Академический Документы

Профессиональный Документы

Культура Документы

Giant Labour Market Powerpoint

Загружено:

api-225869492Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Giant Labour Market Powerpoint

Загружено:

api-225869492Авторское право:

Доступные форматы

Labour markets

2 parts

1. supply, demand and wage determination

2. Labour market failure

Work vs Leisure

An alternative to work is leisure time.

For each hour an individual works there

is an OPPORTUNITY COST

If an hour of leisure time is chosen, the

WAGE is the OPPORTUNITY foregone

PART 1

DEMAND, SUPPLY AND WAGE

DETERMINATION

Supply of labour

The total number of hours that labour is willing and able to supply at a

given wage rate.

And

The number of workers willing and able to work in a given occupation or

industry for a given wage.

wage

Hours/quantity

The labour supply curve

The labour supply curve for any industry or

occupation will be upward sloping because

as wages rise, other workers enter this industry

attracted by the incentive of higher rewards.

They may have moved from other industries or

they may not have previously held a job, such as

housewives or the unemployed.

The extent to which a rise in the wage or salary

in an occupation increases labour supply

depends on the elasticity of labour supply.

Backward sloping labour supply curve!

In the short run the

individuals supply

curve may be

backward sloping

because of the

income and

substitution effects

Income effect

The income effect of a wage rise is to:

Reduce the number of hours people work

because as the wage rate rises, the worker

buys more goods and services including leisure.

They have enough money so if they can earn

the same for doing fewer hours they will.

Substitution effect

The substitution effect of a wage rise is to

Increase the number of hours people work

because as the wage rate rises, the worker gains

more from working and increases the opportunity

cost of leisure so the worker selects to work more

hours. I.e. As the wage rate rises, more labour is

supplied to earn more money.

If the wage rate is low, do you think there will be more of an

income effect or a substitution effect and why?

At a low wage rate there is more likely to be a

substitution effect as working more hours will

increase a workers living standards

Once the wage rate has reached a certain

level, the income effect may outweigh the

substitution effect and an individual will buy

more leisure

Q What is the problem with the income and

substitution effect theory in reality?

Many workers are unable to alter the number

of hours they work in their main jobs.

They have a fixed contract

Supply in the long run

In the long run people are able to change their

occupations - the supply of labour is

influenced by the net advantages of the job.

This means the

Pecuniary (financial) and

Non pecuniary (non financial) factors

Pecuniary factors

Wage rate

Opportunity to work overtime

Possibility of bonuses

Non-pecuniary factors

Convenience and flexibility of hours

Status

Promotion chances

Location (flexibility)

Qualifications and skills

Job security

Pleasantness of the job

Non-pecuniary factors cont

Holidays

Perks and fringe benefits

Quantity and quality of training on offer

Recent performance of the firm

The elasticity of supply of labour

The extent to which the supply of labour

changes as a result of a change in the wage

rate is measure by PES of labour

% change in Q of labour supplied

% change in wage rate

Influences n PES of labour

qualifications and skills required

Supply of skilled workers is more inelastic than the

supply of unskilled workers e.g. the supply of vets is

more inelastic than the supply of shop assistants

the length of training

A long period may discourage people from the

occupation. It will take some time for people to

qualify even if the wage rate rises. If it falls, people

who are a long way into their training may not leave

Influences on PES of labour

the immobility of labour

Depends on how easy it is for workers to switch jobs

(occupational mobility) or to move areas

(geographical mobility). Mobility means more elastic

supply.

the time period

Over a longer period of time, labour supply becomes more

elastic. In the short run, the wage rate can rise but with little

effect on the labour supply

How useful are these explanations?

Doctor

McDonalds worker

Economist

Solicitor

Nurse

Teacher

Firefighter

Summary supply of labour

The supply of labour is upward sloping the

higher the wage, the more labour is supplied

In the short run it may be backward sloping

owing to income and substitution effects

In the long run it is determined by the net

advantages of the job (pec and non pec)

It can be elastic or inelastic depending on

quals and skills required, length of training,

mobility of labour and time.

Demand for labour

In the recession, the UK housing market experienced a

downturn. Housing projects were delayed and scaled down

existing sites.

What is most likely to have happened to the employment of

plasterers and bricklayers? (they will experience lower demand

for their services)

Demand for labour is DERIVED (demand

for one depends on demand for another)

Factors influencing demand for labour

Demand and expected future demand for a product

The expected revenue from increasing/decreasing

production can change demand for labour

Productivity

The higher the output per worker, the more attractive

labour is as a resource

Wage rate

If the wage rate rises about productivity, costs rise and

could contract demand for labour

Factors influencing demand for labour

Complementary labour costs

A change in any other costs associated with labour

e.g. National insurance contributions could change

the demand for labour

The price of other factors of production

When other factors of prod. change demand for

labour can change e.g. If capital becomes cheaper,

workers could be replaced by machines

Question

Why is demand for migrant workers still high

despite the recession?

Demand for firms products means labour still

needed?

Skills shortages in the UK?

Migrant workers more productive?

Cheaper?

More flexible about hours, working conditions etc?

Marginal revenue product of labour

a theory about demand for labour and about the price

of labour

MRP theory states that demand for labour depends

upon 2 things

Productivity of labour

the demand for the good they produce (which

determines price)

MRP Calculation

MPP (marginal physical product)

Marginal revenue (this is the price of the

product in perfect competition)

MRP of labour = MPP x Price

Marginal Revenue Product Theory:

MRP is important in determining wages.

Workers with higher productivity will tend to get higher wages. Also,

workers who help produce profitable goods will get higher salaries. For

example, lawyers and professional footballers get high salaries

because the marginal revenue of their goods are high

Criticisms of MRP theory

it can be difficult to determine the MRP of workers, for

example, many in the service sector do not produce a

tangible output e.g. nurses and teachers

It assumes that workers are homogenous they are

not, they have differing abilities and productivities

It ignores that fact that some businesses have

monopsony power and can dictate a lower wage rate

than MRP suggests

It assumes that workers are geog and occ mobile and

that the supply of labour is perfectly elastic - in reality

it is not

Elasticity of demand for labour

% change in quantity of labour demanded

% change in the wage rate

inelastic

elastic

Factors affecting elasticity of demand for labour

1. The proportion of labour costs in the total costs of a business:

When a businesses labour expenses are a high proportion of total costs, labour

demand can be expected to be more elastic than a business or industry where

fixed costs of capital are the dominant business expense

2. The ease and cost of factor substitution:

The demand for labour tends to be more elastic when labour and capital are easily

substitutable.

This depends on the nature of the production process, the added human value

that the labour input provides (particularly in service industries) and the flexibility

of the labour market (for example the ease and cost of hiring & firing labour is

influenced by existing employment laws). When labour is considered a necessity in

the production process, the demand will be inelastic in responsive to wage

changes. Think about the difference between a car manufacturer and a hotel

Factors affecting elasticity of demand for labour - cont

3. The price elasticity of demand for the final output produced by a

business:

If a firm is operating in a highly competitive market where final

demand for the product is price elastic, they may have little power

to pass on higher wage costs to consumers through a higher price,

the demand for labour may therefore be more elastic as a

consequence

4. The time period under consideration:

In the short run, at least one factor of production is assumed to be

fixed so the demand for labour as an input will be more inelastic

compared to the long run when a business has a much greater

opportunity to vary the factor mix between labour and capital

Summary demand for labour

Demand for labour is DERIVED

Factors that affect it are: demand for the product,

productivity, wage rate, complementary labour

costs

MRP is a theory of demand for labour that

depends on productivity the more productive a

worker, the greater the MRP

Elasticity of demand for labour depends on: Ease

of factor substitution, Time, PED for the product

(final output) and the proportion of labour costs

to total costs

Wage determination

Supply and demand interact to determine the

wage rate

Demand and supply

could be elastic e.g.

cleaners, fast food

worker (lower wage

rate)

Demand and supply

could be inelastic

e.g. brain surgeons,

barristers (higher

wage rate)

Wage determination 2

MRP(L) also explains the wage rate

A worker is paid according to his/her MRP. A

barrister would have a higher MRP than a

cleaner therefore would be paid a higher

wage.

As the MRP of a worker increases, they can be

paid a higher wage

Wage differentials

Why are there differences between the wages earned

in alternative occupations

This occurs because of

Skill levels

Length of time to train

Demand for labour (PED, substitutes)

Public opinion

Government policy

Relative bargaining strength (trade union)

MRP

OTHER FACTORS FOLLOW IN THE NEXT SLIDES

Male vs Female

Male (paid more on average)

More women work part time

Gap narrowing

MRP of women is much lower (average)

Historically men better qualified

MRP lower as women disproportionately employed in

low paid jobs that generate low marginal revenue

Women leave the labour market to have children and

lose out on promotional chances

Discrimination

Skilled vs Unskilled

Skilled (paid more)

Demand is higher and supply is lower

MRP higher as output is higher

Higher level of human capital

Higher education and training = productivity

Difficult to substitute with machines

Part time vs Full time

Part time (lower paid)

Supply high relative to demand

Productivity lower as they receive less training

Higher proportion are women

Only a small number in a trade union

Ethnic minorities

Ethnic minorities (lower paid on average)

Discrimination

High proportion of Asians working in catering

which is low paid

Qualifications are lower particularly in women

Economic Rent and Transfer Earnings

A person stays in a job depending on the

economic rent and transfer earnings

Transfer earnings = the minimum payment

needed to keep a worker in work (min

payment needed to keep a factor of

production in its present use)

Economic rent = the payment to the factor

(worker) over and above its transfer earnings

in the long run

diagram

Transfer earnings is the minimum wage you

would require for doing a job.

Economic rent is the different between what you

get paid and what you would do the job for.

The amount of transfer

earnings and economic

rent depends on the

elasticity of supply

Summary wage determination

Wages are determined in a competitive market

through:

Supply and demand (note the elasticity can be

important)

MRP of labour

Because of pay differentials

Because of economic rent and transfer earnings

Part 2

Labour market failure

Labour Market Failure

Is caused by:

1. Monopsony power

2. Trade Union power

3. Imperfect information

4. Skill shortages

5. Economic inactivity

6. Unemployment

7. Discrimination

8. Segmented labour markets

9. Geographical and occupational immobility of labour

1.Monopsony

A monopsony producer has significant buying power in the labour market when

seeking to employ extra workers. A monopsony employer may use their buying-

power to drive down wage rates. The market fails if this is the case

The marginal cost of employing one more worker

will be higher than the average cost because to

employ one extra worker the firm has to pay more

and increase the wages of all workers.

To maximise the level of profit the firm

employs Q2 of workers where MC = MRP

The firm only has to

pay a wage of W2. This

is less than the

competitive wage

2. Trade Unions

Trade unions are organisations that represent

people at work.

They can put pressure on firms for improved pay

and conditions and higher pay. They can:

Restrict the supply of labour

Strike/stop/disrupt production

This causes labour market failure (see page 18 of

revision booklet for an evaluation of their use)

How do they work?

They push up wages to W2 which is

above the equilibrium and could

cause unemployment between Q2

and Q3

HOWEVER if the employer is a monopsony they

could actually increase employment as at the higher

wage, more people would be willing to supply their

labour

The wage is at W2 but the union could bargain for

W1 or W3. At W3 more people could be employed

but at W3 no extra workers would want to work but

unemployment would not be made worse

Other causes of labour market failure

3. Imperfect information

Workers may not have the information they

need to get a job or a better job - Employers

may not be able to afford to advertise to all

potential employees so dont get the best

employees solution job centres, national

databases of jobs

Other causes of labour market failure

4. Skill shortages

Occur when firms struggle to recruit people

with the right skills may have to bid up

wages = increased costs. Short-termist

attitude towards training? Solutions

education and training, immigration

Other causes of labour market failure

5. Economic inactivity

People who are not in the workforce (actively

seeking or in a job). Some economically

inactive e.g. students will provide a long term

benefit. Others could work and represent a

waste of resources. Solutions cut benefits,

provide training, minimum wage as an

incentive to work

Other causes of labour market failure

6. Unemployment

Unemployment means some labour markets

are not clearing

Those willing and able to work cannot find a

job

Causes- cyclical (lack of aggregate demand)

Voluntary, frictional and structural

7. Discrimination

Could be caused by several factors including:

Personal prejudice

Imperfect information employers do not

know how productive a worker may be so may

avoid employing for e.g. over 50s as they may

wrongly believe they will be less productive

than younger workers

Solutions education, training, information,

laws

8. Segmented labour markets

There are barriers that prevent workers

moving freely between occupations

Some barriers are good e.g. taxi drivers

requiring a driving licence and Surgeons

requiring skills and qualifications

Others are unnecessary and have been

introduced to push up wages and to keep

groups out

9. Geographical and occupational

immobility of labour

Mobility = the ability to move from one sector of

employment to another

Changing occupation (occupational)

Moving to work in another area (geographical)

A lack of labour mobility is the cause of

structural unemployment (mismatches)

Mobility of labour

Occupational immobility is a result of a skills

shortage

Effects

Low skills = low wages

Firms limited to lower profits/cannot achieve

their objectives

Mobility of labour

Inflation and unemployment (because of skills

mismatch )

- there is always a small amount of unemployment

even if the market is in equilibrium.

To solve this AD could be increases but this would lead to

inflation (higher costs = higher prices). The lowest level of

unemployment that keeps inflation stable is called the non

accelerating inflation rate of unemployment (NAIRU)

Limitation on competitiveness

Inequality

Geographical immobility

Lack of information

House prices and structure of housing (renting

vs buying)

Family and social ties

Question

4 (a) With the use of examples, explain what

is meant by labour market failure. [15]

(b) Government attempts to correct market

failure by intervening in the labour market

are likely to cause more problems than they

solve. Discuss this view. *20+

June 2009

Labour market flexibility (solves

market failure)

What is it (different types of)

Where the supply of labour is responsive to

changes in the demand for labour.

Labour mobility (occ and geog)

Flexible working patterns (part time, variable

hours, shift work, temp contracts, home working)

Wage flexibility - wages should move both

upwards and downwards in response to changes

in supply demand

Labour market flexibility

Methods to achieve it

training and education

Cut income tax and UE benefits

Link UE benefit to search for employment

Remove employment protection legislation

(Thatcher did this in the 80s but Labour Govt

signed up to the EU social charter in 1997 so

had to re-introduce more protection)

Implications of it

UK more flexible as govt has removed restrictions

on hiring and firing. USA has lower protection

but other EU has more

Widened participation (i.e. more women in the

workforce as a result of more part time

opportunities

Less job security more frictional unemployment

but greater employment overall.

Greater competitiveness

Evaluation

Look at the figures in your hand out is it

better or worse for the UK economy to have a

flexible workforce.

Why and how does the government intervene

in the labour market?

Employment

Information provision

Regional policy

Training and education

NMW legislation

Discrimination legislation

TU legislation

PENSIONS

Explain why there is a Pensions Crisis.

The Pensions Crisis has come about for various reasons

increasing life expectancy,

early retirement schemes draining pension funds,

poor performance of certain funds,

employers and employees not paying sufficient

contributions.

The crisis is that many funds, particular private sector

ones, will not be in a position to pay out what is

expected in the near future

Discuss the extent to which this Pensions Crisis might impact

on the UK labour market and the economy as a whole.

The most likely impact on the labour market is that the normal

retirement age for male and female workers will increase.

A tightening up on early retirements and similar concessions that

are currently given by pension funds. Consequently, the typical age

of workers will increase some may be rather disillusioned.

The impact on the economy is that government intervention may

be needed in the short term to bale out pension funds.

There are also implications for the funding of the State Pension and

other public services.

Longer term, the economy may become more productive due to

often well qualified people remaining in the labour market.

Unqualified labour may find it more difficult to obtain work and

impact on the rates of direct taxation for those in work.

Immigration

Advantages

An expansion of the labour supply

Reduced pressure on wage inflation

Aggregate demand effects- economic

migrants are likely to earn more than they

spend contributing to the growth of the local

or regional economy

Immigration

The costs of migration

Depressing the real wages of domestic workers

Doubts about productivity effect: Many immigrants,

especially those from poorer countries, have a low

educational level and are more likely to be unemployed

or economically inactive than the domestic population.

Increased pressure on the welfare state (benefits,

education, housing and health)

Unemployment concerns

Increased pressure on scarce resources: (e.g. housing)

EU Directives

EU directives (laws) have to be made into UK law

within a set time period e.g. 2 years

The UK has the least protection for workers in

Europe whereas EU directives tend to help

protect workers e.g. the NMW and maximum

working week came from EU directives. Recently

the parental leave directive was made UK law

evaluate the effects on the labour market

(flexibility in particular)

Poverty and inequality

Represents about market failure as this shouldnt

happen if the market works efficiently the wage

would be at a level that is enough to live on and

everyone would be in a job (this doesnt happen in

reality)

Absolute poverty - The inability to purchase the basic

necessities of life e.g. food, shelter, clothing

Relative poverty (UK) - A measure of households in one

country where income is behind the average

The widely accepted definition of poverty is having an

income which is less than 60% of the national average

What causes poverty?

Unemployment

Low wages

Sickness and disability

Old age

Poverty trap

Bing a lone parent

Reluctance to claim benefits

What are the effects of poverty?

Low life expectancy

Poor health

Lower education

Alienation from society

Burden on government/reduction in

productivity

Measuring relative poverty

(1) The Lorenz Curve a diagram to illustrate income

distribution

(2) The Gini-coefficient - a calculation based on the

lorenz curve to compare income inequality. A value

between 0 and 1. The closer to 1 the more unequal

(3) The percentage of households living below a given

percentage of median incomes (60% in UK)

Most measures of relative poverty concentrate on

income rather than wealth

Causes of income inequality

Main cause: The disparity in wages and earnings growth in different jobs and industries

Huge rises in earnings for the better off

Slower growth of pay for people in low-paid jobs

Welfare:

Falling relative incomes for those dependent on state welfare benefits whose value

rises each year in line with prices rather than incomes

Structural / long-term unemployment

E.g. a high level of workless households (the economically inactive) where no one in

the household is in paid work

Low paid jobs:

A long term shift towards part-time service sector employment often relatively low

paid work with little or no trade union protection

Taxation: Less progressive tax system

Cuts in the higher rates of income tax (40%)

Inequalities in wealth also create income inequalities

(e.g. interest from savings, dividends from shares, income from private occupational

pensions)

Government interventions

A Tax

Increasing progressive taxes such as the higher

rate of income tax from 40% to 50% will take

more income from those on high income

levels. This enables cuts in regressive taxes

and increased benefits which help increase

the income of the poor.

Government interventions

B. increase benefits to the poor

Advantages of means tested benefits:

They allow money to be targeted to those

who need it most. e.g family tax credit or

pension credit.

It is cheaper than universal benefits and

reduces the burden on the tax payer

However means tested benefits are

often unpopular because people are

stigmatised as being poor.

Also it may create a disincentive to

earn a higher wage, because if you

do get a higher paid job you will lose

at least some of your benefits and

pay more tax. This is known as the

benefit trap or the poverty trap

Some relatively poor may fall just

outside the qualifying limit.

Also not everyone entitled to means

tested benefit will collect them

because of ignorance or difficulties in

applying.

The government used to prefer

universal benefits because it avoided

the above problem, and people feel if

they contribute towards taxes they

deserve their benefits regardless of

their wealth

Government interventions

C. Minimum Wage

Since the introduction of the NMW many low paid workers have seen an increase

in the hourly wage as firms are obliged to pay workers the statutory minimum

wage.

To some extent this has helped reduce relative poverty, as the lowest paid

workers have seen a significant increase in their weekly income. This is more

prevalent in the North where wages tended to be lower; fewer jobs in the south

have been affected by the NMW.

A concern about the NMW is that it

may cause unemployment. An increase

in the NMW to above the equilibrium

will lead to real wage unemployment of

Q3 Q2.

Evaluation of NMW

The advantages of a national

minimum wage:

Greater equity will be achieved, and

the distribution of income between

the high paid and the low pay may be

narrowed.

Poverty may be reduced as the low

paid gain more income and the

unemployed may be encouraged to

join the labour market. In this case

the higher wage is an incentive for

individuals to supply their labour.

Less worker exploitation by labour

market monopsonists, who are single

employers is able to pay below the

market equilibrium.

The disadvantages of a national

minimum wage:

A high minimum wage can cause

price inflation as firms pass on the

higher wages in higher prices.

Falling employment, as demand

contracts, and rising unemployment

as supply extends.

The competitiveness of UK goods

abroad can suffer compared with low

wage economies, such as China and

India.

Inward investment may be deterred,

as foreign investors will look to avoid

high wage economies.

The labour market may become

inflexible in response to changes in

the rest of the economy.

Productivity etc

Productivity the output per worker employed

Unit labour cost cost of labour/output

Business owners compare unit labour costs to

measure productivity. If the unit labour cost

decreased over a period of time, productivity

increased.

Possible analyse questions

1. Analyse the factors that determine the supply of

labour in the short run and the long run

2. Analyse the factors that determine elasticity of

supply for labour

3. Analyse why premiership footballers earn more

than nurses

4. Analyse 2 causes of labour market failure.

5. Analyse the reasons for differences in economic

rent and transfer earnings

6. Analyse the reasons for pay differentials

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Chapter 14 InteractiveДокумент8 страницChapter 14 InteractiveAmita50% (2)

- McDonald HRM ReportДокумент9 страницMcDonald HRM ReportMuhammad Sabir40% (5)

- English Skills For Business Communication PDFДокумент3 страницыEnglish Skills For Business Communication PDFMarycela OsorioОценок пока нет

- Ions ConsultingДокумент2 страницыIons ConsultingVishwadeep DubeyОценок пока нет

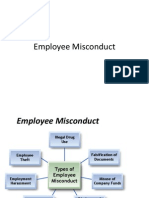

- Employee MisconductДокумент14 страницEmployee Misconductshush10Оценок пока нет

- Differentiated Instruction Unit Planner Due Nov. 29 (FINAL)Документ5 страницDifferentiated Instruction Unit Planner Due Nov. 29 (FINAL)robОценок пока нет

- MGT 300 Lincoln Electric Case StudyДокумент5 страницMGT 300 Lincoln Electric Case Studyapi-240113520Оценок пока нет

- Working in BC QuestionsДокумент4 страницыWorking in BC Questionsapi-311099738Оценок пока нет

- Top 10 Communication Skills For Workplace SuccessДокумент15 страницTop 10 Communication Skills For Workplace Successvarun7karnikОценок пока нет

- Communication Climate InventoryДокумент10 страницCommunication Climate InventoryL1061KОценок пока нет

- The Manager's Role in Employee RetentionДокумент18 страницThe Manager's Role in Employee RetentionRomer OgnitaОценок пока нет

- HRM Chapter 7 With AnsДокумент4 страницыHRM Chapter 7 With Ansjoebloggs1888Оценок пока нет

- Eta HR FinalДокумент55 страницEta HR FinalvipinrajОценок пока нет

- Hexcel S Workday User Manual CompensationДокумент5 страницHexcel S Workday User Manual Compensationsmily103Оценок пока нет

- Department of Labor: 01 063Документ40 страницDepartment of Labor: 01 063USA_DepartmentOfLaborОценок пока нет

- Attracting and Retaining Staff in HealthcareДокумент9 страницAttracting and Retaining Staff in HealthcareAnonymous MFh19TBОценок пока нет

- International Bakery IndustryДокумент19 страницInternational Bakery IndustryVibha AgrawalОценок пока нет

- Talent MGMTДокумент157 страницTalent MGMTAparna Kalla MendirattaОценок пока нет

- DisciplineДокумент27 страницDisciplinenorsiah_shukeriОценок пока нет

- Cover LetterДокумент2 страницыCover Letterapi-378236362Оценок пока нет

- Sample Persuasive LettersДокумент3 страницыSample Persuasive LettersDon P droОценок пока нет

- Labour Turnover and Employee Performance Appraisal - Still On ResearchДокумент12 страницLabour Turnover and Employee Performance Appraisal - Still On Researchgrace evelynОценок пока нет

- 01 Chapter Pages 8-11Документ4 страницы01 Chapter Pages 8-11Joey CastilloОценок пока нет

- New Da 29.96 Ready Recokner From January-2011Документ4 страницыNew Da 29.96 Ready Recokner From January-2011Ramachandra RaoОценок пока нет

- Rig Evaluation MiSWACO New-LogoDay 2Документ72 страницыRig Evaluation MiSWACO New-LogoDay 2Cerón Niño SantiagoОценок пока нет

- Compensation Management PDFДокумент14 страницCompensation Management PDFNarendiran SrinivasanОценок пока нет

- Voya Compass Hospital Confinement Indemnity InsuranceДокумент4 страницыVoya Compass Hospital Confinement Indemnity InsuranceDavid BriggsОценок пока нет

- CV Sonali Gupta UpdatedДокумент1 страницаCV Sonali Gupta UpdatedasdasdОценок пока нет

- Amalgamated Industries Corporation Sample Case StudyДокумент10 страницAmalgamated Industries Corporation Sample Case StudyJake CarvajalОценок пока нет

- New Safety Initiative Ideas To Improve Workplace SafetyДокумент3 страницыNew Safety Initiative Ideas To Improve Workplace SafetyvipinОценок пока нет