Академический Документы

Профессиональный Документы

Культура Документы

Final Economy 2010 Solution

Загружено:

Valadez280 оценок0% нашли этот документ полезным (0 голосов)

116 просмотров6 страницThis document contains an exam for an engineering economics course, including 5 questions. Question 1 involves calculating depreciation amounts for a truck using MACRS. Question 2 deals with depreciation of a machine using the units of production method. Question 3 is calculating an after-tax minimum attractive rate of return. Question 4 analyzes which of two machines is a better alternative investment using a capital budgeting analysis. Question 5 involves determining the optimal replacement time for a truck by comparing the marginal costs of keeping the current truck versus replacing it with a new one.

Исходное описание:

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документThis document contains an exam for an engineering economics course, including 5 questions. Question 1 involves calculating depreciation amounts for a truck using MACRS. Question 2 deals with depreciation of a machine using the units of production method. Question 3 is calculating an after-tax minimum attractive rate of return. Question 4 analyzes which of two machines is a better alternative investment using a capital budgeting analysis. Question 5 involves determining the optimal replacement time for a truck by comparing the marginal costs of keeping the current truck versus replacing it with a new one.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

116 просмотров6 страницFinal Economy 2010 Solution

Загружено:

Valadez28This document contains an exam for an engineering economics course, including 5 questions. Question 1 involves calculating depreciation amounts for a truck using MACRS. Question 2 deals with depreciation of a machine using the units of production method. Question 3 is calculating an after-tax minimum attractive rate of return. Question 4 analyzes which of two machines is a better alternative investment using a capital budgeting analysis. Question 5 involves determining the optimal replacement time for a truck by comparing the marginal costs of keeping the current truck versus replacing it with a new one.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

1

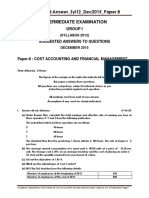

The Islamic University of Gaza

Industrial Engineering department

Engineering Economy, EIND 4303

Instructor: Dr. Mohammad Abuhaiba, P.E.

Fall 2010 Exam date: 23/01/2011

Final Exam (Open Book) Exam Duration: 2 hours

Question Grade Maximum Grade

1 20

2 9

3 6

4 35

5 30

Total 100

2

Question #1 (20 points):

Your Company has purchased a large new truck-tractor for over-the-road use (asset class 00.26). It has a cost

basis of $180,000. With additional options costing $15,000, the cost basis for depreciation purposes is

$195,000. Its MV at the end of five years is estimated as $40,000. Assume it will be depreciated under the

MACRS GDS:

1. What is the cumulative depreciation through the end of year three?

2. What is the MACRS depreciation in the fourth year?

3. What is the BV at the end of year two?

Solution:

From Table 11.2, the truck has a 3-year MACRS class life. Depreciation rates are obtained from Table 11.3 and

listed in the table below.

The amounts of depreciation, cumulative depreciation, and book values are calculated as shown in the table

below.

1. cumulative depreciation through the end of year three = $180,551

2. MACRS depreciation in the fourth year = $14,450

3. BV at the end of year two = $43,329

EOY MV BV

depreciation

rate

dk dk*

0 195000 195000

1 130007 0.3333 64994 64994

2 43329 0.4445 86678 151671

3 14450 0.1481 28880 180551

4 0 0.0741 14450 195000

5 0 0

5 40000 0 0

3

Question #2 (9 points):

A special purpose machine is to be depreciated as a linear function of use (units of production method). It costs

$25,000 and is expected to produce 100,000 units and then be sold for $5000. Up to the end of the third year, it

had produced 60,000 units, and during the fourth year it produced 10,000 units. What is the depreciation

deduction for the fourth year and the BV at the end of the fourth year?

Solution:

Depreciation deduction for the fourth year = (10,000/100,000)*(25,000 5,000) = $2000

Cumulative depreciation through the end of year four = (70,000/100,000)*(25,000 5,000) = $14,000

BV at the end of the fourth year = 25,000 14,000 = $11,000

Question #3 (6 points):

The before-tax MARR for a particular firm is 18% per year. The state income tax rate is 5%, and the federal

income tax rate is 39%. State income taxes are deductable from federal taxable income. What is this firm's

after-tax MARR?

Solution:

Effective tax rate = State tax rate + Federal tax rate * (1 - State tax rate)

= 0.05 + 0.39 (1 0.05) = 0.4205

After tax MARR = Before tax MARR * (1 - Effective tax rate) = 0.18*(1 0.4205) = 0.1043 = 10.43%

4

Question #4 (35 points):

Two alternative machines will produce the same product, but one is capable of higher-quality work, which can

be expected to return greater revenue. The following are relevant data:

Machine A Machine B

Capital investment $20,000 $30,000

Life 12 years 8 years

Terminal BV (and MV) $4,000 $0

Annual receipts $150,000 $188,000

Annual expenses $138,000 $170,000

Determine which is the better alternative, assuming repeatability and using SL depreciation, an income tax rate

of 40%, and after-tax MARR of 10%.

Solution:

Machine A:

(A/P, 10%, 12) = 0.1468

(A/F, 10%, 12) = 0.0468

Annual depreciation = (20000 4000) / 12 = $1333.33

BTCF = Annual Revenues Annual expenses

Taxable income = BTCF - Annual depreciation

Annual tax amount = 0.40*Taxable income

ATCF = BTCF - Annual tax amount

After tax EUAC

A

= -20,000 (A/P, 10%, 12) + 4000 (A/F, 10%, 12) + 7733 = $4985

Machine A

EOY BV Revenues Expenses dk BTCF

Taxable

Income

Tax ATCF EUAC

0 20000

-

20000

-

20000

-2936

1 150000 138000 1333 12000 10667 4267 7733 7733

2 150000 138000 1333 12000 10667 4267 7733

3 150000 138000 1333 12000 10667 4267 7733

4 150000 138000 1333 12000 10667 4267 7733

5 150000 138000 1333 12000 10667 4267 7733

6 150000 138000 1333 12000 10667 4267 7733

7 150000 138000 1333 12000 10667 4267 7733

8 150000 138000 1333 12000 10667 4267 7733

9 150000 138000 1333 12000 10667 4267 7733

10 150000 138000 1333 12000 10667 4267 7733

11 150000 138000 1333 12000 10667 4267 7733

12 150000 138000 1333 12000 10667 4267 7733

12 0 4000 4000 187

4985

5

Machine B:

(A/P, 10%, 8) = 0.18740

Annual depreciation = (30000) / 12 = $3750

BTCF = Annual Revenues Annual expenses

Taxable income = BTCF - Annual depreciation

Annual tax amount = 0.40*Taxable income

ATCF = BTCF - Annual tax amount

After tax EUAC

B

= -30,000 (A/P, 10%, 8) + 12300 = $6678

Machine B

EOY BV Revenues Expenses dk BTCF

Taxable

Income

Tax ATCF EUAC

0 30000

-

30000

-

30000

-5622

1 188000 170000 3750 18000 14250 5700 12300 12300

2 188000 170000 3750 18000 14250 5700 12300

3 188000 170000 3750 18000 14250 5700 12300

4 188000 170000 3750 18000 14250 5700 12300

5 188000 170000 3750 18000 14250 5700 12300

6 188000 170000 3750 18000 14250 5700 12300

7 188000 170000 3750 18000 14250 5700 12300

8 188000 170000 3750 18000 14250 5700 12300

8 0 0 0 0

6678

EUAC

B

> EUAC

A

Therefore, machine B is a better alternative

6

Question #5 (30 points):

A truck was purchased four years ago for $65,000 to move raw materials and finished goods between a

production facility and four remote warehouses. This truck (the defender) can be sold at the present time for

$40,000 and replaced by a new tuck (the challenger) with a purchase price of $70,000. Given the MVs and

operating and maintenance costs that follow and if MARR = 10%:

Defender Challenger

EOY Market Value O&M Costs EOY Market Value O&M Costs

1 $30,000 $8,500 1 $56,000 $5,500

2 20,000 10,500 2 44,000 6,800

3 12,000 14,000 3 34,000 7,400

4 4,000 16,000 4 22,000 9,700

1. What is the total marginal cost of the defender if MARR = 10%?

2. What is the economic life of the challenger if MARR = 10%?

3. When the defender should be replaced.

Solution:

Defender

EOY MV

O&M

Costs

Loss in

MV

Forgone Interest Marginal Cost

40000

1 30000 8500 10000 4000 22500

2 20000 10500 10000 3000 23500

3 12000 14000 8000 2000 24000

4 4000 16000 8000 1200 25200

Challenger

EOY MV

O&M

Costs

P/F A/P EUAC

70000

1 56000 5500 0.9091 1.1000 26500

2 44000 6800 0.8264 0.5762 25500

3 34000 7400 0.7513 0.4021 24381

4 22000 9700 0.6830 0.3155 24539

The defender should be kept for three years, then replaced by the challenger.

Вам также может понравиться

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОценок пока нет

- RevisionДокумент3 страницыRevisionAbed M. SallamОценок пока нет

- Chapter13 Income TaxesДокумент17 страницChapter13 Income TaxesKhilbran MuhammadОценок пока нет

- Engineering Economics Tutorial Chapter Five (1) - 2Документ4 страницыEngineering Economics Tutorial Chapter Five (1) - 2saugat pandeyОценок пока нет

- BFIN525 - Chapter 11 - Problems & AKДокумент10 страницBFIN525 - Chapter 11 - Problems & AKmohamad yazbeckОценок пока нет

- All Work Must Be Shown It Can'T Be Just The AnswersДокумент3 страницыAll Work Must Be Shown It Can'T Be Just The AnswersJoel Christian MascariñaОценок пока нет

- 3415 Corporate Finance Assignment 2: Dean CulliganДокумент13 страниц3415 Corporate Finance Assignment 2: Dean CulliganAdam RogersОценок пока нет

- 10 Nomor EkotekДокумент18 страниц10 Nomor EkotekNurman WibisanaОценок пока нет

- Engineering Economy 16th Edition Sullivan Test BankДокумент9 страницEngineering Economy 16th Edition Sullivan Test Bankjohnquyzwo9qa100% (31)

- BreakevenДокумент3 страницыBreakevenMae Florizel FalculanОценок пока нет

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8Документ15 страницIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 8JOLLYОценок пока нет

- Final Managerial 2014 SolutionДокумент8 страницFinal Managerial 2014 SolutionRanim HfaidhiaОценок пока нет

- Same Questions - F303 - 1st MidДокумент5 страницSame Questions - F303 - 1st MidRafid Al Abid SpondonОценок пока нет

- Working Capital Problem SolutionДокумент10 страницWorking Capital Problem SolutionMahendra ChouhanОценок пока нет

- MBAC1003Документ7 страницMBAC1003SwaathiОценок пока нет

- AccontsДокумент7 страницAccontsAmith MОценок пока нет

- ABC Company Is Considering The Replacement of Old Machine That Is 3 Three Years Old With A NewДокумент9 страницABC Company Is Considering The Replacement of Old Machine That Is 3 Three Years Old With A Newrajaroma45Оценок пока нет

- Ca 1Документ4 страницыCa 1VaibhavrvОценок пока нет

- 610 Midterm 2 S11 02 With SolДокумент6 страниц610 Midterm 2 S11 02 With SolabuzarОценок пока нет

- 025 Za 2010Документ13 страниц025 Za 2010gurpreet_mОценок пока нет

- Literature Review 1 PageДокумент9 страницLiterature Review 1 PageMahbub HussainОценок пока нет

- Cost Accounting - 2 2020Документ5 страницCost Accounting - 2 2020Shone Philips ThomasОценок пока нет

- Capital Structure Self Correction ProblemsДокумент53 страницыCapital Structure Self Correction ProblemsTamoor BaigОценок пока нет

- HW Chap 12Документ6 страницHW Chap 12phương vũОценок пока нет

- Engineering Economics and Finacial Management (HUM 3051) Jul 2022Документ6 страницEngineering Economics and Finacial Management (HUM 3051) Jul 2022uday KiranОценок пока нет

- JRE300-April 2015 - Final Exam - SOLUTIONS KEYДокумент11 страницJRE300-April 2015 - Final Exam - SOLUTIONS KEYSCR PpelusaОценок пока нет

- Lecture 8 NotesДокумент9 страницLecture 8 NotesAna-Maria GhОценок пока нет

- Capital Budgeting ProblemsДокумент9 страницCapital Budgeting ProblemsSugandhaShaikh0% (1)

- Latihan ReplacementДокумент11 страницLatihan ReplacementafifОценок пока нет

- Capital BudgetingДокумент16 страницCapital Budgetingjamn1979Оценок пока нет

- Future Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700Документ9 страницFuture Worth Comparison of Alternatives: Answer: A. FWM - $230,500, FWN - $170,700CloeОценок пока нет

- Assignment3 MatДокумент6 страницAssignment3 MatmohamedashrafsayedОценок пока нет

- Chapter 11Документ10 страницChapter 11Syed Sheraz AliОценок пока нет

- Micro Econs-Tutorial Three and FourДокумент8 страницMicro Econs-Tutorial Three and Fourvc854146Оценок пока нет

- Chapter 10Документ89 страницChapter 10kazimkoroglu100% (1)

- BBA Sem I QPДокумент3 страницыBBA Sem I QPyogeshgharpureОценок пока нет

- Accounting-2009 Resit ExamДокумент18 страницAccounting-2009 Resit ExammasterURОценок пока нет

- Management Accounting 12Документ4 страницыManagement Accounting 12subba1995333333Оценок пока нет

- Practice Questions 1Документ5 страницPractice Questions 1Div_nОценок пока нет

- Bab 9Документ26 страницBab 9Saravanan MathiОценок пока нет

- DipoДокумент4 страницыDipoAfolabi Eniola AbiolaОценок пока нет

- 326 Chapter 9 - Fundamentals of Capital BudgetingДокумент20 страниц326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifОценок пока нет

- Exercise On Capital Budgeting-BSLДокумент19 страницExercise On Capital Budgeting-BSLShafiul AzamОценок пока нет

- Ca-Ipcc Question Paper Cost - FM Nov 13Документ8 страницCa-Ipcc Question Paper Cost - FM Nov 13Pravinn_MahajanОценок пока нет

- Ca-Ipcc Cost-Fm Question Paper Nov 13Документ8 страницCa-Ipcc Cost-Fm Question Paper Nov 13Pravinn_MahajanОценок пока нет

- Cost FM WordДокумент8 страницCost FM WordPravinn_MahajanОценок пока нет

- Brigham Chap 11 Practice Questions Solution For Chap 11Документ11 страницBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterОценок пока нет

- Ch. 13 - Breakeven AnalysisДокумент9 страницCh. 13 - Breakeven AnalysisNeven Ahmed HassanОценок пока нет

- HomeWork Slide 7Документ5 страницHomeWork Slide 7Anisa Fitriani0% (1)

- AAAДокумент7 страницAAAHamis Mohamed100% (1)

- UBS Capital BudgetingДокумент19 страницUBS Capital BudgetingRajas MahajanОценок пока нет

- EE HW3 SolutionДокумент5 страницEE HW3 SolutionLê Trường ThịnhОценок пока нет

- Final Review Questions SolutionsДокумент5 страницFinal Review Questions SolutionsNuray Aliyeva100% (1)

- Engineering Economics and Finacial Management (HUM 3051)Документ5 страницEngineering Economics and Finacial Management (HUM 3051)uday KiranОценок пока нет

- Cost Accounting 2013Документ3 страницыCost Accounting 2013GuruKPO0% (1)

- Chapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesДокумент7 страницChapter 5, Problem 5.: Common Multiple of The Lives of The AlternativesMishalОценок пока нет

- Decision Regarding Alternative ChoicesДокумент29 страницDecision Regarding Alternative ChoicesrhldxmОценок пока нет

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2Документ16 страницAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2ankitshah21Оценок пока нет

- Electrical & Mechanical Components World Summary: Market Values & Financials by CountryОт EverandElectrical & Mechanical Components World Summary: Market Values & Financials by CountryОценок пока нет

- Costing Lessons Entire 2Документ10 страницCosting Lessons Entire 2cindibellamyОценок пока нет

- Accounting For Income Tax-NotesДокумент4 страницыAccounting For Income Tax-NotesMaureen Derial PantaОценок пока нет

- 2.strategic IntentДокумент23 страницы2.strategic IntentAnish ThomasОценок пока нет

- Targeting and Positioning in Rural MarketДокумент17 страницTargeting and Positioning in Rural MarketPallavi MittalОценок пока нет

- 2016 04 1420161336unit3Документ8 страниц2016 04 1420161336unit3Matías E. PhilippОценок пока нет

- ELS4 Examples From Oys YdsДокумент1 страницаELS4 Examples From Oys YdsKranting TangОценок пока нет

- 8C PDFДокумент16 страниц8C PDFReinaОценок пока нет

- Reverse Pricing ProcedureДокумент4 страницыReverse Pricing ProcedureAnonymous 13sDEcwShTОценок пока нет

- CLIL Module "In The Kitchen" Class III C CucinaДокумент9 страницCLIL Module "In The Kitchen" Class III C Cucinanancy bonforteОценок пока нет

- DI and LRДокумент23 страницыDI and LRVarsha SukhramaniОценок пока нет

- Economic Risk Analysis - ICRG Index BRAZILДокумент6 страницEconomic Risk Analysis - ICRG Index BRAZILAthira PanthalathОценок пока нет

- Valeant Case SummaryДокумент2 страницыValeant Case Summaryvidhi100% (1)

- FCE Letter SampleДокумент3 страницыFCE Letter SampleLeezukaОценок пока нет

- COMP2230 Introduction To Algorithmics: A/Prof Ljiljana BrankovicДокумент18 страницCOMP2230 Introduction To Algorithmics: A/Prof Ljiljana BrankovicMrZaggyОценок пока нет

- Betma Cluster RevisedДокумент5 страницBetma Cluster RevisedSanjay KaithwasОценок пока нет

- Month To Go Moving ChecklistДокумент9 страницMonth To Go Moving ChecklistTJ MehanОценок пока нет

- ReshapeДокумент4 страницыReshapearnab1988ghoshОценок пока нет

- Case Study 2 ContinentalДокумент2 страницыCase Study 2 ContinentalSandeep Konda100% (2)

- Ficci Ey M and e Report 2019 Era of Consumer Art PDFДокумент309 страницFicci Ey M and e Report 2019 Era of Consumer Art PDFAbhishek VyasОценок пока нет

- Capital Project AccountingДокумент2 страницыCapital Project AccountingDhaval GandhiОценок пока нет

- Groen BPP-40E Tilt SkilletДокумент2 страницыGroen BPP-40E Tilt Skilletwsfc-ebayОценок пока нет

- RSKMGT NIBM Module Operational Risk Under Basel IIIДокумент6 страницRSKMGT NIBM Module Operational Risk Under Basel IIIKumar SkandaОценок пока нет

- mgm3180 1328088793Документ12 страницmgm3180 1328088793epymaliОценок пока нет

- Barwani PDFДокумент13 страницBarwani PDFvishvarОценок пока нет

- CA FirmsДокумент5 страницCA FirmsbobbydebОценок пока нет

- TRH 14 ManualДокумент22 страницыTRH 14 ManualNelson KachaliОценок пока нет

- Case Study 1 - GilletteДокумент1 страницаCase Study 1 - GilletteLex JonesОценок пока нет

- Lorenzo Shipping V ChubbДокумент1 страницаLorenzo Shipping V Chubbd2015member0% (1)

- 18e Key Question Answers CH 4Документ2 страницы18e Key Question Answers CH 4AbdullahMughal100% (1)

- 环球时报11月14日第一版Документ1 страница环球时报11月14日第一版poundsassonОценок пока нет