinciplesOfEconomics 10e PPT CH01Документ41 страницаMankiw PrinciplesOfEconomics 10e PPT CH01Quỳnh HươngОценок пока нет

- Microeconomics Formulas and ExpressionsДокумент5 страницMicroeconomics Formulas and ExpressionsSteveОценок пока нет

- IB Econ Chap 16 Macro EQДокумент11 страницIB Econ Chap 16 Macro EQsweetlunaticОценок пока нет

- 1 Advanced Microeconomic Theory 3rd Ed. JEHLE RENYДокумент673 страницы1 Advanced Microeconomic Theory 3rd Ed. JEHLE RENYKushal DОценок пока нет

- Perfect CompetitionДокумент27 страницPerfect Competitionkratika singhОценок пока нет

- Microeconomics HomeworkДокумент16 страницMicroeconomics HomeworkTaylor Townsend100% (1)

- AP Macroeconomics TestДокумент10 страницAP Macroeconomics TestTomMusic100% (1)

- Macroeconomics Equations Cheat SheetДокумент2 страницыMacroeconomics Equations Cheat SheetSami B83% (12)

- Microeconomics - 6Документ20 страницMicroeconomics - 6Linh Trinh NgОценок пока нет

- Microeconomics Group - 2Документ99 страницMicroeconomics Group - 2auhsoj raluigaОценок пока нет

- Rent Control Act Extended For Another 2 YearsДокумент3 страницыRent Control Act Extended For Another 2 YearsAnonymous h73ZG0Оценок пока нет

- Factories Act 1948Документ6 страницFactories Act 1948NIHARIKA PARASHARОценок пока нет

- Section I Instructions To BiddersДокумент33 страницыSection I Instructions To Biddersbrook emenikeОценок пока нет

- Retainer Contract SampleДокумент4 страницыRetainer Contract SampleRafael GalosОценок пока нет

- Chavez VS Comelec PDFДокумент3 страницыChavez VS Comelec PDFMarl Dela ROsaОценок пока нет

- 70 Bertram Owners Manual FGДокумент443 страницы70 Bertram Owners Manual FGHassanMashiniОценок пока нет

- Revenue Recovery Act, 1890Документ6 страницRevenue Recovery Act, 1890Haseeb HassanОценок пока нет

- BS en 12432-1998Документ8 страницBS en 12432-1998DoicielОценок пока нет

- EU NB-MED - 2.12 - Rec1 - Rev 11 - Post-Marketing Surveillance - PMSДокумент9 страницEU NB-MED - 2.12 - Rec1 - Rev 11 - Post-Marketing Surveillance - PMSAKSОценок пока нет

- Abu Dhabi 2007 Form of Contract - ArticleДокумент2 страницыAbu Dhabi 2007 Form of Contract - ArticleMahesh Butani100% (1)

- 5678Документ59 страниц5678api-205258037Оценок пока нет

- Transactions: The Barclays Bank A/C 20-77-85 43223280Документ2 страницыTransactions: The Barclays Bank A/C 20-77-85 43223280Doris Zhao100% (2)

- Corporate Governance: The 4 PsДокумент14 страницCorporate Governance: The 4 PsMaricar Dela Cruz VLOGSОценок пока нет

- CA01 Ver4Документ13 страницCA01 Ver4Edison L. Miranda67% (3)

- PLDT Articles of Incorporation (Latest Amended Version) 2020Документ27 страницPLDT Articles of Incorporation (Latest Amended Version) 2020NQ ZОценок пока нет

- Management Representation LetterДокумент2 страницыManagement Representation LetterNupur C DharОценок пока нет

- 5.2.3 CofC 21 JAN 15Документ6 страниц5.2.3 CofC 21 JAN 15Mani Rathinam Rajamani100% (1)

- RMC No. 92-102-2020Документ5 страницRMC No. 92-102-2020nathalie velasquezОценок пока нет

- CSRДокумент2 страницыCSRVictorita TimoceОценок пока нет

- Part A Welcome To Max Life Insurance: Page 1 of 21Документ21 страницаPart A Welcome To Max Life Insurance: Page 1 of 21ZafarОценок пока нет

- H.E. Heacock Co. v. Macondray - Company, IncДокумент3 страницыH.E. Heacock Co. v. Macondray - Company, IncJanlo FevidalОценок пока нет

- External Governance Mechanisms & Case: Restatement of Financial Statement 2018 - PT Garuda Indonesia (Perseso) TBKДокумент20 страницExternal Governance Mechanisms & Case: Restatement of Financial Statement 2018 - PT Garuda Indonesia (Perseso) TBKHadila Franciska StevanyОценок пока нет

- Intellectual Property Rights Laws PDFДокумент4 страницыIntellectual Property Rights Laws PDFpriya100% (1)

- Obtaining An Engagement (CH2)Документ7 страницObtaining An Engagement (CH2)Md. Milon ChowdhuryОценок пока нет

- Regulatory Affairs - Pharmaceutical GuidelinesДокумент2 страницыRegulatory Affairs - Pharmaceutical Guidelinessandro CardosoОценок пока нет

- Audit of State and Local GovernmentsДокумент427 страницAudit of State and Local GovernmentsKendrick PajarinОценок пока нет

- Plantilla 2014Документ19 страницPlantilla 2014api-273918959Оценок пока нет

- Lockout/Tagout: Construction Safety Education ProgramДокумент9 страницLockout/Tagout: Construction Safety Education ProgramLoveОценок пока нет

- Eb Application SubmittedДокумент3 страницыEb Application SubmittedPrasadОценок пока нет

- Fispoi Qual Compliance Work Wcappmce 1419884410775 Eng PDFДокумент2 страницыFispoi Qual Compliance Work Wcappmce 1419884410775 Eng PDFAjay G GopalОценок пока нет