Академический Документы

Профессиональный Документы

Культура Документы

Mdali

Загружено:

MD AbdulMoid MukarramОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Mdali

Загружено:

MD AbdulMoid MukarramАвторское право:

Доступные форматы

Technical Analysis of Cement Sector in India

Executive Summary

The main aim of the investor is to minimize the risk involved in investment &

maximize the return. Today there are number of options available to investor like Post

Office investment, Bank Deposit, nsurance, !utual "und, #tock !arket etc...

Technical analysis is a financial markets techni$ue that claims the ability to

forecast the future direction of security prices throu%h the study of past market data,

primarily price and volume.

This pro&ect is about a brief introduction to Technical 'nalysis, different price

patterns and trends in financial markets and attempt to exploit that patterns.etc( The

contents in this pro&ect are made simple so as to make a layman understands the terms

used in the Technical 'nalysis.

The core area of this pro&ect focuses )hat a technical analysts may employ

models and tradin% rules based, for example, on price transformations, such as the

*elative #tren%th ndex, movin% avera%es, throu%h reco%nition of chart patterns. This

pro&ect contains some elementary statistics )hich are used in calculation )hich help

in dra)in% inferences.

The ob&ective of the study helps to predict or forecast the short, intermediate &

lon% term price movements. +hen to buy and sell stock by analyzin% technical

indicators. 'nd helps to measure to the rate of chan%e bet)een the current price and

price in past and to identify overbou%ht& oversold re%ion. The art of technical

analysis for it is an art is to identify trend chan%es at an early sta%e and to maintain an

investment an investment posture until the )ei%ht of the evidence indicates that the

trend has been reversed.

Technical 'nalysis also provides a comprehensive study on stock historical

price charts and predicts the future trend in the market. But still there is much

controversial opinion on the validity of technical tradin% rule. t re$uires more study

to prove the usefulness of technical analysis in investor,s buy/sell/hold decision

makin%.

The Administrative management college, Bangalore. 1

Technical Analysis of Cement Sector in India

INTRODUCTION

ABOUT TECHNICAL ANALYSIS:

Technical analysis is a financial markets techni$ue that claims the ability to

forecast the future direction of security prices throu%h the study of past market data,

primarily price and volume. n its purest form, technical analysis considers only the

actual price behavior of the market or instrument, on the assumption that price reflects

all relevant factors before an investor becomes a)are of them throu%h other channels.

Technical analysts may employ models and tradin% rules based, for example,

on price transformations, such as the *elative #tren%th ndex, movin% avera%es,

re%ressions, inter-market and intra-market price correlations, cycles or, classically,

throu%h reco%nition of chart patterns.

Genera !e"cri#ti$n

Technical analysts .or technicians/ seek to identify price patterns and trends in

financial markets and attempt to exploit those patterns. +hile technicians use various

methods and tools, the study of price charts is primary. Technicians especially search

for archetypal patterns, such as the )ell-kno)n head and shoulders reversal pattern,

and also study such indicators as price, volume, and movin% avera%es of the price.

!any technical analysts also follo) indicators of investor psycholo%y.

0ritics ar%ue that these 1patterns1 are simply random effects on )hich humans

impose causation. They state that human see patterns that aren1t there and then ascribe

value to them.

Technical analysts also extensively use indicators, )hich are typically

mathematical transformations of price or volume. These indicators are used to help

determine )hether an asset is trendin%, and if it is, its price direction. Technicians also

look for relationships bet)een price, volume, and in the case of futures, open interest.

The Administrative management college, Bangalore. 2

Technical Analysis of Cement Sector in India

2xamples include the relative stren%th index, and !'0D. Other avenues of study

include correlations bet)een chan%es in options 3implied volatility4 and put5call ratios

)ith price.

Technicians seek to forecast price movements such that lar%e %ains from

successful trades exceed more numerous but smaller losin% trades, producin% positive

returns in the lon% run throu%h proper risk control and money mana%ement.

Technical analysis is fre$uently contrasted )ith fundamental analysis, the

study of economic factors that some analysts say can influence prices in financial

markets. Pure technical analysis holds that prices already reflect all such influences

before investors are a)are of them, hence the study of price action alone. #ome

traders use technical or fundamental analysis exclusively, )hile others use both types

to make tradin% decisions.

Lac% $& evi!ence

0ritics of technical analysis include )ell kno)n fundamental analysts. "or

example, Peter 6ynch once commented, 70harts are %reat for predictin% the past.7

+arren Buffet has said, 7 realized technical analysis didn1t )ork )hen turned the

charts upside do)n and didn1t %et a different ans)er7 and 7f past history )as all there

)as to the %ame, the richest people )ould be librarians8.

!ost academic studies say technical analysis has little predictive po)er, but

some studies say it may produce excess returns. "or example, measurable forms of

technical analysis, such as non-linear prediction usin% neural net)orks, have been

sho)n to occasionally produce statistically si%nificant prediction results. ' "ederal

*eserve )orkin% paper re%ardin% support and resistance levels in short-term forei%n

exchan%e rates 7offers stron% evidence that the levels help to predict intraday trend

interruptions,7 althou%h the 7predictive po)er7 of those levels )as 7found to vary

across the exchan%e rates and firms examined.7

The Administrative management college, Bangalore. 3

Technical Analysis of Cement Sector in India

E&&icient mar%et 'y#$t'e"i"

The efficient market hypothesis .2!9/ contradicts the basic tenets of

technical analysis, by statin% that past prices cannot be used to profitably predict

future prices. Thus it holds that technical analysis cannot be effective. 2conomist

2u%ene "ame published the seminal paper on the 2!9 in the :ournal of "inance in

;<=>, and said 7n short, the evidence in support of the efficient markets model is

extensive, and contradictory evidence is sparse8. 2!9 advocates say that if prices

$uickly reflect all relevant information, no method .includin% technical analysis/ can

7beat the market.7 Developments )hich influence prices occur randomly and are

unkno)able in advance.

Technicians say that 2!9 i%nores the )ay markets )ork, in that many

investors base their expectations on past earnin%s or track record, for example.

Because future stock prices can be stron%ly influenced by investor expectations,

technicians claim it only follo)s that past prices influence future prices.

Ran!$m (a% 'y#$t'e"i"

The random )alk hypothesis may be derived from the )eak-form efficient

markets hypothesis, )hich is based on the assumption that market participants take

full account of any information contained in past price movements.7The problem is

that once such re%ularity is kno)n to market participants, people )ill act in such a

)ay that prevents it from happenin% in the future8.

Hi"t$ry

The principles of technical analysis derive from the observation of financial

markets over hundreds of years. The oldest kno)n example of technical analysis )as

a method used by :apanese traders as early as the ;?th century, )hich evolved into the

use of candlestick techni$ues, and is today a main chartin% tool. !any more technical

The Administrative management college, Bangalore. 4

Technical Analysis of Cement Sector in India

tools and theories have been developed and enhanced in recent decades, )ith an

increasin% emphasis on computer-assisted techni$ues.

)rinci#e" $& tec'nica anay"i"

Technicians say that a market1s price reflects all relevant information, so their

analysis looks more at 7internals7 than at 7externals7 such as ne)s events. Price action

also tends to repeat itself because investors collectively tend to)ard patterned

behavior -- hence technicians1 focus on identifiable trends and conditions.

*ar%et acti$n !i"c$unt" everyt'in+

On most of the sizable return days the information that the press cites as the

cause of the market move is not particularly important. Press reports on ad&acent days

also fail to reveal any convincin% accounts of )hy future profits or discount rates

mi%ht have chan%ed. Our inability to identify the fundamental shocks that accounted

for these si%nificant market moves is difficult to reconcile )ith the vie) that such

shocks account for most of the variation in stock returns.

)rice" m$ve in tren!"

Technical analysts believe that prices trend. Technicians say that markets

trend up, do)n, or side)ays .flat/. 'n example of a security that had an apparent

trend is 'O6 from @ovember A>>; throu%h 'u%ust A>>A. ' technical analyst or trend

follo)er reco%nizin% this trend )ould look for opportunities to sell this security. 'O6

consistently moves do)n)ard in price. 2ach time the stock rose, sellers )ould enter

the market and sell the stockB hence the 7zi%-za%7 movement in the price. n other

)ords, each time the stock ed%ed lo)er, it fell belo) its previous relative lo) price.

Hi"t$ry ten!" t$ re#eat it"e&

Technical analysts believe that investors collectively repeat the behavior of the

investors that preceded them. Technical analysis is not limited to chartin%, yet is

al)ays concerned )ith price trends. "or example, many technicians monitor surveys

of investor sentiment.. Technicians use these surveys to help determine )hether a

The Administrative management college, Bangalore. 5

Technical Analysis of Cement Sector in India

trend )ill continue or if a reversal could developB they are most likely to anticipate a

chan%e )hen the surveys report extreme investor sentiment.

Rue,-a"e! tra!in+

*ule-based tradin% is an approach to make one1s tradin% plans by strict and

clear-cut rules. Cnlike some other technical methods or most fundamental analysis, it

defines a set of rules that determines all trades, leavin% minimal discretion. "or

instance, a trader mi%ht make a set of rules statin% that he )ill take a lon% position

)henever the price of a particular instrument closes above its D>-day movin% avera%e,

and shortin% it )henever it drops belo).

C$m-inin+ Tec'nica Anay"i" (it' $t'er *ar%et .$reca"t *et'$!"

:ohn !urphy in his book 7Technical 'nalysis of the "inancial !arkets7, says

that the principal sources of information available to technicians are price, volume

and open interest. Other data, such as indicators and sentiment analysis are considered

secondary. Technical analysis is also often combined )ith $uantitative analysis and

economics. "or example, neural net)orks may be used to help identify inter market

relationships. ' fe) market forecasters combine financial astrolo%y )ith technical

analysis.

C'artin+ term" an! in!icat$r"

+idely-kno)n technical analysis concepts includeE

Breakout - )hen a price passes throu%h and stays above an area of support or

resistance

0ommodity 0hannel ndex - identifies cyclical trends

!omentum - the rate of price chan%e

!ovin% avera%e - la%s behind the price action

The Administrative management college, Bangalore.

Technical Analysis of Cement Sector in India

*elative #tren%th ndex .*#/ - oscillator sho)in% price stren%th

*esistance - an area that brin%s on increased sellin%

AN O/ER/IE0 O. STOC1 *AR1ET:

' stock market is a private or public market for the tradin% of company stock and

derivatives of company stock at an a%reed priceB both of these are securities listed on

a stock exchan%e as )ell as those only traded privately.

De&initi$n:

The expression 1stock market1 refers to the market that enables the tradin% of

company stocks .collective shares/, other securities, and derivatives. Bonds are still

traditionally traded in an informal, over-the-counter market kno)n as the bond

market. 0ommodities are traded in commodities markets, and derivatives are traded in

a variety of markets .but, like bonds, mostly 1over-the-counter1/.

*ar%et #artici#ant":

!any years a%o, )orld)ide, buyers and sellers )ere individual investors, such

as )ealthy businessmen, )ith lon% family histories to particular corporations. Over

time, markets have become more 7institutionalized7B buyers and sellers are lar%ely

institutions .e.%., pension funds, insurance companies, mutual funds, hed%e funds,

investor %roups, and banks/.

The rise of the institutional investor has brou%ht )ith it some improvements in

market operations. Thus, the %overnment )as responsible for 7fixed7 fees bein%

markedly reduced for the 1small1 investor, but only after the lar%e institutions had

mana%ed to break the brokers1 solid front on fees .they then )ent to 1ne%otiated1 fees,

but only for lar%e institutions/.

The Administrative management college, Bangalore. !

Technical Analysis of Cement Sector in India

Im#$rtance $& "t$c% mar%et:

1. .uncti$n an! #ur#$"e:

The stock market is one of the most important sources for companies to raise

money. This allo)s businesses to %o public, or raise additional capital for expansion.

The li$uidity that an exchan%e provides affords investors the ability to $uickly and

easily sell securities. This is an attractive feature of investin% in stocks, compared to

other less li$uid investments such as real estate.

2. Reati$n $& t'e "t$c% mar%et t$ t'e m$!ern &inancia "y"tem:

The financial system in most )estern countries has under%one a remarkable

transformation. One feature of this development is disintermediation. ' portion of the

funds involved in savin% and financin% flo)s directly to the financial markets instead

of bein% routed via banks1 traditional lendin% and deposit operations. The %eneral

public1s hei%htened interest in investin% in the stock market, either directly or throu%h

mutual funds, has been an important component of this process. #tatistics sho) that in

recent decades shares have made up an increasin%ly lar%e proportion of households1

financial assets in many countries.

23 T'e St$c% *ar%et4 in!ivi!ua inve"t$r" 5 &inancia ri"%:

*iskier lon%-term savin% re$uires that an individual possess the ability to mana%e

the associated increased risks. #tock prices fluctuate )idely, in marked contrast to the

stability of bank deposits or bonds. This is somethin% that could affect not only the

individual investor or household, but also the economy on a lar%e scale. This is

certainly more important no) that so many ne)comers have entered the stock market,

or have ac$uired other 1risky1 investments.

The Administrative management college, Bangalore. "

Technical Analysis of Cement Sector in India

Irrati$na -e'avi$r:

#ometimes the market tends to react irrationally to economic ne)s, even if

that ne)s has no real affect on the technical value of securities itself. Therefore, the

stock market can be s)ayed tremendously in either direction by press releases,

rumors, euphoria and mass panic. Over the short-term, stocks and other securities can

be battered or buoyed by any number of fast market-chan%in% events, makin% the

stock market difficult to predict.

63 T'e Cra"'e":

' stock market crash is often defined as a sharp dip in share prices of e$uities

listed on the stock exchan%es. n parallel )ith various economic factors, a reason for

stock market crashes is also due to panic. Often, stock market crashes end up )ith

speculative economic bubbles.

St$c% mar%et in!ex:

The movements of the prices in a market or section of a market are captured in

price indices called stock market indices, of )hich there are many, e.%., the #&P, the

"T#2 and the 2uro next indices. #uch indices are usually market capitalization .the

total market value of floatin% capital of the company/ )ei%hted, )ith the )ei%hts

reflectin% the contribution of the stock to the index. The constituents of the index are

revie)ed fre$uently to include5exclude stocks in order to reflect the chan%in%

business environment.

Derivative in"trument":

"inancial innovation has brou%ht many ne) financial instruments )hose pay-

offs or values depend on the prices of stocks. #ome examples are exchan%e-traded

funds .2T"s/, stock index and stock options, e$uity s)aps, sin%le-stock futures, and

stock index futures. These last t)o may be traded on futures exchan%es .)hich are

distinct from stock exchan%esFtheir history traces back to commodities futures

exchan%es/, or traded over-the-counter. 's all of these products are only derived from

The Administrative management college, Bangalore. #

Technical Analysis of Cement Sector in India

stocks, they are sometimes considered to be traded in a .hypothetical/ derivatives

market, rather than the .hypothetical/ stock market.

Levera+e! Strate+ie":

#tock that a trader does not actually o)n may be traded usin% short sellin%B

mar%in buyin% may be used to purchase stock )ith borro)ed fundsB or, derivatives

may be used to control lar%e blocks of stocks for a much smaller amount of money

than )ould be re$uired by outri%ht purchase or sale.

73 S'$rt "ein+:

n short sellin%, the trader borro)s stock .usually from his brokera%e )hich

holds its clients1 shares or its o)n shares on account to lend to short sellers/ then sells

it on the market, hopin% for the price to fall. The trader eventually buys back the

stock, makin% money if the price fell in the meantime or losin% money if it rose.

2xitin% a short position by buyin% back the stock is called 7coverin% a short position.7

This strate%y may also be used by unscrupulous traders to artificially lo)er the price

of a stock. 9ence most markets either prevent short sellin% or place restrictions on

)hen and ho) a short sale can occur.

83 *ar+in -uyin+:

n mar%in buyin%, the trader borro)s money .at interest/ to buy a stock and

hopes for it to rise. !ost industrialized countries have re%ulations that re$uire that if

the borro)in% is based on collateral from other stocks the trader o)ns outri%ht, it can

be a maximum of a certain percenta%e of those other stocks1 value. ' mar%in call is

made if the total value of the investor1s account cannot support the loss of the trade.

*e%ulation of mar%in re$uirements .by the "ederal *eserve/ )as implemented after

the 0rash of ;<A<. Before that, speculators typically only needed to put up as little as

;> percent .or even less/ of the total investment represented by the stocks purchased.

The Administrative management college, Bangalore. 1$

Technical Analysis of Cement Sector in India

Ne( i""uance:

Global issuance of e$uity and e$uity-related instruments totaled HD>D billion

in A>>I, a A<.?J increase over the HK?< billion raised in A>>K. nitial public offerin%s

.POs/ by C# issuers increased AA;J )ith AKK offerin%s that raised HID billion, and

POs in 2urope, !iddle 2ast and 'frica .2!2'/ increased by KKKJ, from H < billion

to HK< billion.

Inve"tment "trate+ie":

One of the many thin%s people al)ays )ant to kno) about the stock market is,

79o) do make money investin%L7 There are many different approachesB t)o basic

methods are classified as either &un!amenta anay"i" $r tec'nica anay"i".

"undamental analysis refers to analyzin% companies by their financial statements

found in #20 "ilin%s, business trends, %eneral economic conditions, etc. Tec'nica

anay"i" studies price actions in markets throu%h the use of charts and $uantitative

techni$ues to attempt to forecast price trends re%ardless of the company1s financial

prospects.

Taxati$n:

'ccordin% to each national or state le%islation, a lar%e array of fiscal

obli%ations must be respected re%ardin% capital %ains, and taxes are char%ed by the

state over the transactions, dividends and capital %ains on the stock market, in

particular in the stock exchan%es. 9o)ever, these fiscal obli%ations may vary from

&urisdiction to &urisdiction because, amon% other reasons, it could be assumed that

taxation is already incorporated into the stock price throu%h the different taxes

companies pay to the state, or that tax free stock market operations are useful to boost

economic %ro)th.

The Administrative management college, Bangalore. 11

Technical Analysis of Cement Sector in India

RESEARCH DESIGN:

*esearch desi%n is the blue print of the study. t provides a frame)ork under

)hich the research has been conducted. t includes title of the study, problem

statement, ob&ectives, scope & limitations of the study, methods used for data

collection and interpretation and an overvie) of chapter scheme.

837 Tite $& t'e )r$9ect

' #tudy on Technical analysis of cement sector in ndia.

838 Statement $& )r$-em

Technical analysts .or technicians/ seek to identify price patterns and trends in

financial markets and attempt to exploit those patternsB the main problem is that these

patterns are simply random effects on )hich humans impose causation.

832 Revie( $& Literature

@eftci .;<<;/ sho)ed that fe) of the rules used in technical analysis %enerate

)ell-defined techni$ues of forecastin%, but even )ell Mdefined rules are sho)n to be

useless in prediction if the economic times series in Gaussain. 9o) ever, if the

processes under consideration are nonlinear, then the rules mi%ht capture some

information. Tests sho)ed that this may indeed to be the case for the follo)in%

avera%e rule.

Taylor and 'llen .;<<A/ report the results of the survey amon% chief forei%ner

exchan%e dealer based in 6ondon in @ovember ;<?? and found that at least <>

percent of respondent placed some )ei%hts on technical analysis and that there )as

ske) to)ards usin% technical, rather than fundamental analysis at shorter time

horizons.

The Administrative management college, Bangalore. 12

Technical Analysis of Cement Sector in India

n a comprehensive and influential study Brock, 6akonishok and 6ebaron

.;<<A/ analyzed AN technical tradin% rules usin% <> years of daily stock prices from

the Do) :ones industrial avera%e up to ;<?= and found that they all outperformed

market.

Blume, 2asiey and O, 9ara .;<<I/ sho) that volume provides information on

information $uality that cannot be deducted from price. They also sho) that traders

)ho use information contained in market statistics do better than traders )ho do not

Oava&ecz and Odders M +hite .A>>I/ sho) that support and resistance levels

coincide )ith peaks in depth on the limit order book and movin% avera%e forecasts

reveal information about the relative position of depth on the book. They also sho)

that these relationships stem from technical rules locatin% depth already in place on

the limit order book

836 O-9ective $& Stu!y

;. To find out the accuracy of technical analysis in individual stock price prediction.

A. To determine the trend of the stock prices usin% technical analysis.

K. To predict the future share price movements of particular scripts.

83: Sc$#e $& t'e Stu!y

Technical analysis is )idely used by forex, e$uity, and commodity traders, to

determine the short term as )ell as the lon% term trends of the market. The scope of

technical analysis is increasin% every day, as more and more people are tryin% to learn

the skills of technical analysis to earn %ood returns.

The Administrative management college, Bangalore. 13

Technical Analysis of Cement Sector in India

83; *et'$!$$+y

The data collected for the research purpose are secondary data. 0losin% prices

of scripts )ere collected throu%h @ational #tock 2xchan%e )ebsite. The data

employed in this study comprises of five year observations on the 0ement #ector

companies, 0losin% price.

SECONDARY DATA:

#econdary data refers to those data that has already been collected and

analyzed by someone else. n other )ords secondary data is the information

that already exists some)here havin% been collected for another purpose. t this

study secondary data )as collected from various sources likeE

+eb sites

Text Books

Business ma%azines.

The Administrative management college, Bangalore. 14

Technical Analysis of Cement Sector in India

83< Stati"tica T$$" U"e! in Anay"i" $& Stu!y:

;. !ovin% 'vera%e.

A. *elative stren%th index.

7= *$vin+ Avera+e3

!ovin% avera%e is an indicator that sho)s the avera%e value of a security1s price

over a period of time. To find the D>-day movin% avera%e you )ould add up the

closin% prices .but not al)ays(more later/ from the past D> days and divide them by

D>. 'nd because prices are constantly chan%in% it means the movin% avera%e )ill

move as )ell.

The most commonly used movin% avera%es are the A>, K>, D>, ;>>, and A>>-day

avera%es. 2ach movin% avera%e provides a different interpretation on )hat the stock

price )ill do. !ovin% avera%es )ith different time spans each tell a different story.

The shorter the time span, the more sensitive the movin% avera%e )ill be to price

chan%es. The lon%er the time span, the less sensitive or the more smoothed the

movin% avera%e )ill be. !ovin% avera%es are used to emphasize the direction of a

trend and smooth out price and volume fluctuations or that can confuse interpretation.

The %eneral assumption behind all movin% avera%es is that once the stock price

moves above the avera%e it may have substantial momentum behind it and is )orth

buyin%. The opposite is true if the price of a security moves belo) the movin%

avera%e.

Typically, )hen a stock price moves belo) its movin% avera%e it is a bad si%n

because the stock is movin% on a ne%ative trend. The opposite is true for stocks that

exceed their movin% avera%e - in this case, hold on for the ride.

The Administrative management college, Bangalore. 15

Technical Analysis of Cement Sector in India

8= Reative "tren+t' in!ex:

There are a fe) different tools that can be used to interpret the stren%th of a

stock. One of these is the *elative #tren%th ndex .*#/, )hich is a comparison

bet)een the days that a stock finishes up and the days it finishes do)n. This indicator

is a bi% tool in momentum tradin%.

The *# is a reasonably simple model that anyone can use. t is calculated

usin% the follo)in% formula.

RSI > 7?? , @7??/ A7 B RS=C

*# P .'v%. of n-day up closes//.'v%. of n-day do)n closes/

The *# ran%es from > to ;>>. 't around the => levels, a stock is considered

overbou%ht and you should consider sellin%. n a bull market some believe that ?> is a

better level to indicate an overbou%ht stock since stocks often trade at hi%her

valuations durin% bull markets. 6ike)ise, if the *# approaches K>, a stock is

considered oversold and you should consider buyin%. '%ain, make the ad&ustment to

A> in a bear market.

The smaller the number of days used, the more volatile the *# is and the

more often it )ill hit extremes. ' lon%er term *# is more rollin%, fluctuatin% a lot

less. Different sectors and industries have varyin% threshold levels )hen it comes to

the *#. #tocks in some industries )ill %o as hi%h as =D-?> before droppin% back,

)hile others have a tou%h time breakin% past =>. ' %ood rule is to )atch the *# over

the lon% term .one year or more/ to determine at )hat level the historical *# has

traded and ho) the stock reacted )hen it reached those levels.

83D Overvie( $& Re#$rt

The Administrative management college, Bangalore. 1

Technical Analysis of Cement Sector in India

C'a#ter "c'eme:

C'a#ter 7: Intr$!ucti$n

This chapter includes ntroduction of Technical analysis and 0ement sector.

C'a#ter 8: Re"earc' !e"i+n

*esearch desi%n is the blue print of the study. t provides a frame)ork under )hich

the research has been conducted. t includes title of the study, problem statement,

ob&ectives, scope & limitations of the study, methods used for data collection and

interpretation and an overvie) of chapter scheme.

C'a#ter 2: In!u"try #r$&ie

This chapter covers the industry profile.

C'a#ter 6: Anay"i" an! Inter#retati$n $& !ata

This chapter includes the data collected for the purpose of research and the

interpretation of the data, tables and %raphs are used )herever necessary.

C'a#ter :: Summary $& .in!in+"4 C$ncu"i$n" 5Rec$mmen!ati$n"

This chapter provides ma&or findin%s and conclusions of the study for it also includes

the recommendation made by the researcher.

Bi-i$+ra#'y

Annexure

63 INDUSTRY )RO.ILE

The Administrative management college, Bangalore. 1!

Technical Analysis of Cement Sector in India

INTRODUCTION TO CE*ENT SECTOR

ndia is today the second lar%est producer of cement in )orld )ith an installed

capacity of close to ;DD million tonnes per year. <D J is consumed domestically and

only DJ is exported. Demand is %ro)in% at more than ;> J per annum. !ore than

<> J of production comes from lar%e cement plants. There are a total of ;K> lar%e and

more than KD> small cement manufacturin% units in the country. !ore than ?>J of

the cement-manufacturin% units use modern environment friendly Qdry8 process.

The forms of cement producedE

Ordinary Portland 0ement

Portland Pozzolana 0ement

Portland #la% 0ement

Blended 0ement

!a&or players in ndian cement sectorE

9eidelber%

6afar%e

talcementi

9olcim

Gu&rat 'mbu&a 0ement

'00

Cltratech 0ement

ndia 0ements

0entury 0ements

:aypee Group

The Administrative management college, Bangalore. 1"

Technical Analysis of Cement Sector in India

!adras 0ements

Dalima cements

ndia,s per capita cement productionE ;K> k% per annum. +orld avera%e of per

capita cement productionE !ore than A?> k% per annum.

Bottlenecks of 0ement ndustryE

' comparison of the ener%y efficiency of ndian cement industry )ith that of

other developed nations sho)s ndian companies are la%%in%.

*e%ional imbalances in cement production.

9i%h transportation cost involved.

have taken five 0ement #ector 0ompanies )hich are as follo)sE

;. '00

A. C6T*'T209.

K. G*'#!.

I.B*6' #CP2*

D.'!BC:'

;. ACC:

'00 6imited is ndia,s foremost manufacturer of cement and ready mix

concrete )ith a country)ide net)ork of factories and marketin% offices. 2stablished

in ;<KN, '00 has been a pioneer and trendsetter in cement and concrete technolo%y.

'00,s brand name is synonymous )ith cement and en&oys a hi%h level of e$uity in

The Administrative management college, Bangalore. 1#

Technical Analysis of Cement Sector in India

the ndian market. t is the only cement company that fi%ures in the list of 0onsumer

#uperBrands of ndia. 'mon% the first companies in ndia to include commitment to

environment protection as a corporate ob&ective, '00 has )on several prizes and

accolades for environment friendly measures taken at its plants and mines. The

company has also been felicitated for its acts of %ood corporate citizenship.

'00 )as the first recipient of '##O09'!,s first ever @ational ')ard for

outstandin% performance in promotin% rural and a%ricultural development activities in

;<=N. Decades later, P9D 0hamber of 0ommerce and ndustry selected '00 as

)inner of its Good 0orporate 0itizen ')ard for the year A>>A. Over the years, there

have been many a)ards and felicitations for achievements in *ural and community

development, #afety, 9ealth, Tree plantation, afforestation, clean minin%,

2nvironment a)areness and protection.

A. ULTRATECHE

Cltratech 0ement 6imited, a Grasim subsidiary has an annual capacity of ;=

million tonnes. t manufactures and markets Ordinary Portland 0ement, Portland

Blast "urnace #la% 0ement and Portland Pozzolana 0ement.

CltraTech has five inte%rated plants, five %rindin% units and three terminals F

t)o in ndia and one in #ri 6anka. These include an inte%rated plant and t)o %rindin%

units of the erst)hile @armada 0ement 0ompany 6imited, a subsidiary, )hich has

been amal%amated )ith the company in !ay A>>N.CltraTech is the country1s lar%est

exporter of cement clinker. The company exports over A.D million tonnes per annum,

)hich is about K> per cent of the country1s total exports. The export markets span

countries around the ndian Ocean, 'frica, 2urope and the !iddle 2ast.

The cement division of 6&T )as demer%ed in A>>I after Grasim made the K>

per cent open offer for e$uity shares, %ainin% control over the ne) company,

christened CltraTech. *eady !ix 0oncrete is likely to see substantial %ro)th in the

The Administrative management college, Bangalore. 2$

Technical Analysis of Cement Sector in India

comin% years. *eco%nizin% the opportunities that this business )ill offer, CltraTech

has commenced settin% up of *eady !ix 0oncrete plants at various places in the

country. CltraTech1s subsidiaries areE Dakshin 0ements 6imited and CltraTech

0eylinco .Private/ 6imited.

K. GRASI*:

Grasim ndustries 6imited, a fla%ship company of the 'ditya Birla Group,

ranks amon% ndia1s lar%est private sector companies, )ith consolidated net revenues

of *s.;I; billion and a consolidated net profit of *s.A> billion."RA>>=/.

#tartin% as a textiles manufacturer in ;<I?, today Grasim1s businesses comprise

viscose staple fiber .S#"/, cement, spon%e iron, chemicals and textiles. ts core

businesses are S#" and cement, )hich contribute to over <> per cent of its venues and

operatin% profits.

The 'ditya Birla Group is the )orld,s lar%est producer of S#", commandin% a

A; per cent %lobal market share. Grasim, )ith an a%%re%ate capacity of A=>,;>> tpa

has a %lobal market share of ;; per cent. t is also the second lar%est producer of

caustic soda .)hich is used in the production of S#"/ in ndia.

n cement.%rey cement and )hite cement/, Grasim alon% )ith its subsidiary

CltraTech 0ement 6td. has a capacity of K> million tpa and is a leadin% cement player

in ndia. n :uly A>>I, Grasim ac$uired a ma&ority stake and mana%ement control in

CltraTech 0ement 6imited. One of the lar%est of its kind in the cement sector, this

ac$uisition catapulted the 'ditya Birla Group to the top of the lea%ue in ndia.

The Administrative management college, Bangalore. 21

Technical Analysis of Cement Sector in India

'll of Grasim1s units have earned #O <>>A and ;I>>; certifications.

Product $uality, innovation and eco-friendliness are a hallmark of all the company1s

divisions.

:3 BIRLA SU))ER

t is a unit of Grasim Birla #uper 0ement is a %rindin% unit of ;.D !illion Tons

capacity )ith a modern technolo%y manufacturin% process involves a level of

sophistication & ne) to the 0ement industry.

The technolo%y )as supplied by 1Orupp Polysis7 of Germany such as *oller

Press, Grindin% !ill. 2lectronic Packer enables for automatic packin% & )ei%hin% of

0ement Ba%s. Cnloadin% of ra) material .0linker/, )hich is bein% received from

rail)ay, +a%ons are unloaded by atomised 1+a%on Tippler1. 'll the process of

manufacturin% and packin% are atomized & is controlled throu%h electronic devices &

P60 at 0entral 0ontrol *ooms Plant, Packin% Plant & +a%on Tippler.

Three %rades of Products i.e. OP0 IK Grade, OP0 DK & PP0 are

manufactured. The brand names of these $ualities are 1*a&ashree1, 1Birla #uper1 &

1Birla Plus1 respectively.

The plant po)er is connected to ;KA OS Po)er supply of !#2B %rid &

havin% connected load of ;AND> O+. 'll 2lectrical & nstruments e$uipment is of

latest desi%n & hi%h efficiency.

The unit has )on the @ational ')ard for the 72xcellence in 2ner%y conservation7

from the 0 for.

the A>>>-1>> & A>>;-1>A consecutively for the outstandin% savin% in ener%y.

The unit has ba%%ed ENati$na A(ar!E for 12ner%y 0onservation & 2ner%y

!ana%ement1 or%anised by 0 for t)ice i.e., A>>>-1>> & A>>;-1>A.

The Administrative management college, Bangalore. 22

Technical Analysis of Cement Sector in India

!ana%ement of 1Birla #uper 0ement1 takes keen interest in reduction of 1ener%y cost1

by implementin% ener%y conservation activities and mana%in% plant operatin% times to

avail the maximum benefits from the #tate 2lectricity Board in 1Po)er factor1, 1@i%ht

0onsumption rebate

& 1Bulk discount1.

"ollo)in% are the ma&or 2nvironmental & #afety 'ctivities done at our plant.

T nclusion of PP0 %rade 0ement to utilize )aste fly ash from po)er plant.

T 'tomized handlin% of fly ash throu%h air ti%ht tankers to avoid fu%itive natural

escape of fly ash to environment.

T Pneumatic unloadin% systems for dust free unloadin% of fly ash from tankers.

T nstallation of additional t)o dust collectors at +5T to avoid dust emission.

T nstallation of %ypsum shed of AUD>>> !T to avoid land contamination.

T Development of rain )ater harvestin% reservoir.

T 0overin% of belt conveyors to avoid dust emission durin% transportation

:=A*BUFA CE*ENT

Am-u9a Cement" )as set up in ;<?N. n the last decade the company has %ro)n

tenfold. The total cement capacity of the company is ;?.D million tonnes.

ts plants are some of the most efficient in the )orld. +ith environment protection

measures that are on par )ith the finest in the developed )orld.

The company1s most distinctive attribute, ho)ever, is its approach to the business.

'mbu&a follo)s a uni$ue home%ro)n philosophy of %ivin% people the authority to set

their o)n tar%ets, and the freedom to achieve their %oals. This simple vision has

created an environment )here there are no limits to excellence, no limits to

efficiency. 'nd has proved to be a po)erful en%ine of %ro)th for the company.

's a result, 'mbu&a is the most profitable cement company in ndia, and one of

the lo)est cost producer of cement in the )orld.

The Administrative management college, Bangalore. 23

Technical Analysis of Cement Sector in India

2nvironment policy is built around t)o simple truths. One, no cement plant can

flourish at the cost of the environment. 's one of the countrys lar%est producers of

cement, )ith a lar%e presence around the country, )e have an obli%ation to protect the

environment )e function in.

'lso, as )e discovered, bein% environmentally conscious, almost never interfered

)ith runnin% a profitable business. n fact its $uite the contrary.

Our efforts to achieve )orld standards in environment protection, for instance,

have had the happy outcome of substantially improvin% efficiency and profitability.

The fact is, a cleaner environment isnt &ust better for the people, it reduces )ear and

tear on plants and machinery as )ell. Thus directly contributin% to the bottom line.

Besides dust in cement plants is nothin% but cement itself, )hich )e capture and ba%.

Our approach has made us the one of the )orlds most environment friendly

cement companys. 'nd the most profitable.

The Administrative management college, Bangalore. 24

Technical Analysis of Cement Sector in India

63 ANALSIS AND DATA INTER)RETATION:

Cacuati$n:

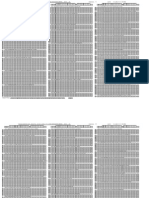

7= ACC Lt!: *O/EING A/ERAGE

MONT

H

CLOSING

PRICE

SUM OF 12

MONTHS

AVERA

GE

SUM OF 3

MONTHS

AVERA

GE

Apr-05 365.7

May-

05 30.02!5

"#$-05 37!.!65 115%20

3%73.3

3

"#&-05 %1!.712 115511

3503.6

7

A#'-05 %5%.265 115603

353%.3

3

S(p-05 %76.661 1156!5 3565

O)*-05 %5!.!5 11577

35!5.6

7

N+,-05 %!1.!27 1157!

3626.3

3

-()-05 537.302 115!70

3656.6

7

"a$-06 550.105 116062

367.3

3

F(.-06 5!1.0! 11615% 371

Mar-06 7%6.%5 553.1555 %7.763 1162%% 37%

Apr-06 !20.%61 6%07.!165 533.!!3 11633% 377

May-

06 72.66 6!00.555

575.0%6

3 116%23

307.6

7

"#$-06 7%6.121 7266.711

605.55!

3 116515

33.3

3

"#&-06 15.035 7662.03%

63.502

116606

36.6

7

A#'-06 .531 0!6.3

67%.6!1

7 1166!

3!!.3

3

S(p-06 !50.75! 570.3!

71%.1!!

1167!0 3!30

The Administrative management college, Bangalore. 25

Technical Analysis of Cement Sector in India

O)*-06 !%.125 !0!%.573

757.1

1 1162

3!60.6

7

N+,-06 10%.%02 !651.0% 0%.25% 116!7%

3!!1.3

3

-()-06 1071.675 1015.%21

%.75

1 117065

3!021.6

7

"a$-07 1063.631 106!.!%7

!1.57

! 117157

3!052.3

3

F(.-07 1005.3! 11113.2%7

!26.103

! 1172%! 3!03

Mar-07 77%.1%! 111%0.!%6

!2.%12

2 11733! 3!113

Apr-07 773.1! 10!!%.30% !16.1!2 117%2! 3!1%3

May-

07 73.%2! 10!!5.065

!16.255

% 11751

3!172.6

7

"#$-07 35.1%3 110%.07

!23.673

! 117610

3!203.3

3

"#&-07 105!.651 1132.703

!%%.05

6 117701

3!233.6

7

A#'-07 1000.50! 11%%0.61

!53.3!0

1 1177!3

3!26%.3

3

S(p-07 112%.0% 11613.!62

!67.30

2 1175 3!2!5

O)*-07 11%%.627 1177%.%6%

!1.205

3 117!77

3!325.6

7

N+,-07 1061.566 1177.62

!2.302

3 1106!

3!356.3

3

-()-07 1053.10% 1176!.057

!0.75%

11160

3!36.6

7

"a$-0 73.152 1157.57

!6%.1

5 11252

3!%17.3

3

F(.-0 77%.20! 113%7.3!

!%5.616

5 113%% 3!%%

Mar-0 7!.572 11362.21

!%6.!01

11%35

3!%7.3

3

Apr-0 0!.!55 113!.!57

!%!.!13

1 11526

3!50.6

7

May-

0 6!%.103 1121!.631

!3%.!6!

3 11616

3!53.6

7

"#$-0 61.516 11003.00% !16.!17 1170

3!56!.3

3

"#&-0 5%0.7%1 10%%.0!%

73.67%

5 117!!

3!5!!.6

7

A#'-0 5!.755 10073.3% 3!.%%5 11!1

3!630.3

3

S(p-0 601.31! !550.61!

7!5.%

! 11!3 3!661

O)*-0 515.3!2 !21.3%

7%3.%%

7 11!075

3!6!1.6

7

N+,-0 %%1.01! 300.37

6!1.736

% 11!167

3!722.3

3

-()-0 %67.3%2 7715.075 6%2.!22 11!25 3!752.6

The Administrative management college, Bangalore. 2

Technical Analysis of Cement Sector in India

! 7

"a$-0! %!!.!3 73%1.53

611.21

1 11!350

3!73.3

3

F(.-0! 5%5.61 7113.25%

5!2.771

2 11!%%2 3!1%

Mar-0! 5%!.%% 673.122

572.760

2 11!532 3!%%

Apr-0! 620.3 663.555

556.!62

! 11!622 3!7%

May-

0! 60.067 666!.51!

555.7!3

3 11!711

3!!03.6

7

"#$-0! 0.!76 65!.!7!

571.66%

! 11!03

3!!3%.3

3

"#&-0! 0.0152 7127.2532

5!3.!37

11!!%

3!!6%.6

7

A#'-0! 23.126 7360.62%2

613.35

% 11!!6

3!!!5.3

3

S(p-0! 02.2!7 7561.6022

630.133

5 12007 %0026

O)*-0! 21.67 767.2

655.657

% 120170

%0056.6

7

N+,-0! 7%.605 175.%7%2

61.2!

5 120262

%007.3

3

-()-0! 3.56% 5%6.6!62

712.22%

7 120353

%0117.6

7

"a$-10 !22.207 !6.!732

7%7.%1%

% 120%%5

%01%.3

3

F(.-10 6.2% !30!.6032

775.00

3 120537 %017!

Mar-10 !70.0! !730.2532

10.5%

% 120627 %020!

83=RSI

The Administrative management college, Bangalore. 2!

Technical Analysis of Cement Sector in India

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-05 365.7

May-05 30.02!5

1%.32!

5

"#$-05 37!.!65 0.06%5

"#&-05 %1!.712 3!.7%7

A#'-05 %5%.265 3%.553

S(p-05 %76.661 22.3!6

O)*-05 %5!.!5 16.711

N+,-05 %!1.!27 31.!77

-()-05 537.302 %5.375

"a$-06 550.105 12.03

F(.-06 5!1.0! %0.!%

Mar-06 7%6.%5

155.36

1

Apr-06 !20.%61

17%.01

1

May-06 72.66 %7.7!3

"#$-06 7%6.121 126.5%7

The Administrative management college, Bangalore.

SUM

571.536

5

1!1.115

5

AVERAGE

3.102%

3

12.7%10

3

RS 2.!!05

RSI

!6.76%!

5

2"

Technical Analysis of Cement Sector in India

MONTH

CLOSING

PRICE GAIN LOSS

"#&-06 15.035

A#'-06 .531 73.%!6

S(p-06 !50.75! 62.22

O)*-06 !%.125 33.366

N+,-06 10%.%02 6%.277

-()-06 1071.675 23.273

"a$-07 1063.631 .0%%

F(.-07 1005.3! 5.2%2

Mar-07 77%.1%! 231.2%

Apr-07 773.1! 0.33

May-07 73.%2! !!.61

"#$-07 35.1%3 3.26

"#&-07 105!.651

22%.50

A#'-07 1000.50! 5!.1%2

S(p-07 112%.0%

123.53

1

SUM 70%.2! 3!5.2%

AVERAGE %6.!526

26.3522

7

RS

1.7172

!

RSI 6%.05

MONT

H

CLOSING

PRICE GAIN LOSS

O)*-07 11%%.627

N+,-07 1061.566 3.061

-()-07 1053.10% .%62

"a$-0 73.152 17!.!52

F(.-0 77%.20! !.!%3

Mar-0 7!.572 15.363

Apr-0 0!.!55 20.33

May-0 6!%.103 115.52

"#$-0 61.516 75.57

The Administrative management college, Bangalore. 2#

Technical Analysis of Cement Sector in India

"#&-0 5%0.7%1 77.775

A#'-0 5!.755 %!.01%

S(p-0 601.31! 11.56%

O)*-0 515.3!2 5.!27

N+,-0 %%1.01! 7%.373

-()-0 %67.3%2 26.323

SUM 122.6%7

7!!.!3

2

AVERAGE

.176%6

7

53.32

RS

0.01022

1

RSI

1.01175

!

MONT

H

CLOSING

PRICE GAIN LOSS

"a$-0! %!!.!3

F(.-0! 5%5.61 %5.6

Mar-0! 5%!.%% 3.3

Apr-0! 620.3 70.!%

May-0! 60.067 5!.67!

"#$-0! 0.!76 12.!0!

"#&-0! 0.0152 0.!60

A#'-0! 23.126 15.110

S(p-0! 02.2!7 20.2!

O)*-0! 21.67 1!.31

N+,-0! 7%.605 73.073

-()-0! 3.56% !.!5!

"a$-10 !22.207 3.6%3

F(.-10 6.2% 35.!67

Mar-10 !70.0! 3.5

The Administrative management college, Bangalore. 3$

Technical Analysis of Cement Sector in India

*$vin+ Avera+e

7= ACC:

S'$rt Term *$vin+ Avera+e:

The Administrative management college, Bangalore.

SUM

600.!!

130.2!

AVERAGE

%0.065!

!

.721!

7

RS

%.5!367

7

RSI

2.1226

7

31

Technical Analysis of Cement Sector in India

n the above chart blue color sho)s the closin% price and red color

sho)s the !ovin% avera%e.i.e. Kmonths/

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e indicates

the possibility of a further fall. 9ence, the "e si%nal is %enerated durin% ,

"ebruary , :uly& October.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility of

the further rise. 9ence, the -uy si%nal is %enerated durin% 'pril, !ay &

December

The movin% avera%e is continuously fallin% from October to :anuary.

The movin% avera%e is continuously risin% from 'u%ust to @ovember.

L$n+ Term *$vin+ Avera+e:

The Administrative management college, Bangalore. 32

Technical Analysis of Cement Sector in India

This chart is similar to previous chart but it is lon% term movin% avera%e.

n the above chart, -ue color indicates closin% price. Re! color indicates lon%

term movin% avera%e .i.e., ;Amonths !S/.

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e indicates the

possibility of a further fall. 9ence, the "e si%nal is %enerated durin%

December & October.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility of the

further rise. 9ence, the -uy si%nal is %enerated durin% #eptember & :anuary.

The movin% avera%e is continuously risin% from October to :anuary.

The movin% avera%e is continuously fallin% from October to 'u%ust .

ULTRATECH

The Administrative management college, Bangalore. 33

Technical Analysis of Cement Sector in India

*O/ING A/ERAGE

MONT

H

CLOSING

PRICE

SUM OF 12

MONTHS AVG

SUM OF 3

MONTHS AVG

Apr-05 355.1%

May-05 337.!6

"#$-05 327.613 1020.73!

3%0.2%6

3

"#&-05 370.57 1036.16

3%5.3!5

3

A#'-05 %06.115 110%.315 36.105

S(p-05 %51.!7 122.6 %0!.56

O)*-05 %25.% 123.%!3 %27.31

N+,-05 %%.335 1325.713

%%1.!0%

3

-()-05 %35.!36 130!.671 %36.557

"a$-06 %.1!7 1372.%6

%57.%!

3

F(.-06 56!.171 1%!3.30% %!7.76

Mar-06 616.3% 5233.2!2

%36.107

7 167%.202

55.067

3

Apr-06 767.36 56%5.53

%70.%61

5 1!53.3!1

651.130

3

May-06 71.711 6026.263

502.1

6 2102.!31 700.!77

"#$-06 6%%.52 63%3.232

52.602

7 2130.67!

710.226

3

"#&-06 70%.! 6677.535

556.%61

3 206.13

6!.3!%

3

A#'-06 751.37! 7022.7!!

55.233

3 2100.51

700.23

7

S(p-06 2.3%5 73!!.166

616.5!7

2 22%.61% 761.53

O)*-06 77.75 751.516 65%.2!3 2%57.%7% 1!.15

N+,-06 !3.2 2!7.001

6!1.%16

25!!.!15

66.63

3

-()-06 !!!.32 60.35

73.365

% 2770.! !23.63

"a$-07 10.!3 !%61.01

7.%23

% 2!2.033 !!%.011

F(.-07 1005.%3% !!7.3%%

2%.77

7 30!3.6%7

1031.21

6

Mar-07 7.731 1006!.2%1

3!.103

% 23.05

!61.01!

3

Apr-07 76!.1 10071.035

3!.252

! 2563.3%5

5%.%%

3

May-07 16.16 1016!.1%

%7.%2

3 237%.727

7!1.575

7

"#$-07 22.!61 103%7.51! 62.2!3 2%0.!57 02.!5

The Administrative management college, Bangalore. 34

Technical Analysis of Cement Sector in India

3 7

"#&-07 !26.16 1056.7!7

0.733

1 2565.!%5 55.315

A#'-07 !1.!56 1070!.37%

!2.%%7

26%1.05

0.361

7

S(p-07 1006.773 107.02

!07.316

22%.!7

!%1.632

3

O)*-07 105.3! 1106.!1

!22.%07

6 2!57.56 !5.56

N+,-07 !!3.% 1116.%71

!30.705

! 305!.012

101!.67

1

-()-07 !.63% 11157.75

!2!.15

% 30%0.73

1013.62

%

"a$-0 !02.37 10!71.72!

!1%.310

2%.71

!61.623

7

F(.-0 76.!23 10%3.21

!03.601

5 276.3!% !22.7!

Mar-0 27.036 101.523

!06.7!3

6 2606.7!6 6.!32

Apr-0 7!3.605 10!05.!% !0.2! 2%!7.56%

32.521

3

May-0 6.72 10777.!1%

!.15!

5 230!.%23

76!.07

7

"#$-0 611.366 10566.31!

0.526

6 20!3.753

6!7.!17

7

"#&-0 570.775 10210.!26

50.!10

5 170.!23 623.6%1

A#'-0 607.677 !!26.6%7

27.220

6 17!.1 5!6.606

S(p-0 563.!35 !%3.0!

7!0.317

% 17%2.37

50.7!5

7

O)*-0 %07.06 32.03

736.002

5 157.672 526.22%

N+,-0 321.511 160.1%1

60.011

12!2.506

%30.35

3

-()-0 336.%5 750.352 625.6!6 1065.%16

355.13

7

"a$-0! 3!.6!2 6!!5.207

52.!33

! 10%.0%

3%!.3%!

3

F(.-0! %22.%76 65%0.76

5%5.063

3 11%!.013

33.00%

3

Mar-0! %!.%7 6203.211

516.!3%

3 1301.655 %33.5

Apr-0! 555.0 5!65.%1%

%!7.117

1%67.771 %!.257

May-0! 623.677 5!00.30!

%!1.6!2

% 166.!72 556.32%

"#$-0! 715.513 600%.%56

500.371

3 1!%.!! 631.666

"#&-0! 7%6.%! 610.17

515.01%

2 205.67!

6!5.226

3

A#'-0! 7%5.221 6317.71% 526.%76 2207.223 735.7%1

The Administrative management college, Bangalore. 35

Technical Analysis of Cement Sector in India

2

S(p-0! 757.127 6510.!06

5%2.575

5 22%.37

7%!.612

3

O)*-0! 0!.7%5 6!13.5!1

576.132

6 2312.0!3

770.6!7

7

N+,-0! 76!.115 7361.1!5

613.%32

! 2335.!7

77.662

3

-()-0! !20.0%5 7!%%.3!5

662.032

! 2%!.!05

32.!6

3

"a$-10 !73.6 52.571

710.71%

3 2663.02 7.676

F(.-10 !!3.275 !0!!.37

75.20

27.1 !62.3!6

Mar-10 1110.1 !71!.!3

0!.!!

6 3077.2%3

1025.7%

RSI

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-05 355.1%

May-05 337.!6 17.15%

"#$-05 327.613 10.373

"#&-05 370.57 %2.!7%

A#'-05 %06.115 35.52

S(p-05 %51.!7 %5.63

O)*-05 %25.% 26.57

N+,-05 %%.335 22.!35

-()-05 %35.!36 12.3!!

The Administrative management college, Bangalore. 3

Technical Analysis of Cement Sector in India

"a$-06 %.1!7 52.261

F(.-06 56!.171 0.!7%

Mar-06 616.3% %7.663

Apr-06 767.36

150.55

2

May-06 71.711 %.675

"#$-06 6%%.52 7%.12!

SUM %7.75 1!.30

AVERAGE

31.!166

7

12.6205

3

RS

2.52!%

RSI

71.662!

%

MONT

H

CLOSING

PRICE GAIN LOSS

"#&-06 70%.!

A#'-06 751.37! %6.%!

S(p-06 2.3%5 76.!66

O)*-06 77.75 %!.%05

N+,-06 !3.2 16.07

-()-06 !!!.32 105.5

"a$-07 10.!3 !.573

F(.-07 1005.%3% 3.%5!

Mar-07 7.731

216.70

3

Apr-07 76!.1 1!.551

May-07 16.16 %7.636

"#$-07 22.!61 6.1%5

"#&-07 !26.16

103.20

7

A#'-07 !1.!56 3%.212

S(p-07 1006.773

11%.1

7

SUM 655.0

353.!2

5

AVERAGE

%3.7205

3 23.5!5

RS

1.52!5

RSI

6%.!%6

6

The Administrative management college, Bangalore. 3!

Technical Analysis of Cement Sector in India

MONT

H

CLOSING

PRICE GAIN LOSS

O)*-07 105.3!

N+,-07 !!3.% 65.%3!

-()-07 !.63% %.766

"a$-0 !02.37 5.7!7

F(.-0 76.!23 25.!1%

Mar-0 27.036 %!.7

Apr-0 7!3.605 33.%31

May-0 6.72

10%.2

3

"#$-0 611.366 77.%16

"#&-0 570.775 %0.5!1

A#'-0 607.677 36.!02

S(p-0 563.!35 %3.7%2

O)*-0 %07.06

156.7

5

N+,-0 321.511 5.5%!

-()-0 336.%5 15.33%

SUM 52.236 77%.23

AVERAGE 3.%2%

51.6153

3

RS

0.067%6

RSI

6.32037

7

MONT

H

CLOSING

PRICE GAIN LOSS

"a$-0! 3!.6!2

The Administrative management college, Bangalore. 3"

Technical Analysis of Cement Sector in India

F(.-0! %22.%76 32.7%

Mar-0! %!.%7 67.011

Apr-0! 555.0 66.321

May-0! 623.677 67.6!

"#$-0! 715.513 !1.36

"#&-0! 7%6.%! 30.!76

A#'-0! 7%5.221 1.26

S(p-0! 757.127 11.!06

O)*-0! 0!.7%5 52.61

N+,-0! 76!.115 %0.63

-()-0! !20.0%5 150.!3

"a$-10 !73.6 53.23

F(.-10 !!3.275 1!.%07

Mar-10 1110.1

116.2

5

SUM 762.306 %1.!

AVERAGE 50.20% 2.7!32

RS

1.1!%3

3

RSI !%.7!

The Administrative management college, Bangalore. 3#

Technical Analysis of Cement Sector in India

8= Utratec': *O/EING A/ERAGE

S'$rt Term *$vin+ Avera+e:

n the above chart, V axis indicates month and the R axis indicates the

price of scrip.

n the above chart, -ue color indicates closin% price. Re! color

indicates lon% term movin% avera%e .i.e.,Kmonths !S/.

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e

indicates the possibility of a further fall. 9ence, the "e si%nal is

%enerated durin% :anuary, October & December.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility

of the further rise. 9ence, the -uy si%nal is %enerated durin% :uly &

@ovember.

The movin% avera%e is continuously risin% from :une to :anuary.

L$n+ Term *$vin+ Avera+e:

The Administrative management college, Bangalore. 4$

Technical Analysis of Cement Sector in India

This chart is similar to previous chart but it is lon% term movin%

avera%e.

n the above chart, -ue color indicates closin% price. Re! color

indicates lon% term movin% avera%e .i.e., ;Amonths !S/.

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e

indicates the possibility of a further fall. 9ence, the "e si%nal is

%enerated durin% December,& :anuary.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility

of the further rise. 9ence, the -uy si%nal is %enerated durin% :uly, !ay

& :anuary.

The movin% avera%e is continuously risin% from :uly to :anuary.

The Administrative management college, Bangalore. 41

Technical Analysis of Cement Sector in India

GRASI*

*O/ING A/ERAGE

MONTH

S CLOSING

SUM OF 12

MONTHS AVG

SUM OF 3

MONTHS AVG

Apr-05 1205.62

May-05 1135.2

"#$-05 10!7.57 3%3.%!5 11%6.165

"#&-05 1112.!15 33%5.72 1115.26067

A#'-05 1273.2%1 3%3.7%3 1161.2%767

S(p-05 1335.712 3721.6 12%0.62267

O)*-05 1206.03 31%.!!1 1271.66367

N+,-05 125.0! 326.% 1275.616

-()-05 1370.511 361.6%7 127.21567

"a$-06 1%36.01 %0!1.627 1363.7567

F(.-06 1612.16 %%1!.3%5 1%73.115

Mar-06 1!16.51 15!7.362 1332.202 %!65.352 1655.11733

Apr-06 227.231 1705!.!65 1%21.663 507.565 1!35.55

May-06 2131.03% 1055.71! 150%.6%33 6325.73 210.5!%33

"#$-06 1761.%%6 171!.57 155!.!6% 6170.711 2056.!0367

"#&-06 1!6!.61% 1!576.277 1631.356% 562.0!% 1!5%.03133

A#'-06 212.%%3 20%5.%7! 1707.1233 5!13.503 1!71.16767

S(p-06 2%00.336 21550.103 17!5.%1! 6552.3!3 21%.131

O)*-06 261%.23 22!5.3% 1!13.1!57 71!7.062 23!!.02067

N+,-06 2725.2%3 2%3!.%!3 2033.207 773!.62 257!.!5%

-()-06 2720.5 257%.562 21%5.7135 060.106 266.702

"a$-07 232.57 271%5.11% 2262.0!2 27.3!3 275!.%6%33

F(.-07 2626.07 215.35 23%6.5321 17!.237 2726.%1233

Mar-07 202.% 232%.707 2360.3!23 75%1.%!7 2513.3233

Apr-07 22!!.265 23%5.7%1 2362.1%51 700.1!2 2336.06%

May-07 2%!0.26 270%.!!3 23!2.02 672.3!1 22!0.7!7

"#$-07 2%5!.233 2!%02.7 2%50.2317 72%.7% 2%16.26133

"#&-07 263.0! 302!6.255 252%.67! 712.60 260%.20267

A#'-07 25!.!11 30!73.723 251.1%36 12.233 2727.%11

S(p-07 3267.263 31%0.65 2653.375 !!0.263 2!!6.75%33

O)*-07 366%.025 32!0.3!2 27%0.66 !7!1.1!! 3263.733

N+,-07 3675.!% 33%1.0!7 220.0!1% 10607.236 3535.7%533

-()-07 3670.%2% 3%7!0.!%1 2!!.2%51 11010.3!7 3670.13233

"a$-0 3266.77 35225.15 2!35.%2! 10613.15! 3537.71!67

F(.-0 263.657 35%62.72 2!55.2273 !00.6 3266.!56

Mar-0 2731.006 36110.!% 300!.2%12 61.%5 2!53.1667

Apr-0 250.!0 363!2.537 3032.711% 175.571 2725.1!033

May-0 223.3 3616.0! 3015.507% 75!5.752 2531.!1733

"#$-0 2152.317 357!.173 2!!.!311 7017.063 233!.021

"#&-0 1752.%65 3%76.5%! 2!7.37!1 61.62 2062.7333

The Administrative management college, Bangalore. 42

Technical Analysis of Cement Sector in India

A#'-0 1!.5!3 33!7.231 22%.76!3 5!3.375 1!6%.%533

S(p-0 1!22.3%3 32552.311 2712.6!26 5663.%01 17.0033

O)*-0 1336.15 30225.101 251.75% 52%7.751 17%!.25033

N+,-0 !%%.76 27%!%.02! 22!1.16!1 %20%.03% 1%01.3%%67

-()-0 1116.236 2%!3!.%1 207.3201 33!7.!27 1132.6%233

"a$-0! 12%6.0!3 22!1!.1%7 1!0!.!2! 3307.205 1102.%0167

F(.-0! 1356.253 21%11.7%3 17%.311! 371.52 123!.52733

Mar-0! 1%72.303 20153.0% 167!.%2 %07%.6%! 135.21633

Apr-0! 16%5.506 1!217.63 1601.%6! %%7%.062 1%!1.35%

May-0! 1!6.71 1!20.51 1576.70!2 510%.51! 1701.50633

"#$-0! 2325.5! 1!0!3.72 15!1.1%5 5!57.05 1!5.!35

"#&-0! 2603.763 1!!%5.0 1662.0! 6!16.062 2305.35%

A#'-0! 2655.73 20612.27 1717.6!2 755.135 252.3733

S(p-0! 2720.265 21%10.1!2 17%.127 7!7!.11 265!.!37

O)*-0! 23%2.10 22%15.%5 167.!571 771.156 2572.7167

N+,-0! 225.3 23755.!!7 1!7!.666% 73%7.761 2%%!.25367

-()-0! 2%1.3 2505.5!! 20.2166 70%6.33% 23%.77

"a$-10 2701.!%5 2651%.%51 220!.5376 7%06.171 2%6.72367

F(.-10 2663.123 2721.321 231.%%3% 773.!06 25!%.63533

Mar-10 2%.76 2!1!7.77 2%33.1%2 213.2 2737.!%267

RSI

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-05 1205.62

May-05 1135.2 70.3%

"#$-05 10!7.57 37.6!3

"#&-05 1112.!15 15.32

A#'-05 1273.2%1

160.32

6

S(p-05 1335.712 62.%71

O)*-05 1206.03

12!.67

%

N+,-05 125.0! 7!.06

-()-05 1370.511 5.%13

"a$-06 1%36.01 65.507

F(.-06 1612.16

176.7!

Mar-06 1!16.51

303.70

2

Apr-06 227.231 361.71

The Administrative management college, Bangalore. 43

Technical Analysis of Cement Sector in India

3

May-06 2131.03%

1%7.1!

7

"#$-06 1761.%%6

36!.5

SUM

1310.31

75%.5

AVERAGE

7.35%5

3 50.3

RS

1.73667

1

RSI

63.%5!2

5

MONH

CLOSING

PRICE GAIN LOSS

"#&-06 1!6!.61%

A#'-06 212.%%3

212.2

!

S(p-06 2%00.336

217.!

3

O)*-06 261%.23

213.!%

7

N+,-06 2725.2%3 110.!6

-()-06 2720.5 %.663

"a$-07 232.57 111.!!

F(.-07 2626.07

206.%

3

Mar-07 202.%

5%3.2%

7

Apr-07 22!!.265

216.%2

5

May-07 2%!0.26

1!1.02

1

"#$-07 2%5!.233 31.053

"#&-07 263.0!

%03.5

6

A#'-07 25!.!11 3.17

S(p-07 3267.263

%07.35

2

SUM

206.27

3 7.62%

AVERAGE

13!.0%

!

52.57%!

3

The Administrative management college, Bangalore. 44

Technical Analysis of Cement Sector in India

RS 2.6%5%6

RSI

72.566

2

MONT

H

CLOSING

PRICE GAIN LOSS

O)*-07 366%.025

N+,-07 3675.!% 11.!23

-()-07 3670.%2% 5.52%

"a$-0 3266.77

%03.63

7

F(.-0 263.657 %03.13

Mar-0 2731.006

132.65

1

Apr-0 250.!0

150.0!

May-0 223.3 2!7.07

"#$-0 2152.317

131.52

1

"#&-0 1752.%65

3!!.5

2

A#'-0 1!.5!3

236.12

S(p-0 1!22.3%3 66.25

O)*-0 1336.15

55.52

N+,-0 !%%.76

3!1.!3

!

-()-0 1116.236 171.36

SUM %1!.%11 2!67.2

AVERAGE

27.!607

3

1!7.13

3

RS

0.1%13%

!

RSI

12.3%3

MONT

H

CLOSING

PRICE GAIN LOSS

"a$-0! 12%6.0!3

F(.-0! 1356.253 110.16

Mar-0! 1%72.303 116.05

Apr-0! 16%5.506

173.20

3

May-0! 1!6.71 3%1.20

The Administrative management college, Bangalore. 45

Technical Analysis of Cement Sector in India

%

"#$-0! 2325.5!

33.7

!

"#&-0! 2603.763

27.17

%

A#'-0! 2655.73 52.02

S(p-0! 2720.265 6%.%2

O)*-0! 23%2.10

37.15

7

N+,-0! 225.3 56.72

-()-0! 2%1.3 133.%5

"a$-10 2701.!%5

23.10

7

F(.-10 2663.123 3.22

Mar-10 2%.76

15.63

7

SUM

2076.36

6 %73.6!!

AVERAGE

13.%2%

%

31.57!!

3

RS

%.3330

2

RSI

1.%2%0

%

2= GRASI*:

S'$rt Term *$vin+ Avera+e:

The Administrative management college, Bangalore. 4

Technical Analysis of Cement Sector in India

n the above chart, V axis indicates month and the R axis indicates the

price of scrip.

n the above chart, -ue color indicates closin% price. Re! color

indicates lon% term movin% avera%e .i.e., K months !S/.

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e

indicates the possibility of a further fall. 9ence, the "e si%nal is

%enerated durin% December, October & :une.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility

of the further rise. 9ence, the -uy si%nal is %enerated durin% :uly,

may ,& 'u%ust

"rom :anuary to October there is a risin% trend and from !arch to

December there is a fallin% trend.

L$n+ Term *$vin+ Avera+e:

This chart is similar to previous chart but it is lon% term movin%

avera%e.

The Administrative management college, Bangalore. 4!

Technical Analysis of Cement Sector in India

n the above chart, -ue color indicates closin% price. Re! color

indicates lon% term movin% avera%e .i.e., ;A months !S/.

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e

indicates the possibility of a further fall. 9ence, the "e si%nal is

%enerated durin% 'u%ust, October and :une.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility

of the further rise. 9ence, the -uy si%nal is %enerated durin% !arch &

:anuary.

The movin% avera%e is continuously risin% from !ay to October.

The movin% avera%e is continuously fallin% in the month of !arch to

:anuary..

BIRLA SU)ER

*O/ING A/ERAGE

MONT

H

CLOSING

PRICE

SUM OF 12

MONTHS AVG

SUM OF 3

MONTHS AVG

Apr-06 6.23

May-06 6!.17!

"#$-06 52.503 1!.!65

63.3216

7

"#&-06 51.657 2%1.622

0.5%06

7

A#'-06 55.%11 22.75 76.25

S(p-06 5%.!6! 21%.5%

71.5133

3

O)*-06 5%.7!5 216.32

72.2773

3

N+,-06 %.2%3 213.%1

71.13!3

3

-()-06 %5.22 203.2! 67.763

"a$-07 5%.077 202.3!7

67.%656

7

F(.-07 50.102 1!7.70% 65.!013

The Administrative management college, Bangalore. 4"

Technical Analysis of Cement Sector in India

3

Mar-07 %3. 6%.3!

5%.032%

2 1!3.3%!

6%.%%!6

7

Apr-07 50.2 630.306 52.5255 1!.267 66.0!

May-07 51.675 612.02

51.066

3 1!5.65

65.23

3

"#$-07 56.03 616.32!

51.3607

5 201.7!3

67.26%3

3

"#&-07 56.1! 620.62 51.735 21%.0!5 71.365

A#'-07 50.5! 616.0%1

51.3367

5 21%.%5 71.%!5

S(p-07 56.5!2 617.66% 51.%72 21!.%02 73.13%

O)*-07 5!.5 622.36!

51.6%0

222.72

7%.2!06

7

N+,-07 76.%2 650.5%6

5%.2121

7 2%3.102 1.03%

F(.-0 71.7 676.!6%

56.%136

7 26%.212

.0706

7

Mar-0 5!.616 62.503

56.752

5 267.236

!.076

7

Apr-0 75.3%7 707.7% 5.!7! 23.03 !%.361

May-0 73.035 736.!5

61.%07!

2 27!.6!

!3.2326

7

"#$-0 67.%3 75%.17

62.%1

7 275.%1 !1.27

"#&-0 63.!73 766.%76 63.73 27!.3

!3.27!3

3

A#'-0 71.05 71.%!6

65.12%6

7 275.5%1 !1.%7

S(p-0 63.76 7!.12

65.7651

7 266.32 .7!%

O)*-0 %2.727 71.31!

65.10!!

2 2%1.626 0.5%2

N+,-0 31.63 756.5!

63.0%!1

7 20!.516

6!.36

7

-()-0 31.03 72.12

60.6766

7 16!.%!6

56.%!6

7

"a$-0! 33.0%5 6%.7%5

57.0620

13.665

%6.2216

7

F(.-0! 33.355 6%6.%

53.666

7 12!.2!3

%3.0!76

7

Mar-0! 33.%62 620.2%6

51.671

7 130.!2

%3.6306

7

Apr-0! %3.1!7 5.0!6 %!.00 1%3.05!

%7.663

3

May-0! 52.15 567.2%6 %7.2705 162.1!!

5%.0663

3

"#$-0! 63.%2 563.13

%6.!31!

2 1!2.26% 6%.0

"#&-0! 5.56 55.066 %6.5055 217.65

72.5526

7

The Administrative management college, Bangalore. 4#

Technical Analysis of Cement Sector in India

A#'-0! 66.2!2 553.30 %6.10! 2%0.753 0.251

S(p-0! 75.35 56%.72

%7.0651

7 263.!1

7.!726

7

O)*-0! 7.135 600.1!

50.015

3 27.633

!2.776

7

N+,-0! 77.77 6%6.20%

53.503

3 2!7.65% !!.21

-()-0! 1.361 6!6.535

5.0%%5

312.723 10%.2%1

"a$-10 !.!52 753.%%2

62.76

3 327.325

10!.10

3

F(.-10 72.!% 7!3.027

66.055

322.13

107.376

7

Mar-10 72.23 32.3

6!.3656

7 317.076 105.6!2

RSI

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-06 6.23

May-06 6!.17! 0.!6

"#$-06 52.503 16.676

"#&-06 51.657 0.%6

A#'-06 55.%11 3.75%

S(p-06 5%.!6! 0.%%2

O)*-06 5%.7!5 0.17%

N+,-06 %.2%3 6.552

-()-06 %5.22 2.!61

"a$-07 5%.077 .7!5

F(.-07 50.102 3.!75

Mar-07 %3. 6.21%

The Administrative management college, Bangalore. 5$

Technical Analysis of Cement Sector in India

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-07 50.2

May-07 51.675 1.%75

"#$-07 56.03 %.355

"#&-07 56.1! 0.16

A#'-07 50.5! 5.6

S(p-07 56.5!2 6.002

O)*-07 5!.5 2.!0

N+,-07 76.%2 16.!2

F(.-0 71.7 %.72

Mar-0 5!.616 12.0%

SUM 31.2 22.%0%

AVERAGE 3.12 2.2%0%

RS

1.%202

2

RSI 5.62

The Administrative management college, Bangalore.

SUM 13.%%5 37.%

AVERAGE

1.120%1

7

0.5173

3

RS

2.16366

3

RSI 6.3!

51

Technical Analysis of Cement Sector in India

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-0 75.3%7

May-0 73.035 2.312

"#$-0 67.%3 5.552

"#&-0 63.!73 3.51

A#'-0 71.05 7.077

S(p-0 63.76 7.17%

O)*-0 %2.727 21.1%!

N+,-0 31.63 10.6%

-()-0 31.03 0.33

"a$-0! 33.0%5 2.015

F(.-0! 33.355 0.31

Mar-0! 33.%62 0.107

SUM !.50! 50.561

AVERAGE

0.7!2%1

7

%.213%1

7

RS 0.107

RSI

15.2!

MONT

H

CLOSING

PRICE GAIN LOSS

Apr-0! %3.1!7

May-0! 52.15 .!

"#$-0! 63.%2 11.235

"#&-0! 5.56 %.56%

A#'-0! 66.2!2 7.%36

S(p-0! 75.35 !.05

O)*-0! 7.135 2.75

The Administrative management college, Bangalore. 52

Technical Analysis of Cement Sector in India

N+,-0! 77.77 0.25

-()-0! 1.361 3.%%

"a$-10 !.!52 .5!1

F(.-10 72.!% 17.012

Mar-10 72.23 0.117

BIRLA SUPER

MOVING AVERAGE

The Administrative management college, Bangalore.

SUM %2.!6 21.!51

AVERAGE

3.5216

7

1.2!2

5

RS

1.!527

1

RSI

66.1!6%

7

53

Technical Analysis of Cement Sector in India

Short term moving average

n the above chart WV, axis sho)s the months and WR, axis sho)s the price

scrip

n the above chart Blue colour indicates the closin% Price and red sho)s the

avera%e

n the above chart, do)n)ard penetration of the risin% avera%e indicates the

possibility of a further fall. 9ence, the "e si%nal is %enerated in "ebruary and

December

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility

of the further rise. 9ence, the -uy si%nal is %enerated 'u%ust and

'pril.

The movin% avera%e continuously fallin% in :uly and December

The !ovin% avera%e continuously risin% in 'pril and December

Long term

The Administrative management college, Bangalore. 54

Technical Analysis of Cement Sector in India

This chart is similar to previous chart but it is lon% term movin% avera%e.

n the above chart, -ue color indicates closin% price. Re! color indicates lon%

term movin% avera%e .i.e., ;>months !S/.

!ovin% avera%es are used alon% )ith the price of the scrip.

n the above chart, do)n)ard penetration of the risin% avera%e indicates the

possibility of a further fall. 9ence, the "e si%nal is %enerated durin% 'pril,&

December.

Cp)ard penetration of a fallin% avera%e )ould indicate the possibility of the

further rise. 9ence, the -uy si%nal is %enerated durin% 'u%ust, &,'pril

The movin% avera%e is continuously risin% from 'pril to December

A*BUFA CE*ENT

The Administrative management college, Bangalore. 55

Technical Analysis of Cement Sector in India

*O/ING A/ERAGE

M0NTH

CLOSING

PRICE

SUM OF 12

MONTHS AVG

SUM OF 3

MONTHS AVG

Apr-05 %1!.!07

May-05 %60.1!7

"#$-05 2!!.5! 117!.6!3 3!3.231

"#&-05 61.!7 21.756 273.!17

A#'-05 110.33 15%1.! 513.!63

S(p-05 71.7%0% 131%.0%0% %3.0135

O)*-05 71.0%25 1323.112! %%1.0376

N+,-05 77.075 21!.70% 73.2!013

-()-05 1.0312 22!.1612 76.3727

"a$-06 .11 2%6.22!32 2.076%%

F(.-06 6.%605 255.60232 5.20077

Mar-06 !6.1 2!!%.3%672

2%!.52

! 271.%515 !0.%33

Apr-06 11%.377 26.1672

22%.06

1 2!7.715 !!.23!5

May-06 106.1205 233%.7%022

1!%.561

7 317.375 105.7!2

"#$-06 !1.!06 2127.05722

177.25%

312.%035 10%.13%5

"#&-06 103.311! 216.3!!12

10.6!!

! 301.33% 100.%%61

A#'-06 10!.1% 10!7.20!12

!1.%3%0

! 30%.357! 101.%526

S(p-06 115.12% 11%0.5!272

!5.0%!3

! 327.575! 10!.1!2

O)*-06 120.5!5 11!0.1%522

!!.177

7 3%%.5! 11%.!53

N+,-06 13%.7523 12%7.1002

103.!%

2 370.%713 123.%!0%

-()-06 13.!25 1305.7032

10.0

6 3!%.2723 131.%2%1

"a$-07 1%1.05 135.672

113.223

2 %1%.7623 13.25%1

F(.-07 133.355 1%05.5727

117.131

1 %13.365 137.73

Mar-07 107.%%7 1%16.137

11.011

6 31.7 127.2!57

Apr-07 111.!52 1%13.7137

117.0!

5 352.75% 117.5%7

May-07 11.7 1%26.3732

11.6%

% 33.17! 112.7263

"#$-07 11%.16! 1%%.6362

120.71!

7 3%%.!01 11%.!67

"#&-07 130.27 1%76.1513 123.012 363.776 121.257

The Administrative management college, Bangalore. 5

Technical Analysis of Cement Sector in India

6

A#'-07 12!.!6 1%!6.!!73

12%.7%!

37%.!2 12%.!!%

S(p-07 1%3.527 1525.%003

127.116

7 %0%.3% 13%.7

O)*-07 1%6.11% 1551.6167

12!.301

% %20.32%% 1%0.101

N+,-07 1%7.0!0! 1563.!553

130.32!

6 %37.%2!3 1%5.0!

-()-07 1%.!5 1573.!1! 131.16 %%2.7!1 1%7.5!73

"a$-0 131.1! 156%.653

130.37

%27.7!!% 1%2.5!!

F(.-0 11.73 1550.036

12!.16!

7 3!!.%%65 133.1%

Mar-0 121.53 156%.11!

130.3%3

3 372.07 12%.02!

Apr-0 116.762 156.!2!

130.7%%

2 357.03 11!.01

May-0 106.7 1557.01!

12!.751

7 3%5.162 115.05%

"#$-0 5.5% 152.3!0

127.365

! 30!.172 103.0573

"#&-0 7!.3! 1%76.!52

123.07!

% 271.7!! !0.5!!67

A#'-0 3.3!7 1%30.363 11!.1!7 2%.326 2.77533

S(p-0 1.602 136.%3

11%.036

6 2%%.3 1.%6267

O)*-0 61.025 122.652%

106.7

7 226.02% 75.3%133

N+,-0 56.%02 11!1.!635

!!.3302

! 1!!.02! 66.3%3

-()-0 6%.%!2 1107.566

!2.2!71

7 11.!1! 60.63!67

"a$-0! 70.5 10%6.327

7.1!3!

2 1!1.%7% 63.2%67

F(.-0! 70.226 !!7.15