Академический Документы

Профессиональный Документы

Культура Документы

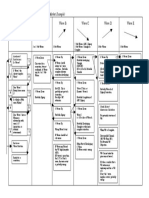

Elliott Wave Crib Sheet

Загружено:

ezrawong0 оценок0% нашли этот документ полезным (0 голосов)

347 просмотров5 страниц- Elliott Wave theory states that financial markets move in 5 wave patterns known as impulses and corrections. Impulses consist of 5 motive waves (1,3,5) separated by reactionary waves (2,4). Corrections consist of 3 waves (A,B,C) that retrace a portion of the previous impulse.

- Wave 3 is usually the longest and strongest wave of an impulse. It often extends past wave 1 and sees higher volume than other waves. Wave 4 typically retraces 38% of wave 3 but may retrace more. Wave 5 then completes the 5 wave pattern in the direction of the initial trend.

- Corrections take various forms like zigzags,

Исходное описание:

EW Sheet

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документ- Elliott Wave theory states that financial markets move in 5 wave patterns known as impulses and corrections. Impulses consist of 5 motive waves (1,3,5) separated by reactionary waves (2,4). Corrections consist of 3 waves (A,B,C) that retrace a portion of the previous impulse.

- Wave 3 is usually the longest and strongest wave of an impulse. It often extends past wave 1 and sees higher volume than other waves. Wave 4 typically retraces 38% of wave 3 but may retrace more. Wave 5 then completes the 5 wave pattern in the direction of the initial trend.

- Corrections take various forms like zigzags,

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

347 просмотров5 страницElliott Wave Crib Sheet

Загружено:

ezrawong- Elliott Wave theory states that financial markets move in 5 wave patterns known as impulses and corrections. Impulses consist of 5 motive waves (1,3,5) separated by reactionary waves (2,4). Corrections consist of 3 waves (A,B,C) that retrace a portion of the previous impulse.

- Wave 3 is usually the longest and strongest wave of an impulse. It often extends past wave 1 and sees higher volume than other waves. Wave 4 typically retraces 38% of wave 3 but may retrace more. Wave 5 then completes the 5 wave pattern in the direction of the initial trend.

- Corrections take various forms like zigzags,

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 5

MOTIVE(5 WAVES)

- waves 2 and 4 never retrace more than 100 % of wave 1 and 3

- wave 3 always travels beyond wave 1

- in price terms, wave 3 is often the longest but NEVER the shortest of the actionary subwaves (i.e. 1,3,5)

Impulse

- should be easily identifiable, volume should be higher

during trend waves and lower during counter trend

waves with wave 3 typically showing the highest (but

this may not be true for very short time frames)

- waves 4 does not overlap wave 1

- actionary subwaves (1,3,5) are motive and subwave 3

is impulse

- no reactionary subwave fully retraces the preceding

actionary subwave

Extension

- most impulse waves contain an extension and do so

mostly in only one of the 3 actionary subwaves

- if below primary degree, developing 5th wave

extension will be confirmed by new high volume

- most commonly extended wave is wave 3 and 3rd

wave of an extended 3rd wave is typically an extension

Truncation

- usually verified by noting that the presumed 5th wave

contains the necessary 5 waves

- often occurs following an extensively strong third

wave

Diagonal Triangles

- motive yet not an impulse

- no reactionary subwave fully retraces the preceding

actionary wave

- 3rd wave is NEVER the shortest

- the only 5 wave structure in direction of main trend

whereby wave 4 almost always overlaps wave 1

- 5th waves of diagonals often end in "throw-over" (i.e.

brief break of trend lines connecting waves 1 and 3)

accompanied by volume spike and in rare cases 5th wave

falls short of resistance trend line

- rising diagonal usually followed by retracement to where

it began (converse is true for falling diagonal)

ENDING DIAGONAL (wedge shaped, converging lines)

- occurs primarily in 5th wave position - when too far to

fast preceding

- always found at termination points of larger patterns

(indicating exhaustion)

- very small percentage appear in wave C position (in

double or triple threes, only as the final C wave)

- each subwave subdivides into 3 (forming a 3-3-3-3-3

wave pattern)

LEADING DIAGONAL

- occurs in wave 1 of impulses and wave A position of

zigzags

- waves 1 and 4 overlap and boundary lines converge

- traces out 5-3-5-3-5 pattern

- don't confuse with series of 1st and 2nd waves (far more

common). differentiate by the slowing of price change in

the 5th subwave relative to the 3rd v increasing short

term speed between 1st and 2nd

CORRECTIVE(3 WAVES)

- they can NEVER be 5 wave patterns (except triangles?)

- there are 4 main categories as below

Zigzags (5-3-5)

-top of wave B is noticeably lower than start of A (in a bull

market) or higher (in a bear market)

- often move quickly and retrace a large portion of the

wave they are correcting

- will occasionally occur twice or three times at most in

succession, particularly when the first zigzag falls short of

a normal target. Here each zigzag is separated by an

intervening "three", making a double or triple zigzag.

These formations are analogous to extension of an

impulse but are less common

Triangles

- cause a sideways movement usually

associated with decreasing volume and

volatility

- contain 5 overlapping waves that

subdivide into 3-3-3-3-3 and are labelled a-

b-c-d-e

- delineated by connecting termination

points of a and c, and b and d

- wave e more often than not overshoots or

undershoots the a-c line

- extremely common for wave b of a

contracting triangle to exceed the start of

wave a (termed 'running triangle)

- despite sideways appearance, all triangles

effect a net retracement of the preceding

wave at wave's end

- most subwaves in a triangle are zigzags,

but sometimes one of the subwaves (usually

c) might be regular or expanded flat or

multiple zigzag.

- rare, but one of the subwaves (usually e) is

itself a triangle (so that entire pattern

protracts into 9 waves)

- nearly always occur in positions prior to

final actionary wave in the pattern of one

larger degree (i.e. wave 4 in an impulse,

wave B in A-B-C, or final wave X in a

double/triple zigzag or combination.

Extremely rare to be in wave 2 of impulse

- when triangle occurs in wave 4 position,

wave 5 is sometimes swift (called "thrust")

and travels approx. distance of widest part

of triangle. Thrust is normally impulse but

can be ending diagonal

CONTRACTING TRIANGLE

- Symmetrical: top declining, bottom rising

- Ascending: top flat, bottom rising

- Descending: top declining, bottom flat

EXPANDING TRIANGLE

- has only one form: top rising, bottom

declining

Combinations

DOUBLE AND TRIPLE THREES (i.e. sideways combinations)

- combination of simpler types of corrections (zigzags,

flats, triangles)

- appears to be flat correction's way of extending the

sideways action

- each simpler correction is labelled W, Y, and Z

- reactionary waves, X, can take any form but are most

commonly zigzags

- appears to be never more than one zigzag or triangle

(which are normally the final wave) in a combination

- in double/triple zigzag, first zigzag is rarely large enough

to constitute adequate price correction of the preceding

wave and the doubling/tripling is needed to make it an

adequate retracement

Flats (3-3-5)

- occur in periods involving strong larger trend and thus

virtually always precede or follow extensions

- the more powerful the underlying trend, the briefer the

flat

- within impulses, 4th waves frequently sport flats, 2nd

waves less so

REGULAR FLAT

- wave B ends near start of A, C generally ends slightly

beyond end of A

EXPANDED /IRREGULAR FLAT (common)

-B terminates beyond start of A, and C ends more

substantially beyond end of A

- show underlying trend is very strong

RUNNING FLAT (rare)

- B terminates well beyond start of A, BUT C falls short of

the end of A

Which actionary waves develop in corrective mode?

- waves 1, 3 and 5 in an ending diagonal

- wave A in a flat correction

- waves A, C and E in a triangle

- waves W and Y in double zigzags and double corrections

- wave Z in triple zigzags and triple corrections

Actionary (1, 3, 5, A, C, E, W, Y and Z) Reactionary (2, 4, B, D and X)

Wave 1s

- rarely recognized at their inception, when the news

is almost universally bad and previous trend is seen

as still being in force

- analysts are revising estimates lower, sentiment

polls are at typically at historic bearish extremes

- much greater interest in put options than call

options and implied volatility is typically quite high

- volume might pick up a bit but should not be very

high (which implies rampant short selling and a bear

market correction)

- slow and steady price increase fits more closely to

start of a new bull market

----------------------------

-roughly speaking, half of wave 1s are part of the

basing process and thus tend to be heavily corrected

by wave 2

- in contrast to the bear market rallies within previous

decline, however, this 1st wave rise is technically

more constructive, often displaying subtle increase in

volume and breadth.

- Plenty of short selling is in evidence as majority

finally become convinced that overall trend is down

and investors take advantage of one more rally to sell

on.

- the other 50% of wave 1s rise from either large

bases formed by previous correction, from downside

failures, or from extreme compression. From such

beginnings they are dynamic and only moderately

retraced

Wave 2s

-they rarely retrace less than 38% and often retrace

61.8% of wave 1 (this can be exceeded if the time

frame is very short or we are fighting off a major,

entrenched bear market, but otherwise there is a

strong possibility the count is wrong)

- assuming a bull market, the drop should be in three

waves (remember if its a-b-c zigzag down, wave a

would still develop in 5 waves but the retrace amount

of wave 1 should be rather small by the time wave a

completes)

-second subwave of wave 3s is often very shallow

and could retrace less than the 38%

- they are often fast and furious though a second

wave which is part of a corrective wave is not likely to

be as powerful as a wave 2 that is correcting the

initial wave of a major reversal

- volume should be lower than wave 1

- second waves often produce downside non-

confirmations and Dow Theory "buy spots", when low

volume and volatility indicate a drying up of selling

pressure

Wave 3s (wonders to behold)

- this is where most of the public will realize that the bear

market is over

-strong and broad (including almost all stocks), trend is

unmistakable, volume is usually highest

- increasingly favourable fundamentals as confidence

returns

- any pull-backs will be short-lived and shallow and

therefore anybody waiting will lose out

- It is most often the extended wave in the series and

wave 3 is usually at least 1.618 times as large as wave 1

in price terms but because it is very powerful will

probably take less than 1.618 times as long to complete

-third wave of a third wave will be the most volatile point

of strength and invariably produce breakouts,

"continuation" gaps, volume expansions, exceptional

breadth, major Dow Theory trend confirmations

- momentum almost always confirms the price highs

- momentum divergences confirm price action at the end

of wave 3 (if it appears complete and momentum does

not confirm it probably means it is a C wave at the end of

a correction or end of a first wave of a larger wave 3)

Wave 4s

-predictable in depth and form because by alternation

they depend and should differ from previous 2nd wave of

the same degree.

- all the books say they should retrace 38% of wave 3 but

they often fail to and may retrace more

- usually clearly corrective, difficult to count, price

declines are shallow and volume is much less than wave

3

- volatility probably wont pick up very much even though

prices are dropping

- can take a long time to develop but should not take

longer than previous impulse waves however, be

warned it is possible if that is the only inconsistency

-this initial deterioration sets stage for non-confirmations

and subtle signs of weakness during wave 5

- it is the first time that some analysts start to warn that

prices have gone to far and profit taking may ensue

Wave 5s

- often ends with momentum divergences, volume is

lower than wave 3 but as high or higher than wave 4

- less dynamic than wave 3 in terms of breadth, slower

max speed of price change (unless extension)

- optimism runs very high despite narrowing of breadth,

everybody is bullish

A waves

-Typically seen as a correction of the then-current

trend when it is actually the first leg of a reversal, or

larger correction

-5 wave A indicates a zigzag for wave B, while a 3

wave A indicates a flat or triangle

-If wave a was just three waves but achieved a deep

retracement of the prior impulse wave, then

probabilities favour a resumption of the prior trend

- if wave a was also very fast, even if the retrace was

deep, the odds favour a period of range trading (i.e.

triangle/flat/irregular/or even more complex)

meaning you can use oscillators for entries and exits

more reliably

- if there are only three subwaves, and if the

correction is shallow, wave a may not be done

- during bear markets, investment world believes

this reaction is just a pullback pursuant to the next

leg of advance

- Volumes and volatility might pick up but not nearly

enough to imply a bottom

B waves (phonies, most difficult to track)

-always either three wave patterns or triangles

- in a flat they should retrace nearly all of wave A

and at least 62% of it and by definition retrace more

than 100% if irregular/expanded

- in a zigzag wave b typically corrects 38% to 62% of

wave A. Zigzags have far more bearish implications

than flats and irregulars do

-if A has five legs (i.e. In a triangle the most

confusing of B waves) the retrace is normally < 62%

- sucker plays, often involve focus on narrow list of

stocks, often unconfirmed by other averages, rarely

technically strong, virtually always doomed to

complete retracement by C

- X and D waves in expanding triangles have the

same characteristics

- B waves of intermediate degree and lower usually

show declining volumes while those of primary

degree and greater can display volume heavier than

that which accompanied preceding bull market

C waves

- very impulsive (high level of fear), always 5 waves,

close relative of third waves

- in zigzags, C waves normally exceed wave A in time

and size

-Volume may be higher in C than A

- some suggest that wave C should not continue

beyond 1.618 times wave A but inconsistencies

occur. If wave C completes a flat, its length is usually

similar to that of wave A

-can be mistaken for new upswing if within upward

corrections of bear markets

D waves

- accompanied by increased volume in all but

expanding triangles

- as phony as B waves

E waves

- in triangles, they appear to most to be dramatic

kick off of a new downtrend after a top has been

built

- almost always accompanied by strongly supportive

views

- tendency to stage a false breakdown through the

triangle boundary line, thus intensifying bearish

conviction

Throw-over

- generally true of the two non-extended waves

when one is an extension and is especially true if the

3rd wave is an extension. If perfect equality is

lacking, a 0.618 multiple is the next likely

relationship

TECHNIQUE

- parallel trend channels typically mark the upper

and lower boundaries of impulse waves, often with

dramatic precision

- when wave 3 ends connect points 1 and 3, then

draw a parallel line touching point 2. This initial

channel provides an estimate boundary for wave 4

- if wave 4 ends at a point not touching the parallel,

you must reconstruct the channel in order to

estimate boundary for wave 5. First connect wave 2

and 4

- if waves 1 and 3 are normal, upper parallel most

accurately forecasts end of wave 5. If wave 3 is

abnormally strong, almost vertical, a parallel

touching the top of wave 1 is usually more useful.

Alternation - always expect a difference in the

next expression of a similar wave

IMPULSES

- one of the two corrective phases will contain a

move back to or beyond the end of the preceding

impulse, the other will not

- Wave 2 and wave 4 will usually not look alike (i.e. if

wave 2 is a sharp correction, wave 4 is more likely to

be sideways and vice versa)

- sharp corrections NEVER include a new price

extreme, they are almost always zigzags (single,

double, triple), occasionally they are double threes

that begin with a zigzag.

- sideways corrections include flats, triangles, double

and triple corrections, they usually include a new

price extreme, in rare cases a regular triangle (i.e.

one that does not include a new price extreme) in

4th wave position will take the place of a sharp

correction and alternate with another type of

sideways pattern in the 2nd wave position

- diagonal triangles do not display alternation

between subwaves 2 and 4, typically both are zigzags

- extensions are an expression of alternation

CORRECTIVE WAVES

- if a large correction begins with a flat a-b-c

construction for wave A, expect a zigzag a-b-c for

wave B and vice versa

- quite often, if a large correction begins with a

simple a-b-c zigzag for wave A, wave B will stretch

out into a more intricately subdivided a-b-c zigzag to

achieve alternation. Sometimes wave C will be yet

more complex. The reverse order of complexity is

less common.

Depth of corrective waves/bear

markets

- corrections/bear markets, especially when they

themselves are 4th waves, tend to register their

maximum retracement within the span of travel of

the previous 4th wave of one lesser degree, most

commonly near the level of its terminus

- however, it is often the case that if wave 1 in a

sequence extends, the correction following the 5th

wave will have as a typical limit, the bottom of the

2nd wave of lesser degree

-On occasion, flat corrections or triangles,

particularly those following extensions, will barely

fail to reach into the 4th wave area

- Second wave corrections tend to be fairly deep

- Zigzags, on occasion will cut deeply and move

down into the area of the 2nd wave of lesser degree,

although this almost exclusively occurs when the

zigzags are themselves 2nd waves. "Double

bottoms" are sometimes formed in this manner

- when wave 5 of an advance is an extension, the

ensuing correction will be sharp and find support at

low of wave 2 of the extension. Sometimes the

correction may end there or it may just be an

accurate turning point for A.

Channelling

- one of the guidelines of EWT is that two of the motive

waves in a five wave sequence will tend toward

equality in time and magnitude. This is generally true of

the two non-extended waves when one is an extension

and is especially true if the 3rd wave is an extension. If

perfect equality is lacking, a 0.618 multiple is the next

likely relationship

TECHNIQUE

- parallel trend channels typically mark the upper and

lower boundaries of impulse waves, often with dramatic

precision

- when wave 3 ends connect points 1 and 3, then draw a

parallel line touching point 2. This initial channel

provides an estimate boundary for wave 4

- if wave 4 ends at a point not touching the parallel, you

must reconstruct the channel in order to estimate

boundary for wave 5. First connect wave 2 and 4

- if waves 1 and 3 are normal, upper parallel most

accurately forecasts end of wave 5. If wave 3 is

abnormally strong, almost vertical, a parallel touching

the top of wave 1 is usually more useful.

THROW-OVER

- within parallel channels and converging lines of

diagonal triangles, a 5th wave approaching the trendline

on declining volume indicates the wave will meet or fall

short of it. Heavy volume indicates a possible throw-

over - near the point of throw-over, a 4th wave of small

degree may trend sideways immediately below the

parallel, allowing 5th to break in final gust of volume

- occasionally telegraphed by a preceding "throw-

under" either by wave 4 or 2 of 5. They are confirmed by

immediate reversal back below the line.

Volume

- a low point in volume often coincides with a

turning point in the market.

- in normal 5th waves below Primary degree, volume

tends to be less than in wave 3s. If volume in wave 5

of less than Primary degree is equal to or greater

than in wave 3, an extension of the 5th wave is in

force (this is expected anyway if wave 1 and 3 are

about equal in length, but it is an excellent warning

of rare times when both wave 3 and 5 are extended)

- volume at terminal point of a bull market above

Primary degree tends to run at all time high

Retracements

-Occasionally a correction retraces a Fib % of the

preceding wave

- markets are more likely to obey Fib lines (and other

measures of support and resistance) during times of

high volatility

-sharp corrections often tend to retrace 61.8% or

50% of the previous wave, particularly when they

occur as wave 2 of an impulse, wave B of a larger

zigzag, or wave X in a multiple zigzag

- sideways corrections tend more often to retrace

38.2% of the previous impulse wave, particularly

when the occur as wave 4

Motive Wave Multiples

- wave 3 usually exceeds the size of wave 1 by 1.618 times but may reach 2.618 or 4.236 times

- a weak wave 5 might only attain 0.618 of wave 1

- if waves 1 and 3 are close in size, wave 5 will likely reach 1.618 or more times wave 1

- the distance travelled by wave 5 usually reaches between 61.8% and 100% of the total price gain/loss

covered by wave 1 through 3. A move greater than 100% likely means current leg is actually wave 3 of very

powerful third

- as a generalization, unless wave 1 is extended, wave 4 (at the point of its start, end or extreme countertrend

point) often divides the price range of an impulse wave into the Golden Section whereby the latter portion is

0.382 of the total distance if wave 5 is not extended (Fig 4-6) and 0.618 when it is (Fig 4-7). It therefore provides

two or three closely clustered targets for the end of wave 5 and this guideline explains why the target for a

retracement following a wave 5 often is doubly indicated by the end of the preceding 4

th

wave and the 0.382

retracement point.

-when wave 3 is extended, 1 and 5 tend to equality or a 0.618 relationship (Fig 4-3)

-wave 5's length is sometimes related by the Fib ratio to the length of wave 1 through 3 (Fig 4-4). 0.382 and

0.618 relationships occur when wave 5 is not extended.

- in rare cases where wave 1 is extended, wave 2 often subdivides the entire impulse wave into the Golden

Section (Fig 4-5)

Corrective Wave Multiples

-wave C is often very close to A in size (Fig 4-8) and usually not more than 1.618 of A in a zigzag and is not

uncommonly also 0.618 times A. The same relationship applies to a second zigzag relative to the first (Fig-4-9)

- weaker corrections may see wave C reach only 61.8% of A

- in flats, wave C rarely exceeds a 1.000 ratio to wave A

- subsequent legs of a triangle often retrace 61.8% of the prior leg

- in a regular flat, A, B and C are approximately equal (4-10)

- in an expanded flat, wave C is often 1.618 times the length of wave A. Sometimes C will terminate beyond

the end of A by 0.618 times the length of A. Both tendencies are illustrated in Fig 4-11

- wave B in an expanded flat is sometimes 1.236 or 1.382 times the length of A

- in rare cases wave C is 2.618 times the length of wave A

- in a triangle at least two of the alternate waves are typically related by 0.618 (i.e. e=0.618c, c=0.618a, or

d=0.618b). In an expanding triangle the multiple is 1.618 and in rare cases, adjacent waves are related by

these ratios

- in double and triple corrections, the net travel of one simple pattern is sometimes related to another by

equality or particularly if one of the threes is a triangle, by 0.618

- wave 4 quite commonly spans a gross and/or net price range that has an equality or Fib relationship to its

corresponding wave 2. As with impulse waves, these relationships usually occur in percentage terms

Вам также может понравиться

- Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureОт EverandHarmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave StructureРейтинг: 3 из 5 звезд3/5 (1)

- Elliott GuideДокумент42 страницыElliott GuideemreОценок пока нет

- Elliott Wave Structures Guide - Page 1Документ2 страницыElliott Wave Structures Guide - Page 1Access LimitedОценок пока нет

- EW RulesДокумент9 страницEW Rulesleslie woods100% (1)

- Elliott Wave Lesson 4Документ6 страницElliott Wave Lesson 4Haryanto Haryanto HaryantoОценок пока нет

- Guideline 1: How To Draw Elliott Wave On ChartДокумент6 страницGuideline 1: How To Draw Elliott Wave On ChartAtul Mestry100% (2)

- EW Swing Sequence SeminarFinalEditedДокумент32 страницыEW Swing Sequence SeminarFinalEditedfrancescoabcОценок пока нет

- Elliot Explisocın To FuckДокумент10 страницElliot Explisocın To FuckAli GBОценок пока нет

- Wave Notes - ElliottwavepredictionsДокумент14 страницWave Notes - Elliottwavepredictionspier100% (1)

- Definitive Guide of Elliott Wave Forecasting EWFДокумент14 страницDefinitive Guide of Elliott Wave Forecasting EWFaqhilОценок пока нет

- Elliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveДокумент30 страницElliot Wave: by Noname Intermediate Elliot Wave Advanced Elliot WaveGlobal Evangelical Church Sogakope BuyingLeads100% (1)

- Elliott Wave Rules - GuidelinesДокумент9 страницElliott Wave Rules - GuidelinesaaaaaОценок пока нет

- Summary of Rules and Guidelines For WavesДокумент6 страницSummary of Rules and Guidelines For WavesemailtodeepОценок пока нет

- Elliott Wave Cheat SheetsДокумент56 страницElliott Wave Cheat SheetsXuân Bắc100% (5)

- Using Elliot Wave For Advanced UsersДокумент9 страницUsing Elliot Wave For Advanced Usersokeke ekene100% (1)

- 1001 Discovering EWPДокумент11 страниц1001 Discovering EWPJustin Yeo0% (1)

- New Elliottwave Short VersionДокумент58 страницNew Elliottwave Short VersionPeter Nguyen100% (1)

- Putting It All Together. Welcome To Module 4Документ52 страницыPutting It All Together. Welcome To Module 4Raul Domingues Porto Junior100% (3)

- 3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave TheoryДокумент13 страниц3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave Theoryomi221Оценок пока нет

- Pattern Analysis: A Capsule Summary of The Wave PrincipleДокумент34 страницыPattern Analysis: A Capsule Summary of The Wave PrincipleCarlos XaplosОценок пока нет

- Introduction & OverviewДокумент26 страницIntroduction & Overviewblank no100% (1)

- The Wavy Tunnel: Trading Live Jody SamuelsДокумент42 страницыThe Wavy Tunnel: Trading Live Jody SamuelsPeter Nguyen100% (1)

- Elliott Wave TheoryДокумент13 страницElliott Wave Theorymark adamОценок пока нет

- Elliott Wave Rules and GuidelinesДокумент4 страницыElliott Wave Rules and Guidelineskacraj100% (1)

- Pattern Analysis: A Capsule Summary of The Wave PrincipleДокумент118 страницPattern Analysis: A Capsule Summary of The Wave PrincipleHarmanpreet DhimanОценок пока нет

- Excerpts, Contents & Prices: Elliott Wave TradingДокумент48 страницExcerpts, Contents & Prices: Elliott Wave TradingCristian100% (2)

- Easy Way To Spot Elliott Waves With Just One Secret Tip PDFДокумент4 страницыEasy Way To Spot Elliott Waves With Just One Secret Tip PDFJack XuanОценок пока нет

- 24.progress Labels in ZigzagsДокумент16 страниц24.progress Labels in ZigzagsSATISHОценок пока нет

- Cheatsheets - Elliot WavesДокумент3 страницыCheatsheets - Elliot WavesPaul Mears100% (1)

- Module 3 Corrective PatternsДокумент46 страницModule 3 Corrective PatternsDuy DangОценок пока нет

- Esignal Manual Ch6Документ10 страницEsignal Manual Ch6dee138100% (1)

- How To Predict Market's Tops & Bottoms Using Elliott Wave PrincipleДокумент20 страницHow To Predict Market's Tops & Bottoms Using Elliott Wave PrincipleHery100% (1)

- New Elliottwave Execution and Correlation Final Aug 13 14552100Документ95 страницNew Elliottwave Execution and Correlation Final Aug 13 14552100Peter Nguyen100% (3)

- Practical Ew StrategiesДокумент48 страницPractical Ew Strategiesanudora100% (2)

- 17.dear FriendsДокумент18 страниц17.dear FriendsSATISHОценок пока нет

- Wave 4 Should Not Overlap Wave 1Документ4 страницыWave 4 Should Not Overlap Wave 1James Roni100% (1)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersДокумент148 страницHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerОценок пока нет

- GuideToElliottWaveAnalysisAug2012 PDFДокумент5 страницGuideToElliottWaveAnalysisAug2012 PDFvhugeat50% (2)

- The Wavy Tunnel: End of Trend Trades Jody SamuelsДокумент42 страницыThe Wavy Tunnel: End of Trend Trades Jody SamuelsPeter Nguyen100% (1)

- 26.missing Waves and EmulationsДокумент11 страниц26.missing Waves and EmulationsSATISHОценок пока нет

- Module 4 - Trade ManagementДокумент43 страницыModule 4 - Trade Managementblank no100% (1)

- Elliott Wave Basics Impulse PatternsДокумент12 страницElliott Wave Basics Impulse Patternsjagadeesh44Оценок пока нет

- Rules & Guidelines of Elliott WaveДокумент12 страницRules & Guidelines of Elliott WaveNd Reyes100% (2)

- EWT Lecture Notes by Soros1Документ131 страницаEWT Lecture Notes by Soros1Shah Aia Takaful Planner100% (1)

- Corrective WaveДокумент1 страницаCorrective WaveMoses ArgОценок пока нет

- Neowave Charts: Gold - Daily DataДокумент5 страницNeowave Charts: Gold - Daily DataSantosh Rangnekar100% (3)

- ElliottWaveManual+G P@FBДокумент71 страницаElliottWaveManual+G P@FBPranshu gupta100% (2)

- Neowave Theory by Glenn Neely. Corrections. Rules To Spot A Flat and Zigzag. Variations of Corrections and Formal Logic RulesДокумент12 страницNeowave Theory by Glenn Neely. Corrections. Rules To Spot A Flat and Zigzag. Variations of Corrections and Formal Logic RulesSATISHОценок пока нет

- The Mystery of Waves - Elliott Wave AnalysisДокумент6 страницThe Mystery of Waves - Elliott Wave AnalysismgrreddyОценок пока нет

- Dynamic Trader Daily Report: Initial Stop PlacementДокумент6 страницDynamic Trader Daily Report: Initial Stop PlacementBudi MuljonoОценок пока нет

- Market Mirrors Trend ChangesДокумент14 страницMarket Mirrors Trend ChangesmrsingkingОценок пока нет

- Fib Calculations in Elliott Wave Theory AnalysisДокумент6 страницFib Calculations in Elliott Wave Theory Analysishaseeb100% (1)

- Wavy Tunnel Module 62012Документ32 страницыWavy Tunnel Module 62012Minh Trần100% (2)

- NEo Wave SensexДокумент1 страницаNEo Wave SensexJatin SoniОценок пока нет

- Edition 24 - Chartered 16 February 2011Документ11 страницEdition 24 - Chartered 16 February 2011Joel HewishОценок пока нет

- ESignal - Manual - ch23 Elliot Wave TriggerДокумент2 страницыESignal - Manual - ch23 Elliot Wave Triggerlaxmicc100% (1)

- Sharpening Skills WyckoffДокумент16 страницSharpening Skills Wyckoffsatish s100% (1)

- Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesОт EverandMastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesРейтинг: 3.5 из 5 звезд3.5/5 (2)

- Seeker S Series Article AogrДокумент2 страницыSeeker S Series Article AogrezrawongОценок пока нет

- JFE CasingДокумент40 страницJFE CasingezrawongОценок пока нет

- Varel Fixed Cutter Drill BitsДокумент28 страницVarel Fixed Cutter Drill Bitsezrawong100% (1)

- JFE CasingДокумент40 страницJFE CasingezrawongОценок пока нет

- Vios BrochureДокумент7 страницVios Brochureezrawong100% (1)

- Tech FactsДокумент24 страницыTech FactsezrawongОценок пока нет

- Bit Hydraulics Optimization AADE 07 NTCE 35Документ10 страницBit Hydraulics Optimization AADE 07 NTCE 35ezrawongОценок пока нет

- A Glossary of Macroeconomics TermsДокумент5 страницA Glossary of Macroeconomics TermsGanga BasinОценок пока нет

- Manual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesДокумент15 страницManual For SOA Exam FM/CAS Exam 2.: Chapter 7. Derivative Markets. Section 7.3. FuturesAlbert ChangОценок пока нет

- Malta in A NutshellДокумент4 страницыMalta in A NutshellsjplepОценок пока нет

- Asiawide Franchise Consultant (AFC)Документ8 страницAsiawide Franchise Consultant (AFC)strawberryktОценок пока нет

- Agony of ReformДокумент3 страницыAgony of ReformHarmon SolanteОценок пока нет

- Arithmetic of EquitiesДокумент5 страницArithmetic of Equitiesrwmortell3580Оценок пока нет

- Dak Tronic SДокумент25 страницDak Tronic SBreejum Portulum BrascusОценок пока нет

- Nissan Leaf - The Bulletin, March 2011Документ2 страницыNissan Leaf - The Bulletin, March 2011belgianwafflingОценок пока нет

- Financial Literacy PDFДокумент44 страницыFinancial Literacy PDFGilbert MendozaОценок пока нет

- Dhiratara Pradipta Narendra (1506790210)Документ4 страницыDhiratara Pradipta Narendra (1506790210)Pradipta NarendraОценок пока нет

- VENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Документ1 страницаVENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Riandi HartartoОценок пока нет

- Is Enron OverpricedДокумент3 страницыIs Enron Overpricedgarimag2kОценок пока нет

- Quasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British AirwaysДокумент12 страницQuasha, Asperilla, Ancheta, Peña, Valmonte & Marcos For Respondent British Airwaysbabyclaire17Оценок пока нет

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenДокумент62 страницы© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊОценок пока нет

- Accra Resilience Strategy DocumentДокумент63 страницыAccra Resilience Strategy DocumentKweku Zurek100% (1)

- Benetton (A) CaseДокумент15 страницBenetton (A) CaseRaminder NagpalОценок пока нет

- The Possibility of Making An Umbrella and Raincoat in A Plastic WrapperДокумент15 страницThe Possibility of Making An Umbrella and Raincoat in A Plastic WrapperMadelline B. TamayoОценок пока нет

- Dimapanat, Nur-Hussein L. Atty. Porfirio PanganibanДокумент3 страницыDimapanat, Nur-Hussein L. Atty. Porfirio PanganibanHussein DeeОценок пока нет

- Measure of Eco WelfareДокумент7 страницMeasure of Eco WelfareRUDRESH SINGHОценок пока нет

- PaySlip 05 201911 5552Документ1 страницаPaySlip 05 201911 5552KumarОценок пока нет

- Patent Trolling in IndiaДокумент3 страницыPatent Trolling in IndiaM VridhiОценок пока нет

- Fire Service Resource GuideДокумент45 страницFire Service Resource GuidegarytxОценок пока нет

- Bill CertificateДокумент3 страницыBill CertificateRohith ReddyОценок пока нет

- Ekspedisi Central - Google SearchДокумент1 страницаEkspedisi Central - Google SearchSketch DevОценок пока нет

- BiogasForSanitation LesothoДокумент20 страницBiogasForSanitation LesothomangooooОценок пока нет

- What Is Zoning?Документ6 страницWhat Is Zoning?M-NCPPCОценок пока нет

- The Making of A Global World 1Документ6 страницThe Making of A Global World 1SujitnkbpsОценок пока нет

- Presentation On " ": Human Resource Practices OF BRAC BANKДокумент14 страницPresentation On " ": Human Resource Practices OF BRAC BANKTanvir KaziОценок пока нет

- Fiscal Deficit UPSCДокумент3 страницыFiscal Deficit UPSCSubbareddyОценок пока нет

- MHO ProposalДокумент4 страницыMHO ProposalLGU PadadaОценок пока нет