Академический Документы

Профессиональный Документы

Культура Документы

Gender Issues For The Fourteenth Finance Commission

Загружено:

Abhishek GuptaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Gender Issues For The Fourteenth Finance Commission

Загружено:

Abhishek GuptaАвторское право:

Доступные форматы

COMMENTARY

Economic & Political Weekly EPW december 21, 2013 vol xlviiI no 51

19

Gender Issues for the Fourteenth

Finance Commission

Dakshita Das

The views expressed here are personal.

Dakshita Das (dakshita.das@gmail.com) is a

civil servant.

In conrmation of its gender-based

commitment, the government

should not consider revenues

arising out of alcoholic beverages

as part of the overall gross state

domestic product of any state; this

will automatically have an impact

on the revenue earning capacity

of a state and may end up in

altering the pattern of resources

that will accrue to it from the

Fourteenth Finance Commission

award. The FFC should also

build gender sensitivity into

the analysis of local issues

and recommend grants which

can further the goal of gender

resource budgeting.

W

ith its report due late next year

which will determine centre-

state scal relationships for the

period 2015-20 the Fourteenth Finance

Commission (FFC) has its work mapped

out. Such are the recommendations of

the nance commissions (FCs) that gen-

erally most of them are accepted by the

union government. Hence, any develop-

ment agenda that needs to be pushed

should be brought out at this stage for

incorporation in the recommendations

of the FFC.

One such agenda relates to gender

issues. Over the last decade, through the

medium of the union and state budgets,

the principle of viewing government

programmes and policies from a gender

lens has been well entrenched. Most

budgets reect a gender budget statement

which also indicates certain programmes

and policies for women. Government de-

partments have constituted gender bud-

geting cells to run through programmes

from a gender lens prior to their formali-

sation and some new schemes have suc-

cessfully incorporated within them a

gender component, the Mahatma Gandhi

National Rural Employment Guarantee

Act (MGNREGA) being a case in point. In

fact, since its very recent introduction

into the Indian public nance system,

gender budgeting can be said to have

been institutionalised, albeit there are

improvements that can be built into it.

The impact analysis of gender budget-

ing is however yet to be studied in ne

detail. Therefore, with the FFC, a new

thrust can be given by establishing linkages

within the devolution pattern and also the

factors that can determine the same.

FCs share resources between the centre

and the states through recommending a

share in the union tax revenues and by

grants-in-aid to states. The Thirteenth

Finance Commission (TFC) envisaged a

transfer of Rs 3,18,581 crore to various

states over its award period as grants-in-aid

and a devolution of 32% as share of the

states from the shareable pool of resources.

Combined, both form a signi cant chunk

of the budgetary revenues for any state.

For 2013-14, for instance, the Haryana

government received close to 15% of its

resources through the FC mode.

Sharing of Union Tax Revenues

Governed by Article 280(3) of the Consti-

tution, the share of union tax revenue

becomes the most important task of any

FC as the share of the states from this

pool is the main source of transfer of

resources from the centre to it. Being an

untied source of revenue, it becomes a

clear stream of funding for the states. In

the Twelfth Finance Commission, tax

devolution accounted for 81.1% of the

total transfers, slightly lower than the

86.5% of the previous commission. In

working out the criteria to determine the

state-wise share, the FCs use various

methodologies along with consulting the

states and the Ministry of Finance at the

centre. They also consider other factors,

i e, economic and scal.

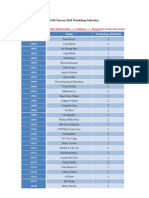

Accordingly, the TFC assigned the fol-

lowing weights for tax devolution:

The criterion varies from commission

to commission but population and area

along with scal discipline/tax effort are

more or less a constant for recent FCs. In

determining the scal criteria, the indi-

vidual states gross state domestic product

(GSDP) is taken into account. Even for

determining the scal discipline criteria,

the TFC relied upon the states capacity

to generate resources and manage their

nances properly. Tax effort, which was

an important weightage for the Twelfth

FC has been merged in the ongoing FC

under scal discipline.

State Excise on Liquor

The issue that arises here is: what exactly

contributes to the GSDP and becomes an

important constituent of the revenue

generating capacity of any state? The FC

seeks responses to questionnaires from

Criteria and Weights for Tax Devolution (in %)

Criteria Weight

Population 25.0

Area 10.0

Fiscal capacity distance 47.5

Fiscal discipline 17.5

COMMENTARY

december 21, 2013 vol xlviiI no 51 EPW Economic & Political Weekly

20

various stakeholders including states. A

perusal of the information so sought for

the deliberations of the current commis-

sion indicates that under the category

revenue receipts, the information sought

is of state excise inclusive of state excise

on country liquor and state excise on

foreign liquor. Therefore, a constituent of

the state revenues is excise duty on liquor.

How important or how signicant that

element is in the overall resources of the

state can be illustrated by going through

some of the state budgets. For instance,

sale of liquor in the state-run Tamil Nadu

State Marketing Corporation (TASMAC)

outlets was a major source of income for

the Tamil Nadu government with a

whopping Rs 21,680.67 crore earned as

total revenue during 2012-13. This was a

19.91% growth from the previous year.

The sum included an excise revenue

of Rs 12,125.31 crore and sales tax of

Rs 9,555.36 crore. The budget estimates

for Haryana indicate a jump of over 30%

over the last scal under the category of

excise collection for the state from country

spirits, foreign liquors and spirits, etc.

These examples are merely illustrative.

The main purpose of taxation is to

generate government revenue. Since

alcohol is a lucrative revenue source,

increased sales are seen by policymakers

as a means to boost the government

coffers. On the ip side, can governments

also use taxes on beverage alcohol for

several other purpose, i e, an attempt to

reduce abuse and harm by making alcohol

less accessible? So far as abuse of alcohol

is concerned, there is evidence that tax-

ation does not effectively target those

with a drinking problem. People will drink

notwithstanding the cost they have to

pay. Regardless of this, as ICAP reports

indicate, increase of public access to

alcohol in a bid to garner higher revenues

may end up encouraging risks of enhanced

partaking with socio- economic conse-

quences. A report by the United Nations

(UN) women (http://www.unwomen-

southasia.org/assets/Violence-Property-

Rights2.pdf) has also conrmed that in-

crease in alcohol consumption has been

indirectly encouraged by the state with

a major stake in its revenues through its

excise policy and licensing of an increasing

number of retail shops.

In the Indian context, despite us hav-

ing a constitutional commitment to pro-

hibition in Article 47 of the Directive

Principles of State Policy, the alcohol in-

dustry churns out huge revenues for the

state. A report entitled Country Prole

on Alcohol in India by Shekhar Saxena

available at APAPAonline.org makes for

interesting reading in this context. It is

argued that apart from tax payments

the l iquor industry also indirectly con-

tributes to revenues through the mode

of advertising, event sponsorships, trav-

el, tourism and sports. The alcohol in-

dustry is lucrative enough to generate a

signicant parallel economy with con-

tenders willing to dole out huge sums as

protection money, etc, to capture liquor-

vending contracts. They no doubt become,

powerful persons with the situation being

used by such power brokers to churn

policy to their advantage with disastrous

social consequences for families and

household incomes.

There are enough number of instances

as also case studies conducted wherein

Indian women have voiced a strong

c orrelation between alcoholism and

violence. The existence of a vast network

of licensed liquor shops has become a

continually growing problem. In the UN

report, women of Haryana openly com-

plain about how their men spend their

income on alcohol and ruin their health.

They consider the spread of liquor and

intoxicants as the cause of tension in

homes leading to shortage of money

for family expenses, frequent quarrels,

and forcible extraction of money from

women and violence. Liquor is clearly

behind the deteriorating quality of a

womans life and cuts across region, caste

and class lines. In fact, the greater the

poverty, the worse is its impact on women

and children.

Therefore, in conrmation of its

gender-based commitment, the govern-

ment should not consider revenues arising

out of alcoholic beverages as part of the

overall GSDP of any state; this will auto-

matically have an impact on the reve-

nue-earning capacity of a state and may

end up altering the pattern of resources

that will accrue to it from the FFC award.

Grants to States

The Terms of Reference (ToR) require

the FC to make recommendations on the

principles that should govern the grants-

in-aid to the states out of the Consolidat-

ed Fund of India. Grants-in-aid are an

important component of FC transfers.

The size of the grants has varied from

7.7% of total transfers under FC-VII to

26.1% of total transfers under FC-VI.

Grants recommended by FC-XII amounted

to 18.9% of total transfers. The TFC

recommendations covered several cate-

gories of grants-in-aid amounting in the

aggregate to Rs 3,18,581 crore which

constitutes 18.03% of total transfers.

Grants of the TFC cover a gamut of sectors

including education, environment, infant

mortality, etc. During the visits of the

EPW E-books

Select EPW books are now available as e-books in Kindle and iBook (Apple) formats.

The titles are

1. Village Society (ED. SURINDER JODHKA)

(http://www.amazon.com/dp/B00CS62AAW ;

https://itunes.apple.com/us/book/village-society/id640486715?mt=11)

2. Environment, Technology and Development (ED. ROHAN DSOUZA)

(http://www.amazon.com/dp/B00CS624E4 ;

https://itunes.apple.com/us/book/environment-technology-development/

id641419331?mt=11)

3. Windows of Opportunity: Memoirs of an Economic Adviser (BY K S KRISHNASWAMY)

(http://www.amazon.com/dp/B00CS622GY ;

https://itunes.apple.com/us/book/windows-of-opportunity/id640490173?mt=11)

Please visit the respective sites for prices of the e-books. More titles will be added gradually.

COMMENTARY

Economic & Political Weekly EPW december 21, 2013 vol xlviiI no 51

21

TFC to the states as well as in their re-

spective memoranda, state governments

highlighted the need for grants to ad-

dress specic issues and l ocal problems.

Some of the central ministries too had in

their communications to the FC drawn

attention to issues which arise across

states, but are required to be addressed

locally. For instance, the Ministry of

Home Affairs referred to the gaps in

training capabilities for the police force

across states; the Ministry of Culture

indicated the states continued need for

assistance, by means of grants, to protect

monuments, etc.

The point that therefore arises is that

based upon memoranda received which

draws attention to specic local issues,

the FC can recommend grants.

Accordingly, this FC can build in gender

sensitivity into the analysis of local issues

and recommend grants which can further

the goal of gender resource budgeting

(GRB). The FFC sought notes on a wide

range of issues which total up to around 57

in number. Sadly, there is no reference to

gender and no note has been sought from

the states on their initiatives for gender re-

form and uplift for which FC grants can be

considered and recommended. States can

be asked to suggest areas where the gap

lling for GRB can be considered. This can

go beyond the normal infant-mother mor-

tality perception of gender issues and can

perhaps be more focused on capacity buil-

ding, a core aim of GRB. Special allocations

for local governance, for skill building, for

sports, etc, targeted at women benecia-

ries could be considered by the FC.

Accordingly, the FFC can look at invit-

ing suggestions from the states on these

lines. Both the core recom mendations of

the FC can be tweaked so that the gender

impact of the devolutions is strength-

ened and augmented.

Вам также может понравиться

- Vision Ias: GENERAL STUDIES (Test Code: 420)Документ68 страницVision Ias: GENERAL STUDIES (Test Code: 420)Abhishek GuptaОценок пока нет

- Honours and Numbers: Commentry On Bloated Egos and Academic Dishonesty of A Topmost Indian ScientistДокумент3 страницыHonours and Numbers: Commentry On Bloated Egos and Academic Dishonesty of A Topmost Indian ScientistDr Abhas MitraОценок пока нет

- Environment and BiodiversityДокумент11 страницEnvironment and BiodiversityAbhishek GuptaОценок пока нет

- Polity Prelim Civil ServicesДокумент75 страницPolity Prelim Civil ServicesAbhishek GuptaОценок пока нет

- Representation of The People Act, 1951Документ67 страницRepresentation of The People Act, 1951kewal1829Оценок пока нет

- Some Notes On The Indian Economy in CrisisДокумент10 страницSome Notes On The Indian Economy in CrisisAbhishek GuptaОценок пока нет

- IPCC (2013) AR5WG1 Summary For Policy Makers (SPM)Документ28 страницIPCC (2013) AR5WG1 Summary For Policy Makers (SPM)HeavenL77Оценок пока нет

- Disaster Management WWW - Visionias.inДокумент20 страницDisaster Management WWW - Visionias.inAbhishek GuptaОценок пока нет

- Known Unknowns of RTIДокумент7 страницKnown Unknowns of RTIRajatBhatiaОценок пока нет

- China - Maritime Silk RoadДокумент4 страницыChina - Maritime Silk RoadAbhishek GuptaОценок пока нет

- DoubleDigit Inclusive GrowthДокумент6 страницDoubleDigit Inclusive Growthchoudhary2k8Оценок пока нет

- GBC 2011 - Case StudyДокумент19 страницGBC 2011 - Case StudyRahul RoonwalОценок пока нет

- GIS Taiwan 2011 Workshop SelectionsДокумент2 страницыGIS Taiwan 2011 Workshop SelectionsAbhishek GuptaОценок пока нет

- E-Commerce Across EuropeДокумент10 страницE-Commerce Across EuropeAbhishek GuptaОценок пока нет

- Luring You To: Case StudyДокумент4 страницыLuring You To: Case StudyAbhishek GuptaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Summary of Grades of Grade 10 OrchidsДокумент2 страницыSummary of Grades of Grade 10 OrchidsFarinasIsisAngelicaPОценок пока нет

- Corporate Finance - Ahuja - Chauhan PDFДокумент177 страницCorporate Finance - Ahuja - Chauhan PDFSiddharth BirjeОценок пока нет

- Legal Profession Cases CompilationДокумент13 страницLegal Profession Cases CompilationManuelMarasiganMismanosОценок пока нет

- Types of RoomДокумент2 страницыTypes of RoomAran TxaОценок пока нет

- Hisnul Muslim in Bangla (Most Popular Dua Book)Документ309 страницHisnul Muslim in Bangla (Most Popular Dua Book)Banda Calcecian95% (66)

- LTC ApllДокумент4 страницыLTC ApllSimranОценок пока нет

- PNP Ethical Doctrine Core ValuesДокумент10 страницPNP Ethical Doctrine Core Valuesunknown botОценок пока нет

- UntitledДокумент3 страницыUntitledSarah Jane UsopОценок пока нет

- Cins Number DefinitionДокумент3 страницыCins Number DefinitionJohnny LolОценок пока нет

- Jeff Gasaway Investigation Report From Plano ISD April 2010Документ21 страницаJeff Gasaway Investigation Report From Plano ISD April 2010The Dallas Morning NewsОценок пока нет

- AFAR04. Long Term Construction ContractsДокумент4 страницыAFAR04. Long Term Construction ContractsJohn Kenneth BacanОценок пока нет

- Far Eastern Bank (A Rural Bank) Inc. Annex A PDFДокумент2 страницыFar Eastern Bank (A Rural Bank) Inc. Annex A PDFIris OmerОценок пока нет

- PARAMUS ROAD BRIDGE DECK REPLACEMENT PROJECT SPECIFICATIONSДокумент156 страницPARAMUS ROAD BRIDGE DECK REPLACEMENT PROJECT SPECIFICATIONSMuhammad irfan javaidОценок пока нет

- Thesis Property ManagementДокумент7 страницThesis Property Managementfjnsf5yf100% (2)

- Sec - Governance ReviewerДокумент4 страницыSec - Governance ReviewerAngela Abrea MagdayaoОценок пока нет

- 13-07-26 Microsoft-Motorola Agreed Jury InstructionsДокумент45 страниц13-07-26 Microsoft-Motorola Agreed Jury InstructionsFlorian MuellerОценок пока нет

- Book 1Документ9 страницBook 1Samina HaiderОценок пока нет

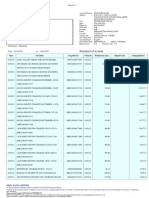

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceДокумент4 страницыStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiraj PОценок пока нет

- Summary - Best BuyДокумент4 страницыSummary - Best BuySonaliiiОценок пока нет

- MC 09-09-2003Документ5 страницMC 09-09-2003Francis Nicole V. QuirozОценок пока нет

- Concessionaire Agreeement Between Bruhat Bengaluru Mahanagara Palike (BBMP) and Maverick Holdings & Investments Pvt. Ltd. For EWS Quarters, EjipuraДокумент113 страницConcessionaire Agreeement Between Bruhat Bengaluru Mahanagara Palike (BBMP) and Maverick Holdings & Investments Pvt. Ltd. For EWS Quarters, EjipurapelicanbriefcaseОценок пока нет

- Thomas T. Scambos, Jr. v. Jack G. Petrie Robert Watson, 83 F.3d 416, 4th Cir. (1996)Документ2 страницыThomas T. Scambos, Jr. v. Jack G. Petrie Robert Watson, 83 F.3d 416, 4th Cir. (1996)Scribd Government DocsОценок пока нет

- Deed of Donation for Farm to Market Road ROWДокумент2 страницыDeed of Donation for Farm to Market Road ROWAntonio Del Rosario100% (1)

- Clarifications On The Availment of Monetization of Leave CreditsДокумент2 страницыClarifications On The Availment of Monetization of Leave CreditsSusie Garrido100% (14)

- Law of Contract Zzds (Part I)Документ27 страницLaw of Contract Zzds (Part I)Yi JieОценок пока нет

- Ventilador PLV-100 Manual en EspañolДокумент34 страницыVentilador PLV-100 Manual en Españoladpodesta5Оценок пока нет

- Building Code PDFДокумент11 страницBuilding Code PDFUmrotus SyadiyahОценок пока нет

- Dizon vs. CA - GR No. 101929 - Case DigestДокумент2 страницыDizon vs. CA - GR No. 101929 - Case DigestAbigail Tolabing100% (1)

- DRS Rev.0 C 051 390 MCC TR2!01!0001 - Condensate StablizationДокумент4 страницыDRS Rev.0 C 051 390 MCC TR2!01!0001 - Condensate StablizationBalasubramanianОценок пока нет

- America's Health Insurance Plans PAC (AHIP) - 8227 - VSRДокумент2 страницыAmerica's Health Insurance Plans PAC (AHIP) - 8227 - VSRZach EdwardsОценок пока нет